444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The France food service industry market represents one of Europe’s most sophisticated and culturally significant culinary ecosystems, encompassing restaurants, cafés, catering services, and institutional food providers. France’s renowned gastronomic heritage continues to drive innovation and excellence across all segments of the food service sector, from traditional bistros to modern quick-service establishments. The market demonstrates remarkable resilience and adaptability, particularly following recent global challenges that reshaped consumer dining preferences and operational models.

Market dynamics indicate sustained growth driven by evolving consumer behaviors, technological integration, and increasing demand for diverse dining experiences. The sector benefits from strong domestic tourism, international visitor flows, and a culture that deeply values culinary experiences. Digital transformation has accelerated across the industry, with establishments adopting advanced ordering systems, delivery platforms, and customer engagement technologies at an unprecedented pace of 78% adoption rate among major operators.

Regional variations within France create distinct market characteristics, with Paris leading in fine dining and innovative concepts, while regional markets maintain strong connections to local culinary traditions. The industry’s evolution reflects broader societal changes, including sustainability concerns, health consciousness, and the integration of international cuisines within the traditional French dining landscape.

The France food service industry market refers to the comprehensive ecosystem of businesses and establishments that prepare, serve, and deliver food and beverages to consumers outside their homes. This market encompasses traditional restaurants, fast-food chains, cafés, catering companies, institutional food services, and emerging delivery-focused concepts that collectively serve millions of meals daily across the country.

Food service establishments in France operate within a unique cultural context where dining represents both sustenance and social experience. The market includes full-service restaurants ranging from neighborhood bistros to Michelin-starred establishments, quick-service restaurants, coffee shops, bars, catering services for events and businesses, and institutional food providers serving schools, hospitals, and corporate facilities.

Modern interpretations of the food service market have expanded to include ghost kitchens, food trucks, meal kit services, and digital-first dining concepts that leverage technology to enhance customer experiences and operational efficiency.

France’s food service industry continues to demonstrate robust performance across multiple segments, driven by strong consumer demand for diverse dining experiences and innovative service models. The market has successfully adapted to changing consumer preferences, integrating digital technologies while maintaining the cultural authenticity that defines French culinary excellence.

Key performance indicators reveal significant growth in delivery services, with online food delivery experiencing 42% year-over-year growth, while traditional dining segments show steady recovery and expansion. The industry benefits from France’s position as a global culinary destination, attracting both domestic and international consumers who value quality, authenticity, and innovation in food service offerings.

Strategic developments include increased investment in sustainable practices, technology integration, and workforce development programs designed to address labor challenges while maintaining service quality standards. The market’s resilience stems from its ability to balance tradition with innovation, creating opportunities for both established operators and emerging concepts.

Future projections indicate continued expansion across all segments, with particular strength in casual dining, quick-service concepts, and technology-enabled service models that enhance convenience without compromising quality.

Strategic analysis of the France food service industry reveals several critical insights that define current market dynamics and future opportunities:

Primary growth drivers propelling the France food service industry include evolving consumer lifestyles that prioritize convenience and quality dining experiences. Urbanization trends continue to support market expansion, as city dwellers increasingly rely on food service establishments for daily meals and social interactions.

Cultural factors play a crucial role in market dynamics, with France’s deep-rooted appreciation for culinary excellence creating sustained demand for high-quality food service experiences. The integration of international cuisines within French dining culture expands market opportunities while maintaining respect for traditional culinary values.

Technology advancement serves as a significant driver, enabling operators to improve efficiency, enhance customer experiences, and develop new service models. Digital ordering systems, mobile applications, and data analytics tools help establishments better understand and serve customer preferences while optimizing operational performance.

Economic factors including disposable income growth and changing work patterns support increased food service consumption. The rise of remote work and flexible schedules creates new dining occasions and service opportunities throughout the day.

Tourism recovery and international travel resumption provide substantial market support, particularly for establishments in major cities and tourist destinations that depend on visitor spending for revenue growth.

Operational challenges facing the France food service industry include persistent labor shortages that affect service quality and expansion capabilities. Skilled workforce availability remains a critical constraint, particularly for establishments requiring specialized culinary expertise and customer service skills.

Regulatory compliance requirements create ongoing operational burdens, including food safety standards, labor regulations, and environmental compliance measures that increase operational complexity and costs. Health and safety protocols continue to influence operational procedures and capacity management across all establishment types.

