444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The food trays and bowls market represents a dynamic segment within the global food packaging and foodservice industry, encompassing disposable and reusable serving solutions across multiple sectors. This market has experienced remarkable transformation driven by evolving consumer preferences, sustainability concerns, and the rapid expansion of food delivery services. Market growth has accelerated significantly, with the industry demonstrating a robust CAGR of 6.2% over recent years, reflecting increasing demand from restaurants, catering services, and retail establishments.

Consumer behavior shifts toward convenience dining and takeaway services have fundamentally reshaped market dynamics, creating substantial opportunities for manufacturers specializing in innovative food tray and bowl solutions. The market encompasses various materials including plastic, paper, foam, aluminum, and biodegradable alternatives, each serving specific applications across foodservice, retail, and institutional segments. Sustainability initiatives have emerged as a primary driver, with approximately 78% of consumers expressing preference for eco-friendly packaging options.

Regional variations in market development reflect diverse regulatory environments, cultural dining preferences, and economic conditions. North America and Europe maintain significant market shares due to established foodservice industries and stringent packaging regulations, while Asia-Pacific demonstrates the highest growth potential driven by urbanization and expanding food delivery networks. Technological advancements in manufacturing processes have enabled production of lightweight, durable, and cost-effective solutions that meet evolving industry requirements.

The food trays and bowls market refers to the comprehensive industry segment focused on manufacturing, distributing, and supplying serving containers designed for food presentation, storage, and transportation across various commercial and institutional applications. These products encompass disposable and reusable solutions crafted from diverse materials to meet specific functional requirements including temperature resistance, moisture barrier properties, and structural integrity.

Market scope includes traditional serving trays used in cafeterias and restaurants, specialized bowls for specific cuisines, compartmentalized trays for portion control, and innovative designs incorporating sustainable materials. The industry serves multiple end-user segments including quick-service restaurants, full-service dining establishments, catering companies, healthcare facilities, educational institutions, and retail food outlets. Product categories range from basic foam containers to premium biodegradable alternatives featuring advanced barrier coatings and temperature-resistant properties.

Market dynamics within the food trays and bowls industry reflect a complex interplay of consumer preferences, regulatory pressures, and technological innovations driving sustained growth across global markets. The industry has demonstrated remarkable resilience and adaptability, particularly during periods of economic uncertainty and changing dining patterns. Key growth drivers include the expansion of food delivery services, increasing demand for convenient dining solutions, and growing emphasis on sustainable packaging alternatives.

Competitive landscape features a diverse mix of established manufacturers, regional suppliers, and innovative startups developing specialized solutions for niche applications. Market leaders have invested significantly in research and development to create products that balance functionality, cost-effectiveness, and environmental responsibility. Innovation trends focus on biodegradable materials, improved barrier properties, and designs optimized for specific food types and serving applications.

Regional market distribution shows North America accounting for approximately 35% market share, followed by Europe at 28%, and Asia-Pacific representing 25% with the highest growth trajectory. Future projections indicate continued expansion driven by urbanization, changing lifestyle patterns, and increasing adoption of sustainable packaging solutions across all major geographic markets.

Strategic market insights reveal several critical trends shaping the food trays and bowls industry landscape. The following key observations provide comprehensive understanding of market dynamics:

Primary market drivers propelling growth in the food trays and bowls industry encompass multiple interconnected factors that create sustained demand across various application segments. The rapid expansion of food delivery and takeaway services represents the most significant growth catalyst, with online food ordering platforms experiencing unprecedented growth rates and creating substantial demand for specialized packaging solutions.

Consumer lifestyle changes toward convenience-oriented dining patterns have fundamentally altered market dynamics, with busy urban populations increasingly relying on prepared meals and takeaway options. This trend has accelerated demand for functional, attractive, and environmentally responsible packaging solutions that maintain food quality during transportation and storage. Urbanization trends in developing markets create additional growth opportunities as expanding middle-class populations adopt Western dining habits and convenience preferences.

Sustainability imperatives drive significant market transformation as consumers, businesses, and regulatory bodies prioritize environmentally responsible packaging alternatives. Approximately 82% of foodservice operators report customer inquiries about sustainable packaging options, creating market pressure for biodegradable and compostable solutions. Corporate social responsibility initiatives among major foodservice chains further accelerate adoption of eco-friendly packaging alternatives, creating substantial market opportunities for innovative manufacturers.

