444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The France engineering plastics market represents a dynamic and rapidly evolving sector within the broader European polymer industry. Engineering plastics have become indispensable materials across diverse industrial applications, offering superior mechanical properties, thermal stability, and chemical resistance compared to conventional plastics. France’s position as a leading industrial nation in Europe has driven substantial demand for these high-performance materials across automotive, aerospace, electronics, and medical device manufacturing sectors.

Market dynamics in France reflect the country’s strong manufacturing base and commitment to technological innovation. The automotive industry, which accounts for approximately 35% of engineering plastics consumption in France, continues to drive market expansion as manufacturers seek lightweight alternatives to traditional materials. Aerospace applications represent another significant growth driver, with France’s prominent position in the global aviation industry through companies like Airbus creating sustained demand for specialized engineering plastics.

Growth trajectories indicate robust expansion potential, with the market experiencing a compound annual growth rate of 6.2% over recent years. This growth is underpinned by increasing adoption of electric vehicles, expanding renewable energy infrastructure, and growing demand for miniaturized electronic components. Sustainability initiatives are also reshaping market dynamics, with bio-based and recycled engineering plastics gaining traction among environmentally conscious manufacturers.

The France engineering plastics market refers to the comprehensive ecosystem encompassing the production, distribution, and application of high-performance polymer materials specifically designed for demanding industrial applications within French territory. Engineering plastics are distinguished from commodity plastics by their superior mechanical properties, including enhanced strength, temperature resistance, dimensional stability, and chemical inertness, making them suitable for precision applications where standard plastics would fail.

Key characteristics of engineering plastics include exceptional durability under stress, resistance to environmental factors such as UV radiation and chemical exposure, and the ability to maintain structural integrity across wide temperature ranges. These materials encompass various polymer families including polyamides, polycarbonates, polyoxymethylene, polybutylene terephthalate, and specialty polymers like polyetheretherketone and liquid crystal polymers.

Market scope extends beyond mere material supply to include value-added services such as custom compounding, technical consultation, and application development support. French manufacturers and suppliers work closely with end-users to develop tailored solutions that meet specific performance requirements while optimizing cost-effectiveness and processing efficiency.

Strategic positioning of the France engineering plastics market reflects the country’s industrial sophistication and innovation-driven economy. The market demonstrates remarkable resilience and growth potential, supported by diverse end-use applications and continuous technological advancement. Automotive lightweighting initiatives represent the primary growth catalyst, with electric vehicle adoption creating new opportunities for specialized polymer applications.

Competitive landscape features a mix of global chemical giants and specialized regional players, each contributing unique capabilities to the market ecosystem. French companies have established strong positions in niche applications, particularly in aerospace and luxury automotive segments, while international suppliers provide scale and technological breadth. Innovation focus centers on developing sustainable alternatives, improving processing efficiency, and expanding application possibilities through advanced polymer chemistry.

Market challenges include raw material price volatility, regulatory compliance requirements, and increasing pressure for environmental sustainability. However, these challenges are driving innovation and creating opportunities for companies that can develop cost-effective, eco-friendly solutions. Digital transformation is also influencing market dynamics, with smart manufacturing and Industry 4.0 initiatives creating demand for specialized electronic-grade engineering plastics.

Market segmentation reveals distinct growth patterns across different application sectors and material types. The following insights highlight critical market dynamics:

Technology trends indicate growing sophistication in polymer chemistry and processing techniques. Advanced compounding technologies enable precise control over material properties, while additive manufacturing applications create new opportunities for specialized engineering plastics. Digitalization is transforming supply chain management and customer interaction, enabling more responsive and efficient market operations.

Automotive transformation serves as the primary catalyst for engineering plastics demand in France. The transition toward electric vehicles requires lightweight materials to maximize battery efficiency and extend driving range. Weight reduction initiatives drive substitution of metal components with high-strength polymers, creating substantial growth opportunities. Additionally, autonomous vehicle development demands sophisticated sensor housings and electronic components manufactured from specialized engineering plastics.

Aerospace excellence continues driving premium demand for advanced polymer materials. France’s leadership in commercial aviation through Airbus and its extensive aerospace supply chain creates sustained demand for materials that meet stringent performance and certification requirements. Space applications represent an emerging growth area, with increasing satellite deployment and space exploration activities requiring materials capable of withstanding extreme environmental conditions.

Electronics miniaturization trends fuel demand for precision-molded components with exceptional dimensional stability and electrical properties. The proliferation of 5G technology, Internet of Things devices, and advanced computing systems creates opportunities for specialized engineering plastics. Renewable energy infrastructure development, particularly in wind and solar power generation, requires durable materials capable of withstanding harsh outdoor environments while maintaining structural integrity over extended periods.

