444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The France access control market represents a dynamic and rapidly evolving sector within the broader European security technology landscape. Access control systems in France encompass a comprehensive range of solutions designed to regulate and monitor entry to physical and digital spaces across various industries. The market demonstrates robust growth potential, driven by increasing security concerns, regulatory compliance requirements, and technological advancements in biometric authentication and smart card technologies.

French enterprises are increasingly adopting sophisticated access control solutions to protect sensitive assets, ensure employee safety, and comply with stringent data protection regulations. The market encompasses traditional mechanical locks, electronic access control systems, biometric authentication devices, and integrated security management platforms. Growth rates in the sector indicate a healthy 8.2% CAGR trajectory, reflecting strong demand across commercial, industrial, and residential segments.

Technological innovation continues to reshape the French access control landscape, with cloud-based solutions, mobile credentials, and artificial intelligence integration driving market expansion. The convergence of physical and logical security systems creates new opportunities for comprehensive security management, positioning France as a key market for advanced access control technologies in Europe.

The France access control market refers to the comprehensive ecosystem of security technologies, systems, and services designed to regulate, monitor, and manage access to physical facilities, digital resources, and restricted areas within French territory. This market encompasses hardware components such as card readers, biometric scanners, electronic locks, and control panels, alongside software platforms for user management, access monitoring, and security analytics.

Access control solutions in France serve multiple functions including identity verification, authorization management, audit trail generation, and integration with broader security infrastructure. The market includes both standalone systems for individual facilities and enterprise-wide platforms that manage access across multiple locations, providing centralized control and comprehensive security oversight.

Modern access control systems in France incorporate advanced technologies such as facial recognition, fingerprint scanning, proximity cards, mobile credentials, and cloud-based management platforms. These solutions address diverse security requirements across sectors including corporate offices, manufacturing facilities, healthcare institutions, educational establishments, and government buildings.

Market dynamics in the France access control sector reflect a mature yet rapidly evolving landscape characterized by technological innovation and increasing security awareness. The market benefits from strong regulatory frameworks, robust economic conditions, and widespread adoption of digital transformation initiatives across French enterprises. Key growth drivers include rising security threats, compliance requirements, and the integration of Internet of Things (IoT) technologies.

Competitive positioning within the French market shows a mix of international technology leaders and specialized local providers offering tailored solutions for specific industry verticals. The market demonstrates particular strength in biometric authentication technologies, with fingerprint recognition accounting for approximately 35% market share among biometric modalities. Cloud-based solutions are gaining significant traction, representing nearly 28% adoption rate among new installations.

Strategic opportunities emerge from the convergence of physical and cyber security, mobile credential adoption, and artificial intelligence integration. The market shows strong potential for growth in smart building applications, with integrated access control forming a cornerstone of comprehensive building management systems across French commercial real estate.

Primary market insights reveal several critical trends shaping the France access control landscape:

Security threat escalation represents the primary driver for access control market growth in France. Increasing incidents of unauthorized access, corporate espionage, and physical security breaches compel organizations to invest in sophisticated access control solutions. Terrorism concerns and heightened security awareness following various security incidents have elevated the importance of robust access control systems across critical infrastructure and public facilities.

Regulatory compliance requirements significantly influence market demand, particularly in sectors such as healthcare, finance, and government. French data protection laws, combined with European GDPR regulations, mandate strict access controls for sensitive information and facilities. Industry-specific regulations in pharmaceuticals, defense, and financial services drive adoption of advanced authentication and monitoring capabilities.

Digital transformation initiatives across French enterprises create substantial opportunities for integrated access control solutions. Organizations seeking to modernize their security infrastructure increasingly prefer systems that offer remote management, real-time monitoring, and integration with existing IT systems. Smart building trends further accelerate demand for access control systems that integrate with building automation, energy management, and occupancy monitoring platforms.

Technological advancement in biometric authentication, mobile credentials, and artificial intelligence continues to drive market innovation and adoption. The availability of more accurate, faster, and cost-effective biometric technologies makes advanced authentication accessible to a broader range of organizations and applications.

High implementation costs present significant barriers for small and medium-sized enterprises considering advanced access control solutions. The total cost of ownership, including hardware, software, installation, training, and ongoing maintenance, can be substantial, particularly for comprehensive enterprise-wide deployments. Budget constraints often force organizations to compromise on system capabilities or delay implementation timelines.

Privacy concerns surrounding biometric data collection and storage create resistance among some user groups and organizations. French privacy regulations require careful handling of biometric information, adding complexity and cost to system implementation. Data protection compliance requirements may limit the deployment of certain biometric technologies or require additional security measures that increase system complexity.

