444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The France DC motors market represents a dynamic and rapidly evolving sector within the country’s industrial automation landscape. DC motors have established themselves as essential components across diverse applications, from automotive systems to renewable energy installations. The French market demonstrates remarkable resilience and innovation, driven by the nation’s commitment to industrial modernization and sustainable energy solutions.

Market dynamics in France reflect a sophisticated understanding of motor technology requirements across various industries. The automotive sector, manufacturing facilities, and renewable energy projects have collectively contributed to sustained demand for DC motor solutions. French manufacturers and end-users increasingly prioritize energy efficiency, with 85% of industrial facilities implementing energy-optimized motor systems to reduce operational costs and environmental impact.

Technological advancement continues to shape market evolution, with brushless DC motors gaining significant traction due to their superior efficiency and reduced maintenance requirements. The market exhibits strong growth potential, supported by government initiatives promoting industrial digitalization and the transition toward Industry 4.0 manufacturing paradigms. Regional distribution shows concentrated activity in industrial hubs including Île-de-France, Auvergne-Rhône-Alpes, and Grand Est regions.

Innovation drivers encompass smart motor technologies, IoT integration capabilities, and enhanced control systems that enable precise performance optimization. The market benefits from France’s robust engineering expertise and established relationships with global technology providers, positioning the country as a key player in European motor technology advancement.

The France DC motors market refers to the comprehensive ecosystem of direct current motor manufacturing, distribution, and application within French industrial and commercial sectors. DC motors are electrical machines that convert direct current electrical energy into mechanical rotational energy, utilizing electromagnetic principles to generate controlled motion for diverse applications.

Market scope encompasses various DC motor types including brushed motors, brushless motors, servo motors, and stepper motors, each designed for specific performance requirements and operational environments. The French market specifically addresses domestic manufacturing needs, export opportunities, and technology integration challenges faced by local industries seeking reliable motor solutions.

Industrial significance extends beyond simple motor supply to include comprehensive system integration, maintenance services, and technological consulting that supports France’s manufacturing competitiveness. The market incorporates both traditional industrial applications and emerging sectors such as electric vehicle components, renewable energy systems, and automated manufacturing equipment.

Economic impact reflects the critical role of DC motors in supporting France’s industrial productivity, export capabilities, and technological innovation initiatives. Market participants include international motor manufacturers, domestic suppliers, system integrators, and end-user industries that collectively drive demand for advanced motor technologies.

Strategic positioning of the France DC motors market demonstrates robust growth potential driven by industrial modernization initiatives and increasing automation adoption across key sectors. The market benefits from strong governmental support for manufacturing excellence and sustainable technology implementation, creating favorable conditions for continued expansion.

Key performance indicators reveal sustained demand growth, with automotive applications representing the largest market segment, followed by industrial automation and renewable energy installations. French manufacturers increasingly prioritize energy-efficient motor solutions, with 78% of procurement decisions influenced by efficiency ratings and total cost of ownership considerations.

Competitive landscape features established international players alongside innovative domestic suppliers, creating a dynamic environment that fosters technological advancement and competitive pricing. Market consolidation trends indicate strategic partnerships between motor manufacturers and system integrators to deliver comprehensive automation solutions.

Future trajectory points toward continued market expansion supported by digital transformation initiatives, electric vehicle adoption, and renewable energy infrastructure development. The market demonstrates resilience against economic uncertainties while maintaining focus on technological innovation and sustainable manufacturing practices that align with France’s environmental objectives.

Market intelligence reveals several critical insights that shape the France DC motors landscape and influence strategic decision-making across industry participants:

Market maturity indicators suggest a sophisticated understanding of motor technology requirements among French end-users, driving demand for advanced features and comprehensive support services. These insights guide strategic planning and investment decisions across the motor supply chain.

Industrial automation expansion serves as the primary catalyst for DC motor market growth in France, with manufacturing facilities increasingly adopting automated systems to enhance productivity and maintain competitive advantages. Automation initiatives across automotive, aerospace, and consumer goods sectors drive sustained demand for precision motor solutions capable of supporting complex manufacturing processes.

