444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The France data center storage market represents a dynamic and rapidly evolving segment within the broader European digital infrastructure landscape. France’s strategic position as a technology hub in Western Europe, combined with its robust regulatory framework and strong emphasis on data sovereignty, has positioned the country as a critical player in the global data center ecosystem. The market encompasses various storage technologies, including traditional hard disk drives, solid-state drives, and emerging storage solutions designed to meet the increasing demands of cloud computing, artificial intelligence, and digital transformation initiatives.

Market dynamics in France are influenced by several key factors, including the country’s commitment to digital sovereignty, stringent data protection regulations such as GDPR, and the growing demand for edge computing solutions. The French government’s initiatives to promote digital transformation across industries have created substantial opportunities for data center storage providers. Growth projections indicate the market is expanding at a compound annual growth rate of 8.2%, driven by increasing data generation, cloud adoption, and the need for enhanced storage performance and reliability.

Regional distribution shows that approximately 45% of data center storage capacity is concentrated in the Île-de-France region, particularly around Paris, which serves as the primary hub for international connectivity and digital services. Other significant regions include Lyon, Marseille, and Toulouse, each contributing to the country’s distributed data center infrastructure. The market is characterized by a mix of hyperscale facilities, colocation providers, and enterprise data centers, each with distinct storage requirements and growth patterns.

The France data center storage market refers to the comprehensive ecosystem of storage technologies, solutions, and services deployed within data center facilities across France to store, manage, and retrieve digital information. This market encompasses various storage architectures, including direct-attached storage, network-attached storage, and storage area networks, designed to support diverse workloads ranging from traditional enterprise applications to modern cloud-native services and artificial intelligence workloads.

Storage solutions within this market include both hardware components such as storage arrays, disk drives, and flash storage systems, as well as software-defined storage platforms that provide virtualization, automation, and management capabilities. The market also encompasses related services including storage consulting, implementation, maintenance, and managed storage services that help organizations optimize their data storage infrastructure for performance, reliability, and cost-effectiveness.

France’s data center storage market demonstrates remarkable resilience and growth potential, driven by the country’s strategic focus on digital transformation and data sovereignty. The market benefits from strong government support for digital infrastructure development, robust regulatory frameworks that ensure data protection and privacy, and a thriving ecosystem of technology companies and service providers. Key growth drivers include the accelerating adoption of cloud services, increasing demand for edge computing solutions, and the proliferation of data-intensive applications across various industries.

Market segmentation reveals diverse opportunities across different storage technologies, with solid-state drives experiencing particularly strong growth due to their superior performance characteristics. The enterprise segment continues to represent a significant portion of the market, while the cloud service provider segment is expanding rapidly. Competitive dynamics are characterized by the presence of both global technology leaders and specialized French companies that offer localized solutions and services tailored to the specific requirements of French organizations.

Future outlook suggests continued expansion driven by emerging technologies such as artificial intelligence, machine learning, and Internet of Things applications that generate massive amounts of data requiring sophisticated storage solutions. The market is expected to benefit from ongoing investments in 5G infrastructure, smart city initiatives, and digital government services that will create additional demand for high-performance storage systems.

Strategic analysis of the France data center storage market reveals several critical insights that shape the competitive landscape and growth trajectory:

Digital transformation initiatives across French enterprises and government organizations serve as the primary catalyst for data center storage market growth. Organizations are modernizing their IT infrastructure to support digital services, improve operational efficiency, and enhance customer experiences. This transformation requires robust storage solutions capable of handling diverse workloads, from traditional business applications to modern cloud-native services and emerging technologies such as artificial intelligence and machine learning.

Cloud adoption acceleration represents another significant driver, with French organizations increasingly embracing public, private, and hybrid cloud models. This shift necessitates scalable and flexible storage infrastructure that can adapt to changing business requirements and support dynamic workload patterns. Service providers are investing heavily in storage capacity and capabilities to meet the growing demand for cloud services while ensuring compliance with local data protection regulations.

