444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview:

The fluid ends market serves the oil and gas industry by providing critical components for hydraulic fracturing equipment. Fluid ends are high-pressure pumping components used in fracking operations to inject fluids into underground formations, aiding in the extraction of oil and natural gas. As hydraulic fracturing continues to be a dominant method for energy extraction, the demand for fluid ends remains robust, driven by the expansion of unconventional oil and gas exploration and production activities.

Meaning:

Fluid ends are essential components of high-pressure pumping systems used in hydraulic fracturing operations. They serve as the interface between the pumping unit and the wellhead, facilitating the injection of fluids, such as water, chemicals, and proppants, into underground formations to stimulate oil and gas production. Fluid ends endure extreme pressure, abrasion, and corrosion during fracking operations, requiring robust design, materials, and manufacturing processes to ensure reliability, safety, and performance.

Executive Summary:

The fluid ends market is experiencing steady growth, supported by the increasing demand for hydraulic fracturing services in the oil and gas industry. Key market players are focusing on innovation, product differentiation, and strategic partnerships to gain a competitive edge and capitalize on emerging opportunities in the expanding fracking market. However, challenges such as fluctuating oil prices, regulatory uncertainties, and environmental concerns pose risks to market growth and profitability, requiring industry participants to adapt and innovate to meet evolving customer needs and market dynamics.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights:

Market Drivers:

Market Restraints:

Market Opportunities:

Market Dynamics:

The fluid ends market operates in a dynamic and evolving landscape influenced by technological innovations, market trends, regulatory developments, and competitive forces. Industry participants must navigate these dynamics, adapt to changing market conditions, and capitalize on emerging opportunities to sustain growth, profitability, and competitive advantage in the competitive fracking equipment segment.

Regional Analysis:

The fluid ends market exhibits regional variations in demand, adoption rates, and growth prospects influenced by factors such as shale geology, regulatory environments, infrastructure development, and market maturity. Regional analysis provides insights into market dynamics, customer preferences, and competitive landscapes in key geographic regions, allowing industry participants to tailor their strategies and offerings to local market requirements and opportunities.

Competitive Landscape:

Leading Companies in the Fluid Ends Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

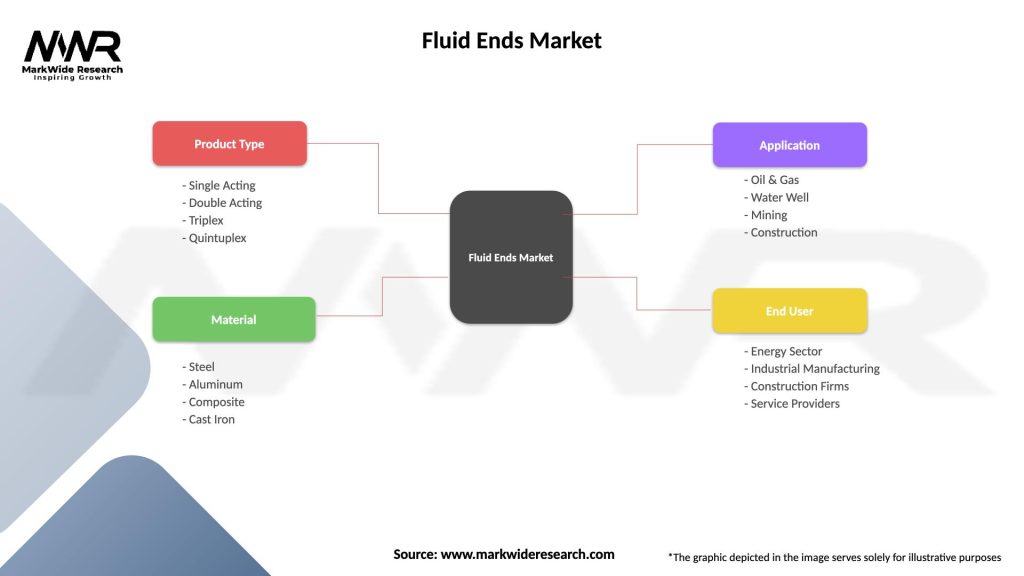

Segmentation:

The fluid ends market can be segmented based on various factors, including pump type, material type, end-user industry, and geographic region, reflecting diverse market needs, customer preferences, and application requirements. Segmentation provides a comprehensive understanding of the fluid ends market landscape, enabling industry participants to identify target segments, tailor their offerings, and develop targeted marketing, sales, and service strategies to capture market share and drive business growth.

