444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The France electric commercial vehicle battery pack market represents a transformative segment within the European automotive industry, driven by stringent environmental regulations and ambitious carbon neutrality goals. French commercial vehicle manufacturers are increasingly adopting advanced battery technologies to meet the growing demand for sustainable transportation solutions across logistics, delivery, and public transport sectors.

Market dynamics indicate robust growth potential, with the sector experiencing a 12.5% CAGR over recent years. The integration of lithium-ion battery systems in commercial vehicles has become a strategic priority for French automotive companies, supported by government incentives and infrastructure development initiatives. Battery pack innovations are focusing on enhanced energy density, faster charging capabilities, and improved thermal management systems.

Regional adoption patterns show significant concentration in major metropolitan areas including Paris, Lyon, and Marseille, where urban delivery requirements and emission restrictions drive electric commercial vehicle deployment. The market encompasses various vehicle categories, from light commercial vehicles to heavy-duty trucks, each requiring specialized battery pack configurations to optimize performance and operational efficiency.

The France electric commercial vehicle battery pack market refers to the comprehensive ecosystem of energy storage solutions specifically designed for commercial electric vehicles operating within French territory. This market encompasses the development, manufacturing, distribution, and maintenance of advanced battery systems that power various commercial vehicle categories including delivery vans, trucks, buses, and specialized utility vehicles.

Battery pack systems in this context integrate multiple components including lithium-ion cells, battery management systems, thermal regulation mechanisms, and safety protocols tailored for commercial vehicle applications. These systems must meet stringent performance requirements for extended operational cycles, rapid charging capabilities, and durability under demanding commercial usage conditions.

The market definition extends beyond hardware components to include supporting infrastructure, charging solutions, maintenance services, and recycling programs that ensure sustainable lifecycle management of commercial vehicle battery systems throughout France’s diverse geographic and operational environments.

Strategic market positioning reveals France as a leading European hub for electric commercial vehicle battery pack innovation, with domestic manufacturers and international partners collaborating to establish comprehensive supply chains. The market benefits from government support initiatives targeting carbon emission reductions and sustainable transportation infrastructure development.

Technology advancement trends show increasing adoption of next-generation battery chemistries, with 85% of new installations utilizing advanced lithium-ion configurations optimized for commercial vehicle requirements. Market participants are investing heavily in research and development to enhance battery performance metrics including energy density, charging speed, and operational lifespan.

Competitive landscape dynamics feature established automotive suppliers, emerging battery technology companies, and strategic partnerships between French manufacturers and global battery producers. The market demonstrates strong growth momentum driven by regulatory compliance requirements and increasing commercial fleet electrification initiatives across various industry sectors.

Market intelligence reveals several critical insights shaping the France electric commercial vehicle battery pack landscape:

Environmental regulations serve as the primary catalyst driving France electric commercial vehicle battery pack market expansion. The French government’s commitment to achieving carbon neutrality by 2050 has established comprehensive policies mandating commercial vehicle electrification across various sectors. Urban emission zones in major cities restrict conventional diesel vehicles, creating immediate demand for electric alternatives.

Economic incentives significantly influence market adoption patterns, with substantial subsidies and tax benefits supporting commercial vehicle electrification initiatives. Total cost of ownership advantages become increasingly apparent as battery costs decline and operational efficiency improvements offset initial investment requirements. Fuel cost volatility further strengthens the economic case for electric commercial vehicle adoption.

Technological advancement in battery performance metrics drives market confidence and adoption rates. Energy density improvements enable extended operational ranges while fast-charging capabilities minimize downtime for commercial operations. Battery durability enhancements ensure reliable performance throughout extended commercial vehicle lifecycles, addressing operator concerns about long-term viability.

Infrastructure development supports market growth through expanding charging networks specifically designed for commercial vehicle requirements. Strategic partnerships between energy companies and logistics providers facilitate comprehensive charging solutions tailored to commercial operational patterns and route optimization strategies.

High initial investment costs represent a significant barrier to widespread commercial vehicle electrification, particularly for small and medium-sized enterprises with limited capital resources. Battery pack expenses constitute a substantial portion of total vehicle costs, creating financial challenges for fleet operators transitioning from conventional vehicles.

Charging infrastructure limitations constrain market expansion in rural and remote areas where commercial vehicle operations require reliable charging access. Grid capacity constraints in certain regions limit the ability to support high-power charging requirements for commercial vehicle fleets, particularly during peak operational periods.

