444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview:

The Float Zone Wafer Market is witnessing significant growth due to the rising demand for high-purity silicon wafers in semiconductor manufacturing, particularly in applications requiring superior material quality, crystal purity, and electrical properties. Float zone wafers are characterized by their unique manufacturing process, which involves the zone melting of high-purity silicon ingots without the need for crucibles, resulting in wafers with minimal impurities and crystal defects.

Meaning:

Float zone wafers are silicon wafers produced using the float zone (FZ) method, a specialized crystal growth technique that involves passing a radiofrequency (RF) induction coil over a cylindrical silicon ingot, melting and solidifying a small portion of the ingot as it moves through the coil. This process allows for the purification and refinement of the silicon material, resulting in wafers with exceptionally high purity and crystalline perfection, making them ideal for high-performance semiconductor devices.

Executive Summary:

The Float Zone Wafer Market is experiencing robust growth driven by the increasing demand for advanced semiconductor materials in electronics, photonics, and renewable energy applications. Key market players are focusing on expanding production capacities, improving process efficiencies, and enhancing product quality to meet the growing requirements of semiconductor manufacturers for high-purity float zone wafers.

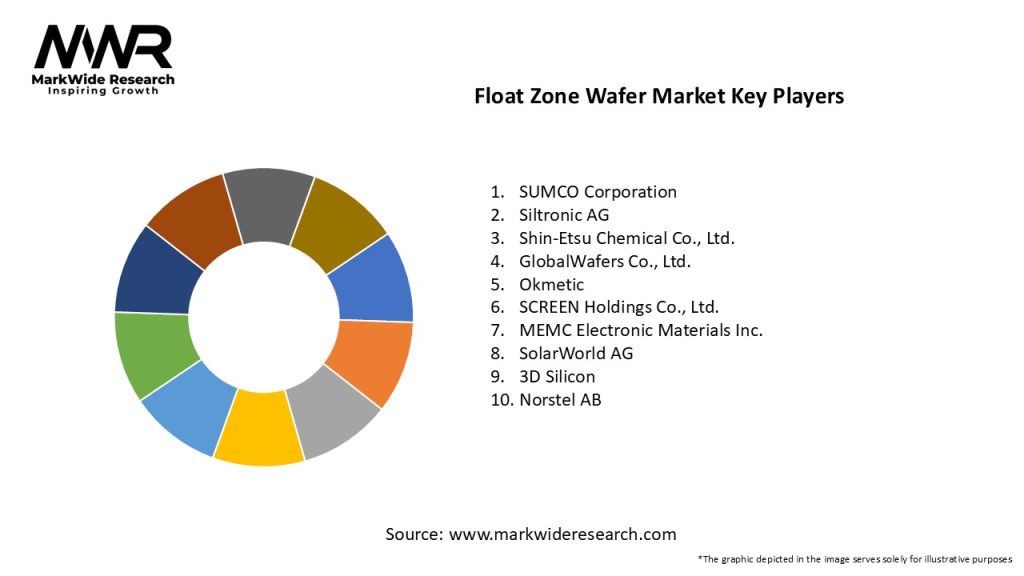

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights:

Market Drivers:

Market Restraints:

Market Opportunities:

Market Dynamics:

The Float Zone Wafer Market is characterized by dynamic trends such as technological innovations, industry collaborations, and market consolidation, influencing market competitiveness, supply chain dynamics, and customer preferences. Key market players must navigate these dynamics by investing in R&D initiatives, strengthening strategic partnerships, and diversifying product portfolios to maintain market leadership and drive sustainable growth.

Regional Analysis:

Competitive Landscape:

Leading Companies in the Float Zone Wafer Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

