444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The Asia food and beverage market represents one of the world’s most dynamic and rapidly evolving consumer sectors, driven by unprecedented urbanization, rising disposable incomes, and shifting dietary preferences across diverse populations. This expansive market encompasses traditional staples, processed foods, beverages, and innovative culinary solutions that cater to over 4.6 billion consumers across the continent. Market dynamics indicate robust growth potential, with the sector experiencing a compound annual growth rate (CAGR) of 6.2% as consumer preferences evolve toward convenience foods, health-conscious options, and premium products.

Regional diversity characterizes this market, spanning from the technologically advanced economies of Japan and South Korea to the rapidly developing markets of Southeast Asia and the massive consumer bases of China and India. The sector encompasses everything from traditional rice and noodle products to sophisticated ready-to-eat meals, functional beverages, and plant-based alternatives. Digital transformation has accelerated market evolution, with e-commerce platforms capturing approximately 23% of total food and beverage sales in major urban centers across Asia.

Consumer behavior patterns reveal increasing demand for authentic flavors, sustainable packaging, and nutritionally enhanced products. The market benefits from strong domestic production capabilities, extensive distribution networks, and growing export opportunities to global markets seeking Asian cuisine and beverage innovations.

The Asia food and beverage market refers to the comprehensive ecosystem of food production, processing, distribution, and consumption across Asian countries, encompassing traditional cuisines, modern processed foods, beverages, and emerging nutritional products that serve diverse cultural preferences and dietary requirements throughout the region.

Market scope includes agricultural commodities, packaged foods, dairy products, meat and seafood, beverages ranging from traditional teas to modern energy drinks, and specialty items like functional foods and dietary supplements. The sector integrates traditional food preparation methods with modern manufacturing technologies, creating unique product categories that blend cultural authenticity with contemporary convenience and nutritional science.

Geographic coverage spans East Asia, Southeast Asia, South Asia, and Central Asia, each contributing distinct culinary traditions, ingredient preferences, and consumption patterns. The market serves both domestic consumption needs and international export demands, positioning Asia as a global hub for food innovation and traditional cuisine preservation.

Strategic positioning of the Asia food and beverage market reflects its critical role in global food security and culinary innovation. The sector demonstrates remarkable resilience and adaptability, successfully navigating supply chain challenges while maintaining consistent growth trajectories across multiple product categories and geographic regions.

Key performance indicators highlight the market’s strength, with processed food segments achieving 8.1% annual growth and beverage categories expanding at 7.3% annually. Consumer spending patterns show increasing allocation toward premium products, organic options, and convenience foods, reflecting rising affluence and lifestyle changes across urban populations.

Innovation drivers include technological advancement in food processing, sustainable packaging solutions, and the integration of traditional ingredients with modern nutritional science. The market benefits from strong government support for food safety standards, export promotion, and agricultural modernization initiatives that enhance production efficiency and product quality.

Competitive landscape features both established multinational corporations and dynamic local brands that leverage cultural authenticity and regional taste preferences. Market consolidation trends indicate strategic partnerships between global food companies and local producers, creating synergies that combine international expertise with regional market knowledge.

Consumer preference evolution reveals significant shifts toward health-conscious choices, with functional foods and beverages gaining substantial market traction. MarkWide Research analysis indicates that health-focused products now represent a growing segment of consumer purchasing decisions across major Asian markets.

Market maturation varies significantly across countries, with developed economies showing sophisticated consumer preferences while emerging markets demonstrate rapid adoption of modern food processing and packaging technologies.

Demographic transformation serves as the primary catalyst for market expansion, with urbanization rates exceeding 55% across major Asian economies and creating concentrated consumer bases with higher disposable incomes and changing lifestyle patterns. Urban populations demonstrate increased demand for convenience foods, premium products, and diverse culinary experiences.

Economic development across the region has elevated consumer purchasing power, enabling greater expenditure on food quality, variety, and convenience. Rising middle-class populations seek products that offer time-saving benefits, nutritional value, and social status, driving demand for premium and imported food items.

Cultural globalization facilitates cross-border culinary exchange, with consumers increasingly open to trying international flavors while maintaining preferences for local tastes. This trend supports both domestic innovation and import market growth, creating opportunities for fusion products that combine global appeal with regional authenticity.