Data generation explosion from various sources including IoT devices, mobile applications, social media platforms, and business systems creates continuous pressure for expanded storage capacity and improved performance. French organizations across industries are generating unprecedented amounts of data that require sophisticated storage solutions for collection, processing, analysis, and long-term retention. Regulatory requirements for data retention and compliance further amplify storage needs across sectors such as healthcare, financial services, and telecommunications.

Edge computing deployment is driving demand for distributed storage solutions that can support low-latency applications and services. The rollout of 5G networks and the proliferation of IoT applications require storage infrastructure positioned closer to end-users and devices, creating opportunities for edge data center storage solutions throughout France.

High capital investment requirements represent a significant barrier for many organizations considering data center storage infrastructure upgrades or expansions. The cost of implementing enterprise-grade storage solutions, including hardware, software, and associated infrastructure components, can be substantial, particularly for small and medium-sized enterprises with limited IT budgets. This financial constraint often leads to delayed technology adoption or the selection of lower-performance solutions that may not fully meet organizational requirements.

Skills shortage in the French IT market poses challenges for organizations seeking to implement and manage advanced storage technologies. The complexity of modern storage systems, including software-defined storage, hyper-converged infrastructure, and cloud-integrated solutions, requires specialized expertise that is often in short supply. This skills gap can result in implementation delays, suboptimal system performance, and increased reliance on external service providers.

Legacy system integration challenges create obstacles for organizations with existing IT infrastructure that must be integrated with new storage solutions. Many French enterprises operate legacy systems that may not be compatible with modern storage technologies, requiring complex migration strategies and potentially costly system modifications. Compatibility issues can extend project timelines and increase implementation costs, making organizations hesitant to pursue storage modernization initiatives.

Regulatory complexity surrounding data protection and privacy requirements can create uncertainty and compliance challenges for storage infrastructure deployments. While regulations such as GDPR provide important protections, they also impose strict requirements for data handling, storage, and processing that can complicate storage architecture decisions and increase operational overhead.

Artificial intelligence and machine learning applications present substantial opportunities for high-performance storage solutions in the French market. Organizations across industries are implementing AI-driven initiatives that require storage systems capable of handling large datasets, supporting real-time analytics, and providing the performance characteristics necessary for training and inference workloads. Storage vendors that can deliver solutions optimized for AI workloads are well-positioned to capture significant market share.

Edge computing expansion creates opportunities for distributed storage solutions that can support the growing number of edge data centers being deployed across France. The increasing demand for low-latency applications, autonomous systems, and real-time data processing drives the need for storage infrastructure positioned closer to end-users and devices. Market participants can capitalize on this trend by developing storage solutions specifically designed for edge environments.

Sustainability initiatives offer opportunities for energy-efficient storage technologies and green data center solutions. French organizations are increasingly focused on reducing their environmental impact and achieving sustainability goals, creating demand for storage systems that minimize power consumption and carbon footprint. Innovative storage technologies such as DNA storage, optical storage, and advanced flash memory architectures may find receptive markets among environmentally conscious organizations.

Government digitization programs represent significant opportunities for storage infrastructure providers. The French government’s commitment to digital transformation across public services creates demand for secure, scalable, and compliant storage solutions that can support citizen services, administrative processes, and data analytics initiatives. Public sector contracts can provide stable revenue streams and serve as reference implementations for private sector opportunities.

Competitive intensity in the France data center storage market continues to increase as both global technology leaders and specialized regional providers compete for market share. This competition drives innovation, improves solution quality, and often results in more favorable pricing for customers. Market consolidation trends are evident as larger companies acquire specialized storage vendors to expand their technology portfolios and market reach.

Technology evolution represents a constant dynamic force, with new storage technologies and architectures regularly entering the market. The transition from traditional storage area networks to software-defined storage, the adoption of NVMe and persistent memory technologies, and the integration of artificial intelligence for storage management are reshaping the competitive landscape. Organizations must continuously evaluate new technologies to maintain competitive advantages and meet evolving business requirements.

