444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The France LED lighting market represents a dynamic and rapidly evolving sector within the country’s broader lighting industry, characterized by significant technological advancement and increasing adoption across residential, commercial, and industrial applications. France’s commitment to energy efficiency and environmental sustainability has positioned the nation as a leading adopter of LED technology in Europe, with the market experiencing robust growth driven by government initiatives, regulatory frameworks, and consumer awareness of energy-saving benefits.

Market dynamics in France reflect a comprehensive shift from traditional lighting technologies toward advanced LED solutions, with the market demonstrating strong growth momentum at approximately 8.2% CAGR over recent years. The French LED lighting landscape encompasses diverse applications ranging from residential retrofits to large-scale commercial installations, smart city initiatives, and industrial automation projects. Energy efficiency regulations implemented by the French government have accelerated market adoption, while technological innovations in smart lighting systems and IoT integration continue to expand market opportunities.

Regional distribution across France shows concentrated activity in major metropolitan areas including Paris, Lyon, Marseille, and Toulouse, where commercial and industrial demand drives significant market volume. The market benefits from France’s strong manufacturing base, established electrical infrastructure, and progressive environmental policies that favor energy-efficient lighting solutions. Consumer preferences increasingly favor LED products offering superior longevity, reduced energy consumption, and enhanced lighting quality compared to traditional incandescent and fluorescent alternatives.

The France LED lighting market refers to the comprehensive ecosystem of light-emitting diode lighting products, systems, and services sold, installed, and maintained within French territory, encompassing residential, commercial, industrial, and outdoor lighting applications across diverse end-user segments.

LED technology represents a semiconductor-based lighting solution that converts electrical energy directly into light through electroluminescence, offering superior energy efficiency, extended operational lifespan, and reduced environmental impact compared to conventional lighting technologies. In the French context, this market includes indoor and outdoor LED fixtures, smart lighting systems, decorative LED products, automotive lighting applications, and specialized industrial LED solutions designed to meet specific French regulatory standards and consumer preferences.

Market scope encompasses the entire value chain from LED component manufacturing and assembly to distribution, installation, and maintenance services. The French LED lighting market operates within a regulatory framework that emphasizes energy efficiency, environmental protection, and product safety standards, creating a structured environment that promotes high-quality LED solutions while ensuring consumer protection and market stability.

France’s LED lighting market demonstrates exceptional growth potential driven by strong government support for energy efficiency initiatives, increasing consumer awareness of environmental benefits, and technological advancements in smart lighting systems. The market has achieved significant penetration across multiple sectors, with commercial applications leading adoption rates at approximately 72% market share, followed by residential and industrial segments showing accelerating growth trajectories.

Key market drivers include stringent energy efficiency regulations, favorable government incentives for LED adoption, rising electricity costs, and growing demand for smart city infrastructure development. The French market benefits from established distribution networks, strong retail presence, and increasing availability of financing options for large-scale LED retrofit projects. Technological innovation continues to expand market opportunities through developments in connected lighting systems, human-centric lighting solutions, and advanced control technologies.

Market challenges include initial cost considerations for premium LED products, technical complexity in smart lighting installations, and competition from imported products. However, these challenges are offset by declining LED prices, improving product quality, and increasing awareness of total cost of ownership benefits. The market outlook remains highly positive with continued growth expected across all major segments, supported by ongoing urbanization, infrastructure modernization, and environmental sustainability initiatives.

Strategic market insights reveal several critical trends shaping the France LED lighting landscape:

Market maturity indicators suggest France has moved beyond early adoption phases into mainstream market acceptance, with LED technology becoming the preferred choice for new installations and replacement projects across most applications. This maturity creates opportunities for premium products, specialized solutions, and value-added services while maintaining competitive pressure on pricing and performance standards.

Government regulations serve as the primary catalyst for LED market growth in France, with energy efficiency mandates, building codes, and environmental standards creating strong demand for LED lighting solutions. The French government’s commitment to reducing carbon emissions and achieving climate targets has resulted in comprehensive policies favoring energy-efficient lighting technologies, including financial incentives, tax benefits, and mandatory efficiency standards for public buildings and new construction projects.

