444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The fish meal and fish oil market represents a critical component of the global aquaculture and animal nutrition industries, experiencing substantial growth driven by increasing demand for protein-rich feed ingredients and omega-3 fatty acids. This specialized market encompasses the production, processing, and distribution of fish meal and fish oil derived from various marine species, serving as essential nutritional supplements for aquaculture, livestock, and pet food applications. The market demonstrates robust expansion with a projected CAGR of 6.2% over the forecast period, reflecting the growing recognition of these products’ nutritional value and sustainability benefits.

Market dynamics indicate that the fish meal and fish oil sector is experiencing unprecedented transformation as manufacturers adapt to evolving regulatory frameworks, sustainability requirements, and changing consumer preferences. The industry’s growth trajectory is supported by increasing global aquaculture production, which accounts for approximately 52% of total fish consumption worldwide, creating substantial demand for high-quality feed ingredients. Additionally, the rising awareness of omega-3 fatty acids’ health benefits has expanded market opportunities beyond traditional animal feed applications into human nutrition and pharmaceutical sectors.

Regional distribution shows significant concentration in key fishing nations, with Peru, Chile, and Denmark maintaining dominant positions in global production. The market’s geographical spread reflects the availability of raw materials, processing infrastructure, and proximity to major consumption centers, particularly in Asia-Pacific regions where aquaculture activities are most intensive.

The fish meal and fish oil market refers to the comprehensive industry ecosystem involved in the production, processing, and commercialization of protein-rich meal and oil products derived from marine fish species. Fish meal represents a concentrated protein source containing essential amino acids, vitamins, and minerals, while fish oil provides valuable omega-3 fatty acids, particularly EPA and DHA, crucial for animal and human health.

Production processes involve the rendering of whole fish or fish processing by-products through cooking, pressing, drying, and grinding operations to create standardized meal products with consistent nutritional profiles. Fish oil extraction occurs simultaneously through mechanical pressing and centrifugal separation, yielding crude oil that undergoes further refinement for various applications. These products serve as fundamental ingredients in aquaculture feeds, livestock nutrition, pet food formulations, and increasingly in human dietary supplements and functional foods.

Market significance extends beyond traditional feed applications, encompassing pharmaceutical, nutraceutical, and cosmetic industries that utilize fish oil’s bioactive compounds. The sector’s importance continues growing as global protein demand increases and sustainable aquaculture practices become more prevalent, positioning fish meal and fish oil as essential components of modern food production systems.

Market performance demonstrates strong growth momentum driven by expanding aquaculture operations, increasing protein consumption, and growing awareness of omega-3 fatty acids’ health benefits. The fish meal and fish oil industry has evolved from a traditional commodity sector into a sophisticated market serving diverse applications across animal nutrition, human health, and industrial sectors. Current market conditions reflect robust demand from Asian aquaculture markets, which represent approximately 78% of global fish farming activities, creating sustained pressure on fish meal and oil supplies.

Key market drivers include the rapid expansion of salmon and shrimp farming operations, increasing adoption of intensive aquaculture practices, and growing consumer preference for sustainably sourced protein products. The market benefits from technological advancements in processing efficiency, quality control, and traceability systems that enhance product value and market acceptance. Additionally, regulatory support for sustainable fishing practices and circular economy principles has created new opportunities for utilizing fish processing waste streams.

Competitive landscape features established players focusing on vertical integration, sustainability certifications, and product differentiation strategies. Market consolidation continues as companies seek economies of scale and enhanced supply chain control, while emerging players leverage innovative processing technologies and specialized product formulations to capture niche market segments.

Strategic insights reveal several critical factors shaping the fish meal and fish oil market’s evolution and growth trajectory:

Primary growth drivers propelling the fish meal and fish oil market include the exponential expansion of global aquaculture production, which continues to outpace traditional capture fisheries growth. The increasing global population and rising protein consumption, particularly in developing economies, create sustained demand for efficient protein conversion through aquaculture operations that rely heavily on fish meal as a primary feed ingredient.

Health consciousness trends significantly impact market dynamics as consumers increasingly recognize omega-3 fatty acids’ cardiovascular, cognitive, and anti-inflammatory benefits. This awareness drives demand for fish oil in dietary supplements, functional foods, and pharmaceutical applications, expanding market opportunities beyond traditional animal feed sectors. The growing pet food industry also contributes substantially to market growth, with premium pet food formulations incorporating fish meal and oil for enhanced nutritional profiles.

