444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The fintech blockchain market is experiencing significant growth and is poised to revolutionize the financial industry. Blockchain technology, which forms the backbone of cryptocurrencies like Bitcoin, has emerged as a disruptive force that enhances security, transparency, and efficiency in financial transactions. Fintech companies are leveraging blockchain to streamline processes, reduce costs, and improve customer experiences. This market overview explores the meaning of fintech blockchain, provides key insights into its market trends, drivers, restraints, and opportunities, examines the regional analysis, competitive landscape, and segmentation, and concludes with future outlook and recommendations.

Fintech blockchain refers to the integration of financial technology (fintech) and blockchain technology. Fintech encompasses a wide range of technological innovations that aim to improve financial services, including online payments, mobile banking, robo-advisory, and peer-to-peer lending. Blockchain, on the other hand, is a distributed ledger technology that enables secure and transparent transactions by recording data across multiple computers. By combining these two technologies, fintech blockchain enhances trust, security, and efficiency in financial transactions, offering immense potential for disruption and innovation in the financial industry.

Executive Summary

The fintech blockchain market is witnessing rapid growth as financial institutions and fintech companies recognize the transformative power of blockchain technology. The market is driven by increasing digitization, rising adoption of cryptocurrencies, and growing demand for secure and transparent financial transactions. However, challenges such as regulatory uncertainties and scalability issues pose significant obstacles to widespread adoption. Nevertheless, the market presents lucrative opportunities for stakeholders who embrace blockchain technology to enhance their operations and customer experiences. In this report, we provide key insights, analyze market dynamics, explore regional variations, discuss the competitive landscape, and offer future outlook and recommendations for industry participants.

