444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The France smart home market represents one of Europe’s most dynamic and rapidly evolving technology sectors, characterized by increasing consumer adoption of connected devices and intelligent home automation systems. French consumers are demonstrating growing enthusiasm for smart home technologies, driven by enhanced convenience, energy efficiency, and security considerations. The market encompasses a comprehensive range of products including smart lighting systems, intelligent thermostats, security cameras, voice assistants, and integrated home automation platforms.

Market penetration in France has accelerated significantly, with smart home device adoption reaching 42% of households as connected living becomes increasingly mainstream. The integration of artificial intelligence and Internet of Things (IoT) technologies has transformed traditional homes into intelligent ecosystems capable of learning user preferences and optimizing energy consumption. Urban centers like Paris, Lyon, and Marseille are leading adoption trends, while suburban and rural areas are experiencing steady growth in smart home technology implementation.

Government initiatives supporting digital transformation and energy efficiency have created favorable conditions for smart home market expansion. French regulatory frameworks emphasizing data privacy and cybersecurity have enhanced consumer confidence in connected home technologies. The market demonstrates robust growth potential with increasing awareness of environmental sustainability and the desire for enhanced home security driving continued adoption across diverse demographic segments.

The France smart home market refers to the comprehensive ecosystem of connected devices, intelligent systems, and automated technologies designed to enhance residential living experiences through digital integration and remote control capabilities. Smart home technology encompasses interconnected devices that can communicate with each other and be controlled remotely via smartphones, tablets, or voice commands, creating an integrated living environment that responds to user preferences and environmental conditions.

Core components of the French smart home market include security systems with intelligent monitoring capabilities, climate control systems that optimize energy usage, lighting solutions that adapt to natural light conditions, and entertainment systems that provide seamless multimedia experiences. These technologies leverage advanced connectivity protocols including Wi-Fi, Bluetooth, Zigbee, and emerging 5G networks to create responsive home environments.

Market definition extends beyond individual devices to encompass comprehensive home automation platforms that integrate multiple systems under unified control interfaces. French smart home solutions emphasize user privacy, energy efficiency, and seamless integration with existing home infrastructure, reflecting local preferences for sophisticated yet user-friendly technology implementations.

France’s smart home market demonstrates exceptional growth momentum, positioning the country as a leading European market for connected home technologies. The convergence of consumer demand for convenience, energy efficiency, and enhanced security has created a robust foundation for sustained market expansion. Technology adoption patterns indicate strong consumer acceptance across multiple demographic segments, with particular strength in urban markets and among tech-savvy millennials and Gen Z consumers.

Key market drivers include increasing awareness of energy conservation benefits, with smart home technologies delivering 23% average energy savings for participating households. Government incentives supporting digital transformation and environmental sustainability have accelerated adoption rates, while improving product affordability has expanded market accessibility. The integration of artificial intelligence and machine learning capabilities has enhanced product sophistication and user experience quality.

Competitive dynamics feature both international technology giants and innovative French companies developing localized solutions that address specific market preferences. The market benefits from strong telecommunications infrastructure, supportive regulatory frameworks, and growing consumer confidence in connected technologies. Future prospects remain highly favorable, with emerging technologies including 5G connectivity and edge computing expected to drive next-generation smart home innovations.

Consumer behavior analysis reveals distinct preferences shaping the French smart home market landscape. French consumers prioritize privacy and data security, influencing product selection toward solutions offering robust cybersecurity features and local data processing capabilities. Energy efficiency remains a primary motivator, with environmental consciousness driving adoption of smart thermostats, intelligent lighting, and energy monitoring systems.

Energy efficiency imperatives serve as primary catalysts for French smart home market growth, with consumers increasingly seeking technologies that reduce energy consumption and environmental impact. Government initiatives promoting energy conservation and carbon footprint reduction have created favorable conditions for smart home technology adoption. Smart thermostats and intelligent lighting systems deliver measurable energy savings, making them attractive investments for environmentally conscious French households.

Enhanced security concerns drive significant demand for smart home security solutions, particularly in urban areas experiencing increased property crime rates. Connected security cameras, smart door locks, and comprehensive monitoring systems provide peace of mind while offering remote surveillance capabilities. The integration of artificial intelligence in security systems enables advanced threat detection and automated response protocols that appeal to safety-conscious consumers.

