444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The fintech lending market represents a transformative segment within the broader financial services industry, characterized by the use of technology and innovative business models to provide lending services to individuals and businesses. Fintech lending platforms leverage data analytics, machine learning algorithms, and digital platforms to streamline the lending process, assess creditworthiness, and facilitate faster loan approvals and disbursements. With the growing demand for accessible, efficient, and flexible lending solutions, fintech lending has emerged as a disruptive force, challenging traditional banking models and empowering borrowers with greater access to credit.

Meaning

Fintech lending refers to the use of technology-driven platforms and alternative data sources to facilitate lending activities, including personal loans, business loans, mortgages, and peer-to-peer (P2P) lending. Fintech lenders utilize digital channels, automated processes, and data-driven algorithms to assess credit risk, underwrite loans, and manage loan portfolios, offering borrowers a seamless and convenient borrowing experience. By leveraging technology, fintech lending platforms aim to improve the efficiency, accessibility, and transparency of lending services, catering to the evolving needs of borrowers in a rapidly changing financial landscape.

Executive Summary

The fintech lending market is experiencing rapid growth driven by factors such as technological innovation, changing consumer preferences, and regulatory developments. Fintech lenders offer a range of lending products tailored to meet the diverse needs of borrowers, including individuals, small businesses, and underserved segments of the population. By leveraging digital platforms, data analytics, and automation, fintech lending platforms streamline the lending process, reduce operational costs, and provide faster and more convenient access to credit. Despite challenges such as regulatory scrutiny and market competition, the fintech lending market presents significant opportunities for innovation, growth, and disruption in the financial services industry.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The fintech lending market operates in a dynamic and evolving landscape shaped by technological innovation, regulatory developments, market competition, and changing consumer preferences. These dynamics influence market trends, growth drivers, and investment opportunities within the fintech lending industry, requiring organizations to adapt their strategies, products, and services to meet the evolving needs of borrowers and stakeholders.

Regional Analysis

The fintech lending market exhibits regional variations in demand, market maturity, regulatory frameworks, and competitive dynamics, reflecting differences in economic conditions, technological adoption rates, and consumer behavior. Regional analysis provides insights into key market trends, growth opportunities, and competitive strategies in major geographical regions such as North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa, guiding organizations in identifying market expansion opportunities and optimizing their regional market strategies.

Competitive Landscape

Leading Companies in the Fintech Lending Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

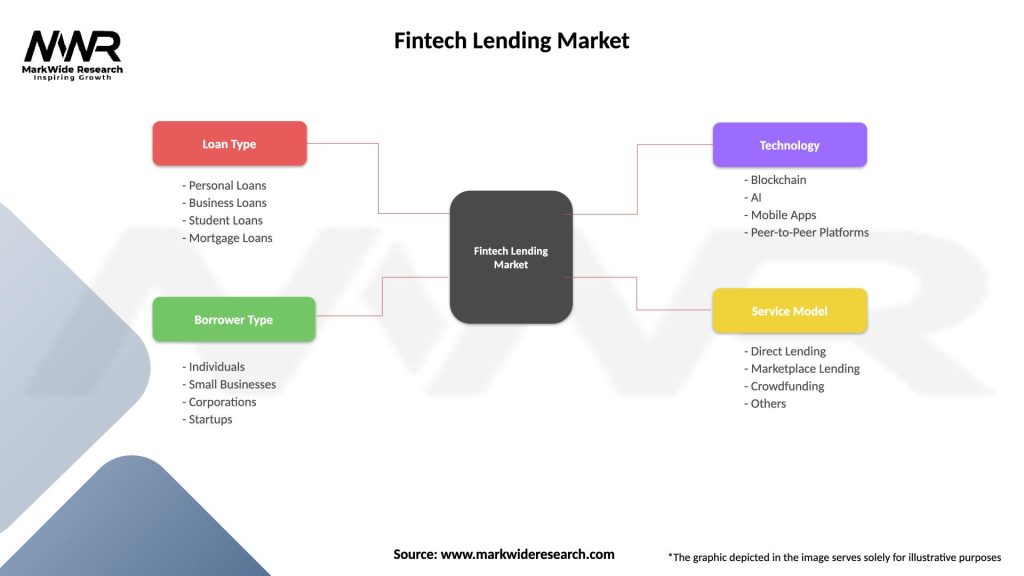

Segmentation

The fintech lending market can be segmented based on factors such as loan type, borrower segment, industry vertical, and geographic region. Segmentation enables organizations to target specific customer segments, customize their product offerings, and address diverse market needs and preferences effectively. Common segmentation categories in the fintech lending market include:

Segmentation provides insights into market trends, customer preferences, and competitive dynamics, enabling organizations to develop targeted marketing strategies, product innovations, and sales initiatives that align with specific market segments and geographical regions.

Category-wise Insights

Categories such as personal loans, business loans, student loans, mortgage loans, and auto loans offer deeper insights into market trends, growth drivers, and investment opportunities within each category. Category-wise analysis enables organizations to understand the unique requirements and preferences of borrowers in different industry verticals, guiding product development, marketing strategies, and sales efforts effectively.