Technical complexity associated with battery pack integration and maintenance requires specialized expertise that may not be readily available across all market segments. Training requirements for maintenance personnel and operational staff create additional implementation challenges and ongoing operational costs.

Range anxiety concerns persist among commercial vehicle operators, particularly for long-haul applications where battery performance must meet demanding operational requirements. Cold weather performance limitations in certain French regions affect battery efficiency and operational reliability during winter months.

Government support programs create substantial opportunities for market expansion through targeted incentives and infrastructure development initiatives. European Union funding for sustainable transportation projects provides additional resources for commercial vehicle electrification programs across France.

Technology partnerships between French automotive manufacturers and international battery producers offer opportunities for advanced technology transfer and local manufacturing capabilities. Research collaboration with academic institutions and technology centers supports innovation in battery chemistry and system integration.

Fleet electrification programs by major logistics companies create significant demand for commercial vehicle battery packs. Last-mile delivery optimization in urban areas presents particular opportunities for light commercial vehicle applications with specialized battery configurations.

Circular economy initiatives offer opportunities for battery recycling and second-life applications, creating additional revenue streams and supporting sustainable business models. Energy storage integration enables commercial vehicle batteries to serve dual purposes in grid stabilization and renewable energy storage applications.

Supply chain evolution demonstrates increasing localization of battery pack production within France, reducing dependency on international suppliers and supporting domestic manufacturing capabilities. Strategic partnerships between automotive manufacturers and battery producers create integrated value chains optimized for commercial vehicle applications.

Demand patterns show strong growth in urban commercial vehicle applications, with 75% of new electric commercial vehicle registrations concentrated in metropolitan areas. Seasonal variations affect battery performance requirements, driving demand for advanced thermal management systems and cold-weather optimization technologies.

Competitive dynamics feature increasing collaboration between traditional automotive suppliers and emerging battery technology companies. Market consolidation trends create opportunities for strategic acquisitions and technology integration initiatives that strengthen competitive positioning.

Innovation cycles accelerate as manufacturers invest in next-generation battery technologies including solid-state systems and advanced lithium-ion chemistries. Performance benchmarking drives continuous improvement in energy density, charging speed, and operational durability metrics.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the France electric commercial vehicle battery pack market. Primary research activities include structured interviews with industry executives, technology experts, and commercial vehicle operators to gather firsthand market intelligence and operational insights.

Secondary research components encompass extensive analysis of industry reports, regulatory documents, patent filings, and company financial statements to establish comprehensive market understanding. Data validation processes ensure information accuracy through cross-referencing multiple sources and expert verification procedures.

Market modeling techniques utilize advanced analytical frameworks to project growth trends and identify emerging opportunities within the commercial vehicle battery pack sector. Statistical analysis methods support quantitative assessments of market dynamics and competitive positioning factors.

Industry expert consultations provide specialized insights into technical developments, regulatory impacts, and strategic market trends affecting commercial vehicle electrification in France. Continuous monitoring systems track market developments and update analysis to reflect evolving industry conditions and technological advancement.

Île-de-France region dominates the French electric commercial vehicle battery pack market, accounting for approximately 35% of total demand driven by extensive urban delivery operations and stringent emission regulations in the Paris metropolitan area. Commercial vehicle density in this region creates substantial opportunities for battery pack suppliers and service providers.

Auvergne-Rhône-Alpes represents the second-largest regional market, with Lyon and Grenoble serving as key commercial centers driving electric vehicle adoption. Industrial manufacturing presence in this region supports local battery pack production capabilities and supply chain integration.

Provence-Alpes-Côte d’Azur demonstrates strong growth potential, particularly in Marseille and Nice, where port operations and tourism-related commercial activities drive demand for electric commercial vehicles. Mediterranean climate conditions provide favorable operating environments for battery pack performance optimization.

Northern regions including Hauts-de-France show increasing adoption rates supported by cross-border logistics operations and proximity to major European commercial vehicle markets. Industrial heritage in these areas facilitates workforce development and manufacturing capabilities for battery pack production.

Rural market segments present unique challenges and opportunities, with agricultural applications and rural delivery services requiring specialized battery pack configurations optimized for extended range and durability requirements.

Market leadership features a combination of established automotive suppliers and specialized battery technology companies competing across various commercial vehicle segments. Strategic positioning varies based on technology focus, manufacturing capabilities, and customer relationship strength.

Competitive strategies emphasize technology differentiation, local manufacturing capabilities, and comprehensive service offerings. Partnership development between battery manufacturers and commercial vehicle producers creates integrated solutions optimized for specific market applications.

