444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The France EV battery pack market represents a pivotal component of the country’s ambitious transition toward sustainable transportation and energy independence. France’s commitment to phasing out internal combustion engine vehicles by 2040 has created unprecedented demand for advanced battery technologies, positioning the nation as a key player in Europe’s electric vehicle revolution. The market encompasses lithium-ion battery packs, solid-state batteries, and emerging battery chemistries designed specifically for electric passenger vehicles, commercial fleets, and two-wheelers.

Market dynamics indicate robust growth driven by government incentives, environmental regulations, and increasing consumer acceptance of electric mobility. The French automotive sector, anchored by manufacturers like Renault and Peugeot, has accelerated EV production timelines, creating substantial demand for locally sourced battery solutions. Battery pack manufacturers are establishing strategic partnerships with automotive OEMs to secure long-term supply agreements and develop customized solutions for French market requirements.

Technological advancement remains at the forefront of market evolution, with French companies investing heavily in next-generation battery technologies. The market benefits from significant government support through the France 2030 investment plan, which allocates substantial resources to battery manufacturing and research initiatives. Regional manufacturing capabilities are expanding rapidly, with several gigafactory projects under development to meet growing domestic and export demand.

The France EV battery pack market refers to the comprehensive ecosystem of battery manufacturing, distribution, and integration services specifically designed for electric vehicles operating within the French automotive landscape. This market encompasses the entire value chain from raw material processing and cell manufacturing to complete battery pack assembly and integration into electric vehicles.

Battery pack systems in this context include high-voltage lithium-ion battery assemblies, battery management systems, thermal management components, and safety systems that power electric passenger cars, commercial vehicles, buses, and motorcycles. The market also covers aftermarket services including battery maintenance, recycling, and second-life applications for used EV batteries.

Market participants include international battery manufacturers establishing French operations, domestic technology companies developing specialized solutions, automotive OEMs with integrated battery strategies, and supporting infrastructure providers. The definition extends to research institutions and startups developing next-generation battery technologies specifically for French and European market applications.

France’s EV battery pack market is experiencing transformational growth as the nation positions itself as a leader in European electric mobility. The market benefits from strong governmental support, strategic automotive industry partnerships, and increasing consumer adoption of electric vehicles across all segments. Key market drivers include stringent emissions regulations, substantial purchase incentives, and expanding charging infrastructure that collectively support accelerated EV adoption rates.

Manufacturing capacity expansion represents a critical market development, with several major battery producers announcing significant investments in French production facilities. These investments aim to reduce supply chain dependencies and create a localized battery ecosystem capable of supporting both domestic demand and export opportunities to neighboring European markets. Technology innovation focuses on improving energy density, reducing charging times, and extending battery lifecycle performance.

Market segmentation reveals strong growth across passenger vehicle applications, with commercial vehicle and public transportation sectors emerging as high-potential segments. The market demonstrates resilience against global supply chain disruptions through strategic partnerships and diversified sourcing strategies. Future growth prospects remain highly positive, supported by continued policy support and accelerating automotive industry electrification timelines.

Strategic market insights reveal several critical factors shaping the France EV battery pack landscape. The market demonstrates strong correlation between government policy initiatives and adoption acceleration, with recent regulatory changes driving significant increases in EV sales and corresponding battery demand.

Market maturation indicators suggest the transition from early adoption phase to mainstream market acceptance, with battery performance and cost considerations becoming increasingly competitive with traditional powertrain alternatives. Consumer confidence in EV technology continues strengthening as battery reliability and charging convenience improve significantly.

Government policy initiatives serve as the primary catalyst for France EV battery pack market expansion. The French government’s commitment to carbon neutrality by 2050 includes comprehensive support for electric vehicle adoption through purchase incentives, tax benefits, and infrastructure development programs. Regulatory frameworks mandate increasing percentages of electric vehicles in public fleets and commercial operations, creating guaranteed demand for battery systems.

Environmental consciousness among French consumers has reached unprecedented levels, driving voluntary adoption of electric vehicles beyond regulatory requirements. Urban air quality concerns, particularly in major cities like Paris and Lyon, motivate consumers to choose electric alternatives. Corporate sustainability initiatives increasingly include fleet electrification targets, creating substantial demand for commercial vehicle battery solutions.

