444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The France electric vehicle battery electrolyte market represents a critical component of the nation’s rapidly evolving automotive electrification landscape. As France accelerates its transition toward sustainable transportation solutions, the demand for high-performance battery electrolytes has experienced unprecedented growth. The market encompasses various electrolyte types including liquid electrolytes, solid-state electrolytes, and gel polymer electrolytes, each serving specific applications in electric vehicle battery systems.

Market dynamics indicate robust expansion driven by government initiatives, environmental regulations, and increasing consumer adoption of electric vehicles. The French market benefits from strong domestic automotive manufacturing capabilities, with major players like Renault and Peugeot driving local demand for advanced battery technologies. Current market trends show a 12.5% annual growth rate in electrolyte consumption, reflecting the accelerating pace of EV adoption across France.

Regional positioning within the European Union provides France with strategic advantages in terms of regulatory alignment and cross-border supply chain optimization. The market demonstrates particular strength in lithium-ion battery electrolytes, which account for 78% of total market share, while emerging solid-state technologies represent the fastest-growing segment with significant potential for future expansion.

The France electric vehicle battery electrolyte market refers to the comprehensive ecosystem of chemical solutions and ionic conductors specifically designed for electric vehicle battery applications within the French automotive sector. These electrolytes serve as the medium through which ions move between the cathode and anode in battery cells, enabling the electrochemical reactions necessary for energy storage and discharge in electric vehicles.

Battery electrolytes encompass various chemical formulations including organic carbonates, lithium salts, and advanced polymer matrices that facilitate ion transport while maintaining battery safety and performance standards. The market includes both traditional liquid electrolyte systems and next-generation solid-state alternatives that promise enhanced safety characteristics and improved energy density for future electric vehicle applications.

Market scope extends beyond simple chemical supply to include research and development activities, manufacturing processes, quality control systems, and distribution networks that support France’s growing electric vehicle industry. This comprehensive market definition reflects the integrated nature of electrolyte supply chains and their critical role in enabling France’s automotive electrification objectives.

Strategic positioning of the France electric vehicle battery electrolyte market reveals a dynamic sector experiencing rapid transformation driven by automotive industry evolution and environmental policy initiatives. The market demonstrates strong fundamentals with increasing demand from domestic vehicle manufacturers and growing consumer acceptance of electric mobility solutions across French urban and rural markets.

Key market characteristics include diversified supply sources, technological innovation focus, and strong regulatory support framework. French companies are investing heavily in electrolyte research and development, with particular emphasis on improving battery performance metrics such as energy density, charging speed, and operational safety. The market shows 85% concentration in lithium-based electrolyte systems, reflecting current industry standards and technological maturity.

Growth trajectory analysis indicates sustained expansion potential supported by government incentives, infrastructure development, and evolving consumer preferences. Market participants are positioning themselves for long-term success through strategic partnerships, technology licensing agreements, and capacity expansion initiatives designed to meet projected demand increases through the next decade.

Market intelligence reveals several critical insights shaping the France electric vehicle battery electrolyte landscape. The following key insights provide strategic context for market participants and stakeholders:

Government policy initiatives serve as the primary catalyst for France electric vehicle battery electrolyte market expansion. The French government’s commitment to carbon neutrality by 2050 has resulted in comprehensive support programs for electric vehicle adoption, including purchase incentives, infrastructure development funding, and regulatory frameworks that favor electric mobility solutions over traditional internal combustion engines.

Environmental consciousness among French consumers continues to drive demand for sustainable transportation alternatives. Public awareness of climate change impacts and air quality concerns in urban areas has created strong market demand for electric vehicles, directly translating to increased requirements for high-performance battery electrolytes that enable reliable and efficient electric vehicle operation.

Technological advancement in battery chemistry and electrolyte formulation has expanded the performance envelope for electric vehicle applications. Improvements in energy density, charging speed, and operational safety have made electric vehicles more attractive to consumers, while advances in electrolyte technology have enabled these performance gains through enhanced ionic conductivity and thermal stability characteristics.

Automotive industry transformation represents another significant driver as traditional French automakers invest heavily in electric vehicle development and production. Companies like Renault, Peugeot, and Citroën are transitioning their product portfolios toward electric powertrains, creating substantial demand for specialized electrolyte solutions that meet automotive quality and performance standards.

High development costs associated with advanced electrolyte formulations present significant barriers to market entry and expansion. Research and development activities require substantial investment in specialized equipment, testing facilities, and technical expertise, while the lengthy development cycles necessary to meet automotive qualification standards can strain financial resources and delay market introduction of new products.

