444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The food grade stainless steel container market occupies a vital position within the food and beverage industry, providing essential storage and transportation solutions for various food products. These containers, known for their durability, hygiene, and corrosion resistance, are widely used for storing, handling, and transporting food ingredients, processed foods, beverages, and pharmaceuticals. The market for food grade stainless steel containers experiences steady growth driven by factors such as stringent food safety regulations, increasing demand for processed and convenience foods, and growing awareness of hygiene and sanitation standards in food handling and storage.

Meaning

Food grade stainless steel containers are specialized containers designed and manufactured using stainless steel materials that comply with food safety and hygiene standards. These containers offer superior corrosion resistance, durability, and ease of cleaning, making them suitable for storing, handling, and transporting food products in various industries such as food processing, pharmaceuticals, cosmetics, and chemicals. Food grade stainless steel containers ensure product integrity, safety, and quality throughout the supply chain, meeting regulatory requirements and consumer expectations for hygienic food handling and storage practices.

Executive Summary

The food grade stainless steel container market serves as a critical component of the food and beverage industry, providing essential storage and transportation solutions for various food products. This executive summary offers insights into key market trends, drivers, challenges, and opportunities, emphasizing the importance of food grade stainless steel containers in ensuring food safety, quality, and compliance with regulatory standards. Understanding these dynamics is essential for industry stakeholders to make informed decisions, address customer needs, and stay competitive in a dynamic market landscape.

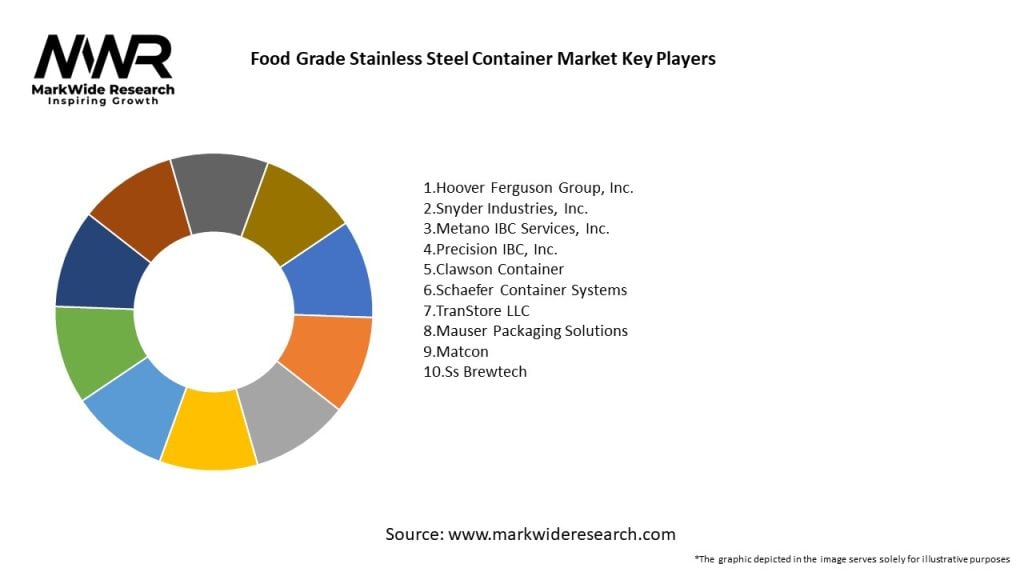

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The food grade stainless steel container market operates in a dynamic environment influenced by factors such as regulatory requirements, consumer preferences, technological advancements, and market trends. These dynamics shape industry trends, market competition, and business strategies, requiring stakeholders to stay agile, innovative, and responsive to changing market demands and opportunities.

Regional Analysis

The food grade stainless steel container market exhibits regional variations in demand, consumption patterns, and regulatory landscapes. Let’s explore key regions:

Competitive Landscape

Leading Companies in the Food Grade Stainless Steel Container Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