Technological advancement in battery performance continues eliminating traditional barriers to EV adoption. Improvements in energy density allow longer driving ranges, while faster charging capabilities reduce convenience concerns. Cost reduction trends make electric vehicles increasingly competitive with conventional alternatives, particularly when considering total ownership costs including fuel and maintenance savings.

Infrastructure development accelerates market growth through expanding charging networks and improved grid integration capabilities. The French government’s investment in charging infrastructure creates confidence among potential EV buyers, while smart grid technologies enable more efficient battery utilization and grid services revenue opportunities.

Supply chain vulnerabilities present significant challenges for the France EV battery pack market, particularly regarding critical raw materials like lithium, cobalt, and rare earth elements. Geopolitical tensions and trade restrictions can disrupt material availability and increase costs, impacting battery production schedules and pricing strategies. The concentration of mining operations in specific regions creates dependency risks that French manufacturers actively work to mitigate.

High capital investment requirements for battery manufacturing facilities create barriers for new market entrants and limit expansion capabilities for existing players. Technology obsolescence risks concern investors and manufacturers, as rapid advancement in battery chemistry and design can quickly render existing production capabilities outdated. The need for continuous research and development investment strains financial resources across the industry.

Skilled workforce shortages in specialized battery technology fields limit industry growth potential. The rapid expansion of battery manufacturing requires engineers, technicians, and production specialists with specific expertise in electrochemical systems and advanced manufacturing processes. Training and education programs require time to develop adequate talent pipelines for industry needs.

Recycling infrastructure limitations create long-term sustainability concerns as the first generation of EV batteries approaches end-of-life status. Regulatory uncertainty regarding future battery performance standards and recycling requirements creates planning challenges for manufacturers and investors in the French market.

Export market potential represents a substantial opportunity for French battery manufacturers to leverage domestic expertise and production capabilities across European markets. The European Union’s push for battery manufacturing independence creates demand for locally produced solutions, positioning French companies advantageously. Strategic partnerships with European automotive manufacturers can secure long-term revenue streams and technology development collaborations.

Second-life battery applications offer emerging revenue opportunities as EV batteries retain significant capacity after automotive use. Energy storage systems for residential, commercial, and grid applications can utilize retired EV batteries, creating circular economy benefits and additional revenue streams. French companies are developing specialized systems for repurposing automotive batteries in stationary applications.

Advanced battery technologies including solid-state batteries and alternative chemistries present opportunities for French companies to establish technology leadership positions. Research and development investments in next-generation battery systems can create competitive advantages and intellectual property portfolios valuable for licensing and partnerships.

Vertical integration opportunities allow battery manufacturers to expand into related areas including battery management systems, thermal management, and charging technologies. Service-based business models including battery-as-a-service and performance guarantees can create recurring revenue streams and stronger customer relationships throughout the battery lifecycle.

Competitive dynamics in the France EV battery pack market reflect the interplay between established international players and emerging domestic capabilities. Market consolidation trends show increasing collaboration between automotive OEMs and battery specialists to secure supply chains and develop customized solutions. The market demonstrates growing technological differentiation as companies focus on specific performance characteristics and application requirements.

Pricing pressures continue influencing market dynamics as battery costs decline and performance improves simultaneously. Scale economies become increasingly important as manufacturers seek to achieve competitive cost structures through higher production volumes. The market shows evidence of learning curve effects where production experience leads to improved efficiency and quality outcomes.

Innovation cycles accelerate as companies compete on battery performance metrics including energy density, charging speed, and lifecycle durability. Patent competition intensifies as companies seek to protect technological advantages and create licensing revenue opportunities. According to MarkWide Research analysis, the market demonstrates increasing sophistication in battery management systems and thermal control technologies.

Customer relationship dynamics evolve toward longer-term partnerships and integrated development programs. Supply chain optimization becomes a critical competitive factor as companies seek to reduce costs and improve reliability through strategic sourcing and vertical integration initiatives.

