444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Finland pharma industry market represents one of Europe’s most innovative and technologically advanced pharmaceutical sectors, characterized by exceptional research capabilities and strong regulatory frameworks. Finland’s pharmaceutical landscape has evolved into a hub of biotechnology innovation, with companies focusing on specialized therapeutic areas including oncology, neurology, and rare diseases. The market demonstrates remarkable resilience and growth potential, driven by substantial investments in research and development activities.

Market dynamics indicate that Finland’s pharmaceutical sector is experiencing robust expansion, with the industry growing at a compound annual growth rate of 6.2% over recent years. This growth trajectory reflects the country’s strategic positioning in Nordic pharmaceutical markets and its emphasis on high-value, specialized drug development. Finnish pharmaceutical companies have established themselves as leaders in biotechnology innovation, particularly in areas requiring advanced manufacturing capabilities and stringent quality standards.

Government support and favorable regulatory environments have contributed significantly to market development, with Finland maintaining approximately 8.5% of the Nordic pharmaceutical market share. The industry benefits from strong collaboration between academic institutions, research organizations, and commercial enterprises, creating a comprehensive ecosystem that supports pharmaceutical innovation from early-stage research through commercial production.

The Finland pharma industry market refers to the comprehensive ecosystem of pharmaceutical research, development, manufacturing, and distribution activities operating within Finnish borders. This market encompasses biotechnology companies, traditional pharmaceutical manufacturers, contract research organizations, and supporting service providers that collectively contribute to drug discovery, clinical development, and therapeutic product commercialization.

Finnish pharmaceutical market includes both domestic companies developing innovative therapies and international corporations maintaining significant operations in Finland. The market spans various therapeutic areas, manufacturing capabilities, and research specializations, with particular strength in biotechnology applications and specialized drug development programs targeting rare diseases and complex medical conditions.

Finland’s pharmaceutical industry demonstrates exceptional performance across multiple market segments, establishing the country as a significant player in European pharmaceutical markets. The industry’s success stems from strategic investments in biotechnology research, advanced manufacturing capabilities, and strong regulatory compliance frameworks that support both domestic innovation and international collaboration.

Key market drivers include substantial government funding for pharmaceutical research, with public sector investment accounting for approximately 35% of total R&D funding in the pharmaceutical sector. The market benefits from Finland’s highly educated workforce, advanced digital infrastructure, and strategic geographic location that facilitates access to both European and global markets.

Market performance reflects strong fundamentals across research and development, manufacturing, and export activities. Finnish pharmaceutical companies have achieved notable success in developing innovative therapies for neurological disorders, cancer treatment, and rare genetic conditions, with several breakthrough therapies receiving international regulatory approval and commercial success.

Strategic market insights reveal several critical factors driving Finland’s pharmaceutical industry success:

Government investment serves as a primary market driver, with Finland allocating substantial resources to pharmaceutical research and development through various funding mechanisms. The government’s commitment to life sciences innovation includes direct funding, tax incentives, and infrastructure development that supports pharmaceutical industry growth and competitiveness.

Academic excellence in Finnish universities creates a strong foundation for pharmaceutical innovation, with institutions like the University of Helsinki and Aalto University maintaining world-renowned research programs in drug discovery, biotechnology, and pharmaceutical sciences. These academic partnerships provide pharmaceutical companies with access to cutting-edge research, talented graduates, and collaborative opportunities.

Digital transformation initiatives across Finland’s pharmaceutical sector drive efficiency improvements and innovation acceleration. Companies are leveraging artificial intelligence, machine learning, and advanced data analytics to enhance drug discovery processes, optimize clinical trials, and improve manufacturing operations, resulting in productivity improvements of up to 25% in key operational areas.

Strategic location advantages position Finland as an ideal hub for pharmaceutical operations serving European and global markets. The country’s membership in the European Union provides regulatory harmonization benefits, while its geographic location facilitates efficient distribution to key European markets and emerging economies in Eastern Europe and Russia.

