444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The fintech market has emerged as a revolutionary force in the financial industry, combining technology and innovation to transform traditional banking and financial services. Fintech, short for financial technology, refers to the use of advanced technologies such as artificial intelligence, blockchain, machine learning, and big data analytics to provide efficient and user-friendly financial solutions. This market has experienced significant growth in recent years, driven by the increasing demand for convenient and accessible financial services across the globe.

Meaning

Fintech encompasses a wide range of services, including digital payments, peer-to-peer lending, crowdfunding, robo-advisory, insurance technology (insurtech), and more. These services leverage technology to streamline processes, reduce costs, enhance security, and improve customer experience. By harnessing the power of technology, fintech companies aim to disrupt traditional financial institutions and create a more inclusive and customer-centric financial ecosystem.

Executive Summary

The fintech market is experiencing rapid growth, driven by several key factors such as increasing smartphone penetration, rising internet connectivity, changing consumer preferences, and supportive regulatory frameworks. Fintech companies are reshaping the financial landscape by providing innovative solutions that cater to the needs of tech-savvy consumers. This report analyzes the current market trends, key insights, drivers, restraints, opportunities, and dynamics that are shaping the fintech industry.

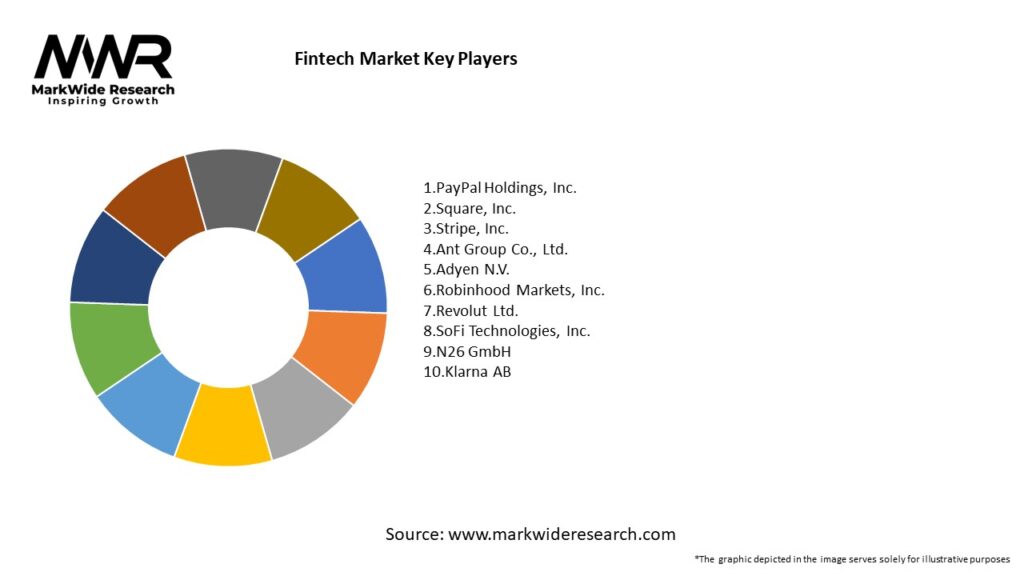

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

The fintech market is witnessing significant growth globally, with North America and Europe leading the way. The adoption of mobile payment solutions, digital wallets, and online banking services has surged, driven by the convenience and speed they offer. Additionally, the rise of open banking and application programming interfaces (APIs) has paved the way for collaboration between traditional financial institutions and fintech companies, fostering innovation and improving customer experience.