Customer expectations are evolving toward solutions that provide greater flexibility, scalability, and automation capabilities. French organizations increasingly demand storage solutions that can seamlessly integrate with cloud platforms, support hybrid and multi-cloud strategies, and provide self-service capabilities for IT teams. Service delivery models are shifting toward consumption-based pricing and managed services that reduce the operational burden on customer IT teams.

Regulatory landscape changes continue to influence market dynamics, with data protection regulations, cybersecurity requirements, and industry-specific compliance standards shaping storage solution requirements. Vendors must ensure their solutions can meet evolving regulatory requirements while providing the performance and functionality needed to support business operations.

Comprehensive market analysis was conducted using a multi-faceted research approach that combines primary and secondary research methodologies to provide accurate and actionable insights into the France data center storage market. The research framework encompasses quantitative data collection, qualitative analysis, and expert interviews to ensure a thorough understanding of market dynamics, competitive landscape, and growth opportunities.

Primary research activities included structured interviews with key stakeholders across the value chain, including storage vendors, system integrators, data center operators, and end-user organizations. These interviews provided insights into market trends, customer requirements, competitive dynamics, and future growth prospects. Survey methodology was employed to gather quantitative data on market size, growth rates, technology adoption patterns, and customer preferences from a representative sample of market participants.

Secondary research involved comprehensive analysis of industry reports, company financial statements, government publications, and technology research studies to validate primary research findings and provide additional market context. Data triangulation techniques were used to ensure accuracy and reliability of market estimates and projections.

Market modeling approaches incorporated various analytical frameworks including bottom-up and top-down market sizing, competitive benchmarking, and scenario analysis to develop robust market forecasts and identify key growth drivers and restraints affecting the France data center storage market.

Île-de-France region dominates the French data center storage market, accounting for approximately 45% of total market activity. The region’s concentration of multinational corporations, financial institutions, and technology companies creates substantial demand for enterprise-grade storage solutions. Paris metropolitan area serves as the primary hub for international connectivity and houses numerous hyperscale data centers operated by global cloud service providers.

Auvergne-Rhône-Alpes region, centered around Lyon, represents the second-largest market for data center storage, driven by its strategic location as a European connectivity hub and the presence of major industrial and technology companies. The region benefits from favorable geography, reliable power infrastructure, and government incentives for digital infrastructure development. Market share in this region is estimated at approximately 18% of the national total.

Provence-Alpes-Côte d’Azur region, including Marseille and Nice, captures significant market share due to its role as a gateway for Mediterranean connectivity and its growing technology sector. The region’s focus on smart city initiatives and digital innovation creates demand for edge computing and distributed storage solutions. Regional growth rates exceed the national average, driven by increasing investment in digital infrastructure.

Occitanie region, anchored by Toulouse, benefits from its aerospace and technology industries, creating demand for high-performance storage solutions to support research and development activities. The region’s emphasis on innovation and technology transfer generates opportunities for advanced storage technologies and specialized solutions.

Market leadership in the France data center storage market is characterized by a mix of global technology giants and specialized regional providers, each offering distinct value propositions and targeting different market segments. The competitive environment is dynamic, with companies continuously innovating to differentiate their offerings and capture market share.

Competitive strategies focus on technology innovation, service excellence, and the development of solutions tailored to specific industry requirements. Companies are investing in research and development to create next-generation storage technologies while building partnerships with cloud service providers and system integrators to expand market reach.

Technology segmentation reveals distinct market dynamics across different storage technologies deployed in French data centers:

By Storage Type:

By Architecture:

By End-User Industry:

Enterprise storage category continues to represent the largest segment of the French data center storage market, driven by the ongoing digital transformation initiatives of large corporations and government organizations. This category encompasses high-end storage arrays, enterprise-class disk drives, and sophisticated storage management software designed to meet the demanding requirements of mission-critical applications. Growth patterns in this category are influenced by the adoption of hybrid cloud strategies and the need for storage solutions that can seamlessly integrate with public cloud platforms.

