444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The France hospitality market stands as one of Europe’s most dynamic and influential sectors, representing a cornerstone of the nation’s economy and cultural identity. France’s hospitality industry encompasses a diverse range of services including luxury hotels, boutique accommodations, restaurants, cafes, event venues, and tourism-related services that collectively contribute to the country’s reputation as a global destination leader.

Market dynamics indicate robust growth potential driven by increasing international tourism, domestic travel recovery, and evolving consumer preferences toward experiential hospitality. The sector demonstrates remarkable resilience with annual growth rates projected at approximately 6.2% CAGR through the forecast period, supported by strategic investments in digital transformation and sustainable hospitality practices.

Regional distribution shows Paris commanding approximately 35% market share, followed by the French Riviera, Loire Valley, and Provence regions. The market benefits from France’s position as the world’s most visited country, welcoming diverse international visitors and maintaining strong domestic tourism patterns that support year-round operational stability.

Innovation trends are reshaping service delivery through contactless technologies, personalized guest experiences, and eco-friendly initiatives that align with contemporary traveler expectations. The integration of artificial intelligence, mobile applications, and sustainable practices positions French hospitality providers at the forefront of industry evolution.

The France hospitality market refers to the comprehensive ecosystem of accommodation, dining, entertainment, and service providers that cater to both domestic and international visitors across French territories. This market encompasses traditional hotels, alternative lodging options, restaurants, event venues, and ancillary services that collectively create memorable guest experiences while contributing significantly to national economic output.

Hospitality services in France extend beyond basic accommodation to include luxury resorts, boutique hotels, vacation rentals, gastronomic establishments, conference facilities, and cultural experience providers. The market represents the intersection of French cultural heritage, culinary excellence, and modern service innovation, creating unique value propositions that distinguish French hospitality on the global stage.

Market participants range from international hotel chains and independent operators to local restaurants, event planners, and specialized service providers who collectively deliver integrated hospitality experiences. The sector’s definition continues evolving with digital transformation, sustainability initiatives, and changing consumer behaviors that demand more personalized and environmentally conscious service delivery.

France’s hospitality market demonstrates exceptional growth momentum supported by strategic location advantages, cultural attractions, and world-renowned culinary traditions. The sector benefits from consistent international visitor flows, with tourism recovery showing strong rebound rates of approximately 78% compared to pre-pandemic levels, indicating robust market resilience and adaptation capabilities.

Key market drivers include increasing demand for authentic cultural experiences, growing preference for sustainable tourism, and rising domestic travel patterns that support local hospitality businesses. Digital transformation initiatives have accelerated, with mobile booking adoption reaching approximately 68% of total reservations, demonstrating successful technology integration across service delivery channels.

Competitive landscape features a balanced mix of international brands and local operators, creating diverse market offerings that cater to varied consumer segments. Premium and luxury segments show particularly strong performance, while mid-market and budget accommodations adapt through value-added services and operational efficiency improvements.

Future prospects remain optimistic with projected growth driven by infrastructure investments, event hosting capabilities, and expanding international connectivity. The market’s evolution toward sustainable practices and experiential offerings positions French hospitality providers for continued success in an increasingly competitive global environment.

Strategic market analysis reveals several critical insights that define the France hospitality landscape and its competitive positioning:

Market intelligence indicates that successful hospitality providers focus on creating distinctive experiences that leverage France’s natural advantages while incorporating modern service innovations. The integration of traditional French hospitality values with contemporary operational efficiency creates competitive differentiation in an increasingly crowded marketplace.

Tourism recovery momentum serves as the primary market driver, with international visitor numbers showing consistent growth patterns and domestic tourism maintaining strong performance levels. France’s reputation as a premier global destination continues attracting diverse traveler segments seeking cultural, culinary, and recreational experiences.

Infrastructure development supports market expansion through improved transportation connectivity, upgraded accommodation facilities, and enhanced digital infrastructure that facilitates seamless guest experiences. Major infrastructure projects, including airport expansions and high-speed rail connections, increase accessibility and visitor capacity.

