444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The food platform to consumer delivery market has emerged as one of the most dynamic and rapidly evolving sectors in the global economy. This comprehensive ecosystem encompasses digital platforms that connect restaurants, food service providers, and consumers through sophisticated delivery networks. Market dynamics indicate unprecedented growth driven by changing consumer behaviors, technological advancements, and urbanization trends. The sector has experienced remarkable expansion with growth rates reaching 12.5% CAGR across major markets globally.

Digital transformation has fundamentally reshaped how consumers access food services, with mobile applications and web platforms becoming primary channels for food ordering. The market encompasses various delivery models including restaurant-to-consumer direct delivery, third-party aggregator platforms, and cloud kitchen operations. Consumer adoption rates have surged to approximately 68% penetration in urban markets, reflecting the fundamental shift in dining and food consumption patterns.

Technological innovation continues to drive market evolution, with artificial intelligence, machine learning, and advanced logistics optimization becoming standard features. The integration of real-time tracking, predictive analytics, and personalized recommendation systems has enhanced user experience significantly. Platform efficiency has improved by approximately 35% through these technological implementations, reducing delivery times and operational costs.

The food platform to consumer delivery market refers to the comprehensive ecosystem of digital platforms, mobile applications, and web-based services that facilitate the ordering, preparation, and delivery of food from restaurants and food service providers directly to consumers’ locations. This market encompasses third-party delivery aggregators, restaurant-owned delivery services, and integrated food technology solutions.

Core components of this market include customer-facing applications, restaurant management systems, delivery logistics networks, payment processing solutions, and data analytics platforms. The market operates through various business models including commission-based aggregator platforms, subscription-based premium services, and direct-to-consumer restaurant delivery systems. Service integration extends beyond simple food delivery to include grocery delivery, alcohol delivery, and specialized dietary meal services.

Market participants range from global technology giants operating multi-national platforms to local delivery services focusing on specific geographic regions. The ecosystem includes restaurants of all sizes, independent delivery drivers, logistics companies, payment processors, and technology solution providers. Value creation occurs through improved convenience for consumers, expanded market reach for restaurants, and employment opportunities for delivery personnel.

Strategic analysis reveals that the food platform to consumer delivery market represents a transformative force in the global food service industry. The market has demonstrated exceptional resilience and growth potential, particularly accelerated by changing lifestyle patterns and technological adoption. Key performance indicators show sustained growth with delivery frequency increasing by 42% among regular users over the past two years.

Market consolidation trends indicate increasing competition among major platforms, driving innovation in service offerings and operational efficiency. Leading platforms are expanding beyond traditional food delivery into grocery, pharmacy, and retail delivery services. Geographic expansion remains a priority, with platforms targeting emerging markets where smartphone penetration and internet connectivity continue to improve.

Investment patterns show significant capital allocation toward technology development, logistics infrastructure, and market expansion initiatives. The sector has attracted substantial venture capital and private equity investment, supporting rapid scaling and international expansion. Operational metrics demonstrate improving unit economics with average order values increasing and delivery costs optimizing through advanced routing algorithms and fleet management systems.

Consumer behavior analysis reveals fundamental shifts in food consumption patterns, with convenience and variety becoming primary decision factors. The following insights represent critical market dynamics:

Urbanization trends represent the primary catalyst driving food platform to consumer delivery market expansion. Increasing urban population density, longer working hours, and changing lifestyle preferences create ideal conditions for delivery service adoption. Demographic shifts toward younger, tech-savvy consumers who prioritize convenience over traditional dining experiences continue to fuel market growth.

Technological advancement enables sophisticated platform capabilities including real-time order tracking, predictive delivery algorithms, and personalized recommendation systems. The proliferation of smartphones and improved internet connectivity has made food delivery platforms accessible to broader consumer segments. Digital payment infrastructure development has eliminated traditional barriers to online food ordering, particularly in emerging markets.

Restaurant industry evolution toward delivery-optimized operations has created symbiotic relationships between platforms and food service providers. Many restaurants now design menus and kitchen operations specifically for delivery, recognizing the channel’s importance for revenue generation. Cloud kitchen concepts have emerged as delivery-first restaurant models, reducing overhead costs while maximizing delivery efficiency.

Consumer lifestyle changes including increased time constraints, dual-income households, and preference for home dining experiences drive sustained demand for delivery services. The growing acceptance of premium pricing for convenience services has improved platform economics and sustainability. Health consciousness trends have expanded market opportunities to include specialized dietary options, organic foods, and nutritional meal services.

