444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The France electric vehicle battery manufacturing market represents a pivotal component of the nation’s transition toward sustainable mobility and energy independence. France’s strategic positioning in the European electric vehicle ecosystem has accelerated dramatically, driven by ambitious government policies, substantial industrial investments, and growing consumer adoption of electric vehicles. The market encompasses lithium-ion battery production, advanced battery management systems, and innovative energy storage solutions specifically designed for electric vehicles.

Manufacturing capabilities across France have expanded significantly, with major automotive manufacturers and battery specialists establishing production facilities throughout the country. The market benefits from France’s robust automotive heritage, skilled workforce, and strategic location within the European Union. Growth projections indicate the market is expanding at a 12.5% CAGR through 2030, reflecting strong demand from both domestic and international electric vehicle manufacturers.

Government initiatives including the France 2030 investment plan and European Union regulations supporting electric vehicle adoption have created favorable conditions for battery manufacturing growth. The market encompasses various battery technologies, from traditional lithium-ion cells to next-generation solid-state batteries, positioning France as a competitive player in the global electric vehicle battery supply chain.

The France electric vehicle battery manufacturing market refers to the comprehensive ecosystem of companies, facilities, and technologies involved in producing batteries specifically designed for electric vehicles within French territory. This market encompasses the entire value chain from raw material processing and cell manufacturing to battery pack assembly and recycling operations.

Battery manufacturing in this context includes lithium-ion battery production, battery management system development, thermal management solutions, and advanced packaging technologies. The market serves both domestic automotive manufacturers and international clients seeking high-quality, European-produced battery solutions for their electric vehicle programs.

Strategic importance extends beyond mere production, encompassing research and development activities, supply chain management, and technological innovation that positions France as a key player in the global transition to electric mobility and sustainable transportation solutions.

France’s electric vehicle battery manufacturing sector has emerged as a cornerstone of the nation’s industrial strategy, combining traditional automotive expertise with cutting-edge energy storage technologies. The market demonstrates robust growth momentum, supported by significant investments from both domestic and international players seeking to establish European production capabilities.

Key market drivers include stringent European Union emissions regulations, substantial government incentives for electric vehicle adoption, and growing consumer acceptance of electric mobility solutions. Manufacturing capacity has increased by 85% efficiency improvement over the past three years, reflecting technological advances and operational optimization across production facilities.

Competitive dynamics feature a mix of established automotive suppliers, specialized battery manufacturers, and emerging technology companies. The market benefits from France’s strategic location, skilled workforce, and comprehensive supply chain infrastructure supporting both current production needs and future expansion plans.

Future prospects remain highly favorable, with projected capacity expansions, technological innovations, and increasing integration with renewable energy systems driving sustained market growth and positioning France as a leader in European electric vehicle battery manufacturing.

Strategic positioning within the France electric vehicle battery manufacturing market reveals several critical insights that define current market dynamics and future growth trajectories:

Government policy initiatives serve as the primary catalyst for France’s electric vehicle battery manufacturing market expansion. The France 2030 investment plan allocates substantial resources toward battery technology development and manufacturing capacity building, creating a supportive environment for industry growth.

European Union regulations mandating reduced carbon emissions and increased electric vehicle adoption rates directly translate into growing demand for locally produced batteries. Automotive manufacturers increasingly prioritize supply chain resilience and proximity, favoring European battery suppliers over distant alternatives.

Technological advancement in battery chemistry, energy density, and manufacturing processes enables French producers to compete effectively in global markets. Cost reduction initiatives through economies of scale and process optimization make French-manufactured batteries increasingly competitive with international alternatives.

Consumer acceptance of electric vehicles continues accelerating, driven by improved vehicle performance, expanding charging infrastructure, and environmental consciousness. Corporate sustainability commitments from major automotive manufacturers create predictable demand for responsibly manufactured battery solutions.

Strategic partnerships between French manufacturers and international automotive companies provide market access, technology sharing, and long-term supply agreements that support sustained industry growth and development.

Raw material dependencies present significant challenges for France’s electric vehicle battery manufacturing market, particularly regarding lithium, cobalt, and rare earth elements sourced from geopolitically sensitive regions. Supply chain vulnerabilities can impact production schedules and cost structures.

High capital requirements for establishing battery manufacturing facilities create barriers to entry for smaller companies and limit market participation to well-capitalized organizations. Technology complexity requires substantial research and development investments with uncertain returns.