Technological advancements in processing efficiency, quality control, and product standardization enable market expansion by improving product consistency, reducing production costs, and meeting stringent quality requirements across diverse applications. Additionally, regulatory support for sustainable fishing practices and circular economy principles creates favorable conditions for utilizing fish processing waste streams, enhancing raw material availability and market sustainability.

Economic factors including rising disposable incomes in emerging markets, urbanization trends, and changing dietary preferences toward protein-rich foods support continued market growth. The development of intensive aquaculture systems and recirculating aquaculture technology (RAS) further drives demand for high-quality feed ingredients with optimal nutritional profiles.

Supply chain challenges represent significant constraints affecting the fish meal and fish oil market, particularly regarding raw material availability and price volatility. Climate change impacts on marine ecosystems, overfishing concerns, and seasonal variations in fish catches create supply uncertainties that affect production planning and pricing strategies. Environmental regulations limiting fishing quotas and seasonal fishing restrictions further constrain raw material access, particularly for anchovy and sardine species commonly used in fish meal production.

Sustainability concerns increasingly influence market dynamics as environmental groups and regulatory bodies scrutinize the industry’s impact on marine ecosystems. The debate over using food-grade fish for animal feed production creates reputational risks and regulatory pressures that may limit future growth opportunities. Additionally, competition from alternative protein sources, including plant-based meals, insect protein, and single-cell proteins, poses long-term challenges to market share retention.

Economic constraints include high processing costs, energy-intensive production methods, and significant capital requirements for establishing modern processing facilities. Price volatility in raw fish markets creates margin pressures for processors, while transportation costs for global distribution add to overall product costs. Currency fluctuations in major producing and consuming regions further complicate pricing strategies and profit margins.

Regulatory challenges encompass evolving food safety standards, traceability requirements, and environmental compliance costs that increase operational complexity and expenses. Quality control demands for pharmaceutical and nutraceutical applications require substantial investments in testing equipment and certification processes, creating barriers for smaller market participants.

Emerging applications present substantial growth opportunities as the fish meal and fish oil market expands beyond traditional animal feed sectors. The rapidly growing nutraceutical industry offers significant potential for high-value fish oil products, particularly in omega-3 supplements, functional foods, and pharmaceutical applications. Cosmetic and personal care industries increasingly incorporate fish oil derivatives for their anti-aging and skin health benefits, creating new revenue streams for market participants.

Technological innovations in processing methods, including enzymatic hydrolysis, supercritical fluid extraction, and membrane separation technologies, enable the development of specialized products with enhanced bioavailability and targeted nutritional profiles. These advanced processing techniques allow for the production of premium-grade products that command higher prices and serve niche market segments with specific requirements.

Sustainability initiatives create opportunities for companies investing in circular economy principles, utilizing fish processing waste streams, and implementing traceability systems. Certification programs such as Marine Stewardship Council (MSC) and Friend of the Sea provide competitive advantages and access to premium market segments. Additionally, the development of integrated aquaculture systems and land-based fish farming creates new demand patterns for specialized feed ingredients.

Geographic expansion opportunities exist in emerging markets where aquaculture development is accelerating, particularly in Africa, Southeast Asia, and Latin America. These regions offer potential for establishing local processing facilities, reducing transportation costs, and serving growing regional demand. Strategic partnerships with local aquaculture operators and feed manufacturers can facilitate market entry and expansion in these high-growth regions.

Supply-demand dynamics in the fish meal and fish oil market reflect complex interactions between marine resource availability, processing capacity, and end-user demand across multiple sectors. The market experiences cyclical patterns influenced by El Niño and La Niña weather phenomena, which significantly impact anchovy populations off the South American coast, affecting global supply levels and pricing structures. These natural cycles create opportunities for strategic inventory management and long-term supply agreements.

Competitive dynamics demonstrate increasing consolidation as larger players acquire smaller processors to achieve economies of scale and enhance supply chain control. Vertical integration strategies enable companies to secure raw material supplies, optimize processing efficiency, and develop direct relationships with end-users. This consolidation trend creates barriers for new entrants while providing opportunities for technology providers and specialized service companies.