Economic pressures including inflation, supply chain disruptions, and fluctuating commodity prices impact profitability and pricing strategies. Rising real estate costs in prime locations limit expansion opportunities for new entrants and existing operators seeking to grow their presence.

Competition intensity from both traditional and emerging food service concepts creates market saturation in certain segments and geographic areas. The proliferation of delivery-only concepts and ghost kitchens increases competitive pressure on traditional restaurant models.

Consumer behavior volatility related to economic uncertainty and changing preferences requires continuous adaptation of service models and menu offerings, creating operational challenges for establishments with fixed operational structures.

Emerging opportunities within the France food service industry include the development of hybrid service models that combine traditional dining with delivery and takeout capabilities. Technology integration creates possibilities for enhanced customer experiences through personalized service, automated ordering systems, and data-driven menu optimization.

Sustainability initiatives present opportunities for differentiation and cost reduction through waste minimization, local sourcing, and energy-efficient operations. Health-focused concepts align with growing consumer awareness of nutrition and wellness, creating market niches for specialized food service providers.

Geographic expansion opportunities exist in underserved suburban and rural markets where food service options remain limited. Franchise development and scalable concept replication enable successful operators to expand their market presence efficiently.

Corporate catering and institutional food service segments offer stable revenue streams and long-term contract opportunities. The evolution of workplace dining needs creates demand for flexible, high-quality food service solutions.

International cuisine integration provides opportunities to attract diverse consumer segments while maintaining French culinary standards and presentation excellence.

Market dynamics in the France food service industry reflect the complex interplay between traditional culinary culture and modern consumer expectations. Supply chain relationships between food service operators and suppliers continue to evolve, emphasizing quality, sustainability, and reliability over purely cost-based considerations.

Competitive positioning strategies focus on differentiation through unique dining experiences, exceptional service quality, and innovative menu offerings that reflect both local preferences and international trends. MarkWide Research analysis indicates that successful operators balance authenticity with innovation to maintain competitive advantages.

Consumer engagement patterns show increasing importance of digital touchpoints, social media presence, and community involvement in building brand loyalty and driving repeat business. Pricing strategies must account for value perception while managing cost pressures from labor, ingredients, and operational expenses.

Operational efficiency improvements through technology adoption and process optimization enable establishments to maintain service quality while managing cost structures. Partnership development with delivery platforms, suppliers, and technology providers creates ecosystem advantages for forward-thinking operators.

Market consolidation trends show larger operators acquiring successful independent concepts while maintaining their unique characteristics and local market appeal.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and actionable insights into the France food service industry. Primary research includes extensive surveys of food service operators, consumer behavior studies, and in-depth interviews with industry executives and market participants.

Secondary research incorporates analysis of industry reports, government statistics, trade association data, and financial performance metrics from publicly available sources. Market observation through field research and establishment visits provides qualitative insights into operational practices and consumer experiences.

Data validation processes ensure accuracy and reliability through cross-referencing multiple sources and expert review of findings. Statistical analysis employs advanced modeling techniques to identify trends, correlations, and predictive indicators within the market data.

Industry expert consultation provides context and interpretation of quantitative findings, ensuring practical relevance and strategic applicability of research conclusions. Continuous monitoring of market developments enables real-time updates and refinement of analytical frameworks.

Paris metropolitan area dominates the France food service landscape, accounting for approximately 28% of total market activity and serving as the epicenter for culinary innovation and fine dining excellence. The capital region supports the highest concentration of Michelin-starred establishments and attracts significant international tourism that drives food service demand.

Lyon and southeastern regions maintain strong market presence with 18% market share, emphasizing traditional French cuisine and regional specialties that attract both domestic and international visitors. These markets benefit from strong local food traditions and proximity to Mediterranean influences.

Northern regions including Lille and surrounding areas represent 15% of market activity, characterized by diverse dining options that reflect proximity to Belgium and other European culinary influences. Industrial heritage and urban development support varied food service segments.

Western coastal regions contribute 14% of market share, with seafood-focused establishments and tourism-driven seasonal variations in demand. These markets benefit from fresh local ingredients and strong regional culinary identities.

Remaining regional markets collectively account for 25% of industry activity, featuring local specialties, traditional establishments, and emerging concepts that serve local populations and regional tourism.

