444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The France energy bar industry market represents a dynamic and rapidly evolving segment within the broader nutrition and wellness sector. Energy bars have gained substantial traction among French consumers seeking convenient, nutritious snacking options that align with increasingly health-conscious lifestyles. The market encompasses a diverse range of products, from protein-rich bars targeting fitness enthusiasts to organic, plant-based alternatives appealing to environmentally conscious consumers.

Market dynamics indicate robust growth driven by changing consumer preferences, urbanization trends, and the rising popularity of active lifestyles. The French market demonstrates particular strength in premium and organic segments, with consumers showing willingness to pay higher prices for quality ingredients and sustainable packaging. Growth rates in the energy bar sector have consistently outpaced traditional confectionery categories, with the market expanding at approximately 8.5% CAGR over recent years.

Consumer demographics reveal strong adoption across multiple age groups, with millennials and Gen Z leading consumption patterns. The market benefits from France’s strong sporting culture, growing fitness consciousness, and increasing demand for on-the-go nutrition solutions. Distribution channels have evolved significantly, with online sales representing approximately 25% of total market share and continuing to expand rapidly.

The France energy bar industry market refers to the comprehensive ecosystem encompassing the production, distribution, and consumption of energy bars within French territory. Energy bars are nutritionally dense, portable food products designed to provide sustained energy through balanced combinations of carbohydrates, proteins, fats, vitamins, and minerals.

Market scope includes various product categories such as protein bars, granola bars, meal replacement bars, and specialized sports nutrition bars. The industry encompasses both domestic manufacturers and international brands competing for market share through product innovation, strategic partnerships, and targeted marketing campaigns. Regulatory frameworks governing food safety, labeling requirements, and nutritional claims significantly influence market operations and product development strategies.

Value chain participants include ingredient suppliers, manufacturers, distributors, retailers, and end consumers. The market’s definition extends beyond simple product sales to encompass related services such as private label manufacturing, co-packing, and specialized distribution networks serving different consumer segments.

France’s energy bar market demonstrates exceptional growth potential driven by evolving consumer lifestyles and increasing health awareness. The market has experienced consistent expansion, with organic and natural products commanding premium pricing and growing market share. Key growth drivers include urbanization, busy lifestyles, fitness trends, and growing awareness of nutritional benefits associated with energy bars.

Market segmentation reveals diverse consumer preferences across protein content, flavor profiles, and ingredient sourcing. Premium segments focusing on organic, non-GMO, and sustainably sourced ingredients show particularly strong growth, with premium products representing approximately 35% of total market value. Distribution strategies have evolved to include omnichannel approaches, with traditional retail, specialty stores, and e-commerce platforms all contributing to market expansion.

Competitive landscape features both established international brands and emerging local players focusing on artisanal and specialty products. Innovation remains crucial for market success, with companies investing heavily in new flavors, functional ingredients, and sustainable packaging solutions. Future projections indicate continued growth, supported by demographic trends and increasing consumer sophistication regarding nutritional products.

Consumer behavior analysis reveals several critical insights shaping the French energy bar market. Primary consumption occasions include pre and post-workout nutrition, meal replacement during busy periods, and healthy snacking alternatives. French consumers demonstrate strong preference for products with clean ingredient lists, minimal processing, and transparent labeling.

Market penetration varies significantly across different demographic segments, with higher adoption rates among urban professionals, fitness enthusiasts, and health-conscious consumers. Regional variations exist within France, with metropolitan areas showing higher consumption rates compared to rural regions.

Health and wellness trends represent the primary driver propelling France’s energy bar market forward. Increasing awareness of nutrition’s impact on physical performance, mental clarity, and overall well-being motivates consumers to seek convenient, nutritious snacking alternatives. Fitness culture expansion throughout France has created substantial demand for specialized sports nutrition products, including energy bars designed for pre-workout energy and post-workout recovery.

