444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The France endoscope industry market represents a critical segment of the country’s advanced medical technology landscape, demonstrating remarkable growth and innovation in minimally invasive diagnostic and therapeutic procedures. France’s healthcare system has embraced endoscopic technologies as essential tools for modern medical practice, driving substantial demand across hospitals, ambulatory surgical centers, and specialized clinics throughout the nation.

Market dynamics in France reflect the country’s commitment to healthcare excellence and technological advancement. The endoscope market encompasses various sophisticated instruments including flexible endoscopes, rigid endoscopes, capsule endoscopes, and robotic-assisted endoscopic systems. French healthcare providers increasingly rely on these technologies for gastrointestinal procedures, respiratory diagnostics, urological interventions, and gynecological examinations.

Growth trajectories indicate the market is expanding at a robust CAGR of 6.8%, driven by aging demographics, increasing prevalence of chronic diseases, and growing preference for minimally invasive procedures. Technological innovations in high-definition imaging, artificial intelligence integration, and wireless capsule endoscopy continue to reshape the competitive landscape and enhance clinical outcomes across French medical institutions.

The France endoscope industry market refers to the comprehensive ecosystem of medical devices, technologies, and services dedicated to endoscopic procedures within the French healthcare system. Endoscopy involves the use of specialized instruments equipped with cameras and light sources to visualize internal body structures, enabling accurate diagnosis and minimally invasive treatment of various medical conditions.

This market encompasses the manufacturing, distribution, and utilization of endoscopic equipment including flexible and rigid endoscopes, video processors, light sources, insufflators, and associated accessories. French medical facilities utilize these technologies across multiple specialties including gastroenterology, pulmonology, urology, gynecology, and general surgery.

Market participants include international medical device manufacturers, domestic technology companies, healthcare providers, and specialized service organizations that support the endoscopy ecosystem. The industry plays a crucial role in advancing France’s healthcare capabilities while contributing to improved patient outcomes and reduced healthcare costs through minimally invasive procedures.

France’s endoscope industry stands at the forefront of European medical technology advancement, characterized by strong market fundamentals and accelerating adoption of next-generation endoscopic solutions. The market benefits from France’s robust healthcare infrastructure, favorable reimbursement policies, and increasing emphasis on preventive care and early disease detection.

Key market drivers include the aging French population, rising incidence of gastrointestinal disorders, and growing awareness of colorectal cancer screening programs. Technological advancement represents approximately 35% of market growth drivers, with artificial intelligence integration and high-definition imaging capabilities leading innovation trends.

Competitive dynamics feature established international players alongside emerging French technology companies developing specialized endoscopic solutions. Market consolidation trends indicate strategic partnerships and acquisitions as companies seek to expand their technological capabilities and market reach within the French healthcare system.

Future prospects remain highly favorable, with digital transformation initiatives and telemedicine integration expected to create new opportunities for endoscopic technology providers. Regulatory support from French health authorities continues to facilitate market access for innovative endoscopic solutions that demonstrate clinical efficacy and cost-effectiveness.

Strategic market insights reveal several critical trends shaping the France endoscope industry landscape:

Primary market drivers propelling the France endoscope industry include demographic, technological, and healthcare policy factors that create sustained demand for endoscopic solutions.

Demographic factors represent the most significant driver, with France’s aging population requiring increased screening and diagnostic procedures. Population statistics indicate that approximately 20.5% of French citizens are over 65 years old, creating substantial demand for gastrointestinal, urological, and respiratory endoscopic procedures.

Disease prevalence trends contribute significantly to market growth, particularly the increasing incidence of colorectal cancer, inflammatory bowel disease, and gastroesophageal reflux disease. National screening programs for colorectal cancer have achieved participation rates of 33.5%, with ongoing efforts to increase screening compliance driving endoscope demand.

Technological advancement serves as a crucial growth driver, with innovations in high-definition imaging, narrow-band imaging, and artificial intelligence enhancing diagnostic capabilities. French healthcare providers increasingly adopt these technologies to improve patient outcomes and operational efficiency.