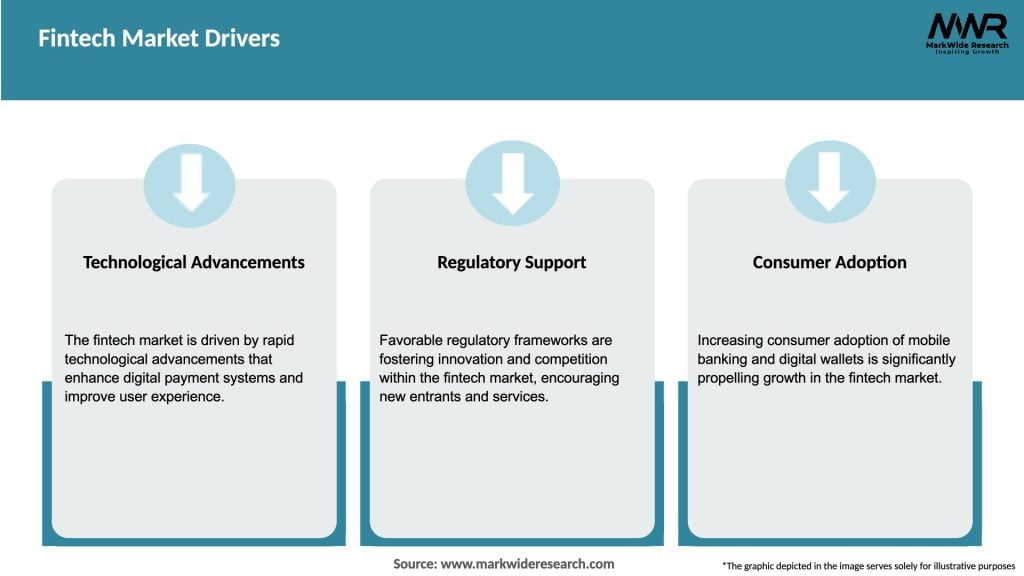

Market Drivers

Several factors are driving the growth of the fintech market. Firstly, the increasing penetration of smartphones and internet connectivity has provided a strong foundation for the adoption of fintech solutions. Moreover, the growing tech-savvy population, especially among millennials and Gen Z, is demanding digital financial services that offer convenience and flexibility. Furthermore, regulatory initiatives aimed at fostering competition and innovation in the financial sector have created a favorable environment for fintech companies to thrive.

Market Restraints

While the fintech market offers immense opportunities, it also faces certain challenges and constraints. One of the primary concerns is cybersecurity and data privacy. As fintech companies handle sensitive financial information, they are exposed to potential security breaches and cyber-attacks. Ensuring robust security measures and building trust among consumers is crucial for the sustained growth of the industry. Additionally, regulatory compliance and licensing requirements pose barriers to entry for new players in the market.

Market Opportunities

The fintech market presents numerous opportunities for growth and expansion. One of the key opportunities lies in emerging markets where there is a large unbanked or underbanked population. Fintech companies can leverage mobile technology and digital platforms to reach these underserved segments and provide them with access to financial services. Furthermore, the integration of fintech solutions with other sectors such as e-commerce, healthcare, and transportation opens up new avenues for collaboration and innovation.

Market Dynamics

The fintech market is characterized by intense competition and rapid technological advancements. Companies are constantly striving to differentiate themselves by offering unique solutions and delivering exceptional user experiences. Partnerships and collaborations between fintech startups, established financial institutions, and technology companies are becoming increasingly common, enabling them to leverage each other’s strengths and expand their market reach. Moreover, investments in research and development are driving the development of new technologies and products in the fintech space.

Regional Analysis

The fintech market exhibits regional variations in terms of adoption, regulations, and market maturity. North America, comprising the United States and Canada, is the largest market for fintech, driven by a strong technological infrastructure, high smartphone penetration, and supportive regulatory frameworks. Europe, particularly the United Kingdom, Germany, and Sweden, is also a significant fintech hub. Asia-Pacific is witnessing rapid growth, fueled by the large population, rising digital literacy, and government initiatives to promote financial inclusion.

Competitive Landscape

Leading Companies in the Fintech Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

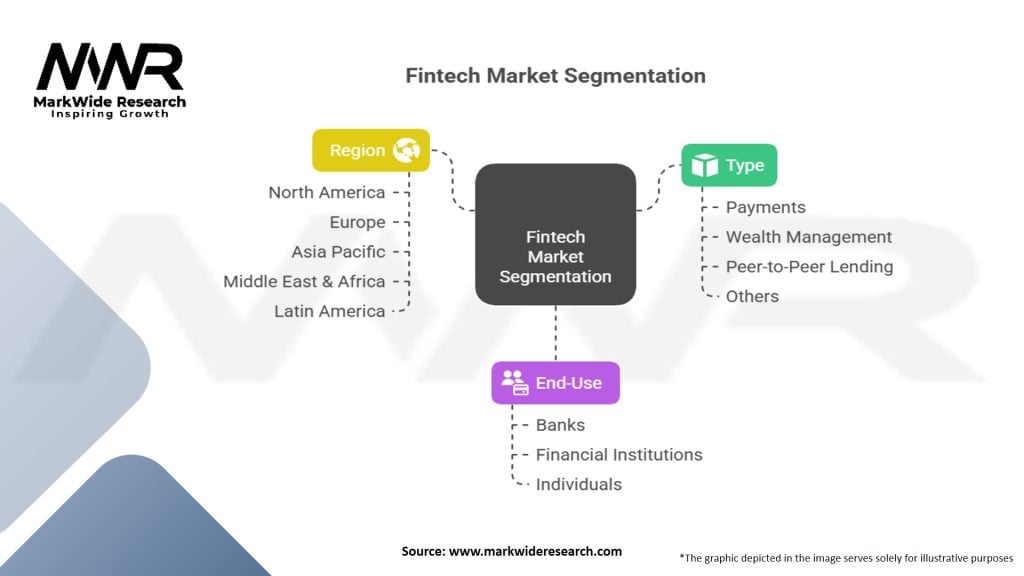

Segmentation

The fintech market can be segmented based on the type of service provided. This includes digital payments, peer-to-peer lending, personal finance management, wealth management, insurance technology, and regulatory technology, among others. Each segment presents unique opportunities and challenges, and companies within these segments employ different technologies and business models to cater to specific customer needs.