Convenience and lifestyle enhancement motivate adoption among busy professionals and tech-savvy consumers seeking streamlined home management solutions. Voice-controlled assistants, automated lighting schedules, and remote appliance control capabilities simplify daily routines and enhance living comfort. The growing popularity of remote work has increased appreciation for smart home technologies that optimize home office environments and improve work-life balance.

Technological advancement in connectivity infrastructure, particularly 5G network deployment and improved broadband access, enables more sophisticated smart home implementations. Enhanced device interoperability and user-friendly interfaces have reduced technical barriers to adoption, making smart home technologies accessible to broader consumer segments beyond early technology adopters.

Privacy and data security concerns represent significant barriers to smart home adoption among privacy-conscious French consumers. High-profile data breaches and cybersecurity incidents have heightened awareness of potential risks associated with connected devices. Regulatory compliance requirements under GDPR and French data protection laws create additional complexity for manufacturers and may limit certain smart home functionalities that consumers find appealing.

High initial investment costs deter price-sensitive consumers from comprehensive smart home implementations, particularly for premium systems requiring professional installation. The fragmented nature of smart home ecosystems often necessitates multiple device purchases and ongoing subscription fees, creating cumulative cost barriers that limit market penetration among middle-income households.

Technical complexity and integration challenges discourage less tech-savvy consumers from adopting smart home technologies. Compatibility issues between different manufacturers’ devices, complex setup procedures, and ongoing maintenance requirements create user experience friction that inhibits broader market adoption. Digital divide factors, including limited technical knowledge among older demographics, further constrain market expansion potential.

Infrastructure limitations in rural and remote areas of France restrict smart home technology deployment due to inadequate broadband connectivity and unreliable internet service. Power grid stability concerns and limited technical support availability in less populated regions create additional adoption barriers that slow market penetration beyond urban centers.

Aging population demographics present substantial opportunities for smart home technologies designed to support independent living and health monitoring. Assisted living solutions including fall detection systems, medication reminders, and emergency response capabilities address growing needs among France’s senior population. The integration of healthcare monitoring devices with smart home platforms creates comprehensive wellness ecosystems that appeal to health-conscious consumers and their families.

Renewable energy integration opportunities emerge as France accelerates its transition toward sustainable energy sources. Smart home systems capable of managing solar panel output, battery storage, and electric vehicle charging create value propositions that align with environmental goals and government incentives. Energy trading capabilities that allow households to sell excess renewable energy back to the grid represent innovative revenue opportunities for smart home users.

Artificial intelligence advancement enables more sophisticated smart home applications including predictive maintenance, personalized automation, and advanced energy optimization. Machine learning algorithms that adapt to user behavior patterns and preferences create increasingly valuable user experiences that justify premium pricing and drive upgrade cycles.

5G network deployment across France unlocks new possibilities for real-time smart home applications requiring ultra-low latency and high bandwidth connectivity. Enhanced network capabilities enable more sophisticated video streaming, augmented reality interfaces, and cloud-based processing that expand smart home functionality beyond current limitations.

Supply chain evolution in the French smart home market reflects increasing localization of manufacturing and distribution networks to reduce costs and improve service quality. European manufacturers are establishing stronger presences in France to compete with Asian technology giants, offering products specifically designed for European market preferences and regulatory requirements. This localization trend enhances product availability and reduces delivery times while supporting local economic development.

Consumer education initiatives by manufacturers, retailers, and government agencies are accelerating market adoption by addressing knowledge gaps and technical concerns. Demonstration programs in retail environments and home improvement stores allow consumers to experience smart home technologies firsthand, reducing purchase hesitation and building confidence in product capabilities. Educational campaigns emphasizing energy savings and security benefits resonate strongly with French consumer values.

Partnership ecosystems between technology companies, telecommunications providers, and home service professionals create comprehensive smart home solutions that address installation, maintenance, and support challenges. These collaborative approaches reduce consumer friction and enable more sophisticated system implementations that drive higher average transaction values and customer satisfaction levels.