Lifestyle changes associated with urbanization and demanding work schedules drive significant market growth. French consumers increasingly seek portable nutrition solutions that fit busy lifestyles without compromising nutritional quality. Meal replacement trends have gained traction, with energy bars serving as convenient alternatives to traditional breakfast or lunch options during hectic periods.

Demographic shifts contribute substantially to market expansion. Millennials and Gen Z consumers demonstrate strong preference for functional foods that align with active lifestyles and health-conscious values. Aging population segments also drive demand for convenient nutrition products that support healthy aging and maintain energy levels throughout the day.

Innovation in ingredients and formulations continues driving market growth. Advances in plant-based proteins, functional ingredients, and natural sweeteners enable manufacturers to create products appealing to diverse consumer preferences. Clean label trends motivate companies to develop products with recognizable, minimally processed ingredients that resonate with health-conscious French consumers.

Price sensitivity among certain consumer segments poses challenges for market expansion. While premium products perform well in urban markets, price-conscious consumers may opt for traditional snacking alternatives or homemade options. Economic uncertainties can impact discretionary spending on premium nutrition products, potentially limiting market growth during challenging economic periods.

Regulatory complexities surrounding food labeling, health claims, and ingredient approvals create barriers for new market entrants and product innovations. European Union regulations governing nutritional claims and novel ingredients require significant compliance investments, potentially limiting smaller companies’ ability to compete effectively.

Market saturation concerns emerge as increasing numbers of brands compete for consumer attention and shelf space. Retail competition intensifies as traditional retailers, specialty stores, and online platforms vie for market share, potentially compressing profit margins for manufacturers and distributors.

Consumer skepticism regarding processed foods and artificial ingredients challenges some energy bar categories. Clean eating movements promote whole foods over packaged alternatives, requiring manufacturers to continuously innovate with natural, minimally processed formulations to maintain consumer trust and market relevance.

Product innovation opportunities abound in the French energy bar market, particularly in specialized formulations targeting specific consumer needs. Functional ingredients such as adaptogens, probiotics, and superfoods present significant opportunities for differentiation and premium positioning. Personalized nutrition trends create potential for customized energy bar solutions tailored to individual dietary requirements and fitness goals.

Sustainability initiatives offer substantial growth opportunities as environmentally conscious consumers seek products with minimal environmental impact. Sustainable packaging solutions, carbon-neutral manufacturing processes, and ethically sourced ingredients can command premium pricing while appealing to values-driven consumers.

Digital commerce expansion presents significant opportunities for direct-to-consumer sales and enhanced customer engagement. Subscription models and personalized product recommendations through digital platforms can increase customer loyalty and lifetime value. Social media marketing and influencer partnerships offer cost-effective ways to reach target demographics and build brand awareness.

Export potential exists for successful French energy bar brands to expand into neighboring European markets and beyond. Premium positioning associated with French food culture and quality standards can facilitate international expansion strategies. Partnership opportunities with fitness centers, sports clubs, and wellness facilities can create new distribution channels and increase brand visibility.

Supply chain dynamics significantly influence the French energy bar market, with ingredient sourcing, manufacturing capabilities, and distribution networks determining competitive advantages. Ingredient costs fluctuate based on global commodity prices, weather conditions, and supply chain disruptions, impacting product pricing and profit margins. Manufacturing efficiency improvements through automation and process optimization help companies maintain competitiveness while managing cost pressures.

Consumer preferences continue evolving rapidly, requiring companies to maintain agility in product development and marketing strategies. Flavor trends shift regularly, with consumers seeking novel taste experiences and authentic ingredient combinations. Nutritional awareness increases continuously, driving demand for products with enhanced functional benefits and transparent nutritional profiles.

Competitive dynamics intensify as established brands defend market share while new entrants attempt to capture consumer attention through innovation and differentiation. Price competition occurs primarily in mainstream segments, while premium categories compete on quality, ingredients, and brand positioning. Marketing investments increase as companies seek to build brand recognition and consumer loyalty in an increasingly crowded marketplace.

