444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Australian food service industry represents one of the most dynamic and rapidly evolving sectors within the nation’s economy, encompassing restaurants, cafes, fast food outlets, catering services, and institutional food providers. This comprehensive market has experienced remarkable transformation over recent years, driven by changing consumer preferences, technological innovations, and evolving dining habits across diverse demographics.

Market dynamics indicate substantial growth momentum, with the industry demonstrating resilience and adaptability in response to various challenges. The sector encompasses traditional dining establishments, quick service restaurants, food trucks, catering companies, and institutional food services serving schools, hospitals, and corporate facilities. Consumer spending patterns have shifted significantly, with increased demand for convenience, quality, and diverse culinary experiences driving market expansion.

Digital transformation has become a cornerstone of industry evolution, with online ordering platforms, delivery services, and mobile applications reshaping how consumers interact with food service providers. The integration of technology has enabled businesses to enhance operational efficiency while meeting growing expectations for seamless customer experiences. Sustainability initiatives and health-conscious menu options have emerged as critical differentiators in an increasingly competitive landscape.

Regional variations across Australia reflect diverse local preferences and economic conditions, with metropolitan areas driving innovation while regional markets maintain strong connections to local suppliers and traditional dining concepts. The industry’s contribution to employment and economic activity remains substantial, supporting hundreds of thousands of jobs across various skill levels and providing opportunities for entrepreneurship and business development.

The food service industry Australia market refers to the comprehensive ecosystem of businesses and organizations involved in preparing, serving, and delivering food and beverages to consumers outside their homes. This sector encompasses a broad spectrum of establishments ranging from fine dining restaurants and casual eateries to fast food chains, coffee shops, catering services, and institutional food providers.

Key components of this market include commercial restaurants, quick service restaurants, cafes and coffee shops, bars and pubs, catering and event services, food trucks and mobile vendors, institutional food services, and delivery platforms. The industry operates through various service models including dine-in experiences, takeaway services, home delivery, catering for events, and contract food services for institutions.

Market participants range from independent operators and family-owned businesses to large multinational chains and franchise systems. The industry’s scope extends beyond traditional food preparation to include supply chain management, technology integration, marketing services, and customer relationship management. Revenue generation occurs through direct food and beverage sales, delivery fees, catering contracts, and ancillary services.

Australia’s food service industry continues to demonstrate robust growth and innovation, establishing itself as a vital component of the national economy. The sector has successfully navigated recent challenges while embracing technological advancement and evolving consumer preferences. Market resilience has been particularly evident in the industry’s ability to adapt business models and service delivery methods to meet changing demands.

Growth drivers include increasing urbanization, rising disposable incomes, changing lifestyle patterns, and growing demand for convenience foods. The industry benefits from Australia’s multicultural population, which drives demand for diverse culinary offerings and authentic international cuisines. Technology adoption has accelerated significantly, with digital ordering systems and delivery platforms becoming integral to business operations.

Competitive dynamics reflect a mix of established players and emerging brands, with innovation and customer experience serving as primary differentiators. The market shows strong potential for continued expansion, supported by favorable demographic trends and increasing consumer willingness to spend on food experiences. Sustainability concerns and health consciousness are reshaping menu development and operational practices across the industry.

Investment activity remains strong, with both domestic and international investors recognizing the sector’s growth potential. The industry’s fragmented nature provides opportunities for consolidation while supporting entrepreneurship and local business development. Future prospects appear positive, with continued urbanization and evolving consumer preferences expected to drive sustained growth.

Consumer behavior analysis reveals significant shifts in dining preferences and spending patterns across Australian markets. The industry has witnessed increased demand for premium experiences alongside growing popularity of convenient, affordable options. Digital engagement has become essential, with consumers increasingly relying on online platforms for restaurant discovery, ordering, and payment processing.

Market segmentation reveals distinct consumer groups with varying preferences and spending behaviors. Premium dining segments continue to attract affluent consumers seeking unique experiences, while value-oriented segments serve price-conscious customers prioritizing convenience and affordability. Demographic analysis shows younger consumers driving demand for innovative concepts and technology-enabled services.

Urbanization trends across Australia continue to fuel food service industry expansion, with metropolitan areas experiencing concentrated population growth and increased demand for dining options. Cities like Sydney, Melbourne, Brisbane, and Perth serve as innovation hubs where new concepts and technologies are tested before broader market deployment. Population density in urban centers creates favorable conditions for diverse food service establishments.

