444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The France luxury real estate market represents one of Europe’s most prestigious and sophisticated property sectors, characterized by exceptional growth dynamics and international investor appeal. France’s luxury property landscape encompasses prime residential estates, historic châteaux, premium urban apartments, and exclusive coastal properties across renowned regions including Paris, French Riviera, Provence, and Bordeaux. The market demonstrates remarkable resilience with annual growth rates exceeding 8.5% in premium segments, driven by sustained international demand and limited supply of exceptional properties.

Market dynamics indicate strong performance across multiple luxury segments, with foreign investment representing approximately 45% of total luxury transactions. The sector benefits from France’s stable political environment, robust legal framework for property ownership, and the country’s enduring appeal as a lifestyle destination. Premium properties in Paris’s arrondissements and the French Riviera continue commanding significant premiums, while emerging luxury markets in Lyon, Bordeaux, and Alpine regions show accelerating growth trajectories.

Investment patterns reveal sophisticated buyer preferences for properties offering unique historical significance, architectural excellence, or exceptional locations. The market attracts diverse international clientele, including European Union residents, North American investors, and increasingly, buyers from Asia-Pacific regions seeking stable luxury assets with strong appreciation potential.

The France luxury real estate market refers to the premium property sector encompassing high-value residential and commercial properties that command prices significantly above average market rates due to exceptional location, architectural significance, historical importance, or exclusive amenities. This market segment typically includes properties valued above €1 million in secondary markets and €2 million in prime locations like Paris and the French Riviera.

Luxury real estate in France encompasses diverse property types including historic châteaux, contemporary villas, premium apartments in prestigious arrondissements, waterfront estates, vineyard properties, and ski chalets in Alpine regions. These properties distinguish themselves through superior craftsmanship, prime locations, extensive grounds, unique architectural features, or significant historical provenance that appeals to affluent domestic and international buyers.

Market characteristics include limited supply, high barriers to entry, sophisticated buyer profiles, and strong correlation with global wealth creation trends. The sector operates through specialized networks of luxury real estate professionals, private wealth managers, and international property consultants who facilitate transactions for ultra-high-net-worth individuals and institutional investors.

France’s luxury real estate sector demonstrates exceptional market strength with sustained growth across key regions and property categories. The market benefits from France’s stable economic environment, favorable tax policies for certain property types, and the country’s unparalleled lifestyle appeal among global luxury buyers. International demand continues driving market expansion, with buyers attracted to France’s rich cultural heritage, world-class amenities, and strategic European location.

Key performance indicators reveal robust transaction volumes in premium segments, with luxury property sales increasing by approximately 12% annually in major markets. Paris maintains its position as Europe’s leading luxury real estate destination, while regional markets including Provence, Bordeaux, and Alpine regions experience accelerating growth driven by lifestyle migration trends and remote work adoption.

Market segmentation shows strong performance across residential estates, urban luxury apartments, historic properties, and recreational real estate. The sector attracts diverse investment motivations including primary residence acquisition, vacation home purchases, investment portfolio diversification, and wealth preservation strategies. Technology integration and sustainable luxury development represent emerging trends shaping future market evolution.

Strategic market analysis reveals several critical insights driving France’s luxury real estate sector performance and future trajectory:

Multiple factors contribute to the sustained growth and attractiveness of France’s luxury real estate market, creating favorable conditions for continued expansion and international investment interest.

Economic stability represents a fundamental driver, with France’s robust legal framework, transparent property ownership laws, and stable political environment providing confidence for long-term real estate investments. The country’s membership in the European Union facilitates property acquisition for EU residents while maintaining attractive investment conditions for international buyers through established legal structures.

Cultural and lifestyle appeal continues attracting global luxury buyers seeking properties in regions renowned for exceptional quality of life, world-class cuisine, historic significance, and natural beauty. France’s reputation for luxury craftsmanship, architectural excellence, and cultural sophistication enhances property desirability and long-term value appreciation potential.

Limited supply dynamics in prime locations create scarcity value, particularly for historic properties, waterfront estates, and properties in protected areas where development restrictions maintain exclusivity. This supply constraint supports price stability and appreciation in established luxury markets while creating opportunities in emerging regions.

Infrastructure development and connectivity improvements enhance property accessibility and desirability, with high-speed rail connections, international airports, and digital infrastructure supporting luxury lifestyle requirements and facilitating property management for international owners.

Several challenges impact France’s luxury real estate market dynamics, requiring careful consideration by investors and market participants seeking optimal investment outcomes.