High operational costs present significant challenges for food delivery platforms, particularly in achieving sustainable unit economics. Delivery logistics, customer acquisition, and technology development require substantial ongoing investment. Commission pressure from restaurants seeking to reduce platform fees creates tension in partnership relationships and limits platform profitability.

Regulatory challenges across different jurisdictions create compliance complexities for platforms operating in multiple markets. Labor classification issues, food safety regulations, and taxation requirements vary significantly between regions. Driver classification debates regarding employment status versus independent contractor relationships create legal and operational uncertainties.

Market saturation in mature urban markets has intensified competition and increased customer acquisition costs. Platforms must invest heavily in marketing and promotions to maintain market share, impacting profitability. Consumer price sensitivity limits platforms’ ability to pass increased costs to customers, particularly during economic downturns.

Quality control challenges in maintaining food quality during delivery can impact customer satisfaction and platform reputation. Temperature control, packaging integrity, and delivery time management require sophisticated logistics coordination. Restaurant dependency creates risks when key restaurant partners modify their platform relationships or develop independent delivery capabilities.

Geographic expansion into underserved markets presents substantial growth opportunities, particularly in suburban and rural areas where delivery services remain limited. Emerging markets with growing smartphone adoption and improving internet infrastructure offer significant potential for platform expansion. International expansion strategies allow successful platforms to leverage proven business models in new geographic regions.

Service diversification beyond traditional food delivery creates multiple revenue streams and increased customer engagement. Grocery delivery, alcohol delivery, and retail marketplace integration expand platform utility and customer lifetime value. Subscription models provide predictable revenue streams while offering customers value through reduced delivery fees and exclusive benefits.

Technology integration opportunities include artificial intelligence for demand prediction, autonomous delivery vehicles, and drone delivery systems. Advanced analytics enable personalized marketing, dynamic pricing, and operational optimization. Blockchain technology applications for supply chain transparency and payment processing represent emerging opportunities.

Partnership expansion with grocery chains, convenience stores, and specialty retailers broadens platform offerings and increases order frequency. Corporate catering services targeting business customers provide higher-value orders and predictable demand patterns. Integration with smart home devices and voice assistants creates new ordering channels and enhanced user experiences.

Competitive intensity continues to shape market dynamics as platforms compete for market share through pricing strategies, service quality improvements, and geographic expansion. The market exhibits network effects where platforms with larger restaurant selections and delivery coverage attract more customers, creating competitive advantages. Platform differentiation increasingly focuses on specialized services, premium offerings, and unique value propositions.

Supply and demand balancing represents a critical operational challenge, with platforms managing restaurant capacity, driver availability, and customer demand fluctuations. Peak hour management requires sophisticated forecasting and resource allocation systems. Seasonal variations in demand create opportunities for platforms to optimize operations and introduce targeted promotional campaigns.

Technology evolution drives continuous platform improvements and operational efficiency gains. Machine learning algorithms optimize delivery routes, predict customer preferences, and manage inventory for cloud kitchens. Data analytics capabilities provide insights for restaurants to optimize menus and pricing strategies based on delivery performance.

Ecosystem relationships between platforms, restaurants, and delivery drivers require careful balance to maintain service quality and participant satisfaction. MarkWide Research analysis indicates that successful platforms achieve optimal balance through transparent fee structures, performance incentives, and technology support for all ecosystem participants.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the food platform to consumer delivery market. Primary research includes surveys of consumers, restaurant operators, and delivery drivers across major markets. Secondary research incorporates industry reports, financial statements, regulatory filings, and technology trend analysis.

Data collection methods include structured interviews with industry executives, platform operators, and technology providers. Consumer behavior analysis utilizes transaction data, usage patterns, and satisfaction surveys to understand market dynamics. Quantitative analysis examines market size, growth rates, and competitive positioning across different geographic regions and market segments.

Market modeling incorporates economic indicators, demographic trends, and technology adoption patterns to project future market development. Scenario analysis considers various growth trajectories based on different market conditions and regulatory environments. Validation processes include expert reviews, industry feedback, and cross-referencing with multiple data sources to ensure accuracy and reliability.

Geographic coverage spans major markets including North America, Europe, Asia-Pacific, and emerging markets to provide comprehensive global perspective. Temporal analysis examines historical trends, current market conditions, and future projections to identify sustainable growth patterns and potential market disruptions.

North America represents the most mature market for food platform to consumer delivery services, with high smartphone penetration and established consumer acceptance. The region demonstrates 45% market share of global platform revenues, driven by major metropolitan areas and suburban expansion. Competitive dynamics feature intense rivalry among established platforms, driving innovation and service improvements.