Regulatory developments continue shaping market dynamics through data protection requirements, cybersecurity standards, and energy efficiency mandates. Government incentive programs supporting smart home adoption for energy conservation create favorable purchasing conditions while establishing quality and performance standards that benefit consumers and legitimate manufacturers.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the French smart home market landscape. Primary research includes extensive consumer surveys, in-depth interviews with industry stakeholders, and focus groups representing diverse demographic segments across French regions. This direct consumer feedback provides valuable insights into purchasing motivations, usage patterns, and satisfaction levels with current smart home technologies.

Secondary research encompasses analysis of industry reports, government statistics, regulatory filings, and company financial statements to establish market sizing, competitive positioning, and growth trend validation. MarkWide Research methodology incorporates both quantitative data analysis and qualitative market intelligence to provide comprehensive market understanding that supports strategic decision-making.

Data validation processes include cross-referencing multiple information sources, conducting expert interviews with industry professionals, and analyzing market trends across comparable European markets to ensure accuracy and reliability. Statistical analysis techniques identify significant market patterns and growth drivers while accounting for seasonal variations and economic factors that influence consumer behavior.

Market modeling approaches utilize historical data, current market indicators, and forward-looking assumptions to project future market development scenarios. This analytical framework considers technological advancement rates, regulatory changes, and demographic shifts that will influence smart home market evolution in France over the forecast period.

Paris metropolitan area dominates the French smart home market, accounting for 34% of national adoption due to high disposable incomes, tech-savvy demographics, and advanced telecommunications infrastructure. Urban density and security concerns drive particularly strong demand for smart security systems and energy-efficient solutions. The concentration of technology companies and early adopters in the Paris region creates a favorable environment for new product launches and innovation testing.

Lyon and Marseille represent significant secondary markets with growing smart home penetration rates driven by expanding technology sectors and improving connectivity infrastructure. These metropolitan areas demonstrate strong 19% annual growth in smart home adoption, particularly among professional demographics seeking convenience and energy efficiency solutions. Regional preferences emphasize integrated systems over standalone devices, reflecting sophisticated consumer expectations.

Suburban markets across France show increasing smart home interest as broadband infrastructure improvements enable reliable connectivity for connected devices. Family households in suburban areas prioritize security systems and energy management solutions that provide tangible benefits for larger homes and properties. The growing popularity of remote work has accelerated smart home office technology adoption in these markets.

Rural regions present emerging opportunities as 5G network deployment and satellite internet services improve connectivity reliability. While adoption rates remain lower than urban areas, rural consumers demonstrate strong interest in security systems and energy monitoring solutions that address specific challenges of remote property management. Government rural development initiatives supporting digital infrastructure create favorable conditions for future market expansion.

Market leadership in the French smart home sector features a diverse mix of international technology giants, European specialists, and innovative French companies developing localized solutions. Competition intensity continues increasing as established players expand product portfolios while new entrants introduce disruptive technologies and business models.

Competitive strategies emphasize ecosystem integration, local customer support, and compliance with French regulatory requirements. Companies investing in French-language interfaces, local data processing, and partnerships with French retailers demonstrate stronger market performance than those relying solely on global product strategies.

Product category segmentation reveals distinct market dynamics across different smart home technology categories, with security systems maintaining the largest market share while energy management solutions demonstrate the fastest growth rates. Consumer preferences vary significantly between product categories, influencing pricing strategies, distribution channels, and marketing approaches employed by manufacturers.

By Technology:

By Application:

By Price Range:

Smart security systems dominate the French market with comprehensive solutions including video surveillance, access control, and alarm monitoring. Consumer preferences favor systems offering local storage options and privacy-focused features that comply with French data protection requirements. Integration with smartphone apps and professional monitoring services drives premium pricing acceptance among security-conscious consumers.

Energy management solutions demonstrate exceptional growth potential as French consumers prioritize environmental sustainability and energy cost reduction. Smart thermostats lead this category with proven energy savings and government incentive eligibility. Intelligent lighting systems and energy monitoring devices complement thermostat installations, creating comprehensive energy optimization ecosystems that appeal to environmentally conscious households.

Voice assistants and smart speakers show strong adoption rates, particularly devices supporting French language processing and local content integration. Privacy concerns influence consumer preferences toward devices offering local processing options and transparent data handling policies. Integration capabilities with other smart home devices drive purchasing decisions as consumers seek unified control interfaces.