Cultural and culinary tourism drives significant demand as travelers increasingly seek authentic local experiences. France’s UNESCO World Heritage sites, renowned gastronomy, and cultural events create compelling reasons for extended stays and repeat visits that benefit hospitality providers across multiple regions.

Business travel recovery contributes to market growth as corporate activities resume and international business relationships strengthen. Conference and event hosting capabilities position French hospitality providers to capture lucrative business segment demand while supporting broader economic recovery initiatives.

Digital transformation adoption enables operational efficiency improvements and enhanced guest experiences through mobile applications, contactless services, and personalized recommendation systems. Technology integration reduces operational costs while improving service delivery quality and guest satisfaction levels.

Sustainability initiatives attract environmentally conscious travelers who prioritize eco-friendly accommodation and dining options. Green certification programs and sustainable operational practices create competitive advantages while aligning with evolving consumer values and regulatory requirements.

Labor shortage challenges impact service delivery capacity across multiple hospitality segments, with skilled workforce availability remaining a persistent concern for operators seeking to maintain service quality standards. Recruitment and retention difficulties affect operational efficiency and expansion capabilities.

Regulatory compliance complexity creates operational challenges as hospitality providers navigate evolving health and safety requirements, environmental regulations, and employment standards. Compliance costs and administrative burden affect profitability, particularly for smaller independent operators.

Economic uncertainty factors influence consumer spending patterns and travel decisions, with inflation concerns and geopolitical tensions affecting both domestic and international visitor confidence. Economic volatility creates demand unpredictability that complicates operational planning and investment decisions.

Seasonal demand fluctuations create revenue concentration challenges for operators in tourist-dependent regions, requiring sophisticated revenue management strategies and diversified service offerings to maintain year-round profitability. Off-season periods strain cash flow and operational sustainability.

Competition intensity from alternative accommodation platforms and international hospitality brands increases market pressure on pricing and service differentiation. Digital disruption through sharing economy platforms creates new competitive dynamics that traditional operators must address.

Infrastructure limitations in certain regions constrain growth potential, with transportation accessibility and utility capacity affecting development opportunities. Rural and secondary market locations face particular challenges in attracting investment and visitor traffic.

Sustainable tourism growth presents significant opportunities for hospitality providers who develop environmentally responsible operations and authentic local experiences. Growing consumer awareness of environmental impact creates demand for eco-certified accommodations and sustainable dining options.

Digital experience enhancement offers opportunities to differentiate service delivery through innovative technology applications, personalized guest journeys, and seamless integration across multiple touchpoints. Investment in digital capabilities can improve operational efficiency while enhancing guest satisfaction.

Niche market development allows specialized hospitality providers to capture high-value segments including wellness tourism, culinary experiences, cultural immersion, and adventure travel. Specialized offerings command premium pricing while building loyal customer bases.

Regional expansion potential exists in underexplored French territories that offer unique attractions and authentic experiences. Secondary cities and rural regions present development opportunities for hospitality providers seeking to diversify geographic exposure.

Corporate partnerships with international businesses, educational institutions, and event organizers create stable revenue streams and long-term growth opportunities. Strategic alliances can provide access to new customer segments and operational synergies.

Event hosting capabilities represent lucrative opportunities as France continues attracting major international conferences, sporting events, and cultural celebrations. Specialized event hospitality services command premium rates while showcasing French hospitality excellence.

Supply and demand balance in the France hospitality market reflects complex interactions between visitor flows, accommodation capacity, and service delivery capabilities. Occupancy rates across major markets average approximately 72% annually, with significant seasonal variations that influence pricing strategies and operational planning.

Pricing dynamics demonstrate sophisticated revenue management approaches as operators optimize rates based on demand patterns, competitive positioning, and value proposition differentiation. Premium segments maintain pricing power through unique experiences and superior service delivery, while mid-market operators focus on value optimization.