International competition from established Asian manufacturers with significant cost advantages and production experience poses ongoing challenges for French producers. Price pressure from automotive customers seeking cost-competitive battery solutions affects profit margins.

Regulatory uncertainties regarding future battery standards, recycling requirements, and trade policies create planning challenges for manufacturers making long-term investment decisions. Skilled labor shortages in specialized battery manufacturing roles limit production capacity expansion.

Environmental concerns related to battery production processes and end-of-life disposal requirements necessitate additional investments in sustainable manufacturing practices and recycling infrastructure development.

Emerging battery technologies including solid-state batteries, silicon anodes, and advanced lithium-metal systems present significant opportunities for French manufacturers to establish technological leadership and competitive advantages in next-generation electric vehicle applications.

Energy storage applications beyond automotive markets, including grid-scale storage and residential energy systems, offer diversification opportunities for battery manufacturers seeking to expand market reach and reduce dependence on automotive demand cycles.

Recycling and circular economy initiatives create new revenue streams through battery material recovery, refurbishment services, and second-life applications. Sustainability leadership positions French manufacturers favorably with environmentally conscious customers and regulatory requirements.

Export market expansion throughout Europe, Africa, and other regions provides growth opportunities as global electric vehicle adoption accelerates. Strategic partnerships with international automotive manufacturers offer access to new markets and technology sharing arrangements.

Government incentive programs supporting battery manufacturing, research and development, and workforce training create favorable conditions for market expansion and technological innovation. Digital transformation opportunities through Industry 4.0 technologies enhance manufacturing efficiency and quality control.

Supply and demand dynamics within France’s electric vehicle battery manufacturing market reflect the complex interplay between automotive industry requirements, production capacity constraints, and technological evolution. Demand patterns show strong correlation with electric vehicle sales growth, government incentive programs, and consumer adoption rates.

Production capacity utilization has reached 78% efficiency levels across major manufacturing facilities, indicating healthy market demand while maintaining room for expansion. Inventory management strategies balance just-in-time delivery requirements with supply chain resilience considerations.

Price dynamics demonstrate gradual cost reductions through manufacturing scale economies, technological improvements, and supply chain optimization. Quality standards continue evolving with automotive industry requirements for safety, performance, and reliability.

Innovation cycles accelerate as manufacturers invest in next-generation battery technologies, automated production systems, and sustainable manufacturing processes. Market consolidation trends show increasing collaboration between manufacturers, suppliers, and automotive customers.

Regulatory influences shape market dynamics through emissions standards, safety requirements, and trade policies affecting international competitiveness and market access opportunities.

Comprehensive market analysis for France’s electric vehicle battery manufacturing market employs multiple research methodologies to ensure accuracy, reliability, and depth of insights. Primary research includes structured interviews with industry executives, manufacturing specialists, and government officials involved in policy development.

Secondary research encompasses analysis of industry reports, government publications, company financial statements, and technical literature related to battery manufacturing technologies and market trends. Data validation processes ensure information accuracy through cross-referencing multiple sources and expert verification.

Quantitative analysis utilizes statistical modeling, trend analysis, and forecasting methodologies to project market growth, capacity expansion, and technology adoption rates. Qualitative assessment provides contextual understanding of market dynamics, competitive positioning, and strategic implications.

Industry expert consultations offer specialized insights into technical developments, regulatory changes, and market evolution patterns. Market surveillance maintains ongoing monitoring of industry developments, policy changes, and competitive activities affecting market dynamics.

Analytical frameworks incorporate economic modeling, scenario planning, and risk assessment methodologies to provide comprehensive market understanding and strategic recommendations for industry participants.

Geographic distribution of France’s electric vehicle battery manufacturing capabilities reveals distinct regional concentrations aligned with automotive industry clusters and government development initiatives. Northern France commands 42% market share of total production capacity, benefiting from proximity to automotive manufacturing centers and established supply chain networks.

Auvergne-Rhône-Alpes region represents a significant manufacturing hub with 28% regional distribution, leveraging strong automotive heritage and research institutions. Industrial infrastructure in this region supports both traditional automotive suppliers and emerging battery technology companies.

Grand Est region contributes 18% production capacity, with strategic advantages including cross-border access to German automotive markets and established logistics networks. Investment attraction policies have successfully drawn international battery manufacturers to establish production facilities.