Electric vehicle adoption represents a transformative market driver, as France accelerates its transition toward sustainable transportation solutions. The automotive industry’s shift toward electric powertrains creates substantial opportunities for DC motor suppliers, particularly in applications requiring high torque density and precise speed control capabilities.

Renewable energy infrastructure development significantly contributes to market expansion, with wind turbine installations, solar tracking systems, and energy storage applications requiring reliable motor solutions. Government commitments to renewable energy targets create long-term demand visibility for motor manufacturers serving the clean energy sector.

Energy efficiency regulations and sustainability mandates encourage industrial facilities to upgrade aging motor systems with more efficient alternatives. Regulatory compliance requirements drive replacement cycles and create opportunities for advanced motor technologies that deliver superior performance while reducing environmental impact.

Digital transformation initiatives across French industries necessitate smart motor solutions capable of integrating with IoT platforms and providing real-time performance data. Industry 4.0 adoption creates demand for motors with advanced communication capabilities and predictive maintenance features that support operational optimization objectives.

High initial investment requirements for advanced DC motor systems present significant barriers for small and medium-sized enterprises seeking to upgrade their equipment. Capital constraints limit adoption rates among cost-sensitive market segments, particularly in traditional manufacturing sectors with established equipment bases and limited modernization budgets.

Technical complexity associated with modern motor control systems requires specialized expertise that may not be readily available within all organizations. Skills gaps in motor system design, installation, and maintenance create implementation challenges and increase total cost of ownership for end-users lacking internal technical capabilities.

Supply chain disruptions and component shortages have periodically impacted motor availability and pricing stability, creating uncertainty for project planning and procurement decisions. Global supply chain vulnerabilities expose the French market to external shocks that can delay installations and increase costs for end-users.

Competition from alternative technologies such as AC motors and servo systems challenges DC motor adoption in certain applications where performance requirements may be met through different technological approaches. Technology substitution risks require DC motor suppliers to continuously demonstrate value propositions and competitive advantages.

Regulatory compliance costs associated with environmental standards and safety requirements increase the overall expense of motor system implementation, particularly for applications requiring specialized certifications or custom engineering solutions that extend development timelines and project costs.

Electric vehicle expansion presents unprecedented opportunities for DC motor suppliers as France accelerates its transition toward sustainable transportation. EV market growth creates demand for specialized motor solutions in applications ranging from traction drives to auxiliary systems, offering substantial revenue potential for companies capable of meeting automotive industry requirements.

Industrial IoT integration opens new market segments for smart motor solutions that provide real-time performance monitoring, predictive maintenance capabilities, and seamless connectivity with manufacturing execution systems. Digital transformation initiatives across French industries create opportunities for motor suppliers to expand beyond traditional hardware provision into comprehensive service offerings.

Renewable energy infrastructure development offers significant growth potential as France pursues ambitious clean energy targets. Wind and solar installations require specialized motor solutions for tracking systems, blade pitch control, and energy storage applications, creating sustained demand for high-performance DC motors designed for harsh environmental conditions.

Automation retrofit projects in existing manufacturing facilities present substantial market opportunities as companies seek to modernize operations without complete equipment replacement. Retrofit solutions enable cost-effective productivity improvements while extending the useful life of existing machinery through advanced motor control integration.

Export market expansion leverages France’s reputation for engineering excellence and quality manufacturing to serve European and international markets seeking reliable motor solutions. Global market access through established trade relationships and technical expertise creates opportunities for French motor suppliers to expand beyond domestic market constraints.

Demand patterns within the France DC motors market reflect cyclical industrial investment trends influenced by economic conditions, technological advancement cycles, and regulatory changes. Market dynamics demonstrate strong correlation between manufacturing activity levels and motor procurement volumes, with automotive and aerospace sectors driving significant demand fluctuations based on production schedules and new model introductions.

Supply side dynamics reveal increasing consolidation among motor manufacturers seeking economies of scale and expanded technical capabilities. Strategic partnerships between international motor suppliers and French system integrators create comprehensive solution offerings that address complex application requirements while maintaining competitive pricing structures.