Primary research methodologies employed in analyzing the France EV battery pack market include comprehensive interviews with industry executives, technology specialists, and government officials involved in electric vehicle policy development. Survey instruments capture quantitative data on market trends, technology preferences, and investment priorities from key market participants including battery manufacturers, automotive OEMs, and component suppliers.

Secondary research sources encompass government publications, industry association reports, patent filings, and academic research papers focused on battery technology advancement and market development. Financial analysis includes examination of public company reports, investment announcements, and merger and acquisition activities within the French battery ecosystem.

Market modeling techniques utilize statistical analysis of historical trends, correlation analysis between policy changes and market responses, and scenario planning for future market development under different regulatory and economic conditions. Technology assessment involves evaluation of patent landscapes, research publication trends, and technology demonstration projects.

Data validation processes include cross-referencing multiple sources, expert review panels, and sensitivity analysis of key assumptions. Quality assurance measures ensure accuracy and reliability of market insights through systematic verification procedures and peer review processes.

Île-de-France region dominates the French EV battery pack market landscape, hosting major research institutions, automotive headquarters, and emerging battery technology companies. The region benefits from concentrated talent pools, access to capital markets, and proximity to key decision-makers in government and industry. Paris metropolitan area serves as the primary hub for battery technology innovation and strategic partnerships between French and international companies.

Hauts-de-France region emerges as a significant manufacturing center, leveraging existing automotive industry infrastructure and skilled workforce capabilities. The region attracts battery manufacturing investments due to favorable logistics, competitive labor costs, and strong government support for industrial development. Cross-border proximity to Belgium and Germany provides strategic advantages for European market access.

Auvergne-Rhône-Alpes region demonstrates strong growth in battery technology research and development, supported by leading universities and research institutions. The region shows particular strength in advanced materials research and battery chemistry development. Industrial clusters in the region focus on high-performance battery applications and specialized manufacturing processes.

Grand Est region benefits from strategic location for European market access and established automotive industry presence. The region attracts international battery manufacturers seeking European production bases with efficient logistics networks. Regional development programs provide targeted support for battery industry investments and workforce development initiatives.

Market leadership in the France EV battery pack sector reflects a combination of international technology leaders and emerging domestic players. The competitive environment demonstrates increasing collaboration between established automotive manufacturers and specialized battery technology companies.

Strategic positioning varies among competitors, with some focusing on cost leadership while others emphasize technology differentiation and premium performance characteristics. Partnership strategies play crucial roles in market success, as companies seek to secure long-term supply agreements and technology development collaborations.

Innovation competition intensifies as companies invest heavily in next-generation battery technologies and manufacturing process improvements. Market entry strategies for international players often involve joint ventures or strategic partnerships with French companies to navigate regulatory requirements and establish local market presence.

By Battery Type: The France EV battery pack market demonstrates clear segmentation across different battery technologies and chemistries. Lithium-ion batteries dominate current market applications, with nickel manganese cobalt (NMC) and lithium iron phosphate (LFP) chemistries leading in different vehicle segments. Solid-state batteries represent emerging technology with significant future potential, while alternative chemistries including sodium-ion and lithium-sulfur batteries attract research investment.

By Vehicle Type: Market segmentation reveals distinct requirements and growth patterns across vehicle categories. Passenger vehicles represent the largest market segment, with compact cars and SUVs driving primary demand. Commercial vehicles including delivery vans and trucks show rapid growth as logistics companies electrify fleets. Public transportation applications including buses and light rail systems require specialized high-capacity battery solutions.

By Capacity Range: Battery pack capacity segmentation reflects diverse vehicle requirements and use cases. Small capacity packs (20-40 kWh) serve urban mobility and compact vehicle applications. Medium capacity systems (40-80 kWh) address mainstream passenger vehicle needs. Large capacity solutions (80+ kWh) support luxury vehicles, commercial applications, and long-range requirements.

By Application: End-use applications demonstrate varying growth rates and technical requirements. Original equipment manufacturer (OEM) applications dominate market volume, while aftermarket replacement and retrofit applications show emerging potential as the EV installed base expands.

Passenger Vehicle Segment: This category represents the primary growth driver for the French EV battery pack market, with increasing consumer adoption across all vehicle classes. Compact and mid-size vehicles dominate sales volumes, requiring battery packs optimized for cost-effectiveness and urban driving patterns. Premium vehicle applications demand higher performance batteries with extended range capabilities and faster charging speeds.