High development costs present significant challenges for pharmaceutical companies operating in Finland, particularly for smaller biotechnology firms developing innovative therapies. The substantial capital requirements for drug development, clinical trials, and regulatory approval processes can strain financial resources and limit the number of development programs that companies can pursue simultaneously.

Regulatory complexity associated with pharmaceutical development and commercialization creates operational challenges, particularly for companies seeking to navigate multiple international regulatory frameworks. While Finland benefits from EU regulatory harmonization, companies must still manage complex approval processes and varying requirements across different therapeutic areas and geographic markets.

Talent competition intensifies as the pharmaceutical industry competes with other high-technology sectors for skilled professionals in areas such as biotechnology, data science, and regulatory affairs. This competition can drive up labor costs and create recruitment challenges, particularly for specialized positions requiring advanced technical expertise.

Market size limitations within Finland’s domestic pharmaceutical market require companies to pursue international expansion strategies to achieve commercial success. This necessity for global market access increases operational complexity and requires substantial investments in international business development and regulatory compliance capabilities.

Biotechnology expansion presents substantial opportunities for Finnish pharmaceutical companies, particularly in areas such as cell and gene therapy, personalized medicine, and advanced biologics. The growing global demand for innovative biotechnology solutions creates significant market potential for companies with specialized capabilities and innovative therapeutic approaches.

Digital health integration offers opportunities to develop innovative pharmaceutical solutions that combine traditional drug therapies with digital health technologies. Finnish companies can leverage the country’s advanced digital infrastructure and expertise in health technology to create comprehensive therapeutic solutions that address complex medical conditions.

Contract manufacturing services represent a growing opportunity as global pharmaceutical companies seek high-quality, reliable manufacturing partners. Finland’s advanced manufacturing capabilities, regulatory expertise, and strategic location position the country well to capture increasing demand for contract development and manufacturing services.

Emerging market expansion provides opportunities for Finnish pharmaceutical companies to leverage their innovative products and expertise in developing markets. According to MarkWide Research analysis, emerging markets represent significant growth potential for specialized pharmaceutical products, particularly in areas where Finnish companies have established expertise.

Innovation ecosystems in Finland create dynamic interactions between pharmaceutical companies, research institutions, government agencies, and supporting organizations. These collaborative networks facilitate knowledge transfer, resource sharing, and joint development projects that accelerate pharmaceutical innovation and commercial success.

Investment flows into Finland’s pharmaceutical sector reflect both domestic and international confidence in the market’s growth potential. Venture capital, private equity, and strategic investments from multinational pharmaceutical companies provide essential funding for research and development activities, with foreign investment representing approximately 40% of total pharmaceutical sector investment.

Competitive dynamics within the Finnish pharmaceutical market encourage continuous innovation and operational excellence. Companies compete on the basis of research capabilities, product quality, regulatory expertise, and international market access, driving overall industry performance and competitiveness improvements.

Regulatory evolution continues to shape market dynamics as Finnish and European regulatory agencies adapt to emerging technologies, new therapeutic approaches, and changing market conditions. These regulatory developments influence product development strategies, market access approaches, and competitive positioning within the pharmaceutical industry.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into Finland’s pharmaceutical industry market. Primary research activities include structured interviews with industry executives, regulatory officials, academic researchers, and other key stakeholders who provide firsthand insights into market conditions, trends, and future prospects.

Secondary research encompasses analysis of government publications, industry reports, academic studies, and corporate disclosures to gather quantitative data and validate primary research findings. This approach ensures comprehensive coverage of market segments, competitive dynamics, and regulatory developments that influence industry performance.

Data validation processes include cross-referencing information from multiple sources, conducting follow-up interviews to clarify findings, and applying statistical analysis techniques to ensure data accuracy and reliability. These validation procedures help maintain research quality and provide confidence in market insights and projections.

Market modeling techniques incorporate historical data analysis, trend identification, and scenario planning to develop realistic projections for market development. These analytical approaches consider various factors including regulatory changes, technological developments, competitive dynamics, and macroeconomic conditions that influence pharmaceutical industry performance.

