444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The food and beverage packaging market represents a dynamic and rapidly evolving industry that serves as the backbone of global food distribution systems. This comprehensive sector encompasses diverse packaging solutions designed to preserve, protect, and present food and beverage products throughout their journey from production facilities to consumer tables. Market dynamics indicate sustained growth driven by increasing consumer demand for convenience foods, rising awareness of food safety, and evolving sustainability requirements.

Industry transformation is occurring at an unprecedented pace, with manufacturers embracing innovative materials, smart packaging technologies, and eco-friendly solutions. The market demonstrates remarkable resilience, experiencing consistent expansion at a compound annual growth rate (CAGR) of 5.2% globally. Regional variations show particularly strong growth in emerging markets, where urbanization and changing dietary patterns fuel demand for packaged food products.

Technological advancements continue reshaping the landscape, with active packaging, intelligent packaging systems, and biodegradable materials gaining significant traction. Consumer preferences increasingly favor packaging that combines functionality with environmental responsibility, creating opportunities for manufacturers who can balance performance with sustainability. Supply chain optimization remains a critical factor, as packaging solutions must ensure product integrity while minimizing environmental impact throughout the distribution process.

The food and beverage packaging market refers to the comprehensive industry segment focused on developing, manufacturing, and supplying protective and promotional packaging solutions specifically designed for food and beverage products. This market encompasses all materials, technologies, and processes used to contain, preserve, transport, and present consumable goods to end consumers.

Core functions of food and beverage packaging extend beyond simple containment to include preservation of nutritional value, prevention of contamination, extension of shelf life, and facilitation of convenient consumption. The market includes diverse packaging formats ranging from flexible pouches and rigid containers to innovative smart packaging systems that monitor product freshness and safety.

Material diversity characterizes this market, incorporating traditional materials like glass, metal, and paper alongside advanced polymers, bio-based materials, and composite structures. Modern packaging solutions integrate multiple functions, serving as barriers against moisture, oxygen, and light while providing tamper evidence, portion control, and brand communication capabilities.

Market leadership in the food and beverage packaging sector is driven by companies that successfully balance innovation, sustainability, and cost-effectiveness. The industry demonstrates robust growth patterns, with flexible packaging segments showing particularly strong performance, capturing approximately 32% market share due to their versatility and resource efficiency.

Sustainability initiatives have become paramount, with 67% of manufacturers actively investing in recyclable and biodegradable packaging solutions. Consumer awareness regarding environmental impact drives demand for eco-friendly alternatives, creating significant opportunities for companies developing innovative sustainable materials. Regulatory compliance remains a critical success factor, as food safety standards become increasingly stringent across global markets.

Digital transformation is revolutionizing the industry through smart packaging technologies, supply chain optimization, and enhanced consumer engagement. Companies leveraging data analytics, IoT integration, and automated manufacturing processes demonstrate superior market positioning. E-commerce growth continues reshaping packaging requirements, with online food delivery and direct-to-consumer models demanding specialized protective and presentation solutions.

Strategic insights reveal several transformative trends shaping the food and beverage packaging landscape. The following key developments define current market dynamics:

Primary growth drivers propelling the food and beverage packaging market forward include fundamental shifts in consumer behavior, technological capabilities, and regulatory environments. Urbanization trends significantly impact packaging demand, as city-dwelling populations increasingly rely on packaged foods for convenience and time efficiency.

Health consciousness among consumers drives demand for packaging that preserves nutritional value and provides clear ingredient information. Transparent packaging materials and informative labeling systems become essential features for health-focused product positioning. Food safety concerns continue intensifying, creating opportunities for packaging solutions that offer enhanced barrier properties and tamper-evident features.

E-commerce expansion fundamentally reshapes packaging requirements, as online food retail demands protective solutions capable of withstanding shipping stresses while maintaining product presentation quality. Demographic changes including aging populations and smaller household sizes drive demand for portion-controlled and easy-open packaging formats. Global trade growth necessitates packaging solutions that can preserve product quality across extended supply chains and diverse climate conditions.

Significant challenges facing the food and beverage packaging market include rising raw material costs, complex regulatory compliance requirements, and increasing environmental scrutiny. Material price volatility particularly affects petroleum-based packaging materials, creating cost pressures that manufacturers must carefully manage while maintaining competitive pricing.