By Vehicle Type:

By Battery Technology:

By Application:

Light commercial vehicle segment demonstrates the highest growth rates, with urban delivery applications driving substantial demand for compact, efficient battery pack solutions. E-commerce expansion creates continuous demand for last-mile delivery vehicles equipped with advanced battery technologies optimized for frequent stop-and-go operations.

Medium commercial vehicle category shows strong adoption in regional distribution networks, where battery pack configurations must balance range requirements with payload capacity. Route optimization technologies integrated with battery management systems enhance operational efficiency and reduce total cost of ownership.

Heavy commercial vehicle applications present the most challenging technical requirements, demanding high-capacity battery systems capable of supporting long-haul operations. Fast-charging infrastructure development specifically for heavy vehicles becomes critical for market expansion in this segment.

Public transportation segment benefits from predictable operational patterns and dedicated charging infrastructure, enabling optimized battery pack designs for specific route requirements. Government procurement programs support widespread adoption of electric buses with advanced battery technologies.

Commercial vehicle operators benefit from reduced operational costs through lower fuel expenses and decreased maintenance requirements associated with electric powertrains. Total cost of ownership improvements become increasingly significant as battery costs decline and operational efficiency gains accumulate over vehicle lifecycles.

Battery pack manufacturers gain access to expanding market opportunities driven by regulatory requirements and environmental consciousness. Technology leadership positions create competitive advantages and enable premium pricing for advanced battery solutions with superior performance characteristics.

Government stakeholders achieve environmental policy objectives through reduced commercial vehicle emissions and improved urban air quality. Economic development benefits include job creation in battery manufacturing and supporting industries, strengthening domestic automotive sector competitiveness.

Energy sector participants benefit from new revenue streams through commercial vehicle charging infrastructure and grid services. Renewable energy integration opportunities emerge as electric commercial vehicles provide flexible demand and potential energy storage capabilities.

Technology suppliers access growing markets for battery management systems, charging equipment, and supporting technologies. Innovation partnerships with automotive manufacturers create opportunities for technology development and market expansion.

Strengths:

Weaknesses:

Opportunities:

Threats:

Battery technology evolution shows accelerating development of next-generation chemistries offering improved energy density and faster charging capabilities. Solid-state battery development represents a significant technological advancement with potential to transform commercial vehicle applications through enhanced safety and performance characteristics.

Charging infrastructure expansion demonstrates rapid growth in high-power charging networks specifically designed for commercial vehicle requirements. Smart charging technologies integrate with fleet management systems to optimize charging schedules and reduce operational costs while supporting grid stability.

Integration with renewable energy creates opportunities for sustainable commercial vehicle operations powered by clean electricity sources. Vehicle-to-grid technologies enable commercial vehicle batteries to provide energy storage services, creating additional revenue streams for fleet operators.

Artificial intelligence integration in battery management systems enables predictive maintenance, performance optimization, and extended battery lifecycles. Data analytics capabilities provide insights into operational patterns and support continuous improvement in battery pack design and performance.

Circular economy principles drive development of comprehensive battery recycling programs and second-life applications. Sustainable manufacturing practices become increasingly important for market acceptance and regulatory compliance.

Manufacturing capacity expansion by major battery producers establishes local production capabilities within France, reducing supply chain dependencies and supporting domestic employment. Gigafactory developments create substantial manufacturing capacity for commercial vehicle battery pack production.

Strategic partnerships between French automotive manufacturers and international battery technology companies accelerate technology transfer and market development. Joint venture formations combine complementary capabilities in vehicle integration and battery technology expertise.

Government investment programs provide substantial funding for battery technology research and development initiatives. Innovation centers established in major French cities support collaborative research between industry and academic institutions.

Regulatory framework updates establish comprehensive standards for commercial vehicle battery pack safety, performance, and environmental impact. Certification processes ensure market quality and support consumer confidence in electric commercial vehicle technologies.

Infrastructure development projects create extensive charging networks optimized for commercial vehicle operations. Public-private partnerships accelerate charging infrastructure deployment across major transportation corridors and urban centers.

MarkWide Research analysis indicates that market participants should prioritize technology differentiation and local manufacturing capabilities to establish competitive advantages. Investment strategies should focus on advanced battery chemistries and integrated charging solutions that address specific commercial vehicle operational requirements.

Strategic recommendations emphasize the importance of developing comprehensive service offerings including maintenance, recycling, and performance optimization services. Partnership development with commercial vehicle manufacturers and fleet operators creates opportunities for integrated solutions and long-term customer relationships.