Market leadership in the France food service industry encompasses both large-scale operators and prestigious independent establishments that define culinary excellence. The competitive environment balances scale advantages with artisanal quality and local market knowledge.

Competitive strategies focus on differentiation through service quality, menu innovation, and customer experience enhancement while managing operational efficiency and cost structures effectively.

Market segmentation within the France food service industry reflects diverse consumer needs, dining occasions, and service preferences that create distinct operational and strategic requirements.

By Service Type:

By Price Segment:

By Cuisine Type:

Full-service restaurants continue to represent the largest segment of the France food service market, benefiting from strong cultural preferences for leisurely dining experiences and social interaction. Traditional bistros and brasseries maintain steady performance while adapting to modern consumer expectations for quality and service efficiency.

Quick-service restaurants show robust growth driven by convenience demands and evolving consumer lifestyles. Health-conscious quick-service concepts gain market share by offering fresh ingredients and customizable options that appeal to nutrition-aware consumers.

Coffee culture expansion creates opportunities for specialty coffee shops and café concepts that serve as social gathering spaces and remote work locations. Premium coffee experiences command higher margins while building customer loyalty through quality and ambiance.

Catering services benefit from corporate event recovery and celebration dining demand. Specialized catering for dietary restrictions and cultural preferences expands market opportunities for service providers with expertise in diverse menu requirements.

Institutional food service provides stable revenue streams through long-term contracts while requiring operational efficiency and nutritional compliance. Innovation in institutional dining improves customer satisfaction and contract retention rates.

Food service operators benefit from France’s strong culinary culture that supports premium pricing for quality experiences and creates customer loyalty based on dining satisfaction. Market stability provides predictable demand patterns that enable effective business planning and investment strategies.

Suppliers and vendors gain from established relationships with food service operators who prioritize quality and reliability over purely cost-based purchasing decisions. Local sourcing preferences create opportunities for regional suppliers to develop long-term partnerships with establishments.

Technology providers find receptive markets for solutions that enhance operational efficiency and customer experiences without compromising service quality. Innovation adoption accelerates as operators recognize competitive advantages from technology integration.

Real estate investors benefit from stable demand for prime food service locations, particularly in high-traffic urban areas and tourist destinations. Property values remain supported by consistent food service industry demand for quality locations.

Consumers enjoy diverse dining options, improved service quality, and innovative concepts that enhance their culinary experiences while maintaining French cultural authenticity and excellence standards.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability integration emerges as a dominant trend, with food service operators implementing comprehensive environmental programs including waste reduction, local sourcing, and energy-efficient operations. Consumer awareness of environmental impact drives demand for establishments that demonstrate genuine commitment to sustainable practices.

Technology-enhanced dining experiences gain prominence through mobile ordering, contactless payment systems, and personalized service recommendations based on customer preferences and dining history. Digital integration improves operational efficiency while maintaining the personal touch that defines quality food service.

Health and wellness focus influences menu development across all segments, with establishments offering nutritional information, allergen-friendly options, and fresh ingredient transparency. Functional foods and beverages that provide health benefits beyond basic nutrition gain consumer acceptance.

Experiential dining concepts that combine food service with entertainment, education, or cultural experiences attract consumers seeking memorable occasions beyond traditional dining. Interactive elements and unique presentations create social media appeal and customer engagement.

Delivery optimization continues evolving with ghost kitchens, delivery-only concepts, and partnership strategies that maximize reach while maintaining food quality during transport. Logistics innovation improves delivery efficiency and customer satisfaction.

Recent industry developments demonstrate the France food service market’s dynamic evolution and adaptation to changing consumer needs and operational challenges. Major restaurant groups continue expanding through strategic acquisitions and concept development that leverage their operational expertise and market presence.

Technology partnerships between food service operators and software providers accelerate digital transformation initiatives that improve customer experiences and operational efficiency. MWR data indicates that establishments investing in comprehensive technology solutions achieve higher customer satisfaction scores and improved profitability metrics.

Sustainability certifications and environmental compliance programs gain adoption as operators recognize both regulatory requirements and consumer preferences for responsible business practices. Supply chain innovations focus on reducing environmental impact while maintaining quality and cost effectiveness.

Workforce development programs address labor shortages through improved training, career advancement opportunities, and enhanced compensation packages that attract and retain skilled employees. Industry collaboration with educational institutions creates pipelines for future food service professionals.

