444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The firewalls and network security market represents one of the most critical segments in the global cybersecurity landscape, experiencing unprecedented growth driven by escalating cyber threats and digital transformation initiatives. Organizations worldwide are increasingly recognizing the paramount importance of robust network security infrastructure as cyberattacks become more sophisticated and frequent. The market encompasses a comprehensive range of solutions including next-generation firewalls, unified threat management systems, intrusion detection and prevention systems, and advanced network security appliances.

Market dynamics indicate substantial expansion across all industry verticals, with enterprises prioritizing network security investments to protect critical digital assets. The proliferation of cloud computing, Internet of Things (IoT) devices, and remote work environments has significantly amplified the attack surface, creating unprecedented demand for advanced firewall solutions. Growth trajectories show consistent upward momentum, with the market experiencing a robust CAGR of 8.5% as organizations modernize their security architectures.

Regional adoption patterns reveal North America maintaining market leadership, followed by strong growth in Asia-Pacific regions where digital transformation initiatives are accelerating security investments. The market’s evolution reflects the critical shift from traditional perimeter-based security models to comprehensive, intelligence-driven network protection strategies that address modern threat landscapes.

The firewalls and network security market refers to the comprehensive ecosystem of hardware, software, and services designed to protect organizational networks from unauthorized access, cyber threats, and malicious activities. This market encompasses traditional firewall solutions, next-generation firewalls (NGFWs), unified threat management (UTM) systems, network access control solutions, and integrated security platforms that provide multi-layered protection for enterprise networks.

Network security solutions within this market operate by monitoring, filtering, and controlling network traffic based on predetermined security policies and real-time threat intelligence. These systems create secure barriers between trusted internal networks and potentially hostile external environments, while simultaneously providing granular visibility into network activities and automated threat response capabilities.

Modern firewall technologies have evolved beyond simple packet filtering to incorporate advanced features such as application awareness, user identity management, intrusion prevention, malware detection, and cloud integration. The market includes both on-premises and cloud-based deployment models, catering to diverse organizational requirements and infrastructure preferences.

Strategic market analysis reveals the firewalls and network security market as a cornerstone of the global cybersecurity industry, driven by relentless cyber threat evolution and regulatory compliance requirements. The market demonstrates remarkable resilience and growth potential, with organizations across all sectors increasing their network security investments to address sophisticated attack vectors and protect critical business operations.

Key growth drivers include the rapid adoption of cloud services, increasing remote workforce requirements, and stringent data protection regulations that mandate robust network security controls. The market benefits from technological advancements in artificial intelligence, machine learning, and behavioral analytics, which enhance threat detection capabilities and reduce false positive rates by approximately 35%.

Competitive landscape dynamics show established security vendors expanding their portfolios through strategic acquisitions and partnerships, while innovative startups introduce specialized solutions targeting emerging threats. The market’s maturation is characterized by solution consolidation, with organizations preferring integrated security platforms over point solutions to reduce complexity and operational overhead.

Future market trajectories indicate continued expansion driven by digital transformation initiatives, edge computing adoption, and the growing sophistication of cyber threats targeting critical infrastructure and enterprise networks.

Comprehensive market analysis reveals several critical insights that define the current state and future direction of the firewalls and network security market:

Escalating cyber threat landscape serves as the primary catalyst driving unprecedented demand for advanced firewall and network security solutions. Organizations face increasingly sophisticated attack vectors including advanced persistent threats (APTs), ransomware campaigns, and state-sponsored cyber espionage activities that traditional security measures cannot adequately address. The frequency and severity of cyberattacks continue to intensify, with security breaches causing significant financial losses and reputational damage.

Digital transformation initiatives across industries create expanded attack surfaces that require comprehensive network security protection. The proliferation of cloud services, mobile devices, IoT endpoints, and remote work environments fundamentally alters traditional network perimeters, necessitating advanced firewall solutions capable of securing distributed and hybrid infrastructure environments.

Regulatory compliance requirements impose stringent network security mandates across various industries, particularly in healthcare, financial services, and government sectors. Regulations such as GDPR, HIPAA, PCI DSS, and SOX require organizations to implement robust network security controls, driving consistent demand for compliant firewall solutions.

Business continuity imperatives emphasize the critical importance of maintaining secure, reliable network operations to support essential business functions. Organizations recognize that network security investments directly correlate with operational resilience and competitive advantage in increasingly digital business environments.