Regulatory complexity presents significant barriers, with French property law, tax obligations, and administrative requirements creating complexity for international buyers. Transaction costs including notary fees, registration taxes, and legal expenses can represent substantial percentages of property values, impacting overall investment returns and buyer decision-making processes.

Tax implications for non-resident owners include wealth taxes, rental income taxation, and inheritance tax considerations that may influence investment attractiveness for certain buyer segments. Changes in tax policy or international tax treaties can affect investment calculations and long-term ownership strategies.

Market liquidity constraints in ultra-luxury segments mean properties may require extended marketing periods to achieve optimal sale prices, limiting flexibility for investors requiring rapid asset liquidation. This illiquidity factor particularly affects unique or highly specialized properties with limited buyer pools.

Currency fluctuations impact international buyers’ purchasing power and investment returns, with exchange rate volatility affecting transaction timing and long-term investment performance for non-Euro zone investors. Economic uncertainty in global markets can influence luxury spending patterns and international investment flows into French real estate.

Significant opportunities exist within France’s luxury real estate market for investors, developers, and service providers capable of identifying emerging trends and unmet market demands.

Regional market expansion presents substantial opportunities beyond traditional luxury centers, with cities like Lyon, Bordeaux, Toulouse, and Strasbourg showing increasing appeal for luxury property development and investment. These markets offer relative value compared to Paris and the French Riviera while providing strong lifestyle amenities and growth potential.

Sustainable luxury development represents a growing opportunity as environmentally conscious buyers seek properties incorporating renewable energy systems, sustainable materials, and eco-friendly design principles. Green building certifications and energy-efficient renovations of historic properties create value differentiation and appeal to contemporary luxury buyers.

Technology integration opportunities include smart home systems, advanced security technologies, and digital property management platforms that enhance luxury living experiences and property operational efficiency. These technological enhancements increasingly influence buyer preferences and property valuations in competitive luxury markets.

Fractional ownership models and luxury real estate investment platforms create opportunities for broader investor participation in high-value properties, potentially expanding the buyer base and improving market liquidity for certain property types.

France’s luxury real estate market operates within complex dynamics influenced by global economic conditions, demographic trends, regulatory changes, and evolving buyer preferences that shape transaction patterns and investment flows.

Supply and demand imbalances characterize most prime luxury markets, with limited availability of exceptional properties supporting price stability and appreciation. New luxury development faces regulatory constraints in historic areas and environmental protection zones, maintaining scarcity value for existing premium properties while creating opportunities in approved development areas.

Buyer demographics continue evolving, with younger ultra-high-net-worth individuals showing different preferences compared to traditional luxury buyers. These emerging buyers often prioritize sustainability, technology integration, and flexible living arrangements that accommodate remote work and lifestyle mobility.

Seasonal market patterns influence transaction timing, with spring and early autumn representing peak activity periods for luxury property viewings and sales. Holiday rental potential increasingly influences luxury property valuations, particularly in tourist destinations where properties can generate substantial rental income during peak seasons.

Global wealth creation trends directly impact luxury real estate demand, with technology entrepreneurship, private equity success, and cryptocurrency wealth creating new buyer segments with distinct property preferences and acquisition approaches.

Comprehensive market analysis employs multiple research methodologies to ensure accurate representation of France’s luxury real estate market conditions, trends, and future prospects.

Primary research includes extensive interviews with luxury real estate professionals, property developers, wealth managers, and recent luxury property buyers across major French markets. This qualitative research provides insights into buyer motivations, market challenges, and emerging trends not captured in transaction data alone.

Secondary data analysis incorporates official property registration records, luxury real estate transaction databases, and market reports from established industry sources. Statistical analysis of price trends, transaction volumes, and market segmentation provides quantitative foundation for market assessments and projections.

Geographic market surveys cover key luxury real estate regions including Paris arrondissements, French Riviera municipalities, Provence markets, Bordeaux wine country, Alpine resort areas, and emerging luxury destinations. This regional analysis ensures comprehensive market coverage and identification of local market dynamics.

Comparative analysis with other European luxury real estate markets provides context for France’s market performance and competitive positioning. Trend analysis incorporates global luxury spending patterns, wealth migration trends, and lifestyle preference evolution affecting luxury real estate demand.

France’s luxury real estate market demonstrates significant regional variation in performance, buyer preferences, and investment opportunities across the country’s diverse geographic and cultural landscapes.

