444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The France diabetes industry market represents a critical healthcare sector addressing one of the nation’s most pressing medical challenges. With diabetes prevalence continuing to rise across French demographics, the market encompasses comprehensive solutions including diagnostic equipment, monitoring devices, therapeutic medications, and innovative treatment technologies. Market dynamics indicate robust growth driven by an aging population, lifestyle changes, and advancing medical technologies that enhance patient outcomes.

Healthcare infrastructure in France supports extensive diabetes management programs, creating substantial demand for both traditional and cutting-edge solutions. The market benefits from France’s universal healthcare system, which ensures broad access to diabetes care while driving innovation in cost-effective treatment modalities. Growth projections suggest the market will expand at a 6.2% CAGR through 2030, reflecting increasing patient populations and technological advancement adoption.

Key market segments include blood glucose monitoring systems, insulin delivery devices, continuous glucose monitors, and digital health platforms. French healthcare providers increasingly prioritize integrated care approaches, combining traditional medical interventions with digital health solutions to optimize patient management and reduce long-term complications.

The France diabetes industry market refers to the comprehensive ecosystem of medical devices, pharmaceuticals, digital health solutions, and healthcare services specifically designed to diagnose, monitor, treat, and manage diabetes mellitus across French healthcare settings. This market encompasses both Type 1 and Type 2 diabetes management solutions, serving patients, healthcare providers, and healthcare institutions throughout France.

Market scope includes glucose monitoring devices, insulin delivery systems, diabetes medications, diagnostic equipment, and emerging technologies such as artificial pancreas systems and telemedicine platforms. The industry serves approximately 5.1% of the French population diagnosed with diabetes, while addressing the broader at-risk population through preventive care solutions and early intervention programs.

Strategic analysis reveals the France diabetes industry market experiencing unprecedented transformation driven by technological innovation, demographic shifts, and evolving healthcare delivery models. The market demonstrates strong fundamentals with consistent demand growth, supported by France’s commitment to comprehensive diabetes care and prevention programs.

Key growth drivers include rising diabetes prevalence, particularly Type 2 diabetes linked to lifestyle factors, an aging population requiring intensive management, and increasing adoption of digital health technologies. Technology integration represents a significant trend, with 42% of diabetes patients now utilizing some form of digital health monitoring or management tool.

Market leaders continue investing heavily in research and development, focusing on personalized medicine approaches, artificial intelligence integration, and patient-centric care solutions. The competitive landscape features both established multinational corporations and innovative French healthcare technology companies developing specialized solutions for the domestic market.

Future prospects remain highly favorable, with emerging technologies such as continuous glucose monitoring, smart insulin pens, and integrated care platforms expected to drive substantial market expansion. MarkWide Research analysis indicates strong potential for market growth across all major segments through the forecast period.

Market intelligence reveals several critical insights shaping the France diabetes industry landscape:

Primary drivers propelling the France diabetes industry market include demographic, technological, and healthcare policy factors creating sustained demand growth across multiple market segments.

Demographic transitions represent the most significant driver, with France’s population aging and lifestyle changes contributing to increased diabetes incidence. Urbanization effects include sedentary lifestyles, dietary changes, and stress factors that elevate Type 2 diabetes risk among working-age populations.

Technological advancement drives market expansion through innovative solutions improving patient quality of life and clinical outcomes. Digital health integration enables remote monitoring, personalized treatment protocols, and predictive analytics that enhance diabetes management effectiveness.

Healthcare policy support through France’s universal healthcare system ensures broad market access while encouraging innovation through favorable reimbursement policies. Government initiatives promoting diabetes prevention and early intervention create additional market opportunities beyond traditional treatment segments.

Clinical evidence demonstrating improved outcomes from advanced diabetes management technologies drives healthcare provider adoption and patient demand. Cost-effectiveness studies showing long-term savings from better diabetes control support continued investment in innovative solutions.

Market challenges facing the France diabetes industry include cost pressures, regulatory complexities, and technology adoption barriers that may limit growth potential in certain segments.

Healthcare budget constraints create pressure for cost-effective solutions, potentially limiting adoption of premium diabetes management technologies. Reimbursement limitations for certain advanced devices or digital health platforms may restrict patient access and market penetration.

Regulatory requirements for medical devices and digital health solutions create lengthy approval processes that can delay market entry for innovative products. Data privacy concerns related to digital health platforms may limit patient adoption, particularly among older demographics.

Technology barriers include digital literacy challenges among certain patient populations and infrastructure limitations in rural areas that may restrict access to advanced diabetes management solutions. Healthcare provider training requirements for new technologies can slow adoption rates across healthcare institutions.