Changing lifestyle patterns significantly impact industry growth, with busy professionals and dual-income households increasingly relying on food service providers for daily meals. The traditional home-cooking model has evolved, with consumers seeking convenient, high-quality alternatives that fit their time-constrained schedules. Work-from-home trends have created new opportunities for neighborhood establishments and delivery services.

Rising disposable incomes enable consumers to allocate larger portions of their budgets to dining experiences and food services. Economic prosperity has elevated consumer expectations regarding food quality, service standards, and overall dining experiences. Premium positioning has become increasingly viable as consumers demonstrate willingness to pay for superior offerings.

Cultural diversity within Australia’s population drives demand for authentic international cuisines and fusion concepts. Immigration patterns have introduced new culinary traditions while creating markets for specialized ethnic foods. Culinary tourism has emerged as a significant factor, with food experiences becoming integral to travel and entertainment decisions.

Technology advancement continues to reshape industry operations and customer interactions. Mobile applications, online ordering systems, and digital payment platforms have become essential infrastructure for modern food service businesses. Automation technologies are improving operational efficiency while reducing labor costs and enhancing consistency.

Labor shortages present ongoing challenges for food service establishments across Australia, with skilled workers increasingly difficult to recruit and retain. The industry’s traditionally high turnover rates are exacerbated by competitive job markets and changing worker expectations regarding compensation and working conditions. Training costs and recruitment expenses continue to pressure profit margins.

Rising operational costs including rent, utilities, and raw materials significantly impact business profitability. Commercial real estate prices in prime locations have increased substantially, forcing many establishments to reconsider their location strategies or accept reduced profit margins. Supply chain disruptions have led to increased ingredient costs and availability challenges.

Regulatory compliance requirements impose additional operational burdens and costs on food service businesses. Health and safety regulations, employment laws, and environmental standards require ongoing investment in training, equipment, and administrative processes. Licensing requirements and permit processes can create barriers for new market entrants.

Intense competition within the industry creates pressure on pricing and profit margins. The low barriers to entry result in market saturation in popular areas, forcing businesses to differentiate through innovation or accept reduced profitability. Brand loyalty challenges make customer acquisition and retention increasingly expensive.

Economic sensitivity affects consumer spending patterns during economic downturns or uncertainty. Food service businesses often experience reduced customer traffic and lower average transaction values during challenging economic periods. Discretionary spending cuts typically impact dining out before essential purchases.

Digital transformation presents substantial opportunities for food service businesses to enhance customer experiences and operational efficiency. Advanced analytics, artificial intelligence, and automation technologies offer potential for improved inventory management, personalized marketing, and streamlined operations. Data-driven insights enable better decision-making regarding menu development, pricing strategies, and customer engagement.

Health and wellness trends create opportunities for establishments specializing in nutritious, organic, and specialized dietary options. Growing awareness of health issues and dietary restrictions drives demand for gluten-free, vegan, keto-friendly, and other specialized menu items. Functional foods and beverages incorporating health benefits represent emerging market segments.

Sustainability initiatives offer differentiation opportunities while addressing growing consumer environmental concerns. Establishments implementing comprehensive sustainability programs including waste reduction, local sourcing, and eco-friendly packaging can command premium pricing and attract environmentally conscious customers. Circular economy principles are becoming increasingly important to consumers.

Delivery and ghost kitchen concepts provide opportunities for market expansion without traditional overhead costs. Virtual restaurants and delivery-only operations enable businesses to serve multiple markets from centralized locations while reducing real estate expenses. Cloud kitchens represent innovative approaches to food service delivery.

Experience-based dining concepts offer opportunities to create memorable customer experiences that justify premium pricing. Interactive dining, chef’s table experiences, cooking classes, and themed restaurants appeal to consumers seeking entertainment value alongside food service. Social media integration amplifies the marketing impact of unique dining experiences.

Supply chain evolution continues to reshape how food service establishments source ingredients and manage inventory. Direct relationships with local producers and farmers are becoming more common, enabling better quality control and cost management while supporting sustainability goals. Technology integration in supply chain management improves efficiency and reduces waste.

Consumer expectations have evolved significantly, with demands for transparency, quality, and convenience driving operational changes across the industry. Customers increasingly expect detailed information about ingredients, preparation methods, and nutritional content. Social responsibility has become a factor in consumer decision-making processes.

Competitive landscape dynamics reflect ongoing consolidation among larger players while supporting continued innovation from independent operators. Franchise systems provide scalability advantages while independent establishments offer unique experiences and local connections. Market positioning strategies increasingly focus on niche specialization rather than broad appeal.