Connected appliances represent an emerging category with significant growth potential as manufacturers integrate smart features into traditional home appliances. Kitchen appliances lead adoption with smart refrigerators, ovens, and dishwashers offering convenience and energy efficiency benefits. Consumer education regarding practical benefits and ease of use remains crucial for broader category adoption.

Manufacturers benefit from the expanding French smart home market through increased revenue opportunities, brand differentiation possibilities, and access to a sophisticated consumer base willing to pay premium prices for quality solutions. Product innovation driven by French consumer preferences for privacy, energy efficiency, and design aesthetics creates competitive advantages that extend to other European markets.

Retailers and distributors gain from higher-margin smart home products that generate increased customer engagement and repeat purchases. Service opportunities including installation, maintenance, and customer support create additional revenue streams while building stronger customer relationships. The complexity of smart home systems encourages professional consultation services that enhance retailer value propositions.

Consumers realize significant benefits including enhanced home security, reduced energy costs, and improved convenience through smart home technology adoption. Long-term savings from energy efficiency improvements often offset initial investment costs while providing ongoing operational benefits. Integration of multiple smart home systems creates comprehensive lifestyle enhancements that justify premium pricing.

Service providers including telecommunications companies, security firms, and home automation specialists benefit from recurring revenue opportunities through monitoring services, maintenance contracts, and system upgrades. Partnership opportunities with manufacturers and retailers create comprehensive solution offerings that address complete customer needs from initial consultation through ongoing support.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration represents the most significant trend shaping the French smart home market, with AI-powered devices offering predictive capabilities, personalized automation, and enhanced user experiences. Machine learning algorithms enable smart home systems to adapt to user behavior patterns, optimize energy consumption, and provide proactive maintenance alerts that enhance system reliability and user satisfaction.

Privacy-first design emerges as a critical trend responding to French consumer concerns about data security and regulatory compliance. Local processing capabilities and edge computing solutions allow smart home devices to operate with minimal cloud connectivity, addressing privacy concerns while maintaining functionality. Manufacturers emphasizing transparent data practices and user control over personal information gain competitive advantages in the French market.

Sustainability focus drives increasing demand for smart home technologies that support environmental goals and energy conservation. Carbon footprint reduction features including energy monitoring, renewable energy integration, and automated efficiency optimization align with French environmental consciousness and government sustainability initiatives. Smart home systems that provide detailed energy usage analytics and optimization recommendations appeal strongly to environmentally aware consumers.

Voice interface evolution continues advancing with improved French language processing, natural conversation capabilities, and integration with local services and content providers. Multilingual support and regional accent recognition enhance user experience quality while cultural localization features make voice assistants more relevant to French users’ daily routines and preferences.

Strategic partnerships between technology companies and French telecommunications providers are accelerating smart home market development through integrated service offerings and improved customer support. Orange and other major carriers are expanding smart home service portfolios to include device sales, installation services, and ongoing technical support, creating comprehensive solutions that address consumer concerns about complexity and reliability.

Regulatory compliance initiatives by manufacturers demonstrate commitment to French data protection and cybersecurity requirements, with companies investing in local data centers and privacy-by-design product development approaches. GDPR compliance and adherence to French cybersecurity standards become competitive differentiators that influence consumer purchasing decisions and retailer partnerships.

Innovation investments by French companies including Schneider Electric, Legrand, and Somfy focus on developing solutions specifically designed for European market preferences and regulatory requirements. These investments in local R&D capabilities create products that better address French consumer needs while supporting domestic technology industry development.

Retail channel expansion includes major home improvement retailers, electronics chains, and specialized smart home showrooms providing hands-on demonstration experiences that educate consumers and reduce purchase hesitation. Professional installation networks are expanding to support growing demand for comprehensive smart home system implementations requiring technical expertise and ongoing support services.

Market entry strategies for new participants should emphasize local partnerships, French language support, and compliance with European regulatory requirements to build consumer trust and market credibility. MarkWide Research analysis indicates that companies demonstrating commitment to French market preferences through localized products and services achieve higher adoption rates and customer satisfaction levels than those relying on global product strategies.

Product development priorities should focus on privacy-first design, energy efficiency optimization, and seamless integration capabilities that address primary French consumer concerns. User experience simplification through intuitive interfaces, automated setup processes, and comprehensive customer support reduces adoption barriers and expands addressable market segments beyond early technology adopters.