Europe shows diverse market characteristics across different countries, with varying regulatory environments and consumer preferences. Western European markets demonstrate strong growth in urban areas, while Eastern European markets present expansion opportunities. Regional platforms maintain significant market presence alongside global competitors, creating fragmented but dynamic market conditions.

Asia-Pacific exhibits the highest growth rates globally, driven by rapid urbanization, increasing disposable income, and smartphone adoption. The region accounts for approximately 35% market share and growing, with China and India representing particularly significant opportunities. Local platform dominance characterizes many Asian markets, with region-specific business models and service offerings.

Latin America demonstrates emerging market potential with growing middle-class populations and improving digital infrastructure. Brazil and Mexico lead regional adoption, while other markets show increasing platform entry and investment. Economic volatility creates challenges but also opportunities for platforms offering value-oriented services.

Middle East and Africa represent frontier markets with significant long-term potential despite current infrastructure limitations. Urban centers in the UAE, Saudi Arabia, and South Africa show strong adoption rates. Mobile-first strategies prove particularly effective in markets with limited traditional internet infrastructure but growing smartphone penetration.

Market leadership is distributed among several global and regional platforms, each with distinct competitive advantages and market positioning strategies. The competitive environment features both horizontal competition among delivery platforms and vertical integration as companies expand service offerings.

Competitive strategies include geographic expansion, service diversification, technology innovation, and strategic partnerships. Platforms differentiate through delivery speed, restaurant selection, pricing models, and customer experience features. Market consolidation trends include strategic acquisitions and partnerships to achieve scale and operational efficiency.

By Service Type:

By Business Model:

By Customer Segment:

Restaurant Delivery Category represents the largest segment, encompassing traditional restaurants adapting to delivery channels and quick-service restaurants optimizing for delivery efficiency. This category benefits from established brand recognition and diverse cuisine options. Performance metrics show consistent growth with average order values increasing as consumers become more comfortable with delivery pricing.

Cloud Kitchen Category demonstrates the highest growth rates as delivery-optimized restaurant concepts gain traction. These virtual restaurants reduce overhead costs while maximizing delivery efficiency and menu optimization. Investment trends show significant capital flowing into cloud kitchen development and management companies.

Grocery Delivery Category has experienced accelerated adoption, particularly following global health concerns that increased demand for contactless shopping. Integration with food delivery platforms creates cross-selling opportunities and increased customer engagement. Market expansion includes partnerships with major grocery chains and independent retailers.

Specialty Services Category includes alcohol delivery, pharmaceutical delivery, and dietary-specific meal services. These categories offer higher margins and specialized customer segments but require additional regulatory compliance and operational expertise. Growth potential remains significant as platforms expand service portfolios and regulatory environments evolve.

For Consumers:

For Restaurants:

For Delivery Drivers:

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial Intelligence Integration is transforming platform operations through predictive analytics, demand forecasting, and personalized recommendations. AI-powered systems optimize delivery routes, predict customer preferences, and manage inventory for cloud kitchens. Machine learning algorithms continuously improve platform efficiency and customer satisfaction through data-driven insights.

Sustainability Initiatives are becoming increasingly important as platforms address environmental concerns related to packaging waste and delivery emissions. Electric vehicle adoption, reusable packaging programs, and carbon offset initiatives demonstrate corporate responsibility. Consumer awareness of environmental impact influences platform selection and operational strategies.

Ghost Kitchen Expansion represents a fundamental shift in restaurant operations, with delivery-only concepts optimizing for platform distribution. These virtual restaurants reduce real estate costs while maximizing delivery efficiency and menu experimentation. Investment growth in ghost kitchen facilities and management companies indicates long-term market transformation.

Subscription Model Evolution includes premium memberships offering delivery fee waivers, exclusive restaurant access, and priority service. These models improve customer retention and provide predictable revenue streams for platforms. Membership adoption rates continue growing as customers recognize value in frequent delivery usage.

Hyperlocal Delivery Services focus on ultra-fast delivery times for convenience items, groceries, and prepared foods. These services require dense fulfillment networks and sophisticated logistics coordination. Market expansion of quick commerce services indicates growing consumer demand for immediate gratification.

Strategic Acquisitions continue reshaping the competitive landscape as platforms seek to expand geographic presence and service capabilities. Recent consolidation activity includes platform mergers, restaurant chain acquisitions, and technology company integrations. Market concentration increases as larger platforms acquire smaller competitors and specialized service providers.