Technical complexity associated with integrating access control systems with existing security infrastructure and IT systems can create implementation challenges. Organizations may lack the internal expertise required for successful deployment and ongoing management of sophisticated access control platforms. Interoperability issues between different vendor systems can complicate integration efforts and limit system effectiveness.

Cybersecurity vulnerabilities in connected access control systems create potential risks that concern security-conscious organizations. The increasing connectivity of access control systems exposes them to cyber threats, requiring ongoing security updates and monitoring that add to operational complexity and costs.

Smart city initiatives across French municipalities present substantial opportunities for access control technology providers. Government investments in digital infrastructure, public safety systems, and citizen services create demand for integrated access control solutions in public facilities, transportation systems, and government buildings. Public-private partnerships in smart city development offer pathways for large-scale access control deployments.

Healthcare sector modernization drives significant demand for specialized access control solutions that address unique requirements for patient privacy, medication security, and staff safety. The integration of access control with patient management systems and medical device security creates opportunities for comprehensive healthcare security platforms. Telemedicine expansion and remote healthcare services require robust authentication and access control for digital health platforms.

Industrial automation and Industry 4.0 initiatives in French manufacturing create opportunities for access control systems that integrate with production management, safety systems, and quality control platforms. Smart factory implementations require sophisticated access control for both physical facilities and digital manufacturing systems, creating demand for integrated security solutions.

Retail transformation and omnichannel commerce strategies drive demand for access control solutions that support flexible retail operations, staff management, and customer experience enhancement. Contactless retail technologies and automated store concepts require advanced access control integration with point-of-sale systems and inventory management platforms.

Competitive dynamics in the France access control market reflect a balance between established international players and innovative local solution providers. Market consolidation trends see larger security companies acquiring specialized access control providers to expand their solution portfolios and market reach. This consolidation creates opportunities for comprehensive security platforms while potentially reducing competitive pricing pressure.

Technology convergence between physical and logical security systems reshapes market dynamics, with traditional access control vendors expanding into cybersecurity and IT security domains. Integration capabilities become increasingly important competitive differentiators, as customers seek unified security management platforms rather than standalone access control systems.

Channel dynamics show evolution from traditional security integrator relationships toward direct sales models and cloud-based service delivery. Subscription-based pricing models gain traction, particularly for cloud-hosted access control solutions, changing the traditional capital expenditure approach to operational expenditure models that improve accessibility for smaller organizations.

Innovation cycles accelerate as artificial intelligence, machine learning, and IoT technologies mature and become more accessible. MarkWide Research analysis indicates that technology refresh cycles are shortening, with organizations upgrading access control systems more frequently to incorporate new capabilities and maintain security effectiveness.

Primary research methodology for analyzing the France access control market encompasses comprehensive data collection through structured interviews with industry stakeholders, including technology vendors, system integrators, end-users, and regulatory authorities. Survey instruments capture quantitative data on market sizing, adoption rates, technology preferences, and purchasing behaviors across different industry verticals and organization sizes.

Secondary research incorporates analysis of industry reports, government publications, regulatory documents, and company financial statements to validate primary research findings and provide historical market context. Market intelligence gathering includes monitoring of patent filings, technology announcements, and competitive developments to identify emerging trends and innovation patterns.

Data validation processes involve triangulation of information sources, cross-verification of market data points, and validation of findings through expert consultations. Statistical analysis employs advanced modeling techniques to project market trends, segment growth patterns, and competitive dynamics. Quality assurance protocols ensure data accuracy and reliability throughout the research process.

Analytical framework combines quantitative market modeling with qualitative trend analysis to provide comprehensive market insights. Forecasting methodologies incorporate multiple scenarios and sensitivity analysis to account for market uncertainties and external factors that may influence market development trajectories.

Paris metropolitan region dominates the French access control market, accounting for approximately 42% market concentration due to the high density of corporate headquarters, government facilities, and financial institutions. The region demonstrates strong adoption of advanced biometric technologies and cloud-based access control solutions, driven by stringent security requirements and technology-forward organizational cultures.

Lyon and Marseille represent significant secondary markets, with growing industrial and commercial sectors driving demand for comprehensive access control solutions. Regional distribution shows Lyon capturing approximately 12% market share while Marseille accounts for roughly 8% market presence. These cities benefit from industrial automation initiatives and smart city development programs that incorporate advanced access control technologies.

Northern France industrial regions, including Lille and surrounding manufacturing centers, show strong demand for industrial-grade access control solutions integrated with production management systems. Manufacturing sector adoption rates in these regions exceed 65% penetration for electronic access control systems, reflecting the importance of security in industrial operations.