Regulatory compliance requirements in various industries drive adoption of engineering plastics that meet specific performance and safety standards. Environmental regulations promoting recyclability and reduced carbon footprint encourage development of sustainable polymer solutions. Industry 4.0 initiatives create demand for smart materials and components that can integrate sensors and communication capabilities.

Raw material volatility presents significant challenges for engineering plastics manufacturers and end-users. Petroleum-based feedstock price fluctuations directly impact production costs, creating uncertainty in pricing and margin management. Supply chain disruptions, as experienced during recent global events, highlight the vulnerability of complex polymer supply networks and the need for greater resilience and diversification.

High development costs associated with new polymer formulations and application development can limit innovation, particularly for smaller companies. The extensive testing and certification requirements for critical applications such as aerospace and medical devices create barriers to market entry and product development. Technical complexity in processing engineering plastics requires specialized equipment and expertise, limiting adoption among smaller manufacturers.

Environmental concerns regarding plastic waste and carbon footprint create regulatory and market pressures that challenge traditional polymer applications. While driving innovation in sustainable alternatives, these concerns also create uncertainty and potential restrictions on certain material types. Competition from alternative materials, including advanced composites and bio-based materials, poses ongoing challenges to market share and growth potential.

Economic uncertainty and cyclical demand patterns in key end-use industries can impact market stability and growth projections. Trade tensions and geopolitical factors may affect raw material availability and market access, creating additional complexity for market participants.

Sustainable innovation represents the most significant opportunity for market expansion and differentiation. Development of bio-based engineering plastics derived from renewable feedstocks addresses environmental concerns while maintaining performance characteristics. Circular economy initiatives create opportunities for advanced recycling technologies that can process engineering plastics into high-quality recycled materials suitable for demanding applications.

Electric vehicle proliferation opens new application areas for specialized engineering plastics in battery systems, charging infrastructure, and lightweight structural components. The growing emphasis on vehicle electrification creates demand for materials with enhanced thermal management properties and electrical insulation capabilities. Autonomous vehicle development requires sophisticated sensor housings and electronic components that present premium opportunities for advanced polymer solutions.

Aerospace expansion continues offering growth potential through commercial aviation recovery, space exploration initiatives, and defense applications. The development of sustainable aviation fuels and next-generation aircraft designs creates opportunities for innovative material solutions. Medical device innovation driven by aging populations and healthcare advancement requires biocompatible engineering plastics for implants, diagnostic equipment, and drug delivery systems.

Digital transformation across industries creates demand for smart materials and components that can integrate electronic functionality. Additive manufacturing applications for engineering plastics enable new design possibilities and customization opportunities, particularly in aerospace and medical applications. Infrastructure modernization projects create demand for durable materials in construction, transportation, and utility applications.

Competitive intensity in the France engineering plastics market reflects the presence of both global chemical companies and specialized regional players. Market consolidation trends have created larger, more integrated suppliers capable of providing comprehensive solutions across multiple application areas. This consolidation enables greater investment in research and development while providing customers with broader product portfolios and technical support capabilities.

Innovation cycles are accelerating as companies respond to evolving customer requirements and regulatory pressures. The development of next-generation polymers with enhanced sustainability profiles requires significant investment in research and development. Collaboration patterns between suppliers and end-users are intensifying, with joint development projects becoming more common to address specific application challenges.

Supply chain optimization has become a critical competitive factor, with companies investing in local production capabilities and inventory management systems to ensure reliable delivery. Digital integration is transforming customer interactions and supply chain management, enabling more responsive and efficient operations. According to MarkWide Research analysis, companies that successfully integrate digital technologies achieve 15-20% improvement in operational efficiency.

Pricing dynamics reflect the balance between raw material costs, processing complexity, and value-added services. Premium applications command higher margins but require extensive technical support and certification processes. Market segmentation strategies enable suppliers to optimize their offerings for specific customer needs while maintaining competitive positioning across diverse application areas.

Comprehensive analysis of the France engineering plastics market employs multiple research methodologies to ensure accuracy and completeness. Primary research involves extensive interviews with industry executives, technical specialists, and end-users across key application sectors. This direct engagement provides insights into market trends, challenges, and opportunities that may not be apparent through secondary sources alone.

Secondary research encompasses analysis of industry reports, company financial statements, patent filings, and regulatory documents to establish market context and validate primary findings. Trade association data and industry statistics provide quantitative foundations for market sizing and trend analysis. Academic research and technical literature contribute to understanding of technological developments and future possibilities.

