444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The France payment market represents one of Europe’s most sophisticated and rapidly evolving financial ecosystems, characterized by widespread digital adoption and innovative payment technologies. French consumers are increasingly embracing contactless payments, mobile wallets, and digital banking solutions, driving significant transformation across the payment landscape. The market demonstrates robust growth potential with digital payment adoption rates reaching approximately 78% among urban populations and continuing to expand into rural areas.

Market dynamics in France reflect a strong shift toward cashless transactions, accelerated by regulatory support from the European Central Bank and local financial authorities. The payment infrastructure benefits from advanced technological frameworks, including widespread point-of-sale terminal deployment and comprehensive mobile payment integration. Traditional banking institutions are collaborating with fintech companies to deliver enhanced payment experiences, while new market entrants continue to introduce innovative solutions targeting specific consumer segments.

Growth trajectories indicate sustained expansion across multiple payment categories, with particular strength in e-commerce transactions, peer-to-peer transfers, and business-to-business payment solutions. The market’s evolution is supported by favorable demographic trends, including high smartphone penetration rates exceeding 85% among adults and increasing comfort with digital financial services across all age groups.

The France payment market refers to the comprehensive ecosystem of financial transaction processing services, technologies, and infrastructure that facilitate monetary exchanges between consumers, businesses, and institutions within the French economy. This market encompasses traditional payment methods such as cash and checks, alongside modern digital solutions including credit and debit cards, mobile payments, online banking transfers, and emerging cryptocurrency platforms.

Payment processing in France involves multiple stakeholders including commercial banks, payment service providers, fintech companies, card networks, and regulatory bodies working together to ensure secure, efficient, and accessible financial transactions. The market includes both consumer-facing payment solutions and business-oriented services such as merchant acquiring, payment gateway services, and enterprise financial management platforms.

Digital transformation has fundamentally reshaped the French payment landscape, with traditional cash-based transactions giving way to electronic alternatives that offer enhanced convenience, security, and tracking capabilities. The market continues to evolve through technological innovation, regulatory changes, and shifting consumer preferences toward seamless, integrated payment experiences.

France’s payment market stands as a leading example of successful digital financial transformation within the European Union, demonstrating remarkable growth across multiple payment channels and technologies. The market benefits from strong regulatory frameworks, advanced technological infrastructure, and high consumer adoption rates that collectively drive sustained expansion and innovation.

Key market characteristics include widespread acceptance of contactless payment technologies, with contactless transaction volumes representing approximately 65% of all card payments in major metropolitan areas. The e-commerce payment segment shows particularly strong performance, supported by robust online retail growth and increasing consumer confidence in digital payment security measures.

Competitive dynamics feature established financial institutions adapting to digital-first strategies while new fintech entrants introduce specialized solutions targeting underserved market segments. The market demonstrates healthy competition across payment processing, mobile wallet services, and business payment solutions, fostering continued innovation and service improvement.

Future prospects remain highly positive, with projected growth driven by increasing smartphone adoption, expanding e-commerce activities, and growing demand for integrated financial services. The market is well-positioned to capitalize on emerging technologies including artificial intelligence, blockchain applications, and enhanced security protocols that will further streamline payment processes.

Strategic market insights reveal several critical trends shaping the French payment landscape and driving long-term growth opportunities across various market segments.

Primary market drivers propelling growth in the French payment market stem from technological advancement, changing consumer behaviors, and supportive regulatory environments that collectively create favorable conditions for continued expansion.

Digital transformation initiatives across French businesses and government institutions accelerate payment modernization efforts, with organizations investing heavily in upgraded payment infrastructure and customer-facing technologies. The widespread adoption of cloud-based payment processing solutions enables smaller businesses to access enterprise-level payment capabilities previously available only to large corporations.

Consumer preference shifts toward convenience and speed drive demand for instant payment solutions, contactless transactions, and integrated shopping experiences that seamlessly combine payment processing with loyalty programs and personalized offers. Demographic trends show younger consumers leading adoption of mobile payment technologies, with usage rates exceeding 72% among adults under 35.

E-commerce growth continues driving payment innovation as online retailers require sophisticated payment processing capabilities to serve diverse customer preferences and international markets. The expansion of omnichannel retail strategies necessitates unified payment systems that work consistently across online, mobile, and physical store environments.

Regulatory support from European Union directives promotes payment market competition and innovation while ensuring consumer protection and data security standards. These frameworks encourage new market entrants and foster technological advancement across the payment ecosystem.

Market restraints in the French payment sector include regulatory complexity, security concerns, and infrastructure challenges that may limit growth potential in certain market segments or geographic regions.