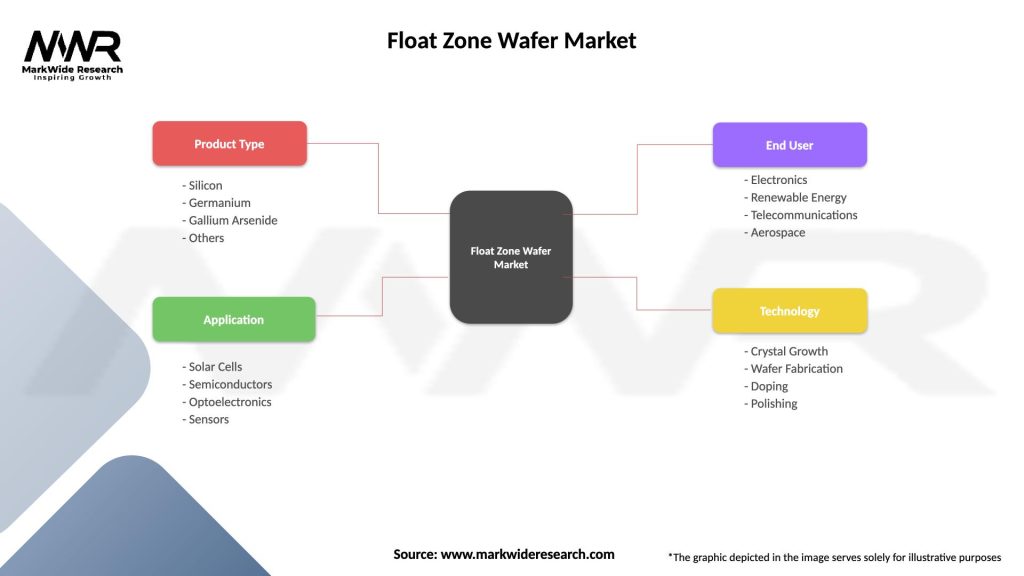

Segmentation:

The Float Zone Wafer Market can be segmented based on:

Category-wise Insights:

Each category of float zone wafers offers unique characteristics, performance attributes, and applications tailored to specific industry requirements and technological advancements, enabling semiconductor manufacturers to address diverse market demands and customer preferences effectively.

Key Benefits for Industry Participants and Stakeholders:

SWOT Analysis:

Market Key Trends:

Covid-19 Impact:

The Covid-19 pandemic has both positive and negative implications for the Float Zone Wafer Market:

Key Industry Developments:

Analyst Suggestions:

Based on market trends and developments, analysts suggest the following strategies for industry participants:

Future Outlook:

The future outlook for the Float Zone Wafer Market is optimistic, with sustained demand expected from semiconductor manufacturers, research institutions, and technology providers for high-purity silicon substrates in advanced electronics, photonics, and renewable energy applications. As semiconductor technologies continue to evolve, float zone wafers remain indispensable materials for enabling next-generation devices and innovations in various industries.

Conclusion:

In conclusion, the Float Zone Wafer Market presents significant growth opportunities driven by the increasing demand for high-purity silicon substrates in semiconductor manufacturing and emerging applications such as power electronics, photovoltaics, and sensor devices. By focusing on technological innovations, market diversification, and strategic collaborations, float zone wafer manufacturers can position themselves for long-term success and leadership in the global semiconductor materials market landscape.

What is Float Zone Wafer?

Float Zone Wafer refers to a type of semiconductor wafer produced using the float zone process, which allows for the creation of high-purity silicon crystals. This method is essential in the manufacturing of various electronic components, including solar cells and integrated circuits.

What are the key players in the Float Zone Wafer Market?

Key players in the Float Zone Wafer Market include companies such as Shin-Etsu Chemical Co., Ltd., SUMCO Corporation, and Siltronic AG, among others. These companies are known for their advanced manufacturing techniques and high-quality products.

What are the growth factors driving the Float Zone Wafer Market?

The Float Zone Wafer Market is driven by the increasing demand for high-efficiency solar cells and the growing semiconductor industry. Additionally, advancements in technology and the need for high-purity materials in electronics are contributing to market growth.

What challenges does the Float Zone Wafer Market face?

Challenges in the Float Zone Wafer Market include the high production costs associated with the float zone process and competition from alternative wafer manufacturing methods. Additionally, fluctuations in raw material availability can impact production efficiency.

What opportunities exist in the Float Zone Wafer Market?

Opportunities in the Float Zone Wafer Market include the expansion of renewable energy applications, particularly in solar technology, and the increasing adoption of electric vehicles. These trends are expected to drive demand for high-quality wafers in the coming years.

What trends are shaping the Float Zone Wafer Market?

Current trends in the Float Zone Wafer Market include the development of larger diameter wafers and the integration of automation in manufacturing processes. Additionally, there is a growing focus on sustainability and reducing the environmental impact of wafer production.

Float Zone Wafer Market

| Segmentation Details | Description |

|---|---|

| Product Type | Silicon, Germanium, Gallium Arsenide, Others |

| Application | Solar Cells, Semiconductors, Optoelectronics, Sensors |

| End User | Electronics, Renewable Energy, Telecommunications, Aerospace |

| Technology | Crystal Growth, Wafer Fabrication, Doping, Polishing |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Float Zone Wafer Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at