Energy cost considerations drive significant market demand as French businesses and consumers seek to reduce electricity expenses through LED adoption. With LED technology offering up to 85% energy savings compared to traditional lighting, the compelling economic case for LED conversion continues to accelerate market growth across all sectors. Rising electricity prices and increasing focus on operational cost optimization further strengthen the value proposition for LED lighting investments.

Technological advancement in LED products creates expanding market opportunities through improved performance, enhanced features, and new application possibilities. Developments in smart lighting systems, tunable white technology, human-centric lighting, and IoT integration attract premium market segments while driving overall market expansion. Product innovation continues to address specific French market needs including design aesthetics, installation flexibility, and integration with existing building systems.

Environmental awareness among French consumers and businesses supports market growth through increasing demand for sustainable lighting solutions. LED technology’s environmental benefits including reduced energy consumption, longer lifespan, and recyclable components align with France’s sustainability goals and corporate environmental responsibility initiatives, creating strong market pull across multiple sectors.

Initial cost barriers continue to challenge LED market penetration, particularly in price-sensitive segments where upfront investment requirements may deter adoption despite long-term savings potential. While LED prices have declined significantly, premium products and smart lighting systems still require substantial initial capital, creating hesitation among budget-conscious consumers and small businesses. Financing limitations for large-scale retrofit projects can delay implementation timelines and reduce market growth velocity.

Technical complexity in advanced LED systems presents implementation challenges, particularly for smart lighting installations requiring specialized knowledge and integration expertise. The complexity of dimming systems, control protocols, and IoT connectivity can create installation difficulties and increase project costs. Compatibility issues with existing electrical infrastructure and building management systems may require additional investment in supporting equipment and professional installation services.

Market saturation concerns in mature segments may limit future growth opportunities as LED adoption reaches high penetration levels in certain applications. The replacement market cycle for LED products, while longer than traditional lighting, eventually creates periods of reduced demand as installed LED systems continue operating efficiently for extended periods. Product commoditization pressures margins and profitability for manufacturers and distributors as LED technology becomes increasingly standardized.

Import competition from low-cost LED products manufactured in other regions creates pricing pressure and quality concerns within the French market. While French and European manufacturers maintain advantages in quality and service, competitive pricing from imported products can impact market share and profitability for domestic suppliers.

Smart city initiatives across French municipalities create substantial opportunities for LED lighting suppliers, with projects encompassing intelligent street lighting, public space illumination, and integrated urban infrastructure systems. These initiatives often include connected lighting networks that provide data collection capabilities, adaptive lighting control, and energy management features. Government funding for smart city development supports large-scale LED deployments while creating opportunities for technology integration and service provision.

Retrofit market expansion presents significant growth potential as existing buildings and facilities upgrade from traditional lighting systems to LED alternatives. The extensive installed base of fluorescent and incandescent lighting in French commercial and residential buildings represents a substantial addressable market for LED conversion projects. Energy service companies and financing programs facilitate retrofit implementations while creating recurring revenue opportunities for LED suppliers and installation services.

Industrial automation trends drive demand for specialized LED lighting solutions in manufacturing facilities, warehouses, and logistics centers. Advanced LED systems offering precise light control, integration with automation systems, and enhanced safety features align with Industry 4.0 initiatives and operational efficiency goals. Customization opportunities exist for LED products designed specifically for industrial applications including hazardous environments, high-bay installations, and process-specific lighting requirements.

Emerging applications in horticulture, healthcare, and specialty markets create new revenue streams for LED technology providers. Growing interest in indoor farming, therapeutic lighting, and circadian rhythm applications expands the addressable market beyond traditional lighting uses. Innovation potential in these emerging segments allows for premium pricing and differentiated product offerings while establishing market leadership positions.

Supply chain evolution within the France LED lighting market reflects increasing localization of manufacturing and assembly operations, driven by quality requirements, delivery speed expectations, and supply security considerations. European and French manufacturers have expanded production capacity while developing closer relationships with component suppliers to ensure product quality and availability. Distribution networks have adapted to accommodate both traditional electrical wholesalers and emerging online channels, creating multi-channel approaches that serve diverse customer segments effectively.

