Segmentation

-

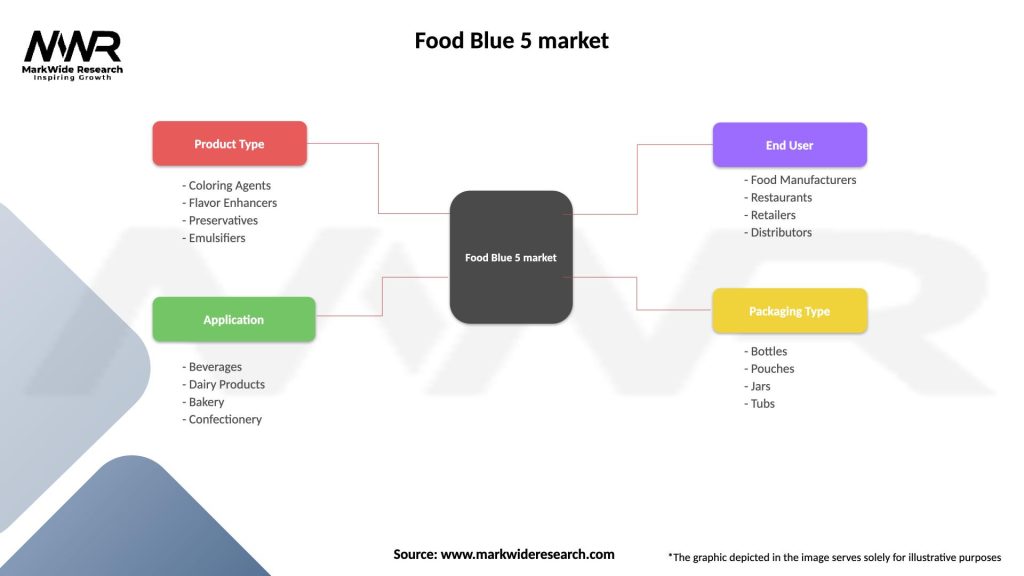

By Form: Water-soluble dye, lake (on permitted substrates), microencapsulated/functionalized, liquid concentrate, granule/low-dust.

-

By Application: Beverages, confectionery, bakery & icings, dairy & frozen, savoury & snacks, nutraceuticals (gummies, tablets/coatings), pet nutrition.

-

By Purity/Grade: Standard food grade, high-purity/low-impurity grade for sensitive markets, pharma/ nutraceutical grade with extended documentation.

-

By End User: CPG brand owners, contract manufacturers, artisanal and SME producers, foodservice/QSR suppliers.

-

By Distribution: Direct to key accounts, specialty distributors, e-procurement/EDI, regional resellers.

-

By Region: North America, Europe, Asia-Pacific, Latin America, Middle East & Africa.

Category-wise Insights

-

Beverages: Clear RTD systems prioritize brilliant mass tone and clarity; dosing accuracy and spectral monitoring at syrup rooms minimize shade drift. Low-pH resilience keeps Food Blue 5 favored over many botanicals.

-

Confectionery: Lakes dominate compound coatings, dragées, sprinkles, and center fillings. Controlled particle size and oil dispersibility govern opacity and gloss.

-

Bakery & Icings: Buttercreams, fondants, and glazes demand migration-resistant lakes; microencapsulation helps in freeze-thaw cycles and high-sugar environments.

-

Dairy & Frozen: Ice cream and yogurt inclusions need low-bleed lakes; in aerated mixes, color loading must account for overrun and melt profiles.

-

Savoury & Snacks: Limited but growing use in extruded snacks and seasoning visuals; encapsulated formats withstand extrusion heat and surface oil.

-

Nutraceuticals: Gummies and tablet coatings value compliance documentation, consistent hue across batches, and non-bleed performance in pectin/gelatin matrices.

-

Pet Nutrition: Treats and kibbles employ lakes for visual differentiation, provided stability under high-temperature drying and fat spray-coating.

Key Benefits for Industry Participants and Stakeholders

-

Brand Owners: Faster time-to-market through ready-to-use blends, consistent global shades, lower complaint rates, and robust regulatory files.

-

Contract Manufacturers: Low-dust, high-strength formats improve throughput and hygiene; tighter ΔE tolerances reduce rework.

-

Retailers/Private Label: Expanded seasonal/colorway options and reliable cross-plant reproducibility.

-

Regulators & Auditors: Clear impurity profiles, traceability, and aligned documentation simplify assessments.

-

Consumers: Stable, attractive colors that maintain product expectations across channels and climates.

SWOT Analysis

Strengths:

High stability in low-pH and high-shear processes; strong cost-in-use; lakes enable migration control in fats and low-moisture systems; broad application versatility.

Weaknesses:

Perception issues vs “natural” labeling; regulatory documentation burden; potential shade variability across diverse substrates without expert support.

