444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The food service dairy products market refers to the industry that provides dairy products for use in the food service sector, including restaurants, cafes, hotels, and other establishments. These products include milk, butter, cheese, cream, yogurt, and various other dairy-based ingredients. The market for food service dairy products has witnessed significant growth in recent years, driven by the rising demand for dairy-based dishes and beverages in the food service industry.

Meaning

Food service dairy products are specifically manufactured and packaged for use in the food service sector. They are designed to meet the specific requirements of food service establishments, such as bulk packaging, extended shelf life, and convenient storage options. These products undergo stringent quality control measures to ensure food safety and meet the regulatory standards of the food service industry.

Executive Summary

The food service dairy products market has experienced steady growth in recent years, driven by factors such as increasing consumer preference for dairy-based dishes, the expansion of the food service industry, and the growing trend of eating out. The market is characterized by intense competition among key players, who strive to offer high-quality products and cater to the diverse needs of food service establishments. However, the market also faces challenges related to fluctuating raw material prices, stringent regulations, and the impact of the COVID-19 pandemic.

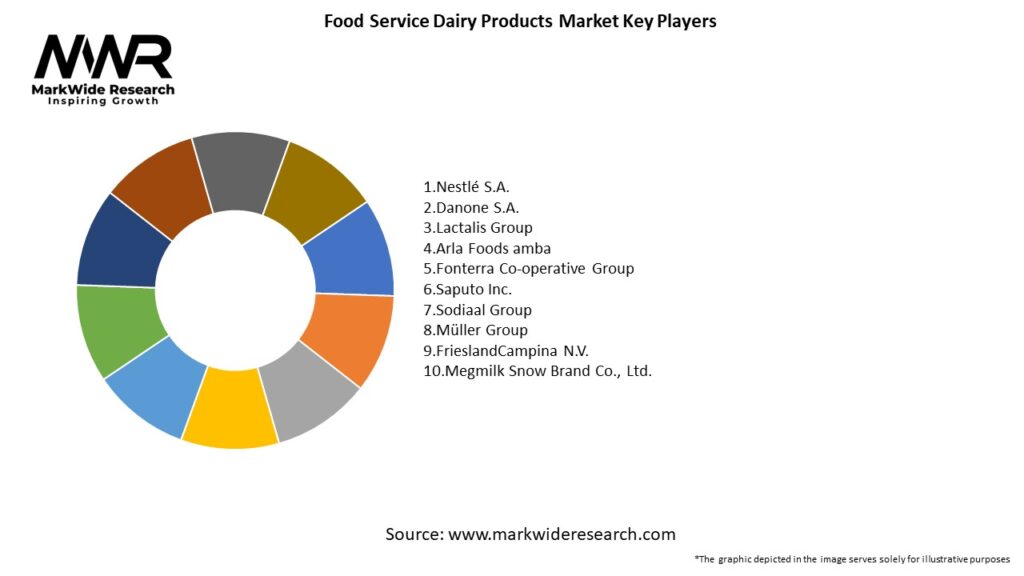

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

The market is projected to grow at a CAGR of ~4.5% through 2030, driven by expanding quick-serve outlets, hotels, and institutional catering.

Cheese varieties (mozzarella, cheddar) make up ~40% of volume; cream and liquid milk products account for ~30%.

Butter and cream cheese represent ~20%, with yogurt and specialty dairy ~10%.

Europe and North America collectively hold ~65% of foodservice dairy usage; Asia-Pacific is the fastest-growing region.

Demand for specialty and artisan cheeses in premium foodservice segments is capturing ~15% of new orders.