Technology integration accelerates across all market segments, with digital adoption rates showing approximately 85% of hospitality providers implementing some form of technology enhancement. Mobile applications, contactless services, and data analytics drive operational improvements and guest experience personalization.

Consumer behavior evolution influences service delivery approaches as travelers seek more authentic, sustainable, and personalized experiences. Booking patterns show increasing preference for direct reservations and last-minute planning, requiring operational flexibility and dynamic pricing capabilities.

Competitive intensity drives continuous innovation and service enhancement as providers differentiate through unique value propositions, specialized offerings, and superior execution. Market consolidation trends create opportunities for both acquisition and partnership strategies.

Regulatory environment continues evolving with emphasis on sustainability, health and safety standards, and consumer protection measures that influence operational practices and investment priorities across the hospitality sector.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into France hospitality market dynamics. Primary research includes direct interviews with industry executives, hospitality operators, and key stakeholders across different market segments and geographic regions.

Secondary research integration incorporates government statistics, industry reports, trade association data, and academic studies to provide comprehensive market context and validate primary research findings. Data triangulation ensures accuracy and reliability of market insights and projections.

Quantitative analysis utilizes statistical modeling and trend analysis to identify growth patterns, market relationships, and forecasting scenarios. Mathematical models incorporate multiple variables including economic indicators, tourism statistics, and operational performance metrics.

Qualitative assessment captures market nuances through expert interviews, focus groups, and observational studies that provide deeper understanding of consumer behavior, competitive dynamics, and emerging trends that quantitative data alone cannot reveal.

Geographic segmentation ensures representative coverage across French regions, urban and rural markets, and different tourism destinations to capture regional variations and local market characteristics that influence overall market dynamics.

Temporal analysis examines historical trends, current market conditions, and future projections to identify cyclical patterns, growth trajectories, and potential disruption factors that may influence market evolution and strategic planning requirements.

Paris and Île-de-France region dominates the hospitality market with approximately 35% market share, driven by business travel, cultural tourism, and international connectivity. The region benefits from diverse accommodation options, world-class dining, and extensive conference facilities that attract both leisure and business travelers year-round.

Provence-Alpes-Côte d’Azur represents the second-largest regional market, capturing approximately 18% market share through luxury resorts, coastal attractions, and cultural destinations. The French Riviera’s reputation for glamour and sophistication supports premium pricing and high-value visitor segments.

Auvergne-Rhône-Alpes region shows strong performance with approximately 12% market share, benefiting from Alpine tourism, Lyon’s gastronomic reputation, and diverse seasonal attractions. Winter sports and summer outdoor activities create year-round demand for hospitality services.

Nouvelle-Aquitaine captures approximately 10% market share through wine tourism, coastal resorts, and cultural heritage sites. The region’s diverse offerings from Bordeaux vineyards to Atlantic beaches create multiple revenue streams for hospitality providers.

Occitanie region demonstrates growing market presence with approximately 8% market share, supported by Mediterranean coastline, historical cities, and emerging wine tourism. Toulouse and Montpellier drive business travel demand while coastal areas attract leisure visitors.

Other regions collectively represent the remaining market share, with Brittany, Normandy, and Loire Valley showing particular strength in cultural tourism and authentic French experiences that appeal to both domestic and international visitors seeking regional diversity.

Market leadership in France’s hospitality sector features a diverse mix of international hotel groups, domestic chains, and independent operators who collectively create a competitive yet collaborative ecosystem. The landscape reflects France’s commitment to preserving local hospitality traditions while embracing global service standards.

Competitive strategies emphasize differentiation through authentic French experiences, culinary excellence, and personalized service delivery. Market leaders invest heavily in digital transformation, sustainability initiatives, and staff training to maintain competitive advantages in an evolving marketplace.

Market consolidation trends create opportunities for strategic partnerships, acquisitions, and franchise development that enable smaller operators to compete effectively while maintaining operational independence and local market knowledge.

By Accommodation Type:

By Customer Segment:

By Service Category:

Luxury segment performance demonstrates exceptional resilience with average daily rates maintaining premium levels despite market challenges. High-end properties benefit from international clientele seeking authentic French luxury experiences, cultural immersion, and world-class service delivery that justifies premium pricing.