Technology adoption in food production, preservation, and distribution enhances product quality, extends shelf life, and improves supply chain efficiency. Advanced processing technologies enable manufacturers to create innovative products that meet evolving consumer expectations for taste, nutrition, and convenience.

Health consciousness drives demand for functional foods, organic products, and nutritionally enhanced options. Consumers increasingly prioritize products that support wellness goals, leading to growth in categories like probiotic foods, plant-based proteins, and fortified beverages.

Regulatory complexity across diverse Asian markets creates challenges for manufacturers seeking regional expansion. Varying food safety standards, labeling requirements, and import regulations necessitate significant compliance investments and can delay product launches or market entry strategies.

Supply chain vulnerabilities expose the market to disruptions from natural disasters, climate change impacts, and geopolitical tensions. Agricultural production faces increasing pressure from extreme weather events, while transportation networks require continuous investment to maintain efficiency and reliability.

Price sensitivity among significant consumer segments limits market penetration for premium products. Despite rising incomes, large populations remain cost-conscious, creating challenges for brands seeking to introduce higher-value products or implement price increases to offset rising production costs.

Cultural resistance to certain food innovations or foreign products can limit market acceptance in traditional communities. Consumer preferences for familiar flavors and preparation methods may slow adoption of new product categories or international brands.

Infrastructure limitations in rural and developing areas restrict distribution reach and cold chain capabilities. Inadequate storage and transportation facilities can increase product losses and limit market access for perishable goods, particularly affecting fresh produce and dairy products.

Health and wellness trends present substantial opportunities for product innovation and market expansion. Growing consumer awareness of nutrition and preventive healthcare creates demand for functional foods, dietary supplements, and products with specific health benefits, enabling premium pricing and brand differentiation.

Digital transformation opens new distribution channels and customer engagement opportunities. E-commerce platforms, mobile applications, and social media marketing enable direct-to-consumer relationships, personalized product offerings, and efficient market penetration strategies that bypass traditional retail limitations.

Sustainability initiatives create competitive advantages for companies implementing environmentally responsible practices. Consumer preference for sustainable packaging, ethical sourcing, and reduced environmental impact drives demand for products that align with environmental consciousness.

Export market development leverages growing international interest in Asian cuisine and ingredients. Authentic Asian food products command premium prices in global markets, while modern processing and packaging technologies enable broader international distribution of traditional products.

Plant-based alternatives represent emerging opportunities as consumers seek sustainable protein sources and dietary diversity. Innovation in plant-based meat substitutes, dairy alternatives, and protein-rich snacks addresses both health and environmental concerns while appealing to younger demographics.

Competitive intensity drives continuous innovation and market differentiation strategies. Companies compete through product quality, brand positioning, distribution efficiency, and customer service excellence, creating dynamic market conditions that benefit consumers through improved offerings and competitive pricing.

Supply and demand fluctuations influence pricing strategies and inventory management approaches. Seasonal variations in agricultural production, changing consumer preferences, and economic conditions create market volatility that requires adaptive business strategies and flexible supply chain management.

Technology integration transforms production processes, quality control systems, and customer interaction methods. Automation in manufacturing, blockchain for supply chain transparency, and artificial intelligence for demand forecasting enhance operational efficiency and market responsiveness.

Consumer behavior evolution shapes product development priorities and marketing strategies. Generational differences in food preferences, shopping habits, and brand loyalty require targeted approaches that address specific demographic segments while maintaining broad market appeal.

Regulatory environment changes impact market access, product formulations, and operational requirements. Government policies regarding food safety, nutrition labeling, and trade regulations influence market dynamics and require continuous monitoring and adaptation by industry participants.

Comprehensive data collection employs multiple research approaches to ensure accuracy and reliability of market insights. Primary research includes consumer surveys, industry expert interviews, and direct engagement with key market participants across major Asian economies to gather firsthand market intelligence.

Secondary research analysis incorporates government statistics, industry reports, trade association data, and academic studies to provide comprehensive market context and historical trend analysis. This approach ensures thorough coverage of market segments, geographic regions, and competitive landscapes.

Quantitative analysis utilizes statistical modeling, trend analysis, and forecasting methodologies to project market growth patterns and identify emerging opportunities. Data validation processes ensure accuracy and reliability of numerical insights and projections.

