444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The France surveillance camera market represents a rapidly evolving security technology sector that has experienced substantial growth driven by increasing security concerns, urbanization, and technological advancements. Security infrastructure across France has undergone significant transformation as both public and private sectors recognize the critical importance of comprehensive surveillance systems. The market encompasses various camera technologies including analog, IP-based systems, thermal imaging, and advanced AI-powered solutions that serve diverse applications from public safety to commercial security.

Market dynamics indicate robust expansion with the sector experiencing a compound annual growth rate of 8.2% as organizations and government entities prioritize enhanced security measures. Digital transformation initiatives have accelerated adoption of smart surveillance technologies, while growing urbanization and infrastructure development projects continue to drive demand. The integration of artificial intelligence, machine learning, and cloud-based analytics has revolutionized traditional surveillance approaches, creating new opportunities for market participants.

French security regulations and compliance requirements have shaped market development, with increasing emphasis on data protection and privacy considerations. The market serves multiple sectors including retail, transportation, healthcare, education, and government facilities, each presenting unique requirements and growth opportunities. Technology convergence between surveillance systems and IoT platforms has opened new avenues for integrated security solutions.

The France surveillance camera market refers to the comprehensive ecosystem of video monitoring technologies, systems, and services deployed across French territories for security, monitoring, and analytical purposes. This market encompasses the design, manufacturing, distribution, installation, and maintenance of various surveillance camera types including dome cameras, bullet cameras, PTZ systems, thermal imaging devices, and advanced IP-based solutions.

Surveillance infrastructure within this context includes both hardware components such as cameras, recording devices, storage systems, and networking equipment, as well as software solutions for video management, analytics, and remote monitoring. The market serves diverse stakeholders including government agencies, law enforcement, commercial enterprises, educational institutions, healthcare facilities, and residential complexes seeking comprehensive security solutions.

Modern surveillance systems integrate advanced technologies such as facial recognition, motion detection, behavioral analytics, and cloud-based storage to provide enhanced security capabilities. The market also encompasses professional services including system design, installation, maintenance, and ongoing technical support that ensure optimal performance of surveillance infrastructure.

Strategic analysis reveals that the France surveillance camera market has emerged as a critical component of the nation’s security infrastructure, driven by evolving threat landscapes and technological innovation. Market expansion has been particularly pronounced in urban areas where smart city initiatives and public safety concerns have accelerated surveillance system deployments. The sector demonstrates strong growth potential with increasing adoption across multiple vertical markets.

Key market drivers include rising security concerns, government initiatives for public safety enhancement, and growing demand for advanced analytics capabilities. Technology evolution has shifted market focus toward IP-based systems that offer superior image quality, remote accessibility, and integration capabilities with existing security infrastructure. The market benefits from 65% adoption rate of digital surveillance systems across major French cities.

Competitive dynamics feature both international technology leaders and domestic solution providers competing across various market segments. Innovation focus centers on AI-powered analytics, cloud-based solutions, and mobile accessibility that enhance surveillance effectiveness while addressing privacy concerns. Market participants are investing heavily in research and development to deliver next-generation surveillance capabilities.

Future prospects indicate continued market expansion driven by smart city projects, infrastructure modernization, and increasing security awareness across commercial and residential sectors. The integration of surveillance systems with broader security ecosystems presents significant opportunities for market growth and technological advancement.

Market intelligence reveals several critical insights that define the current landscape and future trajectory of France’s surveillance camera sector:

According to MarkWide Research, these insights reflect fundamental changes in how surveillance technology is deployed and utilized across French markets, with emphasis on intelligent, connected, and privacy-compliant solutions.

Security concerns represent the primary driver for surveillance camera market expansion in France, with increasing awareness of security threats across public and private sectors. Urban crime rates and terrorism concerns have prompted significant investments in comprehensive surveillance infrastructure, particularly in major metropolitan areas and transportation hubs. Government initiatives focused on public safety enhancement continue to drive substantial market demand.

Smart city initiatives across French municipalities have created substantial opportunities for surveillance system integration with broader urban infrastructure. Digital transformation projects emphasize connected security solutions that provide real-time monitoring and analytics capabilities. These initiatives often include 40% co-funding from government programs, making advanced surveillance technology more accessible to municipal authorities.

Regulatory compliance requirements drive adoption of advanced surveillance systems that meet stringent data protection and privacy standards. Commercial sector growth in retail, hospitality, and logistics industries has increased demand for sophisticated monitoring solutions that provide both security and operational insights. The integration of surveillance with business intelligence systems offers additional value beyond traditional security applications.