Regulatory Developments across various jurisdictions address driver classification, food safety standards, and platform liability issues. New legislation impacts operational costs and business models, requiring platforms to adapt compliance strategies. MWR analysis indicates that regulatory clarity will benefit long-term market stability and growth.

Technology Partnerships with autonomous vehicle companies, drone manufacturers, and robotics firms advance next-generation delivery capabilities. Pilot programs test autonomous delivery solutions in controlled environments with promising results. Investment allocation toward future delivery technologies indicates industry commitment to operational innovation.

Restaurant Technology Integration includes point-of-sale system connections, kitchen display systems, and inventory management integration. These technological improvements streamline order processing and reduce preparation times. Operational efficiency gains benefit both restaurants and platforms through improved service quality.

Financial Services Expansion includes payment processing, lending services for restaurants, and insurance products for drivers. These additional services create new revenue streams while strengthening ecosystem relationships. Platform evolution toward comprehensive business solutions demonstrates market maturation and diversification strategies.

Platform Differentiation should focus on unique value propositions beyond basic delivery services, including specialized cuisine access, premium service tiers, and integrated lifestyle services. Successful platforms will develop distinctive brand positioning and customer loyalty programs. Service quality improvements through technology investment and operational excellence will drive competitive advantages.

Geographic Strategy should prioritize markets with favorable regulatory environments, growing smartphone adoption, and limited competitive presence. International expansion requires careful market analysis and local partnership development. Market entry strategies should consider local preferences, regulatory requirements, and competitive dynamics.

Technology Investment priorities should include artificial intelligence, logistics optimization, and customer experience enhancement. Platforms must balance innovation investment with operational efficiency and profitability goals. Development focus should address scalability, reliability, and security requirements for growing user bases.

Partnership Development with restaurants, retailers, and technology providers creates ecosystem value and competitive barriers. Strategic alliances should focus on mutual benefit and long-term relationship sustainability. Collaboration opportunities include exclusive restaurant partnerships, technology integration, and co-marketing initiatives.

Financial Management should emphasize path to profitability while maintaining growth momentum and market share. Unit economics optimization, cost structure management, and revenue diversification are critical success factors. Investment priorities should balance growth initiatives with operational efficiency improvements.

Market evolution will continue toward increased integration of food delivery with broader lifestyle and convenience services. Platforms are expected to expand beyond traditional food delivery into comprehensive local commerce solutions. Growth projections indicate sustained expansion with projected growth rates of 8-12% CAGR over the next five years across major markets.

Technology advancement will drive significant operational improvements through autonomous delivery vehicles, drone delivery systems, and AI-powered optimization. These innovations will reduce delivery costs and improve service quality while creating new competitive dynamics. Implementation timelines suggest mainstream adoption of advanced delivery technologies within the next decade.

Market consolidation is expected to continue as platforms seek scale advantages and operational efficiency. Strategic acquisitions and partnerships will reshape competitive dynamics while creating more comprehensive service offerings. MarkWide Research projects that market leadership will concentrate among fewer, larger platforms with global reach and diversified services.

Regulatory environment development will provide greater clarity on platform operations, driver classification, and food safety requirements. Standardized regulations will reduce compliance costs and enable more predictable business planning. Policy evolution will balance innovation encouragement with consumer protection and worker rights considerations.

Consumer behavior trends indicate permanent shifts toward convenience-oriented food consumption, with delivery becoming a standard dining option rather than occasional service. Younger demographics will drive continued adoption while older demographics increasingly embrace delivery services. Usage patterns suggest integration of food delivery into regular lifestyle routines rather than special occasion usage.

The food platform to consumer delivery market represents a transformative force in the global food service industry, demonstrating remarkable growth and innovation potential. Market dynamics indicate sustained expansion driven by technological advancement, changing consumer preferences, and urbanization trends. The sector has evolved from a convenience service to an essential component of modern food consumption patterns.

Strategic opportunities abound for platforms that successfully balance growth initiatives with operational efficiency and profitability goals. Geographic expansion, service diversification, and technology innovation provide multiple pathways for market leadership and competitive differentiation. The integration of artificial intelligence, logistics optimization, and customer experience enhancement will determine long-term success in this dynamic market.

Industry transformation continues through ghost kitchen development, subscription model evolution, and comprehensive lifestyle service integration. These trends indicate market maturation while creating new growth opportunities and competitive dynamics. Successful platforms will adapt to changing regulatory environments while maintaining focus on customer satisfaction and ecosystem partner relationships.

