444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The France HVAC market represents a dynamic and rapidly evolving sector within the European heating, ventilation, and air conditioning industry. France’s commitment to energy efficiency and environmental sustainability has positioned the country as a leading adopter of advanced HVAC technologies. The market demonstrates robust growth driven by stringent energy regulations, increasing construction activities, and growing awareness of indoor air quality importance.

Market dynamics in France reflect a strong emphasis on eco-friendly solutions and smart building technologies. The residential sector accounts for approximately 58% of total HVAC installations, while commercial and industrial applications represent significant growth opportunities. Heat pump adoption has accelerated dramatically, with penetration rates reaching 35% in new residential constructions as French consumers increasingly prioritize sustainable heating solutions.

Regulatory frameworks including the RE2020 environmental regulation and various energy efficiency mandates continue to shape market development. The French government’s commitment to carbon neutrality by 2050 has created substantial opportunities for innovative HVAC manufacturers and service providers. Digital transformation trends are also influencing the market, with smart HVAC systems experiencing adoption rates of approximately 28% in premium residential projects.

The France HVAC market refers to the comprehensive ecosystem of heating, ventilation, and air conditioning products, services, and technologies specifically designed for French residential, commercial, and industrial applications. This market encompasses traditional heating systems, modern heat pumps, ventilation equipment, air conditioning units, and integrated smart building solutions that meet France’s unique climate requirements and regulatory standards.

HVAC systems in the French context include various technologies ranging from conventional gas boilers and electric heating to advanced geothermal heat pumps and hybrid renewable energy solutions. The market also covers essential components such as ductwork, controls, sensors, and maintenance services that ensure optimal system performance throughout the building lifecycle.

Market participants include equipment manufacturers, installation contractors, maintenance service providers, and technology integrators who collectively serve France’s diverse building stock. The definition extends to emerging technologies like IoT-enabled systems, predictive maintenance solutions, and energy management platforms that are transforming how French buildings consume and manage energy resources.

France’s HVAC market demonstrates exceptional resilience and growth potential, driven by ambitious environmental policies and increasing consumer demand for energy-efficient solutions. The market benefits from strong government support through various incentive programs, including tax credits and subsidies that encourage adoption of renewable heating technologies.

Key market drivers include the ongoing building renovation wave, with approximately 42% of existing buildings requiring HVAC system upgrades to meet current energy standards. The commercial sector shows particularly strong growth in smart HVAC implementations, with office buildings leading adoption at 31% penetration rates. Heat pump technology represents the fastest-growing segment, supported by favorable electricity pricing and government incentives.

Competitive landscape features both international manufacturers and strong domestic players who understand local market nuances. The market structure supports innovation through strategic partnerships between technology providers and local installation networks. Service sector growth accompanies equipment sales, with maintenance contracts showing annual growth rates of approximately 8.2% as building owners prioritize system reliability and efficiency optimization.

Strategic insights reveal several critical trends shaping the France HVAC market landscape. The following key developments demonstrate the market’s evolution toward sustainability and technological advancement:

Environmental regulations serve as the primary catalyst for France HVAC market expansion. The RE2020 building regulation mandates significantly improved energy performance, compelling builders and renovators to invest in advanced HVAC technologies. Carbon emission reduction targets create additional pressure for efficient heating and cooling solutions across all building types.

Government incentive programs substantially influence purchasing decisions through attractive financial support mechanisms. The MaPrimeRénov program provides direct subsidies for heat pump installations, while tax credits reduce the total cost of ownership for energy-efficient systems. Regional authorities supplement national programs with additional incentives, creating favorable conditions for market growth.

Energy cost considerations drive consumer interest in efficient HVAC solutions as electricity and gas prices continue fluctuating. Heat pumps offer compelling operational cost advantages compared to traditional heating methods, particularly when combined with renewable energy sources. Building owners increasingly recognize long-term savings potential despite higher initial investment requirements.

Climate change awareness influences both residential and commercial decision-making processes. French consumers demonstrate growing environmental consciousness, preferring sustainable technologies that reduce carbon footprints. Corporate sustainability commitments in the commercial sector create demand for green building certifications that require high-performance HVAC systems.

