444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The France car insurance market represents one of Europe’s most mature and regulated automotive insurance sectors, characterized by comprehensive coverage requirements and sophisticated risk assessment mechanisms. French automotive insurance operates under a mandatory framework where all vehicle owners must maintain minimum liability coverage, creating a stable foundation for market growth and innovation.

Market dynamics in France reflect a highly competitive landscape with both traditional insurers and emerging digital-first providers vying for market share. The sector demonstrates remarkable resilience with consistent growth rates of approximately 3.2% annually, driven by increasing vehicle registrations and evolving consumer preferences toward comprehensive coverage options.

Regulatory compliance remains a cornerstone of the French car insurance market, with strict adherence to European Union directives and national legislation governing coverage requirements, claims processing, and consumer protection. The market benefits from advanced telematics integration, with over 28% of policies now incorporating usage-based insurance elements that provide personalized pricing based on driving behavior and vehicle utilization patterns.

Digital transformation continues to reshape the competitive landscape, as traditional insurers invest heavily in online platforms and mobile applications to meet changing consumer expectations. The market shows strong adoption of artificial intelligence and machine learning technologies for risk assessment, fraud detection, and customer service optimization, positioning France as a leader in insurance technology innovation within the European market.

The France car insurance market refers to the comprehensive ecosystem of insurance products, services, and regulatory frameworks designed to provide financial protection for vehicle owners against risks associated with automobile ownership and operation. This market encompasses mandatory third-party liability coverage, optional comprehensive and collision insurance, and specialized products tailored to diverse consumer needs and vehicle types.

Car insurance in France operates within a structured regulatory environment that mandates minimum coverage levels while allowing consumers to enhance protection through additional coverage options. The market includes traditional insurance companies, mutual insurers, bancassurance providers, and emerging insurtech companies that leverage technology to deliver innovative insurance solutions.

Market participants range from established multinational insurance groups to specialized automotive insurance providers, each competing on factors including pricing, coverage options, customer service quality, and digital capabilities. The French car insurance market serves millions of policyholders across diverse demographic segments, from young drivers seeking affordable basic coverage to affluent consumers requiring comprehensive protection for luxury vehicles.

France’s car insurance market demonstrates exceptional stability and growth potential, supported by mandatory insurance requirements and a sophisticated regulatory framework that ensures consumer protection while fostering healthy competition among providers. The market benefits from high vehicle ownership rates and strong economic fundamentals that support sustained demand for automotive insurance products.

Key market drivers include increasing vehicle registrations, growing awareness of comprehensive coverage benefits, and rising adoption of telematics-based insurance products that offer personalized pricing and enhanced risk management capabilities. Digital transformation initiatives have accelerated significantly, with 42% of consumers now preferring online insurance purchasing and management platforms over traditional channels.

Competitive dynamics reflect a balanced market structure where established insurers maintain strong market positions while innovative newcomers introduce disruptive technologies and customer-centric service models. The market shows particular strength in premium segments, where consumers increasingly value comprehensive coverage, additional services, and personalized insurance solutions tailored to individual risk profiles and preferences.

Future prospects remain highly favorable, with projected growth driven by electric vehicle adoption, autonomous driving technology integration, and evolving mobility patterns that create new insurance needs and opportunities for product innovation and market expansion.

Strategic market insights reveal several critical trends shaping the France car insurance landscape, providing valuable intelligence for industry participants and stakeholders seeking to understand market dynamics and competitive positioning opportunities.

Primary market drivers propelling growth in the France car insurance market reflect both regulatory requirements and evolving consumer preferences that create sustained demand for innovative insurance products and services.

Mandatory insurance requirements establish a fundamental driver for market stability, as French law requires all vehicle owners to maintain minimum third-party liability coverage. This regulatory framework ensures consistent market demand while providing a foundation for insurers to build comprehensive product portfolios that address diverse consumer needs and risk profiles.