Supply chain complexities create operational challenges for electrolyte manufacturers serving the French market. Raw material sourcing, particularly for lithium salts and specialized organic solvents, involves complex international supply networks that can be disrupted by geopolitical tensions, trade restrictions, or natural disasters, potentially impacting production schedules and cost structures.

Technical performance requirements for automotive applications impose stringent constraints on electrolyte formulation and manufacturing processes. The need to meet safety standards, performance specifications, and reliability requirements while maintaining cost competitiveness creates technical challenges that can limit the pace of innovation and market adoption of new electrolyte technologies.

Regulatory compliance burden adds complexity and cost to electrolyte development and commercialization activities. Environmental regulations, safety standards, and quality requirements necessitate extensive testing, documentation, and certification processes that can extend development timelines and increase operational expenses for market participants.

Solid-state electrolyte development presents the most significant opportunity for market expansion and technological differentiation. These advanced electrolyte systems offer superior safety characteristics, higher energy density potential, and improved thermal stability compared to conventional liquid electrolytes, positioning companies that successfully develop commercial solid-state solutions for substantial market advantages.

Recycling and sustainability initiatives create new market segments focused on electrolyte recovery and reprocessing. As electric vehicle adoption increases, the need for sustainable end-of-life battery management will drive demand for electrolyte recycling technologies and services, offering opportunities for companies that develop efficient recovery and purification processes.

Export market potential beyond France provides growth opportunities for companies that establish strong domestic market positions. The European Union’s coordinated approach to electric vehicle adoption creates opportunities for French electrolyte suppliers to expand into neighboring markets, leveraging regulatory harmonization and established supply chain relationships.

Strategic partnerships with automotive manufacturers offer opportunities for long-term supply agreements and collaborative development programs. Companies that establish close working relationships with vehicle manufacturers can influence product specifications, secure volume commitments, and participate in next-generation battery development initiatives that shape future market requirements.

Competitive dynamics within the France electric vehicle battery electrolyte market reflect a complex interplay of established chemical companies, emerging technology specialists, and international suppliers seeking to establish local market presence. The market demonstrates characteristics of both mature chemical supply chains and emerging technology sectors, creating unique competitive pressures and strategic considerations for market participants.

Supply and demand balance shows increasing tension as electric vehicle production ramps up faster than electrolyte manufacturing capacity expansion. This dynamic has created opportunities for new market entrants while putting pressure on existing suppliers to invest in capacity expansion and operational efficiency improvements to meet growing demand requirements.

Technology evolution cycles influence market dynamics through the introduction of new electrolyte chemistries and formulations that offer improved performance characteristics. According to MarkWide Research analysis, the transition from conventional liquid electrolytes to advanced solid-state systems represents a fundamental shift that will reshape competitive positions and market structures over the next decade.

Price dynamics reflect the balance between raw material costs, manufacturing efficiency, and competitive pressures. Market participants are experiencing cost pressures from raw material price volatility while facing demands from automotive customers for cost reductions that support electric vehicle affordability objectives and mass market adoption.

Primary research activities encompass comprehensive interviews with key market participants including electrolyte manufacturers, automotive companies, research institutions, and government agencies involved in electric vehicle policy development. These interviews provide insights into market trends, technological developments, competitive dynamics, and future growth prospects that inform market analysis and forecasting activities.

Secondary research sources include industry publications, government statistics, patent databases, and academic research papers that provide quantitative data and qualitative insights into market structure, technology trends, and regulatory developments. This research foundation supports comprehensive market analysis and validation of primary research findings through multiple independent sources.

Market modeling techniques employ statistical analysis methods to identify trends, correlations, and growth patterns within the France electric vehicle battery electrolyte market. These analytical approaches enable accurate market sizing, segmentation analysis, and growth projections that support strategic decision-making for market participants and stakeholders.

Data validation processes ensure research accuracy and reliability through cross-referencing multiple sources, expert review procedures, and statistical verification methods. This rigorous approach to data quality supports confident market analysis and strategic recommendations based on verified market intelligence and validated research findings.

Île-de-France region represents the largest market concentration for electric vehicle battery electrolyte demand, driven by high electric vehicle adoption rates in Paris and surrounding metropolitan areas. The region benefits from strong automotive industry presence, research institutions, and government policy support that creates favorable conditions for electrolyte market development and expansion.