High initial costs represent the most significant barrier to HVAC system adoption, particularly for advanced technologies like geothermal heat pumps. Many French homeowners face budget constraints when considering system replacements, despite long-term operational savings. Installation complexity adds additional costs through specialized labor requirements and potential building modifications.

Skilled technician shortage creates bottlenecks in system installation and maintenance services. The HVAC industry struggles to attract qualified professionals, leading to longer project timelines and increased service costs. Training requirements for new technologies further complicate workforce development efforts, particularly for heat pump and smart system installations.

Regulatory complexity can overwhelm consumers and small contractors navigating various compliance requirements. Building codes, energy standards, and safety regulations create administrative burdens that may delay project implementation. Permit processes in some municipalities add time and cost to HVAC installations, particularly for larger commercial projects.

Technology integration challenges arise when incorporating modern HVAC systems into older French buildings. Historic preservation requirements and structural limitations can complicate installations, requiring specialized solutions that increase project costs. Grid infrastructure limitations in some regions may restrict heat pump adoption due to electrical capacity constraints.

Building renovation programs present substantial growth opportunities as France accelerates efforts to improve existing building stock energy performance. The government’s commitment to renovating residential and commercial buildings creates sustained demand for HVAC system upgrades. Social housing renovation initiatives particularly offer large-scale project opportunities for HVAC contractors and manufacturers.

Smart building integration represents an emerging opportunity as French buildings increasingly adopt IoT technologies and energy management systems. HVAC manufacturers can develop integrated solutions that optimize building performance while providing valuable data insights. Predictive maintenance services offer recurring revenue opportunities through subscription-based models that ensure optimal system performance.

Heat pump market expansion continues offering growth potential as technology costs decrease and performance improves. Air-to-water systems show particular promise in moderate climate regions, while ground-source heat pumps gain traction in new construction projects. Hybrid systems combining heat pumps with existing heating infrastructure provide transition solutions for budget-conscious consumers.

Commercial sector digitization creates opportunities for advanced HVAC control systems and energy management platforms. Office buildings, retail spaces, and industrial facilities seek integrated solutions that reduce operational costs while improving occupant comfort. Data analytics services can help building owners optimize energy consumption and predict maintenance requirements.

Supply chain dynamics in the France HVAC market reflect both global trends and local manufacturing capabilities. European manufacturers maintain strong positions through proximity advantages and regulatory compliance expertise. Component sourcing challenges occasionally impact delivery timelines, particularly for specialized heat pump components and smart control systems.

Competitive pressures intensify as international manufacturers expand French market presence while domestic companies strengthen their technology offerings. Price competition remains significant in commodity segments, while premium products command higher margins through advanced features and superior performance. Service differentiation becomes increasingly important as manufacturers seek competitive advantages beyond product specifications.

Technology evolution accelerates market transformation as digitalization and renewable energy integration reshape HVAC system capabilities. Manufacturers invest heavily in research and development to meet evolving customer expectations and regulatory requirements. Interoperability standards gain importance as building owners seek integrated solutions that work seamlessly with existing infrastructure.

Customer behavior shifts toward sustainability and energy efficiency influence product development priorities and marketing strategies. French consumers increasingly research HVAC options thoroughly before purchasing, seeking systems that deliver both environmental benefits and operational savings. Professional recommendations remain influential in purchase decisions, highlighting the importance of installer relationships and training programs.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the France HVAC market. Primary research includes extensive interviews with industry stakeholders, including manufacturers, distributors, installers, and end-users across various market segments. Survey data collection captures quantitative insights on market trends, customer preferences, and technology adoption patterns.

Secondary research incorporates analysis of government statistics, industry reports, regulatory documents, and company financial statements to validate primary findings. Trade association data and construction industry statistics provide additional context for market sizing and growth projections. MarkWide Research utilizes proprietary databases and analytical tools to process and interpret collected information.

Market segmentation analysis examines various dimensions including product types, applications, end-user categories, and geographic regions within France. Statistical modeling techniques help identify correlations between market drivers and adoption patterns. Competitive intelligence gathering includes analysis of company strategies, product portfolios, and market positioning approaches.

