444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The car rental market in France is a thriving and competitive industry that caters to both domestic and international travelers. France, known for its picturesque landscapes, rich history, and vibrant cities, attracts millions of tourists each year, creating a high demand for car rental services. France offers a diverse range of rental options, from economy cars for budget-conscious travelers to luxury vehicles for those seeking a premium experience. The market is populated by both international car rental companies and local players, providing customers with a wide selection of vehicles and rental packages.

One of the key factors driving the growth of the car rental market in France is the country’s excellent transportation infrastructure. France boasts an extensive network of well-maintained roads, making it convenient for travelers to explore various regions at their own pace. Additionally, the presence of numerous airports and train stations across the country facilitates easy access to rental cars for both domestic and international tourists. Another contributing factor to the market’s growth is the increasing trend of independent travel. Many tourists prefer to explore France independently rather than joining organized tours. Renting a car provides them with the freedom and flexibility to visit off-the-beaten-path destinations and explore the countryside.

Meaning

The France car rental market refers to the industry involved in providing rental services for vehicles to individuals or businesses in France. It encompasses various types of vehicles, including cars, vans, SUVs, and luxury vehicles, which can be rented for short-term or long-term use. The car rental market in France is highly competitive and dynamic, with numerous players offering a wide range of services to cater to the diverse needs of customers.

Executive Summary

The France car rental market has witnessed significant growth in recent years, driven by factors such as increasing tourism, business travel, and the convenience offered by rental services. The market is characterized by intense competition, with both international and domestic players vying for market share. This analysis provides a comprehensive overview of the market, including key insights, market drivers, restraints, opportunities, and regional analysis. Additionally, it examines the competitive landscape, segmentation, category-wise insights, and the impact of the COVID-19 pandemic on the market.

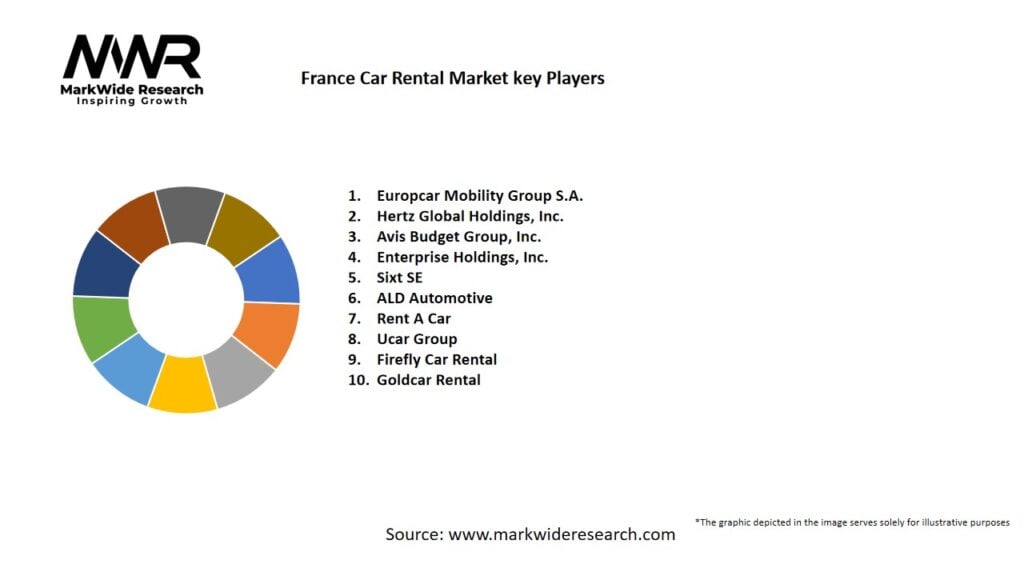

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The France car rental market operates in a dynamic environment influenced by various factors, including consumer preferences, technological advancements, and market trends. The market is highly competitive, with several domestic and international players striving to differentiate themselves through service quality, pricing strategies, and fleet diversity. Additionally, regulatory changes and emerging mobility trends significantly impact the market dynamics, requiring rental companies to adapt and innovate to stay ahead.

Regional Analysis

The car rental market in France exhibits regional variations in terms of demand, competition, and customer preferences. Major cities, such as Paris, Marseille, and Lyon, experience higher demand due to higher population densities, tourist influx, and business activities. Coastal regions, including the French Riviera and Normandy, attract tourists seeking leisure travel, resulting in increased demand for rental vehicles. Regional analysis helps rental companies understand specific market dynamics and tailor their strategies accordingly.