Competitive dynamics show consolidation trends among LED manufacturers and distributors, with larger companies acquiring specialized firms to expand product portfolios and market reach. This consolidation creates opportunities for remaining independent companies to focus on niche markets and specialized applications while larger players compete for mainstream market share. Innovation cycles continue to accelerate, with new product introductions occurring more frequently as companies seek competitive differentiation through advanced features and improved performance.

Customer behavior patterns demonstrate increasing sophistication in LED product selection, with buyers evaluating total cost of ownership, performance specifications, and additional features beyond basic illumination. Professional specifiers and facility managers increasingly consider factors such as maintenance requirements, control capabilities, and integration potential when making LED lighting decisions. Service expectations have evolved to include installation support, system commissioning, and ongoing maintenance services as standard market offerings.

Regulatory influence continues shaping market dynamics through evolving energy efficiency standards, safety requirements, and environmental regulations. According to MarkWide Research analysis, regulatory compliance drives approximately 35% of LED adoption decisions in the French commercial sector, highlighting the significant impact of policy frameworks on market development.

Primary research activities encompass comprehensive interviews with key market participants including LED manufacturers, distributors, installers, and end-users across France’s major economic regions. These interviews provide qualitative insights into market trends, customer preferences, competitive dynamics, and future growth expectations. Survey methodologies capture quantitative data on market size, segmentation, pricing trends, and adoption patterns through structured questionnaires administered to representative sample groups.

Secondary research sources include industry publications, government statistics, trade association reports, and company financial disclosures to validate primary research findings and provide comprehensive market context. Analysis of import/export data, building permit statistics, and energy consumption trends supports market sizing and growth projections. Technical literature review ensures understanding of LED technology developments and their market implications.

Data validation processes involve triangulation of information sources, expert review panels, and statistical analysis to ensure research accuracy and reliability. Market estimates undergo sensitivity analysis and scenario modeling to account for various growth assumptions and external factors. Quality assurance protocols maintain research standards and provide confidence in market insights and projections.

Analytical frameworks employ both quantitative and qualitative research techniques to develop comprehensive market understanding. Statistical modeling, trend analysis, and comparative assessments provide quantitative foundations while expert interviews and case studies offer qualitative context and strategic insights for market participants.

Île-de-France region, encompassing Paris and surrounding areas, dominates the French LED lighting market with approximately 28% market share, driven by high commercial real estate density, government building retrofits, and smart city initiatives. The region’s concentration of corporate headquarters, retail establishments, and cultural institutions creates substantial demand for premium LED lighting solutions. Infrastructure investment in transportation systems, public buildings, and urban development projects supports continued market growth in this key region.

Auvergne-Rhône-Alpes region, centered around Lyon, represents the second-largest market segment with strong industrial and commercial LED adoption. The region’s manufacturing base, technology companies, and logistics facilities drive demand for specialized LED lighting applications. Regional initiatives promoting energy efficiency and environmental sustainability support LED market development while creating opportunities for local suppliers and service providers.

Provence-Alpes-Côte d’Azur region shows significant growth potential driven by tourism infrastructure, residential development, and commercial expansion along the Mediterranean coast. The region’s focus on hospitality, retail, and outdoor lighting applications creates diverse market opportunities for LED suppliers. Climate considerations and extended operating hours in tourist areas favor LED technology’s durability and energy efficiency benefits.

Northern regions including Hauts-de-France and Grand Est demonstrate strong industrial LED adoption, particularly in manufacturing facilities, warehouses, and logistics centers. These regions benefit from proximity to European markets and established industrial infrastructure that supports LED lighting upgrades. Cross-border trade and industrial cooperation create additional market opportunities while maintaining competitive pressure from neighboring European suppliers.