Technological advancements in manufacturing processes enable production of cost-effective, high-performance products that meet evolving industry requirements. Advanced molding techniques, improved material formulations, and automated production systems reduce manufacturing costs while enhancing product quality and consistency. Innovation in materials science creates opportunities for developing products with superior barrier properties, temperature resistance, and structural integrity.

Market constraints within the food trays and bowls industry present significant challenges that manufacturers and suppliers must navigate to maintain competitive positioning and sustainable growth. Raw material price volatility represents a primary concern, with petroleum-based plastics and paper products subject to commodity market fluctuations that impact production costs and profit margins.

Regulatory pressures regarding single-use plastics create compliance challenges and require substantial investments in alternative material development and manufacturing process modifications. Many jurisdictions have implemented or are considering bans on specific plastic products, forcing manufacturers to rapidly adapt product portfolios and production capabilities. Compliance costs associated with meeting diverse regulatory requirements across multiple markets strain resources and complicate international expansion strategies.

Environmental concerns surrounding traditional packaging materials create consumer resistance and negative brand associations that impact market acceptance. Despite improvements in recycling infrastructure and material innovations, public perception challenges persist regarding disposable packaging solutions. Competition from reusable alternatives in certain market segments limits growth potential for disposable products, particularly in institutional and high-volume applications.

Supply chain disruptions and manufacturing capacity constraints periodically impact product availability and delivery schedules, affecting customer relationships and market share. Quality control challenges in maintaining consistent product specifications across high-volume production runs require significant investments in monitoring systems and process optimization technologies.

Emerging opportunities within the food trays and bowls market present substantial potential for growth and innovation across multiple dimensions. The accelerating shift toward sustainable packaging solutions creates significant opportunities for manufacturers developing biodegradable, compostable, and recyclable alternatives that meet performance requirements while addressing environmental concerns.

Geographic expansion in developing markets offers substantial growth potential as urbanization, rising disposable incomes, and changing dietary patterns drive demand for convenient food packaging solutions. Asia-Pacific markets demonstrate particularly strong growth prospects, with expanding food delivery networks and increasing adoption of Western dining concepts creating substantial market opportunities. Market penetration rates in emerging economies remain relatively low, indicating significant room for expansion.

Product innovation opportunities encompass smart packaging technologies, specialized designs for specific cuisines, and multi-functional solutions that combine serving and storage capabilities. Advanced materials incorporating antimicrobial properties, temperature-indicating features, and enhanced barrier characteristics create differentiation opportunities and premium pricing potential. Customization services for branded packaging solutions represent growing revenue streams as foodservice operators seek to enhance customer experience and brand recognition.

Strategic partnerships with food delivery platforms, restaurant chains, and institutional buyers create opportunities for long-term supply agreements and collaborative product development initiatives. Vertical integration strategies enable manufacturers to capture additional value chain segments and improve cost competitiveness while ensuring quality control and supply chain reliability.

Complex market dynamics shape the competitive landscape and growth trajectory of the food trays and bowls industry through interconnected supply and demand factors. Consumer behavior patterns significantly influence product development priorities, with increasing emphasis on convenience, sustainability, and food safety driving innovation investments and manufacturing strategies.

Competitive pressures intensify as market participants compete on multiple dimensions including price, quality, sustainability credentials, and service capabilities. Established manufacturers leverage economies of scale and distribution networks to maintain market position, while innovative startups focus on niche applications and sustainable alternatives to gain market entry. Price competition remains intense in commodity segments, while premium products with enhanced functionality or sustainability features command higher margins.

Supply chain dynamics reflect global sourcing patterns, raw material availability, and transportation costs that impact product pricing and market accessibility. Manufacturers increasingly focus on supply chain resilience and diversification to mitigate risks associated with raw material shortages and logistics disruptions. Inventory management strategies balance cost optimization with service level requirements, particularly for seasonal demand variations and promotional activities.

Technology adoption accelerates across manufacturing processes, with automation and digitalization improving production efficiency and quality consistency. Data analytics applications enable better demand forecasting, inventory optimization, and customer relationship management, creating competitive advantages for technologically advanced manufacturers.