Key Benefits for Industry Participants and Stakeholders

Efficient loan origination, personalized lending solutions, faster approvals, and streamlined loan servicing are among the key benefits offered by fintech lending platforms, creating value for industry participants, stakeholders, and end customers alike. Fintech lenders help individuals and businesses access credit more easily, manage their finances effectively, and achieve their financial goals, driving economic growth and prosperity in the digital age.

SWOT Analysis

A SWOT analysis provides a comprehensive overview of the fintech lending market’s strengths, weaknesses, opportunities, and threats, guiding strategic decision-making and risk management efforts for organizations seeking to capitalize on market opportunities and address challenges effectively.

Market Key Trends

Trends such as digitalization, data-driven lending, embedded finance, and regulatory innovation influence market dynamics and shape the future direction of the fintech lending market. Organizations that embrace these key trends and adapt their strategies, products, and services accordingly will be well-positioned to succeed and thrive in the competitive fintech lending market.

Covid-19 Impact

The COVID-19 pandemic has impacted the fintech lending market by disrupting economic activity, altering consumer behavior, and affecting borrower creditworthiness and repayment capacity. Fintech lenders have responded by implementing risk management measures, offering forbearance programs, and adjusting underwriting criteria to support borrowers impacted by the pandemic, demonstrating resilience and agility in the face of adversity.

Key Industry Developments

Developments such as strategic partnerships, regulatory advancements, technological innovations, and market expansions influence market dynamics and competitive pressures within the fintech lending market, driving continuous improvement and innovation in lending platforms, products, and services.

Analyst Suggestions

Suggestions for industry participants and stakeholders in the fintech lending market include embracing digital transformation, enhancing risk management capabilities, fostering regulatory compliance, and prioritizing customer experience and trust to navigate market challenges and capitalize on growth opportunities effectively.

Future Outlook

The fintech lending market is poised for continued growth and innovation driven by factors such as increasing digital adoption, changing regulatory landscape, evolving consumer preferences, and economic recovery post-COVID-19. Despite challenges such as regulatory uncertainty, credit risk, and cybersecurity threats, the fintech lending market presents significant opportunities for fintech startups, traditional banks, and investors to leverage technology and innovation to reshape the future of lending and finance.

Conclusion

In conclusion, the fintech lending market represents a dynamic and transformative segment within the financial services industry, characterized by technology-driven innovation, changing consumer preferences, and regulatory advancements. Fintech lenders play a critical role in expanding access to credit, improving financial inclusion, and driving economic growth by leveraging technology to streamline lending processes, assess credit risk, and deliver personalized lending solutions to individuals and businesses. Despite challenges such as regulatory scrutiny, credit risk, and market competition, the fintech lending market offers significant opportunities for innovation, growth, and disruption, positioning fintech lenders as key players in shaping the future of finance and lending. By embracing digital transformation, fostering collaboration, and prioritizing customer-centricity, fintech lenders can navigate market challenges, capitalize on growth opportunities, and contribute to a more inclusive and sustainable financial ecosystem in the digital age.

What is Fintech Lending?

Fintech Lending refers to the use of technology to provide financial services related to lending. This includes online platforms that facilitate personal loans, business loans, and peer-to-peer lending, often with faster processing times and lower costs compared to traditional banks.

What are the key players in the Fintech Lending Market?

Key players in the Fintech Lending Market include companies like LendingClub, SoFi, and Prosper, which offer various lending solutions through digital platforms. These companies leverage technology to streamline the lending process and enhance customer experience, among others.

What are the main drivers of growth in the Fintech Lending Market?

The main drivers of growth in the Fintech Lending Market include the increasing demand for quick and accessible credit, advancements in technology that enable better risk assessment, and the rise of digital banking. Additionally, changing consumer preferences towards online services contribute to this growth.

What challenges does the Fintech Lending Market face?

The Fintech Lending Market faces challenges such as regulatory compliance, data security concerns, and competition from traditional financial institutions. These factors can impact the operational efficiency and customer trust in fintech lending solutions.

What opportunities exist in the Fintech Lending Market?

Opportunities in the Fintech Lending Market include expanding into underserved demographics, integrating artificial intelligence for better customer insights, and developing innovative lending products tailored to specific consumer needs. These avenues can enhance market reach and customer engagement.

What trends are shaping the Fintech Lending Market?

Trends shaping the Fintech Lending Market include the rise of mobile lending applications, the use of blockchain technology for secure transactions, and the growing emphasis on personalized lending experiences. These trends are transforming how consumers access and manage loans.

Fintech Lending Market

| Segmentation Details | Description |

|---|---|

| Loan Type | Personal Loans, Business Loans, Student Loans, Mortgage Loans |

| Borrower Type | Individuals, Small Businesses, Corporations, Startups |

| Technology | Blockchain, AI, Mobile Apps, Peer-to-Peer Platforms |

| Service Model | Direct Lending, Marketplace Lending, Crowdfunding, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Fintech Lending Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at