Opportunities:

Microencapsulation, low-dust granules, digital color services, premixed proprietary shades, nutraceutical compliance kits, and ESG-differentiated supply.

Threats:

Clean-label substitution where stability permits; evolving impurity and labeling standards; input cost volatility; wastewater and EHS compliance pressures.

Market Key Trends

-

From pigment supply to color solutions: Vendors provide shade libraries, spectral fingerprints, and plant SOPs alongside the pigment.

-

Encapsulated and low-dust formats: Safety and consistency benefits in high-volume plants; easier automated dosing.

-

Blended “signature” shades: Teals, aquas, violets tailored to brand guidelines; protects identity and simplifies operations.

-

Quality by design (QbD): Statistical control of ΔE, particle size in lakes, and moisture in granules improves line performance.

-

Sustainability reporting: Water, energy, and waste metrics become decision criteria in RFPs; suppliers highlight solvent-free processes and recyclable packaging.

-

Global spec harmonization: Multinationals push single global specifications and require rapid change control and deviation reporting.

-

Color + function pairings: Co-formulation with acids, sweeteners, stabilizers to ensure holistic beverage stability and sensory consistency.

-

E-commerce procurement: Smaller producers source pre-blended concentrates online with tech sheets and virtual color matching tools.

-

Training & upskilling: Plant operators receive colorimetry and batching training to decrease rework and waste.

Key Industry Developments

-

Launch of microencapsulated blues: Improved resistance to light, heat, and moisture, reducing bleed in icings and inclusions.

-

Growth in low-dust granules: Enhanced occupational hygiene and metering accuracy in beverage syrup rooms and confectionery plants.

-

Standardized ΔE contracts: Service-level agreements on shade tolerances and complaint response times become common with key accounts.

-

Expanded nutraceutical grades: Vendors provide coating-system compatibility matrices and dissolution profiles for tablet applications.

-

Sustainability initiatives: Closed-loop water systems, renewable energy adoption, and lighter, recyclable packaging reduce footprint.

-

Distributor capability upgrades: Regional partners add shade-matching benches, pilot kettles, and rapid pack-offs to shorten lead time.

-

Regulatory documentation hubs: Centralized portals for CoAs, CoCs, SDSs, allergen statements, and impurity panels streamline audits.

Analyst Suggestions

-

Compete on reproducibility, not price alone: Guarantee ΔE windows across substrates; provide on-site or virtual commissioning support for first runs.

-

Invest in formats that save time: Prioritize low-dust granules, high-strength concentrates, and premixed blends to reduce customer handling and errors.

-

Build regulatory muscle: Maintain country-by-country dossiers, impurity trend analyses, and rapid customer Q&A to speed approvals.

-

Offer digital color services: Spectral libraries, batch fingerprinting, and shade calculators embedded in customer workflows.

-

Differentiate with sustainability: Publish water/energy/waste metrics, prioritize solvent-free processes, and offer returnable or recyclable packaging.

-

Protect IP via blends: Proprietary pre-blends help anchor long-term supply relationships and reduce cross-shopping.

-

Develop nutraceutical kits: Co-sell lakes with film-coating systems and technical SOPs to capture higher value in health-adjacent categories.

-

Strengthen distribution: Equip distributors with shade-matching and small-pack capabilities to serve SMEs and seasonal surges.

-

Educate on application science: Run customer workshops on pH effects, process shear, light exposure, and fat migration to reduce misuse.

-

Scenario-plan for inputs: Build dual-source strategies and buffer stocks for critical intermediates; maintain flexible pack sizes for volatility.

Future Outlook

The Food Blue 5 market should post steady, mid-single-digit growth in volume with higher value growth as customers migrate to functional formats (microencapsulated, low-dust, pre-blended) and demand documented reproducibility across global plants. Beverages will remain the anchor, with confectionery coatings, bakery icings, and nutraceutical coatings as value-accretive niches. Clean-label blues will continue to gain ground in select segments, but performance constraints—especially in low-pH, heat-processed, or fat-rich systems—will preserve a substantial role for Food Blue 5. Vendors that balance regulatory excellence, application engineering, and sustainability will capture outsized share, even as commodity tailwinds fade.

Conclusion

The Food Blue 5 Market is no longer a simple pigment trade; it is a spec-driven, solution-oriented ecosystem. Success will favor suppliers who deliver reproducible shades across diverse matrices, streamline plant operations with advanced formats, sustain regulatory trust with transparent dossiers, and differentiate with sustainability. For brand owners and contract manufacturers, Food Blue 5 remains a reliable and versatile tool—especially where processing intensity challenges botanical alternatives—enabling bold, memorable products that meet both commercial and compliance goals. As portfolios tilt toward ready-to-use blends, digital color management, and microencapsulation, the category will continue to create value well beyond the per-kilo price of pigment.