High implementation costs represent a significant barrier to market adoption, particularly for small and medium-sized businesses with limited cybersecurity budgets. Advanced firewall solutions require substantial capital investments for hardware, software licensing, and professional services, creating financial constraints that may delay or prevent implementation of comprehensive network security measures.

Complexity of deployment and management poses ongoing challenges for organizations lacking specialized cybersecurity expertise. Modern firewall solutions incorporate sophisticated features and configurations that require skilled security professionals to implement and maintain effectively, creating operational barriers in environments with limited technical resources.

Skills shortage in cybersecurity continues to impact market growth as organizations struggle to find qualified professionals capable of managing advanced network security infrastructure. The global cybersecurity skills gap limits the ability of many organizations to fully leverage sophisticated firewall capabilities and maintain optimal security postures.

Legacy system integration challenges complicate the deployment of modern firewall solutions in environments with established network infrastructure. Organizations must navigate compatibility issues, performance impacts, and migration complexities when upgrading from traditional security systems to next-generation platforms.

Emerging technology integration presents substantial opportunities for market expansion through the incorporation of artificial intelligence, machine learning, and behavioral analytics into firewall solutions. These technologies enable predictive threat detection, automated response capabilities, and adaptive security policies that significantly enhance protection effectiveness while reducing operational overhead.

Cloud-native security solutions offer tremendous growth potential as organizations accelerate cloud adoption and require security solutions designed specifically for cloud environments. Cloud-delivered firewall services provide scalability, flexibility, and cost-effectiveness that appeal to organizations seeking to modernize their security architectures.

Small and medium business market represents an underserved segment with significant growth opportunities as cybersecurity awareness increases and affordable, easy-to-deploy solutions become available. SMBs increasingly recognize the importance of professional-grade network security protection and seek solutions tailored to their specific requirements and budget constraints.

Industry-specific solutions create opportunities for specialized firewall offerings designed to address unique security requirements in sectors such as healthcare, manufacturing, energy, and government. Vertical-specific solutions can command premium pricing while providing enhanced value through tailored features and compliance capabilities.

Competitive intensity within the firewalls and network security market continues to escalate as established vendors and innovative startups compete for market share through technological differentiation and strategic positioning. Market leaders invest heavily in research and development to maintain competitive advantages, while emerging players focus on niche solutions and disruptive technologies to gain market entry.

Technology convergence trends drive the integration of multiple security functions into unified platforms, creating comprehensive solutions that address diverse network security requirements. This convergence reduces complexity, improves operational efficiency, and provides better value propositions for organizations seeking consolidated security architectures.

Customer buying patterns reflect increasing preference for subscription-based and managed service models that provide predictable costs, continuous updates, and professional support. Organizations prioritize solutions that offer rapid deployment, minimal maintenance requirements, and scalable capabilities that adapt to changing business needs.

Partnership ecosystems play crucial roles in market dynamics as vendors collaborate with technology partners, system integrators, and managed service providers to expand market reach and enhance solution capabilities. Strategic alliances enable comprehensive security offerings that address complex customer requirements across diverse deployment scenarios.

Comprehensive market research for the firewalls and network security market employs multi-faceted methodological approaches to ensure accuracy, reliability, and depth of analysis. Primary research activities include extensive interviews with industry executives, security professionals, and end-users across various sectors to gather firsthand insights into market trends, challenges, and opportunities.

Secondary research components encompass detailed analysis of industry reports, financial statements, regulatory filings, and technical documentation from leading market participants. This approach provides quantitative data validation and comprehensive understanding of market structures, competitive positioning, and technological developments.

Data triangulation methods combine multiple information sources to verify findings and eliminate potential biases in market analysis. Cross-referencing primary interview data with secondary research findings ensures robust conclusions and reliable market projections that accurately reflect industry realities.

Expert validation processes involve consultation with cybersecurity specialists, industry analysts, and technology experts to review research findings and provide additional context for market interpretations. This validation ensures that research conclusions align with practical market experiences and emerging industry trends.

North America maintains its position as the dominant regional market for firewalls and network security solutions, accounting for approximately 38% of global market share. The region benefits from advanced cybersecurity awareness, stringent regulatory requirements, and significant technology investments across enterprise and government sectors. United States organizations lead adoption of next-generation firewall technologies and cloud-based security solutions.

Europe represents the second-largest regional market, driven by GDPR compliance requirements and increasing cybersecurity investments across various industries. The region demonstrates strong growth in managed security services and integrated security platforms, with particular strength in financial services and manufacturing sectors.