Vehicle registration growth continues driving market expansion, supported by economic recovery, consumer confidence, and evolving mobility preferences that favor personal vehicle ownership. New vehicle sales and used car market activity contribute to expanding the insurable vehicle population, creating opportunities for insurers to acquire new customers and grow premium volumes.

Technology adoption serves as a significant growth catalyst, with consumers increasingly embracing telematics-based insurance products that offer personalized pricing, enhanced safety features, and improved risk management capabilities. Digital transformation initiatives enable insurers to deliver superior customer experiences while optimizing operational efficiency and competitive positioning.

Risk awareness among consumers drives demand for comprehensive coverage options beyond mandatory minimums, as vehicle owners recognize the financial benefits of protecting their investments against theft, damage, and other covered perils. This trend particularly benefits premium insurance segments where consumers seek enhanced protection and value-added services.

Market restraints in the France car insurance sector present challenges that insurers must navigate while maintaining profitability and competitive positioning in an increasingly complex operating environment.

Regulatory complexity creates compliance burdens that require significant investment in legal expertise, system modifications, and ongoing monitoring to ensure adherence to evolving requirements. These regulatory obligations can limit operational flexibility and increase administrative costs, particularly for smaller insurers with limited resources.

Price competition intensifies pressure on profit margins as insurers compete aggressively for market share through pricing strategies that may compromise long-term profitability. This competitive dynamic particularly affects commodity insurance segments where differentiation opportunities are limited and consumers primarily focus on premium costs.

Claims inflation presents ongoing challenges as repair costs, medical expenses, and legal settlements continue rising faster than premium increases. Modern vehicle complexity, advanced safety systems, and specialized repair requirements contribute to higher average claim costs that pressure underwriting results and profitability metrics.

Fraud concerns require substantial investment in detection technologies, investigation capabilities, and legal proceedings to combat fraudulent claims that increase costs for all market participants. Sophisticated fraud schemes targeting insurance companies necessitate continuous enhancement of prevention and detection systems.

Economic uncertainty can impact consumer spending patterns, vehicle purchases, and insurance buying decisions, creating potential volatility in market demand and premium collection rates during challenging economic periods.

Significant market opportunities emerge from technological advancement, changing consumer behaviors, and evolving mobility patterns that create new avenues for growth and innovation in the France car insurance market.

Electric vehicle adoption presents substantial opportunities for insurers to develop specialized coverage products tailored to electric vehicle characteristics, including battery protection, charging infrastructure coverage, and unique risk profiles associated with electric mobility. This growing segment offers potential for premium pricing and differentiated service offerings.

Autonomous driving technology integration creates opportunities for innovative insurance products that address liability shifts, technology failures, and new risk categories associated with semi-autonomous and fully autonomous vehicles. Early market entry in this emerging segment could provide competitive advantages and market leadership positions.

Mobility-as-a-Service trends open new markets for flexible insurance products that accommodate shared mobility, ride-sharing, and on-demand transportation services. These evolving mobility patterns require innovative coverage solutions that traditional insurance products may not adequately address.

Data analytics capabilities enable insurers to develop more sophisticated risk assessment models, personalized pricing strategies, and predictive maintenance services that add value for customers while improving underwriting profitability. Advanced analytics can also enhance fraud detection and claims processing efficiency.

Partnership opportunities with automotive manufacturers, technology companies, and mobility service providers create potential for integrated offerings, expanded distribution channels, and enhanced customer value propositions that differentiate insurers in competitive markets.

Market dynamics in the France car insurance sector reflect complex interactions between regulatory requirements, competitive pressures, technological innovation, and evolving consumer expectations that shape industry evolution and strategic positioning.

Competitive intensity continues escalating as traditional insurers face challenges from digital-native companies that leverage technology advantages to offer streamlined customer experiences and competitive pricing models. This dynamic forces established players to accelerate digital transformation initiatives while maintaining service quality and regulatory compliance.