Qualitative assessment examines market dynamics, consumer behavior patterns, and industry trends through expert analysis and stakeholder feedback. This approach provides context for quantitative findings and identifies factors that may influence future market development.

Cross-verification protocols ensure data accuracy through multiple source validation and expert review processes. Regional market specialists provide local insights that enhance understanding of cultural nuances and market-specific conditions that influence consumer behavior and business operations.

East Asia dominates market activity with China representing approximately 42% of regional consumption, driven by massive population, rapid urbanization, and increasing consumer sophistication. Japan and South Korea contribute advanced technology adoption and premium product preferences that influence regional trends.

Southeast Asia demonstrates the highest growth potential, with countries like Vietnam, Thailand, and Indonesia showing robust economic development and expanding middle-class populations. The region benefits from agricultural abundance, strategic geographic positioning, and increasing integration with global supply chains.

South Asia, led by India, presents enormous market opportunities with over 1.4 billion consumers and rapidly changing dietary patterns. Traditional food preferences combine with modern convenience demands, creating unique market dynamics that favor both local and international brands.

Market fragmentation varies significantly across regions, with developed economies showing consolidated retail structures while emerging markets maintain diverse distribution channels including traditional wet markets, modern supermarkets, and growing e-commerce platforms.

Cross-border trade facilitates regional integration, with countries specializing in specific product categories and serving broader Asian markets. Thailand’s processed food exports, Japan’s beverage innovations, and India’s spice and tea production exemplify regional specialization patterns.

Market leadership combines established multinational corporations with dynamic regional players that leverage local market knowledge and cultural authenticity. Competition intensifies across all segments as companies seek to capture growing consumer demand and expand market share.

Strategic partnerships between international brands and local companies create synergies that combine global expertise with regional market knowledge. These collaborations enable faster market penetration, cultural adaptation, and supply chain optimization.

Innovation competition drives continuous product development, with companies investing in research and development to create products that meet evolving consumer preferences while maintaining cost competitiveness and operational efficiency.

By Product Category:

By Distribution Channel:

By Consumer Segment:

Processed Foods segment leads market growth with increasing urbanization driving demand for convenient meal solutions. Ready-to-eat products, instant noodles, and packaged snacks show particularly strong performance as busy lifestyles create time constraints for traditional food preparation.

Beverage category demonstrates robust expansion across both traditional and innovative products. Tea and coffee maintain cultural significance while energy drinks and functional beverages gain popularity among younger consumers. Health-focused beverages achieve premium pricing with 15-25% higher margins compared to conventional options.

Dairy products experience steady growth supported by increasing protein consumption awareness and Western dietary influence. Yogurt and flavored milk products show particular strength in urban markets, while traditional dairy products maintain importance in rural areas.

Bakery and confectionery benefits from celebration culture and gift-giving traditions across Asian societies. Premium chocolate and artisanal bakery products command higher prices in affluent urban markets, while traditional sweets maintain cultural significance during festivals and special occasions.

Meat and seafood sectors adapt to changing protein preferences and food safety concerns. Processed and packaged protein products gain market share as consumers seek convenience and quality assurance, while traditional fresh markets remain important for daily protein purchases.

Manufacturers benefit from large and growing consumer markets that provide economies of scale and revenue diversification opportunities. Regional production capabilities enable cost-effective manufacturing while proximity to raw materials reduces supply chain costs and complexity.

Retailers gain from increasing consumer spending on food and beverages, with modern retail formats capturing higher margins through value-added services and premium product positioning. E-commerce integration creates additional revenue streams and customer engagement opportunities.

Suppliers and distributors benefit from market expansion and infrastructure development that creates new business opportunities and operational efficiencies. Technology adoption in logistics and supply chain management enhances service capabilities and competitive positioning.

Consumers enjoy improved product variety, quality, and convenience as competition drives innovation and service enhancement. Access to both traditional and international food options enriches dietary choices while competitive pricing maintains affordability.

Investors find attractive opportunities in a growing market with strong fundamentals and diverse investment options across the value chain. Market resilience and essential nature of food and beverage consumption provide stability during economic uncertainties.

Strengths:

Weaknesses:

Opportunities:

Threats:

Health and wellness integration transforms product development priorities as consumers increasingly seek foods that provide functional benefits beyond basic nutrition. Probiotic foods, fortified beverages, and plant-based alternatives gain market traction as health consciousness influences purchasing decisions.