Market modeling techniques incorporate statistical analysis and forecasting methodologies to project future market developments. Scenario analysis considers various potential outcomes based on different assumptions about economic conditions, regulatory changes, and technological advancement. Cross-validation of findings through multiple sources ensures reliability and reduces potential bias in market assessments.

Expert consultation with industry specialists and technical experts provides additional validation and insights into market dynamics. Field research including facility visits and trade show participation offers direct observation of market conditions and emerging trends. This multi-faceted approach ensures comprehensive coverage of market factors and reliable insights for strategic decision-making.

Geographic distribution of engineering plastics demand across France reflects the country’s industrial concentration patterns. Île-de-France region represents the largest market segment, accounting for approximately 28% of national consumption, driven by aerospace, automotive, and electronics manufacturing activities. The presence of major automotive manufacturers and aerospace companies creates sustained demand for high-performance polymer materials.

Auvergne-Rhône-Alpes region emerges as a significant growth area, with strong automotive and industrial manufacturing presence driving demand for engineering plastics. The region’s focus on innovation and technology development creates opportunities for advanced polymer applications. Grand Est region benefits from its strategic location and manufacturing heritage, particularly in automotive and chemical industries.

Hauts-de-France region demonstrates growing importance in automotive manufacturing and aerospace applications, with several major production facilities driving local demand for engineering plastics. Nouvelle-Aquitaine region shows increasing activity in aerospace and defense applications, supported by the presence of major industry players and research institutions.

Regional specialization patterns reflect local industrial strengths and cluster effects. Aerospace applications concentrate around major production centers, while automotive applications distribute more broadly across manufacturing regions. Supply chain optimization strategies increasingly consider regional demand patterns to minimize transportation costs and improve responsiveness to customer needs.

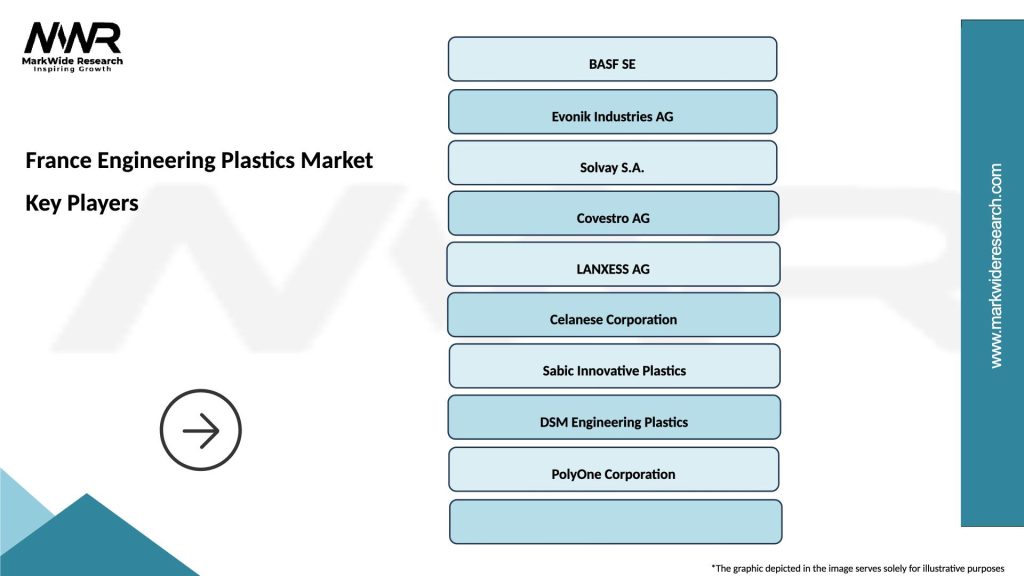

Market leadership in the France engineering plastics sector features a diverse mix of global chemical companies and specialized regional players. The competitive environment emphasizes technical expertise, product quality, and comprehensive customer support capabilities.

Competitive strategies emphasize differentiation through technical innovation, customer service excellence, and sustainable product development. Companies invest heavily in research and development to create next-generation materials that address evolving market requirements. Strategic partnerships with end-users and research institutions enable collaborative development of specialized solutions for specific applications.

Material-based segmentation reveals distinct market dynamics across different polymer families. Polyamides represent the largest segment, accounting for approximately 32% of market volume, driven by automotive and industrial applications requiring high strength and chemical resistance. Polycarbonates demonstrate strong growth in electronics and automotive glazing applications, valued for optical clarity and impact resistance.

By Technology:

By Application:

End-use segmentation reflects the diverse application landscape and varying performance requirements across different industries. Each segment demonstrates unique growth drivers and technical requirements that influence material selection and supplier relationships.