Cloud storage infrastructure represents the fastest-growing category, with cloud service providers investing heavily in storage capacity to support their expanding customer base. This category includes hyperscale storage systems, object storage platforms, and distributed storage architectures designed to provide massive scalability and high availability. Market dynamics in this category are driven by the increasing adoption of cloud services by French organizations and the need for storage solutions that can support multi-tenant environments.

Edge storage solutions constitute an emerging category with significant growth potential, driven by the deployment of edge computing infrastructure across France. This category includes compact, ruggedized storage systems designed for deployment in edge data centers, retail locations, and industrial facilities. Technology requirements for edge storage emphasize reliability, remote management capabilities, and integration with centralized storage and cloud platforms.

Backup and archive storage remains a stable category focused on long-term data retention and disaster recovery requirements. This category includes tape storage systems, disk-based backup appliances, and cloud-integrated backup solutions. Regulatory compliance requirements drive consistent demand in this category, particularly in highly regulated industries such as financial services and healthcare.

Storage vendors benefit from the expanding French data center storage market through increased revenue opportunities, market share growth, and the ability to showcase innovative technologies in a sophisticated market environment. The French market’s emphasis on data sovereignty and regulatory compliance creates opportunities for vendors to differentiate their offerings through security features, compliance capabilities, and local support services. Partnership opportunities with French system integrators and service providers enable vendors to expand their market reach and develop localized solutions.

System integrators and service providers gain advantages through the growing complexity of storage environments, which increases demand for professional services, implementation support, and ongoing management services. The market’s evolution toward software-defined storage and cloud-integrated solutions creates opportunities for service providers to offer specialized expertise and managed services. Revenue diversification through storage-as-a-service and consumption-based models provides more predictable income streams.

End-user organizations benefit from improved storage performance, enhanced data protection capabilities, and greater operational efficiency through the adoption of modern storage technologies. The competitive market environment results in better pricing, more innovative solutions, and improved vendor support. Digital transformation initiatives are enabled by advanced storage capabilities that support new applications and business models.

Data center operators can enhance their service offerings and attract new customers by deploying state-of-the-art storage infrastructure. Modern storage solutions enable data center operators to improve space utilization, reduce power consumption, and offer more competitive pricing to their customers. Operational benefits include simplified management, automated provisioning, and improved reliability.

Strengths:

Weaknesses:

Opportunities:

Threats:

Software-defined storage adoption represents a fundamental shift in how French organizations approach storage infrastructure, with approximately 38% of enterprises implementing or evaluating software-defined storage solutions. This trend enables greater flexibility, automation, and cost optimization while reducing dependence on proprietary hardware platforms. Virtualization capabilities provided by software-defined storage align with broader IT infrastructure modernization initiatives and support hybrid cloud strategies.

Flash storage proliferation continues to accelerate as prices decline and performance advantages become more apparent across diverse workloads. Organizations are transitioning from traditional hard disk drives to solid-state drives for primary storage applications, with flash storage now representing a significant portion of new storage deployments. All-flash data centers are becoming more common as organizations prioritize performance and energy efficiency.

Cloud integration has become a critical requirement for storage solutions, with organizations demanding seamless connectivity between on-premises storage and public cloud platforms. This trend drives the adoption of hybrid storage architectures that can automatically tier data between local and cloud storage based on access patterns and cost considerations. Multi-cloud strategies are creating demand for storage solutions that support multiple cloud providers simultaneously.

Artificial intelligence integration in storage management is gaining traction, with AI-powered analytics helping organizations optimize storage performance, predict failures, and automate routine management tasks. Intelligent storage systems can automatically adjust configurations, migrate data, and optimize resource utilization based on workload patterns and business requirements.