Technology adoption rates vary significantly across different market segments, with quick service restaurants leading in automation while fine dining establishments focus on enhancing personal service through technology. Integration challenges require careful planning and staff training to maximize technology benefits.

Regulatory environment continues to evolve with new requirements related to food safety, employment practices, and environmental responsibility. Businesses must adapt to changing regulations while maintaining operational efficiency and profitability. Compliance costs represent ongoing operational considerations for all market participants.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into Australia’s food service industry. Primary research includes extensive surveys of industry participants, consumer behavior studies, and in-depth interviews with key stakeholders across various market segments. Data collection encompasses both quantitative metrics and qualitative insights to provide complete market understanding.

Secondary research incorporates analysis of industry reports, government statistics, trade association data, and academic studies related to food service trends and market dynamics. Financial performance data from publicly traded companies provides insights into industry profitability and growth patterns. Regulatory filings and licensing data offer additional perspectives on market structure and competitive dynamics.

Market segmentation analysis examines different establishment types, service models, geographic regions, and consumer demographics to identify distinct market characteristics and growth opportunities. Competitive intelligence gathering includes analysis of major players’ strategies, market positioning, and performance metrics.

Trend analysis incorporates examination of historical data patterns, current market conditions, and forward-looking indicators to identify emerging opportunities and potential challenges. Technology impact assessment evaluates the influence of digital transformation on industry operations and consumer behavior.

Validation processes include cross-referencing multiple data sources, expert consultations, and market participant feedback to ensure accuracy and reliability of research findings. Continuous monitoring of market developments enables regular updates to research conclusions and recommendations.

New South Wales represents the largest regional market within Australia’s food service industry, with Sydney serving as the primary innovation and growth center. The state benefits from high population density, strong economic activity, and diverse cultural influences that drive demand for varied dining options. Market concentration in Sydney creates intense competition while supporting premium positioning strategies.

Victoria demonstrates strong market performance with Melbourne’s renowned food culture driving innovation and consumer engagement. The state’s emphasis on coffee culture and artisanal food concepts influences national trends and consumer expectations. Regional Victoria markets show growing sophistication in food service offerings, supported by wine tourism and agricultural connections.

Queensland benefits from tourism-driven demand alongside strong population growth in Brisbane and Gold Coast regions. The state’s climate enables year-round outdoor dining and food festival activities that support industry growth. Tourism integration creates opportunities for unique dining experiences and cultural food offerings.

Western Australia shows robust market development driven by Perth’s economic growth and increasing population diversity. The state’s mining industry prosperity supports premium dining segments while growing cultural diversity drives demand for international cuisines. Regional mining centers create specialized market opportunities for food service providers.

South Australia leverages its wine industry connections to create distinctive food service experiences that attract both local consumers and tourists. Adelaide’s compact urban structure supports neighborhood-based dining concepts and local sourcing initiatives. Food and wine integration provides competitive advantages for regional establishments.

Tasmania demonstrates growing market sophistication with emphasis on local ingredients and sustainable practices. The state’s tourism growth supports premium dining experiences while local food culture drives innovation in menu development. Artisanal focus enables premium positioning and differentiation strategies.

Market leadership within Australia’s food service industry reflects a combination of large multinational chains, successful domestic brands, and innovative independent operators. The competitive environment supports various business models and market positioning strategies, from value-oriented quick service to premium fine dining experiences.

Independent operators continue to play crucial roles in market innovation and local market service. These establishments often lead trends in cuisine development, service concepts, and customer experience innovation. Franchise systems provide scalability advantages while maintaining local market adaptation capabilities.

Emerging competitors include technology-enabled delivery platforms, ghost kitchen operators, and specialized dietary concept restaurants. These new market entrants challenge traditional business models while creating new opportunities for market expansion. Innovation focus remains essential for competitive success across all market segments.

By Service Type: The Australian food service market encompasses multiple service delivery models, each serving distinct consumer needs and preferences. Full-service restaurants provide comprehensive dining experiences with table service and extensive menu options. Quick service restaurants focus on speed and convenience with standardized offerings and efficient operations. Casual dining establishments bridge the gap between quick service and fine dining with moderate pricing and relaxed atmospheres.

By Cuisine Type: Market segmentation reflects Australia’s multicultural population with diverse culinary preferences. Traditional Australian cuisine establishments serve local favorites and contemporary interpretations of classic dishes. International cuisine segments include Italian, Chinese, Indian, Thai, Japanese, and Mediterranean options. Fusion concepts combine multiple culinary traditions to create unique dining experiences.