Market competition from established players creates barriers for new entrants, while price pressure from generic alternatives may limit profitability for innovative solutions.

Emerging opportunities within the France diabetes industry market span technological innovation, market expansion, and healthcare delivery model evolution creating substantial growth potential.

Digital health expansion presents significant opportunities through telemedicine platforms, mobile health applications, and artificial intelligence-powered diabetes management systems. Personalized medicine approaches utilizing genetic testing and biomarker analysis offer potential for customized treatment protocols.

Prevention market opportunities include solutions targeting pre-diabetic populations through lifestyle intervention programs, continuous monitoring for at-risk individuals, and predictive analytics for early intervention. Workplace wellness programs represent an expanding market segment addressing diabetes prevention and management in corporate settings.

Technology integration opportunities include Internet of Things devices, wearable sensors, and smart home integration for comprehensive diabetes monitoring. Artificial intelligence applications in glucose prediction, treatment optimization, and complication prevention offer substantial market potential.

Partnership opportunities between technology companies, pharmaceutical manufacturers, and healthcare providers create potential for integrated solution development and market expansion.

Market forces shaping the France diabetes industry demonstrate complex interactions between healthcare policy, technological innovation, demographic changes, and competitive pressures driving market evolution.

Supply-side dynamics include increasing investment in research and development, manufacturing capacity expansion, and strategic partnerships between technology companies and healthcare providers. Innovation cycles accelerate as companies compete to develop next-generation diabetes management solutions.

Demand-side factors reflect growing patient populations, increasing awareness of diabetes complications, and rising expectations for convenient, effective management solutions. Patient preferences increasingly favor integrated, user-friendly technologies that seamlessly fit into daily routines.

Regulatory environment continues evolving to accommodate digital health innovations while maintaining safety standards. Reimbursement policies adapt to support cost-effective diabetes management approaches that demonstrate improved long-term outcomes.

Competitive dynamics intensify as traditional medical device manufacturers compete with technology companies entering the diabetes market. Market consolidation trends include strategic acquisitions and partnerships aimed at creating comprehensive diabetes care ecosystems.

Comprehensive research approach employed for analyzing the France diabetes industry market combines primary research, secondary data analysis, and expert consultation to provide accurate market intelligence and strategic insights.

Primary research includes structured interviews with healthcare providers, diabetes specialists, industry executives, and patient advocacy groups across France. Survey methodology captures quantitative data on market trends, technology adoption rates, and patient preferences through statistically representative sampling.

Secondary research encompasses analysis of government healthcare statistics, clinical research publications, industry reports, and regulatory filings. Data triangulation ensures accuracy through cross-validation of information sources and methodological approaches.

Market modeling utilizes advanced analytical techniques including regression analysis, scenario planning, and forecasting models to project market trends and growth trajectories. Expert validation through industry advisory panels ensures research findings align with market realities and emerging trends.

Quality assurance processes include peer review, data verification, and methodology validation to maintain research integrity and reliability throughout the analysis process.

Geographic distribution across France reveals distinct regional patterns in diabetes prevalence, healthcare infrastructure, and technology adoption that influence market dynamics and growth opportunities.

Île-de-France region demonstrates the highest market concentration, accounting for approximately 18% of national diabetes market activity. The region benefits from advanced healthcare infrastructure, research institutions, and higher adoption rates for innovative diabetes management technologies.

Auvergne-Rhône-Alpes represents a significant market segment with strong healthcare networks and growing technology adoption. Regional characteristics include established medical device manufacturing presence and active diabetes research programs.

Provence-Alpes-Côte d’Azur shows increasing market importance driven by demographic factors including an aging population and lifestyle-related diabetes risk factors. Healthcare delivery in the region emphasizes integrated care approaches combining traditional and digital solutions.

Northern regions including Hauts-de-France demonstrate higher diabetes prevalence rates linked to socioeconomic factors, creating substantial market demand for cost-effective management solutions. Rural areas across France present opportunities for telemedicine and remote monitoring solutions addressing geographic access challenges.

Regional disparities in healthcare access and technology adoption create targeted market opportunities for companies developing solutions addressing specific geographic needs and demographics.

Market competition within the France diabetes industry features a diverse ecosystem of multinational corporations, specialized medical device manufacturers, pharmaceutical companies, and emerging technology firms.

Competitive strategies emphasize innovation, strategic partnerships, and market expansion through comprehensive diabetes care ecosystems. Market positioning increasingly focuses on integrated solutions combining devices, software, and services to improve patient outcomes.