Comprehensive research methodology employed in analyzing the food trays and bowls market incorporates multiple data collection and analysis techniques to ensure accuracy, reliability, and actionable insights. Primary research activities include structured interviews with industry executives, manufacturers, distributors, and end-users across various geographic markets and application segments.

Secondary research components encompass analysis of industry publications, government statistics, trade association reports, and company financial statements to establish market baselines and identify trends. Market sizing methodologies utilize bottom-up and top-down approaches to validate market estimates and growth projections across different product categories and regional markets.

Qualitative analysis techniques include expert interviews, focus groups, and case study development to understand market dynamics, competitive positioning, and future growth drivers. Quantitative analysis incorporates statistical modeling, trend analysis, and correlation studies to identify relationships between market variables and develop predictive insights.

Data validation processes ensure research accuracy through triangulation of multiple sources, expert review, and cross-verification of key findings. Continuous monitoring of market developments enables regular updates to research findings and maintains relevance of insights for strategic decision-making purposes.

North American markets demonstrate mature characteristics with established foodservice industries, sophisticated distribution networks, and stringent regulatory frameworks governing packaging materials and food safety standards. The region maintains approximately 35% global market share driven by high consumption rates of takeaway foods and strong presence of major restaurant chains. Sustainability regulations in states like California and New York drive demand for eco-friendly alternatives, creating opportunities for innovative manufacturers.

European markets exhibit strong growth in sustainable packaging segments, with regulatory initiatives promoting circular economy principles and reducing single-use plastic consumption. The region accounts for roughly 28% market share with Germany, France, and the United Kingdom representing the largest individual markets. Premium product segments perform well in European markets due to higher consumer willingness to pay for quality and sustainability features.

Asia-Pacific region demonstrates the highest growth potential with rapidly expanding food delivery networks, urbanization trends, and rising disposable incomes driving market expansion. The region currently represents 25% market share but projects the strongest growth trajectory with projected CAGR of 8.1% over the forecast period. China and India represent the largest growth opportunities due to massive population bases and evolving dining preferences.

Latin American markets show increasing adoption of modern packaging solutions driven by expanding quick-service restaurant presence and growing middle-class populations. Middle East and Africa demonstrate emerging market characteristics with significant growth potential in urban centers and tourist destinations where international food concepts gain popularity.

Competitive dynamics within the food trays and bowls market feature a diverse ecosystem of global manufacturers, regional suppliers, and specialized producers serving various market segments and geographic regions. Market leadership positions reflect combinations of scale advantages, innovation capabilities, distribution reach, and customer relationships built over extended periods.

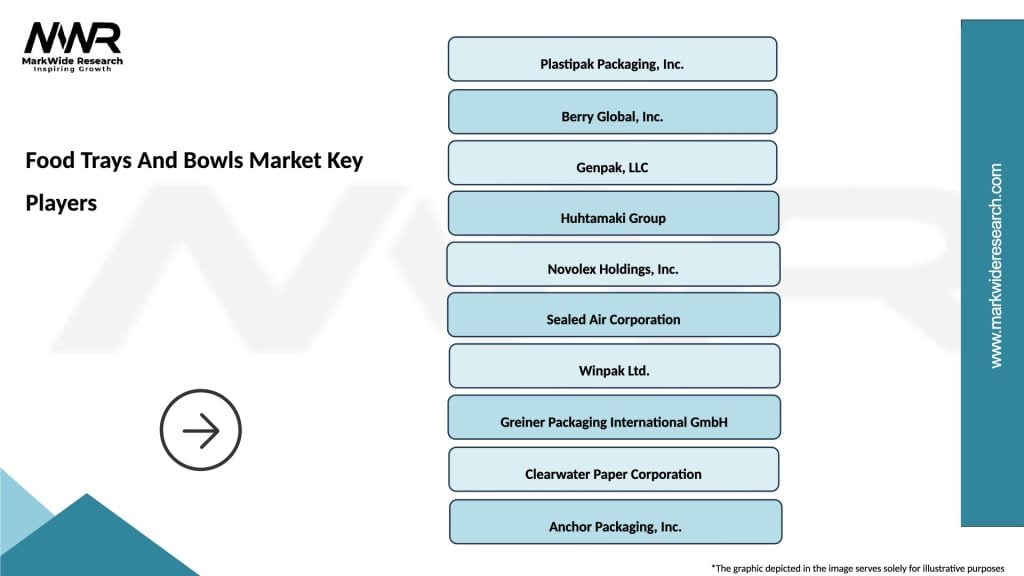

Major market participants include established packaging companies with comprehensive product portfolios and global manufacturing footprints:

Competitive strategies encompass product innovation, geographic expansion, strategic acquisitions, and sustainability initiatives designed to capture market share and enhance customer loyalty. Innovation investments focus on developing products with improved functionality, reduced environmental impact, and cost-effective manufacturing processes.

