444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The France prefab homes market represents a transformative segment within the country’s construction and housing industry, characterized by innovative manufacturing processes and sustainable building solutions. Prefabricated housing in France has evolved from basic modular structures to sophisticated, energy-efficient homes that meet stringent European building standards. The market encompasses various construction methodologies including modular construction, panelized systems, and manufactured housing solutions designed to address France’s growing housing demands.

Market dynamics indicate robust growth driven by increasing urbanization, housing shortages in major metropolitan areas, and government initiatives promoting sustainable construction practices. The French prefab homes sector benefits from advanced manufacturing technologies, skilled workforce capabilities, and strong regulatory frameworks supporting energy-efficient construction. Current market trends show growing adoption rates of 12.5% annually among first-time homebuyers and urban developers seeking cost-effective housing solutions.

Regional distribution across France demonstrates concentrated activity in Île-de-France, Auvergne-Rhône-Alpes, and Nouvelle-Aquitaine regions, where housing demand significantly exceeds supply. The market serves diverse customer segments including individual homeowners, real estate developers, and social housing organizations. Technological advancement in prefab construction has achieved 35% faster construction timelines compared to traditional building methods, making it an attractive option for addressing France’s housing challenges.

The France prefab homes market refers to the comprehensive ecosystem of companies, technologies, and services involved in designing, manufacturing, and assembling prefabricated residential structures within French territory. Prefabricated homes are residential buildings where components are manufactured in controlled factory environments before being transported and assembled at the final construction site.

This market encompasses various construction approaches including modular homes built in complete sections, panelized systems featuring pre-manufactured wall and roof panels, and hybrid solutions combining traditional and prefabricated elements. The French prefab housing sector operates within strict regulatory frameworks ensuring compliance with national building codes, energy efficiency standards, and environmental sustainability requirements.

Key characteristics of the French prefab homes market include emphasis on energy performance, integration of smart home technologies, and adherence to RT 2012 and upcoming RE 2020 environmental regulations. The market serves both urban and rural applications, offering solutions ranging from affordable social housing to luxury custom-designed residences that maintain French architectural heritage while incorporating modern construction efficiencies.

The France prefab homes market demonstrates exceptional growth potential driven by evolving consumer preferences, technological innovations, and supportive government policies promoting sustainable construction practices. Market expansion is particularly pronounced in urban areas experiencing acute housing shortages, where prefab solutions offer accelerated delivery timelines and cost advantages over conventional construction methods.

Key market drivers include increasing environmental consciousness among French consumers, with 68% of potential homebuyers prioritizing energy-efficient housing options. The sector benefits from advanced manufacturing capabilities, skilled labor availability, and established supply chain networks supporting efficient production and distribution processes. Government initiatives promoting affordable housing development have created favorable conditions for prefab home adoption across multiple market segments.

Competitive landscape features both established construction companies diversifying into prefab solutions and specialized manufacturers focusing exclusively on prefabricated housing systems. Market consolidation trends indicate strategic partnerships between traditional builders and prefab specialists, creating integrated service offerings that combine design expertise with manufacturing efficiency. The sector’s growth trajectory suggests continued expansion supported by technological advancement and increasing market acceptance of prefabricated construction solutions.

Strategic market analysis reveals several critical insights shaping the France prefab homes market landscape. Consumer acceptance of prefabricated housing has increased significantly, with market penetration reaching 8.3% of new residential construction projects nationwide. This growth reflects changing perceptions about prefab quality, design flexibility, and long-term value proposition among French homebuyers.

Market maturation indicators suggest the French prefab homes sector is transitioning from niche market to mainstream construction alternative, supported by improved financing options and increased architect engagement with prefabricated design solutions.

Housing shortage pressures across major French metropolitan areas serve as primary catalysts driving prefab homes market expansion. Urban population growth consistently outpaces new housing supply, creating substantial demand for accelerated construction solutions that prefabricated systems can effectively address. The ability to reduce construction timelines by 40-50% compared to traditional methods makes prefab homes particularly attractive to developers and homebuyers facing urgent housing needs.