Regulatory compliance costs present significant barriers for smaller payment service providers and fintech startups, requiring substantial investments in legal expertise, technology infrastructure, and ongoing monitoring systems. The complexity of European payment regulations can delay product launches and increase operational expenses for companies seeking to enter or expand within the French market.

Cybersecurity threats continue evolving alongside payment technologies, requiring constant vigilance and investment in advanced security measures that protect consumer data and financial transactions. High-profile security breaches in the financial services sector can temporarily reduce consumer confidence in digital payment methods and slow adoption rates.

Legacy system integration challenges affect established financial institutions and large retailers who must balance modernization efforts with maintaining existing operational capabilities. The cost and complexity of upgrading payment infrastructure can delay implementation of new technologies and limit competitive responsiveness.

Consumer resistance to new payment technologies exists among certain demographic groups, particularly older consumers who prefer traditional payment methods and may be hesitant to adopt mobile or contactless payment solutions. This resistance can limit market penetration in specific segments and geographic areas.

Significant market opportunities exist across multiple segments of the French payment market, driven by technological innovation, changing business models, and evolving consumer expectations that create new revenue streams and growth potential.

Artificial intelligence integration presents opportunities for enhanced fraud detection, personalized payment experiences, and automated financial management services that can differentiate payment providers and increase customer loyalty. Machine learning applications enable more sophisticated risk assessment and real-time transaction optimization.

Small business payment solutions represent an underserved market segment with substantial growth potential, as independent retailers and service providers seek affordable, easy-to-implement payment processing capabilities that rival those available to larger enterprises. The demand for integrated point-of-sale systems combining payment processing with inventory management and customer relationship tools continues expanding.

Cryptocurrency and blockchain technologies offer opportunities for innovative payment solutions that provide enhanced security, reduced transaction costs, and improved cross-border payment capabilities. While regulatory frameworks continue developing, early adopters may gain competitive advantages in serving tech-savvy consumer segments.

Internet of Things integration enables new payment scenarios including connected vehicle payments, smart home commerce, and automated subscription management that can create recurring revenue streams and increase customer engagement with payment platforms.

Market dynamics in the French payment sector reflect complex interactions between technological innovation, regulatory evolution, competitive pressures, and changing consumer behaviors that collectively shape market development and growth trajectories.

Competitive intensity continues increasing as traditional banks face challenges from agile fintech companies offering specialized payment solutions with superior user experiences and lower costs. This competition drives innovation and service improvement across the market while potentially compressing profit margins for established players.

Technology convergence creates new market dynamics as payment processing integrates with other financial services including lending, insurance, and investment management. This convergence enables comprehensive financial platforms that can capture greater customer lifetime value while increasing switching costs for consumers.

Regulatory evolution significantly influences market dynamics through new compliance requirements, data protection standards, and competitive frameworks that can create opportunities for some market participants while imposing constraints on others. Payment service directive implementations have increased market accessibility while raising operational complexity.

Consumer behavior patterns show increasing demand for seamless, integrated payment experiences that work consistently across multiple channels and devices. This trend drives market consolidation as companies seek to offer comprehensive payment ecosystems rather than standalone solutions.

Comprehensive research methodology employed in analyzing the French payment market combines quantitative data analysis with qualitative insights from industry experts, regulatory bodies, and market participants to provide accurate and actionable market intelligence.

Primary research activities include structured interviews with payment service providers, financial institutions, technology vendors, and regulatory officials to gather firsthand insights into market trends, challenges, and opportunities. Survey research among consumers and businesses provides quantitative data on payment preferences, adoption rates, and satisfaction levels across different market segments.

Secondary research sources encompass financial reports from publicly traded companies, regulatory filings, industry publications, and academic studies that provide historical context and market trend analysis. MarkWide Research databases contribute valuable market intelligence and competitive analysis that enhances understanding of market dynamics and growth patterns.

Data validation processes ensure research accuracy through cross-referencing multiple sources, statistical analysis of survey responses, and expert review of findings and conclusions. Market projections incorporate multiple scenario analyses that account for various economic and technological development possibilities.

Analytical frameworks applied include market segmentation analysis, competitive positioning studies, and trend extrapolation models that identify growth opportunities and potential market disruptions. These methodologies provide comprehensive market understanding that supports strategic decision-making for industry participants.

Regional market analysis reveals significant variations in payment adoption patterns, infrastructure development, and growth opportunities across different geographic areas within France, reflecting diverse economic conditions and demographic characteristics.