Healthcare policy support through favorable reimbursement policies and quality improvement initiatives encourages adoption of advanced endoscopic technologies. Government initiatives promoting preventive care and early disease detection create additional market opportunities for endoscope manufacturers and service providers.

Market restraints present challenges that may limit growth potential in the France endoscope industry, requiring strategic approaches from market participants.

High capital costs associated with advanced endoscopic equipment represent a significant barrier, particularly for smaller healthcare facilities and private practices. Budget constraints in public healthcare institutions may delay equipment upgrades and limit adoption of cutting-edge technologies.

Skilled personnel shortage poses challenges for market expansion, as advanced endoscopic procedures require specialized training and expertise. Training requirements for new technologies can create implementation delays and increase operational costs for healthcare providers.

Regulatory complexity surrounding medical device approval and quality standards may slow market entry for innovative endoscopic solutions. Compliance requirements with French and European medical device regulations can create barriers for smaller technology companies seeking market access.

Infection control concerns and reprocessing requirements for reusable endoscopes create operational challenges and additional costs for healthcare facilities. Quality assurance protocols require significant investment in cleaning, disinfection, and maintenance infrastructure.

Competition from alternative diagnostic technologies, including advanced imaging modalities and non-invasive testing methods, may limit market growth in certain applications. Technology substitution risks require continuous innovation and value demonstration from endoscope manufacturers.

Emerging opportunities in the France endoscope industry present significant potential for market expansion and technological advancement.

Artificial intelligence integration represents a transformative opportunity, with AI-powered diagnostic assistance and automated detection systems enhancing clinical outcomes. Machine learning algorithms can improve polyp detection rates and reduce missed diagnoses, creating value for healthcare providers and patients.

Telemedicine integration offers opportunities for remote consultation and expert guidance during endoscopic procedures. Digital connectivity enables real-time collaboration between specialists and can improve access to expert care in underserved regions.

Single-use endoscope adoption presents growth opportunities as healthcare facilities seek to eliminate infection risks and reduce reprocessing costs. Disposable endoscope technologies continue to improve in quality while offering operational advantages.

Ambulatory care expansion creates opportunities for portable and point-of-care endoscopic solutions. Outpatient procedure growth drives demand for compact, user-friendly endoscopic systems that can operate in diverse clinical settings.

Preventive care emphasis through national health initiatives creates opportunities for screening-focused endoscopic technologies. Population health management programs may drive increased utilization of endoscopic screening procedures.

Market dynamics in the France endoscope industry reflect the interplay of technological innovation, healthcare policy, competitive forces, and evolving clinical practices.

Innovation cycles drive continuous product development, with manufacturers investing heavily in research and development to maintain competitive advantages. Technology refresh rates typically occur every 5-7 years, creating predictable replacement demand cycles for healthcare facilities.

Competitive intensity remains high, with established international players competing alongside emerging technology companies. Market share distribution shows that the top five manufacturers control approximately 68% of the market, while smaller specialized companies capture niche segments.

Pricing pressures from healthcare cost containment initiatives influence purchasing decisions and drive demand for cost-effective solutions. Value-based purchasing models increasingly emphasize clinical outcomes and total cost of ownership rather than initial equipment costs.

Supply chain considerations have gained importance, with healthcare facilities seeking reliable suppliers and service support. Local service capabilities and rapid response times become competitive differentiators in the French market.

Regulatory evolution continues to shape market dynamics, with new standards for cybersecurity, data privacy, and device connectivity affecting product development and market strategies.

Comprehensive research methodology employed in analyzing the France endoscope industry market incorporates multiple data sources and analytical approaches to ensure accuracy and reliability.

Primary research involved extensive interviews with key stakeholders including healthcare administrators, endoscopy department managers, practicing physicians, and medical device executives. Survey data collected from over 200 French healthcare facilities provided insights into purchasing patterns, technology preferences, and future investment plans.