Environmental sustainability mandates increasingly influence construction industry practices, with prefab homes offering superior energy efficiency and reduced carbon footprints. Government regulations promoting green building practices create favorable conditions for prefab adoption, as factory-controlled manufacturing processes typically achieve higher insulation standards and reduced material waste compared to on-site construction methods.

Cost optimization benefits drive market growth as prefab homes often provide 15-25% cost savings over comparable traditionally-built residences. These savings result from standardized manufacturing processes, bulk material purchasing, reduced labor requirements, and minimized weather-related construction delays. Economic pressures on French households seeking homeownership make prefab solutions increasingly attractive, particularly for first-time buyers and young families.

Technological advancement in prefab manufacturing enables sophisticated design capabilities and high-quality finishes that rival custom-built homes. Digital design tools, precision manufacturing equipment, and improved transportation systems enhance the overall value proposition of prefabricated housing solutions, attracting consumers who previously considered only traditional construction options.

Cultural perceptions regarding prefabricated construction continue to present challenges within the French housing market, where traditional building methods maintain strong cultural significance. Consumer skepticism about prefab quality, durability, and resale value persists among certain demographic segments, particularly older homebuyers who associate prefabricated construction with temporary or lower-quality housing solutions.

Regulatory complexities surrounding building permits, zoning approvals, and local construction standards can create delays and additional costs for prefab home projects. Municipal authorities may lack familiarity with prefab approval processes, leading to extended review periods and potential complications during project development phases. These administrative challenges can offset some of the time advantages typically associated with prefabricated construction.

Site preparation requirements and foundation work still require traditional construction approaches, limiting the overall time and cost savings achievable through prefab methods. Transportation constraints related to component size, weight restrictions, and access to construction sites can increase project complexity and costs, particularly in dense urban areas or remote rural locations.

Financing limitations may affect prefab home purchases, as some lenders maintain conservative lending policies regarding non-traditional construction methods. Insurance considerations and mortgage approval processes can be more complex for prefab homes, potentially creating barriers for buyers seeking financing for prefabricated housing purchases.

Social housing development presents significant opportunities for prefab homes market expansion, as French government initiatives prioritize affordable housing creation across urban and suburban areas. Public-private partnerships focused on rapid housing delivery can leverage prefab solutions to meet ambitious construction targets while maintaining quality standards and cost effectiveness.

Renovation and extension markets offer substantial growth potential for prefab solutions, particularly in historic French cities where space constraints and preservation requirements favor modular construction approaches. Prefab additions and home extensions can provide homeowners with expanded living space while minimizing disruption to existing structures and neighborhood aesthetics.

Rural housing revitalization initiatives create opportunities for prefab homes to address population decline in rural French regions. Government incentives promoting rural development can support prefab housing projects that attract young families and remote workers to less populated areas, contributing to regional economic development goals.

Disaster recovery applications represent emerging opportunities for prefab housing solutions, providing rapid deployment capabilities for emergency housing needs. Climate change impacts and extreme weather events may increase demand for quickly-deployable, high-quality temporary and permanent housing solutions that prefab manufacturers can efficiently provide.

Export potential to other European markets offers long-term growth opportunities for French prefab home manufacturers, leveraging advanced design capabilities and manufacturing expertise to serve international customers seeking high-quality prefabricated housing solutions.

Supply chain integration continues evolving within the France prefab homes market, with manufacturers developing closer relationships with material suppliers, transportation companies, and assembly contractors. Vertical integration strategies enable better quality control, cost management, and delivery scheduling, creating competitive advantages for companies that successfully coordinate multiple aspects of the prefab housing value chain.

