444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Finland cybersecurity market represents a dynamic and rapidly evolving landscape characterized by increasing digital transformation initiatives and heightened security awareness across both public and private sectors. Finland’s commitment to digital innovation and its position as a Nordic technology leader has created substantial demand for comprehensive cybersecurity solutions. The market demonstrates robust growth potential, driven by escalating cyber threats, regulatory compliance requirements, and the country’s strategic focus on maintaining its digital sovereignty.

Market dynamics in Finland reflect a sophisticated understanding of cybersecurity challenges, with organizations increasingly investing in advanced threat detection, incident response capabilities, and comprehensive security frameworks. The Finnish cybersecurity ecosystem benefits from strong government support, world-class educational institutions, and a thriving startup environment that fosters innovation in security technologies. Growth projections indicate the market is expanding at a compound annual growth rate of 12.5%, reflecting the urgent need for enhanced digital protection measures.

Key market characteristics include a high concentration of technology-savvy enterprises, significant government investment in national cybersecurity infrastructure, and growing awareness of cyber risks among small and medium-sized enterprises. The market landscape encompasses various segments including network security, endpoint protection, cloud security, and identity management solutions, each experiencing distinct growth patterns and adoption rates.

The Finland cybersecurity market refers to the comprehensive ecosystem of security technologies, services, and solutions designed to protect digital assets, infrastructure, and information systems within Finnish organizations and government entities. This market encompasses a broad spectrum of cybersecurity offerings including threat intelligence platforms, security orchestration tools, managed security services, and specialized consulting services tailored to address the unique security challenges faced by Finnish enterprises and public sector organizations.

Cybersecurity solutions in the Finnish context involve protecting critical national infrastructure, financial services, healthcare systems, and emerging technologies such as IoT devices and smart city implementations. The market includes both domestic security providers and international vendors offering localized solutions that comply with Finnish and European Union regulatory requirements while addressing specific regional threat landscapes and operational needs.

Finland’s cybersecurity market demonstrates exceptional resilience and growth potential, positioning the country as a regional leader in digital security innovation. The market benefits from strong foundational elements including advanced telecommunications infrastructure, high digital literacy rates, and proactive government policies supporting cybersecurity development. Market expansion is driven by increasing digitalization across industries, growing sophistication of cyber threats, and mandatory compliance with evolving regulatory frameworks.

Strategic investments in artificial intelligence-powered security solutions, zero-trust architectures, and cloud-native security platforms are reshaping the competitive landscape. Finnish organizations are demonstrating 65% adoption rates for advanced threat detection solutions, indicating mature security awareness and willingness to invest in cutting-edge protection technologies. The market shows particular strength in sectors such as telecommunications, financial services, and critical infrastructure protection.

Innovation drivers include the emergence of 5G networks, increased remote work adoption, and the growing importance of securing industrial control systems. Finnish cybersecurity companies are gaining international recognition for their expertise in areas such as secure communications, privacy-preserving technologies, and resilient system design, contributing to the country’s reputation as a cybersecurity innovation hub.

Critical market insights reveal several transformative trends shaping Finland’s cybersecurity landscape:

Primary market drivers propelling Finland’s cybersecurity market growth include escalating cyber threat sophistication and frequency. Ransomware attacks targeting Finnish organizations have increased significantly, creating urgent demand for advanced threat prevention and incident response capabilities. The evolving threat landscape, characterized by state-sponsored attacks, advanced persistent threats, and supply chain compromises, is compelling organizations to invest in comprehensive security frameworks.

Digital transformation initiatives across Finnish industries are generating substantial cybersecurity requirements. As organizations modernize their IT infrastructure, adopt cloud technologies, and implement IoT solutions, they require sophisticated security measures to protect expanded attack surfaces. Regulatory compliance requirements, particularly the EU’s NIS2 directive and GDPR, are mandating enhanced security controls and driving systematic security investments.

Government initiatives supporting national cybersecurity resilience are creating market opportunities through public sector procurement and strategic partnerships. Finland’s commitment to maintaining digital sovereignty and protecting critical national infrastructure is generating sustained demand for domestic cybersecurity capabilities and solutions.

Significant market restraints include the persistent cybersecurity skills shortage affecting Finnish organizations’ ability to implement and manage advanced security solutions effectively. Talent scarcity is creating competitive pressure for qualified cybersecurity professionals, driving up implementation costs and potentially delaying security initiative deployment timelines.

Budget constraints particularly impact smaller Finnish organizations that struggle to justify substantial cybersecurity investments despite growing threat awareness. The complexity of modern cybersecurity solutions can overwhelm organizations lacking dedicated security expertise, creating implementation challenges and potentially reducing solution effectiveness.

Integration complexities with legacy systems present ongoing challenges for Finnish organizations seeking to modernize their security infrastructure. Compatibility issues, system downtime concerns, and the need for extensive customization can slow adoption rates and increase total cost of ownership for cybersecurity solutions.