Menu innovation reflects changing consumer preferences for diverse flavors, dietary accommodations, and premium ingredients that justify higher price points while maintaining accessibility across market segments.

Strategic recommendations for food service operators include prioritizing technology investments that enhance both customer experiences and operational efficiency while maintaining the personal service quality that defines successful establishments. Digital transformation should complement rather than replace human interaction in customer service delivery.

Market positioning strategies should emphasize unique value propositions that differentiate establishments from competitors while remaining authentic to brand identity and customer expectations. Consistency in execution across all customer touchpoints builds trust and loyalty in competitive markets.

Operational excellence requires continuous improvement in food quality, service delivery, and cost management through systematic processes and employee training programs. Performance measurement systems should track both financial metrics and customer satisfaction indicators.

Partnership development with suppliers, technology providers, and delivery platforms creates competitive advantages while managing operational complexity and investment requirements. Strategic alliances enable smaller operators to access capabilities typically available only to larger organizations.

Sustainability initiatives should be integrated into core business strategies rather than treated as separate programs, creating operational efficiencies while meeting consumer expectations for environmental responsibility.

Long-term projections for the France food service industry indicate continued growth across all segments, driven by evolving consumer preferences, technological advancement, and sustained demand for quality dining experiences. Market expansion is expected to maintain steady momentum with projected growth rates of 6.2% annually over the next five years.

Innovation acceleration will continue reshaping operational models and customer experiences, with successful operators balancing technological advancement with cultural authenticity. MarkWide Research forecasts indicate that establishments embracing comprehensive digital strategies while maintaining service excellence will capture disproportionate market share growth.

Consumer behavior evolution suggests increasing demand for personalized dining experiences, sustainable practices, and health-conscious menu options that align with lifestyle preferences. Demographic shifts will influence market dynamics as younger consumers prioritize convenience and social responsibility in dining choices.

Market consolidation trends may accelerate as successful operators expand through acquisition and franchise development while maintaining local market appeal and operational quality. Independent establishments that develop strong brand identities and customer loyalty will continue thriving alongside larger operators.

International influence will continue expanding French food service diversity while traditional cuisine maintains its central role in defining market character and consumer expectations for quality and authenticity.

The France food service industry market demonstrates remarkable resilience and adaptability while maintaining its position as a global leader in culinary excellence and dining innovation. Market fundamentals remain strong, supported by cultural appreciation for quality food experiences, robust tourism demand, and successful integration of modern service technologies with traditional hospitality values.

Strategic opportunities abound for operators who can balance innovation with authenticity, leveraging technology to enhance rather than replace the personal connections that define exceptional food service. Sustainability initiatives, health-conscious menu development, and digital transformation will continue driving competitive differentiation and customer loyalty.

Future success in the France food service market will depend on operators’ ability to adapt to evolving consumer preferences while maintaining the quality standards and cultural authenticity that distinguish French dining experiences globally. The industry’s continued evolution promises exciting opportunities for established operators and innovative new concepts alike.

What is France Food Service Industry?

The France Food Service Industry encompasses all businesses that prepare and serve food and beverages outside the home, including restaurants, cafes, catering services, and institutional food services.