Technological advancement impacts various aspects of market operations, from manufacturing processes to consumer engagement strategies. Production technologies enable more efficient manufacturing and improved product consistency. Digital technologies enhance customer relationship management, supply chain visibility, and market intelligence capabilities.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the French energy bar industry. Primary research includes extensive consumer surveys, in-depth interviews with industry stakeholders, and focus groups representing diverse demographic segments. Secondary research encompasses analysis of industry reports, government statistics, trade publications, and company financial statements.

Data collection methods utilize both quantitative and qualitative approaches to capture comprehensive market understanding. Consumer behavior studies examine purchasing patterns, consumption habits, and preference drivers across different demographic segments. Industry expert interviews provide insights into market trends, competitive dynamics, and future growth prospects from seasoned professionals.

Market sizing methodologies employ bottom-up and top-down approaches to validate market estimates and growth projections. Statistical analysis techniques ensure data accuracy and reliability while identifying significant trends and correlations. Forecasting models incorporate multiple variables including demographic trends, economic indicators, and industry-specific factors to project future market development.

Quality assurance processes include data triangulation, peer review, and validation against multiple sources to ensure research reliability. Continuous monitoring of market developments enables real-time updates to research findings and maintains relevance of insights provided to stakeholders.

Paris and Île-de-France region dominates the French energy bar market, representing approximately 28% of national consumption due to high population density, elevated income levels, and strong fitness culture. Urban consumers in this region demonstrate higher willingness to pay premium prices for innovative products and convenient nutrition solutions. Distribution infrastructure in the capital region provides excellent market access for both domestic and international brands.

Lyon and Rhône-Alpes region shows strong market performance driven by active outdoor recreation culture and health-conscious consumer base. Sports nutrition segments perform particularly well in this region, supported by proximity to Alpine recreational activities and established fitness communities. Local manufacturing presence in this region contributes to supply chain efficiency and regional brand development.

Provence-Alpes-Côte d’Azur region demonstrates growing market adoption influenced by Mediterranean lifestyle values emphasizing health and wellness. Premium organic products show strong performance in this region, aligning with consumer preferences for natural, high-quality ingredients. Tourism influence creates seasonal demand fluctuations and opportunities for specialty product positioning.

Northern regions including Nord-Pas-de-Calais and Normandy show emerging market potential with growing health consciousness and increasing fitness facility development. Price-sensitive segments dominate these regions, creating opportunities for value-oriented product positioning. Rural areas throughout France demonstrate lower penetration rates but represent significant long-term growth opportunities as health trends spread beyond urban centers.

Market leadership in the French energy bar industry features a mix of international brands and domestic players competing across different segments and price points. Established multinational companies leverage extensive distribution networks, marketing resources, and product development capabilities to maintain strong market positions.

Competitive strategies vary significantly across market segments, with premium brands emphasizing quality ingredients and sustainability while mainstream brands focus on accessibility and value positioning. Innovation cycles accelerate as companies compete to introduce new flavors, functional ingredients, and packaging solutions that resonate with evolving consumer preferences.

Market consolidation trends emerge as larger companies acquire successful smaller brands to expand portfolio offerings and access specialized market segments. Partnership strategies between manufacturers and retailers create exclusive product lines and enhanced market access opportunities.

Product type segmentation reveals diverse consumer preferences across multiple energy bar categories. Protein bars represent the largest segment, appealing to fitness enthusiasts and health-conscious consumers seeking muscle building and recovery benefits. Granola and cereal bars maintain strong positions in mainstream markets, offering familiar flavors and accessible pricing.

By Ingredient Type:

By Distribution Channel:

Consumer demographic segmentation identifies distinct purchasing patterns across age groups, income levels, and lifestyle preferences. Millennials and Gen Z demonstrate highest adoption rates and willingness to experiment with new products and flavors.