Design innovation drives market differentiation as prefab manufacturers invest in architectural expertise and customization capabilities. Collaboration with architects and interior designers enhances the aesthetic appeal and functional sophistication of prefab homes, addressing consumer concerns about standardized appearances and limited design options.

Technology adoption accelerates across the sector, with manufacturers implementing Industry 4.0 concepts including automated production systems, quality monitoring sensors, and predictive maintenance capabilities. Digital transformation initiatives improve manufacturing efficiency while enabling greater customization and faster response to customer requirements.

Market consolidation trends indicate strategic acquisitions and partnerships as larger construction companies acquire prefab specialists to expand service offerings. Competitive dynamics favor companies that can offer integrated solutions combining traditional construction expertise with prefab manufacturing capabilities, creating comprehensive housing development services.

Regulatory evolution supports market growth as French authorities develop more streamlined approval processes for prefab construction projects. Building code updates increasingly recognize prefab construction methods as equivalent to traditional approaches, reducing regulatory barriers and approval timeframes for prefabricated housing developments.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the France prefab homes market. Primary research includes structured interviews with industry executives, prefab manufacturers, construction professionals, and end-users to gather firsthand perspectives on market trends, challenges, and opportunities.

Secondary research incorporates analysis of government housing statistics, construction industry reports, regulatory documents, and academic studies related to prefabricated construction in France. Data triangulation methods validate findings across multiple sources to ensure research accuracy and reliability.

Market sizing methodologies utilize bottom-up and top-down approaches, analyzing production capacity, sales volumes, and market penetration rates across different prefab housing segments. Statistical analysis techniques identify growth patterns, seasonal variations, and regional differences in market performance.

Expert consultation with industry specialists, construction economists, and housing policy experts provides contextual understanding of market dynamics and future development prospects. Field research includes site visits to prefab manufacturing facilities, construction sites, and completed prefab housing developments to observe operational practices and quality standards.

Trend analysis examines historical market data to identify patterns and project future growth trajectories, while scenario modeling evaluates potential impacts of regulatory changes, economic conditions, and technological developments on market evolution.

Île-de-France region dominates the French prefab homes market, accounting for approximately 28% of national demand due to acute housing shortages and high property values in the Paris metropolitan area. Urban density constraints and expensive land costs make prefab solutions particularly attractive for developers seeking to maximize housing unit delivery while controlling construction costs.

Auvergne-Rhône-Alpes represents the second-largest regional market, driven by economic growth in Lyon, Grenoble, and surrounding urban centers. Industrial infrastructure in this region supports prefab manufacturing operations, while growing population and employment opportunities create sustained housing demand that prefab solutions can efficiently address.

Nouvelle-Aquitaine demonstrates strong market potential, particularly in coastal areas experiencing tourism-driven development and population growth. Rural housing needs and second-home construction contribute to prefab market expansion, with manufacturers developing specialized solutions for vacation homes and retirement residences.

Occitanie region shows increasing prefab adoption, supported by government initiatives promoting affordable housing development and urban renewal projects. Mediterranean climate conditions favor year-round construction activities, enabling efficient prefab manufacturing and assembly operations.

Northern regions including Hauts-de-France and Grand Est present opportunities for prefab market growth, particularly in areas undergoing economic transition and urban revitalization. Cross-border proximity to Germany and Belgium facilitates technology transfer and best practice sharing in prefab construction methods.

Market leadership in the France prefab homes sector features a diverse mix of established construction companies, specialized prefab manufacturers, and innovative startups developing next-generation housing solutions. Competitive positioning varies based on target market segments, technological capabilities, and geographic coverage across French regions.

Strategic partnerships between traditional builders and prefab specialists create integrated service offerings that combine construction expertise with manufacturing efficiency. Market differentiation strategies focus on design innovation, sustainability features, and customer service excellence to establish competitive advantages in the growing prefab housing sector.