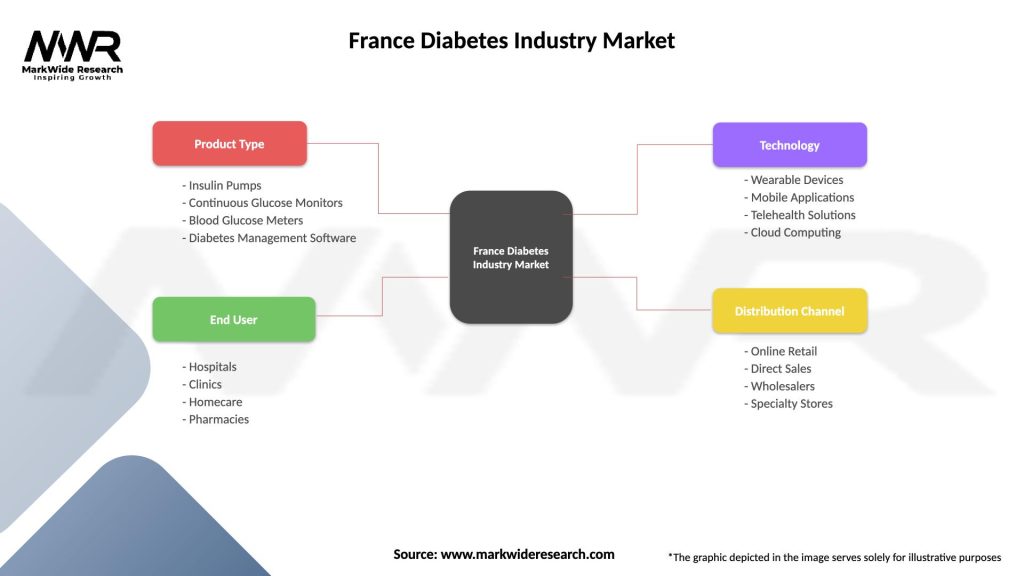

Market segmentation analysis reveals distinct categories based on product type, technology, application, and end-user demographics, each demonstrating unique growth patterns and opportunities.

By Product Type:

By Technology:

By End User:

Detailed analysis of key market categories reveals specific trends, growth drivers, and competitive dynamics shaping each segment within the France diabetes industry.

Blood Glucose Monitoring remains the largest market category, benefiting from established user bases and consistent replacement demand. Innovation trends include smartphone integration, reduced testing requirements, and improved accuracy. Market maturity drives focus on cost-effectiveness and user experience enhancement.

Continuous Glucose Monitoring represents the fastest-growing category with superior clinical outcomes driving adoption among both Type 1 and Type 2 diabetes patients. Technology advancement includes extended sensor life, improved accuracy, and integration with insulin delivery systems.

Insulin Delivery Systems demonstrate steady growth with innovation focusing on smart pens, automated delivery, and user-friendly interfaces. Market trends emphasize convenience, discretion, and integration with monitoring systems for comprehensive diabetes management.

Digital Health Solutions show rapid expansion as patients and providers embrace connected care approaches. Key developments include AI-powered analytics, personalized recommendations, and seamless healthcare provider integration.

Pharmaceutical segment maintains stable growth with focus on long-acting formulations, biosimilar competition, and combination therapies addressing multiple aspects of diabetes management.

Stakeholder advantages within the France diabetes industry market span multiple participant categories, each realizing distinct benefits from market participation and growth.

For Patients:

For Healthcare Providers:

For Industry Players:

Strategic assessment of the France diabetes industry market reveals key strengths, weaknesses, opportunities, and threats influencing market dynamics and future growth potential.

Strengths:

Weaknesses:

Opportunities:

Threats:

Emerging trends shaping the France diabetes industry market reflect technological advancement, changing patient expectations, and evolving healthcare delivery models driving market transformation.

Digital Integration represents a dominant trend with healthcare digitalization accelerating across all market segments. Connected devices enable seamless data sharing between patients, providers, and care teams, improving treatment coordination and outcomes.

Personalized Medicine gains momentum through genetic testing, biomarker analysis, and AI-powered treatment optimization. Precision approaches enable customized therapy selection and dosing based on individual patient characteristics and response patterns.

Artificial Intelligence integration transforms diabetes management through predictive analytics, automated insulin dosing, and complication risk assessment. Machine learning algorithms continuously improve treatment recommendations based on real-world patient data.

Telemedicine Adoption accelerates, particularly following healthcare delivery changes during recent years. Remote consultations and monitoring reduce healthcare access barriers while maintaining quality care standards.

