444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The France diabetes devices market refers to the industry that focuses on manufacturing and supplying various devices used in the management and treatment of diabetes. These devices are designed to help individuals monitor their blood glucose levels, administer insulin, and maintain a healthy lifestyle despite living with diabetes. The market in France is a vital segment of the healthcare industry, as the prevalence of diabetes continues to rise, and there is a growing need for effective diabetes management solutions.

Meaning

The France diabetes devices market encompasses a wide range of medical devices that aid in the management of diabetes. These devices include blood glucose monitoring systems, insulin delivery devices, continuous glucose monitoring systems, insulin pumps, and other related accessories. They are developed using advanced technology to ensure accurate readings, ease of use, and enhanced patient convenience. The market plays a crucial role in supporting individuals with diabetes by providing them with the tools necessary for self-monitoring and effective treatment.

Executive Summary

The France diabetes devices market is witnessing steady growth due to the increasing prevalence of diabetes and the rising demand for advanced and user-friendly devices. The market is driven by factors such as the growing aging population, sedentary lifestyles, and unhealthy dietary habits. Additionally, advancements in technology, such as the development of connected and wearable devices, have revolutionized diabetes management. The market offers significant opportunities for manufacturers and suppliers to introduce innovative solutions that cater to the evolving needs of individuals with diabetes.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The France diabetes devices market is driven by a combination of factors, including the increasing prevalence of diabetes, technological advancements, and changing healthcare policies. The market is highly competitive, with key players striving to introduce innovative devices and expand their market share. The dynamics of the market are influenced by consumer preferences, government regulations, reimbursement policies, and evolving healthcare practices.

Regional Analysis

The France diabetes devices market is geographically segmented into various regions, including major cities and rural areas. The market exhibits regional variations in terms of product demand, healthcare infrastructure, and accessibility to diabetes care. Urban regions with higher population densities tend to have a greater demand for diabetes devices due to better healthcare facilities and higher awareness levels. However, efforts are being made to improve access to diabetes care in rural areas and promote equitable distribution of diabetes devices across the country.

Competitive Landscape

Leading Companies in the France Diabetes Devices Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

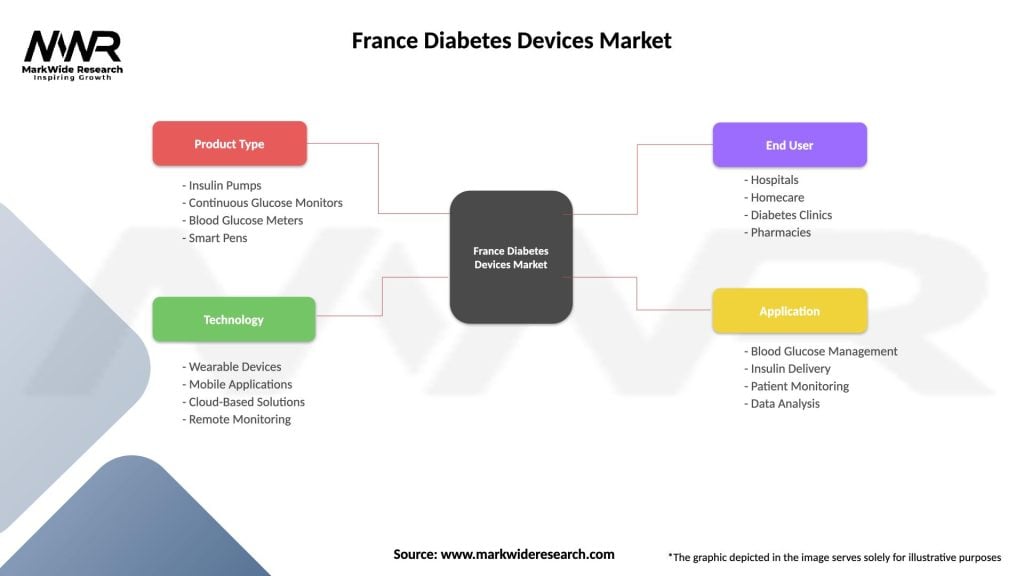

The France diabetes devices market can be segmented based on product type, end-user, and distribution channel.