Helsinki metropolitan area serves as the primary hub for Finland’s pharmaceutical industry, hosting the majority of major pharmaceutical companies, research institutions, and supporting organizations. This concentration creates significant agglomeration benefits, including access to specialized talent, research facilities, and business services that support pharmaceutical industry operations.

Turku region has emerged as an important pharmaceutical cluster, particularly for biotechnology companies and research organizations focused on drug discovery and development. The region benefits from strong academic institutions, specialized research facilities, and growing venture capital investment that supports pharmaceutical innovation and commercialization activities.

Tampere area contributes to Finland’s pharmaceutical landscape through specialized manufacturing capabilities and research activities, particularly in areas such as pharmaceutical technology and process development. The region’s industrial heritage and technical expertise provide valuable capabilities for pharmaceutical manufacturing and development operations.

Regional distribution of pharmaceutical activities reflects strategic considerations including access to talent, research facilities, manufacturing capabilities, and transportation infrastructure. MWR data indicates that the Helsinki region accounts for approximately 55% of pharmaceutical industry employment, while other regions contribute specialized capabilities and manufacturing capacity.

Market leadership in Finland’s pharmaceutical industry includes both domestic companies and international corporations with significant Finnish operations:

International presence includes major multinational pharmaceutical companies maintaining significant operations in Finland, including research and development facilities, manufacturing operations, and regional headquarters serving Nordic and European markets.

Competitive strategies focus on innovation leadership, therapeutic specialization, strategic partnerships, and international market expansion. Companies compete through research excellence, product quality, regulatory expertise, and ability to access global markets for their innovative pharmaceutical products.

By therapeutic area, Finland’s pharmaceutical market demonstrates strength across multiple segments:

By company type, the market includes diverse organizational structures:

By development stage, pharmaceutical activities span the complete development lifecycle from early research through commercial production and distribution.

Biotechnology segment represents the most dynamic area of Finland’s pharmaceutical industry, with companies developing innovative therapies using advanced biological approaches. This category benefits from strong research capabilities, government support, and growing international recognition for Finnish biotechnology expertise.

Generic pharmaceuticals provide stable revenue streams and market presence for Finnish companies, particularly in European markets where regulatory harmonization facilitates market access. This segment offers opportunities for companies with strong manufacturing capabilities and regulatory expertise.

Specialty pharmaceuticals focusing on rare diseases and complex medical conditions represent high-value market opportunities where Finnish companies can leverage their research expertise and innovation capabilities. These products typically command premium pricing and face limited competition.

Contract services category includes contract research organizations, contract manufacturing organizations, and other service providers supporting pharmaceutical development and production activities. This segment benefits from growing outsourcing trends in the global pharmaceutical industry.

Pharmaceutical companies operating in Finland benefit from access to world-class research capabilities, highly skilled workforce, advanced manufacturing infrastructure, and favorable regulatory environment. These advantages support innovation, operational efficiency, and international competitiveness across various therapeutic areas and market segments.

Research institutions gain access to industry partnerships, funding opportunities, and commercial applications for their research discoveries. Collaboration with pharmaceutical companies provides resources for advanced research projects and pathways for translating scientific discoveries into therapeutic applications.

Government stakeholders benefit from pharmaceutical industry contributions to economic development, employment creation, export revenues, and healthcare innovation. The industry supports Finland’s position as a leader in high-technology industries and contributes to national competitiveness in global markets.

Healthcare systems benefit from access to innovative therapies developed by Finnish pharmaceutical companies, improved treatment options for patients, and contributions to medical knowledge that advance healthcare delivery and patient outcomes.

Strengths:

Weaknesses:

Opportunities:

Threats:

Personalized medicine emerges as a dominant trend in Finland’s pharmaceutical industry, with companies developing targeted therapies based on individual patient characteristics, genetic profiles, and biomarker analysis. This approach enables more effective treatments with reduced side effects and improved patient outcomes.