Preventive Care Focus expands market opportunities beyond traditional treatment to include lifestyle intervention programs, continuous monitoring for at-risk populations, and early intervention strategies. Population health approaches emphasize diabetes prevention and delay progression.

Integrated Care Ecosystems emerge as companies develop comprehensive solutions combining devices, medications, digital platforms, and services. Holistic approaches address all aspects of diabetes management through coordinated care delivery.

Recent developments within the France diabetes industry market demonstrate continued innovation, strategic partnerships, and regulatory advancement supporting market growth and evolution.

Technology Launches include next-generation continuous glucose monitors with extended wear time, improved accuracy, and smartphone integration. Smart insulin pens with dose tracking and reminder capabilities gain market traction among Type 2 diabetes patients.

Strategic Partnerships between pharmaceutical companies and technology firms create integrated diabetes management platforms combining medications, devices, and digital health solutions. Healthcare provider collaborations enable real-world evidence generation and clinical validation.

Regulatory Approvals for innovative diabetes technologies accelerate market access for advanced solutions. Reimbursement expansions for continuous glucose monitoring and digital health platforms improve patient affordability and adoption.

Research Breakthroughs in artificial pancreas systems, glucose-responsive insulin, and regenerative therapies advance toward clinical application. Clinical trials demonstrate efficacy of novel treatment approaches and combination therapies.

Market Consolidation continues through strategic acquisitions aimed at creating comprehensive diabetes care portfolios. Investment activity in diabetes technology startups indicates continued innovation and market expansion potential.

Strategic recommendations for France diabetes industry market participants emphasize innovation, market positioning, and partnership development to capitalize on growth opportunities and address market challenges.

Innovation Investment should prioritize digital health integration, artificial intelligence capabilities, and user experience enhancement. MWR analysis suggests companies focusing on seamless technology integration will achieve competitive advantages in the evolving market landscape.

Market Segmentation strategies should address diverse patient needs across age groups, diabetes types, and technology comfort levels. Targeted solutions for specific demographics, such as elderly patients or tech-savvy millennials, can capture distinct market opportunities.

Partnership Development with healthcare providers, technology companies, and research institutions can accelerate innovation and market penetration. Collaborative approaches enable comprehensive solution development addressing complex diabetes management challenges.

Regulatory Engagement should focus on early dialogue with authorities to streamline approval processes for innovative technologies. Proactive compliance strategies ensure market readiness and competitive timing advantages.

Geographic Expansion within France should consider regional healthcare infrastructure variations and demographic differences. Localized strategies addressing specific regional needs can optimize market penetration and growth potential.

Cost-Effectiveness Focus becomes increasingly important as healthcare systems emphasize value-based care. Economic evidence demonstrating long-term cost savings through improved diabetes management supports reimbursement and adoption decisions.

Long-term prospects for the France diabetes industry market remain highly favorable, driven by demographic trends, technological advancement, and healthcare system evolution supporting sustained growth across multiple market segments.

Market expansion will continue through 2030 and beyond, with growth rates expected to maintain momentum at approximately 6.5% annually. Technology adoption will accelerate as digital health solutions become standard care components rather than optional enhancements.

Artificial intelligence integration will transform diabetes management through predictive analytics, automated treatment adjustments, and personalized care recommendations. Machine learning capabilities will enable continuous improvement in treatment outcomes and patient experience.

Prevention market expansion represents significant future opportunity as healthcare systems increasingly emphasize early intervention and lifestyle modification programs. Population health approaches will drive demand for monitoring solutions targeting pre-diabetic and at-risk populations.

Regulatory evolution will accommodate emerging technologies while maintaining safety standards, potentially accelerating approval processes for innovative solutions. Reimbursement policies will adapt to support cost-effective diabetes management approaches demonstrating improved outcomes.

Market consolidation trends will continue as companies seek to create comprehensive diabetes care ecosystems through strategic acquisitions and partnerships. MarkWide Research projects increased integration between traditional medical device manufacturers and digital health companies.

Global competitiveness of French diabetes industry participants will strengthen through domestic market success, enabling international expansion and technology export opportunities. Innovation leadership in key segments will support long-term market position and growth potential.

The France diabetes industry market demonstrates exceptional growth potential driven by demographic trends, technological innovation, and healthcare system support creating favorable conditions for sustained market expansion. Market fundamentals remain strong with consistent demand growth, advancing treatment options, and increasing focus on comprehensive diabetes management approaches.

Key success factors for market participants include innovation investment, strategic partnerships, and patient-centric solution development addressing diverse needs across the French healthcare landscape. Technology integration will continue driving market evolution, with digital health solutions, artificial intelligence, and personalized medicine approaches creating competitive advantages.