Regulatory complexity presents ongoing challenges as food safety standards vary significantly across global markets, requiring manufacturers to develop region-specific solutions that comply with diverse requirements. Environmental regulations increasingly restrict certain packaging materials and mandate recyclability standards, forcing companies to invest heavily in alternative material development.

Consumer skepticism regarding certain packaging materials and additives creates market resistance that companies must address through transparency and education initiatives. Supply chain disruptions experienced in recent years highlight vulnerabilities in global packaging material sourcing, prompting companies to diversify supplier networks and develop contingency strategies. Technology adoption costs for smart packaging and sustainable materials can be prohibitive for smaller manufacturers, potentially limiting market participation.

Emerging opportunities in the food and beverage packaging market center around sustainability innovation, smart technology integration, and expanding global food trade. Circular economy principles create substantial opportunities for companies developing packaging solutions that support reuse, recycling, and composting initiatives.

Plant-based packaging materials represent a rapidly growing opportunity segment, as consumers increasingly prefer biodegradable alternatives to traditional petroleum-based packaging. Smart packaging technologies offer significant potential for premium product segments, enabling features like freshness monitoring, temperature tracking, and interactive consumer experiences.

Developing markets present substantial growth opportunities as rising disposable incomes and urbanization drive increased demand for packaged foods. Functional packaging that provides additional benefits beyond basic containment, such as antimicrobial properties or extended shelf life, creates differentiation opportunities. Customization capabilities enabled by digital printing and flexible manufacturing processes allow companies to serve niche markets and seasonal demands more effectively.

Complex interactions between supply and demand factors create dynamic market conditions that require strategic adaptability from industry participants. Consumer preferences continue evolving toward sustainable, convenient, and health-conscious packaging solutions, driving innovation cycles and competitive repositioning throughout the industry.

Technological convergence between packaging materials, manufacturing processes, and digital technologies creates new possibilities for enhanced functionality and cost optimization. MarkWide Research analysis indicates that companies successfully integrating multiple technology platforms achieve superior market performance compared to single-focus competitors.

Supply chain resilience has become a critical competitive factor, with companies investing in diversified sourcing strategies and local manufacturing capabilities to mitigate disruption risks. Regulatory evolution continues shaping market dynamics, as governments worldwide implement stricter environmental standards and food safety requirements. Investment patterns show increasing capital allocation toward sustainable material development and automated manufacturing technologies, reflecting long-term industry transformation trends.

Comprehensive analysis of the food and beverage packaging market employs multiple research methodologies to ensure accuracy and reliability of insights. Primary research includes extensive interviews with industry executives, packaging engineers, sustainability experts, and regulatory specialists across major global markets.

Secondary research incorporates analysis of industry reports, patent filings, regulatory documents, and company financial statements to provide comprehensive market understanding. Quantitative analysis utilizes statistical modeling to project market trends, growth patterns, and competitive dynamics across different segments and regions.

Market validation processes include cross-referencing multiple data sources, expert panel reviews, and real-time market monitoring to ensure findings reflect current industry conditions. Technology assessment involves evaluation of emerging materials, manufacturing processes, and digital integration capabilities that may impact future market development. Regulatory analysis examines current and proposed legislation across major markets to identify compliance requirements and potential market impacts.

North American markets demonstrate strong demand for sustainable packaging solutions, with regulatory pressures driving adoption of recyclable and compostable materials. The region shows particular strength in smart packaging technologies and premium product segments, supported by high consumer spending power and environmental awareness.

European markets lead global sustainability initiatives, with stringent environmental regulations creating opportunities for innovative eco-friendly packaging solutions. The region captures approximately 28% of global market share in sustainable packaging segments, driven by strong regulatory frameworks and consumer environmental consciousness.

Asia-Pacific regions exhibit the highest growth rates, with rapid urbanization and changing dietary patterns driving increased demand for packaged foods. Countries like China and India show exceptional growth potential, with expanding middle-class populations and improving cold chain infrastructure supporting market development. Manufacturing capabilities in the region continue expanding, with significant investments in advanced packaging technologies and sustainable material production.

Latin American markets demonstrate growing demand for affordable packaging solutions that maintain product quality in challenging climate conditions. Economic development and improving distribution infrastructure create opportunities for packaging innovation tailored to regional requirements.

