444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The France motor insurance market has experienced significant growth in recent years, driven by the increasing number of vehicles on the road and the mandatory requirement for motor insurance. Motor insurance, also known as auto insurance, provides financial protection to vehicle owners against physical damage and bodily injury resulting from accidents. It plays a crucial role in safeguarding both individuals and businesses from potential liabilities arising from road accidents.

Meaning

Motor insurance refers to a contract between an individual or organization and an insurance company. This contract ensures that the insured party receives financial compensation for any damage caused to their vehicle or third-party vehicles, property, or individuals in the event of an accident. The policyholder pays a premium to the insurance company in exchange for the coverage provided. Motor insurance policies vary in terms of coverage options, premiums, deductibles, and other factors.

Executive Summary

The France motor insurance market has witnessed steady growth over the years, driven by factors such as the increasing number of vehicles, government regulations mandating motor insurance, and rising awareness about the benefits of insurance coverage. The market is highly competitive, with several insurance companies offering a wide range of motor insurance products to cater to the diverse needs of vehicle owners.

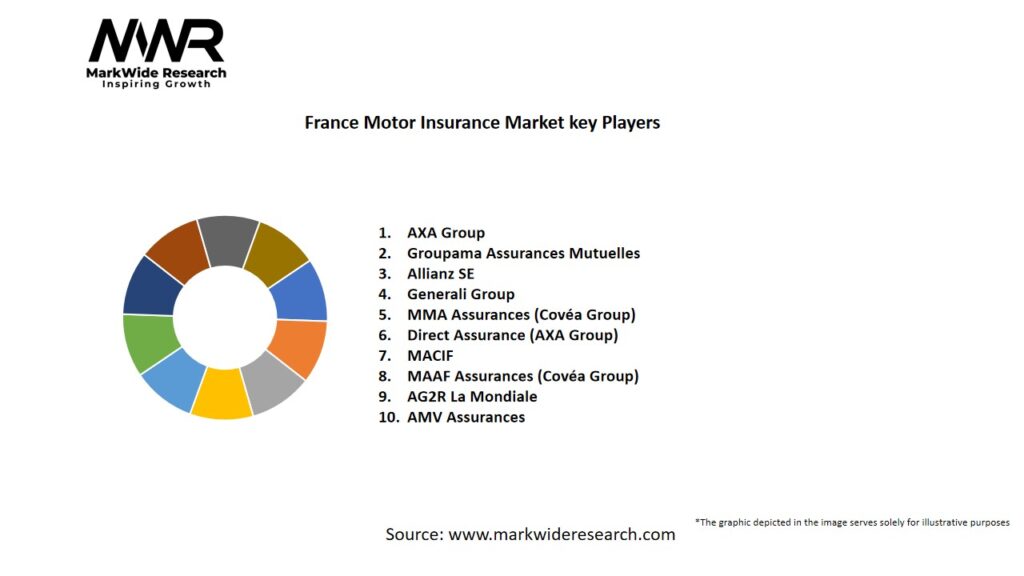

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The France motor insurance market is dynamic and constantly evolving. It is influenced by various factors such as government regulations, economic conditions, technological advancements, and changing customer preferences. Insurance companies need to adapt to these dynamics and stay ahead of the competition to ensure sustained growth and profitability.

Regional Analysis

The motor insurance market in France exhibits regional variations in terms of insurance penetration and customer preferences. Urban areas with higher population densities and higher vehicle ownership tend to have greater demand for motor insurance. Additionally, regions with higher accident rates or vehicle theft incidents may have higher insurance premiums.

Competitive Landscape

Leading Companies in the France Motor Insurance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The France motor insurance market can be segmented based on various factors, including insurance type, vehicle type, customer segment, and distribution channel. Common insurance types include third-party liability insurance, comprehensive insurance, and specialized coverage for commercial vehicles or high-value vehicles. Vehicle types can include cars, motorcycles, trucks, and other commercial vehicles.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic had a significant impact on the France motor insurance market. During the lockdown periods, there was a decline in vehicle usage and a reduction in accidents, leading to a temporary decrease in insurance claims. However, the pandemic also highlighted the importance of insurance coverage as individuals became more conscious of financial risks. The market experienced shifts in customer preferences, with increased interest in usage-based insurance and flexible coverage options to accommodate changing driving habits.

Key Industry Developments

Analyst Suggestions

Future Outlook

The France motor insurance market is expected to continue its growth trajectory in the coming years. Factors such as increasing vehicle ownership, regulatory mandates, and technological advancements will drive market expansion. The integration of telematics, usage-based insurance, and digitalization will reshape the industry, providing opportunities for insurers to offer personalized and efficient insurance solutions. However, insurance companies will need to address challenges such as price competition, fraud prevention, and changing customer preferences to maintain profitability and sustain growth.

Conclusion

The France motor insurance market is a dynamic and competitive industry driven by the increasing number of vehicles and government mandates for insurance coverage. The market offers opportunities for insurers to provide financial protection to vehicle owners and mitigate potential liabilities arising from accidents. Technological advancements, such as telematics and digitalization, are transforming the industry and enabling personalized insurance solutions. To succeed in this evolving market, insurers need to embrace technological innovations, prioritize customer satisfaction, and collaborate with relevant stakeholders. The future outlook for the motor insurance market in France is promising, with continued growth expected in the coming years.

What is Motor Insurance?

Motor insurance is a type of insurance policy that provides financial protection against physical damage or bodily injury resulting from traffic collisions, as well as liability that could arise from incidents involving vehicles. It typically covers various aspects such as property damage, medical expenses, and theft.

What are the key players in the France Motor Insurance Market?

Key players in the France Motor Insurance Market include AXA, Groupama, and Allianz, which offer a range of motor insurance products tailored to different consumer needs. These companies compete on factors such as coverage options, pricing, and customer service, among others.

What are the growth factors driving the France Motor Insurance Market?

The France Motor Insurance Market is driven by factors such as the increasing number of vehicles on the road, rising awareness of the importance of insurance, and regulatory requirements mandating coverage. Additionally, advancements in technology are enabling more personalized insurance solutions.

What challenges does the France Motor Insurance Market face?

The France Motor Insurance Market faces challenges such as rising claims costs due to more severe accidents and fraud, as well as regulatory pressures that can affect pricing and profitability. Additionally, competition from insurtech companies is reshaping traditional business models.

What opportunities exist in the France Motor Insurance Market?

Opportunities in the France Motor Insurance Market include the potential for growth in telematics-based insurance products, which offer personalized premiums based on driving behavior. There is also an increasing demand for eco-friendly vehicle insurance options as consumers become more environmentally conscious.

What trends are shaping the France Motor Insurance Market?

Trends in the France Motor Insurance Market include the rise of digital platforms for policy management and claims processing, as well as the integration of artificial intelligence in underwriting and customer service. Additionally, there is a growing focus on customer-centric products and services.

France Motor Insurance Market

| Segmentation Details | Description |

|---|---|

| Coverage Type | Third Party, Comprehensive, Fire & Theft, Personal Accident |

| Customer Type | Individual, Fleet, Commercial, Corporate |

| Vehicle Type | Passenger Cars, Motorcycles, Vans, Trucks |

| Policy Duration | Short-term, Annual, Multi-year, Pay-as-you-go |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at