Technology evolution continuously reshapes market dynamics as brushless motors gain market share over traditional brushed alternatives, driven by superior efficiency and reduced maintenance requirements. Innovation cycles accelerate as manufacturers invest in smart motor technologies, IoT integration capabilities, and advanced control algorithms that enhance performance and operational flexibility.

Pricing dynamics reflect competitive pressures balanced against rising material costs and technological complexity. Value-based pricing models increasingly replace cost-plus approaches as customers recognize total cost of ownership benefits from premium motor solutions that deliver superior efficiency and reliability performance.

Regulatory influences shape market dynamics through energy efficiency standards, environmental regulations, and safety requirements that drive technology adoption and influence product development priorities. Compliance requirements create both challenges and opportunities as manufacturers adapt to evolving regulatory landscapes while maintaining competitive positioning.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the France DC motors market landscape. Primary research activities include structured interviews with industry executives, technical specialists, and end-user representatives across key market segments to gather firsthand perspectives on market trends, challenges, and opportunities.

Secondary research encompasses extensive analysis of industry publications, technical journals, regulatory documents, and company financial reports to establish market context and validate primary research findings. Data triangulation techniques ensure consistency across multiple information sources while identifying potential discrepancies that require additional investigation.

Market sizing methodologies utilize bottom-up and top-down approaches to establish accurate market parameters and growth projections. Statistical analysis of historical data patterns, industry production volumes, and import/export statistics provides quantitative foundation for market assessments and future trend projections.

Expert validation processes involve consultation with industry specialists, academic researchers, and technology consultants to verify research findings and ensure analytical conclusions reflect current market realities. Peer review mechanisms maintain research quality standards and provide additional perspectives on complex market dynamics.

Continuous monitoring systems track market developments, regulatory changes, and competitive activities to maintain current market intelligence and identify emerging trends that may impact future market evolution. Real-time updates ensure research findings remain relevant and actionable for strategic decision-making purposes.

Île-de-France region dominates the France DC motors market with 32% market share, driven by concentrated automotive manufacturing facilities, aerospace industries, and advanced manufacturing operations. Regional leadership reflects the area’s industrial diversity, technical expertise, and proximity to major transportation infrastructure that facilitates efficient supply chain operations.

Auvergne-Rhône-Alpes represents the second-largest regional market, accounting for 24% of national demand, supported by strong automotive presence, precision manufacturing industries, and renewable energy installations. Industrial clusters in Lyon, Grenoble, and surrounding areas create concentrated demand for specialized motor solutions across diverse applications.

Grand Est region contributes 18% of market volume through automotive manufacturing, chemical processing, and traditional manufacturing industries that require reliable motor solutions for production equipment and process automation. Cross-border trade with Germany and other European markets enhances regional market dynamics and creates export opportunities.

Hauts-de-France accounts for 15% of regional distribution, driven by automotive component manufacturing, textile industries, and emerging renewable energy projects. Industrial transformation initiatives in the region create opportunities for motor suppliers supporting modernization and automation projects.

Remaining regions collectively represent 11% of market activity, with notable concentrations in Nouvelle-Aquitaine’s aerospace sector, Occitanie’s renewable energy installations, and Provence-Alpes-Côte d’Azur’s specialized manufacturing operations. Regional diversification provides market stability and reduces dependence on individual industrial sectors or geographic concentrations.

Market leadership within the France DC motors sector features a combination of established international manufacturers and innovative domestic suppliers, creating a dynamic competitive environment that drives technological advancement and competitive pricing strategies.

Competitive strategies emphasize technological innovation, comprehensive service offerings, and strategic partnerships that enable companies to address complex customer requirements while maintaining competitive positioning. Market differentiation occurs through specialized expertise, custom engineering capabilities, and integrated solution approaches that extend beyond traditional motor supply.

Strategic alliances between motor manufacturers and system integrators create comprehensive automation solutions that address end-user requirements for turnkey project implementation and ongoing technical support services.