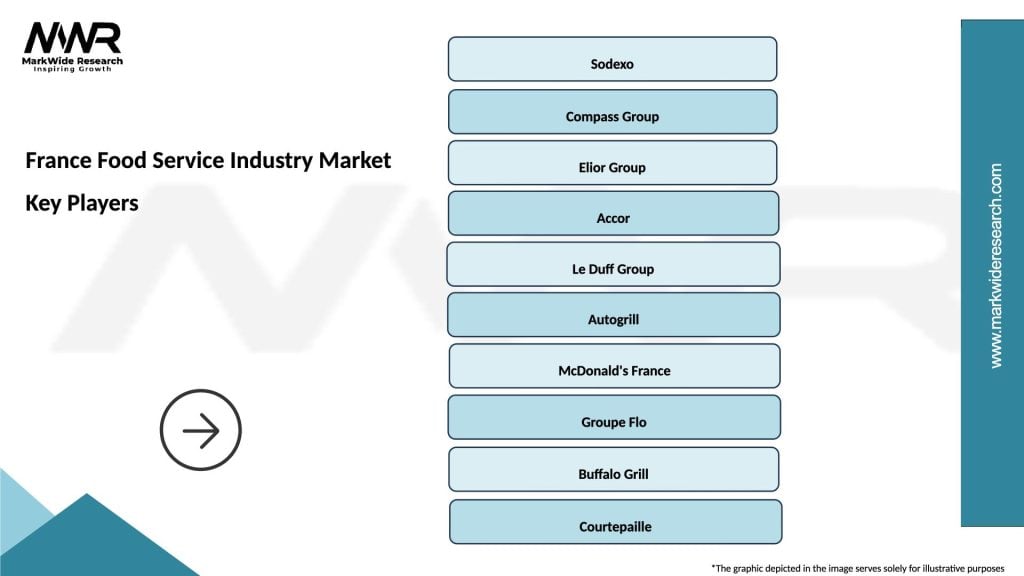

What are the key players in the France Food Service Industry Market?

Key players in the France Food Service Industry Market include Sodexo, Elior Group, and Groupe Bertrand, which operate various segments such as catering, fast food, and casual dining, among others.

What are the main drivers of growth in the France Food Service Industry Market?

The main drivers of growth in the France Food Service Industry Market include increasing consumer demand for convenience, the rise of food delivery services, and a growing trend towards dining out and experiencing diverse cuisines.

What challenges does the France Food Service Industry Market face?

Challenges in the France Food Service Industry Market include rising food costs, labor shortages, and the need to adapt to changing consumer preferences towards healthier and sustainable food options.

What opportunities exist in the France Food Service Industry Market?

Opportunities in the France Food Service Industry Market include the expansion of online ordering and delivery platforms, the growth of plant-based and organic food offerings, and the potential for innovative dining experiences.

What trends are shaping the France Food Service Industry Market?

Trends shaping the France Food Service Industry Market include the increasing popularity of food trucks, the integration of technology in ordering and payment systems, and a focus on sustainability and local sourcing of ingredients.

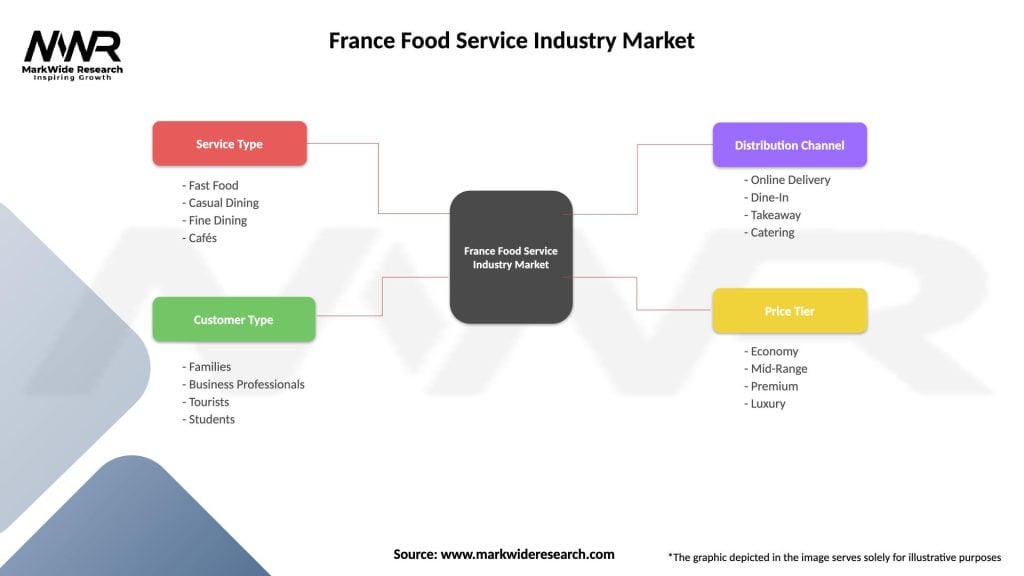

France Food Service Industry Market

| Segmentation Details | Description |

|---|---|

| Service Type | Fast Food, Casual Dining, Fine Dining, Cafés |

| Customer Type | Families, Business Professionals, Tourists, Students |

| Distribution Channel | Online Delivery, Dine-In, Takeaway, Catering |

| Price Tier | Economy, Mid-Range, Premium, Luxury |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the France Food Service Industry Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at