Auvergne-Rhône-Alpes demonstrates significant market potential through its automotive manufacturing base and chemical industry infrastructure. The region hosts major automotive production facilities and chemical companies that support electrolyte supply chain development, while local research institutions contribute to technology advancement and innovation activities.

Grand Est region shows growing market importance through its strategic location for European supply chain integration and cross-border trade activities. The region’s proximity to Germany and other European markets provides opportunities for electrolyte suppliers to serve broader European demand while benefiting from local manufacturing and logistics advantages.

Regional distribution patterns indicate 42% market concentration in major metropolitan areas, with 35% share in industrial regions and 23% distribution across other areas. This pattern reflects the correlation between urban electric vehicle adoption rates and regional electrolyte demand, while industrial regions provide manufacturing and supply chain capabilities that support market development.

Market leadership is distributed among several key players representing different segments of the electrolyte supply chain. The competitive landscape includes established chemical companies, specialized battery material suppliers, and emerging technology companies focused on next-generation electrolyte solutions.

Competitive strategies focus on technology differentiation, supply chain optimization, and strategic partnerships with automotive manufacturers. Companies are investing in research and development activities while building manufacturing capabilities to support growing market demand and evolving technical requirements.

By Electrolyte Type:

By Application:

By Technology:

Liquid electrolyte category maintains market dominance through proven performance, established supply chains, and cost-effective manufacturing processes. These systems demonstrate reliable operation across various temperature ranges and charging conditions, making them suitable for current generation electric vehicle applications. Market trends show continued optimization of liquid electrolyte formulations to improve performance while maintaining cost competitiveness.

Solid-state electrolyte category represents the most dynamic market segment with 28% annual growth in development activities and prototype testing. These advanced systems offer significant advantages in terms of safety, energy density, and operational temperature range, positioning them as the preferred solution for next-generation electric vehicle applications. However, manufacturing scalability and cost challenges continue to limit commercial adoption.

Automotive application category drives the majority of market demand through passenger vehicle electrification and commercial fleet conversion initiatives. This category demonstrates strong growth potential supported by government incentives, environmental regulations, and improving electric vehicle performance characteristics that enhance consumer acceptance and market adoption rates.

Energy storage application category shows emerging importance as France develops renewable energy infrastructure and grid modernization initiatives. This category creates additional demand for electrolyte solutions while offering opportunities for technology transfer and scale economies that benefit automotive applications through shared research and development activities.

Manufacturers benefit from growing market demand that supports capacity expansion, technology development, and operational scale economies. The expanding electric vehicle market creates opportunities for long-term supply agreements, collaborative development programs, and strategic partnerships that provide revenue stability and growth potential for electrolyte suppliers serving the French market.

Automotive companies gain access to advanced electrolyte technologies that enable improved battery performance, enhanced safety characteristics, and competitive differentiation in the electric vehicle market. Strategic relationships with electrolyte suppliers support product development activities while ensuring reliable supply chain access for production scaling and market expansion initiatives.

Research institutions enjoy increased funding opportunities and industry collaboration possibilities that support technology advancement and knowledge development activities. The growing importance of electrolyte technology creates opportunities for academic-industry partnerships, research grants, and technology transfer activities that benefit both scientific advancement and commercial application development.

Government stakeholders achieve environmental policy objectives through market development that supports electric vehicle adoption and carbon emission reduction goals. The growing electrolyte market contributes to economic development, technology leadership, and industrial competitiveness while advancing France’s position in the global transition to sustainable transportation systems.

Strengths:

Weaknesses:

Opportunities:

Threats:

Solid-state electrolyte advancement represents the most significant technological trend shaping the France electric vehicle battery electrolyte market. Research and development activities are intensifying as companies work to overcome manufacturing challenges and cost barriers that currently limit commercial adoption of these advanced systems. Progress in solid-state technology promises to revolutionize battery performance through enhanced safety, higher energy density, and improved operational characteristics.

Sustainability integration is becoming increasingly important as environmental considerations influence electrolyte development and manufacturing processes. Companies are investing in green chemistry approaches, renewable energy utilization, and circular economy principles that reduce environmental impact while meeting performance requirements. This trend reflects growing awareness of lifecycle environmental impacts and regulatory pressures for sustainable manufacturing practices.

Supply chain localization efforts are gaining momentum as companies seek to reduce dependence on international suppliers and enhance supply chain resilience. French companies are investing in domestic production capabilities, regional sourcing strategies, and strategic partnerships that support supply chain security while reducing transportation costs and environmental impacts associated with long-distance shipping.