Protein bar category dominates market performance with consistent growth driven by fitness trends and muscle-building awareness. Whey protein bars maintain strong positions among traditional fitness enthusiasts, while plant-based protein alternatives gain traction among environmentally conscious consumers. Innovation focus centers on improving taste profiles while maintaining high protein content and clean ingredient lists.

Meal replacement bars show significant growth potential as busy professionals seek convenient nutrition solutions. Balanced macronutrient profiles combining proteins, healthy fats, and complex carbohydrates appeal to consumers using bars as complete meal alternatives. Fortification trends include addition of vitamins, minerals, and functional ingredients to enhance nutritional completeness.

Sports performance bars target serious athletes and fitness enthusiasts with specialized formulations for pre-workout energy and post-workout recovery. Caffeine-enhanced varieties provide energy boosts for training sessions, while recovery-focused formulations emphasize protein and amino acid content. Timing-specific products cater to different phases of athletic training and competition cycles.

Snack and granola bars maintain broad appeal across diverse consumer segments through familiar flavors and accessible pricing. Indulgent varieties featuring chocolate, nuts, and dried fruits compete with traditional confectionery products. Better-for-you positioning emphasizes whole grains, reduced sugar content, and added nutritional benefits compared to conventional snacks.

Manufacturers benefit from growing market demand and opportunities for product innovation and differentiation. Scalable production capabilities enable efficient manufacturing while maintaining quality standards. Brand building opportunities exist across multiple consumer segments, from mainstream to premium positioning strategies.

Retailers gain from energy bars’ high-margin characteristics and strong consumer demand driving traffic and repeat purchases. Category management opportunities include optimizing product assortments and promotional strategies to maximize sales performance. Private label development enables retailers to capture additional value while meeting specific consumer preferences.

Consumers receive convenient access to nutritious snacking options that support active lifestyles and health goals. Product variety ensures options for diverse dietary requirements, taste preferences, and nutritional objectives. Transparency improvements in labeling and ingredient sourcing enable informed purchasing decisions aligned with personal values.

Ingredient suppliers benefit from growing demand for high-quality proteins, natural sweeteners, and functional ingredients. Innovation partnerships with manufacturers create opportunities for developing novel ingredient solutions. Sustainability initiatives throughout supply chains appeal to environmentally conscious consumers and support premium positioning.

Strengths:

Weaknesses:

Opportunities:

Threats:

Clean label movement significantly influences product development strategies as consumers increasingly demand transparency in ingredient sourcing and processing methods. Minimally processed formulations featuring recognizable ingredients gain preference over products with artificial additives or complex chemical names. Organic certification becomes increasingly important for premium positioning and consumer trust building.

Personalization trends drive demand for customized nutrition solutions tailored to individual dietary requirements, fitness goals, and taste preferences. Subscription services offering personalized product selections gain traction among convenience-seeking consumers. DNA-based nutrition and metabolic testing create opportunities for highly targeted product recommendations.

Sustainability consciousness influences purchasing decisions across all consumer segments, with approximately 60% of consumers considering environmental impact when selecting energy bars. Carbon-neutral manufacturing, biodegradable packaging, and ethical ingredient sourcing become competitive differentiators. Circular economy principles guide packaging design and waste reduction initiatives.

Functional food integration expands beyond basic nutrition to include mood enhancement, cognitive support, and immune system benefits. Adaptogenic ingredients such as ashwagandha and rhodiola gain popularity for stress management. Probiotic formulations address digestive health concerns while nootropic compounds target cognitive performance enhancement.

Product innovation acceleration characterizes recent industry developments as companies compete to introduce novel formulations and flavors. Plant-based protein advancement enables creation of products matching traditional whey protein performance while appealing to vegan consumers. Texture improvements address common consumer complaints about chalky or overly dense energy bar experiences.