Southern France markets, including Nice, Toulouse, and Montpellier, demonstrate growing adoption driven by technology sector expansion and tourism industry security requirements. Tourism-related applications create unique demands for scalable access control solutions that can accommodate seasonal workforce variations and visitor management requirements.

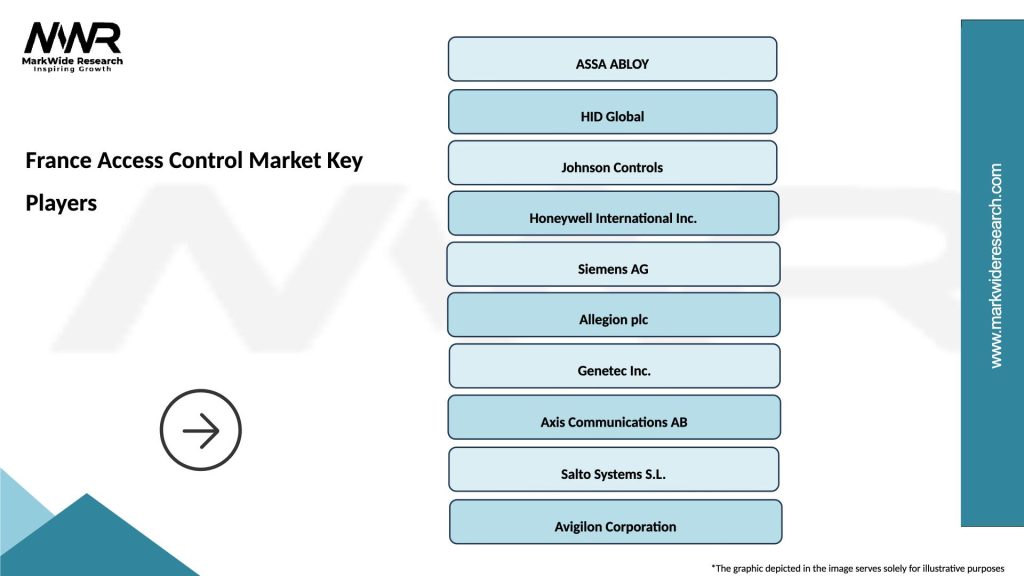

Market leadership in the France access control sector features a diverse ecosystem of international technology providers and specialized local companies:

Competitive strategies focus on technology innovation, integration capabilities, and vertical market specialization. Partnership ecosystems play crucial roles, with vendors collaborating with system integrators, consultants, and technology partners to deliver comprehensive solutions.

By Technology:

By Component:

By Application:

Biometric authentication represents the most dynamic category within the French access control market, with facial recognition technologies experiencing particularly rapid adoption. Accuracy improvements and cost reductions make biometric solutions accessible to broader market segments, while privacy regulations drive demand for systems with local processing capabilities and encrypted data storage.

Mobile credential systems demonstrate exceptional growth potential, particularly among younger workforce demographics and technology-forward organizations. Smartphone penetration rates exceeding 85% adoption among French professionals create favorable conditions for mobile access solutions. Integration with existing mobile device management platforms enhances appeal for enterprise deployments.

Cloud-based platforms gain significant traction among organizations seeking scalable, remotely manageable access control solutions. Software-as-a-Service models reduce upfront investment requirements and provide automatic updates, making advanced access control capabilities accessible to smaller organizations. Hybrid cloud deployments address data sovereignty concerns while providing cloud benefits.

Integrated security platforms combining access control with video surveillance, intrusion detection, and visitor management create comprehensive security ecosystems. Single-pane-of-glass management interfaces reduce operational complexity and improve security effectiveness through correlated event analysis and automated response capabilities.

Technology vendors benefit from expanding market opportunities driven by digital transformation initiatives and increasing security awareness. Innovation leadership in areas such as artificial intelligence, mobile credentials, and cloud platforms creates competitive advantages and premium pricing opportunities. Recurring revenue models through software subscriptions and managed services provide stable income streams and improved customer relationships.

System integrators gain value through specialization in vertical markets and comprehensive solution delivery capabilities. Certification programs and technical expertise development enable premium service pricing and long-term customer relationships. Managed services opportunities create ongoing revenue streams beyond initial installation projects.

End-user organizations achieve enhanced security, operational efficiency, and regulatory compliance through advanced access control implementations. Cost savings result from reduced security incidents, automated access management, and integration with existing systems. User experience improvements through mobile credentials and seamless authentication enhance employee satisfaction and productivity.

