444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The France lithium-ion battery for electric vehicle market represents one of Europe’s most dynamic and rapidly evolving sectors, driven by ambitious government policies, increasing consumer adoption, and substantial investments in clean transportation infrastructure. France’s commitment to achieving carbon neutrality by 2050 has positioned the country as a leader in electric vehicle adoption and battery technology development across the European Union.

Market dynamics indicate that France is experiencing unprecedented growth in electric vehicle sales, with lithium-ion batteries serving as the cornerstone technology enabling this transformation. The French automotive industry, home to renowned manufacturers like Renault and Peugeot, has embraced electrification as a strategic priority, driving demand for advanced battery solutions. Government incentives and regulatory frameworks continue to accelerate market penetration, with electric vehicle registrations growing at a remarkable 45% annually over the past three years.

Industrial partnerships between French automakers and international battery manufacturers have established France as a critical hub for lithium-ion battery production and innovation in Europe. The country’s strategic location, skilled workforce, and robust research infrastructure make it an attractive destination for battery manufacturing investments. Technological advancements in battery chemistry, energy density, and charging capabilities are continuously improving the performance and affordability of electric vehicles in the French market.

The France lithium-ion battery for electric vehicle market refers to the comprehensive ecosystem encompassing the production, distribution, and application of lithium-ion battery technologies specifically designed for electric vehicles operating within the French automotive sector. This market includes battery cells, modules, packs, and associated management systems that power passenger cars, commercial vehicles, and two-wheelers across France.

Lithium-ion battery technology represents the dominant energy storage solution for electric vehicles due to its superior energy density, longer lifespan, and declining costs compared to alternative battery chemistries. In the French context, this market encompasses both domestic battery production facilities and imported battery systems integrated into vehicles manufactured or sold within France. Market participants include battery manufacturers, automotive OEMs, component suppliers, and technology developers contributing to the electric vehicle value chain.

France’s lithium-ion battery market for electric vehicles stands at the forefront of Europe’s clean transportation revolution, characterized by robust growth trajectories and substantial investment commitments from both public and private sectors. The market benefits from strong governmental support through the France Relance recovery plan and the European Green Deal initiatives, which prioritize sustainable mobility solutions and battery technology development.

Key market drivers include stringent emissions regulations, expanding charging infrastructure, and increasing consumer awareness of environmental sustainability. French consumers are demonstrating growing acceptance of electric vehicles, with battery performance improvements addressing traditional concerns about range anxiety and charging times. The market is witnessing significant technological innovations in battery chemistry, with next-generation lithium-ion technologies promising enhanced energy density and faster charging capabilities.

Strategic partnerships between French automotive manufacturers and global battery suppliers are establishing integrated supply chains and localized production capabilities. The government’s commitment to supporting domestic battery manufacturing through the Important Projects of Common European Interest (IPCEI) framework is attracting substantial investments in gigafactory developments across France.

Market analysis reveals several critical insights shaping the France lithium-ion battery for electric vehicle market:

Regulatory frameworks serve as the primary catalyst driving France’s lithium-ion battery market for electric vehicles. The French government’s comprehensive climate action plan includes ambitious targets for electric vehicle adoption, supported by substantial financial incentives and regulatory mandates. Emissions standards are becoming increasingly stringent, compelling automotive manufacturers to accelerate their electrification strategies and invest heavily in battery technology development.

Consumer behavior shifts represent another significant market driver, with French consumers demonstrating growing environmental consciousness and willingness to adopt sustainable transportation solutions. Rising fuel costs and increasing awareness of air quality issues in urban areas are motivating consumers to consider electric vehicles as viable alternatives to traditional combustion engines. Total cost of ownership advantages are becoming more apparent as battery costs decline and government incentives reduce purchase prices.

Technological advancements in lithium-ion battery technology continue to address historical barriers to electric vehicle adoption. Improvements in energy density are extending vehicle range, while faster charging capabilities are reducing charging times to levels comparable with traditional refueling. Battery management systems are becoming more sophisticated, optimizing performance and extending battery lifespan, which enhances the overall value proposition for consumers.

Infrastructure development across France is creating an enabling environment for electric vehicle adoption. The government’s commitment to installing comprehensive charging networks, combined with private sector investments in charging infrastructure, is addressing range anxiety concerns and supporting market growth.