Paris and Île-de-France region demonstrate the highest digital payment adoption rates, with metropolitan areas showing 82% contactless payment usage among regular consumers. This region benefits from advanced technological infrastructure, high smartphone penetration, and concentrated fintech activity that drives innovation and market development.

Major urban centers including Lyon, Marseille, and Toulouse show strong payment market growth supported by robust e-commerce activities, growing startup ecosystems, and increasing consumer comfort with digital financial services. These cities serve as regional hubs for payment technology deployment and market expansion initiatives.

Rural and semi-rural areas present both challenges and opportunities for payment market growth, with lower digital adoption rates but significant potential for market expansion as infrastructure improvements and targeted education programs increase accessibility to modern payment solutions.

Cross-border regions along France’s borders with Germany, Switzerland, and other European Union countries show unique payment patterns influenced by international commerce and tourism activities. These areas require specialized payment solutions that accommodate multiple currencies and regulatory frameworks.

Tourism-dependent regions including the French Riviera and Alpine areas demonstrate seasonal payment volume fluctuations that create opportunities for flexible, scalable payment processing solutions designed to handle variable transaction loads efficiently.

Competitive landscape in the French payment market features a diverse mix of established financial institutions, innovative fintech companies, and international payment processors competing across multiple market segments and customer categories.

Market competition drives continuous innovation in payment technologies, customer service quality, and pricing strategies as companies seek to differentiate their offerings and capture market share across various customer segments.

Market segmentation analysis reveals distinct customer categories and payment types that require specialized solutions and targeted marketing approaches to maximize growth potential and customer satisfaction.

By Payment Type:

By End User:

Category-wise analysis provides detailed understanding of performance patterns, growth opportunities, and competitive dynamics within specific segments of the French payment market.

Consumer Payment Solutions demonstrate strong growth driven by increasing smartphone adoption and consumer preference for convenient, secure payment methods. Mobile wallet adoption rates have reached approximately 58% among smartphone users, with particularly strong uptake in urban areas and among younger demographics. This category benefits from continuous feature enhancement including loyalty program integration, spending analytics, and social payment capabilities.

Business Payment Services show robust demand as companies seek to optimize cash flow management, reduce payment processing costs, and improve customer experience through streamlined checkout processes. The segment includes point-of-sale systems, online payment gateways, and enterprise payment management platforms that serve businesses of all sizes.

E-commerce Payment Processing represents a high-growth category driven by expanding online retail activities and increasing consumer comfort with digital shopping experiences. This segment requires sophisticated fraud prevention capabilities, multiple payment method support, and seamless integration with e-commerce platforms and marketplaces.

Cross-border Payment Solutions gain importance as French businesses increase international trade activities and consumers engage in global e-commerce. This category faces challenges from currency exchange complexities and regulatory requirements but offers significant growth potential as globalization continues.

Industry participants in the French payment market enjoy numerous benefits from market growth and technological advancement that create value for payment service providers, financial institutions, merchants, and consumers.

Payment Service Providers benefit from expanding market opportunities, recurring revenue streams, and opportunities to develop specialized solutions for underserved market segments. The growing demand for integrated payment solutions enables providers to increase customer lifetime value through comprehensive service offerings.

Financial Institutions gain competitive advantages through payment innovation that enhances customer relationships, reduces operational costs, and creates new revenue opportunities. Digital payment capabilities help banks retain customers and attract new account holders seeking modern banking experiences.

Merchants and Retailers experience improved cash flow management, reduced transaction costs, and enhanced customer satisfaction through efficient payment processing capabilities. Advanced payment solutions provide valuable customer data and analytics that support business decision-making and marketing efforts.

Consumers enjoy increased convenience, enhanced security, and greater choice in payment methods that suit their preferences and lifestyle needs. Digital payment solutions offer features such as spending tracking, instant transfers, and integrated rewards programs that add value beyond basic transaction processing.

Technology Vendors find growing demand for payment infrastructure, security solutions, and integration services that support market expansion and innovation. The evolving payment landscape creates opportunities for specialized technology providers to develop niche solutions and capture market share.

Strengths:

Weaknesses:

Opportunities:

Threats:

Key market trends shaping the French payment landscape reflect broader technological and social changes that influence consumer behavior, business operations, and competitive dynamics across the payment ecosystem.

Contactless Payment Expansion continues accelerating with tap-to-pay transactions representing 69% of all card payments in major French cities. This trend extends beyond traditional retail environments into public transportation, vending machines, and service industries where speed and convenience are priorities.