Customer expectations evolve rapidly toward digital-first experiences, personalized products, and transparent pricing models that reflect individual risk profiles and usage patterns. Insurers must balance these expectations with profitability requirements and regulatory constraints while investing in technology capabilities and customer service enhancements.

Regulatory evolution creates both opportunities and challenges as authorities implement new requirements for data protection, consumer rights, and market transparency. Successful navigation of regulatory changes requires proactive compliance strategies and stakeholder engagement to influence policy development.

Technology disruption accelerates across multiple dimensions, including artificial intelligence, blockchain, Internet of Things, and mobile technologies that transform insurance operations, customer interactions, and product development processes. Insurers achieving 35% efficiency improvements through technology adoption gain significant competitive advantages in cost structure and service delivery capabilities.

Economic factors influence consumer behavior, vehicle ownership patterns, and insurance purchasing decisions, requiring insurers to maintain flexible strategies that can adapt to changing economic conditions while preserving market position and profitability objectives.

Comprehensive research methodology employed in analyzing the France car insurance market incorporates multiple data sources, analytical techniques, and validation processes to ensure accuracy, reliability, and actionable insights for industry stakeholders and decision-makers.

Primary research components include extensive surveys of insurance consumers, in-depth interviews with industry executives, and focus groups examining consumer preferences and behavior patterns. This primary data collection provides current market insights and validates secondary research findings through direct stakeholder input.

Secondary research encompasses analysis of regulatory filings, industry reports, financial statements, and market intelligence from authoritative sources including insurance associations, regulatory bodies, and industry publications. This comprehensive secondary research foundation ensures broad market coverage and historical context for trend analysis.

Quantitative analysis employs statistical modeling, trend analysis, and market sizing methodologies to identify growth patterns, market share dynamics, and competitive positioning metrics. Advanced analytical techniques provide robust foundations for market projections and strategic recommendations.

Qualitative assessment incorporates expert opinions, industry insights, and strategic analysis to interpret quantitative findings within broader market contexts. This qualitative dimension ensures research conclusions reflect practical market realities and strategic implications for industry participants.

Data validation processes include cross-referencing multiple sources, expert review panels, and sensitivity analysis to ensure research accuracy and reliability. Rigorous validation methodologies support confident decision-making based on research findings and recommendations.

Regional market analysis reveals significant variations in car insurance demand, competitive dynamics, and growth opportunities across different geographic areas within France, reflecting diverse economic conditions, demographic profiles, and regulatory implementations.

Île-de-France region dominates market activity with approximately 22% of national premium volume, driven by high vehicle density, affluent consumer demographics, and concentration of luxury vehicle ownership that supports premium insurance product demand. The region benefits from advanced digital infrastructure and tech-savvy consumers who readily adopt innovative insurance solutions.

Auvergne-Rhône-Alpes represents the second-largest regional market, accounting for roughly 15% market share, supported by strong economic fundamentals, growing population, and diverse industrial base that drives commercial vehicle insurance demand alongside personal auto coverage requirements.

Nouvelle-Aquitaine shows robust growth potential with expanding tourism industry, agricultural activities, and rural mobility needs that create demand for specialized insurance products addressing unique regional risk profiles and coverage requirements.

Provence-Alpes-Côte d’Azur demonstrates strong premium segment performance, benefiting from affluent demographics, luxury vehicle concentration, and seasonal population variations that influence insurance demand patterns and product preferences.

Rural regions collectively represent significant market opportunities for insurers developing products tailored to agricultural vehicles, lower-density driving patterns, and cost-conscious consumers seeking basic coverage options with competitive pricing structures.

Competitive landscape in the France car insurance market features a diverse mix of established multinational insurers, domestic market leaders, and innovative technology-driven companies that compete across multiple dimensions including pricing, coverage options, and customer service quality.

Market competition intensifies through digital innovation, with leading insurers investing heavily in mobile applications, artificial intelligence, and automated claims processing to enhance customer experiences and operational efficiency while maintaining competitive pricing structures.