Asia-Pacific emerges as the fastest-growing regional market, experiencing rapid expansion due to digital transformation initiatives, increasing cyber threat awareness, and growing technology infrastructure investments. Countries such as China, India, and Japan lead regional adoption, with small and medium businesses showing accelerated implementation rates.

Latin America and Middle East & Africa regions show promising growth potential as organizations increase cybersecurity investments and governments implement national cybersecurity strategies. These regions benefit from increasing technology adoption and growing recognition of network security importance for economic development.

Market leadership dynamics reveal a competitive environment characterized by both established cybersecurity vendors and innovative technology companies competing through product differentiation, strategic partnerships, and comprehensive solution portfolios. The competitive landscape continues to evolve through mergers, acquisitions, and strategic alliances that reshape market positioning.

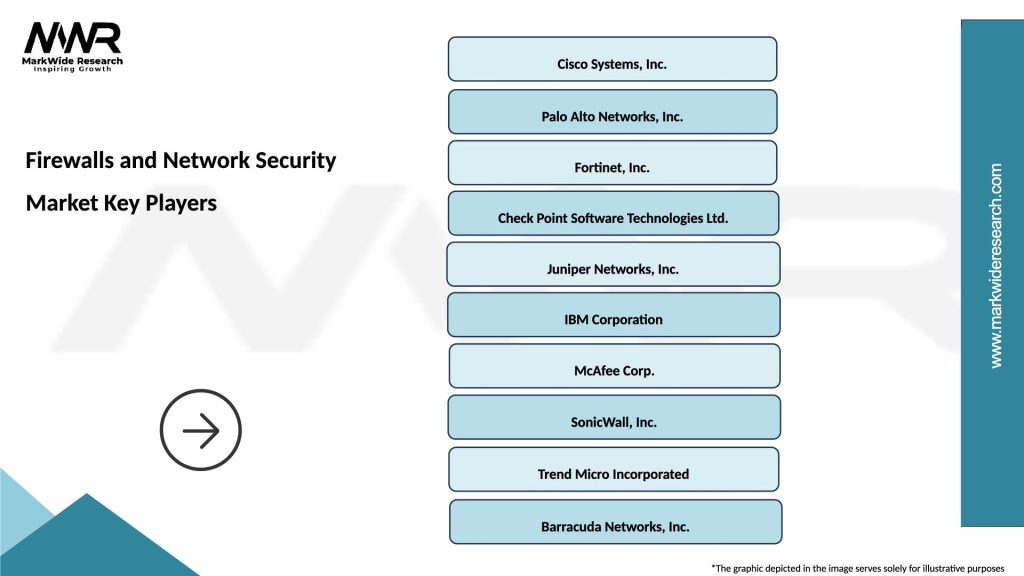

Leading market participants include:

Competitive strategies emphasize technological innovation, market expansion through partnerships, and development of industry-specific solutions that address unique customer requirements across various sectors.

Technology-based segmentation reveals distinct market categories that address different security requirements and deployment scenarios:

By Technology:

By Deployment Model:

By Organization Size:

Next-Generation Firewalls dominate the premium market segment, offering advanced capabilities such as application visibility, user identification, and integrated threat intelligence. These solutions provide superior protection against sophisticated attacks while enabling granular policy control and comprehensive network visibility. Enterprise adoption of NGFWs continues to accelerate as organizations seek to replace legacy firewall infrastructure with modern, intelligent security platforms.

Unified Threat Management systems appeal to organizations seeking comprehensive security functionality in single, integrated platforms. UTM solutions provide cost-effective protection for small and medium businesses while reducing complexity through consolidated management interfaces and simplified deployment processes.

Cloud firewall solutions experience rapid growth as organizations migrate workloads to cloud environments and require security solutions designed specifically for cloud architectures. These solutions offer scalability, flexibility, and integration capabilities that traditional on-premises firewalls cannot match in cloud-native environments.

Managed firewall services gain traction among organizations lacking internal cybersecurity expertise or seeking to reduce operational overhead. These services provide professional monitoring, management, and incident response capabilities while ensuring optimal firewall performance and security effectiveness.

Organizations implementing advanced firewall and network security solutions realize substantial benefits across multiple dimensions of business operations and risk management:

Security Enhancement Benefits:

Operational Efficiency Benefits:

Business Continuity Benefits:

Strengths:

Weaknesses:

Opportunities:

Threats:

Zero Trust Architecture adoption represents a fundamental shift in network security philosophy, moving away from traditional perimeter-based security models toward comprehensive identity verification and continuous monitoring approaches. Organizations increasingly implement zero trust principles that require verification for every user and device attempting to access network resources, regardless of their location or previous authentication status.