By Price Point: Value segment establishments focus on affordable pricing with basic service levels and standardized offerings. Mid-range restaurants provide balanced value propositions with quality food and service at moderate prices. Premium segments emphasize exceptional quality, unique experiences, and superior service levels with corresponding pricing strategies.

By Location Type: Urban establishments benefit from high foot traffic and diverse customer bases but face higher operational costs and intense competition. Suburban locations serve local communities with family-friendly concepts and convenient parking. Tourist destinations create opportunities for specialized concepts and premium pricing strategies.

By Technology Integration: Traditional establishments maintain conventional service models with limited technology adoption. Technology-enabled businesses integrate digital ordering, payment systems, and customer relationship management tools. Fully digital operations rely primarily on technology for customer interaction and service delivery.

Quick Service Restaurants continue to dominate transaction volumes while facing pressure to improve food quality and service experiences. This category benefits from convenience positioning but must address growing consumer demands for healthier options and sustainable practices. Technology integration has become essential for maintaining competitive advantages in ordering efficiency and customer engagement.

Casual Dining establishments represent the largest segment by revenue, serving diverse consumer groups with varied menu options and moderate pricing. This category shows strong resilience during economic fluctuations while providing opportunities for local differentiation and community engagement. Family-friendly positioning remains important for sustained success in suburban markets.

Fine Dining segments demonstrate premium positioning capabilities with emphasis on culinary excellence, service quality, and unique experiences. These establishments command higher profit margins but serve smaller customer bases and face greater economic sensitivity. Experience differentiation becomes crucial for justifying premium pricing and maintaining customer loyalty.

Coffee Shops and Cafes benefit from Australia’s strong coffee culture and growing demand for casual meeting spaces and remote work environments. This category shows consistent growth with opportunities for local branding and community integration. Specialty coffee positioning enables premium pricing and customer loyalty development.

Delivery and Takeaway services have experienced rapid growth with changing consumer lifestyles and technology adoption. This category requires different operational models and cost structures compared to traditional dine-in establishments. Efficiency optimization becomes critical for maintaining profitability in delivery-focused operations.

Restaurant Operators benefit from comprehensive market insights that enable informed decision-making regarding location selection, menu development, and operational strategies. Understanding consumer trends and competitive dynamics helps optimize business performance and identify growth opportunities. Risk mitigation strategies can be developed based on market analysis and trend identification.

Investors and Franchisors gain valuable perspectives on market potential, growth segments, and competitive positioning opportunities. Market analysis supports investment decisions and franchise development strategies while identifying emerging trends and consumer preferences. Portfolio optimization becomes possible through detailed market segmentation and performance analysis.

Suppliers and Vendors benefit from understanding industry demand patterns, growth projections, and emerging requirements for products and services. Market insights enable better inventory planning, product development, and customer relationship management. Partnership opportunities can be identified through analysis of industry trends and operator needs.

Technology Providers gain insights into adoption patterns, implementation challenges, and emerging requirements for digital solutions within the food service industry. Understanding market dynamics helps prioritize product development and marketing strategies. Solution customization becomes possible through detailed analysis of different market segments and their specific needs.

Government and Regulatory Bodies benefit from comprehensive industry analysis that supports policy development, economic planning, and regulatory framework design. Market insights help assess industry contributions to employment, economic activity, and community development. Evidence-based policy making becomes possible through detailed market analysis and trend identification.

Strengths:

Weaknesses:

Opportunities:

Threats:

Health and Wellness Integration has become a dominant trend across Australia’s food service industry, with establishments increasingly offering nutritious options, transparent ingredient information, and specialized dietary accommodations. Consumers actively seek restaurants that support their health goals while maintaining taste and convenience. Functional ingredients and superfoods are being incorporated into mainstream menu items.

Technology-Enabled Experiences continue to reshape customer interactions and operational processes throughout the industry. Mobile ordering, contactless payments, and AI-powered recommendations enhance convenience while providing valuable customer data. Automation technologies are being implemented to address labor shortages and improve consistency in food preparation and service delivery.

Sustainability and Environmental Responsibility have evolved from niche concerns to mainstream expectations among Australian consumers. Restaurants are implementing comprehensive sustainability programs including waste reduction, local sourcing, renewable energy, and eco-friendly packaging. Circular economy principles are being adopted to minimize environmental impact while potentially reducing operational costs.