Market leadership in the food and beverage packaging industry is characterized by companies that successfully balance innovation, sustainability, and operational efficiency. The competitive environment features both large multinational corporations and specialized niche players serving specific market segments.

Material-based segmentation reveals distinct market dynamics across different packaging substrate categories. Flexible packaging materials including films, pouches, and wraps demonstrate strong growth due to their resource efficiency and versatility in application.

By Material Type:

By Application:

Flexible packaging categories demonstrate exceptional growth performance, with stand-up pouches and retort packaging gaining significant market traction. These formats offer superior resource efficiency, reduced transportation costs, and enhanced consumer convenience compared to traditional rigid packaging alternatives.

Sustainable packaging categories show accelerating adoption rates, with compostable films and recyclable barrier materials experiencing strong demand growth. MWR analysis indicates that sustainable packaging categories achieve premium pricing of 15-25% compared to conventional alternatives, reflecting consumer willingness to pay for environmental benefits.

Smart packaging categories represent emerging high-value segments, incorporating technologies like freshness indicators, temperature monitoring, and interactive features. These advanced packaging solutions command significant price premiums while providing enhanced functionality for both manufacturers and consumers.

Convenience packaging categories including single-serve portions, easy-open features, and microwave-safe containers address changing lifestyle patterns and demographic trends. Portion control packaging particularly benefits from health-conscious consumer preferences and regulatory initiatives addressing obesity concerns.

Manufacturers benefit from advanced packaging solutions that extend product shelf life, reduce spoilage rates, and enhance brand differentiation capabilities. Cost optimization opportunities arise through lightweight packaging designs, improved supply chain efficiency, and reduced material waste throughout production processes.

Retailers gain advantages through packaging solutions that improve product presentation, reduce handling costs, and optimize shelf space utilization. Smart packaging technologies enable better inventory management, reduced shrinkage, and enhanced customer engagement through interactive features.

Consumers benefit from packaging innovations that provide convenience, safety assurance, and environmental responsibility. Functional improvements include easier opening mechanisms, portion control features, and clear product information that supports informed purchasing decisions.

Environmental stakeholders benefit from industry initiatives toward sustainable packaging materials, reduced carbon footprints, and circular economy principles. Recycling infrastructure development and biodegradable material adoption contribute to waste reduction and environmental protection goals.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability transformation represents the most significant trend reshaping the food and beverage packaging landscape. Companies increasingly invest in circular economy solutions, developing packaging materials that support reuse, recycling, and composting initiatives while maintaining product protection standards.

Digital integration continues accelerating, with smart packaging technologies becoming mainstream in premium product segments. QR codes, NFC chips, and augmented reality features enhance consumer engagement while providing valuable data insights for manufacturers and retailers.

Minimalist design approaches gain popularity as consumers prefer clean, simple packaging aesthetics that communicate authenticity and environmental responsibility. Reduced packaging initiatives balance environmental concerns with product protection requirements, driving innovation in high-performance barrier materials.

Personalization capabilities enabled by digital printing technologies allow brands to create customized packaging for special events, regional preferences, and individual consumer preferences. Limited edition packaging and seasonal designs become important marketing tools for brand differentiation.

Recent innovations in the food and beverage packaging industry focus on breakthrough materials and manufacturing technologies that address sustainability and functionality requirements simultaneously. Bio-based barrier coatings enable paper packaging to compete with plastic alternatives in moisture and oxygen protection applications.

Automation advances in packaging manufacturing improve efficiency, reduce costs, and enable mass customization capabilities. Artificial intelligence integration optimizes production processes, quality control, and supply chain management throughout the packaging value chain.

Collaborative initiatives between packaging manufacturers, food companies, and recycling organizations develop comprehensive solutions for packaging waste management. Industry partnerships focus on creating standardized recyclable packaging formats that support efficient waste processing infrastructure.

Regulatory developments including extended producer responsibility programs and plastic waste reduction mandates drive industry investment in alternative materials and circular economy solutions. Government incentives for sustainable packaging development accelerate innovation timelines and market adoption rates.

Strategic recommendations for food and beverage packaging industry participants emphasize the importance of balancing sustainability initiatives with performance requirements and cost considerations. Investment priorities should focus on developing scalable sustainable material solutions that can compete effectively with traditional packaging alternatives.