Artificial Intelligence integration transforms firewall capabilities through advanced threat detection, behavioral analysis, and automated response mechanisms. AI-powered firewalls demonstrate superior accuracy in identifying sophisticated threats while reducing false positive rates and enabling proactive security measures based on predictive analytics.

Cloud-first security strategies drive demand for cloud-native firewall solutions that provide seamless protection for hybrid and multi-cloud environments. Organizations prioritize security solutions that offer consistent policy enforcement across on-premises and cloud infrastructure while providing centralized visibility and management capabilities.

Security orchestration and automation trends emphasize the integration of firewall solutions with broader security ecosystems to enable coordinated threat response and streamlined security operations. Automated workflows and orchestrated responses significantly improve incident response times and overall security effectiveness.

Strategic acquisitions continue to reshape the competitive landscape as major cybersecurity vendors acquire specialized companies to enhance their firewall and network security portfolios. Recent acquisitions focus on cloud security capabilities, AI-powered threat detection, and industry-specific solutions that address unique vertical market requirements.

Technology partnerships between firewall vendors and cloud service providers create integrated security offerings that provide seamless protection for cloud workloads. These partnerships enable native integration with major cloud platforms while maintaining consistent security policies across hybrid environments.

Regulatory developments in various regions introduce new cybersecurity requirements that drive demand for advanced firewall solutions. Government initiatives and industry-specific regulations continue to mandate robust network security controls, creating consistent market demand and driving solution innovation.

Product innovations focus on enhancing threat detection accuracy, improving management simplicity, and providing better integration capabilities with existing security infrastructure. Vendors invest heavily in research and development to maintain competitive advantages and address evolving customer requirements in dynamic threat environments.

MarkWide Research analysis indicates that organizations should prioritize next-generation firewall implementations that incorporate artificial intelligence and machine learning capabilities to address evolving cyber threats effectively. The integration of advanced analytics and automated response mechanisms provides significant advantages in threat detection accuracy and incident response speed.

Strategic recommendations emphasize the importance of adopting comprehensive security platforms rather than point solutions to reduce complexity and improve operational efficiency. Organizations benefit from unified management interfaces and integrated threat intelligence that provide holistic network security visibility and control.

Investment priorities should focus on cloud-compatible firewall solutions that support hybrid and multi-cloud deployments while maintaining consistent security policies across diverse infrastructure environments. Cloud-native security capabilities become increasingly critical as organizations accelerate digital transformation initiatives.

Vendor selection criteria should emphasize solution scalability, integration capabilities, and long-term technology roadmaps that align with organizational growth plans and evolving security requirements. Organizations benefit from partnerships with vendors that demonstrate consistent innovation and comprehensive support capabilities.

Market trajectory analysis projects continued robust growth for the firewalls and network security market, driven by persistent cyber threats, regulatory compliance requirements, and digital transformation initiatives across all industry sectors. The market demonstrates strong resilience and consistent demand patterns that support sustained expansion over the forecast period.

Technology evolution trends indicate increasing integration of artificial intelligence, machine learning, and behavioral analytics into firewall solutions, enabling predictive threat detection and automated response capabilities. These technological advancements significantly enhance security effectiveness while reducing operational complexity and management overhead.

Cloud security dominance will continue to reshape market dynamics as organizations prioritize cloud-native security solutions that provide seamless protection for distributed and hybrid infrastructure environments. MWR projections suggest cloud-based firewall deployments will experience accelerated adoption rates exceeding 25% annually as cloud migration initiatives intensify.

Market consolidation patterns will likely continue through strategic acquisitions and partnerships as vendors seek to expand their capabilities and market reach. This consolidation creates opportunities for comprehensive security platforms while potentially reducing the number of independent specialized vendors in the market.

The firewalls and network security market stands as a cornerstone of the global cybersecurity industry, demonstrating remarkable resilience and consistent growth driven by escalating cyber threats and digital transformation imperatives. Market analysis reveals a dynamic ecosystem characterized by technological innovation, competitive intensity, and evolving customer requirements that create substantial opportunities for both established vendors and emerging market participants.

Strategic market positioning requires organizations to embrace next-generation firewall technologies that incorporate artificial intelligence, machine learning, and comprehensive threat intelligence capabilities. The transition from traditional perimeter-based security models to zero trust architectures represents a fundamental shift that will define future market development and competitive advantage.