Distribution channel optimization requires multi-channel approaches combining online sales, traditional retail partnerships, and specialized smart home demonstration centers. Professional service integration including installation, configuration, and ongoing support services creates competitive advantages while addressing consumer concerns about technical complexity and system reliability.

Investment recommendations favor companies developing AI-powered solutions, privacy-focused technologies, and energy management systems that align with French market priorities and regulatory requirements. Long-term growth potential appears strongest for integrated platform providers capable of offering comprehensive smart home ecosystems rather than standalone device manufacturers.

Market expansion prospects for the French smart home sector remain highly favorable, with continued growth expected across all major product categories and geographic regions. Technology advancement in artificial intelligence, 5G connectivity, and edge computing will enable more sophisticated smart home applications that deliver enhanced value propositions to consumers. The convergence of smart home technologies with renewable energy systems and electric vehicle infrastructure creates additional growth opportunities aligned with France’s sustainability goals.

Consumer adoption patterns indicate accelerating mainstream acceptance of smart home technologies, with penetration rates expected to reach 65% of French households within the next five years. Demographic shifts including aging population trends and increasing environmental consciousness will drive demand for specialized smart home solutions addressing health monitoring, energy efficiency, and sustainable living requirements.

Regulatory evolution will continue shaping market development through enhanced cybersecurity standards, data protection requirements, and energy efficiency mandates that favor advanced smart home technologies. Government incentive programs supporting digital transformation and environmental sustainability will create favorable purchasing conditions while establishing quality standards that benefit consumers and legitimate manufacturers.

Innovation trajectories point toward more intelligent, autonomous smart home systems capable of predictive maintenance, personalized automation, and seamless integration with urban infrastructure and services. MWR projections indicate that the French smart home market will continue outperforming broader European averages due to favorable demographic trends, strong infrastructure, and supportive regulatory frameworks that encourage technology adoption and innovation.

France’s smart home market represents a compelling growth opportunity characterized by strong consumer demand, advanced infrastructure, and supportive regulatory frameworks that favor continued expansion. The convergence of technology advancement, environmental consciousness, and changing lifestyle preferences creates favorable conditions for sustained market development across diverse product categories and consumer segments. Key success factors include privacy-first design, energy efficiency optimization, and seamless user experiences that address specific French market preferences and regulatory requirements.

Strategic positioning in this dynamic market requires comprehensive understanding of local consumer preferences, regulatory compliance requirements, and competitive dynamics that differentiate the French market from broader European trends. Companies demonstrating commitment to French market needs through localized products, services, and partnerships achieve superior performance compared to those relying solely on global strategies. Long-term prospects remain highly favorable as technology advancement, demographic trends, and government initiatives continue supporting smart home adoption and innovation throughout France.

What is Smart Home?

Smart Home refers to a residential setup where appliances and devices are interconnected and can be controlled remotely, enhancing convenience, security, and energy efficiency. This includes smart lighting, thermostats, security systems, and home entertainment systems.