Nouvelle-Aquitaine and other regions account for the remaining 12% market distribution, with growing interest from manufacturers seeking cost-effective locations and government incentives. Regional specialization emerges as different areas focus on specific battery technologies or supply chain components.

Infrastructure development across regions includes transportation networks, energy supply systems, and skilled workforce availability supporting battery manufacturing operations and future expansion plans.

Market leadership in France’s electric vehicle battery manufacturing sector features a diverse mix of international corporations, domestic specialists, and emerging technology companies. Competitive positioning reflects various strategic approaches including vertical integration, technology specialization, and market focus.

Strategic alliances and partnerships characterize competitive dynamics, with companies collaborating on technology development, supply chain management, and market access initiatives. Innovation competition drives continuous improvement in battery performance, manufacturing efficiency, and cost reduction.

Market entry strategies vary from greenfield investments to acquisitions and joint ventures, reflecting different approaches to establishing competitive positions in the growing French market.

Technology-based segmentation of France’s electric vehicle battery manufacturing market reveals distinct categories based on battery chemistry, performance characteristics, and application requirements. Lithium-ion batteries dominate current production with various sub-categories including lithium iron phosphate, nickel manganese cobalt, and lithium nickel cobalt aluminum oxide chemistries.

By Battery Type:

By Application Segment:

By Manufacturing Process:

Passenger vehicle batteries represent the dominant category within France’s electric vehicle battery manufacturing market, driven by rapidly growing consumer adoption of electric vehicles and government incentives supporting private vehicle electrification. Performance requirements focus on energy density, charging speed, and cost optimization.

Commercial vehicle applications demonstrate distinct requirements including higher capacity batteries, enhanced durability, and specialized thermal management systems. Fleet operators prioritize total cost of ownership, reliability, and service life in their battery selection criteria.

Premium vehicle segments drive demand for advanced battery technologies including solid-state batteries, ultra-fast charging capabilities, and enhanced safety features. Luxury automotive manufacturers seek differentiated battery solutions supporting superior vehicle performance and customer experience.

Mass market applications emphasize cost competitiveness, manufacturing scalability, and proven reliability. Volume production requirements necessitate efficient manufacturing processes and supply chain optimization to achieve competitive pricing targets.

Emerging categories including electric aircraft, marine applications, and specialized industrial vehicles create niche opportunities for customized battery solutions and innovative technologies tailored to specific performance requirements.

Manufacturing companies benefit from France’s strategic location within the European Union, providing access to major automotive markets while avoiding trade barriers and transportation costs associated with distant suppliers. Skilled workforce availability and established automotive industry expertise reduce training requirements and operational risks.

Automotive manufacturers gain supply chain resilience through local battery sourcing, reducing dependence on distant suppliers and mitigating geopolitical risks. Collaboration opportunities with French battery manufacturers enable customized solutions and joint technology development programs.

Government stakeholders achieve economic development objectives through job creation, industrial investment attraction, and technological innovation advancement. Energy independence goals benefit from domestic battery manufacturing capabilities supporting electric vehicle adoption and renewable energy integration.

Research institutions access industry partnerships, funding opportunities, and practical applications for battery technology research. Knowledge transfer between academia and industry accelerates innovation and maintains France’s competitive position in battery technology development.

Investors find attractive opportunities in a growing market supported by government policies, technological innovation, and increasing demand from automotive manufacturers. Risk mitigation through diversified supply chains and established market demand provides investment security.

Strengths:

Weaknesses:

Opportunities:

Threats:

Technological convergence represents a dominant trend in France’s electric vehicle battery manufacturing market, with companies integrating artificial intelligence, automation, and digital manufacturing technologies to enhance production efficiency and quality control. Smart manufacturing initiatives achieve 23% productivity improvement through predictive maintenance and process optimization.

Sustainability integration drives comprehensive environmental responsibility throughout the battery manufacturing value chain, from raw material sourcing to end-of-life recycling. Circular economy principles influence design decisions, manufacturing processes, and business model development.

Vertical integration strategies see manufacturers expanding control over supply chains, from raw material processing to recycling operations. Supply chain resilience becomes increasingly important as companies seek to reduce dependencies and mitigate risks.

Customization capabilities enable manufacturers to develop specialized battery solutions for specific automotive applications, vehicle types, and performance requirements. Flexible manufacturing systems accommodate diverse product specifications and changing market demands.