Innovation dynamics drive market evolution through the development of alternative raw materials, including fish processing by-products, krill, and algae-based alternatives. These innovations address sustainability concerns while potentially reducing dependence on traditional fish stocks. Processing technology improvements continue enhancing extraction efficiency, product quality, and operational cost-effectiveness, creating competitive advantages for early adopters.

Regulatory dynamics increasingly influence market operations through environmental protection measures, food safety standards, and traceability requirements. These regulations create compliance costs but also establish quality standards that benefit established players with robust quality control systems. International trade policies and tariff structures further impact global market dynamics and regional competitiveness.

Research approach for analyzing the fish meal and fish oil market employs comprehensive primary and secondary research methodologies to ensure accurate market assessment and reliable forecasting. Primary research involves extensive interviews with industry stakeholders, including fish meal processors, aquaculture operators, feed manufacturers, and regulatory officials across major producing and consuming regions. These interviews provide insights into market trends, operational challenges, and future growth prospects from industry participants’ perspectives.

Secondary research encompasses analysis of industry publications, government statistics, trade association reports, and academic studies to establish market baselines and validate primary research findings. Data sources include fisheries departments, aquaculture associations, and international organizations such as FAO and IFFO (The Marine Ingredients Organisation) to ensure comprehensive market coverage and statistical accuracy.

Analytical framework utilizes quantitative and qualitative analysis techniques, including market sizing calculations, trend analysis, competitive benchmarking, and scenario modeling. Statistical methods ensure data reliability and forecast accuracy, while qualitative analysis provides context for market dynamics and strategic implications. Cross-validation techniques compare multiple data sources to enhance research credibility and minimize potential biases.

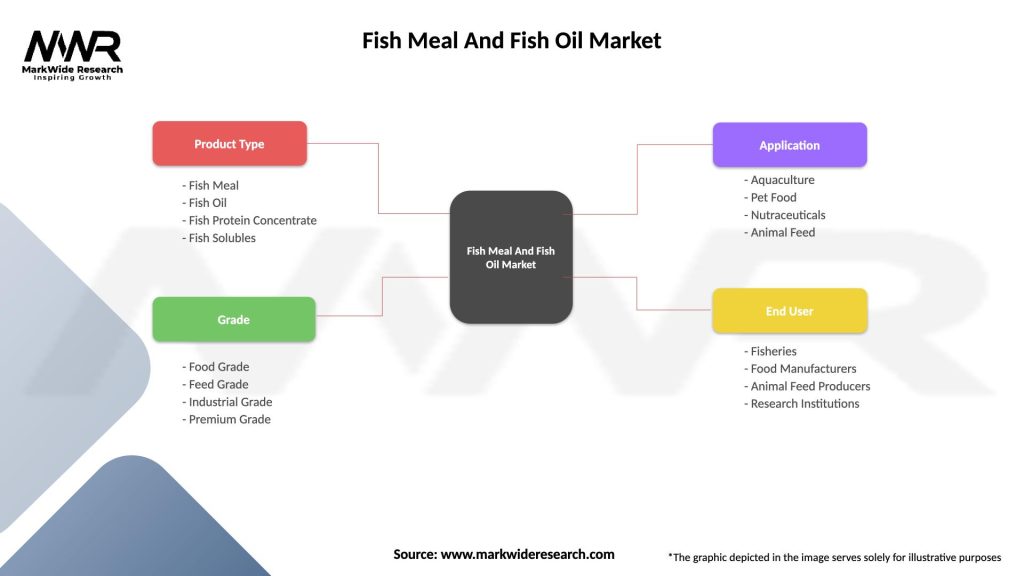

Market segmentation analysis examines various dimensions including product type, application, end-user industry, and geographic regions to provide detailed market insights. This segmentation approach enables identification of growth opportunities, competitive positioning, and strategic recommendations for market participants seeking to optimize their market presence and growth strategies.

Asia-Pacific region dominates global fish meal and fish oil consumption, accounting for approximately 58% of total market demand, driven by intensive aquaculture operations in China, Vietnam, Thailand, and Indonesia. The region’s leadership in salmon, shrimp, and tilapia farming creates substantial demand for high-quality feed ingredients, supporting continued market growth. China represents the largest single market, with rapidly expanding aquaculture production and increasing adoption of commercial feed formulations.

South America maintains its position as the primary production hub, with Peru and Chile contributing significantly to global fish meal and oil supplies. Peru’s anchovy fishery provides the foundation for the world’s largest fish meal industry, while Chile’s salmon farming sector creates substantial domestic demand. The region benefits from abundant marine resources, established processing infrastructure, and proximity to major export markets.