Secondary research encompassed analysis of industry reports, government healthcare statistics, medical device registration data, and academic publications. Market intelligence gathered from trade associations, professional societies, and regulatory agencies provided additional context and validation.

Quantitative analysis utilized statistical modeling techniques to project market trends and growth patterns. Data triangulation methods ensured consistency across multiple information sources and enhanced the reliability of market estimates.

Expert validation through advisory panels comprising industry experts, clinical specialists, and market analysts provided critical review and refinement of research findings. Peer review processes ensured methodological rigor and analytical accuracy throughout the research process.

Regional market distribution across France reveals distinct patterns influenced by healthcare infrastructure, population density, and economic factors.

Île-de-France region dominates the endoscope market, accounting for approximately 28% of national demand. Paris metropolitan area concentrates major teaching hospitals, research institutions, and private healthcare facilities that drive adoption of advanced endoscopic technologies.

Auvergne-Rhône-Alpes region represents the second-largest market segment with 15% market share, benefiting from strong healthcare infrastructure in Lyon and Grenoble. Medical device manufacturing presence in the region creates synergies between local industry and healthcare providers.

Provence-Alpes-Côte d’Azur captures significant market share through major medical centers in Marseille and Nice. Mediterranean region demographics, including higher elderly population concentrations, drive demand for diagnostic endoscopy services.

Northern regions including Hauts-de-France and Grand Est show growing market potential as healthcare modernization initiatives expand access to advanced endoscopic technologies. Cross-border healthcare activities with neighboring countries create additional market opportunities.

Rural market segments present unique challenges and opportunities, with mobile endoscopy units and telemedicine-enabled solutions addressing geographic access barriers. Regional healthcare planning initiatives increasingly emphasize equitable access to endoscopic services across all French territories.

Competitive landscape in the France endoscope industry features a mix of established multinational corporations and innovative specialty companies competing across various market segments.

Market competition intensifies around technological innovation, clinical outcomes, and total cost of ownership. Strategic partnerships between device manufacturers and healthcare providers create competitive advantages through integrated service offerings and clinical support programs.

Market segmentation analysis reveals distinct categories based on product type, application, end-user, and technology platform.

By Product Type:

By Application:

By End-User:

Gastrointestinal endoscopy represents the largest market category, driven by colorectal cancer screening programs and increasing prevalence of digestive disorders. Advanced imaging technologies including narrow-band imaging and confocal endomicroscopy enhance diagnostic accuracy and therapeutic outcomes.

Therapeutic endoscopy shows rapid growth as minimally invasive procedures replace traditional surgical approaches. Endoscopic submucosal dissection and endoscopic retrograde cholangiopancreatography procedures require specialized equipment and expertise, creating premium market segments.

Respiratory endoscopy benefits from growing awareness of lung cancer screening and chronic respiratory disease management. Bronchoscopy applications expand beyond traditional diagnostics to include therapeutic interventions and lung volume reduction procedures.

Single-use endoscope adoption accelerates in response to infection control concerns and reprocessing cost considerations. Disposable bronchoscopes and ureteroscopes gain market acceptance as quality improvements and cost reductions make them competitive alternatives.

Digital integration capabilities become increasingly important as healthcare facilities seek workflow optimization and data analytics capabilities. Cloud-based platforms and artificial intelligence integration create new value propositions for endoscopy equipment manufacturers.

Healthcare providers benefit from advanced endoscopic technologies through improved diagnostic accuracy, reduced procedure times, and enhanced patient safety. Clinical outcomes improve significantly with high-definition imaging and AI-assisted detection capabilities.

Patients experience reduced discomfort, shorter recovery times, and improved diagnostic accuracy through minimally invasive endoscopic procedures. Early detection capabilities enable timely intervention and better treatment outcomes across various medical conditions.

Healthcare systems achieve cost savings through reduced hospitalization requirements, improved operational efficiency, and preventive care capabilities. Resource optimization through advanced endoscopic technologies supports sustainable healthcare delivery models.