Data validation processes ensure research accuracy through triangulation of multiple information sources and expert review panels. Regional market variations receive particular attention given France’s diverse climate zones and economic conditions. Trend analysis incorporates historical data patterns to support future market projections and identify emerging opportunities.

Île-de-France region dominates the French HVAC market, accounting for approximately 23% of total installations due to high construction activity and building renovation projects in the Paris metropolitan area. The region shows strong demand for premium HVAC systems and smart building technologies. Commercial sector concentration drives adoption of advanced air conditioning and ventilation systems in office buildings and retail spaces.

Auvergne-Rhône-Alpes represents the second-largest regional market, benefiting from robust industrial activity and significant residential construction. The region’s diverse climate conditions create demand for versatile HVAC solutions capable of handling both heating and cooling requirements. Alpine areas show particular interest in geothermal heat pump systems due to stable ground temperatures.

Northern regions including Hauts-de-France and Grand Est demonstrate strong heating system demand due to colder climate conditions. Heat pump adoption accelerates as residents seek alternatives to traditional gas heating systems. Industrial heritage in these regions creates opportunities for large-scale commercial and industrial HVAC projects.

Southern regions such as Provence-Alpes-Côte d’Azur and Occitanie show increasing air conditioning demand driven by rising summer temperatures and tourism industry requirements. Reversible heat pump systems gain popularity for their dual heating and cooling capabilities. Mediterranean climate influences create unique market dynamics with seasonal demand variations.

Market leadership in the France HVAC sector features a mix of international corporations and specialized domestic companies that serve different market segments. The competitive environment encourages innovation and service excellence as companies compete for market share in various applications.

Product segmentation reveals distinct market categories with varying growth trajectories and customer requirements. Each segment demonstrates unique characteristics and competitive dynamics that influence manufacturer strategies and market development approaches.

By Product Type:

By Application:

Heat pump category demonstrates exceptional growth momentum as French consumers increasingly recognize the technology’s environmental and economic benefits. Air-to-water systems lead adoption in residential renovations, while air-to-air units gain popularity in new construction projects. Government incentives significantly influence purchase decisions, with rebate programs reducing effective system costs by substantial amounts.

Smart HVAC systems represent an emerging category with significant growth potential as building owners seek enhanced control and energy optimization capabilities. Connected thermostats and IoT-enabled equipment provide valuable data insights while improving occupant comfort. Integration challenges with existing building systems create opportunities for specialized service providers and system integrators.

Maintenance services evolve into a distinct market category as system complexity increases and building owners prioritize reliability. Predictive maintenance solutions using sensor data and analytics help prevent system failures while optimizing performance. Service contracts provide recurring revenue streams for HVAC companies while ensuring customer satisfaction and system longevity.

Renewable integration creates new product categories combining HVAC systems with solar panels, energy storage, and smart grid connectivity. These integrated solutions appeal to environmentally conscious consumers and buildings seeking energy independence. Hybrid systems offer transition paths for customers upgrading from traditional heating methods while maintaining backup capabilities.

Manufacturers benefit from strong market demand driven by environmental regulations and government incentive programs. The French market offers opportunities for premium product positioning and technology differentiation. Innovation investments in heat pump technology and smart systems generate competitive advantages and higher profit margins.

Installation contractors experience increased business opportunities as building owners upgrade HVAC systems to meet energy efficiency requirements. Specialized training in heat pump and smart system installation commands premium service rates. Service expansion into maintenance and energy optimization creates additional revenue streams and customer relationships.

Building owners achieve significant operational cost savings through efficient HVAC systems while improving occupant comfort and satisfaction. Energy-efficient systems enhance property values and support sustainability goals. Government incentives reduce initial investment costs while long-term energy savings provide ongoing financial benefits.

End users enjoy improved indoor comfort, better air quality, and reduced energy bills through modern HVAC systems. Smart controls provide convenient system management and optimization capabilities. Environmental benefits support personal sustainability goals while contributing to national carbon reduction objectives.

Strengths:

Weaknesses:

Opportunities:

Threats:

Electrification trend accelerates across the French HVAC market as heat pumps replace traditional gas and oil heating systems. This transition supports national decarbonization goals while providing consumers with efficient heating solutions. Utility companies adapt their infrastructure and pricing models to accommodate increased electrical heating demand.