Mobile-First Payment Design becomes standard practice as payment providers prioritize smartphone-optimized experiences that integrate seamlessly with other mobile applications and services. This trend drives development of comprehensive digital wallets that combine payment processing with loyalty programs, coupons, and social features.

Artificial Intelligence Integration enhances payment security through advanced fraud detection algorithms while enabling personalized payment experiences based on individual spending patterns and preferences. AI-powered systems help reduce false positive fraud alerts while maintaining high security standards.

Subscription Economy Support grows as more businesses adopt recurring revenue models that require sophisticated payment processing capabilities for automated billing, dunning management, and customer retention optimization. This trend creates demand for specialized payment solutions that handle complex subscription scenarios.

Social Commerce Integration emerges as social media platforms incorporate payment capabilities that enable direct purchasing within social applications, creating new payment processing opportunities and changing consumer shopping behaviors.

Recent industry developments highlight significant changes in the French payment market that influence competitive positioning, regulatory compliance, and technology adoption across various market segments.

Open Banking Implementation has transformed the competitive landscape by enabling third-party payment providers to access bank account information and initiate payments directly, creating new business models and increasing competition for traditional banking services. This development has accelerated fintech growth and enhanced consumer choice in payment solutions.

Instant Payment System Launch by the European Central Bank provides real-time payment processing capabilities that enable immediate fund transfers between bank accounts, reducing settlement times and improving cash flow management for businesses and consumers. MWR analysis indicates strong adoption potential for instant payment services across multiple market segments.

Cryptocurrency Regulation Advancement has provided clearer frameworks for digital currency payment processing, enabling more financial institutions and payment providers to offer cryptocurrency-related services while maintaining compliance with anti-money laundering and consumer protection requirements.

Biometric Authentication Integration has enhanced payment security through fingerprint, facial recognition, and voice authentication technologies that reduce fraud risk while improving user experience by eliminating the need for passwords and PINs in many payment scenarios.

Green Payment Initiatives have gained momentum as payment providers implement environmentally sustainable practices including digital receipts, carbon offset programs, and energy-efficient payment processing infrastructure that appeals to environmentally conscious consumers and businesses.

Strategic recommendations for market participants focus on leveraging emerging opportunities while addressing key challenges that could impact long-term growth and competitive positioning in the French payment market.

Investment in Security Infrastructure remains critical as cyber threats continue evolving and consumer trust depends on robust protection of financial data and transaction information. Payment providers should prioritize advanced encryption, multi-factor authentication, and real-time fraud monitoring capabilities that exceed regulatory requirements and industry standards.

Customer Experience Optimization should focus on creating seamless, intuitive payment processes that work consistently across multiple channels and devices. Companies should invest in user interface design, customer support capabilities, and integration with popular e-commerce platforms and mobile applications.

Partnership Strategy Development can accelerate market expansion through collaborations with fintech companies, technology vendors, and industry-specific solution providers. Strategic partnerships enable access to new customer segments, specialized expertise, and innovative technologies without requiring substantial internal development investments.

Regulatory Compliance Planning should anticipate future regulatory changes and ensure payment solutions can adapt quickly to new requirements. Companies should maintain close relationships with regulatory bodies and invest in flexible technology architectures that support rapid compliance updates.

Market Segment Specialization offers opportunities to develop deep expertise in specific customer categories or payment types that may be underserved by larger, generalist payment providers. Specialization can create competitive advantages and premium pricing opportunities in niche markets.

Future market outlook for the French payment sector remains highly positive, with multiple growth drivers supporting continued expansion and innovation across various payment categories and customer segments over the coming years.

Technology advancement will continue driving market evolution through artificial intelligence applications, blockchain implementations, and Internet of Things integration that create new payment scenarios and enhance existing service capabilities. MarkWide Research projects that emerging technologies will contribute to sustained market growth and competitive differentiation opportunities.

Consumer behavior evolution toward digital-first financial services will accelerate payment market growth, with digital payment adoption rates expected to reach 85% among all adult demographics within the next five years. This trend supports expansion opportunities for mobile payment providers and digital wallet services.

Business digitalization initiatives across French companies will drive demand for comprehensive payment management solutions that integrate with enterprise resource planning systems, customer relationship management platforms, and e-commerce infrastructure. This trend creates opportunities for B2B payment service providers and technology integrators.

Cross-border payment growth will benefit from continued European Union integration and increasing global trade activities that require efficient, cost-effective international payment processing capabilities. French payment providers are well-positioned to serve as gateways for European market expansion by international businesses.

Regulatory evolution will likely continue supporting market competition and innovation while maintaining strong consumer protection standards that build trust in digital payment systems and encourage broader adoption across all demographic groups and geographic regions.