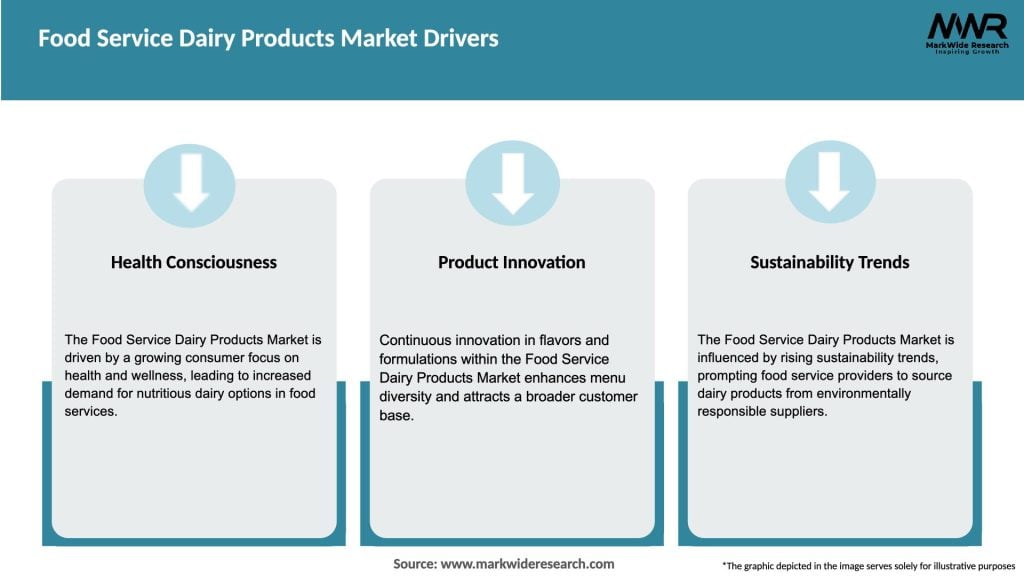

Market Drivers

Culinary Trends: Artisan, ethnic, and fusion cuisines in restaurants boost specialty dairy usage.

Breakfast & Brunch Growth: Expansion of all-day breakfast menus increases egg-and-dairy combinations.

Chain Restaurant Expansion: International hotel and café chains standardizing dairy ingredient sourcing.

Value-Added Formats: Ready-to-use shredded, sliced, and whipped dairy products reduce kitchen labor.

Food Safety Regulations: Strict HACCP and cold-chain compliance favor reliable foodservice dairy suppliers.

Market Restraints

Price Volatility: Global milk powder and cream costs subject to seasonal supply fluctuations.

Cold-Chain Challenges: Inconsistent refrigeration in emerging markets can lead to spoilage.

Lactose Intolerance Awareness: Growing demand for nondairy alternatives may limit dairy uptake.

Operational Waste: High perishability leads to foodservice plate-waste concerns.

Import Tariffs: Trade barriers on dairy can increase sourcing costs for international operators.

Market Opportunities

Functional Dairy: Fortified yogurts, probiotic creams, and protein-enriched milk for wellness menus.

Dairy Alternatives: Integration of oat-, almond-, and pea-based creams and cheeses in hybrid menus.

Customized Blends: Tailored formulations for coffee shops and gelato retailers to enhance texture and flavor.

Eco-Friendly Packaging: Bulk dispensers and reusable kegs for coffee-and-cream stations.

Culinary Training: Partnerships to educate chefs on innovative dairy uses, driving premium menu offerings.

Market Dynamics

The food service dairy products market is influenced by various dynamics, including consumer trends, technological advancements, regulatory factors, and market competition. Consumer preferences play a crucial role in shaping the demand for different dairy products in the food service industry. Technological advancements in dairy processing and packaging techniques enable manufacturers to meet the specific requirements of food service establishments. However, stringent regulations and quality control standards pose challenges to market players. The market is highly competitive, with key players striving to offer differentiated products and gain a competitive edge.

Regional Analysis

The food service dairy products market can be segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. Each region has its own unique characteristics and market dynamics. North America and Europe are mature markets with established food service sectors and high consumption of dairy products. The Asia Pacific region is witnessing rapid growth, driven by changing consumer lifestyles and increasing disposable incomes. Latin America, the Middle East, and Africa offer untapped opportunities for market players, with a growing food service industry and increasing demand for dairy products.

Competitive Landscape

Leading Companies in the Food Service Dairy Products Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