Competitive Landscape

Leading Companies in the France Car Rental Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

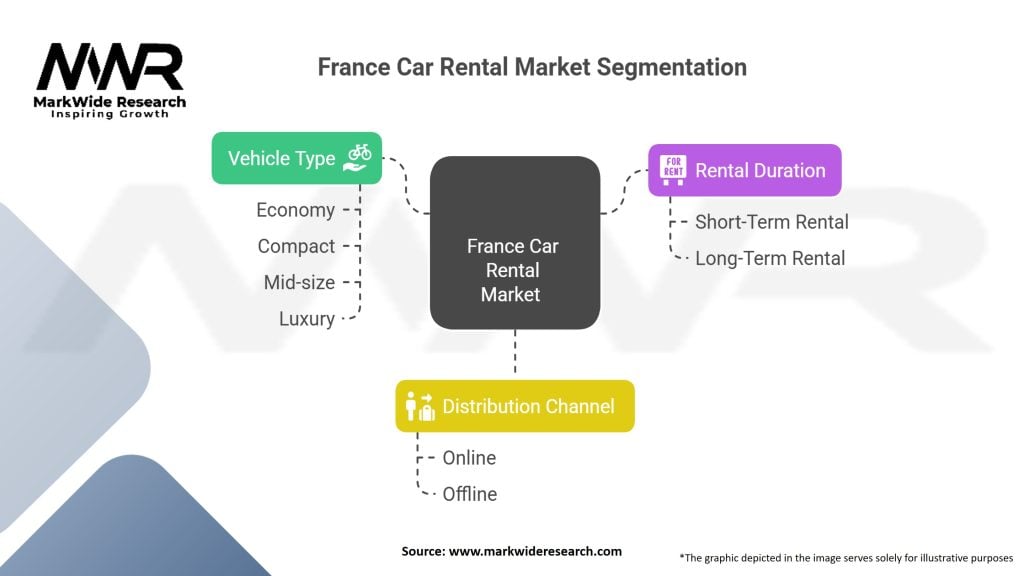

The car rental market in France can be segmented based on various factors, including vehicle type, rental duration, customer segment, and distribution channel.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic had a significant impact on the car rental industry in France. Travel restrictions, lockdowns, and reduced tourism activities led to a sharp decline in demand for rental vehicles. Rental companies faced challenges such as fleet management, revenue losses, and adapting to new health and safety protocols. However, as travel restrictions ease and vaccination rates increase, the market is gradually recovering. The emphasis on hygiene and sanitization measures, contactless transactions, and flexible cancellation policies has become crucial to restore customer confidence.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future of the car rental market in France looks promising, driven by factors such as the recovery of the tourism industry, increasing demand for flexible transportation options, and the adoption of sustainable practices. However, rental companies need to adapt to evolving customer expectations, emerging technologies, and regulatory changes. Expanding electric vehicle fleets, integrating smart technologies, and providing personalized experiences will be key strategies to stay competitive and capture a larger market share.

Conclusion

The France car rental market is a dynamic and competitive industry, shaped by factors such as tourism, business travel, and changing consumer preferences. The market offers a wide range of vehicle options, catering to diverse customer segments and preferences. Technological advancements, digitalization, and the integration of smart technologies have transformed the rental experience, improving operational efficiency and customer satisfaction. Despite challenges posed by the COVID-19 pandemic and emerging mobility trends, the market is poised for growth, with opportunities for expansion, sustainability, and collaboration. By adapting to market dynamics, focusing on customer needs, and embracing innovation, car rental companies can thrive in the evolving landscape of the France car rental market.

What is Car Rental?

Car rental refers to the service of renting automobiles for short periods, typically ranging from a few hours to a few weeks. This service is popular among travelers and businesses needing temporary transportation solutions.

What are the key players in the France Car Rental Market?

Key players in the France Car Rental Market include companies like Europcar, Sixt, and Hertz, which offer a range of vehicles for both leisure and business purposes. These companies compete on factors such as pricing, vehicle availability, and customer service, among others.

What are the growth factors driving the France Car Rental Market?

The France Car Rental Market is driven by factors such as the increasing number of tourists, the rise in business travel, and the growing trend of car-sharing services. Additionally, urbanization and the need for flexible transportation options contribute to market growth.

What challenges does the France Car Rental Market face?

Challenges in the France Car Rental Market include regulatory hurdles, fluctuating fuel prices, and competition from ride-sharing services. These factors can impact profitability and operational efficiency for rental companies.

What opportunities exist in the France Car Rental Market?

Opportunities in the France Car Rental Market include the expansion of electric vehicle rentals and the integration of technology for improved customer experiences. Additionally, partnerships with travel agencies and hotels can enhance service offerings.

What trends are shaping the France Car Rental Market?

Trends in the France Car Rental Market include the increasing adoption of digital platforms for booking and managing rentals, a shift towards sustainable vehicle options, and the growth of subscription-based rental services. These trends reflect changing consumer preferences and technological advancements.

France Car Rental Market Segmentation:

| Segment | Segmentation Details |

|---|---|

| Vehicle Type | Economy, Compact, Mid-size, Luxury, Others |

| Rental Duration | Short-Term Rental, Long-Term Rental |

| Distribution Channel | Online, Offline (Airports, Others) |

| Region | France |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the France Car Rental Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at