Europe represents a mature market characterized by high-quality standards, sustainability focus, and technological innovation. Norway’s salmon farming industry drives regional demand, while Denmark and Iceland maintain significant processing capabilities. The European market emphasizes premium products, organic certifications, and sustainable sourcing practices, creating opportunities for differentiated product offerings.

North America demonstrates steady growth driven by expanding aquaculture operations, particularly salmon farming in Canada and the United States. The region’s focus on food safety, traceability, and environmental compliance creates demand for certified products and sustainable sourcing practices. Additionally, the growing pet food industry and nutraceutical sector provide alternative demand sources beyond traditional aquaculture applications.

Market leadership in the fish meal and fish oil industry is characterized by a combination of large-scale integrated processors and specialized companies focusing on specific market segments or geographic regions. The competitive environment demonstrates ongoing consolidation as companies seek economies of scale, supply chain control, and market diversification opportunities.

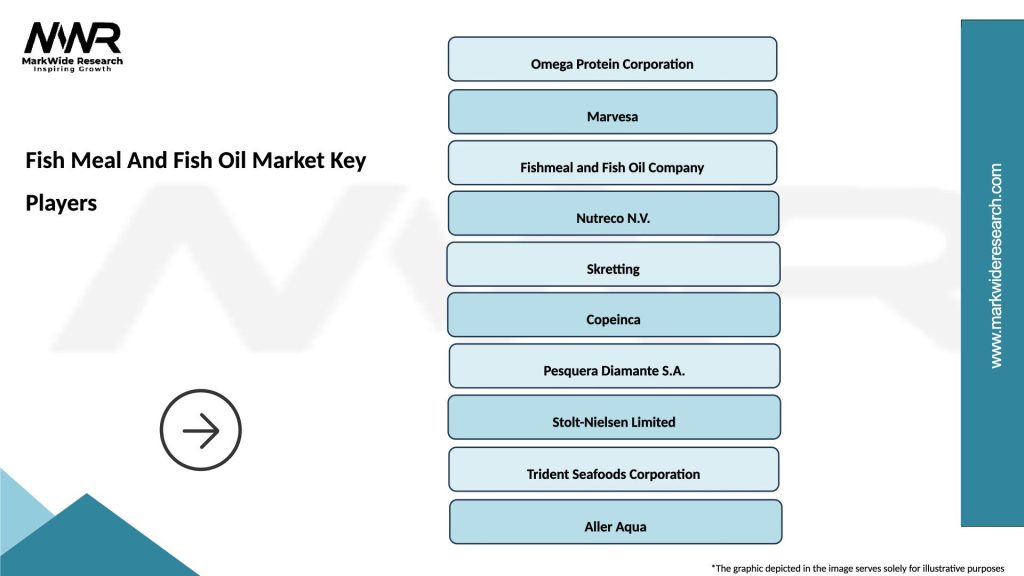

Leading market participants include:

Competitive strategies emphasize vertical integration, sustainability certifications, product differentiation, and geographic expansion. Companies increasingly invest in processing technology upgrades, quality control systems, and traceability capabilities to meet evolving market requirements and maintain competitive advantages in premium market segments.

By Product Type:

By Source:

By Application:

By End-User:

Fish Meal Category represents the largest market segment by volume, serving primarily as a protein source in aquaculture and livestock feeds. Premium-grade fish meal commands higher prices due to superior amino acid profiles, lower ash content, and enhanced digestibility. The category benefits from consistent demand growth driven by expanding aquaculture operations, particularly in salmon and shrimp farming sectors where protein quality significantly impacts growth performance and feed conversion ratios.

Fish Oil Category demonstrates the highest growth rates and profit margins, driven by expanding applications in nutraceutical, pharmaceutical, and functional food sectors. Omega-3 fatty acid content, particularly EPA and DHA concentrations, determines product value and market positioning. The category’s growth trajectory reflects increasing health consciousness and regulatory approvals for omega-3 health claims in various markets.

Specialty Products Category includes fish protein concentrates, hydrolysates, and customized formulations serving niche applications with specific nutritional requirements. These products typically command premium prices due to specialized processing requirements and targeted market applications. Growth in this category reflects market sophistication and demand for value-added products with enhanced functionality.