Sustainability focus drives packaging innovation and supply chain transparency initiatives. Consumers, particularly younger demographics, prioritize environmentally responsible products, creating opportunities for brands that demonstrate commitment to sustainable practices and ethical sourcing.

Premium product adoption reflects rising affluence and quality consciousness among urban consumers. Artisanal foods, organic products, and imported specialties command higher prices as consumers seek unique experiences and superior quality.

Digital integration revolutionizes customer engagement and distribution strategies. Social media marketing, influencer partnerships, and e-commerce platforms enable direct consumer relationships and personalized product recommendations that enhance brand loyalty and sales effectiveness.

Convenience culture accelerates demand for time-saving food solutions. Ready-to-eat meals, meal kits, and on-the-go snacks cater to busy lifestyles while maintaining taste and nutritional quality that meets consumer expectations.

Technology adoption accelerates across the value chain, with companies implementing automation, artificial intelligence, and blockchain technologies to enhance production efficiency, quality control, and supply chain transparency. These investments improve operational performance while enabling better customer service and product traceability.

Strategic partnerships between international brands and local companies create synergies that combine global expertise with regional market knowledge. Recent collaborations focus on product innovation, distribution expansion, and cultural adaptation that enhances market penetration effectiveness.

Regulatory harmonization efforts across Asian markets aim to reduce trade barriers and standardize food safety requirements. Government initiatives supporting regional integration facilitate cross-border commerce while maintaining consumer protection standards.

Investment in infrastructure includes cold chain development, modern processing facilities, and digital commerce platforms that enhance market efficiency and product quality. Both private companies and government agencies contribute to infrastructure improvements that benefit the entire industry.

Sustainability initiatives gain momentum as companies implement environmentally responsible practices throughout their operations. Packaging innovations, waste reduction programs, and sustainable sourcing commitments address consumer concerns while potentially reducing operational costs.

Market entry strategies should prioritize cultural adaptation and local partnership development to navigate complex regulatory environments and consumer preferences effectively. MWR analysis suggests that successful market penetration requires deep understanding of regional taste preferences and shopping behaviors.

Product innovation focus should emphasize health benefits, convenience, and authentic flavors that resonate with evolving consumer demands. Companies should invest in research and development capabilities that enable rapid response to market trends while maintaining cost competitiveness.

Distribution diversification across traditional and modern channels ensures comprehensive market coverage and risk mitigation. E-commerce integration becomes essential for reaching younger consumers and urban markets where digital adoption rates exceed 70% among target demographics.

Supply chain resilience requires investment in multiple sourcing options, inventory management systems, and logistics capabilities that can adapt to disruptions while maintaining product quality and availability. Companies should develop contingency plans for various risk scenarios.

Brand positioning strategies should balance global appeal with local relevance, creating products that meet international quality standards while respecting cultural preferences and dietary traditions. Authentic storytelling and community engagement enhance brand credibility and consumer loyalty.

Growth trajectory remains positive across most market segments, with health-focused products and premium categories expected to outperform traditional segments. Urbanization trends and rising incomes support continued market expansion, while technology adoption enhances operational efficiency and customer engagement capabilities.

Innovation acceleration will drive product development in functional foods, sustainable packaging, and personalized nutrition solutions. Companies that successfully integrate technology with traditional food culture will gain competitive advantages in rapidly evolving market conditions.

Regional integration continues to deepen through trade agreements, infrastructure development, and regulatory harmonization initiatives. Cross-border commerce will expand as companies leverage regional specializations and economies of scale to serve broader Asian markets more effectively.

Sustainability requirements will become increasingly important for market success as consumers and regulators prioritize environmental responsibility. Companies that proactively implement sustainable practices will benefit from enhanced brand reputation and potential cost savings through operational efficiency improvements.

Digital transformation will reshape industry operations from production planning to customer service delivery. Companies that successfully integrate digital technologies throughout their value chains will achieve competitive advantages through improved efficiency, customer insights, and market responsiveness capabilities.

The Asia food and beverage market represents a dynamic and rapidly evolving sector that combines traditional culinary heritage with modern consumer demands and technological innovation. Market fundamentals remain strong, supported by large and growing populations, rising disposable incomes, and increasing urbanization that drives demand for diverse, convenient, and high-quality food products.