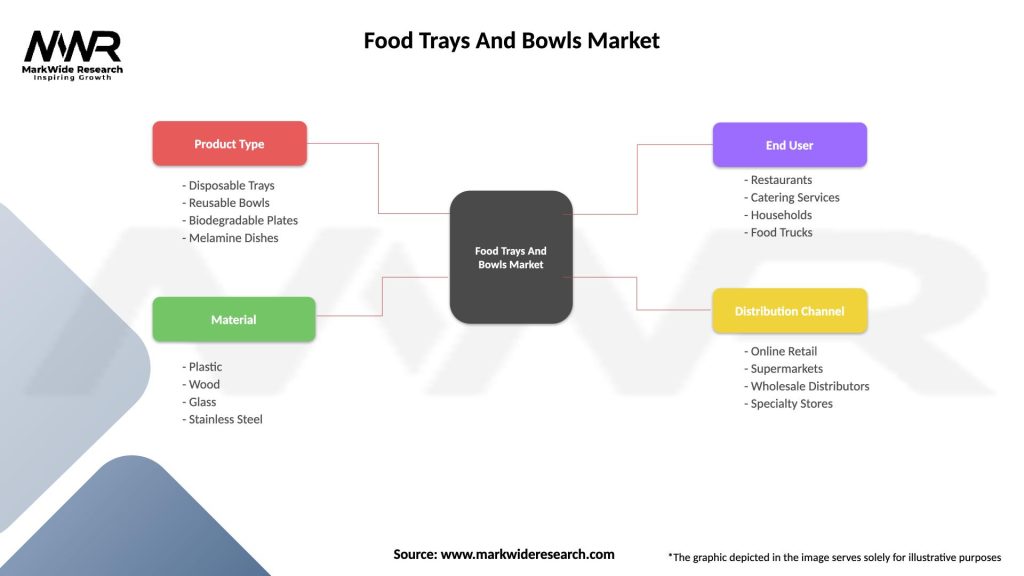

Market segmentation analysis reveals distinct product categories, material types, and application segments that demonstrate varying growth patterns and competitive dynamics. Understanding these segments enables targeted strategies for manufacturers, distributors, and end-users seeking optimal solutions for specific requirements.

By Product Type:

By Material Type:

By Application Segment:

Disposable food trays represent the largest product category, driven by widespread adoption in quick-service restaurants and institutional foodservice applications. This segment benefits from cost advantages, convenience factors, and standardized sizing that facilitates efficient operations. Growth trends favor sustainable alternatives within this category, with biodegradable and compostable options gaining market share despite premium pricing.

Specialty bowl products demonstrate strong growth in premium dining segments and ethnic cuisine applications where presentation quality significantly impacts customer satisfaction. Innovation focus in this category emphasizes designs optimized for specific food types, including soup bowls with enhanced heat retention and salad bowls with integrated compartments for dressings and toppings.

Reusable products gain traction in institutional settings where cost savings from repeated use offset higher initial investment costs. This category particularly appeals to healthcare facilities and educational institutions seeking to reduce waste generation while maintaining operational efficiency. Durability requirements drive material selection toward high-quality plastics and melamine compounds that withstand commercial dishwashing cycles.

Customized solutions represent a growing category as foodservice operators seek differentiation through branded packaging that enhances customer experience and promotes brand recognition. Digital printing technologies enable cost-effective customization even for moderate volume orders, expanding market accessibility for smaller operators.

Manufacturers benefit from diverse market opportunities spanning multiple application segments, geographic regions, and product categories that enable portfolio diversification and risk mitigation. Innovation capabilities create competitive advantages and premium pricing opportunities, particularly in sustainable packaging segments where environmental benefits justify higher costs.

Foodservice operators gain access to packaging solutions that enhance operational efficiency, food safety, and customer satisfaction while supporting sustainability initiatives and brand differentiation strategies. Cost optimization opportunities through bulk purchasing, standardization, and supply chain partnerships enable improved profitability and competitive positioning.