Packaging innovation focuses on sustainability and convenience improvements. Compostable wrappers made from plant-based materials replace traditional plastic packaging. Resealable formats enhance product freshness and portion control capabilities. Smart packaging incorporating QR codes provides access to detailed nutritional information and brand storytelling.

Distribution channel evolution includes expansion into non-traditional retail environments. Workplace vending programs target office professionals seeking healthy snacking options. Healthcare facility partnerships position energy bars as nutritional support tools. Educational institution contracts introduce products to younger consumer segments.

Manufacturing technology advancement improves production efficiency and product consistency. Cold-press techniques preserve heat-sensitive nutrients while creating appealing textures. Automated packaging systems reduce labor costs and improve hygiene standards. Quality control technologies ensure consistent nutritional profiles and safety standards across production runs.

MarkWide Research recommends that industry participants focus on sustainable differentiation strategies that align with evolving consumer values and preferences. Investment priorities should emphasize research and development capabilities, sustainable sourcing practices, and digital marketing competencies. Brand positioning strategies must clearly communicate unique value propositions while building authentic connections with target consumer segments.

Product development focus should prioritize clean label formulations, functional ingredient integration, and taste profile optimization. Innovation partnerships with ingredient suppliers, research institutions, and technology companies can accelerate development timelines and reduce costs. Consumer feedback integration throughout development processes ensures market relevance and acceptance.

Distribution strategy optimization requires balancing traditional retail relationships with emerging digital commerce opportunities. Omnichannel approaches provide comprehensive market coverage while meeting diverse consumer shopping preferences. Direct-to-consumer capabilities enable higher margins and enhanced customer relationship management.

Sustainability integration should encompass entire value chains from ingredient sourcing through packaging and distribution. Transparency initiatives including supply chain traceability and environmental impact reporting build consumer trust and support premium positioning. Circular economy principles guide long-term strategic planning and operational improvements.

Market expansion prospects remain robust driven by demographic trends, lifestyle changes, and increasing health consciousness across French society. Growth projections indicate continued market development with particular strength in premium and functional product segments. Consumer sophistication will continue increasing, demanding higher quality products and more transparent business practices.

Technology integration will transform various aspects of the industry from manufacturing processes to consumer engagement strategies. Artificial intelligence applications in product development and marketing optimization will become increasingly important competitive advantages. Blockchain technology may enhance supply chain transparency and authenticity verification.

Regulatory evolution will likely focus on enhanced labeling requirements, sustainability standards, and health claim substantiation. Industry consolidation may accelerate as larger companies acquire innovative smaller brands to expand portfolio offerings and market reach. International expansion opportunities will grow for successful French brands leveraging quality reputation and innovation capabilities.

MWR analysis suggests that companies maintaining agility in product development, sustainability leadership, and consumer engagement will achieve the strongest long-term performance. Market leaders will emerge from organizations successfully balancing innovation, quality, and accessibility while building authentic brand relationships with evolving consumer bases.

The France energy bar industry market represents a dynamic and promising sector within the broader nutrition and wellness landscape. Strong fundamentals including growing health consciousness, active lifestyle adoption, and convenience-seeking behaviors support continued market expansion and innovation opportunities. Consumer sophistication drives demand for higher quality products with clean ingredients, functional benefits, and sustainable practices.

Market participants who successfully navigate evolving consumer preferences, regulatory requirements, and competitive dynamics will capture significant growth opportunities. Innovation leadership, sustainability commitment, and authentic brand building emerge as critical success factors for long-term market performance. Digital transformation and omnichannel distribution strategies will become increasingly important for reaching and engaging target consumer segments effectively.

Future success in the French energy bar market will require balancing traditional quality values with emerging trends in personalization, functionality, and environmental responsibility. Companies that maintain focus on consumer needs while building scalable, sustainable business models will achieve the strongest competitive positions in this expanding and evolving marketplace.

What is Energy Bar?

Energy bars are convenient snack options designed to provide a quick source of energy, often made from a blend of carbohydrates, proteins, and fats. They are popular among athletes and health-conscious consumers for their portability and nutritional benefits.

