444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The Food and Beverages Industry Pumps market plays a crucial role in ensuring the smooth and efficient transfer of fluids within the food and beverages industry. These pumps are specifically designed to meet the unique requirements of this industry, including handling various types of liquids, maintaining hygiene standards, and meeting strict regulations. The market for food and beverages industry pumps has witnessed significant growth in recent years, driven by the increasing demand for processed and packaged food and beverages globally.

Meaning

Food and beverages industry pumps are mechanical devices used for the transportation of liquids in the food and beverages sector. These pumps are designed to handle a wide range of fluids, including ingredients, additives, flavors, and finished products. They are essential for maintaining the efficiency and productivity of manufacturing processes, ensuring the quality and safety of food and beverages, and complying with regulatory standards.

Executive Summary

The food and beverages industry pumps market has experienced substantial growth in recent years, driven by the expanding food processing and packaging industry. The increasing demand for convenience food, ready-to-drink beverages, and a variety of processed food products has propelled the need for efficient and reliable pumping solutions. Manufacturers in this market are focusing on developing pumps that can handle different types of fluids, maintain hygiene standards, and improve operational efficiency.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

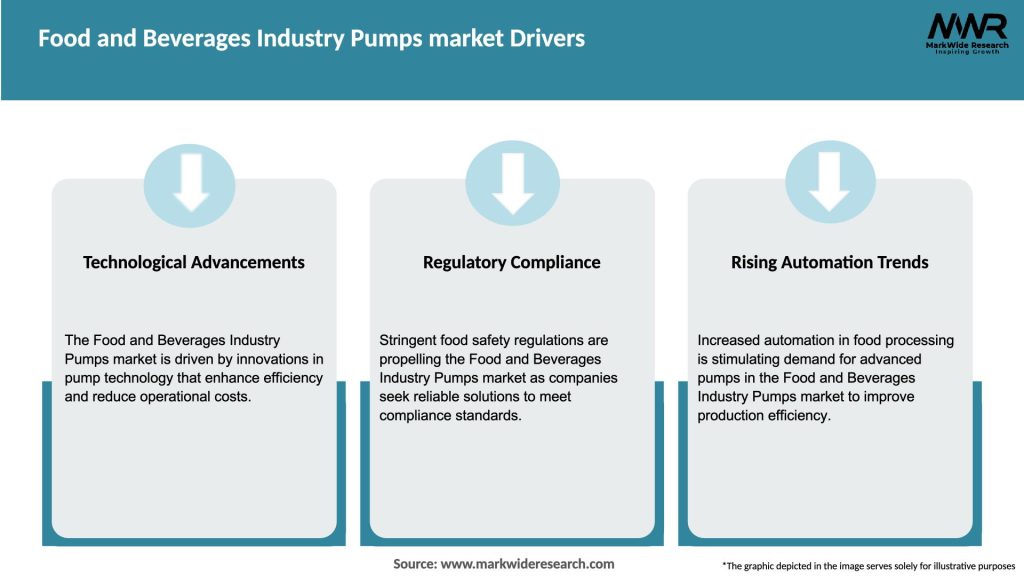

The food and beverages industry pumps market is driven by several dynamic factors, including technological advancements, changing consumer preferences, regulatory requirements, and economic factors. These dynamics influence the market trends, opportunities, and challenges faced by industry participants.

Technological advancements play a significant role in shaping the market landscape. Pump manufacturers are continually investing in research and development to introduce innovative and efficient pumping solutions. The integration of automation, IoT, and advanced monitoring systems is enabling real-time data analysis, predictive maintenance, and remote control capabilities.

Changing consumer preferences and lifestyle trends are driving the demand for processed and packaged food and beverages. This trend is expected to continue, with consumers seeking convenience, variety, and healthier options. Pump manufacturers need to align their product offerings with these evolving consumer preferences to stay competitive in the market.

Regulatory requirements and hygiene standards are stringent in the food and beverages industry. Pump manufacturers must ensure compliance with these standards, including regulations related to food contact materials, cleanability, and sanitary design.Compliance with regulations is crucial to maintain the integrity and safety of food and beverages. Manufacturers that can provide pumps that meet these requirements have a competitive advantage in the market.

Economic factors also influence the food and beverages industry pumps market. Factors such as GDP growth, disposable incomes, and consumer spending patterns impact the demand for processed and packaged food and beverages. Pump manufacturers need to closely monitor economic trends to identify opportunities in different regions and adjust their strategies accordingly.