By Construction Type:

By Application:

By Price Range:

Modular construction represents the fastest-growing segment within the France prefab homes market, achieving 18.2% annual growth due to superior quality control and reduced construction timelines. Factory-built modules enable precise manufacturing tolerances and consistent quality standards that often exceed site-built construction capabilities.

Panelized systems maintain strong market position among builders seeking to incorporate prefab efficiencies while retaining traditional construction flexibility. Wall panel systems offer particular advantages in French construction markets where local building codes and architectural requirements favor customized approaches to residential development.

Single-family applications dominate market demand, representing approximately 72% of prefab home sales in France. Individual homeowners increasingly recognize prefab advantages including faster delivery, predictable costs, and energy efficiency benefits that align with French environmental regulations and personal sustainability goals.

Multi-family housing presents emerging opportunities as developers explore prefab solutions for apartment buildings and townhouse projects. Urban density requirements and construction efficiency demands make prefab approaches increasingly attractive for large-scale residential developments in major French cities.

Premium segment growth indicates evolving consumer perceptions about prefab quality and design capabilities. High-end prefab homes featuring luxury finishes, smart home technology, and architectural sophistication compete directly with custom-built residences while offering superior construction timelines and cost predictability.

Manufacturers benefit from scalable production systems that enable efficient resource utilization and consistent quality output. Factory-controlled environments reduce weather-related delays, material waste, and labor inefficiencies while enabling year-round production schedules that maximize manufacturing capacity utilization.

Developers gain competitive advantages through accelerated project delivery timelines and predictable construction costs. Prefab solutions enable faster market response to housing demand while reducing financial risks associated with traditional construction delays and cost overruns.

Homebuyers receive superior value propositions including faster occupancy, energy efficiency, and often lower total costs compared to traditionally-built homes. Quality assurance through factory manufacturing processes provides confidence in construction standards and long-term durability.

Financial institutions benefit from reduced lending risks due to predictable construction timelines and standardized quality processes. Prefab construction enables more accurate project cost estimation and timeline prediction, supporting improved loan underwriting and risk management.

Environmental stakeholders gain from reduced construction waste, improved energy efficiency, and lower carbon footprints associated with prefab manufacturing and assembly processes. Sustainable construction practices align with French environmental goals and climate change mitigation strategies.

Local communities experience reduced construction disruption, shorter project timelines, and improved housing availability through efficient prefab development processes that minimize neighborhood impact while addressing housing needs.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability integration drives market evolution as prefab manufacturers increasingly emphasize carbon-neutral construction and renewable energy systems. Green building certifications become standard features in prefab homes, with manufacturers incorporating solar panels, advanced insulation systems, and energy-efficient appliances to meet French environmental regulations.

Smart home technology integration transforms prefab housing offerings, with manufacturers incorporating IoT devices, automated systems, and digital connectivity as standard features. Technology partnerships between prefab manufacturers and smart home companies create comprehensive solutions that appeal to tech-savvy French consumers.

Customization capabilities expand significantly as manufacturers develop flexible design platforms enabling extensive personalization options. Digital design tools allow customers to visualize and modify home layouts, finishes, and features while maintaining manufacturing efficiency and cost advantages.

Urban density solutions emerge as prefab manufacturers develop specialized products for high-density urban environments. Vertical construction techniques and compact design solutions address space constraints in major French cities while maintaining quality and functionality standards.

Circular economy principles influence prefab design and manufacturing, with companies developing recyclable components and modular systems that enable future reconfiguration or relocation. Sustainable materials sourcing and end-of-life planning become integral aspects of prefab home development strategies.

Manufacturing automation advances significantly across French prefab facilities, with companies investing in robotic assembly systems and computer-controlled production equipment. Industry 4.0 implementations improve manufacturing precision while reducing labor costs and production timeframes.

Strategic partnerships between prefab manufacturers and traditional construction companies create integrated service offerings combining manufacturing efficiency with construction expertise. Collaboration agreements enable market expansion and technology sharing that benefits both prefab specialists and established builders.

