444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview: The Food Emulsion Composition Analysis Market plays a vital role in the food industry by offering insights into the composition of food emulsions, aiding in product development, quality control, and regulatory compliance. Food emulsions are widely used in various food products, including dressings, sauces, beverages, and dairy products, making the analysis of their composition essential for manufacturers to ensure product stability, texture, and sensory attributes.

Meaning: The Food Emulsion Composition Analysis Market involves the analysis of the composition of food emulsions, which are colloidal systems consisting of two immiscible phases (such as oil and water) stabilized by an emulsifier. This analysis provides valuable information about the physical, chemical, and functional properties of emulsions, including droplet size distribution, emulsifier concentration, and stability characteristics.

Executive Summary: The Food Emulsion Composition Analysis Market is witnessing steady growth, driven by increasing consumer demand for emulsion-based food products, stringent regulations governing food quality and safety, and advancements in analytical techniques. Analyzing the composition of food emulsions enables manufacturers to optimize product formulations, ensure product quality and consistency, and meet regulatory requirements, thereby enhancing consumer satisfaction and market competitiveness.

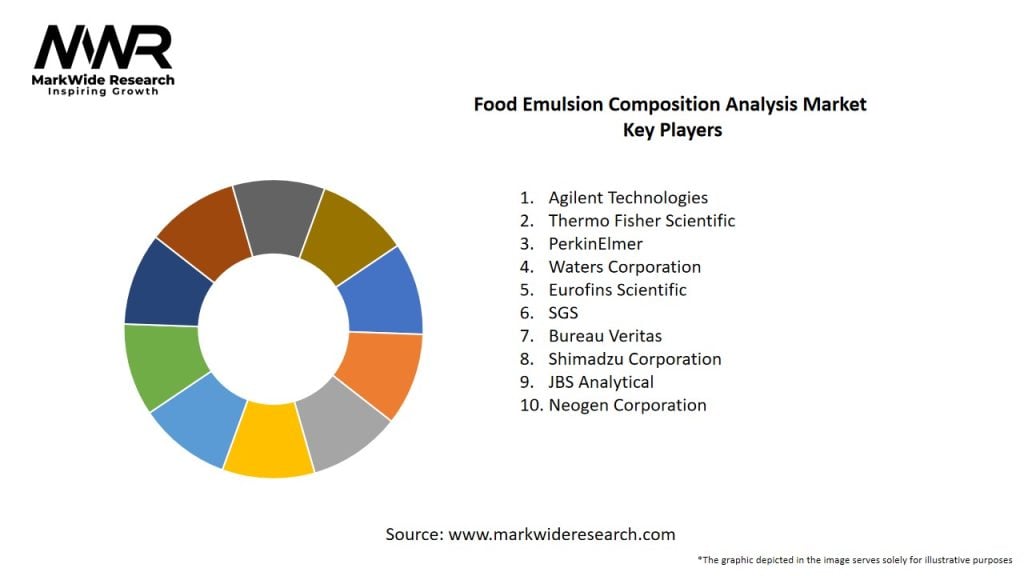

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights:

Market Drivers:

Market Restraints:

Market Opportunities:

Market Dynamics: The Food Emulsion Composition Analysis Market operates within a dynamic ecosystem influenced by factors such as technological advancements, regulatory developments, consumer trends, market competition, and industry collaborations. Understanding and navigating these dynamics are essential for stakeholders to identify opportunities, mitigate risks, and drive strategic growth initiatives.

Regional Analysis: Regional variations in consumer preferences, regulatory frameworks, market maturity, and industry dynamics influence the demand for composition analysis services and solutions across different geographical regions. Notable regions include North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa, each offering unique opportunities and challenges for market players.

Competitive Landscape:

Leading Companies in the Food Emulsion Composition Analysis Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