Personalization and Customization trends reflect consumer desires for tailored dining experiences that accommodate individual preferences and dietary requirements. Menu customization options, personalized recommendations, and flexible service models cater to diverse consumer needs. Data analytics enable restaurants to provide increasingly personalized experiences based on customer behavior and preferences.

Local Sourcing and Authenticity trends emphasize connections to local communities, suppliers, and cultural traditions. Consumers increasingly value transparency about ingredient origins and preparation methods. Farm-to-table concepts and partnerships with local producers create competitive advantages while supporting regional economies.

Digital Platform Integration has accelerated significantly, with major food delivery platforms expanding their services and restaurant partnerships across Australian markets. MarkWide Research analysis indicates that technology investments have become essential for competitive success, particularly in urban markets where consumer expectations for digital convenience continue to rise.

Franchise Expansion activities have intensified as successful concepts seek to capitalize on market opportunities through rapid scaling. International brands continue to enter Australian markets while domestic success stories expand their geographic footprints. Master franchise agreements and area development deals have become common expansion strategies.

Ghost Kitchen Development represents a significant industry innovation, with delivery-only concepts gaining traction among operators seeking to reduce overhead costs while serving multiple markets. These virtual restaurants enable experimentation with new concepts and cuisines without traditional restaurant investment requirements. Shared kitchen facilities are emerging to support this business model.

Sustainability Certifications and environmental programs have gained prominence as restaurants seek to differentiate themselves through responsible practices. Industry associations and certification bodies are developing standards for sustainable operations. Consumer awareness of environmental issues drives demand for certified sustainable dining options.

Labor Market Innovations include new approaches to recruitment, training, and retention as the industry addresses ongoing workforce challenges. Technology-assisted training programs, flexible scheduling systems, and enhanced benefits packages are being implemented. Career development programs aim to improve job satisfaction and reduce turnover rates.

Technology Investment Prioritization should focus on solutions that directly enhance customer experience and operational efficiency. Restaurants should evaluate technology options based on return on investment and integration capabilities with existing systems. Phased implementation approaches can help manage costs while ensuring successful adoption and staff training.

Menu Innovation Strategies should balance consumer trends with operational feasibility and cost management. Establishments should regularly assess menu performance and customer feedback to optimize offerings. Seasonal menu adjustments can maintain customer interest while supporting local sourcing initiatives.

Staff Development Programs require increased investment to address labor shortages and improve service quality. Comprehensive training programs, career advancement opportunities, and competitive compensation packages can improve retention rates. Cross-training initiatives enhance operational flexibility while providing employee development opportunities.

Market Positioning Clarity becomes increasingly important as competition intensifies across all segments. Restaurants should clearly define their target customers and value propositions while consistently delivering on brand promises. Differentiation strategies should be sustainable and difficult for competitors to replicate.

Financial Management Discipline requires careful attention to cost control and profit margin optimization. Regular financial analysis and benchmarking against industry standards can identify improvement opportunities. Cash flow management becomes critical during periods of economic uncertainty or seasonal fluctuations.

Growth projections for Australia’s food service industry remain positive, supported by favorable demographic trends, continued urbanization, and evolving consumer preferences. The industry is expected to maintain steady expansion with annual growth rates of 6-8% driven by innovation, technology adoption, and market diversification. MWR analysis suggests that successful operators will be those who effectively balance traditional hospitality values with modern operational efficiency.

Technology integration will continue to accelerate, with artificial intelligence, automation, and data analytics becoming standard operational tools rather than competitive advantages. Establishments that fail to adopt relevant technologies may struggle to maintain competitiveness. Digital-first approaches to customer engagement and service delivery will become increasingly important.

Market consolidation is expected to continue as successful concepts expand while underperforming establishments exit the market. Franchise systems and multi-unit operators may gain market share at the expense of independent operators who cannot achieve operational efficiencies. Strategic partnerships and collaborative approaches may help smaller operators remain competitive.

Sustainability requirements will likely become more stringent as environmental concerns and regulatory requirements evolve. Establishments that proactively implement comprehensive sustainability programs will be better positioned for long-term success. Consumer expectations regarding environmental responsibility will continue to influence purchasing decisions.

Innovation opportunities will emerge from changing consumer lifestyles, technological advancement, and evolving dietary preferences. Successful market participants will need to maintain flexibility and adaptability while building strong operational foundations. Continuous improvement in customer experience and operational efficiency will remain essential for sustained success.