Supply chain challenges pose significant constraints on the France lithium-ion battery market, particularly regarding the availability of critical raw materials such as lithium, cobalt, and nickel. Global supply chain disruptions and geopolitical tensions have highlighted the vulnerability of battery supply chains, leading to price volatility and potential supply shortages. Raw material costs fluctuations can significantly impact battery pricing and overall electric vehicle affordability.

Manufacturing capacity limitations represent another key restraint, as current European battery production capacity remains insufficient to meet projected demand growth. The time required to establish new gigafactory facilities and scale production capabilities creates temporary supply-demand imbalances. Technical expertise shortages in battery manufacturing and electric vehicle integration pose additional challenges for rapid market expansion.

Consumer adoption barriers persist despite growing market acceptance, including concerns about charging infrastructure availability, battery degradation, and resale values. Initial purchase costs for electric vehicles, despite government incentives, remain higher than comparable conventional vehicles, limiting market penetration among price-sensitive consumers.

Regulatory uncertainties regarding future policy directions and incentive programs create planning challenges for manufacturers and consumers. Changes in government support levels or regulatory requirements could significantly impact market dynamics and investment decisions.

Gigafactory development presents substantial opportunities for establishing France as a European leader in lithium-ion battery manufacturing. Strategic partnerships between French companies and international battery manufacturers are creating opportunities for technology transfer and domestic production capabilities. Government support through the IPCEI framework and regional development programs provides favorable conditions for large-scale manufacturing investments.

Circular economy initiatives offer significant opportunities for developing comprehensive battery recycling and second-life applications. As the first generation of electric vehicle batteries reaches end-of-life, opportunities emerge for establishing efficient recycling processes and recovering valuable materials. Battery repurposing for stationary energy storage applications creates additional revenue streams and extends battery lifecycle value.

Technology innovation opportunities exist in developing next-generation battery chemistries, solid-state batteries, and advanced battery management systems. French research institutions and companies are well-positioned to contribute to breakthrough technologies that could provide competitive advantages in global markets. Collaboration opportunities with European partners through Horizon Europe programs support joint research and development initiatives.

Export potential to other European markets and emerging economies presents growth opportunities as French battery manufacturing capabilities mature. The country’s strategic location and established automotive industry provide advantages for serving broader European markets.

Competitive dynamics in the France lithium-ion battery market are intensifying as both established automotive manufacturers and new entrants compete for market share. Traditional French automakers like Renault and Stellantis are forming strategic alliances with battery manufacturers to secure supply chains and develop proprietary technologies. Market consolidation trends are evident as companies seek to achieve economies of scale and technological synergies.

Innovation cycles are accelerating, with battery energy density improvements of approximately 8% annually driving enhanced vehicle performance and consumer acceptance. MarkWide Research analysis indicates that technological advancement rates are exceeding initial projections, with solid-state battery technologies potentially reaching commercial viability earlier than anticipated.

Price dynamics reflect the ongoing cost reduction trends in lithium-ion battery technology, with manufacturing scale increases and technological improvements driving down unit costs. Learning curve effects in battery manufacturing are contributing to cost reductions, making electric vehicles increasingly competitive with conventional alternatives.

Supply chain evolution is characterized by efforts to establish more resilient and localized supply networks. French companies are investing in upstream integration and strategic partnerships to secure critical material supplies and reduce dependency on single-source suppliers.

Comprehensive market analysis for the France lithium-ion battery for electric vehicle market employs a multi-faceted research approach combining primary and secondary data sources. Primary research includes structured interviews with industry executives, government officials, and technology experts across the electric vehicle and battery manufacturing value chain.

Secondary research encompasses analysis of government publications, industry reports, patent filings, and financial statements from key market participants. Data validation processes ensure accuracy and reliability through cross-referencing multiple sources and expert verification procedures.

Market modeling techniques incorporate quantitative analysis of historical trends, current market conditions, and forward-looking projections based on identified drivers and constraints. Scenario analysis evaluates potential market outcomes under different regulatory, technological, and economic conditions.

Industry expert consultations provide qualitative insights into market dynamics, competitive positioning, and future development prospects. Regular engagement with stakeholders ensures research findings reflect current market realities and emerging trends.