Medical device manufacturers benefit from growing market demand, technological innovation opportunities, and expanding application areas. Market expansion potential exists through product diversification and geographic market development.

Healthcare payers realize cost benefits through reduced complications, shorter procedure times, and improved preventive care outcomes. Value-based care models increasingly recognize the economic benefits of advanced endoscopic technologies.

Medical professionals gain access to advanced diagnostic and therapeutic capabilities that enhance clinical practice and patient care quality. Professional development opportunities expand through training programs and technology advancement.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration emerges as the most significant trend, with AI-powered diagnostic assistance improving polyp detection rates by up to 25% in clinical studies. Machine learning algorithms continue advancing to support real-time decision making during endoscopic procedures.

Single-use endoscope adoption accelerates across multiple specialties as manufacturers improve quality while reducing costs. Disposable bronchoscopes and ureteroscopes gain market acceptance, particularly in infection-sensitive applications and resource-constrained settings.

High-definition imaging becomes standard across endoscopy platforms, with 4K resolution and enhanced optical technologies improving diagnostic capabilities. Advanced imaging modalities including narrow-band imaging and confocal endomicroscopy expand clinical applications.

Miniaturization trends enable development of ultra-thin endoscopes that improve patient comfort while maintaining diagnostic quality. Pediatric applications benefit significantly from smaller diameter instruments and improved maneuverability.

Digital workflow integration streamlines endoscopy operations through electronic health record connectivity and automated documentation systems. Cloud-based platforms enable remote consultation and collaborative diagnosis capabilities.

Robotic assistance in endoscopic procedures grows through computer-assisted navigation and enhanced precision capabilities. Robotic colonoscopy systems demonstrate potential for improved screening efficiency and patient comfort.

Recent industry developments highlight the dynamic nature of the France endoscope market and emerging technological capabilities.

Regulatory approvals for next-generation endoscopic systems with AI integration mark significant milestones for the industry. French health authorities increasingly recognize the clinical value of AI-assisted diagnostic technologies in endoscopy applications.

Strategic partnerships between international manufacturers and French healthcare institutions accelerate technology adoption and clinical validation. Collaborative research programs focus on developing specialized endoscopic solutions for French market needs.

Investment in training and education programs expands as manufacturers and healthcare institutions recognize the importance of skilled personnel in technology adoption. Simulation-based training platforms improve learning outcomes and reduce training time requirements.

Quality improvement initiatives drive adoption of advanced reprocessing technologies and infection control protocols. Automated endoscope reprocessors with enhanced monitoring capabilities improve safety and operational efficiency.

Telemedicine integration projects demonstrate the potential for remote endoscopy consultation and expert guidance. Digital connectivity solutions enable real-time collaboration between specialists across different healthcare facilities.

Research and development investments focus on next-generation technologies including wireless capsule endoscopy improvements and robotic-assisted procedures. Innovation partnerships between academic institutions and industry accelerate technology development timelines.

MarkWide Research analysis suggests several strategic recommendations for stakeholders in the France endoscope industry market.

Healthcare providers should prioritize comprehensive technology assessment and staff training programs when implementing advanced endoscopic systems. Total cost of ownership analysis should include training, maintenance, and operational efficiency factors beyond initial equipment costs.

Medical device manufacturers should focus on developing integrated solutions that combine advanced imaging, AI assistance, and digital workflow capabilities. Local partnerships with French healthcare institutions can accelerate market penetration and clinical validation.

Investment in cybersecurity and data privacy capabilities becomes critical as endoscopy systems increasingly connect to hospital networks and cloud platforms. Regulatory compliance with European data protection requirements should be prioritized in product development.

Service and support capabilities require enhancement to meet growing demand for rapid response and technical expertise. Local service networks and remote diagnostic capabilities can provide competitive advantages in the French market.

Collaboration with healthcare payers on value-based purchasing models can demonstrate the economic benefits of advanced endoscopic technologies. Clinical outcome data collection and analysis support reimbursement discussions and adoption decisions.