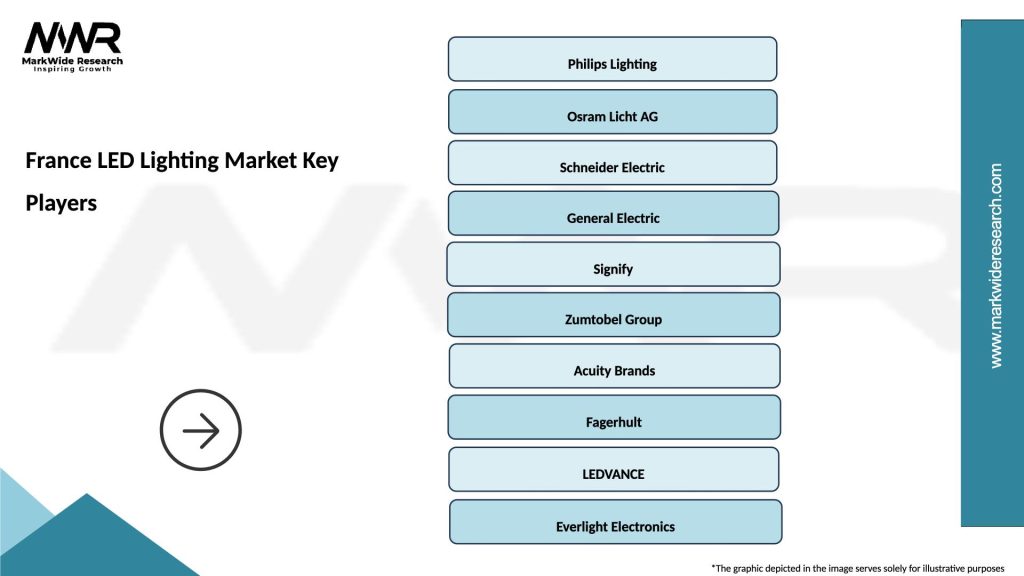

Market leadership in the France LED lighting sector is distributed among several key players, each maintaining distinct competitive advantages and market positioning strategies:

Competitive strategies focus on product innovation, service differentiation, and market segment specialization. Leading companies invest heavily in research and development to maintain technological advantages while building comprehensive service capabilities including design support, installation services, and maintenance programs. Partnership approaches with electrical contractors, system integrators, and facility management companies expand market reach and create competitive moats through relationship-based selling.

By Product Type:

By Application:

By Technology:

Residential LED segment demonstrates strong growth momentum driven by increasing consumer awareness of energy savings and declining product prices. French homeowners increasingly choose LED replacements for traditional bulbs, with retrofit applications representing the largest volume segment. Premium residential products featuring smart controls, design aesthetics, and enhanced functionality capture growing market share as consumers seek lighting solutions that combine efficiency with lifestyle benefits.

Commercial LED applications lead market adoption with approximately 45% segment share, driven by corporate sustainability initiatives, energy cost reduction goals, and building certification requirements. Office buildings, retail stores, and hospitality venues prioritize LED lighting for both operational savings and improved lighting quality. Smart building integration creates additional value through occupancy sensing, daylight harvesting, and automated control systems.

Industrial LED segment shows accelerating growth as manufacturing facilities and warehouses upgrade lighting systems to improve productivity, safety, and energy efficiency. High-bay LED fixtures, hazardous location lighting, and specialized industrial applications drive segment expansion. Maintenance reduction benefits particularly appeal to industrial users where lighting accessibility and replacement costs significantly impact operational efficiency.

Outdoor infrastructure lighting benefits from municipal LED conversion programs and smart city initiatives. Street lighting retrofits, park illumination, and transportation facility upgrades create substantial market opportunities. Connected outdoor lighting systems offering remote monitoring, adaptive control, and data collection capabilities represent the fastest-growing subsegment within outdoor applications.

Manufacturers benefit from expanding market opportunities, premium product positioning, and recurring revenue potential through smart lighting systems and service offerings. The French market’s emphasis on quality and performance allows manufacturers to command higher margins while building long-term customer relationships. Innovation opportunities in connected lighting, human-centric applications, and specialized solutions create competitive differentiation and market leadership positions.

Distributors and retailers gain from increased product margins, expanded customer base, and opportunities for value-added services including design consultation and installation support. LED product diversity enables distributors to serve multiple market segments while building expertise in emerging technologies. Training and certification programs enhance distributor capabilities and create competitive advantages in professional markets.

Installers and contractors benefit from growing project volumes, higher-value installations, and opportunities for specialized services in smart lighting systems. LED technology’s complexity creates demand for professional installation and commissioning services while generating recurring maintenance revenue. Technical expertise in LED systems becomes a key differentiator for electrical contractors serving commercial and industrial markets.