Market entry strategies should consider regional variations in demand patterns and regulatory requirements across different French markets. Localization approaches that address specific operational needs and infrastructure constraints will be critical for market success.

Technology investment priorities should focus on fast-charging capabilities, cold-weather performance optimization, and battery management system advancement. Innovation partnerships with research institutions and technology companies can accelerate development timelines and reduce investment risks.

Sustainability initiatives including circular economy programs and renewable energy integration will become increasingly important for market acceptance and regulatory compliance. Long-term planning should incorporate evolving environmental standards and customer expectations for sustainable commercial vehicle operations.

Market trajectory indicates sustained growth driven by strengthening regulatory requirements and improving battery technology economics. Adoption acceleration is expected as total cost of ownership advantages become more pronounced and charging infrastructure reaches critical mass for commercial operations.

Technology advancement will continue driving performance improvements in energy density, charging speed, and operational durability. Next-generation battery technologies including solid-state systems are expected to achieve commercial viability within the forecast period, creating new market opportunities.

Market expansion beyond urban centers will accelerate as charging infrastructure development reaches rural and regional areas. Heavy commercial vehicle adoption is projected to increase significantly as battery technology advances address range and payload requirements for long-haul applications.

Integration opportunities with smart grid systems and renewable energy sources will create additional value propositions for commercial vehicle battery packs. Circular economy development will establish comprehensive recycling and second-life application markets supporting sustainable industry growth.

Competitive landscape evolution will feature increasing collaboration between traditional automotive suppliers and emerging battery technology companies. Market consolidation may occur as companies seek to achieve scale advantages and technology integration capabilities necessary for long-term competitiveness.

France electric commercial vehicle battery pack market represents a dynamic and rapidly evolving sector with substantial growth potential driven by regulatory support, technological advancement, and increasing commercial adoption. Market fundamentals demonstrate strong alignment between government policy objectives, industry capabilities, and customer demand for sustainable transportation solutions.

Strategic opportunities exist for companies that can successfully combine advanced battery technologies with comprehensive service offerings tailored to commercial vehicle operational requirements. Success factors include technology differentiation, local manufacturing capabilities, and strategic partnerships that create integrated value propositions for commercial vehicle operators.

Future market development will be characterized by continued technology advancement, infrastructure expansion, and increasing adoption across diverse commercial vehicle applications. MWR analysis suggests that companies positioning themselves at the forefront of battery technology innovation and commercial vehicle integration will be best positioned to capitalize on emerging market opportunities and achieve sustainable competitive advantages in this transformative industry sector.

What is Electric Commercial Vehicle Battery Pack?

Electric Commercial Vehicle Battery Pack refers to the energy storage systems used in electric commercial vehicles, providing the necessary power for propulsion and operation. These battery packs are crucial for the performance, range, and efficiency of electric vehicles used in various sectors such as logistics, public transport, and delivery services.

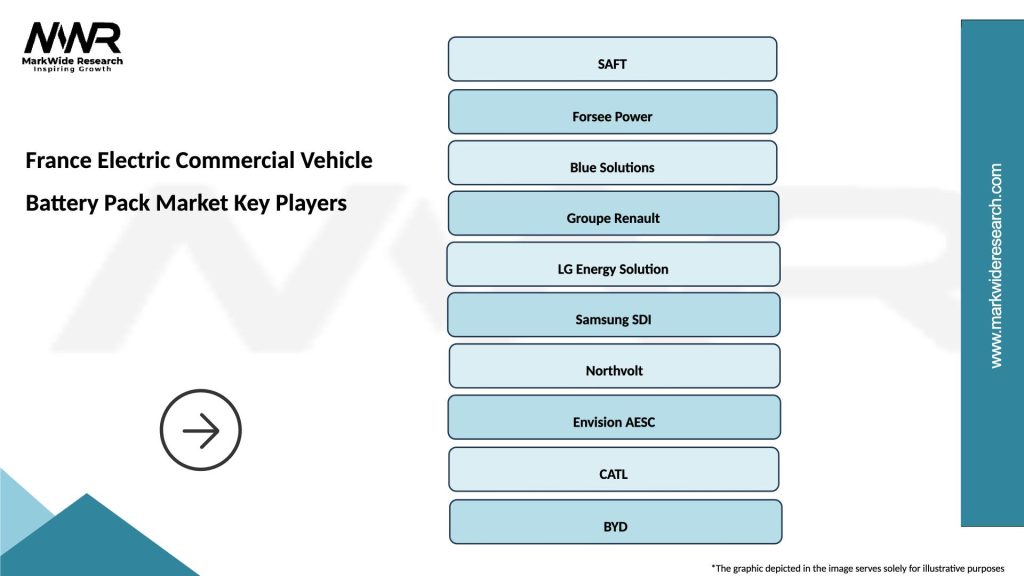

What are the key players in the France Electric Commercial Vehicle Battery Pack Market?