Future market prospects for the France endoscope industry remain highly favorable, with multiple growth drivers supporting sustained expansion through the next decade.

Demographic trends will continue driving demand as France’s aging population requires increased screening and diagnostic procedures. Population projections indicate the 65+ age group will reach 23.6% by 2030, creating substantial market opportunities for endoscopy providers.

Technology advancement will accelerate through AI integration, robotic assistance, and enhanced imaging capabilities. Next-generation systems combining multiple advanced technologies will create new market segments and premium pricing opportunities.

Market consolidation may occur as smaller manufacturers seek partnerships or acquisition opportunities to compete effectively. Strategic alliances between technology companies and healthcare providers will become increasingly important for market success.

Regulatory evolution will likely favor technologies that demonstrate clear clinical benefits and cost-effectiveness. Evidence-based adoption criteria will influence purchasing decisions and market access for new endoscopic technologies.

Digital transformation in healthcare will create new opportunities for connected endoscopy systems and data analytics platforms. MWR projections suggest digital integration capabilities will become standard requirements for endoscopy equipment by 2027.

The France endoscope industry market represents a dynamic and rapidly evolving sector within the country’s advanced healthcare technology landscape. Strong fundamentals including demographic trends, technological innovation, and supportive healthcare policies create favorable conditions for sustained market growth and development.

Market opportunities abound through AI integration, single-use technology adoption, and digital workflow enhancement. Healthcare providers increasingly recognize the value proposition of advanced endoscopic technologies in improving patient outcomes while optimizing operational efficiency and cost-effectiveness.

Competitive dynamics will continue evolving as established manufacturers and emerging technology companies compete to deliver innovative solutions that address evolving clinical needs. Success factors include technological excellence, comprehensive service support, and strong partnerships with French healthcare institutions.

Future growth prospects remain robust, supported by demographic trends, technology advancement, and expanding clinical applications. The France endoscope industry market is well-positioned to maintain its leadership role in European medical technology while contributing to improved healthcare outcomes for the French population through continued innovation and excellence in endoscopic care delivery.

What is Endoscope?

Endoscopes are medical instruments used to examine the interior of a hollow organ or cavity in the body. They are commonly used in procedures such as gastrointestinal examinations, respiratory assessments, and minimally invasive surgeries.

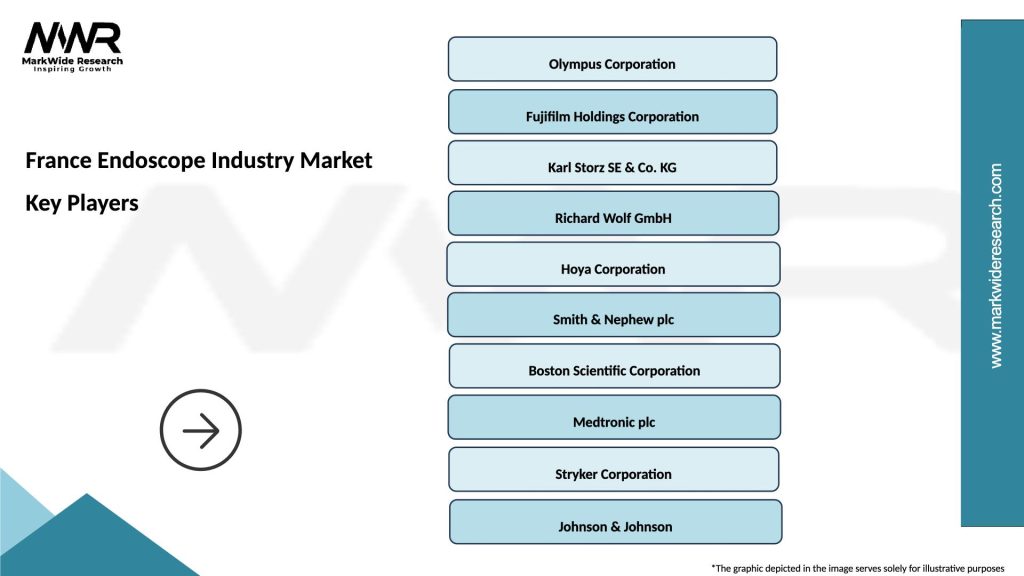

What are the key players in the France Endoscope Industry Market?