Strategic opportunities abound for companies that can successfully navigate cultural diversity, regulatory complexity, and competitive intensity while delivering products that meet evolving consumer preferences for health, convenience, and authenticity. Success requires balanced approaches that respect local traditions while embracing innovation and sustainability principles.

Future market development will be shaped by continued economic growth, technological advancement, and changing lifestyle patterns that favor premium products, digital commerce, and health-conscious choices. Companies that invest in understanding local markets, building resilient supply chains, and developing innovative products will be best positioned to capitalize on the substantial opportunities this vibrant market provides for sustainable growth and profitability.

What is Food & Beverage in Asia?

Food & Beverage in Asia refers to the diverse range of food products and beverages consumed across Asian countries, encompassing traditional cuisines, modern dining trends, and various beverage categories such as tea, coffee, and alcoholic drinks.

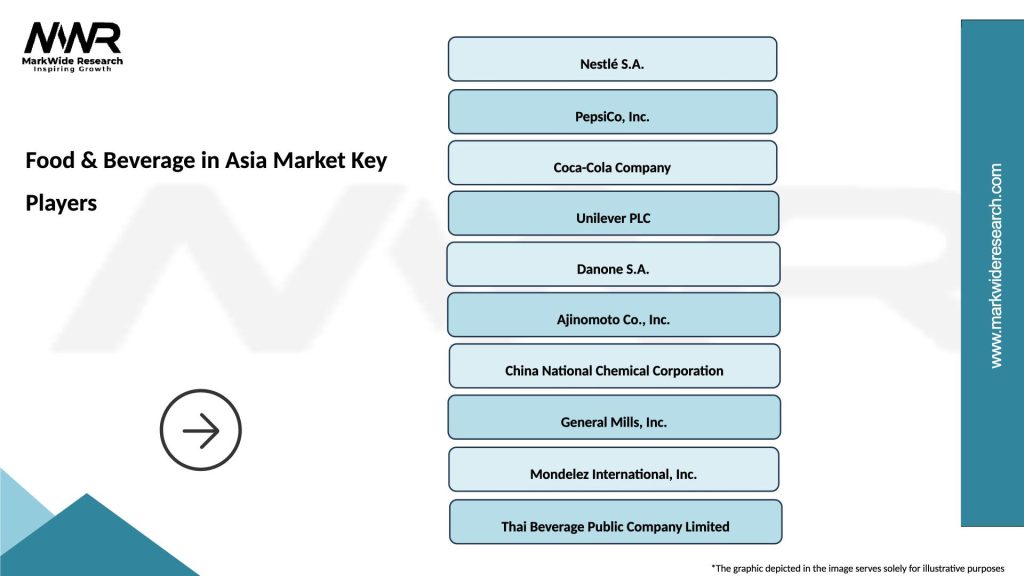

What are the key companies in the Food & Beverage in Asia Market?

Key companies in the Food & Beverage in Asia Market include Nestlé, PepsiCo, and Coca-Cola, which play significant roles in product innovation and distribution across the region, among others.

What are the growth factors driving the Food & Beverage in Asia Market?

The Food & Beverage in Asia Market is driven by increasing urbanization, rising disposable incomes, and changing consumer preferences towards healthier and convenient food options.

What challenges does the Food & Beverage in Asia Market face?

Challenges in the Food & Beverage in Asia Market include stringent regulations on food safety, intense competition among brands, and the need for sustainable sourcing practices.

What opportunities exist in the Food & Beverage in Asia Market?

Opportunities in the Food & Beverage in Asia Market include the growing demand for plant-based products, the rise of e-commerce for food delivery, and the increasing popularity of ethnic cuisines.

What trends are shaping the Food & Beverage in Asia Market?

Trends in the Food & Beverage in Asia Market include the shift towards organic and natural ingredients, the integration of technology in food production, and the rise of health-conscious consumer behaviors.

Food & Beverage in Asia Market

| Segmentation Details | Description |

|---|---|

| Product Type | Snacks, Beverages, Dairy, Confectionery |

| Distribution Channel | Supermarkets, Online Retail, Convenience Stores, Food Service |

| Customer Type | Retail Consumers, Food Manufacturers, Wholesalers, Restaurants |

| Price Tier | Premium, Mid-Range, Economy, Discount |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Food & Beverage in Asia Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at