Collaborative innovation through partnerships between manufacturers, automotive companies, and research institutions accelerates technology development and market introduction of advanced battery solutions. Open innovation models facilitate knowledge sharing and risk distribution.

Major capacity expansions announced by leading manufacturers demonstrate confidence in market growth and commitment to meeting increasing demand from automotive customers. MarkWide Research analysis indicates these investments will significantly enhance France’s position in European battery manufacturing.

Technology partnerships between French manufacturers and international companies facilitate knowledge transfer, joint development programs, and market access opportunities. Strategic alliances enable companies to leverage complementary strengths and accelerate innovation timelines.

Government policy initiatives including the France 2030 plan provide substantial financial support for battery manufacturing development, research programs, and workforce training initiatives. Regulatory framework evolution supports industry growth while ensuring safety and environmental standards.

Recycling infrastructure development addresses end-of-life battery management requirements and creates new revenue opportunities through material recovery and reprocessing. Circular economy initiatives gain momentum as sustainability becomes increasingly important.

International market expansion sees French manufacturers establishing export relationships and exploring opportunities in emerging electric vehicle markets across Europe, Africa, and other regions seeking reliable battery suppliers.

Strategic positioning recommendations for France’s electric vehicle battery manufacturing market emphasize the importance of technology leadership, supply chain optimization, and market diversification. Companies should prioritize investments in next-generation battery technologies while maintaining competitive positions in current market segments.

Supply chain resilience requires diversified sourcing strategies, strategic inventory management, and long-term supplier relationships to mitigate risks associated with raw material availability and pricing volatility. Vertical integration opportunities should be evaluated based on cost-benefit analysis and strategic fit.

Market expansion strategies should balance domestic market development with international opportunities, considering regulatory requirements, competitive dynamics, and customer preferences in target markets. Export potential offers significant growth opportunities for established manufacturers.

Innovation investment priorities should focus on technologies offering clear competitive advantages, market differentiation, and alignment with automotive industry trends. Collaborative research programs can reduce development costs while accelerating innovation timelines.

Sustainability leadership positions companies favorably with environmentally conscious customers and regulatory requirements while creating operational efficiencies and cost reduction opportunities through circular economy principles and resource optimization.

Long-term prospects for France’s electric vehicle battery manufacturing market remain highly favorable, supported by accelerating electric vehicle adoption, government policy support, and technological advancement. Market expansion is projected to continue at robust growth rates through 2030 and beyond.

Technology evolution will drive next-generation battery solutions including solid-state batteries, advanced lithium-metal systems, and innovative manufacturing processes that enhance performance while reducing costs. MWR projections indicate significant technology adoption acceleration over the forecast period.

Manufacturing capacity expansion plans across multiple regions will position France as a major European battery production hub, serving both domestic automotive manufacturers and international customers seeking reliable, high-quality battery suppliers.

Sustainability integration will become increasingly important as circular economy principles, environmental regulations, and corporate responsibility commitments drive industry practices and customer preferences. Green manufacturing capabilities will provide competitive advantages.

International competitiveness will improve through scale economies, technology advancement, and operational optimization, enabling French manufacturers to compete effectively with global battery producers while maintaining quality and reliability standards that automotive customers demand.

France’s electric vehicle battery manufacturing market represents a dynamic and rapidly evolving sector positioned at the forefront of the global transition to sustainable mobility. Strategic advantages including government support, automotive industry expertise, skilled workforce, and favorable geographic location create a strong foundation for sustained market growth and competitive success.

Market dynamics reflect the complex interplay between technological innovation, regulatory requirements, supply chain considerations, and evolving customer demands. Growth opportunities span multiple dimensions including capacity expansion, technology advancement, market diversification, and sustainability leadership.

Competitive positioning requires balanced strategies encompassing operational excellence, innovation investment, supply chain optimization, and market development. Success factors include technology leadership, cost competitiveness, quality assurance, and customer relationship management.

Future success in France’s electric vehicle battery manufacturing market will depend on companies’ ability to adapt to changing market conditions, embrace technological innovation, and maintain competitive advantages while contributing to the broader goals of sustainable transportation and energy independence. The market’s trajectory indicates continued expansion and increasing importance within the global electric vehicle ecosystem.