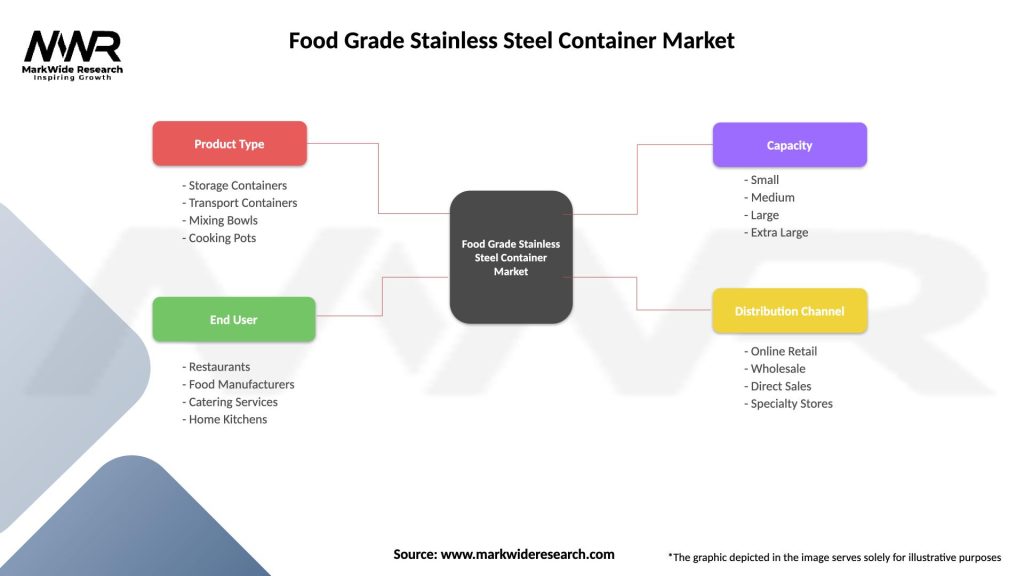

Segmentation

The food grade stainless steel container market can be segmented based on various factors, including:

Segmentation provides a more detailed understanding of market dynamics, customer needs, and competitive landscapes, enabling manufacturers, distributors, and end-users to make informed decisions and maximize market opportunities.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic had a significant impact on the food grade stainless steel container market, influencing demand, supply chains, and consumer behaviors. Some key impacts include:

Key Industry Developments

Analyst Suggestions

Future Outlook

The food grade stainless steel container market is poised for robust growth and innovation driven by factors such as stringent food safety regulations, increasing demand for processed and convenience foods, growing awareness of hygiene and sanitation standards, and technological advancements in container design and materials. As industries seek reliable, hygienic, and sustainable food packaging solutions, the demand for food grade stainless steel containers is expected to rise, presenting opportunities for manufacturers to innovate, collaborate, and capture market share in a dynamic and competitive landscape.

Conclusion

The food grade stainless steel container market plays a pivotal role in ensuring food safety, quality, and compliance with regulatory standards in the food and beverage industry. With increasing consumer demand for convenience foods, stringent food safety regulations, and growing awareness of hygiene and sanitation standards, the market for food grade stainless steel containers experiences steady growth and innovation. Manufacturers, distributors, and end-users must stay abreast of market trends, regulatory requirements, and technological advancements to capitalize on market opportunities, address customer needs, and maintain competitiveness in a dynamic and evolving market landscape. By embracing innovation, sustainability, and regulatory compliance, stakeholders can drive growth, profitability, and sustainability in the food grade stainless steel container market while ensuring the safety, integrity, and quality of food products throughout the supply chain.

What is Food Grade Stainless Steel Container?

Food Grade Stainless Steel Containers are specially designed storage solutions made from stainless steel that meet safety and hygiene standards for food contact. They are used in various applications, including food storage, preparation, and transportation, ensuring that food remains uncontaminated and fresh.

What are the key players in the Food Grade Stainless Steel Container Market?

Key players in the Food Grade Stainless Steel Container Market include companies like Thermos LLC, Zojirushi Corporation, and Eco-Products, among others. These companies are known for their innovative designs and commitment to quality in food storage solutions.

What are the growth factors driving the Food Grade Stainless Steel Container Market?

The growth of the Food Grade Stainless Steel Container Market is driven by increasing consumer awareness of food safety, the rising demand for sustainable packaging solutions, and the growing trend of meal prepping. Additionally, the durability and reusability of stainless steel containers contribute to their popularity.

What challenges does the Food Grade Stainless Steel Container Market face?

The Food Grade Stainless Steel Container Market faces challenges such as high production costs and competition from alternative materials like plastic and glass. Additionally, consumer preferences for lightweight and disposable options can hinder market growth.

What opportunities exist in the Food Grade Stainless Steel Container Market?

Opportunities in the Food Grade Stainless Steel Container Market include the expansion of e-commerce platforms for direct consumer sales and the increasing demand for eco-friendly products. Furthermore, innovations in design and functionality can attract a broader customer base.

What trends are shaping the Food Grade Stainless Steel Container Market?

Trends shaping the Food Grade Stainless Steel Container Market include a growing emphasis on sustainability, with consumers seeking reusable and recyclable options. Additionally, there is an increasing focus on multifunctional containers that cater to diverse food storage needs.

Food Grade Stainless Steel Container Market

| Segmentation Details | Description |

|---|---|

| Product Type | Storage Containers, Transport Containers, Mixing Bowls, Cooking Pots |

| End User | Restaurants, Food Manufacturers, Catering Services, Home Kitchens |

| Capacity | Small, Medium, Large, Extra Large |

| Distribution Channel | Online Retail, Wholesale, Direct Sales, Specialty Stores |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Food Grade Stainless Steel Container Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at