Digitalization integration transforms HVAC systems into connected devices that provide real-time performance data and remote control capabilities. Smart thermostats and IoT sensors enable predictive maintenance and energy optimization. Data analytics help building owners understand usage patterns and identify efficiency improvement opportunities.

Sustainability focus influences both product development and customer purchasing decisions as environmental consciousness grows. Manufacturers emphasize refrigerant improvements, energy efficiency ratings, and lifecycle environmental impact. Circular economy principles drive interest in system refurbishment and component recycling programs.

Service model evolution shifts from traditional installation and repair toward comprehensive building performance management. Energy service companies offer guaranteed performance contracts that align contractor interests with customer energy savings goals. Subscription-based services provide ongoing system optimization and maintenance through predictable monthly fees.

Regulatory developments continue shaping the French HVAC market through updated building codes and energy efficiency requirements. The RE2020 regulation implementation creates new standards for heating system performance and carbon emissions. Local authorities supplement national regulations with additional requirements that influence system selection and installation practices.

Technology innovations advance heat pump efficiency and smart system capabilities through ongoing research and development investments. Variable-speed compressors and advanced refrigerants improve system performance across wider temperature ranges. Artificial intelligence integration enables autonomous system optimization and predictive maintenance capabilities.

Market consolidation activities reshape the competitive landscape as manufacturers seek scale advantages and expanded product portfolios. Strategic acquisitions combine complementary technologies and distribution channels. Partnership agreements between manufacturers and service providers create integrated solution offerings.

Training initiatives address skilled technician shortages through expanded educational programs and certification systems. Industry associations collaborate with educational institutions to develop specialized HVAC training curricula. Digital training tools provide flexible learning options for working professionals seeking skill upgrades.

MarkWide Research recommends that HVAC manufacturers prioritize heat pump technology development and smart system integration to capitalize on market growth opportunities. Companies should invest in local partnerships and service capabilities to support market expansion. Training programs for installation and maintenance personnel represent critical investments for sustainable growth.

Strategic positioning should emphasize sustainability benefits and total cost of ownership advantages rather than focusing solely on initial purchase prices. Manufacturers can differentiate through comprehensive service offerings and performance guarantees. Digital capabilities become increasingly important for competitive positioning and customer engagement.

Market entry strategies for international companies should consider local partnerships and regulatory compliance expertise. Understanding regional climate variations and building characteristics enables targeted product development. Distribution network development requires careful selection of partners with appropriate technical capabilities and market coverage.

Innovation investments should focus on system integration, energy optimization, and user experience improvements. Companies can explore opportunities in adjacent markets such as energy storage and building automation. Sustainability initiatives throughout the product lifecycle support brand positioning and regulatory compliance.

Market growth trajectory remains positive as France accelerates building decarbonization efforts and energy efficiency improvements. Heat pump adoption is expected to continue expanding at approximately 12% annual growth rates through the next decade. Government support through incentive programs and regulatory requirements provides sustained market momentum.

Technology evolution will drive system performance improvements and cost reductions that expand market accessibility. Smart HVAC systems are projected to achieve 45% market penetration in new commercial buildings by 2030. Integration capabilities with renewable energy systems and energy storage will become standard features rather than premium options.

Service sector expansion will accompany equipment growth as system complexity increases and building owners seek performance optimization. Maintenance and energy management services are expected to grow at 9.5% annually as building owners prioritize system reliability and efficiency. MWR analysis indicates that service revenues will represent an increasing share of total market value.

Market maturation will bring increased competition and margin pressure in commodity segments while creating opportunities for differentiation through advanced technologies and services. Companies that successfully combine product innovation with service excellence will capture disproportionate market share. Sustainability leadership will become a key competitive differentiator as environmental regulations tighten and consumer awareness increases.

France HVAC market presents exceptional growth opportunities driven by strong regulatory support, environmental consciousness, and technological advancement. The market’s transformation toward sustainable heating solutions and smart building integration creates favorable conditions for innovative manufacturers and service providers. Heat pump technology leads market evolution while smart systems and comprehensive services represent emerging growth areas.

Success factors in this dynamic market include technology leadership, local market understanding, and comprehensive service capabilities. Companies that invest in training, partnerships, and innovation will be best positioned to capitalize on market opportunities. Regulatory compliance and sustainability focus remain critical for long-term market participation and growth.