Additionally, the COVID-19 pandemic has had a significant impact on the food and beverages industry and, consequently, the pumps market. The pandemic disrupted supply chains, restricted movement, and caused a decline in consumer spending. However, as economies recover and the situation stabilizes, the market is expected to regain momentum, driven by the pent-up demand for food and beverages.

Regional Analysis

The food and beverages industry pumps market can be analyzed on a regional basis to understand the trends, opportunities, and challenges specific to each geographical region. The market is segmented into key regions such as North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa.

North America and Europe are mature markets for food and beverages industry pumps, characterized by stringent regulations and high adoption of advanced technologies. These regions have a well-established food processing and packaging industry, which drives the demand for efficient pumping solutions. The focus on food safety, quality, and sustainability further contributes to market growth.

The Asia Pacific region, particularly countries like China, India, and Japan, is witnessing rapid growth in the food and beverages industry. The increasing population, urbanization, and changing lifestyles are driving the demand for processed and packaged food and beverages, creating significant opportunities for pump manufacturers. The region’s expanding food service industry also contributes to market growth.

Latin America and the Middle East and Africa regions are experiencing steady growth in the food and beverages industry. The rising disposable incomes, urbanization, and changing dietary habits are fueling the demand for processed and packaged food and beverages. Pump manufacturers can tap into these emerging markets by offering innovative and cost-effective pumping solutions.

Competitive Landscape

Leading Companies in the Food and Beverages Industry Pumps Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

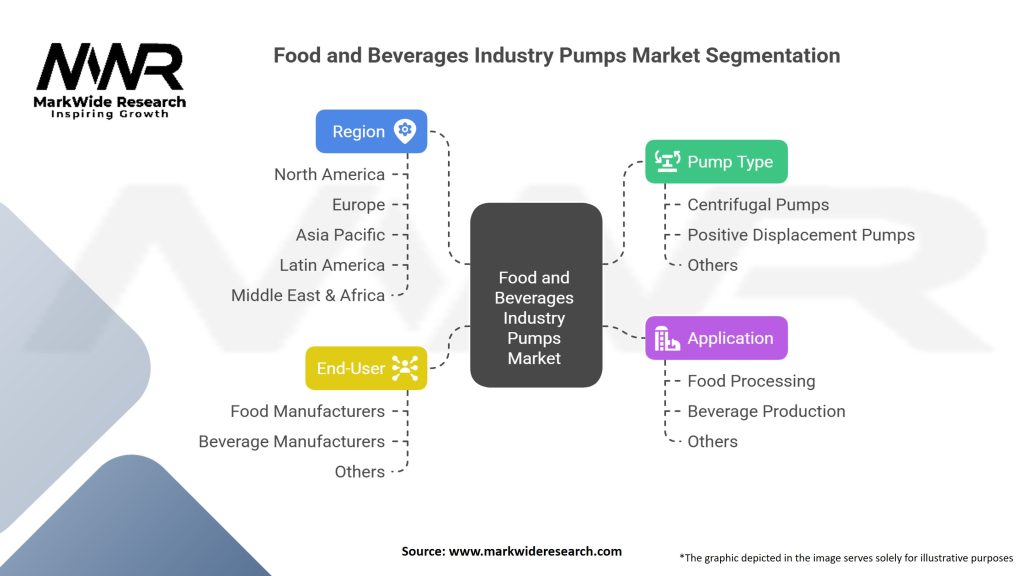

Segmentation

The food and beverages industry pumps market can be segmented based on various parameters to gain deeper insights into market dynamics and customer preferences. The segmentation can be done on the basis of pump type, application, end-user, and geography.

Segmentation helps pump manufacturers and industry participants understand the specific needs and demands of different customer segments. It allows companies to develop targeted marketing strategies, customize product offerings, and identify untapped opportunities in specific market segments.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic had a significant impact on the food and beverages industry, including the pumps market. The pandemic caused disruptions in the supply chain, decreased consumer spending, and led to changes in consumer behavior.

During the initial stages of the pandemic, there was a surge in panic buying and stockpiling of essential food and beverages, leading to increased production and demand. However, the closure of restaurants, cafes, and hotels resulted in a decline in the food service sector, affecting the overall market.

Supply chain disruptions, including restrictions on transportation and logistics, affected the availability of raw materials and components for pump manufacturers. This, coupled with the reduced operational capacities of manufacturing facilities, led to delays in production and delivery.