Sustainable Products Category encompasses certified products meeting environmental and social responsibility standards. This category experiences rapid growth as end-users increasingly prioritize sustainability credentials in procurement decisions. Certification costs are offset by price premiums and access to premium market segments, particularly in European and North American markets.

For Fish Meal Producers:

For Aquaculture Operators:

For Nutraceutical Companies:

For Investors and Stakeholders:

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability Integration represents the most significant trend reshaping the fish meal and fish oil market, with companies increasingly adopting circular economy principles and implementing comprehensive traceability systems. MarkWide Research analysis indicates that sustainability certifications now influence approximately 35% of purchasing decisions in premium market segments, driving industry transformation toward responsible sourcing practices and environmental stewardship.

Technology Advancement continues revolutionizing processing efficiency and product quality through implementation of advanced extraction methods, automated quality control systems, and real-time monitoring technologies. These innovations enable processors to maximize yield, improve product consistency, and reduce operational costs while meeting increasingly stringent quality requirements across diverse applications.

Market Diversification trends show expanding applications beyond traditional animal feed sectors, with growing demand from nutraceutical, pharmaceutical, and cosmetic industries. This diversification strategy reduces market risk while capturing higher-value opportunities in human health and wellness sectors that prioritize product quality and sustainability credentials.

Regional Market Development demonstrates shifting production and consumption patterns as emerging markets develop local aquaculture industries and processing capabilities. This trend creates opportunities for technology transfer, joint ventures, and strategic partnerships while potentially reducing transportation costs and improving supply chain resilience.

Product Innovation focuses on developing specialized formulations with enhanced bioavailability, targeted nutritional profiles, and improved stability characteristics. These innovations address specific customer requirements while enabling premium pricing strategies and market differentiation in competitive segments.

Processing Technology Upgrades across major production facilities have enhanced extraction efficiency, reduced energy consumption, and improved product quality standards. Leading processors have invested significantly in modern equipment, automation systems, and quality control technologies to maintain competitive advantages and meet evolving market requirements.

Sustainability Certifications have become increasingly important as major buyers require verified sustainable sourcing practices. Multiple certification programs, including MSC, Friend of the Sea, and IFFO RS, now cover substantial portions of global production, creating market differentiation opportunities and access to premium market segments.

Strategic Acquisitions and partnerships have reshaped the competitive landscape as companies seek vertical integration, geographic expansion, and technology access. These transactions enable market consolidation, supply chain optimization, and enhanced customer service capabilities while creating economies of scale in processing operations.

Research and Development initiatives focus on alternative raw materials, processing innovations, and product applications to address sustainability concerns and market diversification opportunities. Collaborative research programs between industry participants, academic institutions, and government agencies advance technological capabilities and market understanding.

Regulatory Developments include updated food safety standards, environmental protection measures, and international trade agreements that influence market operations and competitive dynamics. These regulatory changes create compliance requirements while potentially establishing competitive advantages for companies with robust quality control and environmental management systems.

Strategic Recommendations for market participants emphasize the importance of sustainability integration, technology adoption, and market diversification to ensure long-term competitiveness and growth. Companies should prioritize investments in processing technology upgrades, quality control systems, and certification programs to meet evolving market requirements and capture premium pricing opportunities.

Market Entry Strategies for new participants should focus on niche segments, specialized products, or geographic markets with limited competition and specific customer requirements. Partnerships with established players, technology providers, or research institutions can accelerate market entry while reducing risks and capital requirements.

Investment Priorities should emphasize sustainability initiatives, technology modernization, and supply chain optimization to enhance operational efficiency and market positioning. Companies should also consider investments in research and development capabilities to support product innovation and application diversification strategies.

Risk Management approaches should address supply chain vulnerabilities, regulatory compliance requirements, and market volatility through diversification strategies, long-term supply agreements, and comprehensive quality management systems. Environmental risk assessment and climate change adaptation planning are increasingly important for long-term business sustainability.

Growth Strategies should balance organic expansion with strategic acquisitions, geographic diversification with market deepening, and product innovation with operational excellence. Companies should develop comprehensive market intelligence capabilities to identify emerging opportunities and competitive threats in rapidly evolving market conditions.