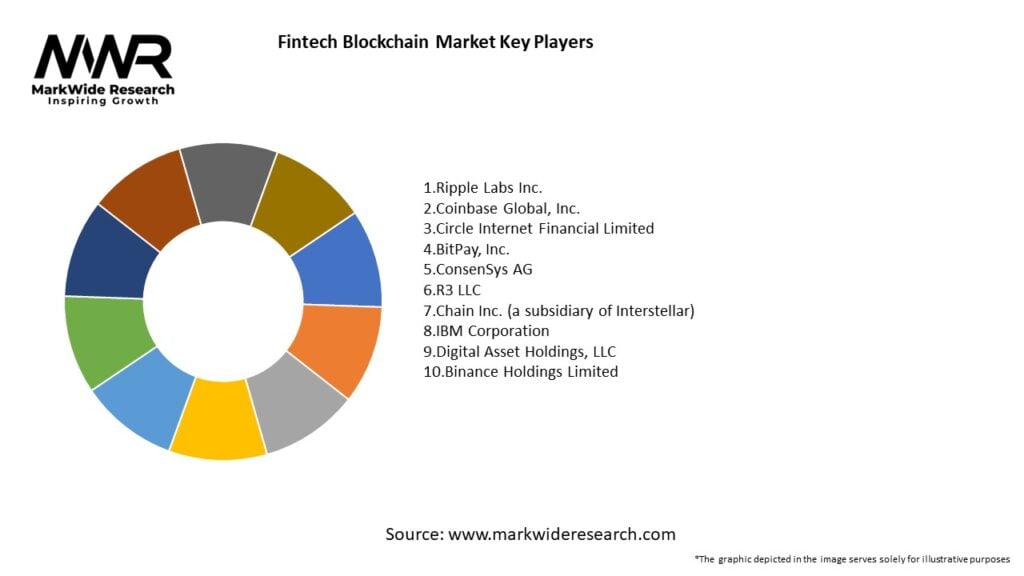

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

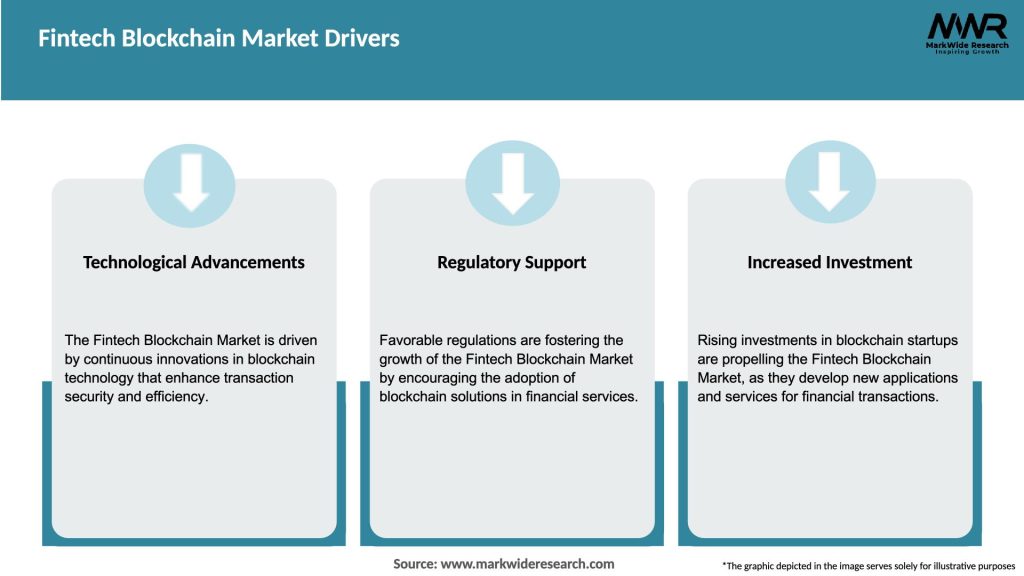

Market Drivers

Market Opportunities

Market Dynamics

The fintech blockchain market is dynamic and evolving, driven by technological advancements, regulatory changes, and market demands. Financial institutions, technology companies, and startups are actively exploring and implementing blockchain solutions to gain a competitive edge. Collaborations, partnerships, and investments are common in the market, aiming to develop innovative applications and address scalability and interoperability challenges. The market dynamics are shaped by customer preferences for secure and convenient financial services, increasing demand for transparency, and the need to streamline operations and reduce costs.

Regional Analysis

The fintech blockchain market exhibits regional variations influenced by factors such as regulatory environment, technological infrastructure, and market maturity. The Asia-Pacific region, including countries like China, Japan, and South Korea, is witnessing significant growth, driven by government initiatives, digital transformation, and a large unbanked population. North America and Europe also hold substantial market shares, benefiting from established financial ecosystems and early blockchain adoption. Emerging markets in Latin America, the Middle East, and Africa are gradually embracing fintech blockchain, presenting growth opportunities fueled by increasing smartphone penetration, rising digital payments, and the need for financial inclusion.

Competitive Landscape

leading companies in the Fintech Blockchain Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