Technology adoption strategies should prioritize smart packaging capabilities that provide measurable value to both manufacturers and consumers. MarkWide Research suggests that companies investing in integrated digital solutions achieve superior market positioning and customer loyalty compared to traditional packaging providers.

Market expansion opportunities in developing economies require careful consideration of local preferences, regulatory requirements, and infrastructure capabilities. Partnership strategies with local manufacturers and distributors can accelerate market entry while reducing investment risks.

Sustainability communication becomes increasingly important as consumers demand transparency regarding environmental impact and recyclability. Clear labeling and education initiatives help consumers make informed choices while supporting brand differentiation efforts.

Long-term projections for the food and beverage packaging market indicate continued strong growth driven by global population expansion, urbanization trends, and evolving consumer preferences. Sustainable packaging solutions are expected to capture increasing market share, with bio-based materials achieving cost parity with conventional alternatives within the next decade.

Technology convergence will create new packaging categories that combine multiple functions including preservation, monitoring, and consumer interaction capabilities. Smart packaging adoption is projected to accelerate significantly, with mainstream implementation expected across major food categories by 2030.

Regulatory evolution will continue driving industry transformation, with stricter environmental standards and extended producer responsibility programs becoming standard across developed markets. Companies that proactively address these requirements will gain competitive advantages in market positioning and operational efficiency.

Global market integration will increase as trade barriers reduce and supply chain technologies improve. Standardization initiatives for sustainable packaging formats will facilitate international trade while supporting efficient recycling infrastructure development worldwide.

The food and beverage packaging market stands at a transformative juncture, where sustainability imperatives, technological capabilities, and evolving consumer preferences converge to create unprecedented opportunities and challenges. Industry leaders who successfully navigate this complex landscape will be those who balance innovation with practicality, environmental responsibility with economic viability, and global reach with local relevance.

Sustainable packaging solutions will continue gaining momentum, driven by regulatory requirements, consumer preferences, and corporate responsibility initiatives. The transition toward circular economy principles represents both a challenge and an opportunity, requiring significant investment in new materials and technologies while creating potential for premium market positioning and long-term competitive advantages.

Technology integration will accelerate, with smart packaging capabilities becoming standard features rather than premium options. Companies that invest early in digital technologies, automation capabilities, and data analytics will achieve superior market positioning and operational efficiency. Future success in the food and beverage packaging market will depend on the ability to adapt quickly to changing requirements while maintaining focus on fundamental packaging functions of protection, preservation, and presentation.

What is Food And Beverage Packaging?

Food and beverage packaging refers to the materials and methods used to enclose and protect food and drink products. This includes various types of packaging such as bottles, cans, cartons, and flexible pouches designed to preserve freshness and ensure safety during transportation and storage.

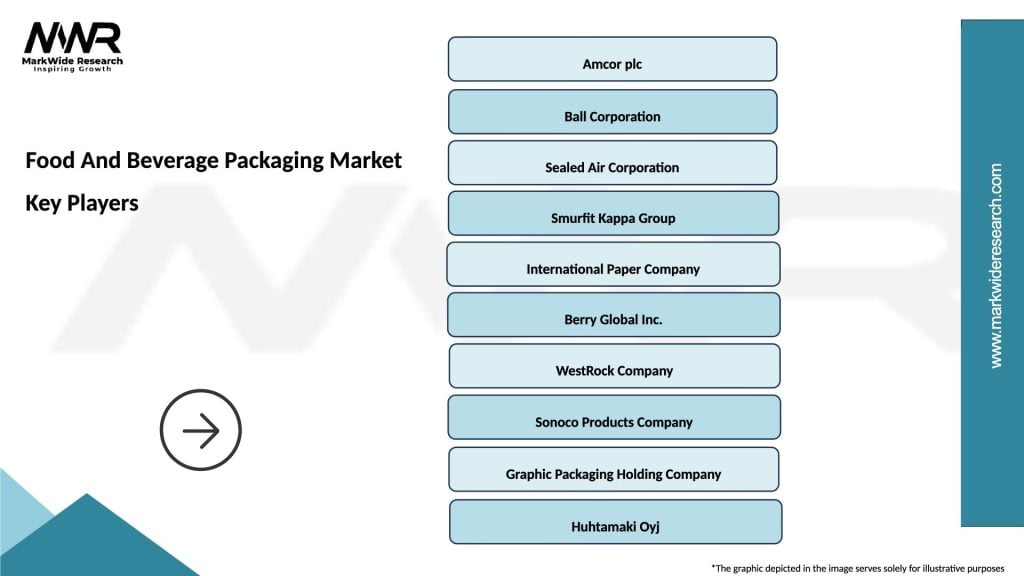

What are the key players in the Food And Beverage Packaging Market?