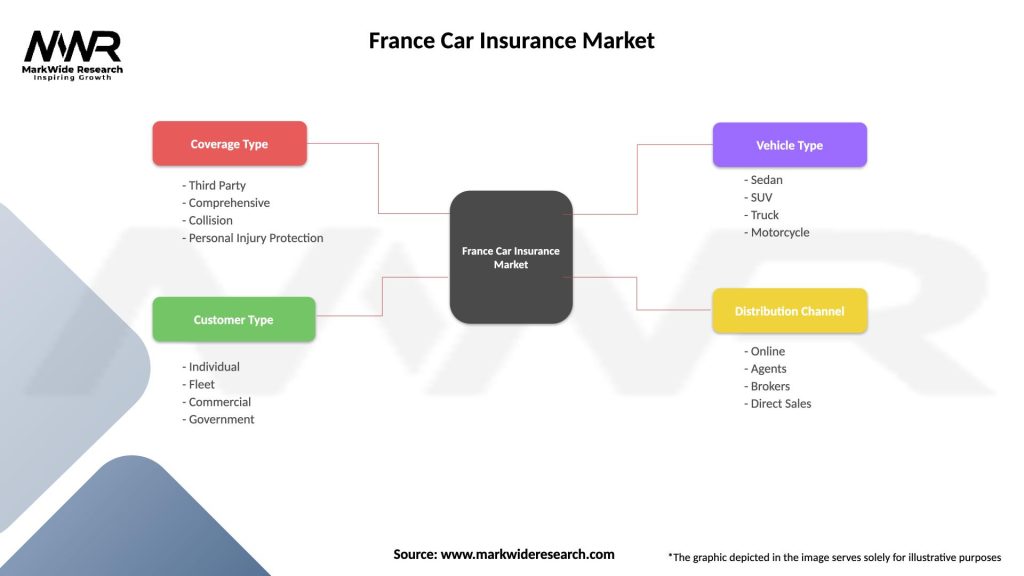

Market segmentation in the France car insurance sector reflects diverse customer needs, vehicle types, and coverage preferences that create distinct market segments with unique characteristics and growth opportunities.

By Coverage Type:

By Vehicle Type:

By Distribution Channel:

Category-wise analysis provides detailed insights into specific market segments, revealing unique dynamics, growth patterns, and strategic opportunities within the France car insurance market ecosystem.

Premium Insurance Category: This segment demonstrates exceptional growth potential with affluent consumers increasingly seeking comprehensive coverage, additional services, and personalized insurance solutions. Premium customers show strong loyalty and willingness to pay higher premiums for superior coverage and service quality, creating attractive profit margins for insurers.

Young Driver Segment: Represents both challenges and opportunities, with higher risk profiles offset by technology adoption and willingness to embrace telematics-based insurance products. Insurers developing specialized products for young drivers achieve 12% higher retention rates through innovative pricing models and digital engagement strategies.

Fleet Insurance Category: Commercial fleet segment shows steady growth driven by e-commerce expansion, delivery services, and business mobility needs. Fleet customers value comprehensive risk management services, competitive pricing, and efficient claims handling that minimize business disruption.

Electric Vehicle Insurance: Emerging category with significant growth potential as electric vehicle adoption accelerates. Specialized coverage requirements create opportunities for premium pricing and differentiated service offerings that address unique risks and customer needs in this expanding segment.

Usage-Based Insurance: Technology-driven category leveraging telematics data to provide personalized pricing and risk assessment. This segment appeals to safety-conscious drivers and offers insurers improved risk selection and pricing accuracy that enhances underwriting profitability.

Industry participants and stakeholders in the France car insurance market realize substantial benefits through strategic positioning, operational excellence, and customer-focused service delivery that create sustainable competitive advantages.