Digital transformation accelerates across pharmaceutical operations, with companies implementing artificial intelligence, machine learning, and advanced analytics to enhance drug discovery, optimize clinical trials, and improve manufacturing processes. These technologies are achieving efficiency improvements of up to 30% in key operational areas.

Sustainability initiatives gain prominence as pharmaceutical companies adopt environmentally responsible practices in manufacturing, packaging, and distribution activities. Finnish companies are leading efforts to reduce environmental impact while maintaining product quality and regulatory compliance.

Collaborative partnerships between pharmaceutical companies, academic institutions, and technology providers create innovative approaches to drug development and commercialization. These partnerships leverage complementary expertise and resources to accelerate innovation and improve success rates.

Recent regulatory approvals for Finnish pharmaceutical products in international markets demonstrate the industry’s innovation capabilities and regulatory expertise. These approvals provide validation for Finnish pharmaceutical development approaches and create opportunities for commercial expansion.

Investment announcements from both domestic and international sources indicate continued confidence in Finland’s pharmaceutical industry potential. Major investments in research facilities, manufacturing capabilities, and technology development support long-term industry growth and competitiveness.

Strategic acquisitions and partnerships involving Finnish pharmaceutical companies reflect the industry’s growing international recognition and commercial value. These transactions provide access to global markets, additional resources, and complementary capabilities that enhance competitive positioning.

Technology breakthroughs achieved by Finnish pharmaceutical companies in areas such as drug delivery systems, biotechnology applications, and therapeutic approaches contribute to global pharmaceutical knowledge and establish Finland as an innovation leader.

Investment priorities should focus on strengthening research and development capabilities, particularly in emerging therapeutic areas such as cell and gene therapy, immunotherapy, and precision medicine. Companies should also invest in digital technologies that enhance operational efficiency and accelerate innovation processes.

Strategic partnerships with international pharmaceutical companies, academic institutions, and technology providers can provide access to additional resources, expertise, and market opportunities. These collaborations should focus on complementary capabilities and shared strategic objectives.

Market expansion strategies should prioritize high-growth international markets where Finnish pharmaceutical companies can leverage their specialized expertise and innovative products. MarkWide Research recommends focusing on markets with favorable regulatory environments and growing demand for specialized therapeutics.

Talent development initiatives should address skill gaps in emerging areas such as biotechnology, data science, and digital health technologies. Companies should collaborate with educational institutions to develop specialized training programs and attract international talent.

Long-term growth prospects for Finland’s pharmaceutical industry remain positive, supported by continued innovation, government investment, and growing international recognition. The industry is projected to maintain steady growth rates of 5-7% annually over the next decade, driven by breakthrough therapies and expanding market opportunities.

Technology integration will continue transforming pharmaceutical operations, with artificial intelligence, biotechnology, and digital health solutions creating new possibilities for drug development and patient care. Finnish companies are well-positioned to capitalize on these technological advances through their innovation capabilities and strategic investments.

International expansion will remain essential for Finnish pharmaceutical companies seeking to achieve commercial success and scale their operations. Companies will need to develop sophisticated global market strategies while maintaining their innovation focus and operational excellence.

Regulatory evolution will continue shaping industry development as authorities adapt to new technologies, therapeutic approaches, and market conditions. Finnish companies’ regulatory expertise positions them well to navigate these changes and maintain market access across multiple jurisdictions.

Finland’s pharmaceutical industry demonstrates exceptional strength across multiple dimensions, including research excellence, innovation capabilities, regulatory expertise, and international competitiveness. The market benefits from strong government support, world-class academic institutions, and a collaborative ecosystem that supports pharmaceutical innovation from early-stage research through commercial success.

Market fundamentals remain robust, with continued growth driven by biotechnology innovation, digital transformation, and expanding international opportunities. Finnish pharmaceutical companies have established strong positions in specialized therapeutic areas and continue to develop breakthrough therapies that address significant medical needs.