Technology advancement continues to drive market expansion as improved capabilities and reduced costs make surveillance systems more attractive to diverse user segments. Insurance incentives for properties with comprehensive surveillance systems provide additional economic drivers for market adoption across commercial and residential sectors.

Privacy concerns represent significant challenges for surveillance camera market expansion in France, with strict GDPR regulations and French data protection laws imposing complex compliance requirements. Public resistance to extensive surveillance in certain areas creates implementation challenges for both government and private sector deployments. These concerns require careful balance between security needs and privacy rights.

High implementation costs associated with comprehensive surveillance systems can limit adoption, particularly among small and medium enterprises with constrained budgets. Infrastructure requirements for advanced IP-based systems often necessitate significant networking and storage investments that may deter potential adopters. Ongoing maintenance and upgrade costs add to the total cost of ownership considerations.

Technical complexity of modern surveillance systems requires specialized expertise for installation, configuration, and maintenance, creating potential barriers for organizations lacking technical resources. Integration challenges with existing security infrastructure can complicate deployment projects and increase implementation timelines. Legacy system compatibility issues may require additional investments in infrastructure upgrades.

Cybersecurity vulnerabilities associated with connected surveillance systems create concerns about potential security breaches and unauthorized access to sensitive video data. Data storage requirements for high-resolution video content can strain IT infrastructure and increase operational costs, particularly for organizations with extensive surveillance networks.

Smart city expansion presents substantial opportunities for surveillance camera market growth as French municipalities invest in comprehensive urban monitoring systems. Infrastructure modernization projects create demand for advanced surveillance technologies that integrate with broader city management platforms. These initiatives often include substantial government funding that supports market expansion.

Artificial intelligence integration offers significant opportunities for market differentiation and value creation through advanced analytics capabilities. Behavioral analysis, facial recognition, and predictive analytics features provide enhanced security effectiveness while creating new revenue streams for solution providers. The development of AI-powered surveillance solutions addresses growing demand for intelligent monitoring systems.

Cloud-based solutions present opportunities for scalable surveillance deployments that reduce infrastructure requirements and enable remote management capabilities. Subscription-based models for surveillance services create recurring revenue opportunities while making advanced technology more accessible to smaller organizations. These models align with growing preferences for operational expenditure over capital investment.

Vertical market expansion into healthcare, education, and transportation sectors offers growth opportunities as these industries recognize the value of comprehensive surveillance systems. Integration opportunities with access control, alarm systems, and building management platforms create comprehensive security solutions that address multiple organizational needs simultaneously.

Technology evolution continues to reshape market dynamics as surveillance systems become increasingly sophisticated and integrated with broader security ecosystems. Digital transformation initiatives across public and private sectors drive demand for advanced surveillance capabilities that provide both security and operational insights. The shift toward IP-based systems has fundamentally changed market structure and competitive dynamics.

Competitive pressures intensify as both established security companies and technology innovators compete for market share across diverse application segments. Innovation cycles accelerate as companies invest in AI, machine learning, and cloud technologies to differentiate their offerings. Market consolidation trends create opportunities for strategic partnerships and acquisitions that enhance technological capabilities.

Regulatory influences significantly impact market dynamics through privacy protection requirements and security standards that shape product development and deployment strategies. Customer expectations continue to evolve toward more intelligent, user-friendly, and integrated surveillance solutions that provide comprehensive security coverage. The market demonstrates 85% preference for systems with mobile accessibility and remote monitoring capabilities.

Economic factors influence market dynamics through budget constraints and investment priorities that affect adoption timelines and technology choices. Supply chain considerations impact product availability and pricing strategies, particularly for advanced technology components and specialized surveillance equipment.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the France surveillance camera market. Primary research includes extensive interviews with industry stakeholders, including manufacturers, distributors, system integrators, and end-users across various sectors. These interviews provide valuable insights into market trends, challenges, and opportunities from diverse perspectives.

Secondary research encompasses analysis of industry reports, government publications, trade association data, and company financial statements to establish market context and validate primary research findings. Quantitative analysis includes statistical modeling and trend analysis to project market growth patterns and identify key performance indicators. Data triangulation ensures consistency and reliability across multiple information sources.

Market segmentation analysis examines various dimensions including technology types, application sectors, end-user categories, and geographic regions to provide comprehensive market understanding. Competitive intelligence gathering includes analysis of company strategies, product portfolios, market positioning, and financial performance to assess competitive dynamics.