Australia’s food service industry represents a dynamic and evolving market with substantial opportunities for growth and innovation. The sector has demonstrated remarkable resilience and adaptability while embracing technological advancement and changing consumer preferences. Market fundamentals remain strong, supported by favorable demographics, urbanization trends, and increasing consumer willingness to invest in food experiences.

Success factors for industry participants include effective technology integration, clear market positioning, operational efficiency, and strong customer relationship management. The ability to balance traditional hospitality values with modern operational requirements will distinguish successful operators from those who struggle to adapt. Continuous innovation in menu development, service delivery, and customer engagement remains essential for competitive success.

Future opportunities will emerge from evolving consumer preferences, technological advancement, and market expansion into underserved segments and geographic areas. The industry’s fragmented nature provides space for both large-scale operators and specialized niche players to succeed. Strategic planning and careful execution will be crucial for capitalizing on emerging opportunities while managing operational challenges and competitive pressures in this vibrant and essential industry sector.

What is Food Service Industry?

The Food Service Industry encompasses businesses that prepare and serve food and beverages to customers. This includes restaurants, cafes, catering services, and food trucks, among others.

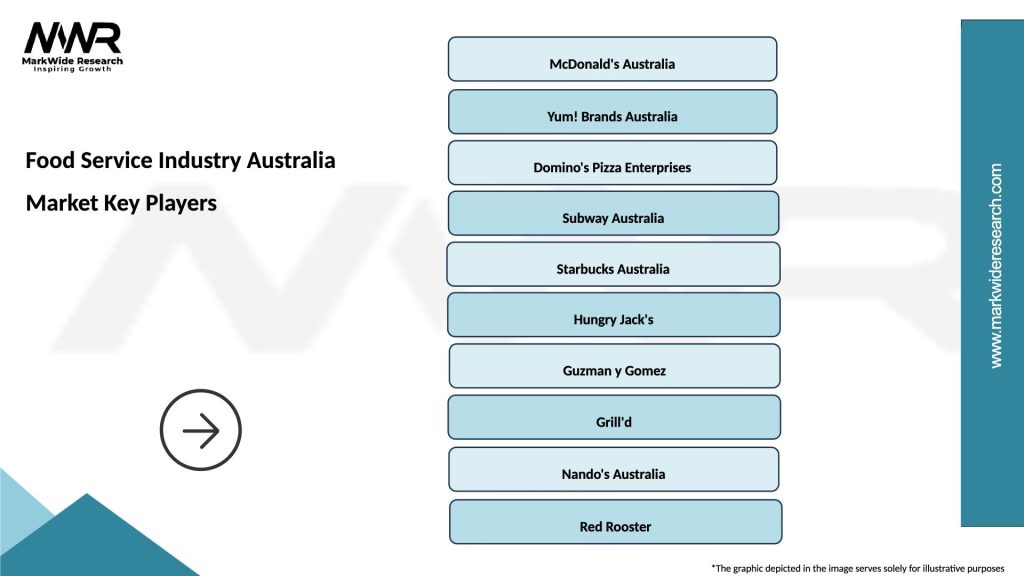

What are the key players in the Food Service Industry Australia Market?

Key players in the Food Service Industry Australia Market include companies like Domino’s Pizza Enterprises, Collins Foods, and Restaurant Brands New Zealand, among others.

What are the main drivers of growth in the Food Service Industry Australia Market?

Growth in the Food Service Industry Australia Market is driven by factors such as increasing consumer demand for convenience, the rise of food delivery services, and a growing trend towards dining out.

What challenges does the Food Service Industry Australia Market face?

The Food Service Industry Australia Market faces challenges such as rising food costs, labor shortages, and increased competition from home meal kits and grocery delivery services.

What opportunities exist in the Food Service Industry Australia Market?

Opportunities in the Food Service Industry Australia Market include the expansion of plant-based menu options, the integration of technology for online ordering, and the growth of sustainable dining practices.

What trends are shaping the Food Service Industry Australia Market?

Trends shaping the Food Service Industry Australia Market include the increasing popularity of health-conscious dining, the use of local and organic ingredients, and the rise of experiential dining concepts.

Food Service Industry Australia Market

| Segmentation Details | Description |

|---|---|

| Product Type | Fast Food, Casual Dining, Fine Dining, Cafés |

| Customer Type | Families, Young Adults, Business Professionals, Tourists |

| Service Type | Dine-In, Takeaway, Delivery, Catering |

| Price Tier | Budget, Mid-Range, Premium, Luxury |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Food Service Industry Australia Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at