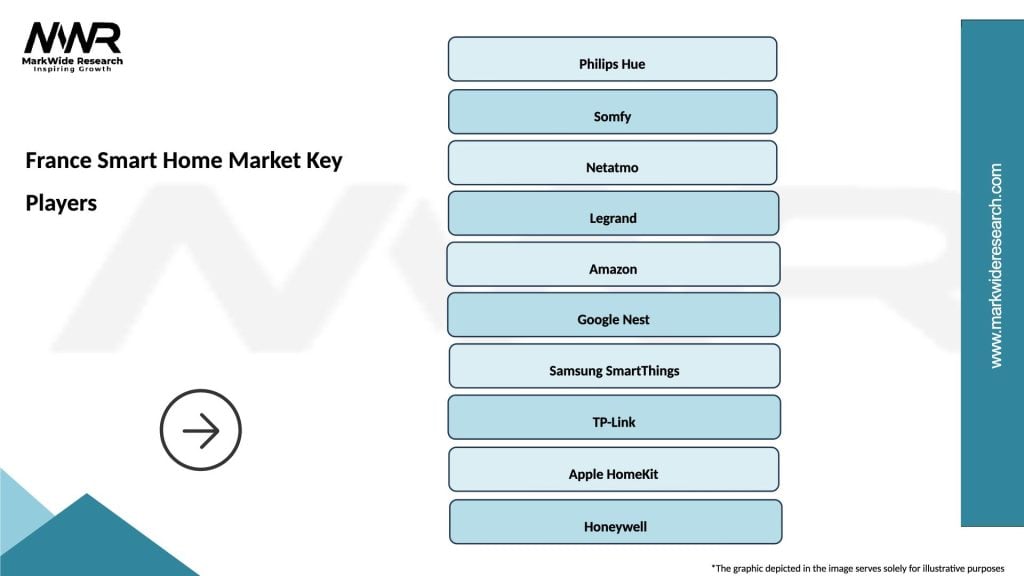

What are the key players in the France Smart Home Market?

Key players in the France Smart Home Market include companies like Legrand, Somfy, and Netatmo, which offer a range of smart home solutions such as automated blinds, smart thermostats, and security cameras, among others.

What are the growth factors driving the France Smart Home Market?

The France Smart Home Market is driven by increasing consumer demand for energy-efficient solutions, advancements in IoT technology, and a growing focus on home security. Additionally, the rise in smart device adoption among consumers contributes to market growth.

What challenges does the France Smart Home Market face?

Challenges in the France Smart Home Market include concerns over data privacy and security, high installation costs, and the complexity of integrating various smart devices. These factors can hinder consumer adoption and market expansion.

What opportunities exist in the France Smart Home Market?

The France Smart Home Market presents opportunities in the development of innovative products, such as AI-driven home automation systems and energy management solutions. Additionally, increasing government initiatives promoting smart city projects can further enhance market prospects.

What trends are shaping the France Smart Home Market?

Trends in the France Smart Home Market include the growing popularity of voice-activated devices, the integration of artificial intelligence for personalized experiences, and the rise of energy-efficient smart appliances. These trends are transforming how consumers interact with their homes.

France Smart Home Market

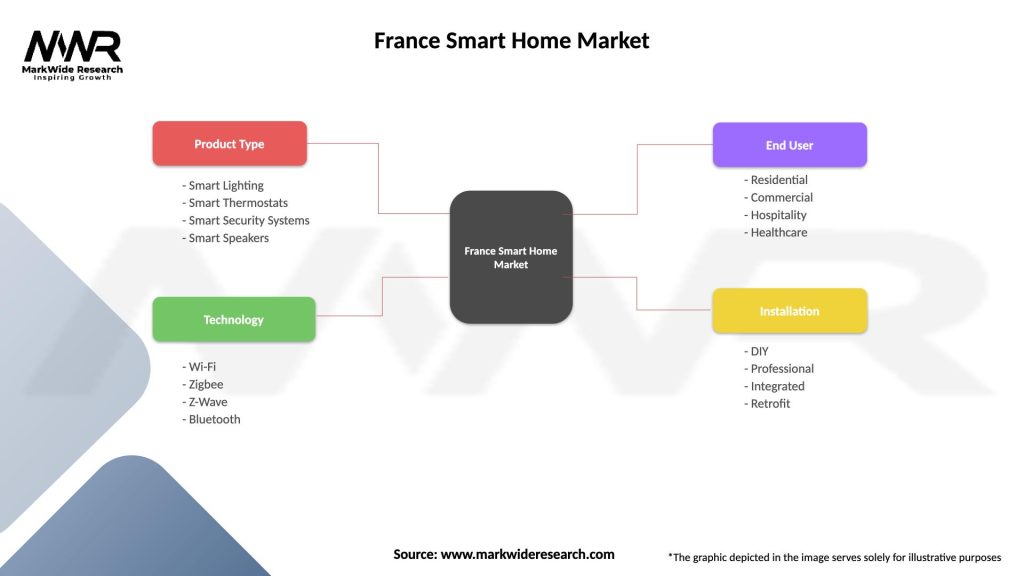

| Segmentation Details | Description |

|---|---|

| Product Type | Smart Lighting, Smart Thermostats, Smart Security Systems, Smart Speakers |

| Technology | Wi-Fi, Zigbee, Z-Wave, Bluetooth |

| End User | Residential, Commercial, Hospitality, Healthcare |

| Installation | DIY, Professional, Integrated, Retrofit |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the France Smart Home Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at