Mid-market accommodation shows strong adaptation capabilities through value-added services, technology integration, and operational efficiency improvements. This segment captures the largest volume of travelers while maintaining healthy profit margins through strategic positioning and service optimization.

Budget accommodation sector evolves rapidly with technology adoption, streamlined operations, and strategic location selection. Economy operators focus on essential service delivery while leveraging digital platforms to reduce operational costs and improve booking efficiency.

Boutique and independent properties differentiate through unique experiences, local partnerships, and personalized service delivery. These operators leverage France’s cultural diversity and regional characteristics to create distinctive value propositions that command premium rates.

Food and beverage operations represent critical revenue streams with French culinary traditions providing competitive advantages. Restaurant and bar services contribute significantly to overall profitability while enhancing guest satisfaction and property differentiation.

Event and conference services generate high-margin revenue through specialized facilities, professional support services, and comprehensive event management capabilities. Business events and social gatherings create additional revenue opportunities beyond accommodation services.

Revenue diversification opportunities enable hospitality providers to reduce dependence on single revenue streams through integrated service offerings, seasonal optimization, and market segment diversification. Multiple revenue channels improve financial stability and growth potential.

Brand recognition advantages in the French market create long-term value through customer loyalty, premium pricing capability, and expansion opportunities. Strong brand positioning supports marketing efficiency and competitive differentiation in crowded marketplaces.

Operational efficiency gains through technology integration, staff training, and process optimization reduce costs while improving service quality. Digital transformation initiatives enable better resource allocation and enhanced guest experience delivery.

Market access benefits provide hospitality operators with entry into one of the world’s most attractive tourism markets, offering exposure to diverse customer segments and stable demand patterns that support sustainable business growth.

Partnership opportunities with local suppliers, cultural institutions, and tourism organizations create synergistic relationships that enhance service offerings while supporting community development and authentic experience creation.

Investment returns in the French hospitality market benefit from stable regulatory environment, strong tourism fundamentals, and growing demand for quality hospitality services that support long-term asset appreciation and operational profitability.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability integration emerges as a dominant trend with hospitality providers implementing comprehensive environmental programs, local sourcing initiatives, and carbon reduction strategies. Green certification adoption reaches approximately 42% of hospitality providers, reflecting growing commitment to environmental responsibility.

Digital transformation acceleration continues reshaping service delivery through mobile applications, contactless technologies, and artificial intelligence integration. Smart room technologies, automated check-in processes, and personalized recommendation systems enhance operational efficiency while improving guest satisfaction.

Experiential hospitality focus drives service innovation as providers create unique, memorable experiences that extend beyond traditional accommodation and dining services. Cultural immersion programs, local partnership initiatives, and specialized activity offerings differentiate properties in competitive markets.

Health and wellness emphasis influences facility design, service offerings, and operational protocols as travelers prioritize well-being during their stays. Spa services, fitness facilities, healthy dining options, and wellness programs become standard expectations rather than luxury amenities.

Personalization advancement through data analytics and guest preference tracking enables customized service delivery that enhances satisfaction and loyalty. Tailored recommendations, personalized amenities, and individualized experiences create competitive advantages and premium pricing opportunities.

Local partnership development strengthens community connections while enhancing authentic experience offerings. Collaborations with local artisans, cultural institutions, and specialty providers create unique value propositions that differentiate properties from standardized hospitality offerings.

Technology infrastructure investments accelerate across the hospitality sector with major operators implementing comprehensive digital transformation programs. Cloud-based property management systems, mobile applications, and integrated booking platforms improve operational efficiency while enhancing guest experience delivery.

Sustainability certification programs gain widespread adoption as hospitality providers pursue environmental credentials that appeal to conscious travelers. Green building standards, renewable energy implementation, and waste reduction initiatives become competitive differentiators in the marketplace.