Distributors and suppliers benefit from stable demand patterns and opportunities for value-added services including inventory management, customization, and technical support. Market expansion potential in emerging economies creates growth opportunities for distributors with established relationships and logistics capabilities.

End consumers benefit from improved food safety, convenience, and sustainability options that align with evolving lifestyle preferences and environmental consciousness. Product innovations enhance dining experiences through improved functionality, temperature retention, and presentation quality.

Environmental stakeholders benefit from industry trends toward sustainable materials and circular economy principles that reduce waste generation and environmental impact. Regulatory compliance initiatives drive adoption of eco-friendly alternatives that support broader sustainability objectives.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability transformation represents the most significant trend reshaping the food trays and bowls market, with manufacturers investing heavily in biodegradable materials, recyclable designs, and circular economy principles. Consumer awareness of environmental issues drives demand for eco-friendly alternatives, with approximately 71% of consumers willing to pay premium prices for sustainable packaging options.

Smart packaging integration emerges as a growing trend with temperature-indicating labels, freshness sensors, and QR codes providing enhanced functionality and customer engagement opportunities. Digital connectivity enables tracking capabilities and interactive features that add value beyond basic containment functions.

Customization and branding trends reflect foodservice operators’ desire for differentiation through personalized packaging that reinforces brand identity and enhances customer experience. Digital printing technologies make customization more accessible and cost-effective for smaller operators seeking branded solutions.

Material innovation continues advancing with development of plant-based alternatives, improved barrier properties, and enhanced durability characteristics that expand application possibilities. Nanotechnology applications create opportunities for antimicrobial surfaces and improved food safety features.

Convenience optimization drives design innovations including stackable configurations, integrated utensil storage, and multi-compartment layouts that enhance user experience and operational efficiency. Portion control features support health-conscious dining trends and food cost management objectives.

Recent industry developments highlight the dynamic nature of the food trays and bowls market with significant investments in sustainable technologies, strategic acquisitions, and innovative product launches. MarkWide Research analysis indicates accelerating pace of innovation as companies respond to evolving market demands and regulatory requirements.

Sustainability initiatives dominate recent developments with major manufacturers announcing commitments to eliminate traditional plastics and transition to biodegradable alternatives. Several companies have established dedicated research facilities focused on developing next-generation sustainable packaging solutions that maintain performance while reducing environmental impact.

Strategic partnerships between packaging manufacturers and food delivery platforms create integrated solutions optimized for transportation and customer experience. These collaborations result in specialized products designed specifically for delivery applications with enhanced insulation, leak-proof designs, and branding capabilities.

Technology investments include automation upgrades, digital printing capabilities, and quality control systems that improve production efficiency and product consistency. Manufacturing expansion in emerging markets reflects growing demand and desire to reduce transportation costs while improving service levels.

Regulatory compliance drives product reformulations and manufacturing process modifications to meet evolving environmental standards and food safety requirements. Companies invest significantly in testing facilities and certification processes to ensure compliance across multiple jurisdictions.

Strategic recommendations for market participants emphasize the importance of sustainability leadership, innovation investment, and geographic diversification to capture growth opportunities while mitigating competitive pressures. MWR analysis suggests that companies prioritizing environmental responsibility will achieve superior long-term performance as regulatory pressures intensify and consumer preferences evolve.

Investment priorities should focus on research and development capabilities, particularly in sustainable materials and smart packaging technologies that create competitive differentiation. Companies should establish dedicated innovation teams and partnerships with material science organizations to accelerate product development cycles and maintain technological leadership.

Market expansion strategies should target high-growth regions in Asia-Pacific and Latin America where urbanization and rising disposable incomes drive demand for convenient food packaging solutions. Local partnerships and manufacturing facilities can reduce costs while improving market responsiveness and customer service capabilities.

Operational excellence initiatives should emphasize supply chain resilience, quality consistency, and cost optimization to maintain competitive positioning in price-sensitive market segments. Digital transformation investments in manufacturing processes, inventory management, and customer relationship systems create operational advantages and improve profitability.

Customer relationship management should focus on understanding evolving needs, providing technical support, and developing customized solutions that create value beyond basic product functionality. Long-term partnerships with major foodservice operators provide stability and collaborative innovation opportunities.