Future opportunities span prevention, treatment, and management segments, with particular potential in digital health platforms, continuous monitoring technologies, and integrated care solutions. Market challenges including cost pressures and regulatory complexity require strategic approaches but do not diminish overall growth prospects.

The France diabetes industry market represents a dynamic, growing sector with substantial opportunities for companies developing innovative solutions addressing patient needs, healthcare provider requirements, and system-wide efficiency goals. Long-term outlook remains highly positive, supported by demographic trends, technological advancement, and continued healthcare system investment in diabetes care improvement.

What is Diabetes?

Diabetes is a chronic health condition that occurs when the body cannot effectively regulate blood sugar levels. It is characterized by high blood glucose levels and can lead to serious health complications if not managed properly.

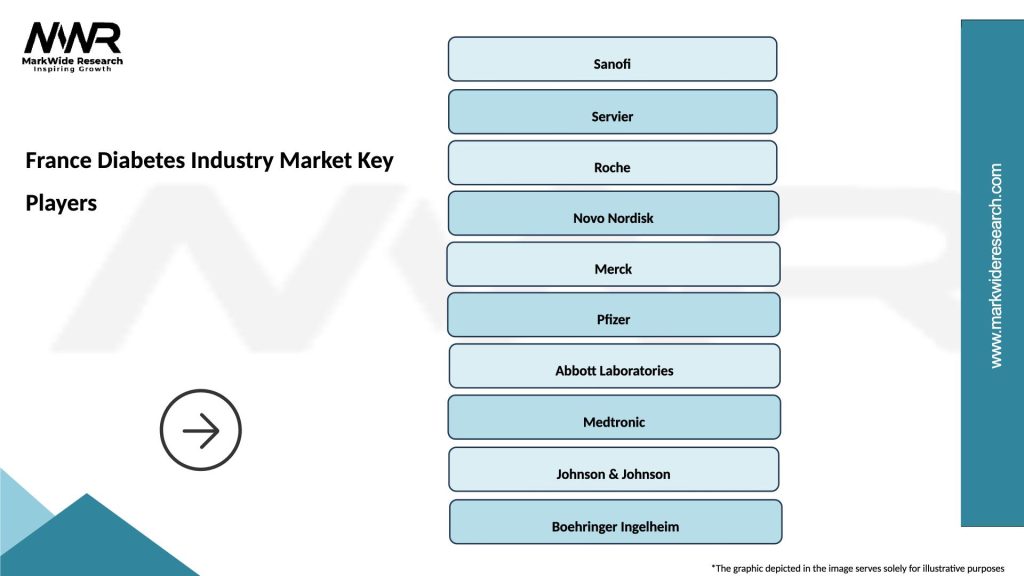

What are the key players in the France Diabetes Industry Market?

Key players in the France Diabetes Industry Market include Sanofi, Novo Nordisk, and Roche, which are known for their diabetes management products and technologies. These companies focus on insulin delivery systems, glucose monitoring devices, and diabetes care solutions, among others.

What are the growth factors driving the France Diabetes Industry Market?

The France Diabetes Industry Market is driven by factors such as the increasing prevalence of diabetes, advancements in diabetes management technologies, and rising awareness about diabetes care. Additionally, government initiatives to improve healthcare access contribute to market growth.

What challenges does the France Diabetes Industry Market face?

The France Diabetes Industry Market faces challenges such as high treatment costs, the complexity of diabetes management, and the need for continuous innovation in therapies and devices. These factors can hinder patient access to necessary treatments and technologies.

What opportunities exist in the France Diabetes Industry Market?

Opportunities in the France Diabetes Industry Market include the development of personalized medicine, the integration of digital health solutions, and the expansion of telehealth services. These trends can enhance patient engagement and improve diabetes management outcomes.

What trends are shaping the France Diabetes Industry Market?

Trends shaping the France Diabetes Industry Market include the rise of continuous glucose monitoring systems, the use of artificial intelligence in diabetes management, and the growing emphasis on preventive care. These innovations aim to improve patient outcomes and streamline diabetes care.

France Diabetes Industry Market

| Segmentation Details | Description |

|---|---|

| Product Type | Insulin Pumps, Continuous Glucose Monitors, Blood Glucose Meters, Diabetes Management Software |

| End User | Hospitals, Clinics, Homecare, Pharmacies |

| Technology | Wearable Devices, Mobile Applications, Telehealth Solutions, Cloud Computing |

| Distribution Channel | Online Retail, Direct Sales, Wholesalers, Specialty Stores |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the France Diabetes Industry Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at