The pandemic also highlighted the importance of food safety and hygiene, driving the demand for pumps that comply with strict sanitary standards and regulations. Manufacturers focused on developing pumps with enhanced cleanability, self-priming capabilities, and contactless operation to address the evolving requirements of the post-pandemic market.

As the situation gradually stabilizes and economies recover, the food and beverages industry is expected to bounce back, driving the demand for industry pumps. The focus on automation, energy efficiency, and sustainability is expected to intensify post-pandemic, presenting new opportunities for pump manufacturers.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future of the food and beverages industry pumps market looks promising, driven by the growing demand for processed and packaged food, increasing focus on food safety and hygiene, and technological advancements in pumping systems. Pump manufacturers will continue to innovate and develop pumps that meet the evolving needs of the food and beverages industry. This includes pumps with enhanced cleanability, hygienic designs, energy-efficient features, and advanced control systems. The integration of digital technologies, such as IoT, automation, and remote monitoring, will play a crucial role in optimizing pump performance, reducing maintenance costs, and improving operational efficiency. Real-time data analysis, predictive maintenance, and remote control capabilities will become standard features in advanced pumping solutions.

Emerging markets, particularly in Asia Pacific, Latin America, and Africa, offer significant growth opportunities for pump manufacturers. The expanding food and beverages industry, rising consumer disposable incomes, and changing consumption patterns in these regions create a favorable market environment. Sustainability will continue to be a key focus in the food and beverages industry, and pump manufacturers need to align their product offerings with sustainable practices. Energy-efficient pumps, use of eco-friendly materials, and waste reduction initiatives will be essential to meet the sustainability goals of food and beverages companies.

In conclusion, the food and beverages industry pumps market is poised for growth with technological advancements, increasing demand for processed food and beverages, and a focus on sustainability. Pump manufacturers need to stay at the forefront of innovation, forge strong partnerships, and adapt to changing market dynamics to capitalize on the opportunities presented by this dynamic industry.

In conclusion, the food and beverages industry pumps market is experiencing significant growth driven by the increasing demand for processed and packaged food and beverages globally. These pumps play a crucial role in ensuring the smooth and efficient transfer of fluids within the industry while maintaining hygiene standards and complying with strict regulations. The market is characterized by technological advancements, such as IoT integration and automation, to enhance operational efficiency and optimize production processes. Energy efficiency and sustainability are also key trends in the market, with pump manufacturers developing eco-friendly and energy-efficient pumping solutions.

What is Food and Beverages Industry Pumps?

Food and Beverages Industry Pumps are specialized pumps designed to handle various liquids and semi-solids in the food and beverage sector, ensuring safe and efficient transfer, mixing, and processing of products such as juices, dairy, and sauces.

What are the key players in the Food and Beverages Industry Pumps market?

Key players in the Food and Beverages Industry Pumps market include companies like Grundfos, GEA Group, and Alfa Laval, which provide innovative pumping solutions tailored for food processing and beverage production, among others.

What are the growth factors driving the Food and Beverages Industry Pumps market?

The Food and Beverages Industry Pumps market is driven by increasing demand for processed food, advancements in pump technology, and the need for efficient production processes to meet consumer preferences for quality and safety.

What challenges does the Food and Beverages Industry Pumps market face?

Challenges in the Food and Beverages Industry Pumps market include stringent regulatory requirements for food safety, the need for regular maintenance to ensure hygiene, and competition from alternative technologies that may offer lower costs.

What opportunities exist in the Food and Beverages Industry Pumps market?

Opportunities in the Food and Beverages Industry Pumps market include the growing trend towards automation in food processing, the expansion of plant-based food products, and the increasing focus on sustainability and energy-efficient pumping solutions.

What trends are shaping the Food and Beverages Industry Pumps market?

Trends in the Food and Beverages Industry Pumps market include the integration of IoT technology for real-time monitoring, the development of hygienic pump designs to prevent contamination, and the rising demand for customized pumping solutions to cater to diverse food applications.

Food and Beverages Industry Pumps market:

| Segmentation | Details |

|---|---|

| Pump Type | Centrifugal Pumps, Positive Displacement Pumps, Others |

| Application | Food Processing, Beverage Production, Others |

| End-User | Food Manufacturers, Beverage Manufacturers, Others |

| Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Food and Beverages Industry Pumps Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at