444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The Fixed Ophthalmic Examination System Market is a crucial segment of the healthcare industry, providing essential diagnostic tools for eye care professionals. These systems are integral to comprehensive eye examinations, facilitating the detection and management of various ocular conditions and diseases. With advancements in technology and an increasing focus on preventive eye care, the market for fixed ophthalmic examination systems continues to expand globally.

Meaning

Fixed ophthalmic examination systems are specialized medical devices used by ophthalmologists and optometrists to assess the visual acuity, refractive errors, intraocular pressure, and overall health of the eyes. These systems typically include components such as slit lamps, phoropters, tonometers, fundus cameras, and optical coherence tomography (OCT) scanners. By providing detailed insights into ocular health and function, these systems play a vital role in diagnosing and managing eye conditions such as cataracts, glaucoma, macular degeneration, and diabetic retinopathy.

Executive Summary

The Fixed Ophthalmic Examination System Market is experiencing steady growth due to factors such as increasing prevalence of eye disorders, rising geriatric population, technological advancements in diagnostic equipment, and growing awareness about the importance of regular eye examinations. Key market players are focusing on product innovation, strategic collaborations, and expanding their global footprint to capitalize on emerging opportunities in both developed and emerging markets.

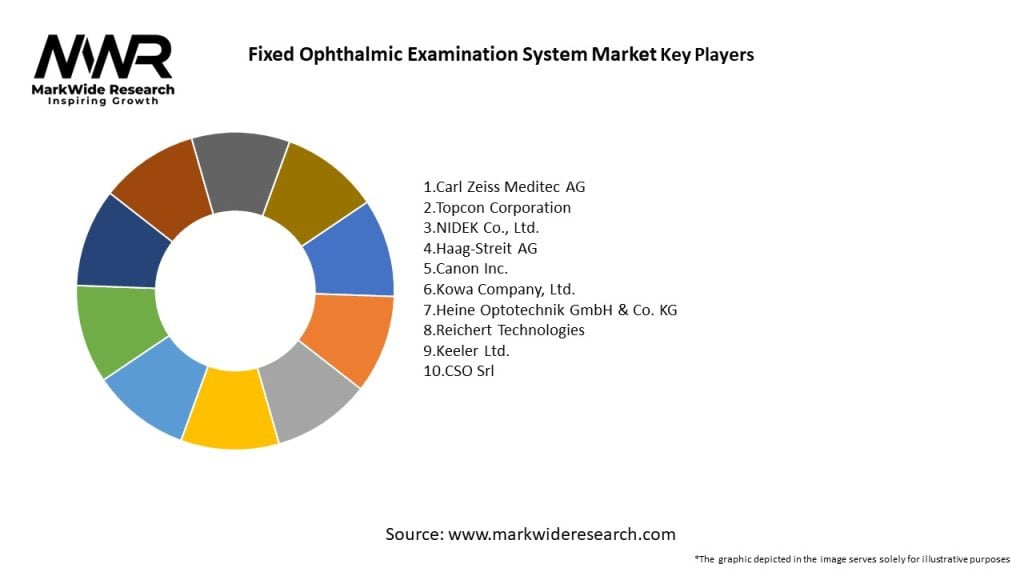

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Fixed Ophthalmic Examination System Market is characterized by dynamic trends and factors influencing market growth, including:

Regional Analysis

The Fixed Ophthalmic Examination System Market exhibits regional variations in market size, growth trends, and adoption rates, influenced by factors such as healthcare infrastructure, economic development, regulatory environment, and cultural attitudes towards eye care. Key regional markets include:

Competitive Landscape

The Fixed Ophthalmic Examination System Market is highly competitive, with several key players competing based on product innovation, technological advancements, pricing strategies, and geographical presence. Some of the leading companies operating in the market include:

Segmentation

The Fixed Ophthalmic Examination System Market can be segmented based on product type, end-user, and geography:

Segmentation allows for a deeper understanding of market dynamics, customer preferences, and growth opportunities across different segments and regions.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

A SWOT analysis of the Fixed Ophthalmic Examination System Market provides insights into its strengths, weaknesses, opportunities, and threats:

Understanding these factors helps industry participants and stakeholders formulate effective strategies to capitalize on strengths, mitigate weaknesses, exploit opportunities, and address potential threats in the market.

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has had a significant impact on the Fixed Ophthalmic Examination System Market, leading to disruptions in manufacturing, supply chain disruptions, and changes in healthcare delivery models. Some key impacts include:

Key Industry Developments

Analyst Suggestions

Future Outlook

The Fixed Ophthalmic Examination System Market is poised for continued growth and innovation, driven by technological advancements, demographic trends, evolving healthcare delivery models, and increasing demand for preventive eye care. Key factors shaping the future of the market include:

Conclusion

The Fixed Ophthalmic Examination System Market plays a critical role in the diagnosis, management, and treatment of ocular diseases and conditions, supporting the delivery of high-quality eye care services worldwide. Despite challenges posed by the Covid-19 pandemic and healthcare disparities, the market is poised for growth driven by technological innovations, demographic trends, and evolving healthcare delivery models. By embracing teleophthalmology, advancing AI-driven diagnostics, promoting preventive eye care. The Fixed Ophthalmic Examination System Market is poised for continued growth and innovation, driven by technological advancements, demographic trends, evolving healthcare delivery models, and increasing demand for preventive eye care.

Fixed Ophthalmic Examination System Market

| Segmentation Details | Description |

|---|---|

| Product Type | Fundus Camera, Optical Coherence Tomography, Visual Field Analyzer, Slit Lamp |

| End User | Hospitals, Clinics, Research Institutions, Private Practices |

| Technology | Digital Imaging, Laser Technology, Non-Contact, Automated |

| Application | Retinal Examination, Glaucoma Screening, Cataract Assessment, General Eye Check-up |

Leading Companies in the Fixed Ophthalmic Examination System Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at