Future success will depend on continued investment in research and development, strategic partnerships, international market expansion, and adaptation to evolving technologies and regulatory requirements. The Finland pharma industry market is well-positioned to maintain its leadership role in European pharmaceutical markets while contributing to global healthcare innovation and patient care improvements.

What is Pharma?

Pharma refers to the industry involved in the research, development, production, and marketing of medications and pharmaceuticals. It encompasses various segments including biotechnology, generic drugs, and over-the-counter products.

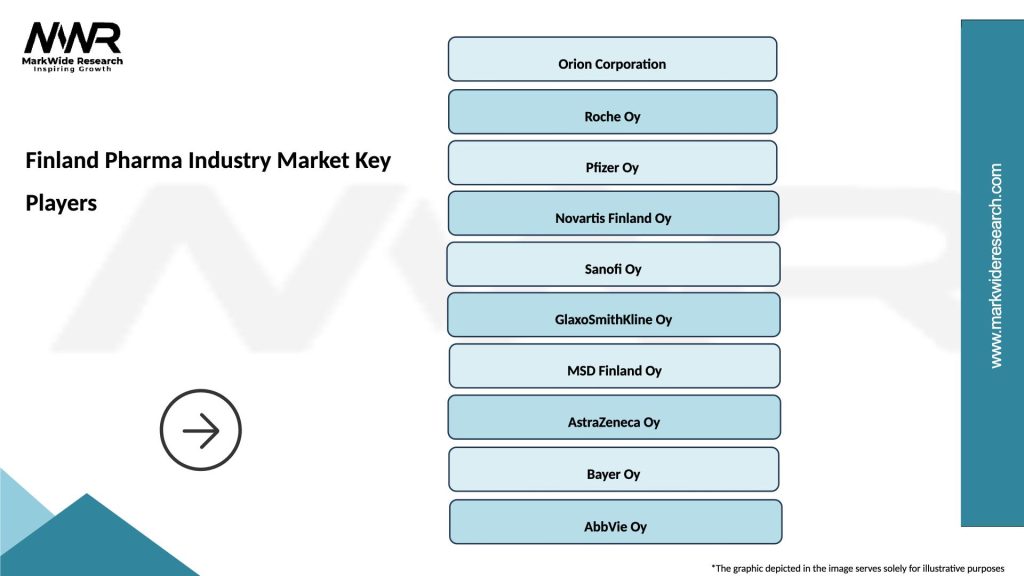

What are the key players in the Finland Pharma Industry Market?

Key players in the Finland Pharma Industry Market include Orion Corporation, Bayer, and Novartis, which are known for their contributions to pharmaceuticals and healthcare solutions, among others.

What are the growth factors driving the Finland Pharma Industry Market?

The Finland Pharma Industry Market is driven by factors such as increasing healthcare expenditure, a growing aging population, and advancements in biotechnology and personalized medicine.

What challenges does the Finland Pharma Industry Market face?

Challenges in the Finland Pharma Industry Market include stringent regulatory requirements, high research and development costs, and competition from generic drug manufacturers.

What opportunities exist in the Finland Pharma Industry Market?

Opportunities in the Finland Pharma Industry Market include the potential for growth in biopharmaceuticals, increased investment in healthcare innovation, and expanding markets for digital health solutions.

What trends are shaping the Finland Pharma Industry Market?

Trends in the Finland Pharma Industry Market include a focus on precision medicine, the integration of artificial intelligence in drug development, and a shift towards sustainable practices in pharmaceutical manufacturing.

Finland Pharma Industry Market

| Segmentation Details | Description |

|---|---|

| Product Type | Prescription Drugs, Over-the-Counter Medications, Biologics, Generics |

| Therapy Area | Oncology, Cardiovascular, Neurology, Infectious Diseases |

| Delivery Mode | Injectable, Oral, Transdermal, Inhalation |

| End User | Hospitals, Pharmacies, Clinics, Research Institutions |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Finland Pharma Industry Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at