Technology-based segmentation reveals distinct market categories based on motor design principles and performance characteristics that address specific application requirements across diverse industrial sectors.

By Motor Type:

By Power Rating:

By Application Sector:

Brushless DC motor category demonstrates the strongest growth trajectory, driven by increasing demand for energy-efficient solutions and reduced maintenance requirements. Technology advantages including longer operational life, precise speed control, and quiet operation make brushless motors particularly attractive for automotive and precision manufacturing applications.

Automotive sector applications represent the largest category by volume, encompassing electric vehicle traction motors, power steering systems, cooling fans, and various auxiliary systems. EV transition accelerates demand for high-performance DC motors capable of delivering superior torque density and efficiency characteristics required for electric powertrains.

Industrial automation category shows consistent growth as French manufacturers invest in modernization and productivity improvement initiatives. Automation projects require reliable motor solutions capable of integrating with advanced control systems and providing consistent performance in demanding industrial environments.

Renewable energy applications emerge as a high-growth category, driven by France’s commitment to clean energy targets and infrastructure development. Wind and solar installations require specialized motor solutions designed for harsh environmental conditions and long-term reliability requirements.

High-power motor segment serves critical applications in heavy industry, automotive manufacturing, and large-scale automation projects where performance and reliability requirements justify premium pricing. Custom engineering capabilities become essential for addressing unique application requirements and performance specifications.

Manufacturing efficiency gains represent primary benefits for industrial end-users implementing advanced DC motor solutions, with modern motor systems delivering 20-30% efficiency improvements compared to legacy alternatives. Operational optimization through precise speed control and torque management enables manufacturers to enhance product quality while reducing energy consumption and operational costs.

Maintenance cost reduction provides significant value for stakeholders through brushless motor technology that eliminates brush replacement requirements and reduces scheduled maintenance intervals. Predictive maintenance capabilities enabled by smart motor systems help prevent unexpected failures and optimize maintenance scheduling to minimize production disruptions.

Energy cost savings deliver substantial financial benefits as high-efficiency motors reduce electrical consumption and support corporate sustainability objectives. Environmental compliance advantages help organizations meet regulatory requirements while demonstrating commitment to responsible manufacturing practices.

Competitive advantages accrue to companies implementing advanced motor technologies through improved product quality, enhanced production flexibility, and reduced time-to-market for new products. Innovation capabilities supported by modern motor systems enable manufacturers to develop differentiated products and maintain market leadership positions.

Supply chain resilience benefits emerge from partnerships with reliable motor suppliers offering comprehensive technical support and local service capabilities. Strategic relationships with motor manufacturers provide access to latest technologies and ensure continuity of supply for critical production applications.

Strengths:

Weaknesses:

Opportunities:

Threats:

Smart motor integration represents the most significant trend shaping the France DC motors market, with manufacturers increasingly demanding motors equipped with IoT capabilities, real-time monitoring systems, and predictive maintenance features. Digital connectivity enables seamless integration with manufacturing execution systems and provides valuable operational data for optimization purposes.

Energy efficiency prioritization drives market evolution as organizations seek to reduce operational costs and meet environmental compliance requirements. High-efficiency motors with ratings exceeding 95% efficiency become standard requirements for new installations, particularly in energy-intensive industrial applications.

Customization demand increases as industries require application-specific motor solutions that address unique performance requirements, environmental conditions, and integration challenges. Engineering services become essential differentiators for motor suppliers capable of delivering tailored solutions and comprehensive technical support.

Miniaturization trends influence motor design as applications demand compact solutions with high power density characteristics. Advanced materials and innovative design approaches enable manufacturers to deliver superior performance in increasingly constrained space requirements.

Sustainability focus shapes procurement decisions as organizations prioritize suppliers demonstrating environmental responsibility and offering products that support circular economy principles. Lifecycle considerations including recyclability and environmental impact become important selection criteria alongside traditional performance parameters.