Automotive applications continue dominating the engineering plastics landscape in France, driven by lightweighting initiatives and electric vehicle adoption. Under-hood components require materials capable of withstanding high temperatures and chemical exposure from automotive fluids. Interior applications emphasize aesthetics, durability, and safety compliance, while structural components demand high strength-to-weight ratios.

Aerospace category represents the most demanding application segment, requiring materials that meet stringent certification requirements and perform reliably under extreme conditions. Weight reduction remains a critical driver, with engineering plastics replacing metal components in non-structural applications. Fire resistance, low smoke emission, and dimensional stability under temperature variations are essential characteristics for aerospace applications.

Electronics segment demonstrates rapid growth driven by miniaturization trends and increasing electronic content across all industries. Dimensional precision and electrical properties become critical factors, with materials requiring excellent moldability and long-term stability. The proliferation of 5G technology and Internet of Things devices creates new opportunities for specialized polymer formulations.

Medical applications require the highest levels of quality control and regulatory compliance. Biocompatibility and sterilization resistance are fundamental requirements, while traceability and documentation standards exceed those of other industries. The aging population and healthcare innovation drive sustained growth in this premium market segment.

Manufacturers benefit from engineering plastics through improved product performance, reduced weight, and enhanced design flexibility. Cost optimization opportunities arise from material consolidation, reduced assembly complexity, and improved manufacturing efficiency. The ability to integrate multiple functions into single components reduces overall system costs while improving reliability and performance.

Suppliers gain competitive advantages through technical expertise and comprehensive solution capabilities. Value-added services including application development, technical support, and custom compounding create differentiation opportunities and stronger customer relationships. Long-term partnerships with key customers provide stability and growth opportunities in premium market segments.

End-users achieve performance improvements, cost reductions, and sustainability benefits through advanced engineering plastics adoption. Innovation enablement allows development of products that would be impossible with traditional materials, creating competitive advantages and new market opportunities. Reduced maintenance requirements and extended service life provide total cost of ownership benefits.

Research institutions contribute to market development through fundamental research and collaborative projects with industry partners. Technology transfer opportunities create pathways for commercializing advanced polymer technologies and materials science innovations. Academic-industry partnerships accelerate development of next-generation materials and applications.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability transformation represents the most significant trend reshaping the engineering plastics market. Circular economy principles drive development of recyclable and bio-based materials that maintain performance characteristics while reducing environmental impact. Companies invest heavily in sustainable alternatives, with bio-based content reaching 12-15% in some specialized applications.

Digital integration accelerates across the value chain, from smart manufacturing processes to customer interaction platforms. Industry 4.0 technologies enable real-time monitoring of material properties and processing conditions, improving quality control and efficiency. Predictive maintenance applications create demand for sensor-integrated components manufactured from specialized engineering plastics.

Lightweighting initiatives continue driving material substitution across multiple industries. Multi-material design approaches combine engineering plastics with other advanced materials to optimize performance and cost. Additive manufacturing technologies enable complex geometries and customized solutions that were previously impossible with traditional processing methods.

Regulatory evolution influences material selection and application development. REACH compliance and other environmental regulations drive reformulation of existing materials and development of safer alternatives. Medical device regulations become increasingly stringent, requiring enhanced documentation and traceability throughout the supply chain.

Strategic investments in sustainable technology development accelerate across the industry. Major chemical companies announce significant commitments to bio-based feedstock development and advanced recycling technologies. Capacity expansion projects focus on high-growth applications and sustainable material production capabilities.

Partnership formations between material suppliers and end-users intensify, with collaborative development projects addressing specific application challenges. Acquisition activity consolidates specialized capabilities and expands geographic reach for major market participants. Technology licensing agreements enable broader access to advanced polymer formulations and processing technologies.

Research breakthroughs in polymer chemistry create opportunities for next-generation materials with enhanced performance characteristics. Nanotechnology integration enables development of materials with unique properties for specialized applications. Advanced characterization techniques improve understanding of structure-property relationships, accelerating material development cycles.

Regulatory developments influence market dynamics through new standards and compliance requirements. Sustainability reporting mandates drive transparency in environmental impact assessment and supply chain management. Industry standards evolution reflects advancing technology and changing application requirements across key market segments.

Strategic positioning recommendations emphasize the importance of sustainability leadership and technical innovation. Companies should invest in developing comprehensive sustainable material portfolios while maintaining performance excellence. MWR analysis indicates that early movers in sustainable engineering plastics achieve 20-25% premium pricing compared to conventional alternatives.