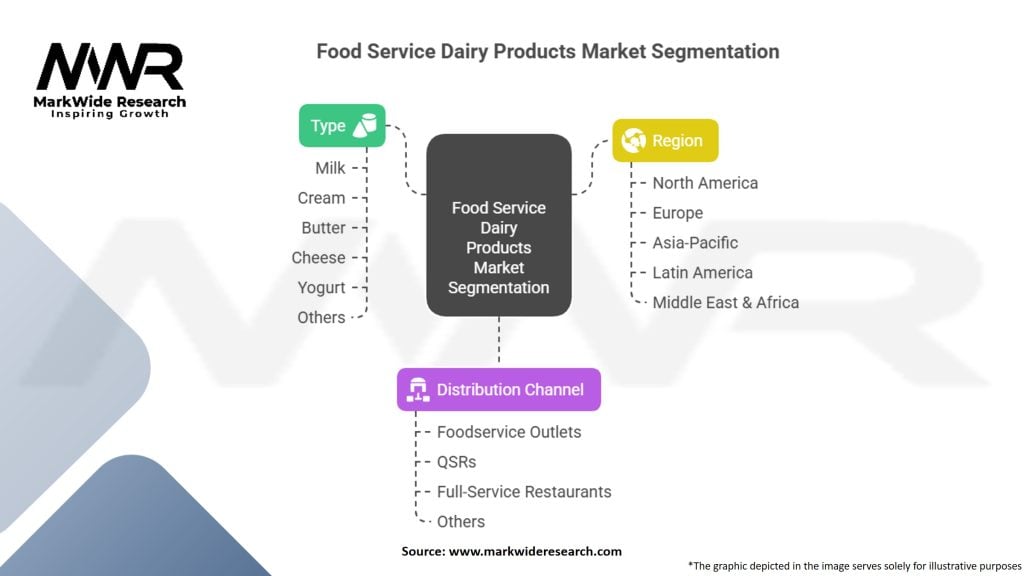

Segmentation

The food service dairy products market can be segmented based on product type, end-user, and geography:

By Product Type

By End-User

By Geography

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic had a significant impact on the food service industry, including the dairy products market. The closure of restaurants, cafes, and other food service establishments during lockdowns resulted in a decline in demand for dairy products. However, with the easing of restrictions and the gradual reopening of the industry, the market is expected to recover. Consumer preferences for dairy-based dishes and beverages are likely to remain strong, driving the growth of the food service dairy products market.

Key Industry Developments

Analyst Suggestions

Future Outlook

The food service dairy products market is expected to witness steady growth in the coming years. The rising demand for dairy-based dishes and beverages, coupled with the expansion of the food service industry, will drive market growth. However, market players need to address challenges related to raw material prices, regulatory compliance, and the impact of the COVID-19 pandemic. Innovation, sustainability, and meeting consumer preferences will be key factors for success in the future.

Conclusion

The food service dairy products market offers significant opportunities for growth and expansion. With the increasing demand for dairy-based dishes and beverages in the food service industry, market players need to focus on product innovation, quality, and sustainability. Collaboration with food service establishments, investment in research and development, and staying updated with market trends are essential to stay competitive. Despite challenges posed by fluctuating raw material prices and regulatory compliance, the future outlook for the food service dairy products market remains promising.

What is Food Service Dairy Products?

Food Service Dairy Products refer to a range of dairy items specifically designed for use in food service operations, including restaurants, cafes, and catering services. These products encompass milk, cheese, yogurt, and butter, tailored to meet the needs of food professionals.

What are the key players in the Food Service Dairy Products Market?

Key players in the Food Service Dairy Products Market include companies like Dairy Farmers of America, Land O’Lakes, and Saputo. These companies are known for their extensive product offerings and distribution networks, serving various food service establishments, among others.

What are the growth factors driving the Food Service Dairy Products Market?

The Food Service Dairy Products Market is driven by increasing consumer demand for dairy-based dishes, the rise of food delivery services, and the growing trend of health-conscious eating. Additionally, innovations in dairy processing and product development are contributing to market growth.

What challenges does the Food Service Dairy Products Market face?

Challenges in the Food Service Dairy Products Market include fluctuating milk prices, stringent food safety regulations, and competition from plant-based alternatives. These factors can impact profitability and operational efficiency for food service providers.

What opportunities exist in the Food Service Dairy Products Market?

Opportunities in the Food Service Dairy Products Market include the expansion of plant-based dairy alternatives, the growing trend of gourmet and artisanal dairy products, and the increasing demand for organic and locally sourced dairy items. These trends present avenues for innovation and market penetration.

What trends are shaping the Food Service Dairy Products Market?

Trends shaping the Food Service Dairy Products Market include the rise of sustainable dairy practices, the popularity of functional dairy products enriched with probiotics, and the increasing use of dairy in plant-based recipes. These trends reflect changing consumer preferences and health considerations.

Food Service Dairy Products Market Segmentation

| Segmentation Details | Information |

|---|---|

| Type | Milk, Cream, Butter, Cheese, Yogurt, Others |

| Distribution Channel | Foodservice Outlets, QSRs, Full-Service Restaurants, Others |

| Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Food Service Dairy Products Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at