Technology partnerships between motor manufacturers and automotive companies accelerate development of specialized solutions for electric vehicle applications. Collaborative innovation initiatives focus on improving motor efficiency, reducing weight, and enhancing integration capabilities for next-generation electric powertrains.

Manufacturing facility investments by international motor suppliers establish local production capabilities to serve French and European markets more effectively. Localization strategies reduce supply chain risks while providing opportunities for closer customer collaboration and customization capabilities.

Research and development initiatives focus on advanced motor technologies including magnetic gear systems, integrated power electronics, and artificial intelligence-enabled control algorithms. Innovation investments position French market participants at the forefront of motor technology advancement.

Acquisition activities reshape the competitive landscape as larger companies acquire specialized motor manufacturers to expand technical capabilities and market reach. Industry consolidation creates opportunities for enhanced service offerings and comprehensive solution development.

Regulatory developments including updated energy efficiency standards and environmental regulations influence product development priorities and market dynamics. Compliance requirements drive technology adoption while creating opportunities for suppliers offering advanced solutions that exceed regulatory minimums.

Strategic positioning recommendations emphasize the importance of developing comprehensive solution capabilities that extend beyond traditional motor supply to include system integration, maintenance services, and technical consulting. MarkWide Research analysis indicates that companies offering integrated solutions achieve 25% higher customer retention rates compared to product-only suppliers.

Technology investment priorities should focus on smart motor capabilities, IoT integration features, and predictive maintenance systems that align with Industry 4.0 trends and customer digitalization objectives. Innovation leadership becomes essential for maintaining competitive advantages in an increasingly sophisticated market environment.

Market expansion strategies should leverage France’s central European location to serve broader regional markets while maintaining focus on domestic market leadership. Export opportunities require careful consideration of local market requirements and competitive dynamics in target countries.

Partnership development with system integrators, automation specialists, and end-user industries creates opportunities for collaborative solution development and market access. Strategic alliances enable companies to address complex customer requirements while sharing development costs and market risks.

Sustainability initiatives should encompass product design, manufacturing processes, and supply chain management to address growing customer demands for environmentally responsible solutions. Environmental leadership provides competitive differentiation and supports long-term market positioning objectives.

Market trajectory for the France DC motors sector indicates continued growth driven by industrial automation expansion, electric vehicle adoption, and renewable energy infrastructure development. Long-term prospects remain positive despite potential short-term economic uncertainties and competitive pressures from international suppliers.

Technology evolution will continue reshaping market dynamics as smart motor solutions become standard requirements and traditional motor technologies face displacement by more advanced alternatives. Digital transformation initiatives across French industries will drive sustained demand for motors with IoT capabilities and advanced control features.

Electric vehicle market expansion presents substantial growth opportunities as France accelerates its transition toward sustainable transportation solutions. MWR projections suggest that automotive applications will represent 40% of market growth over the next five years, driven by EV adoption and associated infrastructure development.

Renewable energy sector development will create sustained demand for specialized motor solutions designed for wind turbines, solar tracking systems, and energy storage applications. Clean energy targets established by the French government provide long-term demand visibility for motor suppliers serving this growing sector.

Competitive landscape evolution will likely feature continued consolidation as companies seek economies of scale and expanded technical capabilities. Market leadership will increasingly depend on innovation capabilities, comprehensive service offerings, and strategic partnerships that enable companies to address complex customer requirements effectively.

France DC motors market demonstrates robust fundamentals and promising growth prospects supported by diverse industrial applications, technological innovation, and favorable regulatory environment. The market benefits from strong domestic demand across automotive, industrial automation, and renewable energy sectors while maintaining opportunities for export expansion throughout Europe.

Strategic success factors include technological leadership, comprehensive solution capabilities, and strategic partnerships that enable companies to address evolving customer requirements in an increasingly sophisticated market environment. Innovation investments in smart motor technologies, IoT integration, and energy efficiency improvements will determine competitive positioning and long-term market success.

Market evolution toward digitalization, sustainability, and application-specific solutions creates both challenges and opportunities for industry participants. Companies capable of adapting to these trends while maintaining operational excellence and customer focus will achieve sustainable competitive advantages in this dynamic market landscape.