Workforce development initiatives address labor shortage challenges through enhanced training programs, competitive compensation packages, and career development opportunities. Industry partnerships with educational institutions create talent pipelines while improving service quality standards.

Regional development projects expand hospitality capacity in underserved markets while preserving local character and cultural authenticity. Public-private partnerships support infrastructure development that enables sustainable tourism growth in emerging destinations.

Strategic acquisitions and partnerships reshape competitive dynamics as operators seek scale advantages, geographic expansion, and operational synergies. Consolidation trends create opportunities for both large-scale integration and boutique specialization strategies.

Regulatory framework evolution adapts to changing market conditions with updated health and safety standards, environmental requirements, and consumer protection measures that influence operational practices and investment priorities across the sector.

MarkWide Research recommends that hospitality providers prioritize digital transformation investments to improve operational efficiency and guest experience delivery. Technology adoption should focus on mobile applications, contactless services, and data analytics capabilities that enable personalized service delivery and operational optimization.

Sustainability integration represents a critical strategic priority as environmental consciousness influences booking decisions and regulatory requirements. Operators should implement comprehensive sustainability programs that reduce environmental impact while creating marketing advantages and operational cost savings.

Market differentiation strategies should emphasize unique French cultural elements, authentic local experiences, and specialized service offerings that justify premium pricing and build customer loyalty. Generic hospitality approaches face increasing competitive pressure from alternative accommodation platforms.

Regional expansion opportunities exist in secondary markets and underexplored destinations that offer authentic experiences and lower operational costs. Strategic geographic diversification can reduce seasonal dependency while capturing emerging tourism trends.

Partnership development with local suppliers, cultural institutions, and tourism organizations creates synergistic relationships that enhance service offerings while supporting community development. Collaborative approaches strengthen market positioning and operational sustainability.

Workforce investment in training, retention, and development programs addresses labor shortage challenges while improving service quality and operational efficiency. Human capital development represents a critical competitive advantage in service-intensive hospitality operations.

Growth projections for the France hospitality market remain optimistic with sustained expansion rates expected at approximately 6.2% CAGR through the forecast period. Recovery momentum continues strengthening as international travel normalizes and domestic tourism maintains robust performance levels.

Technology integration will accelerate with artificial intelligence, Internet of Things, and mobile technologies becoming standard operational tools. Smart hospitality solutions will improve efficiency while enabling personalized guest experiences that differentiate successful operators from competitors.

Sustainability requirements will intensify as environmental regulations strengthen and consumer awareness increases. Hospitality providers must implement comprehensive sustainability programs to maintain competitive positioning and regulatory compliance in evolving market conditions.

Market segmentation will continue evolving with specialized niches gaining prominence as travelers seek unique, authentic experiences. Wellness tourism, culinary experiences, cultural immersion, and adventure travel represent high-growth segments with premium pricing potential.

Regional development will expand hospitality capacity beyond traditional tourist centers, creating opportunities in secondary cities and rural areas that offer authentic French experiences. Infrastructure investments will support sustainable tourism growth in emerging destinations.

MWR analysis indicates that successful hospitality providers will combine traditional French hospitality values with modern operational efficiency and technological innovation. The integration of cultural authenticity with contemporary service delivery will define market leadership in the evolving competitive landscape.

France’s hospitality market represents a dynamic and resilient sector that combines cultural heritage with modern service innovation to create compelling value propositions for diverse traveler segments. The market’s strength derives from France’s position as a global tourism leader, supported by exceptional cultural attractions, culinary excellence, and comprehensive infrastructure that facilitates memorable guest experiences.

Strategic opportunities abound for hospitality providers who embrace digital transformation, sustainability initiatives, and experiential service delivery while maintaining the authentic French hospitality traditions that differentiate the market globally. Technology integration, environmental responsibility, and personalized guest experiences will define competitive success in the evolving marketplace.

Market resilience demonstrated through recovery from recent challenges positions the France hospitality sector for sustained growth and continued global leadership. The combination of international appeal, domestic market strength, and operational innovation creates a foundation for long-term success and value creation across all market segments and stakeholder groups.