Key players in the Food And Beverage Packaging Market include Amcor, Ball Corporation, and Tetra Pak, among others. These companies are known for their innovative packaging solutions and commitment to sustainability in food and beverage packaging.

What are the main drivers of the Food And Beverage Packaging Market?

The main drivers of the Food And Beverage Packaging Market include the increasing demand for convenience foods, the rise in e-commerce for food delivery, and growing consumer awareness regarding food safety and sustainability. These factors are pushing companies to innovate and improve packaging solutions.

What challenges does the Food And Beverage Packaging Market face?

The Food And Beverage Packaging Market faces challenges such as regulatory compliance regarding materials used in packaging, the environmental impact of plastic waste, and the need for cost-effective solutions. These challenges require companies to adapt and find sustainable alternatives.

What opportunities exist in the Food And Beverage Packaging Market?

Opportunities in the Food And Beverage Packaging Market include the development of biodegradable and recyclable packaging materials, advancements in smart packaging technologies, and the growing trend of personalized packaging solutions. These innovations can enhance consumer experience and reduce environmental impact.

What trends are shaping the Food And Beverage Packaging Market?

Trends shaping the Food And Beverage Packaging Market include the shift towards sustainable packaging solutions, the use of digital printing for customization, and the integration of smart technology for tracking and freshness monitoring. These trends reflect changing consumer preferences and technological advancements.

Food And Beverage Packaging Market

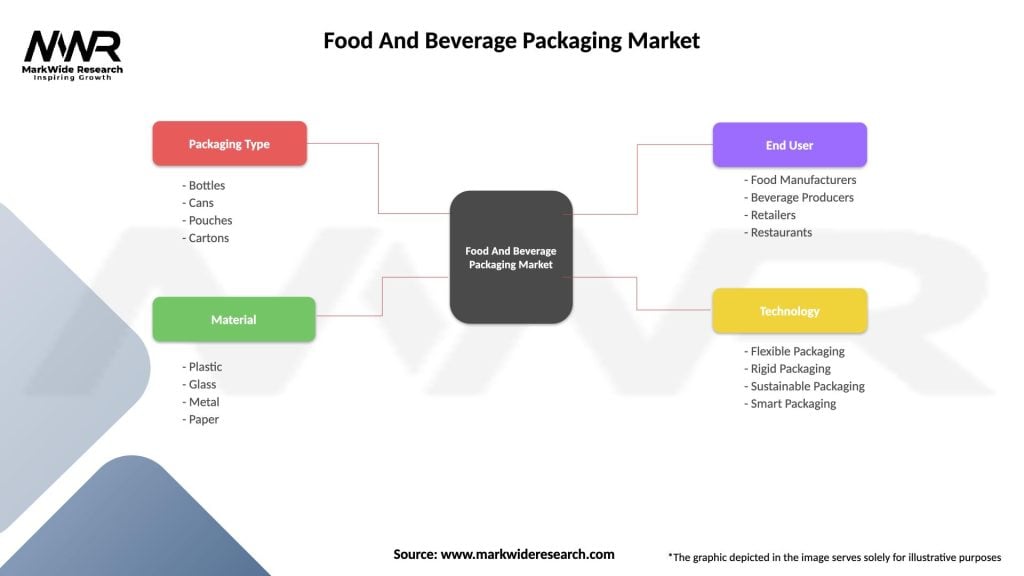

| Segmentation Details | Description |

|---|---|

| Packaging Type | Bottles, Cans, Pouches, Cartons |

| Material | Plastic, Glass, Metal, Paper |

| End User | Food Manufacturers, Beverage Producers, Retailers, Restaurants |

| Technology | Flexible Packaging, Rigid Packaging, Sustainable Packaging, Smart Packaging |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Food And Beverage Packaging Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at