Performance optimization continues through advanced formulation development and manufacturing process improvements. MWR data indicates that companies are achieving 15% annual improvement in key performance metrics including ionic conductivity, thermal stability, and operational safety through systematic research and development activities focused on molecular-level optimization and manufacturing excellence.

Strategic partnerships between electrolyte suppliers and automotive manufacturers are reshaping market dynamics through long-term supply agreements and collaborative development programs. These partnerships provide market stability for suppliers while ensuring automotive companies have access to advanced electrolyte technologies that support their electric vehicle development objectives and competitive positioning strategies.

Manufacturing capacity expansion initiatives are underway as companies respond to growing market demand and prepare for future growth projections. Major players are investing in new production facilities, equipment upgrades, and process optimization activities that will support increased production volumes while maintaining quality standards essential for automotive applications.

Technology licensing agreements are facilitating knowledge transfer and accelerating commercialization of advanced electrolyte technologies. International technology companies are establishing licensing partnerships with French manufacturers, enabling local production of advanced electrolyte systems while supporting technology transfer and capability development within the French market.

Research and development investments are increasing as companies recognize the strategic importance of electrolyte technology for future market success. Government funding programs, industry partnerships, and private investment are supporting comprehensive research activities focused on next-generation electrolyte systems that will enable improved battery performance and competitive advantages.

Investment priorities should focus on solid-state electrolyte development and manufacturing capabilities that position companies for future market leadership. Companies that successfully develop commercial solid-state solutions will gain significant competitive advantages through superior performance characteristics and differentiated product offerings that command premium pricing and preferred supplier status with automotive manufacturers.

Strategic partnerships with automotive manufacturers represent critical success factors for long-term market participation and growth. Companies should prioritize relationship development, collaborative research programs, and supply agreement negotiations that provide market access, volume commitments, and influence over future product specifications and technology requirements.

Supply chain optimization initiatives should emphasize domestic sourcing, regional partnerships, and supply chain resilience strategies that reduce dependence on international suppliers while maintaining cost competitiveness. Companies that establish robust supply chains will be better positioned to serve growing market demand while managing risks associated with geopolitical tensions and trade disruptions.

Sustainability integration should be incorporated into all aspects of business strategy including product development, manufacturing processes, and supply chain management. Companies that demonstrate leadership in environmental stewardship will benefit from regulatory compliance advantages, customer preference, and access to green financing opportunities that support business growth and market expansion.

Market expansion trajectory indicates sustained growth driven by accelerating electric vehicle adoption, government policy support, and technological advancement in battery systems. The France electric vehicle battery electrolyte market is positioned for continued expansion as automotive electrification trends gain momentum and consumer acceptance of electric vehicles increases across all market segments.

Technology evolution will fundamentally transform market dynamics as solid-state electrolyte systems achieve commercial viability and begin displacing conventional liquid electrolytes in premium applications. This technological transition will create opportunities for companies that successfully develop and commercialize advanced electrolyte solutions while challenging traditional suppliers to adapt their product portfolios and capabilities.

Competitive landscape changes are expected as market growth attracts new entrants while established players consolidate positions through strategic acquisitions and partnerships. Market concentration may increase as companies seek scale advantages and technology capabilities necessary to compete effectively in an increasingly sophisticated and demanding market environment.

Growth projections suggest the market will experience 18% compound annual growth over the next five years, driven by electric vehicle production increases, technology advancement, and expanding application areas. MarkWide Research analysis indicates that solid-state electrolyte adoption will accelerate significantly after 2026, potentially capturing 35% market share by 2030 as manufacturing scalability and cost challenges are resolved through continued innovation and investment.

The France electric vehicle battery electrolyte market represents a dynamic and rapidly evolving sector positioned at the intersection of automotive transformation, environmental policy, and technological innovation. Market fundamentals demonstrate strong growth potential supported by government initiatives, automotive industry investment, and increasing consumer adoption of electric vehicles across French markets.

Strategic opportunities exist for companies that successfully navigate the transition from conventional liquid electrolytes to advanced solid-state systems while building sustainable supply chains and strategic partnerships with automotive manufacturers. The market rewards innovation, quality, and reliability while demanding continuous improvement in performance characteristics and cost competitiveness.

Future success will depend on companies’ ability to balance technological advancement with commercial viability, ensuring that new electrolyte solutions meet stringent automotive requirements while supporting the broader objectives of electric vehicle adoption and environmental sustainability. The France electric vehicle battery electrolyte market offers significant opportunities for companies prepared to invest in technology development, manufacturing capabilities, and strategic relationships that position them for long-term success in this transformative industry.