Government initiatives supporting affordable housing development create favorable conditions for prefab market growth. Public procurement programs increasingly specify prefab solutions for social housing projects, providing stable demand and market validation for prefabricated construction methods.

Research and development investments focus on advanced materials, construction techniques, and energy systems that enhance prefab home performance. University partnerships and government research grants support innovation in sustainable construction technologies and manufacturing processes.

International expansion strategies see French prefab manufacturers exploring export opportunities in European and global markets. Technology licensing agreements and joint ventures enable market entry while leveraging French expertise in prefab design and manufacturing.

Market positioning strategies should emphasize quality, sustainability, and design sophistication to differentiate prefab offerings from traditional construction alternatives. MarkWide Research analysis indicates successful companies focus on premium market segments where prefab advantages create clear value propositions for discerning customers.

Technology investment priorities should include digital design platforms, automated manufacturing systems, and customer visualization tools that enhance the prefab purchasing experience. Digital transformation initiatives enable better customer engagement while improving manufacturing efficiency and quality control processes.

Partnership development with architects, interior designers, and real estate professionals can expand market reach and improve design capabilities. Professional relationships help overcome market perception challenges while providing access to customer networks and design expertise.

Geographic expansion strategies should target regions experiencing housing shortages and supportive regulatory environments. Regional market analysis can identify optimal locations for manufacturing facilities and sales operations that maximize market access and operational efficiency.

Sustainability leadership positions companies advantageously as environmental regulations become more stringent. Green building expertise and carbon-neutral manufacturing processes create competitive advantages while aligning with French climate goals and consumer preferences.

Market expansion prospects remain highly favorable for the France prefab homes sector, with continued growth expected across multiple market segments and geographic regions. Housing demand fundamentals including population growth, urbanization trends, and affordability pressures create sustained opportunities for prefab solutions that address these challenges efficiently.

Technology evolution will continue transforming prefab manufacturing capabilities, with advances in automation, materials science, and digital design enabling more sophisticated and cost-effective housing solutions. Manufacturing innovation is expected to achieve 25% efficiency improvements over the next five years while expanding customization options and reducing environmental impact.

Regulatory support for sustainable construction practices will likely strengthen, creating additional advantages for prefab manufacturers that prioritize environmental performance. Building code evolution toward performance-based standards rather than prescriptive requirements may favor innovative prefab approaches that achieve superior results through non-traditional methods.

Market maturation will see increased consumer acceptance and mainstream adoption of prefab housing solutions. MWR projections suggest prefab market penetration could reach 15-18% of new residential construction within the next decade, representing substantial growth from current levels.

International opportunities may provide additional growth avenues as French prefab expertise gains recognition in global markets. Export potential and technology licensing agreements could create new revenue streams while leveraging domestic market success to support international expansion initiatives.

The France prefab homes market represents a dynamic and rapidly evolving sector within the country’s construction industry, characterized by technological innovation, sustainability focus, and growing consumer acceptance. Market fundamentals including housing shortages, environmental regulations, and cost pressures create favorable conditions for continued prefab market expansion across multiple segments and regions.

Industry transformation through advanced manufacturing technologies, digital design capabilities, and sustainable construction practices positions prefab solutions as increasingly competitive alternatives to traditional building methods. Quality improvements and design sophistication have largely addressed historical consumer concerns while maintaining the core advantages of faster delivery and cost efficiency.

Strategic opportunities exist for companies that can effectively combine manufacturing excellence with customer service, design innovation, and market positioning strategies that emphasize prefab advantages. Market leaders will likely be those organizations that successfully integrate technology, sustainability, and customer experience to create compelling value propositions for French homebuyers and developers.

Future success in the France prefab homes market will depend on continued innovation, strategic partnerships, and effective communication of prefab benefits to consumers, regulators, and industry professionals. Long-term prospects remain highly positive for companies that can navigate market challenges while capitalizing on the substantial opportunities presented by France’s evolving housing needs and construction industry transformation.