Future market development will be shaped by electric vehicle adoption, industrial automation expansion, and renewable energy infrastructure growth, creating sustained demand for advanced DC motor solutions. The France DC motors market is well-positioned to capitalize on these trends through continued innovation, strategic partnerships, and commitment to technological excellence that supports French industrial competitiveness and economic growth objectives.

What is DC Motors?

DC Motors are electric motors that run on direct current electricity. They are widely used in various applications, including automotive, industrial machinery, and consumer electronics due to their simplicity and efficiency.

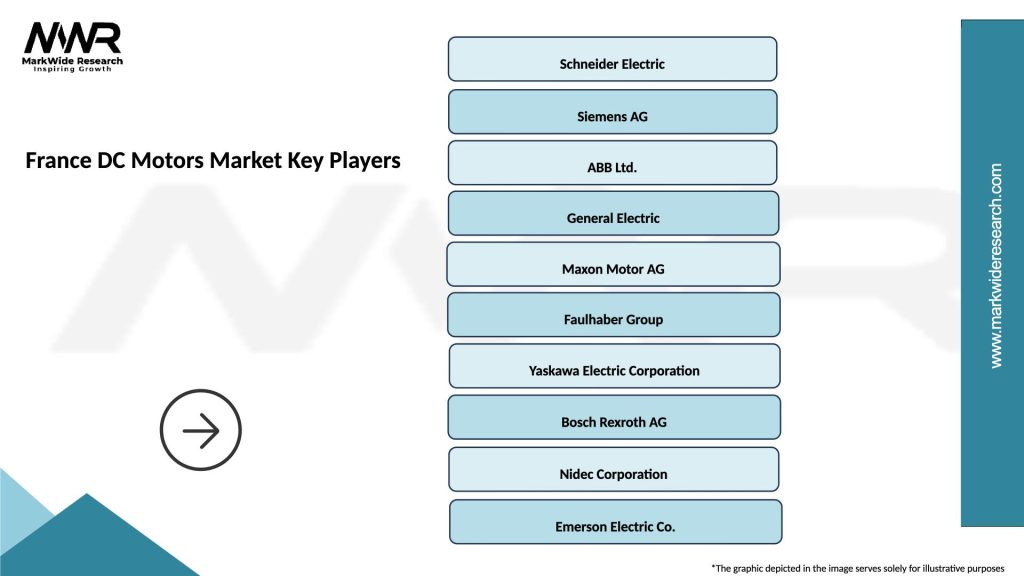

What are the key players in the France DC Motors Market?

Key players in the France DC Motors Market include companies like Schneider Electric, Siemens, and Nidec Corporation, which are known for their innovative motor solutions and extensive product ranges, among others.

What are the growth factors driving the France DC Motors Market?

The France DC Motors Market is driven by the increasing demand for automation in industries, the rise of electric vehicles, and advancements in motor technology that enhance efficiency and performance.

What challenges does the France DC Motors Market face?

Challenges in the France DC Motors Market include the high cost of advanced motor technologies, competition from alternative motor types, and the need for continuous innovation to meet evolving consumer demands.

What opportunities exist in the France DC Motors Market?

Opportunities in the France DC Motors Market include the growing trend towards renewable energy solutions, the expansion of electric vehicle infrastructure, and the increasing adoption of smart technologies in industrial applications.

What trends are shaping the France DC Motors Market?

Trends in the France DC Motors Market include the integration of IoT technology for enhanced monitoring and control, the shift towards energy-efficient designs, and the development of compact and lightweight motor solutions.

France DC Motors Market

| Segmentation Details | Description |

|---|---|

| Product Type | Brushed, Brushless, Stepper, Servo |

| End User | Automotive OEMs, Industrial Equipment, Consumer Electronics, Robotics |

| Technology | Permanent Magnet, Synchronous, Asynchronous, Linear |

| Application | Electric Vehicles, Home Appliances, HVAC Systems, Medical Devices |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the France DC Motors Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at