Commercial Vehicle Category: The commercial segment shows accelerating growth as businesses recognize total cost of ownership advantages and regulatory compliance requirements. Last-mile delivery vehicles require batteries optimized for frequent stop-start operations and daily charging cycles. Long-haul commercial applications demand high-capacity battery systems with rapid charging capabilities and extended operational life.

Two-Wheeler Segment: Electric motorcycles and scooters represent a rapidly expanding category with unique battery requirements including lightweight design and removable battery options. Urban mobility solutions drive demand for compact, efficient battery systems with convenient charging characteristics. Performance motorcycles require specialized high-power battery systems capable of supporting rapid acceleration and sustained high-speed operation.

Public Transportation Category: Municipal and regional transportation authorities increasingly adopt electric bus systems, creating demand for large-capacity battery solutions with proven reliability and long operational life. Charging infrastructure integration becomes critical for public transportation applications, requiring coordination between battery specifications and charging system capabilities.

Automotive Manufacturers benefit from the expanding French EV battery pack market through improved supply chain security, reduced dependency on international suppliers, and access to cutting-edge battery technologies. Local sourcing advantages include reduced logistics costs, shorter lead times, and enhanced collaboration opportunities for customized battery solutions. Technology partnerships with French battery companies enable automotive OEMs to influence battery development priorities and secure preferential access to advanced technologies.

Battery Manufacturers gain access to a sophisticated market with strong government support, established automotive industry relationships, and growing consumer acceptance of electric vehicles. Market entry benefits include regulatory support for manufacturing investments, skilled workforce availability, and strategic location for European market access. Innovation ecosystem advantages provide access to leading research institutions and technology development partnerships.

Government Stakeholders achieve multiple policy objectives through market development including reduced carbon emissions, enhanced energy security, and industrial competitiveness improvements. Economic benefits include job creation in high-technology manufacturing, increased tax revenues, and reduced dependence on fossil fuel imports. Strategic autonomy gains result from reduced dependence on foreign battery suppliers and enhanced domestic manufacturing capabilities.

Investors and Financial Institutions benefit from attractive growth prospects, government policy support, and increasing market maturity that reduces investment risks. Portfolio diversification opportunities include exposure to clean technology trends and sustainable transportation development. Long-term value creation potential stems from the fundamental shift toward electric mobility and supporting infrastructure development.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability Integration emerges as a dominant trend shaping the French EV battery pack market, with manufacturers increasingly focusing on environmentally responsible production processes and materials sourcing. Circular economy principles drive development of comprehensive battery lifecycle management including recycling and second-life applications. Carbon footprint reduction becomes a key competitive differentiator as companies seek to minimize environmental impact throughout the battery value chain.

Technology Convergence accelerates as battery systems integrate with vehicle electronics, charging infrastructure, and grid management systems. Smart battery management incorporates artificial intelligence and machine learning to optimize performance and extend battery life. Vehicle-to-grid capabilities enable EV batteries to provide grid services and energy storage functions beyond transportation applications.

Manufacturing Localization intensifies as companies seek to reduce supply chain risks and improve cost competitiveness through domestic production capabilities. Gigafactory development represents a key trend with multiple large-scale battery manufacturing facilities planned or under construction in France. Vertical integration strategies see companies expanding into related areas including battery materials processing and recycling operations.

Performance Enhancement continues driving market evolution with focus on increased energy density, faster charging capabilities, and extended operational life. Solid-state battery development represents a significant technology trend with potential to revolutionize EV battery performance characteristics. Thermal management innovation improves battery safety and performance across diverse operating conditions.

Major investment announcements have transformed the French EV battery pack market landscape, with several international battery manufacturers committing to establish significant production facilities in France. Stellantis partnerships with battery technology companies create integrated supply chains for French automotive production. Government funding initiatives through the France 2030 plan provide substantial support for battery manufacturing and research development projects.