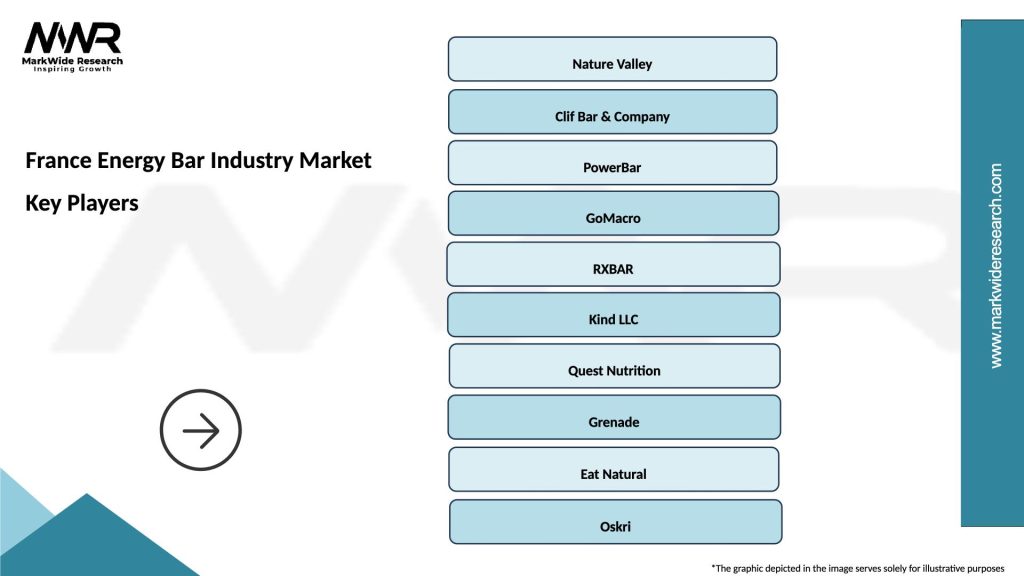

What are the key players in the France Energy Bar Industry Market?

Key players in the France Energy Bar Industry Market include companies like Clif Bar & Company, Quest Nutrition, and Grenade, which offer a variety of energy bar products catering to different consumer preferences, among others.

What are the growth factors driving the France Energy Bar Industry Market?

The France Energy Bar Industry Market is driven by increasing health awareness, a growing trend towards on-the-go snacking, and the rising popularity of fitness and sports activities among consumers. Additionally, the demand for convenient and nutritious food options is contributing to market growth.

What challenges does the France Energy Bar Industry Market face?

The France Energy Bar Industry Market faces challenges such as intense competition among brands, fluctuating ingredient prices, and consumer skepticism regarding the nutritional claims of energy bars. These factors can impact brand loyalty and market penetration.

What opportunities exist in the France Energy Bar Industry Market?

Opportunities in the France Energy Bar Industry Market include the potential for product innovation, such as the introduction of plant-based and organic energy bars, as well as expanding distribution channels to reach a broader audience. Additionally, targeting niche markets can enhance growth prospects.

What trends are shaping the France Energy Bar Industry Market?

Trends shaping the France Energy Bar Industry Market include the increasing demand for clean-label products, the rise of functional ingredients that offer health benefits, and the growing popularity of personalized nutrition. These trends reflect changing consumer preferences towards healthier snack options.

France Energy Bar Industry Market

| Segmentation Details | Description |

|---|---|

| Product Type | Protein Bars, Meal Replacement Bars, Snack Bars, Energy Chews |

| End User | Athletes, Fitness Enthusiasts, Busy Professionals, Students |

| Distribution Channel | Supermarkets, Health Food Stores, Online Retailers, Gyms |

| Packaging Type | Single-Serve Packs, Multi-Packs, Bulk Packaging, Resealable Bags |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the France Energy Bar Industry Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at