Major infrastructure investments by global cloud service providers have significantly expanded data center storage capacity in France, with several hyperscale facilities coming online in recent years. These investments demonstrate confidence in the French market and create opportunities for storage vendors to supply large-scale deployments. Capacity expansion projects are planned across multiple regions to support growing demand for cloud services.

Strategic partnerships between storage vendors and French system integrators have strengthened local market presence and improved customer support capabilities. These partnerships enable global vendors to leverage local expertise while providing French companies with access to advanced storage technologies. Collaboration initiatives focus on developing industry-specific solutions and supporting digital transformation projects.

Technology innovations in areas such as persistent memory, computational storage, and DNA-based storage are being tested and evaluated by French organizations seeking competitive advantages through advanced storage capabilities. Research collaborations between technology companies and French universities are driving innovation in storage technologies and applications.

Regulatory developments continue to shape the market, with new data protection requirements and cybersecurity standards influencing storage infrastructure decisions. Compliance initiatives are driving investment in secure storage solutions and data governance platforms that can support regulatory reporting and audit requirements.

MarkWide Research recommends that storage vendors focus on developing solutions that address the specific requirements of the French market, including data sovereignty concerns, regulatory compliance needs, and integration with local business practices. Localization strategies should encompass not only language support but also adaptation to French business culture and regulatory requirements.

Investment priorities should emphasize technologies that support hybrid and multi-cloud strategies, as French organizations increasingly adopt flexible IT architectures that span on-premises and cloud environments. Product development efforts should focus on solutions that provide seamless data mobility, automated management capabilities, and integration with popular cloud platforms used by French organizations.

Partnership strategies represent critical success factors, with vendors advised to establish strong relationships with local system integrators, service providers, and technology distributors. These partnerships enable market access, provide local expertise, and support customer success initiatives. Channel development should include training programs and certification processes to ensure partner competency.

Market positioning should emphasize value propositions that resonate with French customers, including total cost of ownership benefits, security and compliance capabilities, and support for digital transformation initiatives. Competitive differentiation through innovative features, superior performance, or specialized industry solutions can help vendors establish market leadership positions.

Growth trajectory for the France data center storage market remains positive, with continued expansion expected across all major segments and regions. The market is projected to maintain robust growth rates driven by ongoing digital transformation initiatives, increasing data generation, and the adoption of emerging technologies such as artificial intelligence and Internet of Things applications. Market maturation is expected to bring greater sophistication in customer requirements and increased emphasis on value-added services.

Technology evolution will continue to reshape the market landscape, with emerging storage technologies such as persistent memory, computational storage, and quantum storage potentially disrupting traditional architectures. Innovation cycles are accelerating, requiring market participants to maintain strong research and development capabilities and adapt quickly to changing customer needs.

Regulatory environment is expected to become more complex, with additional data protection requirements and cybersecurity standards influencing storage infrastructure decisions. Organizations will need storage solutions that can adapt to evolving regulatory requirements while maintaining performance and cost-effectiveness. Compliance automation will become increasingly important as regulatory reporting requirements expand.

Market consolidation trends may accelerate as larger companies acquire specialized storage vendors to expand their technology portfolios and market reach. This consolidation could result in fewer but more comprehensive solution providers, potentially changing competitive dynamics and customer relationships. Strategic positioning will become increasingly important for companies seeking to maintain independence or achieve favorable acquisition terms.

The France data center storage market represents a dynamic and growing segment of the European technology landscape, characterized by strong fundamentals, supportive government policies, and increasing demand from organizations across diverse industries. Market opportunities are substantial, driven by digital transformation initiatives, cloud adoption, and the emergence of new technologies that require advanced storage capabilities.

Competitive dynamics favor companies that can deliver innovative solutions tailored to French market requirements while providing exceptional customer support and local expertise. The market’s emphasis on data sovereignty, regulatory compliance, and security creates opportunities for differentiation and value creation. Success factors include technology innovation, strategic partnerships, and deep understanding of local market dynamics.