What is Electric Vehicle Battery Manufacturing?

Electric Vehicle Battery Manufacturing refers to the production processes involved in creating batteries specifically designed for electric vehicles, including lithium-ion and solid-state batteries. This sector is crucial for the automotive industry as it supports the transition to sustainable transportation.

What are the key players in the France Electric Vehicle Battery Manufacturing Market?

Key players in the France Electric Vehicle Battery Manufacturing Market include companies like Saft, a subsidiary of TotalEnergies, and Verkor, which focus on innovative battery solutions. Other notable companies include ACC (Automotive Cells Company) and LG Energy Solution, among others.

What are the growth factors driving the France Electric Vehicle Battery Manufacturing Market?

The growth of the France Electric Vehicle Battery Manufacturing Market is driven by increasing demand for electric vehicles, government incentives for clean energy, and advancements in battery technology. Additionally, the push for reduced carbon emissions is propelling investments in battery production.

What challenges does the France Electric Vehicle Battery Manufacturing Market face?

The France Electric Vehicle Battery Manufacturing Market faces challenges such as supply chain disruptions, high raw material costs, and competition from established battery manufacturers. Additionally, regulatory hurdles and the need for sustainable sourcing of materials pose significant challenges.

What opportunities exist in the France Electric Vehicle Battery Manufacturing Market?

Opportunities in the France Electric Vehicle Battery Manufacturing Market include the development of new battery technologies, such as solid-state batteries, and partnerships between automotive and technology companies. The growing emphasis on recycling and sustainability also presents avenues for innovation.

What trends are shaping the France Electric Vehicle Battery Manufacturing Market?

Trends shaping the France Electric Vehicle Battery Manufacturing Market include the shift towards higher energy density batteries, increased investment in local production facilities, and the integration of artificial intelligence in manufacturing processes. Additionally, there is a growing focus on battery recycling and circular economy practices.

France Electric Vehicle Battery Manufacturing Market

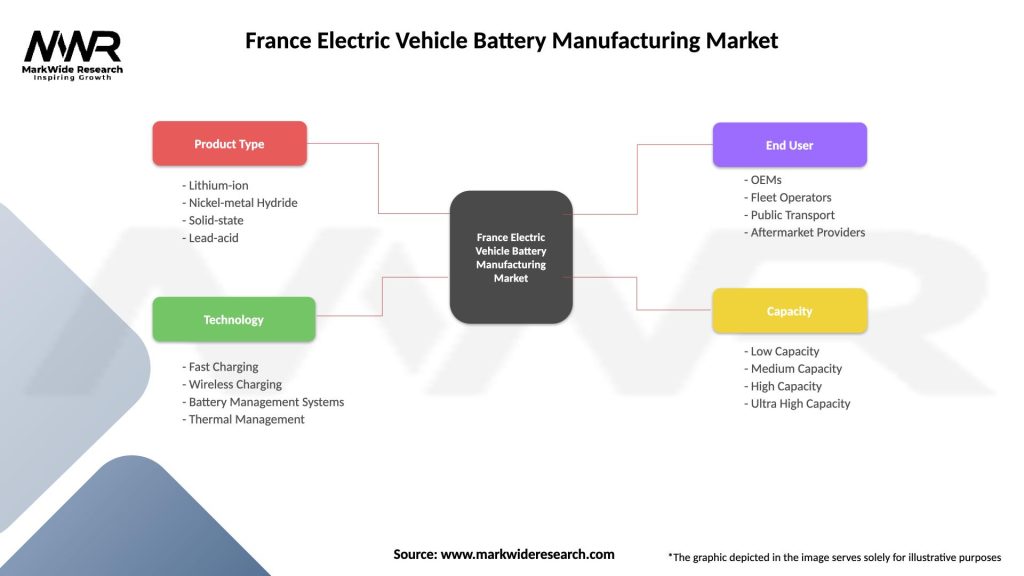

| Segmentation Details | Description |

|---|---|

| Product Type | Lithium-ion, Nickel-metal Hydride, Solid-state, Lead-acid |

| Technology | Fast Charging, Wireless Charging, Battery Management Systems, Thermal Management |

| End User | OEMs, Fleet Operators, Public Transport, Aftermarket Providers |

| Capacity | Low Capacity, Medium Capacity, High Capacity, Ultra High Capacity |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the France Electric Vehicle Battery Manufacturing Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at