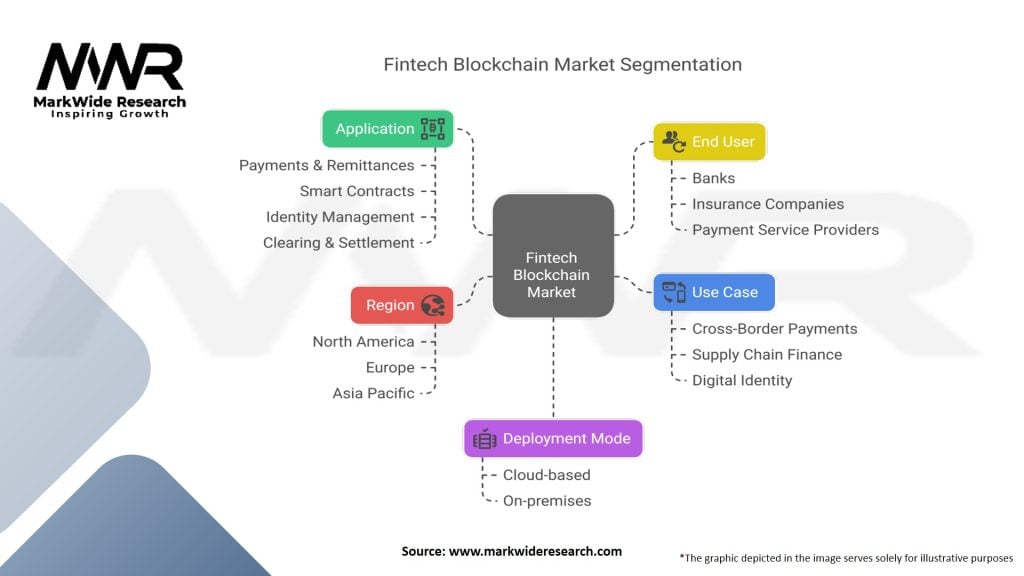

Segmentation

The fintech blockchain market can be segmented based on various factors, including technology, application, end-user, and geography. Technological segments include public blockchain, private blockchain, and consortium blockchain. Application segments encompass payments, remittances, identity management, smart contracts, supply chain finance, and others. End-user segments comprise banks, financial institutions, fintech companies, insurance companies, and others. Geographical segmentation covers North America, Europe, Asia-Pacific, Latin America, and the Middle East and Africa.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has accelerated digital transformation and highlighted the importance of secure and efficient financial systems. The fintech blockchain market has witnessed increased interest and adoption during the pandemic. Blockchain technology’s ability to enable remote transactions, enhance supply chain resilience, and provide transparent tracking of relief funds has become more apparent. However, the pandemic has also created economic challenges, impacting funding and investment opportunities for fintech blockchain startups. The long-term impact of the pandemic on the fintech blockchain market will depend on factors such as the speed of economic recovery, regulatory responses, and changes in consumer behavior.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future of the fintech blockchain market is promising, with continued growth and innovation on the horizon. As blockchain technology matures, scalability and interoperability solutions will improve, overcoming current limitations. Regulatory frameworks will evolve to provide clarity and support market growth. The integration of blockchain with other emerging technologies like AI, Internet of Things (IoT), and cloud computing will unlock new possibilities for financial services. Fintech blockchain will continue to disrupt traditional financial systems, enhancing security, transparency, and efficiency, and opening up new opportunities for financial inclusion and innovation.

Conclusion

The fintech blockchain market is experiencing remarkable growth, driven by the convergence of financial technology and blockchain technology. Fintech blockchain offers enhanced security, transparency, and efficiency in financial transactions, benefiting both financial institutions and customers. While challenges such as regulatory uncertainties and scalability issues persist, the market presents significant opportunities in areas like DeFi, cross-border payments, smart contracts, and supply chain finance. Collaboration, innovation, and proactive regulatory compliance will be crucial for industry participants to thrive in this dynamic market. As blockchain technology evolves, the future outlook for fintech blockchain is highly promising, with the potential to revolutionize the financial industry and create a more secure, transparent, and inclusive financial ecosystem.

What is the Fintech Blockchain?

The Fintech Blockchain refers to the integration of blockchain technology within the financial technology sector, enabling secure, transparent, and efficient transactions. It encompasses various applications such as digital currencies, smart contracts, and decentralized finance (DeFi).

What are the key companies in the Fintech Blockchain market?

Key companies in the Fintech Blockchain market include Ripple, Chainalysis, ConsenSys, and BlockFi, among others.

What are the main drivers of growth in the Fintech Blockchain market?

The main drivers of growth in the Fintech Blockchain market include the increasing demand for secure payment solutions, the rise of decentralized finance applications, and the need for transparency in financial transactions.

What challenges does the Fintech Blockchain market face?

The Fintech Blockchain market faces challenges such as regulatory uncertainty, scalability issues, and the need for interoperability between different blockchain systems.

What opportunities exist in the Fintech Blockchain market?

Opportunities in the Fintech Blockchain market include the potential for new financial products, the expansion of blockchain-based identity verification solutions, and the growth of cross-border payment systems.

What trends are shaping the Fintech Blockchain market?

Trends shaping the Fintech Blockchain market include the increasing adoption of non-fungible tokens (NFTs), the integration of artificial intelligence with blockchain for enhanced security, and the growing interest in central bank digital currencies (CBDCs).

Fintech Blockchain Market:

| Segmentation Details | Description |

|---|---|

| Application | Payments & Remittances, Smart Contracts, Identity Management, Clearing & Settlement, Others |

| Deployment Mode | Cloud-based, On-premises |

| End User | Banks, Insurance Companies, Payment Service Providers, Others |

| Use Case | Cross-Border Payments, Supply Chain Finance, Digital Identity, Trade Finance, Others |

| Region | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

Please note: The segmentation can be entirely customized to align with our client’s needs.

leading companies in the Fintech Blockchain Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at