Paris and Île-de-France maintain market leadership with approximately 35% of national luxury transactions, driven by international business presence, cultural attractions, and limited supply of premium properties in prestigious arrondissements. The 1st, 6th, 7th, 8th, and 16th arrondissements command highest prices, while emerging areas like the 11th and 20th show growing luxury development activity.

French Riviera represents France’s second-largest luxury market, encompassing Monaco’s periphery, Cannes, Nice, Saint-Tropez, and exclusive coastal communities. This region attracts international buyers seeking Mediterranean lifestyle properties, with waterfront estates showing annual appreciation rates exceeding 10% in prime locations.

Provence-Alpes-Côte d’Azur offers luxury properties combining historic charm with natural beauty, attracting buyers seeking authentic French countryside experiences. Markets in Aix-en-Provence, Avignon, and rural Provence show steady growth driven by lifestyle migration and vacation home demand.

Bordeaux and Nouvelle-Aquitaine benefit from wine tourism, historic architecture, and relative value compared to traditional luxury centers. The region shows emerging market growth rates approaching 15% annually in premium segments, supported by improved transportation links and lifestyle appeal.

Alpine regions including Chamonix, Courchevel, and Megève maintain strong luxury markets focused on ski properties and mountain estates, with seasonal demand patterns and international buyer concentration from neighboring countries.

France’s luxury real estate market features a sophisticated ecosystem of specialized professionals, international networks, and established firms serving ultra-high-net-worth clientele across diverse property segments and geographic markets.

Market competition centers on property portfolio quality, international buyer networks, marketing capabilities, and specialized knowledge of local luxury markets. Technology adoption and digital marketing sophistication increasingly differentiate leading firms in reaching global luxury buyers.

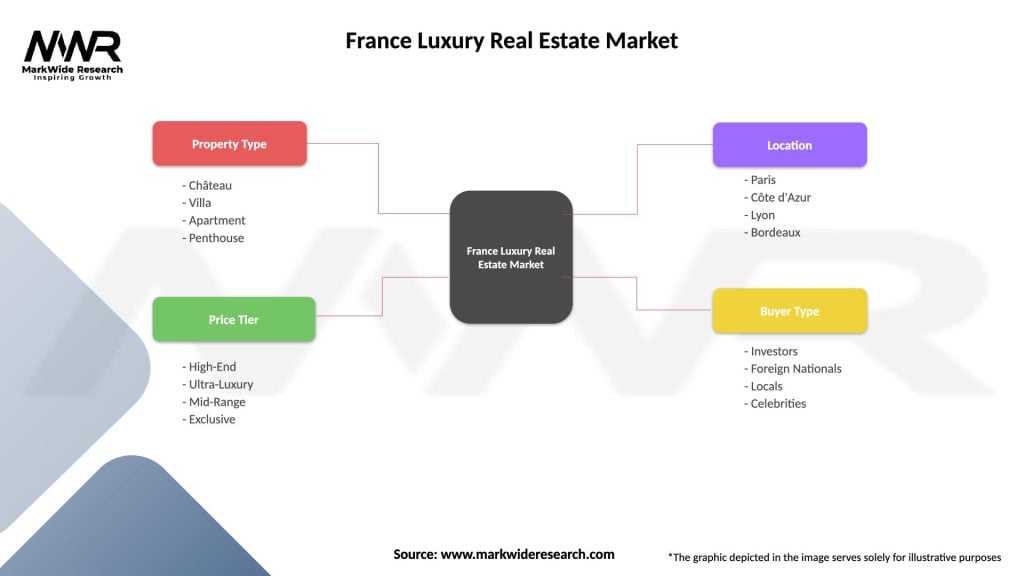

France’s luxury real estate market demonstrates clear segmentation patterns across multiple dimensions, enabling targeted analysis of buyer preferences, investment opportunities, and market dynamics within specific property categories and geographic regions.

By Property Type:

By Geographic Region:

Detailed analysis of luxury real estate categories reveals distinct market dynamics, buyer preferences, and investment characteristics that influence property performance and future prospects across France’s diverse luxury market segments.

Historic Properties demonstrate exceptional market resilience with appreciation rates averaging 9.2% annually for well-maintained châteaux and heritage estates. These properties attract buyers seeking unique architectural features, historical significance, and cultural prestige. Restoration projects create value-addition opportunities while preserving France’s architectural heritage, though regulatory requirements and specialized expertise increase complexity and costs.