Category-wise Insights

Key Benefits for IndustryParticipants and Stakeholders

SWOT Analysis

Market Key Trends

COVID-19 Impact

The COVID-19 pandemic has had a significant impact on the France diabetes devices market. The healthcare system has experienced strains due to the increased burden on hospitals and clinics, leading to delays in routine diabetes care. However, the pandemic has also highlighted the importance of self-monitoring and remote management options.

During the pandemic, individuals with diabetes have increasingly relied on home monitoring devices and telehealth consultations to manage their condition. This shift towards remote care has accelerated the adoption of connected diabetes devices and telemedicine platforms.

Manufacturers have responded to the pandemic by ensuring the availability of essential diabetes devices and implementing strict safety measures in production facilities. The pandemic has also underscored the need for robust supply chains to avoid disruptions in the availability of diabetes devices.

Key Industry Developments

Analyst Suggestions

Future Outlook

The France diabetes devices market is expected to continue its growth trajectory in the coming years. Factors such as the increasing prevalence of diabetes, technological advancements, and the growing emphasis on diabetes management and prevention will drive market expansion. The integration of AI, ML, and data connectivity in diabetes devices will enable more personalized and efficient diabetes management.

The market is likely to witness increased competition among key players, leading to further innovations and product advancements. Manufacturers will focus on developing user-friendly and connected devices to meet the evolving needs of individuals with diabetes.

Additionally, the market will see a shift towards remote monitoring and telehealth solutions as the importance of healthcare accessibility and convenience continues to grow. The COVID-19 pandemic has accelerated this trend, highlighting the potential for remote care in diabetes management.

Overall, the France diabetes devices market presents significant opportunities for industry participants to contribute to improving the lives of individuals with diabetes and advancing diabetes management technologies.

Conclusion

The France diabetes devices market is a vital segment of the healthcare industry, driven by the increasing prevalence of diabetes and the demand for advanced and user-friendly devices. Technological advancements, such as connected and wearable devices, have revolutionized diabetes management and opened new avenues for innovation. However, challenges such as the high cost of devices and regulatory requirements need to be addressed to ensure broader accessibility and market growth.

The market offers numerous opportunities for manufacturers and suppliers to introduce innovative solutions that cater to the evolving needs of individuals with diabetes. Emphasizing user-friendly design, remote monitoring capabilities, and affordability will be crucial for success in the market.

What is Diabetes Devices?

Diabetes devices refer to medical tools and technologies used to manage diabetes, including blood glucose monitors, insulin pumps, and continuous glucose monitoring systems. These devices help patients track their blood sugar levels and administer insulin as needed.

What are the key players in the France Diabetes Devices Market?

Key players in the France Diabetes Devices Market include companies such as Roche, Medtronic, and Abbott. These companies are known for their innovative diabetes management solutions and play a significant role in shaping the market landscape, among others.

What are the growth factors driving the France Diabetes Devices Market?

The France Diabetes Devices Market is driven by factors such as the increasing prevalence of diabetes, advancements in technology, and a growing focus on personalized healthcare. Additionally, rising awareness about diabetes management and the benefits of continuous monitoring contribute to market growth.

What challenges does the France Diabetes Devices Market face?

Challenges in the France Diabetes Devices Market include regulatory hurdles, high costs of advanced devices, and the need for continuous innovation. Additionally, patient adherence to device usage and the integration of new technologies into existing healthcare systems can pose difficulties.

What opportunities exist in the France Diabetes Devices Market?

Opportunities in the France Diabetes Devices Market include the development of smart insulin delivery systems, integration of artificial intelligence in diabetes management, and expansion into telehealth services. These innovations can enhance patient outcomes and improve accessibility to diabetes care.

What trends are shaping the France Diabetes Devices Market?

Trends in the France Diabetes Devices Market include the rise of wearable technology for glucose monitoring, increased use of mobile health applications, and a shift towards more user-friendly devices. These trends reflect a growing emphasis on patient engagement and real-time data access.

France Diabetes Devices Market

| Segmentation Details | Description |

|---|---|

| Product Type | Insulin Pumps, Continuous Glucose Monitors, Blood Glucose Meters, Smart Pens |

| Technology | Wearable Devices, Mobile Applications, Cloud-Based Solutions, Remote Monitoring |

| End User | Hospitals, Homecare, Diabetes Clinics, Pharmacies |

| Application | Blood Glucose Management, Insulin Delivery, Patient Monitoring, Data Analysis |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at