Future prospects remain positive, with continued growth expected across all major market segments and regions. Organizations that can effectively navigate the evolving technology landscape, regulatory environment, and competitive dynamics will be well-positioned to capture significant market opportunities and achieve sustainable growth in the France data center storage market.

What is Data Center Storage?

Data Center Storage refers to the systems and technologies used to store and manage data in data centers. This includes various storage solutions such as hard drives, solid-state drives, and cloud storage services that support enterprise data management and accessibility.

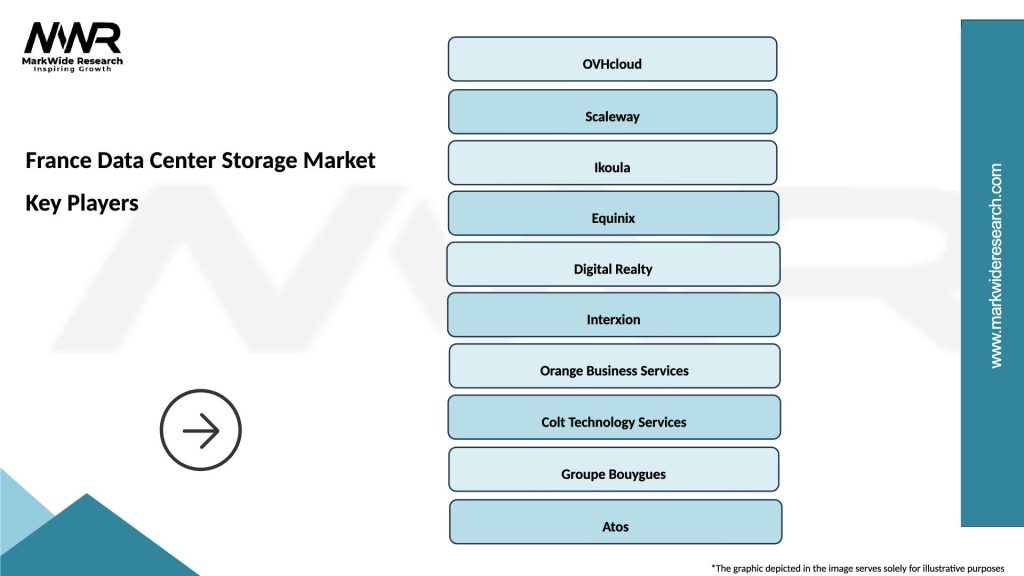

What are the key players in the France Data Center Storage Market?

Key players in the France Data Center Storage Market include companies like Dell Technologies, IBM, and NetApp, which provide a range of storage solutions and services tailored for data centers, among others.

What are the main drivers of growth in the France Data Center Storage Market?

The main drivers of growth in the France Data Center Storage Market include the increasing demand for data storage due to digital transformation, the rise of cloud computing, and the need for enhanced data security and compliance solutions.

What challenges does the France Data Center Storage Market face?

Challenges in the France Data Center Storage Market include the high costs associated with advanced storage technologies, the complexity of data management, and the need for continuous upgrades to keep pace with evolving data storage requirements.

What opportunities exist in the France Data Center Storage Market?

Opportunities in the France Data Center Storage Market include the growing adoption of hybrid cloud solutions, advancements in storage technologies like NVMe, and the increasing focus on sustainability and energy-efficient storage solutions.

What trends are shaping the France Data Center Storage Market?

Trends shaping the France Data Center Storage Market include the shift towards software-defined storage, the integration of artificial intelligence for data management, and the increasing importance of data privacy regulations influencing storage solutions.

France Data Center Storage Market

| Segmentation Details | Description |

|---|---|

| Product Type | Direct Attached Storage, Network Attached Storage, Storage Area Network, Cloud Storage |

| Deployment | On-Premises, Hybrid, Public Cloud, Private Cloud |

| End User | Telecommunications, BFSI, Government, Healthcare |

| Service Type | Managed Services, Professional Services, Consulting, Support Services |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the France Data Center Storage Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at