The France payment market demonstrates exceptional growth potential and innovation capacity, positioning itself as a leading example of successful digital financial transformation within the European payment ecosystem. Strong market fundamentals including advanced infrastructure, supportive regulatory frameworks, and high consumer adoption rates create favorable conditions for sustained expansion across multiple payment categories and customer segments.

Market participants benefit from diverse opportunities ranging from traditional payment processing services to emerging technologies such as artificial intelligence, blockchain applications, and Internet of Things integration. The competitive landscape encourages continuous innovation while providing multiple pathways for market entry and growth, whether through direct competition, strategic partnerships, or specialized niche solutions.

Future prospects remain highly promising as digital payment adoption continues expanding, business digitalization accelerates, and new technologies create additional payment scenarios and service capabilities. The French payment market’s combination of stability, innovation, and growth potential makes it an attractive opportunity for both established financial institutions and emerging fintech companies seeking to capture value from the ongoing transformation of financial services.

What is France Payment?

France Payment refers to the various methods and systems used for financial transactions within France, including credit and debit cards, mobile payments, and online banking solutions.

What are the key players in the France Payment Market?

Key players in the France Payment Market include companies like BNP Paribas, Société Générale, and Worldline, which provide a range of payment processing services and solutions, among others.

What are the main drivers of growth in the France Payment Market?

The main drivers of growth in the France Payment Market include the increasing adoption of digital payment methods, the rise of e-commerce, and consumer demand for faster and more secure transaction options.

What challenges does the France Payment Market face?

Challenges in the France Payment Market include regulatory compliance issues, cybersecurity threats, and the need to keep up with rapidly changing consumer preferences and technological advancements.

What opportunities exist in the France Payment Market?

Opportunities in the France Payment Market include the expansion of contactless payment technologies, the growth of fintech startups, and the potential for enhanced cross-border payment solutions.

What trends are shaping the France Payment Market?

Trends shaping the France Payment Market include the increasing use of mobile wallets, the integration of artificial intelligence in fraud detection, and the growing emphasis on sustainability in payment solutions.

France Payment Market

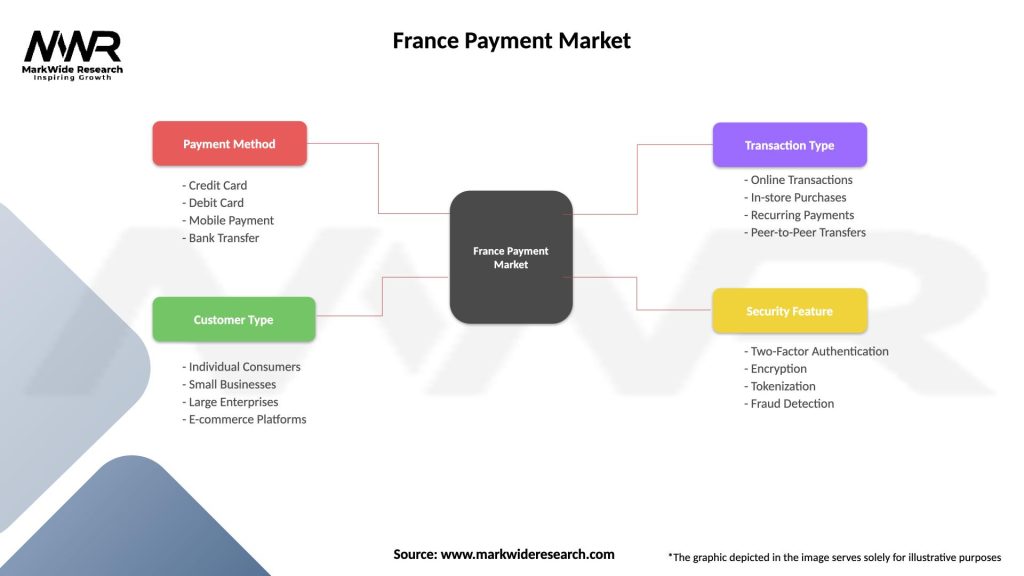

| Segmentation Details | Description |

|---|---|

| Payment Method | Credit Card, Debit Card, Mobile Payment, Bank Transfer |

| Customer Type | Individual Consumers, Small Businesses, Large Enterprises, E-commerce Platforms |

| Transaction Type | Online Transactions, In-store Purchases, Recurring Payments, Peer-to-Peer Transfers |

| Security Feature | Two-Factor Authentication, Encryption, Tokenization, Fraud Detection |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the France Payment Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at