Future success factors emphasize the critical importance of cloud-native security solutions, integrated security platforms, and managed service offerings that address the growing complexity of modern network environments. Organizations that prioritize scalable, intelligent firewall solutions while maintaining focus on operational simplicity and cost-effectiveness will achieve optimal security outcomes and business value in an increasingly challenging cyber threat landscape.

What is Firewalls and Network Security?

Firewalls and Network Security refer to the technologies and practices designed to protect networks from unauthorized access, attacks, and data breaches. This includes hardware and software solutions that monitor and control incoming and outgoing network traffic based on predetermined security rules.

What are the key players in the Firewalls and Network Security Market?

Key players in the Firewalls and Network Security Market include Cisco Systems, Palo Alto Networks, Fortinet, and Check Point Software Technologies. These companies provide a range of solutions, including next-generation firewalls, intrusion prevention systems, and unified threat management, among others.

What are the main drivers of growth in the Firewalls and Network Security Market?

The main drivers of growth in the Firewalls and Network Security Market include the increasing frequency of cyberattacks, the rise of remote work, and the growing adoption of cloud services. Organizations are investing in advanced security measures to protect sensitive data and maintain compliance with regulations.

What challenges does the Firewalls and Network Security Market face?

The Firewalls and Network Security Market faces challenges such as the complexity of security solutions, the shortage of skilled cybersecurity professionals, and the evolving nature of cyber threats. These factors can hinder the effective implementation and management of security measures.

What opportunities exist in the Firewalls and Network Security Market?

Opportunities in the Firewalls and Network Security Market include the development of AI-driven security solutions, the integration of security with IoT devices, and the expansion of managed security services. These trends can help organizations enhance their security posture and respond to emerging threats more effectively.

What trends are shaping the Firewalls and Network Security Market?

Trends shaping the Firewalls and Network Security Market include the shift towards zero-trust security models, the increasing use of cloud-based security solutions, and the growing importance of regulatory compliance. Organizations are focusing on proactive security measures to address vulnerabilities and protect their networks.

Firewalls and Network Security Market

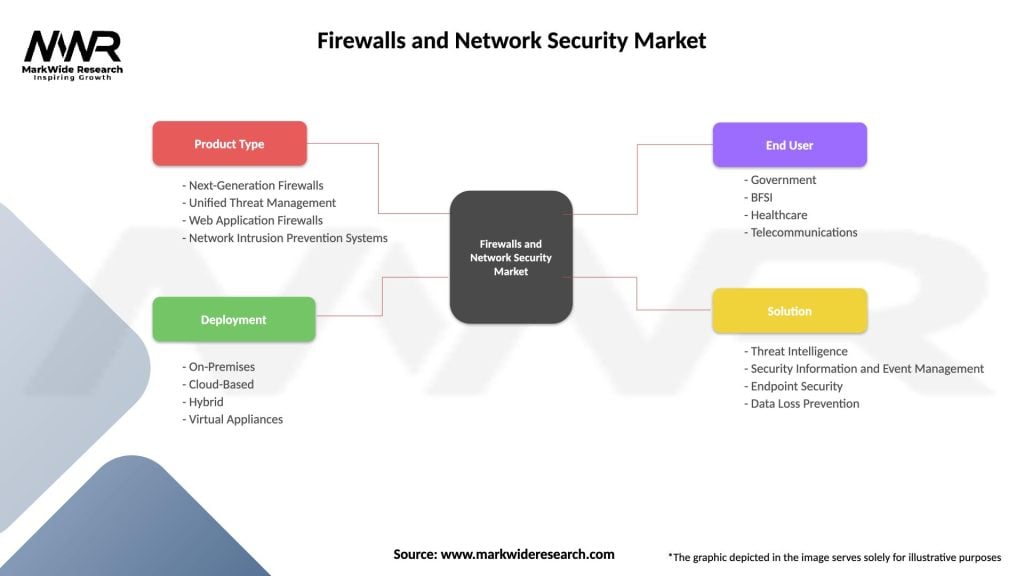

| Segmentation Details | Description |

|---|---|

| Product Type | Next-Generation Firewalls, Unified Threat Management, Web Application Firewalls, Network Intrusion Prevention Systems |

| Deployment | On-Premises, Cloud-Based, Hybrid, Virtual Appliances |

| End User | Government, BFSI, Healthcare, Telecommunications |

| Solution | Threat Intelligence, Security Information and Event Management, Endpoint Security, Data Loss Prevention |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Firewalls and Network Security Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at