Regional distribution across France reveals distinct patterns in electric vehicle adoption and battery market development. The Île-de-France region, encompassing Paris and surrounding areas, leads in electric vehicle registrations with approximately 35% market share, driven by urban mobility needs and comprehensive charging infrastructure.

Auvergne-Rhône-Alpes emerges as a significant manufacturing hub, hosting major automotive and battery component production facilities. The region benefits from established industrial infrastructure and proximity to European markets, making it attractive for battery manufacturing investments. Government incentives at regional levels complement national policies in supporting electric vehicle adoption.

Hauts-de-France is positioning itself as a key player in battery manufacturing, with several announced gigafactory projects expected to commence operations in the coming years. The region’s strategic location near major European markets and existing automotive manufacturing capabilities provide competitive advantages.

Southern regions including Provence-Alpes-Côte d’Azur and Occitanie show growing electric vehicle adoption rates, supported by favorable climate conditions for electric vehicle operation and increasing charging infrastructure deployment. Rural areas present both challenges and opportunities, with lower current adoption rates but significant potential for growth as charging infrastructure expands.

Market leadership in France’s lithium-ion battery sector involves a combination of international battery manufacturers and domestic automotive companies establishing strategic partnerships. The competitive landscape is characterized by rapid evolution and significant investment commitments:

Strategic alliances and joint ventures are common competitive strategies, enabling companies to combine technological expertise, manufacturing capabilities, and market access. Vertical integration trends are evident as automotive manufacturers seek greater control over battery supply chains and technology development.

By Battery Type:

By Vehicle Type:

By Application:

Passenger car segment dominates the France lithium-ion battery market, accounting for approximately 75% of total battery demand. This segment benefits from strong consumer incentives, expanding model availability, and improving charging infrastructure. Premium vehicle manufacturers are leading adoption with high-performance electric vehicles featuring advanced battery technologies.

Commercial vehicle applications represent the fastest-growing segment, with annual growth rates exceeding 60% as fleet operators recognize operational cost advantages and regulatory compliance benefits. Last-mile delivery applications are particularly strong, driven by e-commerce growth and urban emission restrictions.

Battery chemistry preferences vary by application, with NMC technologies dominating passenger car applications due to energy density requirements, while LFP batteries gain traction in commercial applications where cost and safety are prioritized over maximum range. Technology evolution continues toward higher energy densities and faster charging capabilities across all segments.

Manufacturing localization efforts are focusing on establishing domestic production capabilities for key battery components, reducing supply chain risks and supporting local employment. Research and development investments are concentrated on next-generation technologies including solid-state batteries and advanced recycling processes.

Automotive manufacturers benefit from access to advanced battery technologies that enable competitive electric vehicle offerings and compliance with emissions regulations. Strategic partnerships with battery suppliers provide technology access, supply security, and cost optimization opportunities while reducing development risks and time-to-market.

Battery manufacturers gain access to one of Europe’s largest automotive markets with strong government support and growing consumer acceptance. Manufacturing investments in France provide strategic positioning for serving broader European markets while benefiting from skilled workforce availability and research infrastructure.

Government stakeholders achieve environmental policy objectives through accelerated electric vehicle adoption while supporting domestic industrial development and employment creation. Economic benefits include reduced dependence on fossil fuel imports and positioning France as a leader in clean transportation technologies.

Consumers benefit from expanding electric vehicle choices, improving performance characteristics, and declining costs supported by government incentives. Environmental benefits include reduced emissions and improved air quality, particularly in urban areas.

Research institutions and universities gain opportunities for collaboration with industry partners on cutting-edge battery technologies and sustainable transportation solutions. Innovation ecosystems develop around battery technology hubs, creating additional economic and technological benefits.

Strengths:

Weaknesses:

Opportunities:

Threats:

Solid-state battery development represents the most significant technological trend, with French research institutions and companies actively pursuing breakthrough technologies that promise higher energy densities, improved safety, and faster charging capabilities. Commercial viability of solid-state batteries is expected within the next decade, potentially revolutionizing electric vehicle performance characteristics.

Sustainability focus is driving increased emphasis on battery recycling, responsible sourcing, and circular economy principles. MarkWide Research indicates that sustainability considerations are becoming increasingly important in consumer purchasing decisions and corporate procurement policies.