Substantial market opportunities exist in developing specialized cybersecurity solutions for Finland’s unique industry sectors including forestry, mining, and clean technology. These industries are increasingly digitizing their operations while requiring security solutions tailored to their specific operational environments and regulatory requirements.

Emerging technologies such as quantum-resistant cryptography, AI-powered threat detection, and automated incident response present significant growth opportunities for innovative Finnish cybersecurity companies. The country’s strong research and development capabilities position it well to lead in next-generation security technology development.

International expansion opportunities are emerging as Finnish cybersecurity companies leverage their expertise in secure communications, privacy protection, and critical infrastructure security to serve global markets. The reputation for reliability and innovation that Finnish technology companies enjoy internationally creates favorable conditions for cybersecurity solution exports.

Market dynamics in Finland’s cybersecurity sector reflect a complex interplay between technological innovation, regulatory requirements, and evolving threat landscapes. Competitive pressures are intensifying as both domestic and international security vendors compete for market share, driving innovation and improving solution quality while potentially compressing profit margins.

Customer expectations are evolving rapidly, with Finnish organizations demanding more integrated, automated, and user-friendly security solutions. The shift toward managed security services is accelerating, with managed service adoption growing at 18% annually as organizations seek to address skills shortages while maintaining robust security postures.

Technology convergence is creating new market dynamics as cybersecurity increasingly integrates with broader IT infrastructure, cloud platforms, and business applications. This convergence is blurring traditional market boundaries and creating opportunities for comprehensive security platform providers while challenging specialized point solution vendors.

Comprehensive research methodology employed in analyzing Finland’s cybersecurity market incorporates multiple data collection and analysis techniques to ensure accuracy and reliability. Primary research involves extensive interviews with cybersecurity executives, government officials, technology vendors, and end-user organizations across various Finnish industry sectors.

Secondary research encompasses analysis of government publications, industry reports, regulatory documents, and financial statements from key market participants. MarkWide Research analysts utilize proprietary databases and market intelligence platforms to track market trends, competitive developments, and technology adoption patterns across the Finnish cybersecurity landscape.

Quantitative analysis includes statistical modeling of market trends, growth projections, and segment performance metrics. Qualitative analysis incorporates expert opinions, industry insights, and strategic assessments of market opportunities and challenges. Data validation processes ensure information accuracy and reliability through multiple source verification and expert review procedures.

Regional analysis reveals distinct cybersecurity market characteristics across Finland’s geographic regions. Helsinki metropolitan area dominates market activity, accounting for approximately 55% of total cybersecurity spending, driven by the concentration of large enterprises, government agencies, and technology companies in the capital region.

Tampere and Turku regions represent significant secondary markets, with strong industrial bases driving demand for operational technology security and critical infrastructure protection solutions. These regions show growing adoption rates of 22% for industrial cybersecurity solutions as manufacturing companies enhance their digital security postures.

Northern Finland regions present unique opportunities in sectors such as mining, forestry, and renewable energy, where remote operations and harsh environmental conditions require specialized cybersecurity approaches. The expansion of 5G networks and IoT deployments in these regions is creating new security requirements and market opportunities.

Cross-regional collaboration is strengthening Finland’s overall cybersecurity posture through information sharing initiatives, joint training programs, and coordinated incident response capabilities. Regional cybersecurity clusters are emerging, fostering innovation and knowledge exchange between organizations across different geographic areas.

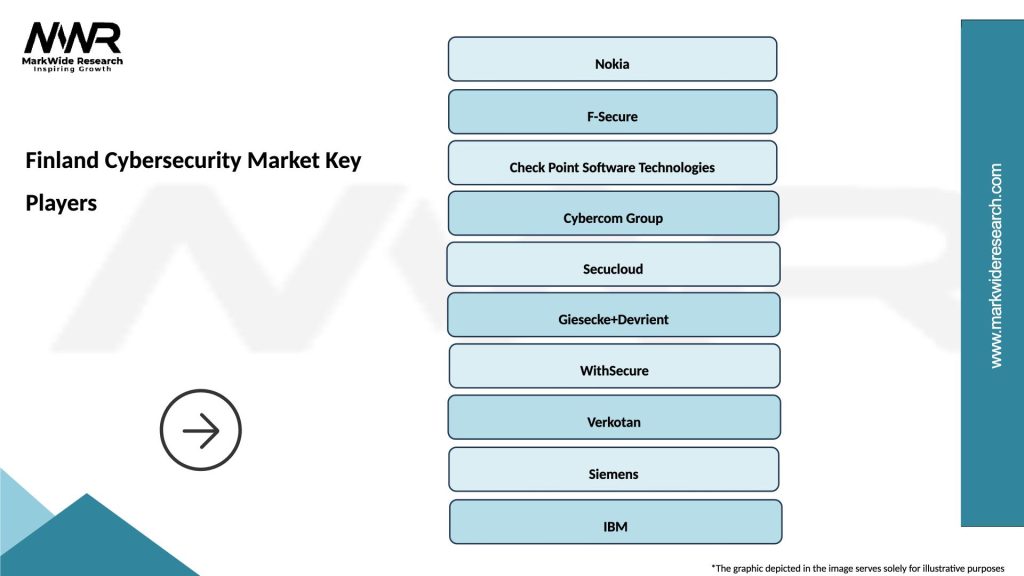

Finland’s cybersecurity competitive landscape features a dynamic mix of domestic innovators and international security vendors. Key market participants include:

Competitive strategies focus on developing specialized solutions for Finnish market requirements, establishing local partnerships, and providing comprehensive managed services to address skills shortages. Market consolidation trends are emerging as larger vendors acquire specialized Finnish cybersecurity companies to enhance their regional capabilities and market access.