Insurance Companies benefit from stable regulatory environment, mandatory coverage requirements, and growing vehicle population that provide predictable revenue streams and expansion opportunities. Advanced technology adoption enables operational efficiency improvements, enhanced customer experiences, and improved risk management capabilities that support profitability objectives.

Consumers gain access to diverse coverage options, competitive pricing, and innovative services that provide financial protection and peace of mind. Digital transformation initiatives deliver convenient purchasing experiences, transparent pricing, and efficient claims processing that enhance overall customer satisfaction and value realization.

Automotive Industry benefits from insurance partnerships that facilitate vehicle sales, provide integrated service offerings, and support customer financing options. Collaboration between insurers and manufacturers creates opportunities for data sharing, risk assessment improvements, and innovative product development.

Technology Providers find substantial opportunities in supporting digital transformation initiatives, telematics solutions, and artificial intelligence applications that enhance insurance operations and customer experiences. The growing demand for insurance technology creates expanding markets for specialized service providers.

Regulatory Authorities achieve consumer protection objectives through market oversight, compliance monitoring, and policy development that ensures fair practices and market stability while fostering healthy competition and innovation.

Economic Development benefits from insurance market stability that supports vehicle ownership, business operations, and economic activity through risk mitigation and financial protection services that enable commerce and mobility.

Strengths:

Weaknesses:

Opportunities:

Threats:

Key market trends shaping the France car insurance landscape reflect technological advancement, changing consumer behaviors, and evolving regulatory requirements that create both opportunities and challenges for industry participants.

Digital-First Customer Experience emerges as a dominant trend with consumers increasingly expecting seamless online interactions, mobile-optimized services, and self-service capabilities. Insurers investing in digital platforms achieve 25% higher customer satisfaction scores and improved retention rates through enhanced user experiences and convenient service delivery.

Personalized Insurance Products gain traction as consumers seek coverage tailored to individual needs, driving behaviors, and risk profiles. Advanced data analytics enable insurers to develop customized products that better align with customer requirements while improving risk assessment accuracy and pricing precision.

Sustainability Focus influences consumer preferences and corporate strategies, with growing demand for environmentally responsible insurance options, carbon-neutral operations, and support for electric vehicle adoption. Green insurance initiatives create differentiation opportunities and appeal to environmentally conscious consumers.

Artificial Intelligence Integration transforms insurance operations through automated underwriting, intelligent claims processing, and predictive analytics that enhance efficiency and decision-making capabilities. AI applications enable insurers to process claims faster, detect fraud more effectively, and provide personalized customer service.

Partnership Ecosystems develop as insurers collaborate with automotive manufacturers, technology companies, and mobility service providers to create integrated offerings and expanded value propositions that address evolving customer needs and market opportunities.

Recent industry developments in the France car insurance market demonstrate accelerating innovation, strategic partnerships, and regulatory evolution that reshape competitive dynamics and market opportunities.

Technology Integration Initiatives have accelerated significantly, with major insurers launching comprehensive digital transformation programs that modernize customer interfaces, streamline operations, and enhance data analytics capabilities. These initiatives focus on improving customer experiences while reducing operational costs and enhancing competitive positioning.

Telematics Expansion continues gaining momentum as insurers deploy sophisticated usage-based insurance programs that leverage real-time driving data to provide personalized pricing and risk assessment. Advanced telematics solutions now monitor multiple risk factors including driving behavior, vehicle condition, and environmental conditions.

Regulatory Updates include enhanced consumer protection measures, data privacy requirements, and market transparency initiatives that influence insurance operations and customer relationships. Recent regulatory developments focus on ensuring fair pricing practices and protecting consumer rights in digital insurance transactions.

Strategic Acquisitions and partnerships reshape market structure as established insurers acquire technology companies, form alliances with automotive manufacturers, and develop integrated service offerings that address evolving mobility needs and customer expectations.

Product Innovation accelerates with introduction of specialized coverage for electric vehicles, autonomous driving features, and shared mobility services that address emerging risks and market opportunities in the evolving automotive landscape.