Expert consultation with industry specialists, technology experts, and regulatory authorities provides additional validation and insights into market trends and future developments. Field research includes site visits and technology demonstrations to understand practical implementation challenges and opportunities in real-world environments.

Paris metropolitan area dominates the France surveillance camera market, accounting for approximately 35% of total market activity due to high population density, extensive transportation infrastructure, and significant commercial activity. Urban security initiatives in the capital region drive substantial investments in advanced surveillance systems across public spaces, transportation hubs, and commercial districts. The region benefits from strong government support for smart city projects and public safety enhancement.

Lyon and Marseille represent significant regional markets with growing adoption of surveillance technology across municipal and commercial applications. Industrial regions in northern France demonstrate strong demand for surveillance systems in manufacturing facilities, logistics centers, and transportation infrastructure. These areas benefit from 25% higher adoption rates of industrial-grade surveillance solutions compared to national averages.

Coastal regions including Nice, Cannes, and Bordeaux show increased surveillance system deployment driven by tourism security requirements and port facility protection needs. Border regions experience heightened demand for advanced surveillance technology due to security considerations and immigration monitoring requirements. These areas often implement specialized thermal imaging and perimeter protection systems.

Rural and suburban markets demonstrate growing interest in surveillance technology, particularly for agricultural applications, residential security, and small business protection. Regional development programs support surveillance system adoption in smaller municipalities through funding assistance and technical support initiatives.

Market leadership in the France surveillance camera sector features a diverse mix of international technology companies and specialized security solution providers competing across various market segments:

Competitive strategies focus on technology innovation, strategic partnerships, and vertical market specialization to differentiate offerings and capture market share. Market positioning varies from cost-effective solutions for price-sensitive segments to premium offerings for demanding applications requiring advanced capabilities.

Technology-based segmentation reveals distinct market categories with varying growth patterns and application requirements:

By Camera Type:

By Application Sector:

By Technology Features:

IP camera category demonstrates the strongest growth trajectory with advanced features including high-definition video, remote accessibility, and integration capabilities driving adoption across multiple sectors. Smart analytics embedded in modern IP cameras provide facial recognition, motion detection, and behavioral analysis that enhance security effectiveness while reducing false alarms. This category benefits from declining hardware costs and improving network infrastructure.

Thermal imaging category serves specialized applications requiring detection capabilities in challenging environmental conditions. Perimeter security applications in critical infrastructure, industrial facilities, and government installations drive demand for thermal technology. These systems provide 24/7 monitoring capabilities regardless of lighting conditions or weather factors.

PTZ camera category addresses applications requiring flexible monitoring coverage and remote operator control. Large area surveillance in airports, stadiums, and public spaces benefits from PTZ capabilities that provide comprehensive coverage with fewer camera installations. Advanced PTZ systems integrate with video management software for automated tracking and preset positioning.

Dome camera category remains popular for indoor applications due to discrete design and vandal-resistant construction. Retail environments particularly favor dome cameras for their aesthetic appeal and comprehensive coverage capabilities. These systems often integrate with point-of-sale systems for loss prevention and operational analytics.

Enhanced security capabilities provide primary benefits for end-users through improved threat detection, incident documentation, and deterrent effects that reduce security risks. Operational insights derived from surveillance analytics help organizations optimize processes, improve customer service, and enhance operational efficiency beyond traditional security applications.

Cost reduction benefits include decreased security personnel requirements, reduced insurance premiums, and prevention of losses through theft or vandalism. Remote monitoring capabilities enable centralized security management across multiple locations, reducing operational costs and improving response times. Organizations report 30% reduction in security-related incidents following comprehensive surveillance system implementation.

Compliance advantages help organizations meet regulatory requirements for security documentation and incident reporting. Legal protection through video evidence supports liability reduction and dispute resolution across various business scenarios. Surveillance systems provide valuable documentation for insurance claims and legal proceedings.

Technology integration benefits enable surveillance systems to work with access control, alarm systems, and building management platforms for comprehensive security solutions. Scalability advantages allow organizations to expand surveillance coverage as needs grow without requiring complete system replacement. Cloud-based solutions provide particular flexibility for growing organizations.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration represents the most significant trend transforming surveillance camera capabilities through advanced analytics, automated threat detection, and behavioral analysis features. Machine learning algorithms enable systems to distinguish between normal activities and potential security threats, reducing false alarms while improving detection accuracy. This trend drives 45% of new installations to include AI-powered features.

Cloud-based surveillance continues gaining momentum as organizations seek scalable solutions that reduce infrastructure requirements and enable remote management capabilities. Hybrid cloud models combine local storage for immediate access with cloud backup for long-term retention and disaster recovery. This approach addresses both performance and compliance requirements effectively.