Market trajectory for the fish meal and fish oil industry indicates continued growth driven by expanding global aquaculture production, increasing protein consumption, and growing health consciousness trends. MWR projections suggest that market expansion will accelerate with projected growth rates of 6.8% annually over the next five years, supported by technological innovations, sustainability initiatives, and market diversification strategies.

Technology evolution will continue transforming industry operations through advanced processing methods, automation systems, and quality control technologies that enhance efficiency, reduce costs, and improve product consistency. Emerging technologies including enzymatic processing, membrane separation, and biotechnology applications offer potential for revolutionary improvements in product quality and processing efficiency.

Sustainability transformation will accelerate as environmental regulations tighten, consumer awareness increases, and corporate responsibility initiatives expand. The industry’s evolution toward circular economy principles, alternative raw materials, and comprehensive traceability systems will create competitive advantages for proactive companies while potentially disrupting traditional business models.

Market diversification trends will continue expanding applications beyond traditional animal feed sectors into high-value human nutrition, pharmaceutical, and industrial applications. This diversification strategy reduces market risk while capturing growth opportunities in rapidly expanding health and wellness sectors that prioritize product quality and sustainability credentials.

Regional development patterns suggest continued growth in Asian markets, expansion in emerging economies, and potential shifts in production locations as companies optimize supply chains and serve local markets. These developments create opportunities for strategic partnerships, technology transfer, and market expansion while potentially reducing transportation costs and improving supply chain resilience.

The fish meal and fish oil market represents a dynamic and evolving industry positioned for sustained growth driven by fundamental trends in global protein consumption, aquaculture expansion, and health consciousness. The market’s transformation from a traditional commodity sector into a sophisticated industry serving diverse applications demonstrates its adaptability and long-term viability in changing market conditions.

Strategic success in this market requires balancing traditional strengths in protein production with innovative approaches to sustainability, technology adoption, and market diversification. Companies that proactively address environmental concerns, invest in processing technologies, and develop specialized products for emerging applications will capture the greatest opportunities in this evolving market landscape.

Future market development will be shaped by the industry’s ability to address sustainability challenges while meeting growing demand for high-quality protein and omega-3 products. The successful integration of circular economy principles, advanced processing technologies, and comprehensive quality management systems will determine competitive positioning and long-term market success in this essential industry serving global food security and human health objectives.

What is Fish Meal And Fish Oil?

Fish meal and fish oil are products derived from fish processing, primarily used as high-protein animal feed and dietary supplements. They are rich in omega-3 fatty acids and are utilized in aquaculture, livestock feed, and pet food.

What are the key companies in the Fish Meal And Fish Oil Market?

Key companies in the Fish Meal And Fish Oil Market include Omega Protein Corporation, Marvesa Holding, and Aker BioMarine, among others. These companies are involved in the production and distribution of fish meal and fish oil products globally.

What are the growth factors driving the Fish Meal And Fish Oil Market?

The Fish Meal And Fish Oil Market is driven by the increasing demand for high-protein animal feed, the growth of the aquaculture industry, and the rising awareness of the health benefits of omega-3 fatty acids. Additionally, the expansion of the pet food sector contributes to market growth.

What challenges does the Fish Meal And Fish Oil Market face?

The Fish Meal And Fish Oil Market faces challenges such as overfishing, regulatory restrictions on fishing practices, and fluctuating raw material prices. Environmental concerns regarding sustainability also pose significant challenges to the industry.

What opportunities exist in the Fish Meal And Fish Oil Market?

Opportunities in the Fish Meal And Fish Oil Market include the development of sustainable fishing practices, innovations in processing technologies, and the growing trend of plant-based alternatives. These factors can enhance product offerings and expand market reach.

What trends are shaping the Fish Meal And Fish Oil Market?

Trends in the Fish Meal And Fish Oil Market include increasing consumer preference for sustainably sourced products, advancements in extraction technologies, and the rising popularity of fish oil supplements among health-conscious consumers. These trends are influencing production and marketing strategies.

Fish Meal And Fish Oil Market

| Segmentation Details | Description |

|---|---|

| Product Type | Fish Meal, Fish Oil, Fish Protein Concentrate, Fish Solubles |

| Grade | Food Grade, Feed Grade, Industrial Grade, Premium Grade |

| Application | Aquaculture, Pet Food, Nutraceuticals, Animal Feed |

| End User | Fisheries, Food Manufacturers, Animal Feed Producers, Research Institutions |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Fish Meal And Fish Oil Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at