Future market development will be characterized by increased consolidation, technology-driven efficiency improvements, and expansion into underserved geographic markets. The food platform to consumer delivery market is positioned for continued growth as it becomes increasingly integrated into global food consumption patterns and urban lifestyle preferences, creating lasting value for consumers, restaurants, and platform operators alike.

What is Food Platform to Consumer Delivery?

Food Platform to Consumer Delivery refers to services that connect consumers directly with food providers, enabling the ordering and delivery of meals through digital platforms. This model enhances convenience and accessibility for consumers while supporting local restaurants and food businesses.

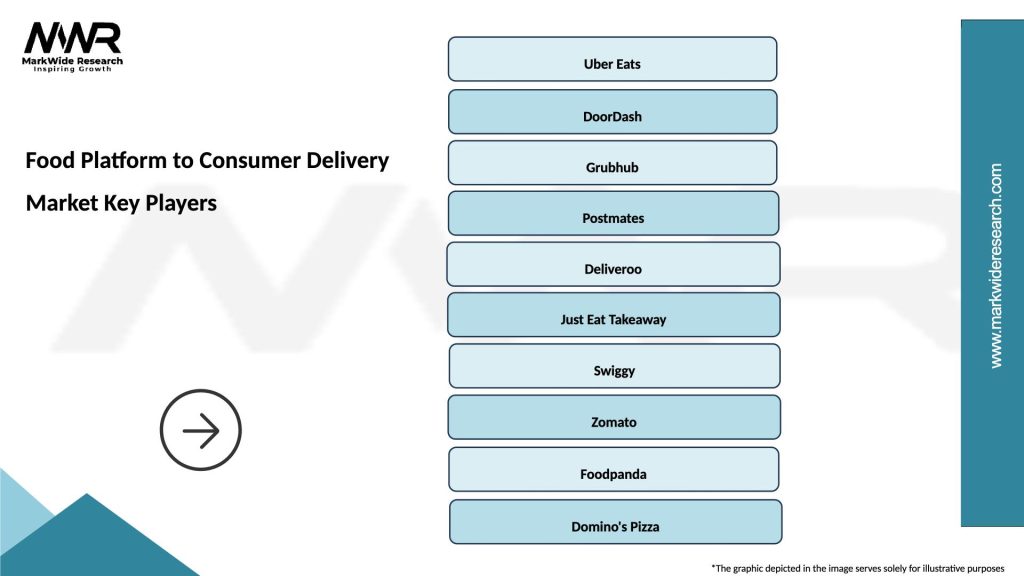

What are the key players in the Food Platform to Consumer Delivery Market?

Key players in the Food Platform to Consumer Delivery Market include companies like Uber Eats, DoorDash, and Grubhub, which provide various food delivery services. These companies leverage technology to streamline the ordering process and enhance customer experience, among others.

What are the growth factors driving the Food Platform to Consumer Delivery Market?

The Food Platform to Consumer Delivery Market is driven by increasing consumer demand for convenience, the rise of mobile technology, and the growing trend of online food ordering. Additionally, the expansion of restaurant partnerships and promotional offers further fuels market growth.

What challenges does the Food Platform to Consumer Delivery Market face?

Challenges in the Food Platform to Consumer Delivery Market include intense competition among delivery services, fluctuating delivery costs, and regulatory hurdles related to food safety and labor practices. These factors can impact profitability and operational efficiency.

What opportunities exist in the Food Platform to Consumer Delivery Market?

Opportunities in the Food Platform to Consumer Delivery Market include the potential for expansion into underserved regions, the integration of advanced technologies like AI for personalized recommendations, and the growing demand for healthy and sustainable food options. These trends can enhance service offerings and attract new customers.

What trends are shaping the Food Platform to Consumer Delivery Market?

Trends shaping the Food Platform to Consumer Delivery Market include the increasing popularity of ghost kitchens, the rise of subscription meal services, and a focus on sustainability in packaging and delivery practices. These trends reflect changing consumer preferences and the evolving landscape of food delivery.

Food Platform to Consumer Delivery Market

| Segmentation Details | Description |

|---|---|

| Product Type | Meal Kits, Grocery Delivery, Restaurant Takeout, Specialty Foods |

| Customer Type | Families, Singles, Students, Professionals |

| Distribution Channel | Mobile Apps, Websites, Third-Party Platforms, Direct Sales |

| Service Type | Subscription Services, On-Demand Delivery, Scheduled Delivery, Bulk Orders |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Food Platform to Consumer Delivery Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at