Manufacturing localization trends continue accelerating, with multiple gigafactory announcements and investments in domestic battery production capabilities. Supply chain resilience concerns are motivating strategic efforts to reduce dependencies on single-source suppliers and geographically concentrated production.

Vehicle-to-grid integration is emerging as a significant trend, with electric vehicle batteries serving dual purposes as mobile energy storage and grid stabilization resources. Smart charging technologies are enabling optimized charging patterns that support grid stability and renewable energy integration.

Battery-as-a-Service business models are gaining traction, offering consumers alternatives to traditional battery ownership and addressing concerns about battery degradation and replacement costs.

Major investment announcements have characterized recent industry developments, with several international battery manufacturers committing to establish production facilities in France. Stellantis announced plans for multiple gigafactory developments across Europe, including significant investments in French facilities.

Research partnerships between French institutions and international companies are advancing battery technology development, with particular focus on solid-state batteries and sustainable manufacturing processes. Government funding through various research programs is supporting collaborative innovation initiatives.

Regulatory developments include updated emissions standards and electric vehicle mandates that are accelerating market transformation. EU battery regulations are establishing comprehensive requirements for battery sustainability, recycling, and supply chain transparency.

Infrastructure investments continue expanding, with both public and private sector commitments to comprehensive charging network development. Fast-charging technologies are being deployed to address consumer concerns about charging times and convenience.

Strategic acquisitions and partnerships are reshaping the competitive landscape, with companies seeking to strengthen their positions in battery technology, manufacturing capabilities, and market access.

Investment priorities should focus on establishing domestic battery manufacturing capabilities while developing strategic partnerships with international technology leaders. Government support programs should continue emphasizing both demand-side incentives and supply-side manufacturing investments to create comprehensive market development.

Technology development efforts should prioritize next-generation battery chemistries, particularly solid-state technologies, while maintaining competitiveness in current lithium-ion technologies. Research collaboration between industry and academic institutions should be strengthened to accelerate innovation cycles.

Supply chain strategies must address critical material dependencies through diversification, strategic partnerships, and recycling capabilities. Circular economy initiatives should be integrated into business models from the outset rather than as afterthoughts.

Market positioning should leverage France’s strengths in automotive manufacturing, research capabilities, and strategic location while addressing weaknesses in domestic production capacity. Export opportunities should be developed as domestic capabilities mature.

Regulatory engagement remains crucial for ensuring policy stability and continued government support for market development. Industry collaboration on standards development and best practices will benefit all market participants.

Market projections indicate continued robust growth in France’s lithium-ion battery market for electric vehicles, with annual growth rates expected to maintain momentum above 25% through 2030. Technology advancement will continue driving performance improvements and cost reductions, making electric vehicles increasingly competitive with conventional alternatives.

Manufacturing capacity expansion will significantly reduce import dependencies, with domestic production expected to meet a substantial portion of national demand by the end of the decade. MWR analysis suggests that France could become a net exporter of battery technologies to other European markets as production capabilities mature.

Innovation leadership in next-generation battery technologies positions France to capture significant value in the global transition to electric mobility. Solid-state battery commercialization could provide competitive advantages and export opportunities for French companies.

Sustainability initiatives will become increasingly important, with comprehensive recycling capabilities and circular economy principles integrated throughout the value chain. Consumer acceptance will continue growing as charging infrastructure expands and vehicle performance improves.

Policy evolution will likely include additional support for manufacturing development while gradually reducing consumer incentives as market maturity increases. International cooperation on battery standards and supply chain development will support market growth and stability.

France’s lithium-ion battery market for electric vehicles represents a transformative opportunity at the intersection of environmental sustainability, technological innovation, and economic development. The market benefits from strong governmental support, established automotive industry presence, and growing consumer acceptance of electric mobility solutions.

Strategic investments in domestic manufacturing capabilities, combined with continued technology development and infrastructure expansion, position France to become a European leader in battery technologies and electric vehicle adoption. Challenges remain in establishing supply chain resilience and achieving cost competitiveness, but the overall market trajectory remains highly positive.