Technology breakthrough achievements by French research institutions advance next-generation battery technologies including solid-state systems and alternative chemistry developments. Verkor’s gigafactory project represents a significant milestone in establishing domestic battery manufacturing capabilities with sustainable production processes. Saft’s expansion into automotive applications leverages decades of industrial battery expertise for EV market opportunities.

Strategic partnership formations between automotive OEMs and battery suppliers create long-term supply security and technology development collaborations. Recycling infrastructure development addresses end-of-life battery management with several new facilities announced for battery material recovery. MWR data indicates accelerating patent filing activity in battery technology areas, reflecting intensifying innovation competition.

Regulatory framework updates strengthen support for domestic battery manufacturing while establishing performance and safety standards for EV applications. Charging infrastructure integration projects demonstrate coordination between battery development and supporting infrastructure deployment. Export market development initiatives position French battery manufacturers for broader European market opportunities.

Strategic positioning recommendations emphasize the importance of establishing strong technology differentiation and sustainable competitive advantages in the rapidly evolving French EV battery pack market. Companies should prioritize investments in next-generation battery technologies while building robust manufacturing capabilities to serve both domestic and export markets. Partnership strategies with automotive OEMs and research institutions can accelerate technology development and market penetration.

Investment priorities should focus on developing comprehensive battery lifecycle capabilities including manufacturing, recycling, and second-life applications. Supply chain diversification becomes critical for reducing dependency risks and ensuring reliable material access for battery production. Workforce development initiatives require immediate attention to build adequate talent pipelines for expanding battery manufacturing operations.

Market entry strategies for international companies should emphasize local partnerships and technology transfer arrangements that contribute to French industrial development objectives. Domestic companies should leverage government support programs while building scale and technical capabilities to compete effectively with international players. Technology licensing opportunities can provide revenue streams and market access for companies with strong intellectual property portfolios.

Risk management approaches should address supply chain vulnerabilities, technology obsolescence risks, and regulatory change impacts through diversified strategies and flexible business models. Sustainability integration becomes essential for long-term market success as environmental considerations increasingly influence purchasing decisions and regulatory requirements.

Long-term growth prospects for the France EV battery pack market remain exceptionally positive, driven by accelerating electric vehicle adoption, supportive government policies, and expanding manufacturing capabilities. Market maturation over the next decade will see increased competition, technology standardization, and cost reduction trends that benefit consumers and accelerate adoption rates. Technology evolution toward solid-state batteries and advanced chemistries will create new performance benchmarks and market opportunities.

Manufacturing capacity expansion will transform France into a significant European battery production hub, with multiple gigafactory projects expected to commence operations within the forecast period. Export market development will leverage domestic manufacturing capabilities to serve broader European demand while creating economies of scale for French producers. Innovation leadership in sustainable battery technologies and circular economy applications will differentiate French companies in global markets.

Market consolidation trends may emerge as the industry matures, with successful companies expanding through acquisitions and strategic partnerships. Vertical integration will become increasingly common as companies seek to control critical supply chain elements and capture additional value throughout the battery lifecycle. MarkWide Research projects continued strong growth momentum supported by favorable policy environment and accelerating automotive industry transformation.

Emerging applications beyond traditional automotive uses will create additional market opportunities including stationary energy storage, marine applications, and specialized industrial uses. Technology convergence with renewable energy systems and smart grid infrastructure will expand the addressable market for French battery manufacturers and create new revenue streams.

The France EV battery pack market stands at a pivotal moment in its development trajectory, positioned to become a cornerstone of European electric mobility and sustainable transportation infrastructure. Strong government commitment to carbon neutrality objectives, combined with substantial investment in domestic manufacturing capabilities, creates a foundation for sustained market growth and technological leadership. The market demonstrates remarkable resilience and adaptability in addressing supply chain challenges while maintaining focus on innovation and sustainability objectives.

Strategic advantages including established automotive industry relationships, world-class research capabilities, and favorable geographic location for European market access position French companies advantageously in the global battery market competition. Technology development initiatives in next-generation battery systems and sustainable manufacturing processes will likely create lasting competitive advantages and export opportunities for French battery manufacturers.