Contemporary Luxury Residences show strong performance in urban markets and resort destinations, with buyers prioritizing modern amenities, energy efficiency, and smart home technologies. New construction in approved luxury developments commands premium pricing while offering customization opportunities and latest building standards.

Waterfront Properties maintain premium market positioning with limited supply and strong international demand. Mediterranean coastal estates show particular strength, benefiting from climate advantages, tourism infrastructure, and lifestyle appeal. Environmental regulations and coastal protection measures limit new development, supporting existing property values.

Investment Properties including luxury rental estates and hospitality-focused properties benefit from France’s strong tourism industry and short-term rental market growth. Rental yield potential varies significantly by location and property type, with prime tourist destinations offering highest income generation possibilities.

France’s luxury real estate market offers substantial benefits for diverse stakeholder groups, creating value through various mechanisms and supporting broader economic development across luxury property regions.

For Property Investors:

For Real Estate Professionals:

For Local Communities:

Comprehensive SWOT analysis reveals France’s luxury real estate market positioning, competitive advantages, and strategic considerations for future development and investment decisions.

Strengths:

Weaknesses:

Opportunities:

Threats:

Several transformative trends shape France’s luxury real estate market evolution, influencing buyer behavior, property development, and investment strategies across the sector.

Sustainability Integration emerges as a dominant trend with luxury buyers increasingly prioritizing environmental responsibility and energy efficiency. Green building certifications and renewable energy systems become standard expectations rather than premium features, with sustainable properties commanding price premiums approaching 15% in competitive markets.

Technology Adoption accelerates across luxury properties, with smart home systems, advanced security technologies, and integrated automation becoming essential amenities. Virtual reality marketing and digital property tours expand international buyer reach while reducing travel requirements for initial property evaluation.

Lifestyle Migration trends drive demand for properties offering space, privacy, and outdoor amenities as remote work capabilities enable location flexibility for affluent buyers. Rural luxury markets benefit from this trend, with properties offering home office capabilities and high-speed internet connectivity showing increased demand.

Fractional Ownership Models gain acceptance among luxury buyers seeking access to premium properties without full ownership responsibilities. These innovative ownership structures expand market accessibility while maintaining property exclusivity and professional management standards.

Wellness-Focused Properties incorporating spa facilities, fitness centers, and health-oriented design elements appeal to luxury buyers prioritizing personal wellness and lifestyle quality in their property decisions.

Recent developments within France’s luxury real estate sector demonstrate market evolution, regulatory changes, and emerging opportunities that influence investment strategies and market dynamics.

Regulatory Modernization initiatives streamline property acquisition processes for international buyers while maintaining market oversight and transparency requirements. Digital documentation and electronic signature capabilities reduce transaction complexity and timeline requirements for luxury property purchases.

Infrastructure Investments in high-speed rail connections, airport expansions, and digital connectivity enhance property accessibility and desirability across French regions. The Grand Paris Express project significantly impacts luxury property values in connected suburban areas, creating new premium residential opportunities.

Sustainable Development Incentives encourage eco-friendly property renovations and new construction through tax benefits and expedited approval processes. These initiatives support market trends toward environmental responsibility while maintaining luxury standards and amenities.

International Marketing Expansion by French luxury real estate professionals increases global market reach through digital platforms, international property exhibitions, and strategic partnerships with overseas wealth management firms. MarkWide Research indicates these marketing initiatives contribute to increased international buyer engagement rates exceeding 25% in targeted markets.

Hospitality Integration trends see luxury properties incorporating hotel-style services and amenities, creating hybrid residential-hospitality experiences that appeal to ultra-high-net-worth buyers seeking comprehensive lifestyle solutions.

Strategic recommendations for market participants focus on capitalizing on emerging opportunities while navigating market challenges and regulatory requirements effectively.

For Investors: Diversify across multiple French regions to balance risk and opportunity, with particular attention to emerging luxury markets in secondary cities offering relative value and growth potential. Due diligence should emphasize legal compliance, tax implications, and long-term market fundamentals rather than short-term appreciation expectations.

For Developers: Focus on sustainable luxury development incorporating environmental certifications, smart home technologies, and wellness amenities that appeal to contemporary luxury buyers. Location selection should prioritize areas with infrastructure development plans and regulatory support for luxury property development.

For Real Estate Professionals: Invest in technology platforms and digital marketing capabilities to reach international buyers effectively while developing specialized expertise in luxury market segments and regulatory requirements. Partnership strategies with international wealth management firms and luxury service providers enhance client value propositions.