Future success will depend on continued collaboration between government, industry, and research institutions to address technological challenges, develop sustainable business models, and maintain competitive positioning in the rapidly evolving global electric vehicle market. The foundation for long-term growth and leadership in clean transportation technologies is firmly established in France.

What is Lithium-ion Battery for Electric Vehicle?

Lithium-ion batteries for electric vehicles are rechargeable batteries that use lithium ions as a key component of their electrochemistry. They are widely used in electric vehicles due to their high energy density, efficiency, and ability to be recharged multiple times.

What are the key players in the France Lithium-ion Battery For Electric Vehicle Market?

Key players in the France Lithium-ion Battery for Electric Vehicle market include companies like Saft Groupe, Renault, and TotalEnergies, which are involved in battery manufacturing and electric vehicle production, among others.

What are the growth factors driving the France Lithium-ion Battery For Electric Vehicle Market?

The growth of the France Lithium-ion Battery for Electric Vehicle market is driven by increasing demand for electric vehicles, government incentives for clean energy, and advancements in battery technology that enhance performance and reduce costs.

What challenges does the France Lithium-ion Battery For Electric Vehicle Market face?

Challenges in the France Lithium-ion Battery for Electric Vehicle market include supply chain issues for raw materials, environmental concerns regarding battery disposal, and competition from alternative energy storage technologies.

What opportunities exist in the France Lithium-ion Battery For Electric Vehicle Market?

Opportunities in the France Lithium-ion Battery for Electric Vehicle market include the expansion of charging infrastructure, innovations in battery recycling technologies, and partnerships between automotive manufacturers and battery producers to enhance product offerings.

What trends are shaping the France Lithium-ion Battery For Electric Vehicle Market?

Trends in the France Lithium-ion Battery for Electric Vehicle market include the shift towards solid-state batteries, increased focus on sustainability in battery production, and the integration of smart technologies in battery management systems.

France Lithium-ion Battery For Electric Vehicle Market

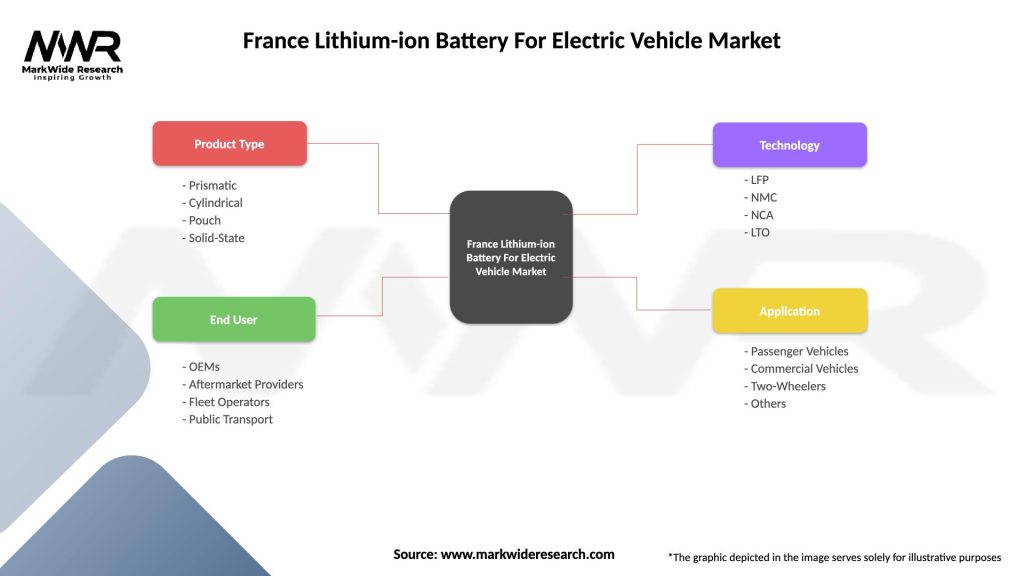

| Segmentation Details | Description |

|---|---|

| Product Type | Prismatic, Cylindrical, Pouch, Solid-State |

| End User | OEMs, Aftermarket Providers, Fleet Operators, Public Transport |

| Technology | LFP, NMC, NCA, LTO |

| Application | Passenger Vehicles, Commercial Vehicles, Two-Wheelers, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the France Lithium-ion Battery For Electric Vehicle Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at