What is Electric Vehicle Battery Electrolyte?

Electric Vehicle Battery Electrolyte refers to the medium that allows the flow of electric charge between the anode and cathode in a battery. It plays a crucial role in the performance, safety, and longevity of electric vehicle batteries.

What are the key players in the France Electric Vehicle Battery Electrolyte Market?

Key players in the France Electric Vehicle Battery Electrolyte Market include companies like Solvay, BASF, and Arkema, which are known for their innovative electrolyte solutions. These companies focus on enhancing battery performance and sustainability, among others.

What are the growth factors driving the France Electric Vehicle Battery Electrolyte Market?

The growth of the France Electric Vehicle Battery Electrolyte Market is driven by the increasing demand for electric vehicles, advancements in battery technology, and government initiatives promoting sustainable transportation. Additionally, the push for higher energy density and faster charging capabilities is influencing market expansion.

What challenges does the France Electric Vehicle Battery Electrolyte Market face?

The France Electric Vehicle Battery Electrolyte Market faces challenges such as the high cost of advanced electrolyte materials and concerns regarding safety and stability. Additionally, the need for recycling and environmental impact of battery production poses significant hurdles.

What opportunities exist in the France Electric Vehicle Battery Electrolyte Market?

Opportunities in the France Electric Vehicle Battery Electrolyte Market include the development of next-generation solid-state electrolytes and the increasing investment in research and development. The growing trend towards electric mobility and renewable energy integration also presents significant potential for market players.

What trends are shaping the France Electric Vehicle Battery Electrolyte Market?

Trends shaping the France Electric Vehicle Battery Electrolyte Market include the shift towards sustainable and eco-friendly materials, advancements in nanotechnology for improved performance, and the rise of electric vehicle adoption. Additionally, innovations in battery recycling processes are gaining traction.

France Electric Vehicle Battery Electrolyte Market

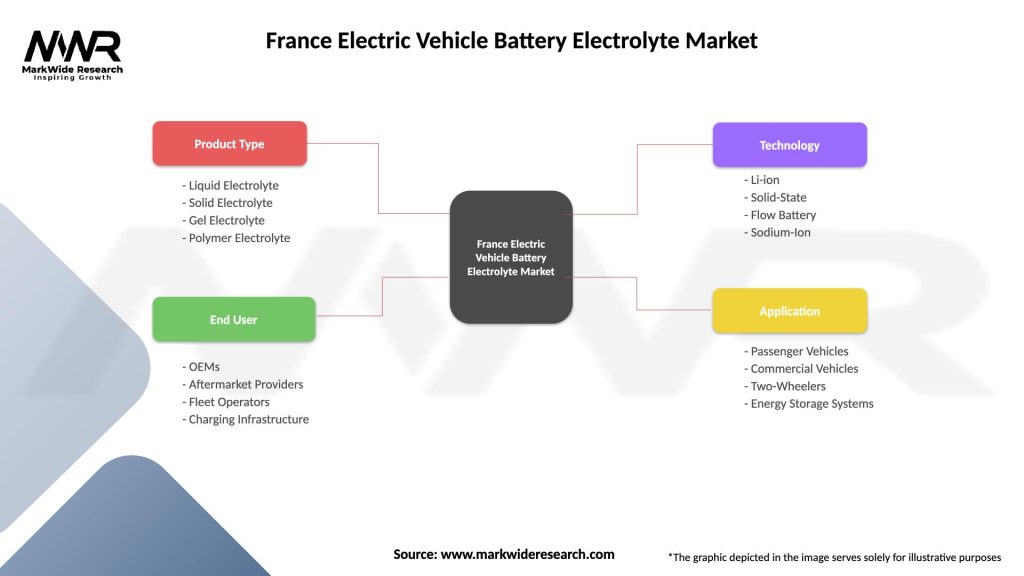

| Segmentation Details | Description |

|---|---|

| Product Type | Liquid Electrolyte, Solid Electrolyte, Gel Electrolyte, Polymer Electrolyte |

| End User | OEMs, Aftermarket Providers, Fleet Operators, Charging Infrastructure |

| Technology | Li-ion, Solid-State, Flow Battery, Sodium-Ion |

| Application | Passenger Vehicles, Commercial Vehicles, Two-Wheelers, Energy Storage Systems |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the France Electric Vehicle Battery Electrolyte Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at