Facility managers benefit from centralized access control management, real-time monitoring capabilities, and integration with building management systems. Operational insights from access control analytics support space utilization optimization and security policy refinement. Emergency response capabilities improve through automated lockdown procedures and evacuation management features.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration emerges as a transformative trend, with AI-powered analytics enabling predictive security, behavioral analysis, and automated threat detection. Machine learning algorithms improve authentication accuracy while reducing false positives and enhancing user experience. Predictive maintenance capabilities help organizations optimize system performance and reduce operational costs.

Contactless authentication continues gaining momentum, driven by hygiene concerns and user convenience preferences. Proximity-based technologies and mobile credentials eliminate physical contact requirements while maintaining security effectiveness. Gesture recognition and voice authentication represent emerging contactless modalities with growing market interest.

Zero-trust security models influence access control system design, emphasizing continuous authentication and authorization rather than perimeter-based security. Dynamic access policies adapt to user behavior, location, and risk factors to provide appropriate access levels. Identity-centric security approaches integrate access control with broader identity and access management platforms.

Sustainability considerations increasingly influence purchasing decisions, with organizations seeking energy-efficient access control solutions and vendors with strong environmental credentials. Green building certifications often require energy-efficient security systems, driving demand for low-power access control technologies. Circular economy principles promote system designs that support upgrade and recycling rather than complete replacement.

Strategic partnerships between access control vendors and cloud platform providers accelerate market adoption of hosted solutions. Integration alliances with building automation, HR systems, and cybersecurity platforms create comprehensive solution ecosystems that address broader organizational needs. Technology licensing agreements enable rapid innovation diffusion and market expansion.

Regulatory developments in data protection and cybersecurity continue shaping market requirements and solution designs. Industry standards evolution promotes interoperability while addressing emerging security threats and technology capabilities. Certification programs for installers and integrators ensure quality deployment and ongoing system effectiveness.

Investment activities include venture capital funding for innovative startups developing next-generation access control technologies. Acquisition strategies by major security companies consolidate market capabilities and expand solution portfolios. Research and development investments focus on artificial intelligence, quantum-resistant encryption, and advanced biometric technologies.

Market expansion initiatives target underserved segments such as small businesses and residential applications through simplified solutions and flexible pricing models. Vertical market specialization creates tailored solutions for healthcare, education, retail, and other specific industry requirements. Geographic expansion strategies leverage successful French market approaches in other European markets.

Technology investment priorities should focus on artificial intelligence capabilities, mobile credential platforms, and cloud-native architectures to address evolving market demands. MWR recommends that vendors prioritize interoperability and integration capabilities to differentiate their solutions in an increasingly competitive market. Cybersecurity features must be embedded throughout solution architectures rather than added as afterthoughts.

Market entry strategies for new participants should emphasize vertical market specialization and partnership development rather than broad horizontal approaches. Channel development through system integrator relationships and managed service provider partnerships provides scalable market access. Pricing innovation through subscription models and outcome-based pricing can improve market accessibility and customer value perception.

Customer engagement approaches should emphasize total cost of ownership, security effectiveness, and operational benefits rather than purely technical specifications. Proof-of-concept programs and pilot deployments help customers evaluate solutions while reducing implementation risks. Training and support services become critical differentiators in complex technology deployments.

Innovation focus areas include privacy-preserving biometric technologies, quantum-resistant security protocols, and seamless integration with emerging technologies such as augmented reality and Internet of Things platforms. Sustainability initiatives should address both product lifecycle environmental impact and operational energy efficiency to meet evolving customer requirements.

Market trajectory for the France access control sector indicates sustained growth driven by technological innovation, regulatory requirements, and evolving security threats. Digital transformation acceleration across French organizations creates expanding opportunities for integrated access control solutions that support broader business objectives beyond basic security.

Technology evolution will likely emphasize artificial intelligence integration, with predictive analytics and automated threat response becoming standard capabilities rather than premium features. Biometric technology advancement may achieve 95% accuracy rates across diverse user populations while addressing privacy concerns through local processing and encrypted storage.

Market consolidation trends may continue as larger security companies acquire specialized access control providers to build comprehensive solution portfolios. Platform approaches combining physical and logical security management will likely dominate enterprise market segments, while simplified solutions address small business and residential markets.

Regulatory influence will probably intensify as cybersecurity requirements extend to physical access control systems and data protection regulations evolve to address emerging technologies. Standardization efforts may improve interoperability while addressing security and privacy concerns. MarkWide Research projects that cloud-based solutions could achieve 60% market penetration within the next five years, fundamentally changing solution delivery and management models.