Mobile integration has become standard expectation with surveillance systems providing smartphone and tablet accessibility for remote monitoring and management. Real-time notifications and mobile video streaming enable immediate response to security events regardless of location. Mobile applications increasingly include advanced features such as two-way audio and remote camera control.

Privacy-by-design approaches influence system development as manufacturers incorporate privacy protection features directly into surveillance technology. Automated data anonymization, selective recording capabilities, and granular access controls address privacy concerns while maintaining security effectiveness. These features become increasingly important for GDPR compliance and public acceptance.

Technology partnerships between surveillance manufacturers and AI companies have accelerated development of intelligent video analytics capabilities. Strategic alliances focus on integrating machine learning, facial recognition, and behavioral analysis into surveillance platforms. These collaborations enable rapid innovation and market differentiation through advanced features.

Government initiatives for smart city development have created substantial opportunities for surveillance system integration with broader urban infrastructure. Public-private partnerships facilitate large-scale surveillance deployments while sharing costs and expertise between sectors. Recent projects in major French cities demonstrate successful integration of surveillance with traffic management and emergency response systems.

Regulatory developments continue shaping market dynamics through updated privacy protection requirements and security standards. Industry standards for cybersecurity and data protection influence product development and deployment practices. Compliance certification programs help organizations navigate complex regulatory requirements.

Market consolidation through acquisitions and mergers has created larger, more capable solution providers with comprehensive product portfolios. Vertical integration strategies enable companies to control entire value chains from manufacturing to installation and maintenance services. These developments improve solution quality while potentially reducing costs through economies of scale.

MWR analysis recommends that market participants focus on developing privacy-compliant solutions that address growing regulatory requirements while maintaining security effectiveness. Investment priorities should emphasize AI integration, cloud capabilities, and mobile accessibility to meet evolving customer expectations. Organizations should consider hybrid deployment models that balance performance, cost, and compliance requirements.

Technology roadmap planning should account for rapid evolution in AI capabilities and ensure systems can accommodate future upgrades without complete replacement. Partnership strategies with technology innovators, system integrators, and vertical market specialists can accelerate market penetration and solution development. Companies should invest in cybersecurity capabilities to address growing concerns about connected surveillance systems.

Market positioning strategies should differentiate based on specific vertical market needs rather than competing solely on price or basic features. Service offerings including installation, maintenance, and ongoing support become increasingly important for customer retention and recurring revenue generation. Organizations should develop expertise in regulatory compliance to support customer deployment projects.

Geographic expansion opportunities exist in underserved regions and emerging application sectors such as healthcare and education. Scalable solution development can address diverse market segments from small businesses to large enterprise and government installations. Companies should monitor emerging technologies such as 5G connectivity and edge computing that may create new opportunities or disrupt existing approaches.

Market trajectory indicates continued strong growth driven by increasing security awareness, technology advancement, and smart city initiatives across France. Innovation acceleration in AI, machine learning, and cloud technologies will create new capabilities and market opportunities while potentially disrupting traditional surveillance approaches. The market is expected to maintain robust expansion with projected growth rates exceeding 8% annually through the forecast period.

Technology convergence between surveillance systems and broader IoT platforms will create integrated security ecosystems that provide comprehensive monitoring and analytics capabilities. 5G connectivity will enable new applications including real-time video analytics, remote system management, and enhanced mobile accessibility. These technological advances will expand market opportunities while improving system capabilities.

Regulatory evolution will continue influencing market development through updated privacy protection requirements and security standards that shape product development and deployment strategies. Industry maturation will likely result in further consolidation and standardization that improves interoperability while potentially reducing costs through economies of scale.

Emerging applications in healthcare monitoring, educational facility security, and smart transportation systems will create new market segments with specialized requirements. Sustainability considerations may influence technology choices and deployment strategies as organizations seek energy-efficient and environmentally responsible security solutions. The integration of renewable energy sources with surveillance systems presents opportunities for off-grid and environmentally conscious deployments.

The France surveillance camera market demonstrates strong growth potential driven by evolving security needs, technological innovation, and supportive government initiatives. Market dynamics favor intelligent, connected solutions that provide enhanced security capabilities while addressing privacy concerns and regulatory requirements. The transition from analog to IP-based systems continues reshaping competitive dynamics and creating opportunities for technology-focused companies.