Key players in the France Endoscope Industry Market include companies like Olympus Corporation, Karl Storz, and Medtronic, which are known for their innovative endoscopic technologies and products, among others.

What are the growth factors driving the France Endoscope Industry Market?

The France Endoscope Industry Market is driven by factors such as the increasing prevalence of chronic diseases, advancements in endoscopic technology, and a growing preference for minimally invasive surgical procedures.

What challenges does the France Endoscope Industry Market face?

Challenges in the France Endoscope Industry Market include high costs associated with advanced endoscopic equipment, stringent regulatory requirements, and the need for continuous training of healthcare professionals.

What opportunities exist in the France Endoscope Industry Market?

Opportunities in the France Endoscope Industry Market include the development of new endoscopic techniques, the integration of artificial intelligence in diagnostics, and the expansion of telemedicine services for remote consultations.

What trends are shaping the France Endoscope Industry Market?

Trends in the France Endoscope Industry Market include the increasing adoption of single-use endoscopes, advancements in imaging technologies, and a focus on patient safety and infection control measures.

France Endoscope Industry Market

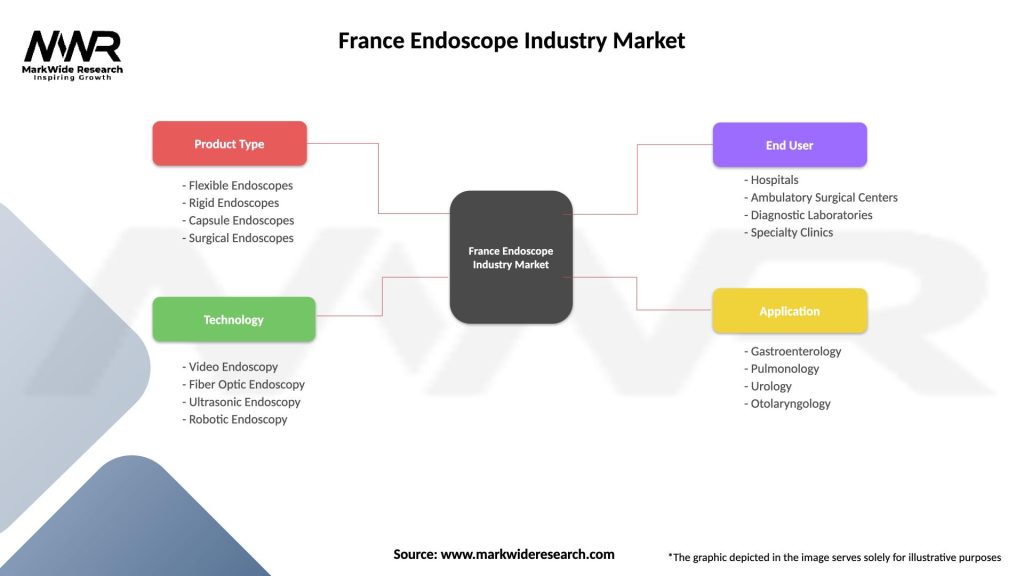

| Segmentation Details | Description |

|---|---|

| Product Type | Flexible Endoscopes, Rigid Endoscopes, Capsule Endoscopes, Surgical Endoscopes |

| Technology | Video Endoscopy, Fiber Optic Endoscopy, Ultrasonic Endoscopy, Robotic Endoscopy |

| End User | Hospitals, Ambulatory Surgical Centers, Diagnostic Laboratories, Specialty Clinics |

| Application | Gastroenterology, Pulmonology, Urology, Otolaryngology |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the France Endoscope Industry Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at