What is Prefab Homes?

Prefab homes, or prefabricated homes, are structures that are manufactured off-site in advance, often in sections, and then transported to the building site for assembly. They offer a range of designs and can be customized to meet specific needs.

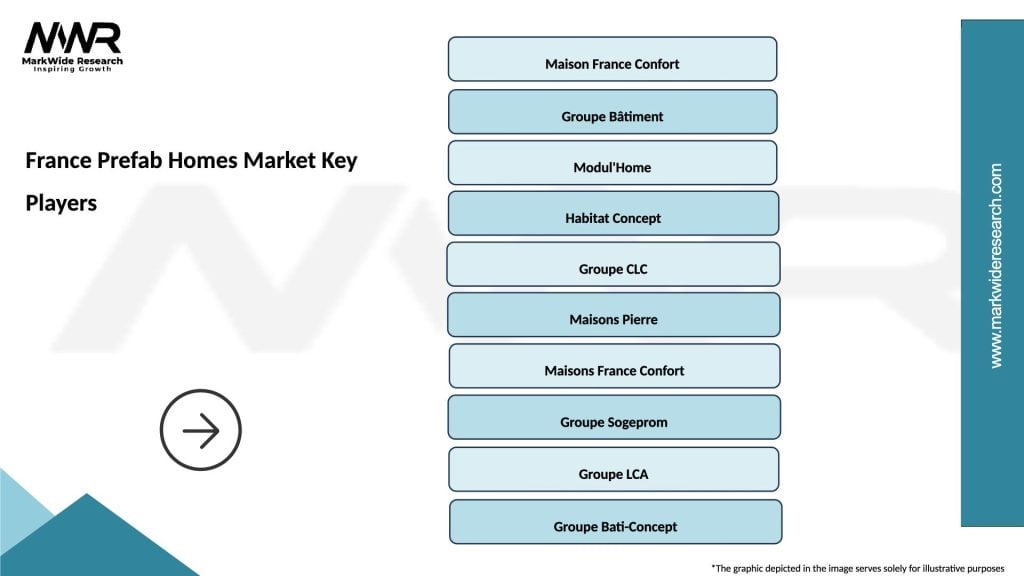

What are the key players in the France Prefab Homes Market?

Key players in the France Prefab Homes Market include companies like Bouygues Construction, Maisons France Confort, and Groupe BDL, which are known for their innovative designs and sustainable building practices, among others.

What are the growth factors driving the France Prefab Homes Market?

The France Prefab Homes Market is driven by factors such as the increasing demand for affordable housing, the need for faster construction methods, and a growing emphasis on sustainability and energy efficiency in building practices.

What challenges does the France Prefab Homes Market face?

Challenges in the France Prefab Homes Market include regulatory hurdles, public perception of prefab homes, and competition from traditional construction methods, which can affect market growth and acceptance.

What opportunities exist in the France Prefab Homes Market?

Opportunities in the France Prefab Homes Market include the potential for innovation in design and materials, the rise of eco-friendly building solutions, and the increasing interest in modular construction techniques among consumers.

What trends are shaping the France Prefab Homes Market?

Trends in the France Prefab Homes Market include a shift towards sustainable building practices, the integration of smart home technologies, and a growing preference for customizable living spaces that cater to individual lifestyles.

France Prefab Homes Market

| Segmentation Details | Description |

|---|---|

| Product Type | Modular Homes, Panelized Homes, Pre-Cut Homes, Hybrid Homes |

| End User | Residential Buyers, Commercial Developers, Government Projects, Non-Profit Organizations |

| Material | Wood, Steel, Concrete, Composite |

| Technology | Smart Home Integration, Energy Efficiency Solutions, Sustainable Building Practices, Prefabrication Techniques |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the France Prefab Homes Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at