End users achieve significant energy cost savings, reduced maintenance requirements, and improved lighting quality through LED adoption. Commercial and industrial users particularly benefit from operational cost reductions and productivity improvements. Environmental benefits support corporate sustainability goals while smart lighting capabilities enable advanced building management and optimization strategies.

Strengths:

Weaknesses:

Opportunities:

Threats:

Smart lighting integration represents the most significant trend shaping the French LED market, with IoT-enabled systems gaining rapid adoption across commercial and municipal applications. These systems offer remote monitoring, automated control, and data analytics capabilities that extend beyond basic illumination to provide building management and operational insights. Wireless connectivity and cloud-based management platforms enable scalable smart lighting deployments while reducing installation complexity and ongoing maintenance requirements.

Human-centric lighting emerges as a key trend driven by increasing awareness of lighting’s impact on health, productivity, and well-being. Tunable white LED systems that adjust color temperature throughout the day to support natural circadian rhythms gain acceptance in office buildings, healthcare facilities, and educational institutions. Biodynamic lighting applications create premium market opportunities while demonstrating LED technology’s versatility beyond energy efficiency benefits.

Sustainability focus intensifies across the French LED market with increasing emphasis on product lifecycle management, recyclability, and circular economy principles. Manufacturers develop LED products with reduced environmental impact while end users prioritize suppliers demonstrating environmental responsibility. Carbon footprint reduction becomes a key selection criterion for large-scale LED projects, creating competitive advantages for environmentally conscious suppliers.

Customization and personalization trends drive demand for LED lighting solutions tailored to specific applications, aesthetic preferences, and functional requirements. Modular LED systems, configurable control options, and design flexibility enable customized installations while maintaining cost efficiency. MWR data indicates that customized LED solutions command approximately 25% price premiums over standard products, reflecting market willingness to pay for tailored solutions.

Technology advancement continues accelerating with LED manufacturers introducing higher efficiency products, improved color quality, and enhanced control capabilities. Recent developments include LED chips exceeding 200 lumens per watt efficiency, advanced phosphor technologies for superior color rendering, and integrated sensor systems for autonomous lighting operation. Miniaturization trends enable LED integration into previously inaccessible applications while maintaining performance standards.

Strategic partnerships between LED manufacturers, technology companies, and service providers create comprehensive solution offerings that address complex customer requirements. These partnerships combine LED hardware with software platforms, installation services, and ongoing support to deliver turnkey lighting solutions. Ecosystem development around smart lighting platforms creates competitive moats while expanding addressable market opportunities.

Manufacturing localization initiatives bring LED production closer to French markets, reducing supply chain risks while improving delivery times and customer service. European manufacturers expand production capacity while developing specialized products for regional market requirements. Supply chain resilience becomes increasingly important following global disruptions, driving investment in local manufacturing capabilities.

Regulatory evolution includes updated energy efficiency standards, expanded LED application requirements, and enhanced product safety regulations. These regulatory changes create market opportunities for compliant products while establishing barriers for substandard imports. Standardization efforts improve product interoperability and system integration while reducing customer confusion and installation complexity.

Market participants should prioritize smart lighting capabilities and IoT integration to capture premium market segments and differentiate from commodity LED products. Investment in connected lighting platforms, mobile applications, and cloud-based management systems creates competitive advantages while enabling recurring revenue models. Partnership strategies with technology companies, system integrators, and service providers expand market reach while building comprehensive solution capabilities.

Product development focus should emphasize application-specific LED solutions that address unique French market requirements including design aesthetics, installation constraints, and regulatory compliance. Customization capabilities, modular designs, and flexible control options enable market differentiation while commanding premium pricing. Innovation investment in emerging applications such as horticulture, healthcare, and specialty markets creates new revenue streams and market leadership opportunities.

Service expansion represents critical growth opportunity as LED markets mature and customers seek comprehensive solutions beyond product supply. Installation services, system commissioning, maintenance programs, and energy management consulting create recurring revenue while building customer loyalty. Digital service platforms enable scalable service delivery while providing valuable customer data and insights.

Geographic expansion within France should target underserved regions and emerging market segments while building local partnerships and distribution capabilities. Regional market development requires understanding of local preferences, regulatory requirements, and competitive dynamics. Channel diversification through online platforms, specialty retailers, and direct sales approaches expands market reach while serving diverse customer segments effectively.