Strategic recommendations for France car insurance market participants focus on leveraging technology advantages, enhancing customer experiences, and positioning for future market evolution while maintaining operational excellence and profitability objectives.

Digital Transformation Priority: Insurers should accelerate digital transformation initiatives with particular emphasis on mobile-first customer experiences, artificial intelligence integration, and automated service delivery. Companies achieving comprehensive digital capabilities gain significant competitive advantages in customer acquisition and retention while reducing operational costs.

Data Analytics Investment: Enhanced data analytics capabilities enable superior risk assessment, personalized pricing, and predictive modeling that improve underwriting results and customer satisfaction. MarkWide Research analysis indicates that insurers with advanced analytics capabilities achieve 15% better loss ratios compared to traditional approaches.

Partnership Strategy Development: Strategic partnerships with automotive manufacturers, technology providers, and mobility service companies create opportunities for integrated offerings, expanded distribution channels, and enhanced value propositions that differentiate insurers in competitive markets.

Electric Vehicle Specialization: Early investment in electric vehicle insurance expertise, specialized coverage products, and charging infrastructure partnerships positions insurers for leadership in this rapidly growing segment with premium pricing opportunities and customer loyalty benefits.

Customer Experience Focus: Continuous investment in customer experience improvements through streamlined processes, transparent communication, and personalized service delivery creates sustainable competitive advantages and supports premium pricing strategies in competitive markets.

Future market outlook for the France car insurance sector remains highly positive, supported by technological innovation, evolving mobility patterns, and regulatory stability that create sustainable growth opportunities and market expansion potential.

Growth projections indicate continued market expansion driven by vehicle population growth, increasing coverage awareness, and technology adoption that enhances insurance value propositions. The market is expected to maintain steady growth rates of approximately 4.1% annually over the next five years, supported by economic stability and consumer confidence.

Technology evolution will continue transforming insurance operations, customer interactions, and product development through artificial intelligence, blockchain applications, and Internet of Things integration. These technological advances enable insurers to deliver superior customer experiences while improving operational efficiency and risk management capabilities.

Electric vehicle adoption accelerates market transformation as consumers increasingly choose electric mobility options that require specialized insurance coverage and create new market segments. MWR projections suggest electric vehicle insurance could represent 20% of new policies by 2030, creating substantial growth opportunities for prepared insurers.

Autonomous driving integration will gradually reshape insurance requirements and liability frameworks, creating opportunities for innovative products that address technology-related risks and changing mobility patterns. Early preparation for autonomous vehicle insurance needs provides competitive advantages in emerging market segments.

Regulatory evolution continues supporting market development through consumer protection enhancements, digital transaction frameworks, and sustainability initiatives that align with broader European Union objectives and environmental goals.

The France car insurance market represents a dynamic and evolving sector characterized by strong fundamentals, technological innovation, and substantial growth opportunities that position it as a leading European insurance market. The combination of mandatory coverage requirements, sophisticated regulatory frameworks, and advanced digital infrastructure creates an attractive environment for both established insurers and innovative market entrants.

Market dynamics reflect healthy competition, continuous innovation, and evolving consumer preferences that drive product development and service enhancement across all market segments. The successful integration of technology, particularly telematics and artificial intelligence, demonstrates the market’s capacity for adaptation and improvement while maintaining stability and consumer protection.

Future prospects remain exceptionally favorable, with multiple growth drivers including electric vehicle adoption, autonomous driving technology, and evolving mobility patterns creating new opportunities for market expansion and product innovation. The market’s demonstrated resilience and adaptability position it well for continued success in an increasingly complex and technology-driven insurance landscape.

Strategic positioning for market success requires balanced investment in technology capabilities, customer experience enhancement, and regulatory compliance while maintaining operational excellence and profitability objectives. Companies that successfully navigate these requirements while anticipating future market evolution will achieve sustainable competitive advantages and market leadership positions in the France car insurance market.