What is Hospitality?

Hospitality refers to the industry that provides services related to accommodation, food, and drink, including hotels, restaurants, and event planning. It encompasses various sectors that cater to the needs of travelers and locals alike.

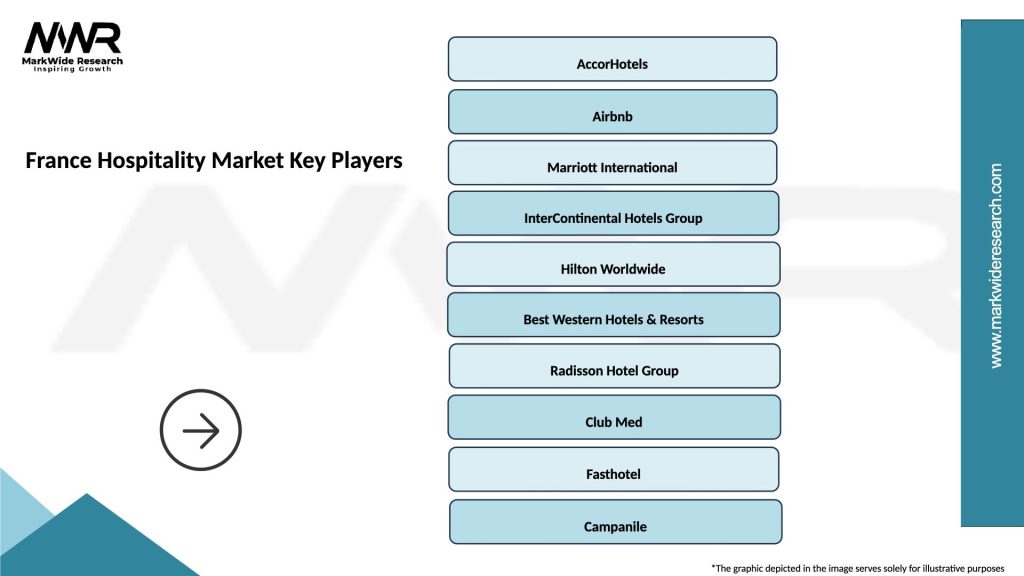

What are the key players in the France Hospitality Market?

Key players in the France Hospitality Market include AccorHotels, Groupe Pierre & Vacances, and Club Med, which offer a range of services from luxury accommodations to family-oriented resorts. These companies are known for their diverse offerings and strong presence in the French tourism sector, among others.

What are the growth factors driving the France Hospitality Market?

The France Hospitality Market is driven by factors such as the increasing number of international tourists, the growth of business travel, and the rising demand for unique dining experiences. Additionally, events like trade shows and cultural festivals contribute to the market’s expansion.

What challenges does the France Hospitality Market face?

Challenges in the France Hospitality Market include intense competition, fluctuating economic conditions, and the impact of seasonal tourism. Additionally, regulatory changes and labor shortages can pose significant hurdles for businesses in this sector.

What opportunities exist in the France Hospitality Market?

Opportunities in the France Hospitality Market include the rise of eco-friendly accommodations, the integration of technology in guest services, and the growing trend of experiential travel. These factors present avenues for innovation and differentiation among hospitality providers.

What trends are shaping the France Hospitality Market?

Trends shaping the France Hospitality Market include the increasing focus on sustainability, the use of digital platforms for bookings, and the popularity of boutique hotels. Additionally, personalized guest experiences and local culinary offerings are becoming more prominent in attracting customers.

France Hospitality Market

| Segmentation Details | Description |

|---|---|

| Service Type | Accommodation, Food & Beverage, Event Management, Travel Services |

| Customer Type | Leisure Travelers, Business Travelers, Group Bookings, Corporate Clients |

| Distribution Channel | Online Travel Agencies, Direct Bookings, Travel Agents, Mobile Apps |

| End User | Hotels, Restaurants, Cafés, Resorts |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the France Hospitality Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at