Market evolution toward increased localization, technology sophistication, and circular economy integration aligns with broader European objectives for strategic autonomy and environmental sustainability. The successful development of France’s EV battery pack market will contribute significantly to achieving national climate objectives while establishing a high-value industrial sector with substantial employment and economic benefits. Future success will depend on continued collaboration between government, industry, and research institutions to maintain innovation momentum and competitive positioning in the rapidly evolving global battery market landscape.

What is EV Battery Pack?

EV Battery Pack refers to a collection of battery cells that are assembled together to store energy for electric vehicles. These packs are crucial for powering electric vehicles, influencing their range, performance, and overall efficiency.

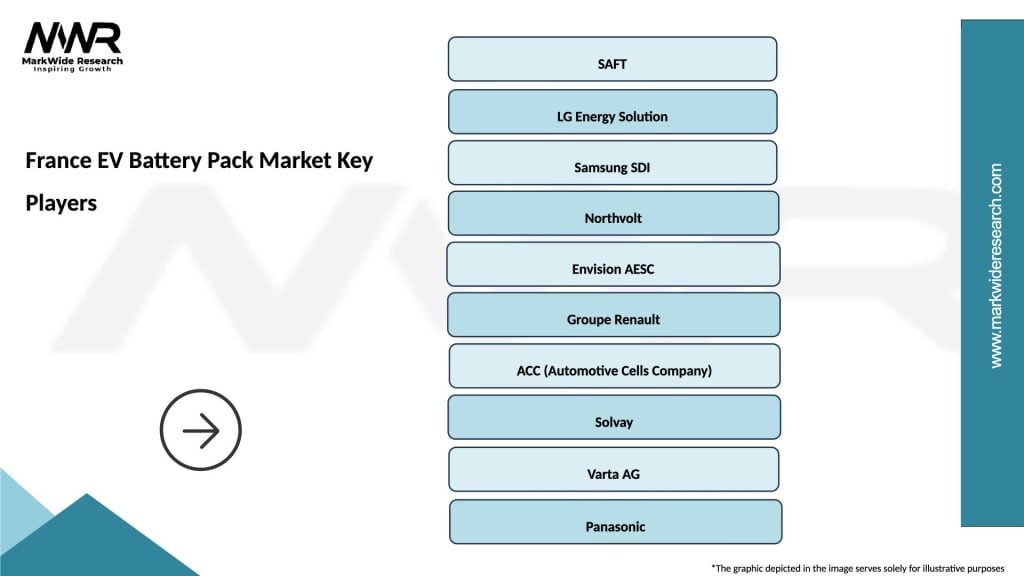

What are the key players in the France EV Battery Pack Market?

Key players in the France EV Battery Pack Market include companies like Saft, LG Chem, and AESC, which are known for their innovative battery technologies and contributions to the electric vehicle sector, among others.

What are the growth factors driving the France EV Battery Pack Market?

The France EV Battery Pack Market is driven by increasing demand for electric vehicles, advancements in battery technology, and government initiatives promoting sustainable transportation. Additionally, the growing focus on reducing carbon emissions is propelling market growth.

What challenges does the France EV Battery Pack Market face?

The France EV Battery Pack Market faces challenges such as high production costs, supply chain disruptions, and the need for recycling solutions for used batteries. These factors can hinder the widespread adoption of electric vehicles.

What opportunities exist in the France EV Battery Pack Market?

Opportunities in the France EV Battery Pack Market include the development of solid-state batteries, expansion of charging infrastructure, and increasing investments in renewable energy sources. These factors can enhance the viability of electric vehicles.

What trends are shaping the France EV Battery Pack Market?

Trends shaping the France EV Battery Pack Market include the shift towards higher energy density batteries, integration of smart technologies, and a focus on sustainability in battery production. These trends are expected to influence future innovations in the sector.

France EV Battery Pack Market

| Segmentation Details | Description |

|---|---|

| Product Type | Lithium-ion, Solid State, Nickel Manganese Cobalt, Lead Acid |

| End User | Passenger Vehicles, Commercial Vehicles, Two-Wheelers, Buses |

| Technology | Fast Charging, Wireless Charging, Battery Management Systems, Thermal Management |

| Capacity | 20 kWh, 40 kWh, 60 kWh, 100 kWh |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the France EV Battery Pack Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at