Key players in the France Electric Commercial Vehicle Battery Pack Market include companies like Renault, Peugeot, and Bollinger Motors, which are actively involved in the development and production of electric commercial vehicles and their battery systems. These companies focus on enhancing battery technology and expanding their electric vehicle offerings, among others.

What are the growth factors driving the France Electric Commercial Vehicle Battery Pack Market?

The growth of the France Electric Commercial Vehicle Battery Pack Market is driven by increasing environmental regulations, the push for sustainable transportation solutions, and advancements in battery technology. Additionally, the rising demand for electric delivery vehicles in urban areas contributes to market expansion.

What challenges does the France Electric Commercial Vehicle Battery Pack Market face?

The France Electric Commercial Vehicle Battery Pack Market faces challenges such as high initial costs of electric vehicles, limited charging infrastructure, and concerns regarding battery lifespan and recycling. These factors can hinder widespread adoption and market growth.

What opportunities exist in the France Electric Commercial Vehicle Battery Pack Market?

Opportunities in the France Electric Commercial Vehicle Battery Pack Market include the potential for innovation in battery technology, such as solid-state batteries, and the expansion of charging networks. Additionally, government incentives for electric vehicle adoption can further stimulate market growth.

What trends are shaping the France Electric Commercial Vehicle Battery Pack Market?

Trends shaping the France Electric Commercial Vehicle Battery Pack Market include the increasing integration of renewable energy sources for charging, advancements in battery management systems, and the growing interest in vehicle-to-grid technology. These trends are enhancing the efficiency and sustainability of electric commercial vehicles.

France Electric Commercial Vehicle Battery Pack Market

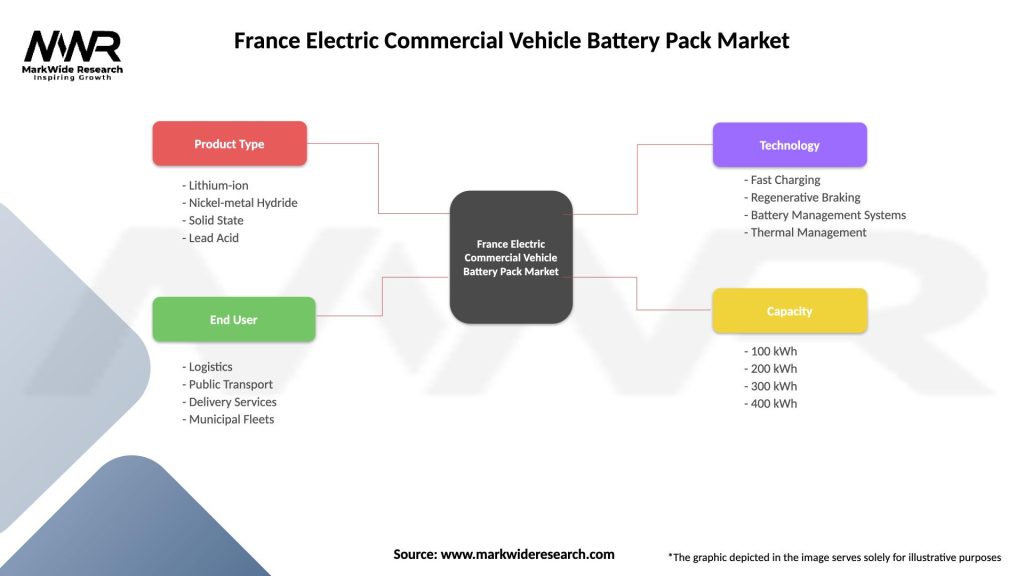

| Segmentation Details | Description |

|---|---|

| Product Type | Lithium-ion, Nickel-metal Hydride, Solid State, Lead Acid |

| End User | Logistics, Public Transport, Delivery Services, Municipal Fleets |

| Technology | Fast Charging, Regenerative Braking, Battery Management Systems, Thermal Management |

| Capacity | 100 kWh, 200 kWh, 300 kWh, 400 kWh |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the France Electric Commercial Vehicle Battery Pack Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at