Key success factors include AI integration, cloud capabilities, mobile accessibility, and privacy compliance that address diverse customer requirements across multiple vertical markets. Strategic positioning should emphasize solution differentiation through advanced features, vertical market expertise, and comprehensive service offerings rather than competing solely on price. The market rewards companies that can demonstrate clear value propositions and regulatory compliance capabilities.

Future opportunities exist in smart city expansion, emerging vertical markets, and technology convergence with broader security ecosystems. Market participants should invest in innovation capabilities, strategic partnerships, and regulatory expertise to capitalize on growth opportunities while navigating evolving market dynamics. The surveillance camera market in France is well-positioned for continued expansion as security technology becomes increasingly sophisticated and integrated with broader digital infrastructure initiatives.

What is Surveillance Camera?

Surveillance cameras are devices used to monitor and record activities in a specific area for security purposes. They are commonly employed in various settings, including public spaces, businesses, and residential properties to enhance safety and deter crime.

What are the key players in the France Surveillance Camera Market?

Key players in the France Surveillance Camera Market include companies like Axis Communications, Hikvision, and Dahua Technology, which are known for their innovative surveillance solutions. These companies offer a range of products, including IP cameras and video management systems, among others.

What are the growth factors driving the France Surveillance Camera Market?

The France Surveillance Camera Market is driven by increasing security concerns, advancements in technology, and the growing adoption of smart city initiatives. Additionally, the rise in criminal activities and the need for effective monitoring solutions contribute to market growth.

What challenges does the France Surveillance Camera Market face?

Challenges in the France Surveillance Camera Market include privacy concerns, regulatory compliance issues, and the high costs associated with advanced surveillance technologies. These factors can hinder widespread adoption and implementation in certain areas.

What opportunities exist in the France Surveillance Camera Market?

The France Surveillance Camera Market presents opportunities in the integration of artificial intelligence and machine learning for enhanced analytics. Additionally, the increasing demand for cloud-based surveillance solutions and smart home technologies offers significant growth potential.

What trends are shaping the France Surveillance Camera Market?

Trends in the France Surveillance Camera Market include the shift towards wireless and IP-based cameras, the integration of video analytics, and the growing emphasis on cybersecurity measures. These trends reflect the evolving needs of consumers and businesses for more efficient surveillance solutions.

France Surveillance Camera Market

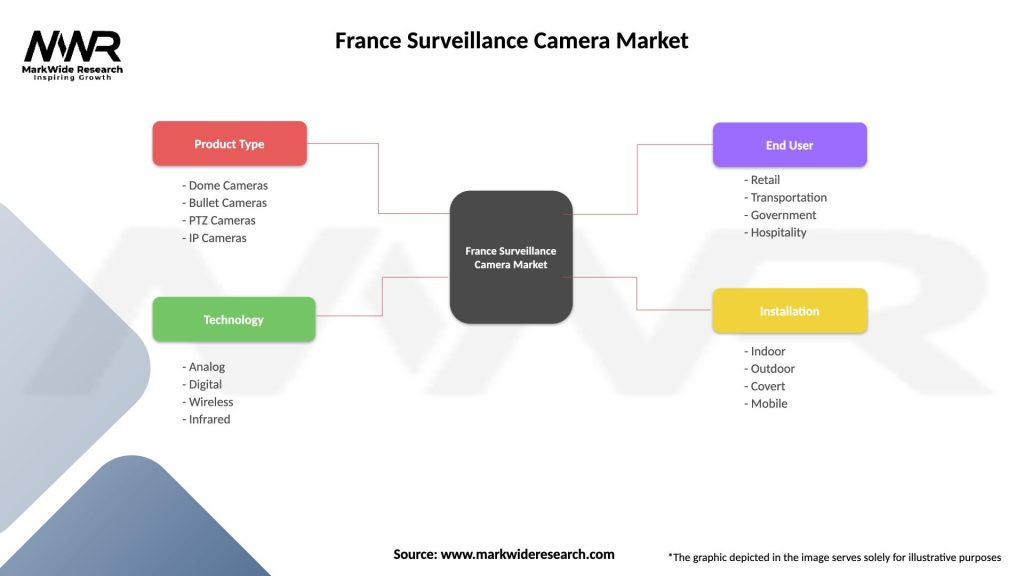

| Segmentation Details | Description |

|---|---|

| Product Type | Dome Cameras, Bullet Cameras, PTZ Cameras, IP Cameras |

| Technology | Analog, Digital, Wireless, Infrared |

| End User | Retail, Transportation, Government, Hospitality |

| Installation | Indoor, Outdoor, Covert, Mobile |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the France Surveillance Camera Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at