Future market prospects for the food trays and bowls industry remain highly positive, driven by fundamental trends including urbanization, convenience dining preferences, and sustainability consciousness that support sustained demand growth. Projected growth rates indicate continued expansion with the market expected to maintain a CAGR of 6.5% over the next five years, reflecting robust underlying demand drivers and innovation opportunities.

Sustainability transformation will accelerate as regulatory pressures intensify and consumer preferences increasingly favor environmentally responsible packaging solutions. Companies investing early in sustainable alternatives and circular economy principles will capture disproportionate market share and achieve premium pricing opportunities. Material innovations will continue advancing with plant-based alternatives achieving cost parity with traditional materials within the forecast period.

Geographic expansion in emerging markets presents the greatest growth opportunities, with Asia-Pacific markets projected to achieve CAGR of 8.3% driven by rapid urbanization and expanding food delivery networks. Market penetration rates in developing economies remain low, indicating substantial room for expansion as economic development and lifestyle changes drive adoption of modern packaging solutions.

Technology integration will create new product categories and value propositions, with smart packaging features becoming standard in premium segments. Digital connectivity and data analytics capabilities will enable enhanced customer experiences and operational efficiencies that justify premium pricing and create competitive barriers.

Consolidation trends may accelerate as companies seek scale advantages and complementary capabilities through strategic acquisitions. Innovation partnerships between packaging manufacturers, material suppliers, and technology companies will drive breakthrough developments that reshape market dynamics and create new growth opportunities.

The food trays and bowls market represents a dynamic and evolving industry segment with substantial growth potential driven by fundamental shifts in consumer behavior, sustainability consciousness, and technological innovation. Market fundamentals remain strong with diverse application segments, geographic expansion opportunities, and continuous innovation creating multiple avenues for sustainable growth and competitive differentiation.

Sustainability leadership emerges as the critical success factor for long-term market participation, with companies investing in eco-friendly alternatives positioned to capture premium market segments and achieve superior financial performance. Innovation capabilities in materials science, manufacturing processes, and product design create competitive advantages that enable market share expansion and margin improvement.

Strategic positioning for future success requires balanced focus on operational excellence, customer relationship management, and geographic diversification while maintaining investment in research and development capabilities. Market participants that successfully navigate the transition toward sustainable packaging solutions while maintaining cost competitiveness will achieve leadership positions in this essential industry segment.

What is Food Trays And Bowls?

Food trays and bowls are essential dining and serving items used in various settings, including households, restaurants, and catering services. They come in various materials such as plastic, glass, and metal, designed for both functionality and aesthetics.

What are the key players in the Food Trays And Bowls Market?

Key players in the Food Trays And Bowls Market include companies like Dart Container Corporation, Huhtamaki, and Pactiv Evergreen. These companies are known for their innovative designs and sustainable practices, among others.

What are the growth factors driving the Food Trays And Bowls Market?

The Food Trays And Bowls Market is driven by the increasing demand for convenient food packaging solutions, the growth of the foodservice industry, and rising consumer preferences for takeout and delivery options. Additionally, sustainability trends are pushing manufacturers to develop eco-friendly products.

What challenges does the Food Trays And Bowls Market face?

The Food Trays And Bowls Market faces challenges such as fluctuating raw material prices and increasing regulations regarding food safety and packaging waste. These factors can impact production costs and market dynamics.

What opportunities exist in the Food Trays And Bowls Market?

Opportunities in the Food Trays And Bowls Market include the growing trend of meal kits and ready-to-eat meals, which require efficient packaging solutions. Additionally, advancements in biodegradable materials present new avenues for product development.

What trends are shaping the Food Trays And Bowls Market?

Trends shaping the Food Trays And Bowls Market include the rise of sustainable packaging, increased customization options for food service providers, and the integration of technology in food packaging solutions. These trends reflect changing consumer preferences and environmental concerns.

Food Trays And Bowls Market

| Segmentation Details | Description |

|---|---|

| Product Type | Disposable Trays, Reusable Bowls, Biodegradable Plates, Melamine Dishes |

| Material | Plastic, Wood, Glass, Stainless Steel |

| End User | Restaurants, Catering Services, Households, Food Trucks |

| Distribution Channel | Online Retail, Supermarkets, Wholesale Distributors, Specialty Stores |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Food Trays And Bowls Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at