What is Car Insurance?

Car insurance is a contract between a vehicle owner and an insurance company that provides financial protection against physical damage or bodily injury resulting from traffic collisions, theft, and other incidents. It typically covers liability, collision, and comprehensive damages.

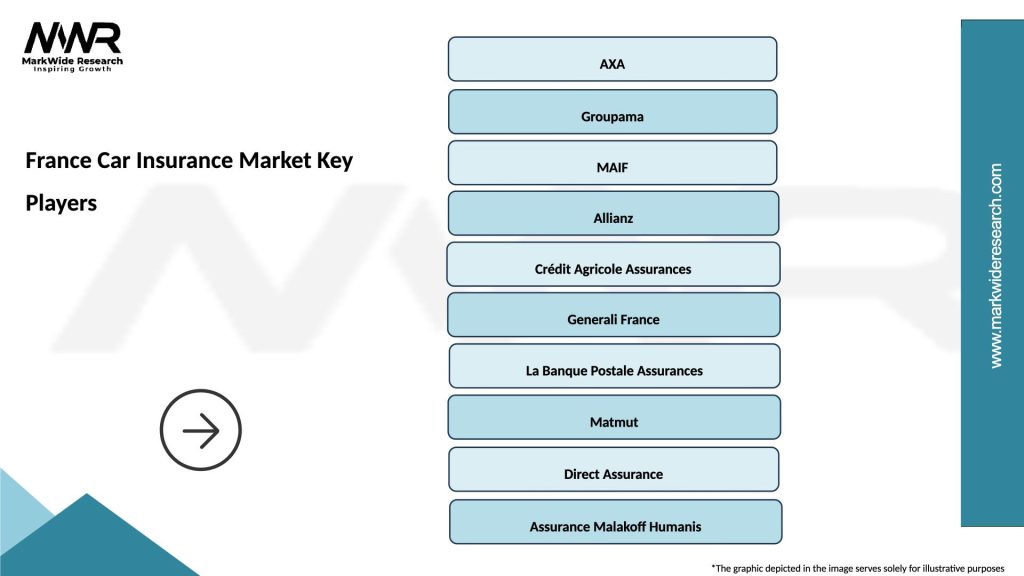

What are the key players in the France Car Insurance Market?

Key players in the France Car Insurance Market include AXA, Groupama, and Allianz, which offer a range of car insurance products tailored to different consumer needs. These companies compete on factors such as coverage options, pricing, and customer service, among others.

What are the growth factors driving the France Car Insurance Market?

The France Car Insurance Market is driven by factors such as the increasing number of vehicles on the road, rising awareness of the importance of insurance, and advancements in technology that enhance customer experience. Additionally, regulatory changes are also influencing market growth.

What challenges does the France Car Insurance Market face?

The France Car Insurance Market faces challenges such as rising claims costs due to more severe accidents and fraud, as well as increased competition leading to price wars. Additionally, changing consumer preferences towards digital solutions can pose a challenge for traditional insurers.

What opportunities exist in the France Car Insurance Market?

Opportunities in the France Car Insurance Market include the growing demand for telematics-based insurance products and the potential for expansion into underserved segments. Insurers can also leverage data analytics to better understand customer needs and tailor their offerings.

What trends are shaping the France Car Insurance Market?

Trends shaping the France Car Insurance Market include the rise of usage-based insurance models, increased adoption of digital platforms for policy management, and a focus on sustainability in insurance practices. These trends reflect changing consumer behaviors and technological advancements.

France Car Insurance Market

| Segmentation Details | Description |

|---|---|

| Coverage Type | Third Party, Comprehensive, Collision, Personal Injury Protection |

| Customer Type | Individual, Fleet, Commercial, Government |

| Vehicle Type | Sedan, SUV, Truck, Motorcycle |

| Distribution Channel | Online, Agents, Brokers, Direct Sales |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the France Car Insurance Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at