Category-wise Insights:

Key Benefits for Industry Participants and Stakeholders:

SWOT Analysis: A SWOT analysis provides insights into the fluid ends market’s strengths, weaknesses, opportunities, and threats, guiding strategic decision-making, risk assessment, and performance evaluation for industry participants and stakeholders.

Market Key Trends:

Covid-19 Impact: The COVID-19 pandemic has affected the fluid ends market in various ways:

Key Industry Developments:

Analyst Suggestions:

Future Outlook:

The fluid ends market is poised for steady growth and innovation in the coming years, driven by factors such as increasing oil and gas production, technological advancements, and market trends. While challenges such as price volatility, regulatory uncertainties, and environmental concerns persist, opportunities abound for industry participants to innovate, collaborate, and adapt to changing market dynamics, customer needs, and industry standards. By embracing innovation, sustainability, and collaboration, fluid end stakeholders can navigate market challenges, capitalize on growth opportunities, and lead the industry towards a cleaner, safer, and more sustainable future.

Conclusion:

The fluid ends market plays a critical role in the hydraulic fracturing industry, providing essential components for pumping systems used in well stimulation operations. With increasing demand for hydraulic fracturing services in the oil and gas sector, the fluid ends market experiences steady growth, driven by technological advancements, market trends, and customer requirements. While challenges such as price volatility, regulatory uncertainties, and environmental concerns pose risks to market growth and profitability, opportunities for innovation, service expansion, and market penetration abound for fluid end manufacturers and suppliers willing to invest in technology, talent, and partnerships. By understanding market dynamics, customer needs, and industry trends, fluid end stakeholders can position themselves for success and leadership in a dynamic and evolving market landscape.

What is Fluid Ends?

Fluid ends are critical components in high-pressure pumping systems, primarily used in oil and gas extraction, water treatment, and industrial applications. They facilitate the transfer of fluids under high pressure and are essential for the efficiency of hydraulic fracturing processes.

What are the key players in the Fluid Ends Market?

Key players in the Fluid Ends Market include companies such as Baker Hughes, Schlumberger, and Halliburton, which are known for their innovative solutions and extensive product lines. These companies focus on enhancing the performance and durability of fluid ends to meet industry demands, among others.

What are the main drivers of the Fluid Ends Market?

The Fluid Ends Market is driven by the increasing demand for energy, particularly in oil and gas exploration, and the need for efficient water management systems. Additionally, advancements in technology and the push for sustainable practices in hydraulic fracturing are contributing to market growth.

What challenges does the Fluid Ends Market face?

The Fluid Ends Market faces challenges such as the high cost of raw materials and the need for regular maintenance and replacement of components. Additionally, fluctuating oil prices can impact investment in new projects, affecting demand for fluid ends.

What opportunities exist in the Fluid Ends Market?

Opportunities in the Fluid Ends Market include the development of more durable and efficient fluid ends that can withstand extreme conditions. The growing trend towards automation and digitalization in the oil and gas sector also presents avenues for innovation and market expansion.

What trends are shaping the Fluid Ends Market?

Trends in the Fluid Ends Market include the increasing adoption of advanced materials and coatings to enhance performance and longevity. Additionally, there is a growing focus on environmentally friendly practices and the integration of smart technologies in fluid end designs.

Fluid Ends Market

| Segmentation Details | Description |

|---|---|

| Product Type | Single Acting, Double Acting, Triplex, Quintuplex |

| Material | Steel, Aluminum, Composite, Cast Iron |

| Application | Oil & Gas, Water Well, Mining, Construction |

| End User | Energy Sector, Industrial Manufacturing, Construction Firms, Service Providers |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Fluid Ends Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at