Market diversification strategies should balance growth opportunities across multiple application segments while building deep expertise in selected niches. Geographic expansion within France should consider regional industrial clusters and supply chain optimization opportunities. Investment in local technical service capabilities enhances customer relationships and competitive positioning.

Innovation focus should prioritize applications with the highest growth potential and technical barriers to entry. Digital transformation initiatives can create competitive advantages through improved customer service and operational efficiency. Collaboration with research institutions and end-users accelerates development of breakthrough technologies and applications.

Supply chain resilience requires diversification of raw material sources and development of alternative feedstock options. Inventory optimization strategies should balance cost efficiency with service level requirements across different customer segments. Investment in predictive analytics and demand forecasting improves planning accuracy and customer satisfaction.

Growth trajectory for the France engineering plastics market remains positive, supported by industrial transformation and technological advancement. Electric vehicle adoption will accelerate demand for specialized materials, with battery applications representing a particularly high-growth segment. The market is projected to maintain a compound annual growth rate of 5.8% through the forecast period.

Sustainability integration will become a fundamental requirement rather than a competitive advantage. Circular economy implementation will drive development of closed-loop recycling systems and bio-based alternatives. Regulatory pressure and customer demands will accelerate adoption of sustainable materials across all application segments.

Technology convergence will create new opportunities at the intersection of materials science, electronics, and biotechnology. Smart materials with integrated sensing and communication capabilities will enable new applications in automotive, aerospace, and industrial sectors. Additive manufacturing will expand beyond prototyping to production applications, requiring specialized material formulations.

Market consolidation will continue as companies seek scale advantages and comprehensive solution capabilities. Vertical integration strategies may emerge as companies seek greater control over supply chains and technology development. According to MarkWide Research projections, the market will experience 15-20% improvement in operational efficiency through digital transformation initiatives over the next five years.

The France engineering plastics market stands at a pivotal juncture, characterized by robust growth potential and transformative industry trends. Sustainability imperatives and technological advancement create both challenges and opportunities for market participants. Companies that successfully navigate this evolving landscape through innovation, strategic positioning, and customer-centric approaches will achieve sustainable competitive advantages.

Market fundamentals remain strong, supported by France’s industrial excellence and commitment to technological leadership. The automotive industry’s transformation toward electrification, aerospace sector growth, and expanding electronics applications provide sustained demand drivers. Regional strengths in manufacturing and innovation create favorable conditions for continued market development.

Future success will depend on companies’ ability to balance performance excellence with sustainability requirements while maintaining cost competitiveness. Strategic investments in research and development, sustainable technology, and customer service capabilities will differentiate market leaders from followers. The France engineering plastics market is positioned for continued growth and evolution, offering significant opportunities for companies that can adapt to changing requirements and capitalize on emerging trends.

What is Engineering Plastics?

Engineering plastics are a group of plastic materials that have superior mechanical and thermal properties compared to standard plastics. They are commonly used in applications such as automotive components, electrical housings, and industrial machinery due to their strength and durability.

What are the key players in the France Engineering Plastics Market?

Key players in the France Engineering Plastics Market include BASF, DuPont, and SABIC, which are known for their innovative solutions and extensive product portfolios in engineering plastics. These companies focus on various applications, including automotive, aerospace, and consumer goods, among others.

What are the growth factors driving the France Engineering Plastics Market?

The France Engineering Plastics Market is driven by the increasing demand for lightweight materials in the automotive industry and the growing need for high-performance plastics in electronics. Additionally, advancements in manufacturing technologies are enhancing the properties and applications of engineering plastics.

What challenges does the France Engineering Plastics Market face?

Challenges in the France Engineering Plastics Market include the high cost of raw materials and the environmental concerns associated with plastic waste. These factors can hinder market growth and push manufacturers to seek sustainable alternatives.

What opportunities exist in the France Engineering Plastics Market?

Opportunities in the France Engineering Plastics Market include the rising demand for bio-based engineering plastics and the expansion of electric vehicle production. These trends are likely to create new applications and drive innovation in the sector.

What trends are shaping the France Engineering Plastics Market?

Trends in the France Engineering Plastics Market include the increasing adoption of recycled materials and the development of high-performance composites. Additionally, there is a growing focus on sustainability and reducing the carbon footprint of plastic production.

France Engineering Plastics Market

| Segmentation Details | Description |

|---|---|

| Product Type | Polycarbonate, Polyamide, Polyethylene Terephthalate, Acrylonitrile Butadiene Styrene |

| End Use Industry | Automotive, Electronics, Consumer Goods, Medical Devices |

| Form | Granules, Sheets, Films, Rods |

| Grade | High Performance, Standard, Engineering, Specialty |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the France Engineering Plastics Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at