The France access control market represents a dynamic and evolving sector with substantial growth potential driven by technological innovation, regulatory requirements, and increasing security awareness. Market fundamentals remain strong, supported by robust economic conditions, mature infrastructure, and widespread digital transformation initiatives across French organizations.

Competitive dynamics favor companies that can deliver integrated solutions combining advanced technology with comprehensive service capabilities. Success factors include artificial intelligence integration, mobile credential support, cloud-native architectures, and strong cybersecurity features. Vertical market specialization and partnership ecosystem development provide pathways for sustainable competitive advantage.

Future market development will likely emphasize seamless user experiences, predictive security capabilities, and integration with broader digital business platforms. Organizations that can navigate regulatory requirements while delivering innovative, cost-effective solutions will be best positioned to capitalize on expanding market opportunities in the French access control sector.

What is Access Control?

Access control refers to the security technique that regulates who or what can view or use resources in a computing environment. It is essential in various applications, including physical security systems, IT security, and identity management.

What are the key players in the France Access Control Market?

Key players in the France Access Control Market include ASSA ABLOY, Johnson Controls, and Honeywell, among others. These companies provide a range of access control solutions, including electronic locks, biometric systems, and integrated security management systems.

What are the main drivers of growth in the France Access Control Market?

The growth of the France Access Control Market is driven by increasing security concerns, the rise in smart building technologies, and the demand for advanced authentication methods. Additionally, regulatory requirements for security compliance are also contributing to market expansion.

What challenges does the France Access Control Market face?

The France Access Control Market faces challenges such as high installation costs, the complexity of integrating new systems with existing infrastructure, and concerns over data privacy. These factors can hinder the adoption of advanced access control solutions.

What opportunities exist in the France Access Control Market?

Opportunities in the France Access Control Market include the growing trend of IoT integration, advancements in biometric technologies, and the increasing need for remote access solutions. These trends are expected to create new avenues for innovation and growth.

What trends are shaping the France Access Control Market?

Trends shaping the France Access Control Market include the shift towards cloud-based access control systems, the adoption of mobile access solutions, and the increasing use of AI for enhanced security features. These innovations are transforming how access control is implemented across various sectors.

France Access Control Market

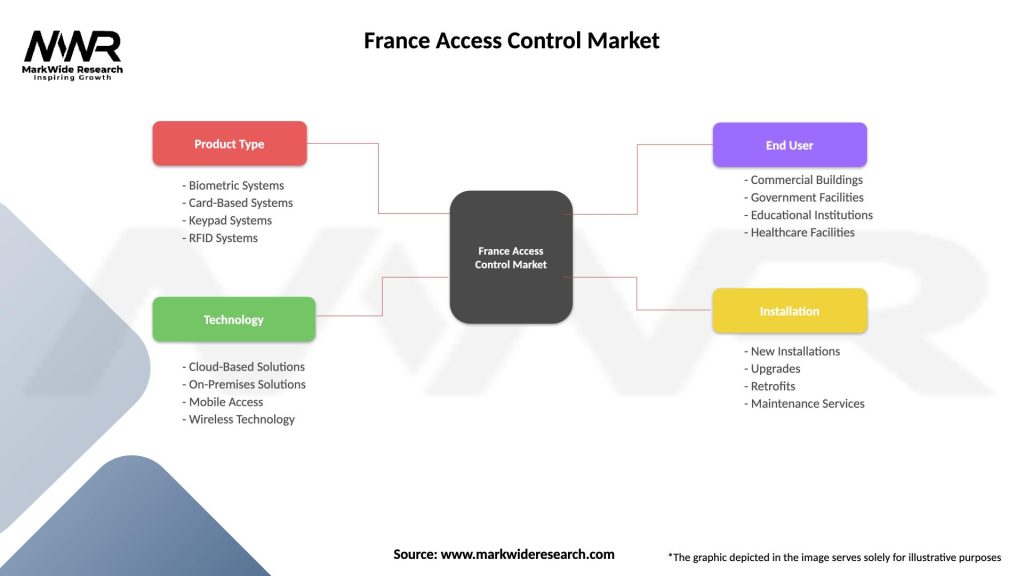

| Segmentation Details | Description |

|---|---|

| Product Type | Biometric Systems, Card-Based Systems, Keypad Systems, RFID Systems |

| Technology | Cloud-Based Solutions, On-Premises Solutions, Mobile Access, Wireless Technology |

| End User | Commercial Buildings, Government Facilities, Educational Institutions, Healthcare Facilities |

| Installation | New Installations, Upgrades, Retrofits, Maintenance Services |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the France Access Control Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at