Category-wise Insights

Within the fintech market, certain categories have experienced significant growth and disruption. Digital payments, driven by the rise of mobile wallets and contactless payments, have transformed the way people make transactions. Peer-to-peer lending platforms have democratized lending by connecting borrowers directly with lenders, bypassing traditional financial intermediaries. Insurance technology has revolutionized the insurance industry by leveraging data analytics and artificial intelligence to offer personalized coverage and streamline claims processing.

Key Benefits for Industry Participants and Stakeholders

The fintech market offers several benefits for industry participants and stakeholders. For consumers, fintech solutions provide greater convenience, accessibility, and customization compared to traditional financial services. Fintech companies benefit from lower operational costs, scalability, and the ability to rapidly innovate and iterate their products. Traditional financial institutions can collaborate with fintech startups to enhance their service offerings, improve efficiency, and tap into new customer segments.

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Several key trends are shaping the fintech market. Firstly, the rise of open banking and the implementation of regulatory initiatives such as the Revised Payment Services Directive (PSD2) in Europe are fostering collaboration and data sharing between financial institutions and fintech companies. Secondly, the adoption of artificial intelligence and machine learning is enhancing the accuracy of credit assessments, fraud detection, and personalized financial recommendations. Lastly, decentralized finance (DeFi) and blockchain technology are disrupting traditional financial intermediaries and enabling peer-to-peer transactions without the need for intermediaries.

Covid-19 Impact

The COVID-19 pandemic has had a significant impact on the fintech market. The lockdowns and social distancing measures implemented worldwide accelerated the shift towards digital financial services. Fintech companies offering contactless payments, online banking, and digital lending experienced increased demand during this period. The pandemic also highlighted the importance of digital resilience and the need for robust cybersecurity measures in the financial sector.

Key Industry Developments

In recent years, several notable developments have shaped the fintech industry. The emergence of neobanks, such as Chime, N26, and Monzo, has disrupted the traditional banking model by offering mobile-first banking experiences with no physical branches. The rise of cryptocurrencies and digital assets, led by Bitcoin and Ethereum, has opened up new opportunities for fintech companies operating in the blockchain and cryptocurrency space. Additionally, the growing popularity of robo-advisory services has democratized investment management by offering low-cost automated investment solutions.

Analyst Suggestions

To thrive in the competitive fintech market, companies should focus on the following strategies:

Future Outlook

The future of the fintech market looks promising, with continued growth and innovation expected. As technology continues to advance, fintech solutions will become more sophisticated, personalized, and integrated into everyday life. The adoption of emerging technologies such as artificial intelligence, blockchain, and decentralized finance will reshape the financial landscape, offering new opportunities and disrupting traditional business models. Furthermore, the increasing demand for financial inclusion and the rise of emerging markets will fuel the expansion of fintech services globally.

Conclusion

The fintech market is revolutionizing the financial industry by leveraging technology to provide innovative, user-friendly, and accessible financial services. With the increasing adoption of smartphones, changing consumer preferences, and supportive regulatory frameworks, fintech companies are reshaping the way financial transactions are conducted. While the market presents immense opportunities, companies must navigate challenges such as cybersecurity risks and regulatory compliance. By embracing innovation, collaboration, and customer-centricity, fintech companies can position themselves for success in this dynamic and transformative industry.

What is fintech?

Fintech refers to the integration of technology into offerings by financial services companies to improve their use of financial services. It encompasses a wide range of applications, including mobile banking, online lending, and blockchain technology.

Who are the major players in the fintech market?

Major players in the fintech market include companies like PayPal, Square, and Stripe, which focus on payment processing and digital wallets. Other notable companies are Robinhood and SoFi, which provide investment and lending services, among others.

What are the key drivers of growth in the fintech market?

Key drivers of growth in the fintech market include the increasing adoption of smartphones, the demand for faster and more convenient financial services, and the rise of digital currencies. Additionally, regulatory changes are also fostering innovation in this space.

What challenges does the fintech market face?

The fintech market faces several challenges, including regulatory compliance, cybersecurity threats, and competition from traditional financial institutions. These factors can hinder the growth and adoption of fintech solutions.

What opportunities exist in the fintech market for future growth?

Opportunities in the fintech market include the expansion of financial services to underserved populations, the development of artificial intelligence for personalized banking experiences, and the potential for blockchain technology to revolutionize transactions.

What trends are shaping the fintech market today?

Current trends in the fintech market include the rise of neobanks, the integration of AI and machine learning for risk assessment, and the growing popularity of decentralized finance (DeFi) platforms. These trends are transforming how consumers interact with financial services.

Fintech Market

| Segmentation Details | Description |

|---|---|

| Type | Payments, Wealth Management, Peer-to-Peer Lending, Others |

| End-Use | Banks, Financial Institutions, Individuals |

| Region | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Fintech Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at