Market growth prospects remain highly positive with continued expansion expected across all major segments, driven by ongoing LED technology advancement, regulatory support, and increasing customer acceptance. The French LED lighting market is projected to maintain robust growth momentum with particularly strong performance in smart lighting, retrofit applications, and emerging specialty markets. Technology convergence with IoT, artificial intelligence, and building automation systems creates expanding opportunities for integrated lighting solutions.

Innovation trajectories point toward increasingly sophisticated LED systems offering enhanced functionality, improved efficiency, and seamless integration with smart building technologies. Future LED products will likely incorporate advanced sensors, wireless connectivity, and autonomous operation capabilities as standard features rather than premium options. MarkWide Research projects that smart LED systems will represent approximately 60% of commercial installations by the end of the forecast period, reflecting rapid technology adoption.

Market consolidation trends are expected to continue as larger companies acquire specialized firms and technology assets to build comprehensive solution portfolios. This consolidation creates opportunities for remaining independent companies to focus on niche markets while larger players compete for mainstream market share. Vertical integration strategies may emerge as companies seek to control more of the LED value chain from components to services.

Sustainability imperatives will increasingly influence LED market development with circular economy principles, carbon footprint reduction, and environmental responsibility becoming key competitive factors. Future market success will depend on companies’ ability to demonstrate environmental leadership while maintaining product performance and cost competitiveness. Regulatory evolution toward more stringent environmental standards will create both challenges and opportunities for LED market participants.

France’s LED lighting market represents a dynamic and rapidly evolving sector characterized by strong growth momentum, technological innovation, and expanding application opportunities. The market benefits from comprehensive government support, mature infrastructure, and increasing customer acceptance across residential, commercial, and industrial segments. Smart lighting integration and IoT connectivity emerge as key differentiators while sustainability considerations increasingly influence purchasing decisions.

Market opportunities abound in retrofit applications, smart city initiatives, emerging specialty markets, and service expansion areas. However, success requires strategic focus on innovation, customer service, and market differentiation to compete effectively in an increasingly competitive landscape. Technology advancement continues creating new possibilities while regulatory support maintains favorable market conditions for LED adoption.

Future success in the French LED lighting market will depend on companies’ ability to adapt to evolving customer requirements, embrace technological innovation, and build comprehensive solution capabilities that extend beyond basic product supply. The market outlook remains highly positive with substantial growth potential for well-positioned participants who can navigate competitive challenges while capitalizing on emerging opportunities in this dynamic and expanding sector.

What is LED Lighting?

LED Lighting refers to the use of light-emitting diodes (LEDs) as a source of illumination. This technology is known for its energy efficiency, long lifespan, and versatility in various applications such as residential, commercial, and industrial lighting.

What are the key players in the France LED Lighting Market?

Key players in the France LED Lighting Market include Philips Lighting, Osram, and Schneider Electric, among others. These companies are known for their innovative lighting solutions and significant market presence.

What are the growth factors driving the France LED Lighting Market?

The France LED Lighting Market is driven by factors such as increasing energy efficiency regulations, growing demand for smart lighting solutions, and the rising awareness of environmental sustainability among consumers.

What challenges does the France LED Lighting Market face?

Challenges in the France LED Lighting Market include high initial costs of LED technology, competition from traditional lighting sources, and the need for continuous innovation to meet changing consumer preferences.

What opportunities exist in the France LED Lighting Market?

Opportunities in the France LED Lighting Market include the expansion of smart city initiatives, advancements in lighting technology, and increasing investments in energy-efficient infrastructure.

What trends are shaping the France LED Lighting Market?

Trends in the France LED Lighting Market include the integration of IoT in lighting systems, the shift towards human-centric lighting designs, and the growing popularity of tunable white and color-changing LEDs.

France LED Lighting Market

| Segmentation Details | Description |

|---|---|

| Product Type | Bulbs, Fixtures, Strips, Panels |

| Technology | Incandescent, Fluorescent, OLED, Quantum Dot |

| End User | Residential, Commercial, Industrial, Hospitality |

| Application | Outdoor Lighting, Indoor Lighting, Architectural Lighting, Decorative Lighting |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the France LED Lighting Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at