Market outlook remains optimistic as France continues its energy transition journey and building stock modernization efforts. The combination of government support, consumer demand, and technological advancement creates a sustainable foundation for continued market expansion. Strategic investments in capabilities and market presence will determine competitive success in this evolving landscape.

What is HVAC?

HVAC stands for Heating, Ventilation, and Air Conditioning, which refers to the technology used for indoor environmental comfort. It encompasses systems that provide heating and cooling to residential, commercial, and industrial buildings.

What are the key players in the France HVAC Market?

Key players in the France HVAC Market include companies like Daikin, Carrier, and Trane, which offer a range of heating and cooling solutions. These companies are known for their innovative technologies and energy-efficient products, among others.

What are the main drivers of the France HVAC Market?

The main drivers of the France HVAC Market include the increasing demand for energy-efficient systems, the growth of smart home technologies, and the rising awareness of indoor air quality. Additionally, regulatory initiatives promoting sustainable building practices are also contributing to market growth.

What challenges does the France HVAC Market face?

The France HVAC Market faces challenges such as high installation costs and the need for skilled labor for system maintenance. Additionally, fluctuating energy prices and stringent regulations can impact market dynamics.

What opportunities exist in the France HVAC Market?

Opportunities in the France HVAC Market include the growing trend of smart HVAC systems and the increasing focus on renewable energy sources. The demand for retrofitting existing buildings with modern HVAC solutions also presents significant growth potential.

What trends are shaping the France HVAC Market?

Trends shaping the France HVAC Market include the integration of IoT technology for enhanced system control and monitoring, as well as a shift towards eco-friendly refrigerants. Additionally, the emphasis on energy efficiency and sustainability is driving innovation in HVAC solutions.

France HVAC Market

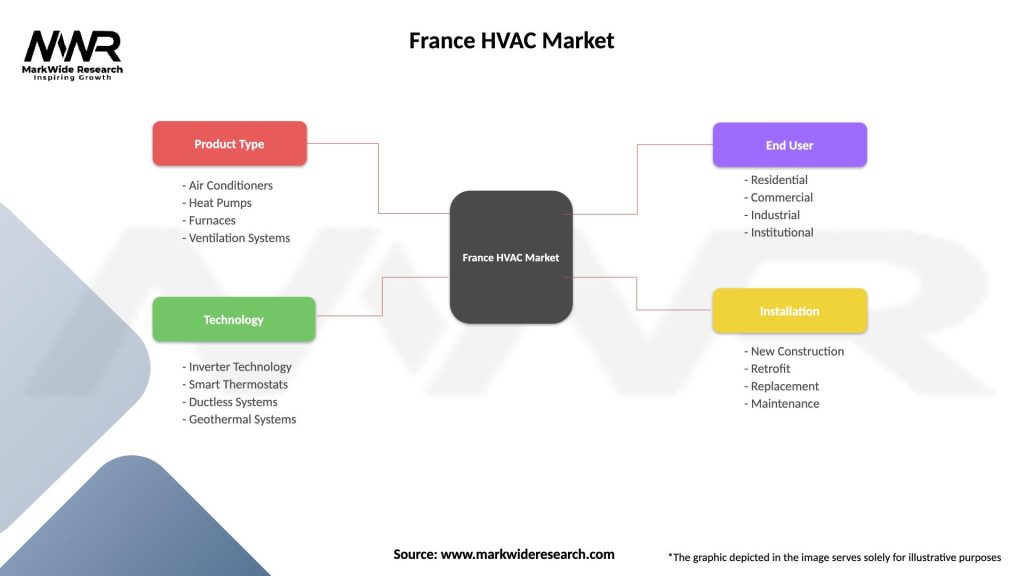

| Segmentation Details | Description |

|---|---|

| Product Type | Air Conditioners, Heat Pumps, Furnaces, Ventilation Systems |

| Technology | Inverter Technology, Smart Thermostats, Ductless Systems, Geothermal Systems |

| End User | Residential, Commercial, Industrial, Institutional |

| Installation | New Construction, Retrofit, Replacement, Maintenance |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the France HVAC Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at