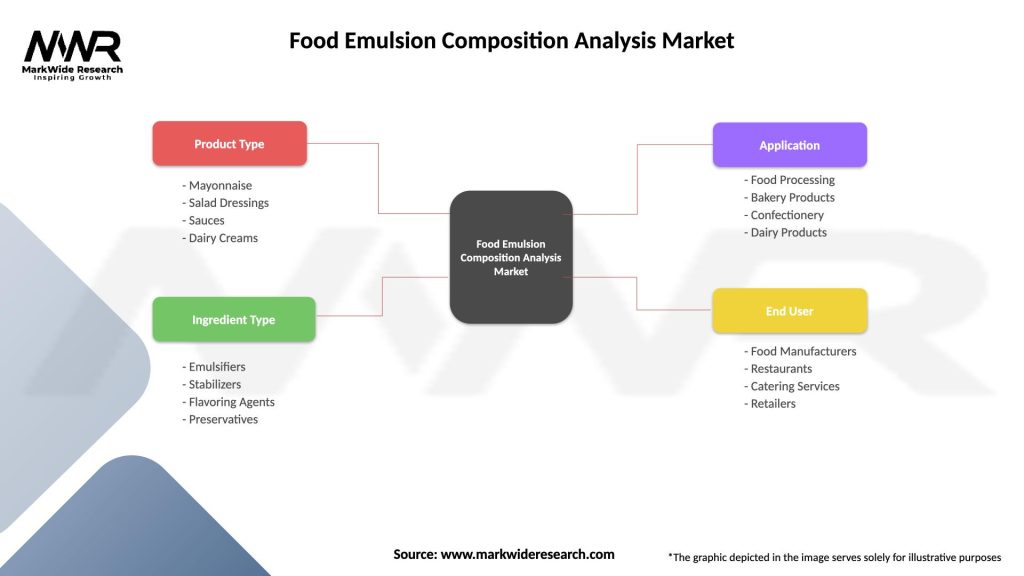

Segmentation: The Food Emulsion Composition Analysis Market can be segmented based on various factors, including service type, analytical technique, end-use industry, and geography. This segmentation enables targeted marketing, product development, and customer engagement strategies tailored to specific market segments and customer needs.

Category-wise Insights:

Key Benefits for Industry Participants and Stakeholders:

SWOT Analysis:

Market Key Trends:

Covid-19 Impact: The Covid-19 pandemic has underscored the importance of food safety, quality, and traceability, driving increased demand for composition analysis services and solutions. Key impacts include:

Key Industry Developments:

Analyst Suggestions:

Future Outlook: The Food Emulsion Composition Analysis Market is poised for robust growth, driven by increasing consumer demand for safe, high-quality food products, stringent regulatory requirements, technological advancements, and industry collaborations. Continued focus on innovation, sustainability, and customer-centricity will be critical for unlocking new opportunities, addressing emerging challenges, and sustaining long-term growth and competitiveness.

Conclusion: The Food Emulsion Composition Analysis Market serves as a cornerstone in the food industry, enabling manufacturers to ensure product safety, quality, and compliance with regulatory standards. Despite challenges posed by regulatory complexities, technological barriers, and market competition, the market presents significant opportunities for growth and innovation. By embracing technological advancements, fostering collaborations, and prioritizing customer needs and regulatory compliance, stakeholders can navigate the evolving market landscape and drive sustainable growth in the dynamic food industry ecosystem.

What is Food Emulsion Composition Analysis?

Food Emulsion Composition Analysis refers to the study and evaluation of the components and characteristics of food emulsions, which are mixtures of fat and water stabilized by emulsifiers. This analysis is crucial for understanding texture, stability, and flavor in various food products.

What are the key players in the Food Emulsion Composition Analysis Market?

Key players in the Food Emulsion Composition Analysis Market include companies like DuPont, BASF, and Kerry Group, which specialize in food ingredients and emulsifiers. These companies focus on innovation and quality to meet the demands of the food industry, among others.

What are the growth factors driving the Food Emulsion Composition Analysis Market?

The Food Emulsion Composition Analysis Market is driven by the increasing demand for processed foods, the need for improved food quality, and the rising consumer preference for convenience foods. Additionally, advancements in analytical techniques enhance the accuracy of emulsion analysis.

What challenges does the Food Emulsion Composition Analysis Market face?

Challenges in the Food Emulsion Composition Analysis Market include the complexity of food formulations and the variability in ingredient quality. Furthermore, regulatory compliance and the need for standardized testing methods can hinder market growth.

What opportunities exist in the Food Emulsion Composition Analysis Market?

Opportunities in the Food Emulsion Composition Analysis Market include the growing trend towards clean label products and the increasing focus on health and wellness. Innovations in emulsification technology also present avenues for new product development.

What trends are shaping the Food Emulsion Composition Analysis Market?

Trends in the Food Emulsion Composition Analysis Market include the rise of plant-based emulsifiers and the use of advanced analytical methods such as spectroscopy and chromatography. Additionally, there is a growing emphasis on sustainability and eco-friendly ingredients in food formulations.

Food Emulsion Composition Analysis Market

| Segmentation Details | Description |

|---|---|

| Product Type | Mayonnaise, Salad Dressings, Sauces, Dairy Creams |

| Ingredient Type | Emulsifiers, Stabilizers, Flavoring Agents, Preservatives |

| Application | Food Processing, Bakery Products, Confectionery, Dairy Products |

| End User | Food Manufacturers, Restaurants, Catering Services, Retailers |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Food Emulsion Composition Analysis Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at