For Stakeholders: Monitor regulatory developments, tax policy changes, and international economic conditions that influence luxury real estate investment flows and market dynamics. Market timing considerations should account for seasonal patterns, economic cycles, and currency fluctuation impacts on international buyer activity.

France’s luxury real estate market demonstrates strong fundamentals supporting continued growth and international investment appeal over the medium to long term, despite potential short-term volatility from global economic conditions.

Market projections indicate sustained growth across key luxury segments, with annual appreciation rates expected to maintain 6-8% ranges in prime locations supported by limited supply and continued international demand. Regional diversification trends will likely continue, with secondary luxury markets gaining market share as buyers seek value and lifestyle alternatives to traditional premium centers.

Technology integration will accelerate, with smart home capabilities, sustainable technologies, and digital property management becoming standard expectations rather than premium features. Virtual reality and augmented reality technologies will enhance international buyer engagement and streamline property evaluation processes.

Demographic evolution among luxury buyers will influence property preferences, with younger ultra-high-net-worth individuals prioritizing flexibility, sustainability, and technology integration in their property decisions. Generational wealth transfer will create new buyer segments with distinct preferences and acquisition approaches.

Regulatory environment evolution will likely focus on balancing international investment attraction with local market stability and environmental protection objectives. MWR analysis suggests policy frameworks will continue supporting luxury real estate investment while implementing measures ensuring sustainable development and community benefit.

Global economic integration will maintain France’s position as a preferred luxury real estate destination, with the country’s political stability, cultural appeal, and strategic location supporting long-term market attractiveness for international investors seeking premium European property assets.

France’s luxury real estate market represents a sophisticated and resilient sector offering substantial opportunities for investors, developers, and service providers capable of navigating its complexities and capitalizing on emerging trends. The market’s strength derives from France’s unique combination of cultural heritage, lifestyle appeal, regulatory stability, and strategic European location that continues attracting international luxury buyers seeking exceptional properties.

Market fundamentals remain robust despite global economic uncertainties, with limited supply in prime locations, sustained international demand, and evolving buyer preferences supporting continued growth and value appreciation. The sector’s diversification across property types, geographic regions, and buyer segments provides resilience against market volatility while creating multiple investment and development opportunities.

Future success in France’s luxury real estate market will depend on adapting to evolving buyer preferences, embracing technological innovations, and maintaining focus on sustainability and lifestyle quality that define contemporary luxury property expectations. MarkWide Research analysis indicates the market’s long-term prospects remain positive, supported by France’s enduring appeal as a luxury lifestyle destination and the country’s commitment to maintaining its position as a leading global luxury real estate market.

What is France Luxury Real Estate?

France Luxury Real Estate refers to high-end properties in France, including villas, penthouses, and historic estates, often located in prestigious areas such as Paris, the French Riviera, and Provence.

What are the key players in the France Luxury Real Estate Market?

Key players in the France Luxury Real Estate Market include companies like Knight Frank, Savills, and Sotheby’s International Realty, which specialize in high-value properties and cater to affluent clients, among others.

What are the main drivers of the France Luxury Real Estate Market?

The main drivers of the France Luxury Real Estate Market include the increasing demand from international buyers, the appeal of France’s cultural heritage, and the stability of the French economy, which attracts investment in luxury properties.

What challenges does the France Luxury Real Estate Market face?

Challenges in the France Luxury Real Estate Market include regulatory hurdles, fluctuating market conditions, and the impact of global economic uncertainties, which can affect buyer confidence and investment.

What opportunities exist in the France Luxury Real Estate Market?

Opportunities in the France Luxury Real Estate Market include the growing trend of remote work, which has led to increased interest in second homes, and the potential for sustainable luxury developments that appeal to environmentally conscious buyers.

What trends are shaping the France Luxury Real Estate Market?

Trends shaping the France Luxury Real Estate Market include a rise in demand for smart home technology, a focus on wellness amenities, and a shift towards properties with outdoor spaces, reflecting changing lifestyle preferences.

France Luxury Real Estate Market

| Segmentation Details | Description |

|---|---|

| Property Type | Château, Villa, Apartment, Penthouse |

| Price Tier | High-End, Ultra-Luxury, Mid-Range, Exclusive |

| Location | Paris, Côte d’Azur, Lyon, Bordeaux |

| Buyer Type | Investors, Foreign Nationals, Locals, Celebrities |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the France Luxury Real Estate Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at