Market segmentation analysis reveals distinct categories driving Finland’s cybersecurity market growth:

By Solution Type:

By Deployment Model:

By Organization Size:

Network security solutions maintain the largest market share in Finland, driven by the need to protect increasingly complex network infrastructures and support remote work environments. Advanced threat detection capabilities are becoming standard requirements, with organizations investing in AI-powered network monitoring and automated response systems.

Cloud security represents the fastest-growing segment, with adoption rates increasing by 35% annually as Finnish organizations accelerate their cloud migration strategies. Multi-cloud security management platforms are gaining traction as organizations seek to maintain consistent security policies across diverse cloud environments.

Identity and access management solutions are experiencing strong growth driven by zero-trust architecture adoption and regulatory compliance requirements. Finnish organizations are implementing sophisticated identity governance frameworks to manage user access across hybrid IT environments while maintaining security and compliance standards.

Managed security services are becoming increasingly popular among Finnish SMEs, with service adoption growing at 25% annually as organizations seek to access enterprise-grade security capabilities without significant internal resource investments.

Industry participants in Finland’s cybersecurity market benefit from several strategic advantages including access to highly skilled technical talent, strong government support for cybersecurity innovation, and a sophisticated customer base that values advanced security solutions. Domestic vendors enjoy competitive advantages through deep understanding of local regulatory requirements and cultural preferences.

Enterprise stakeholders benefit from improved risk management capabilities, enhanced regulatory compliance, and protection of critical business assets and intellectual property. Cybersecurity investments enable Finnish organizations to maintain customer trust, support digital transformation initiatives, and compete effectively in global markets.

Government stakeholders achieve enhanced national security posture, protection of critical infrastructure, and improved resilience against state-sponsored cyber threats. Public sector cybersecurity investments support economic competitiveness and maintain Finland’s reputation as a secure and reliable digital economy.

Technology ecosystem benefits include accelerated innovation, increased international competitiveness, and the development of exportable cybersecurity solutions that can serve global markets while strengthening Finland’s position as a technology leader.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration represents a dominant trend transforming Finland’s cybersecurity landscape. Organizations are implementing AI-powered threat detection, automated incident response, and predictive security analytics to enhance their defensive capabilities while addressing skills shortages through intelligent automation.

Zero-trust architecture adoption is accelerating across Finnish enterprises as organizations recognize the limitations of traditional perimeter-based security models. Implementation rates for zero-trust principles are growing at 30% annually as companies redesign their security frameworks around continuous verification and least-privilege access principles.

Cloud-native security solutions are gaining prominence as Finnish organizations migrate to cloud platforms and adopt containerized applications. Security teams are implementing DevSecOps practices and cloud security posture management tools to maintain security standards in dynamic cloud environments.

Privacy-preserving technologies are becoming increasingly important as Finnish organizations seek to balance security requirements with privacy protection obligations. Homomorphic encryption, differential privacy, and secure multi-party computation technologies are gaining attention for their ability to enable secure data analysis while protecting individual privacy.

Recent industry developments highlight Finland’s growing prominence in the global cybersecurity ecosystem. Strategic acquisitions by international vendors of Finnish cybersecurity companies demonstrate the value and innovation potential of the domestic market while providing growth capital for continued development.

Government initiatives including the establishment of national cybersecurity centers and increased funding for cybersecurity research are strengthening Finland’s defensive capabilities and fostering innovation. Public-private partnerships are expanding to address critical infrastructure protection and incident response coordination.

Educational program expansion at Finnish universities and technical institutes is addressing the cybersecurity skills shortage through specialized degree programs, professional certifications, and industry collaboration initiatives. MWR analysis indicates these programs are producing graduates with skills aligned to current market demands.

International collaboration through EU cybersecurity initiatives and Nordic cooperation agreements is enhancing Finland’s cybersecurity capabilities while creating opportunities for Finnish companies to participate in larger regional and global security projects.

Strategic recommendations for market participants include focusing on developing specialized solutions that address unique Finnish market requirements while maintaining global scalability. Domestic vendors should leverage their local market knowledge and regulatory expertise to compete effectively against international competitors.

Investment priorities should emphasize artificial intelligence, automation, and cloud-native security technologies that can address the skills shortage while providing superior threat detection and response capabilities. Organizations should consider strategic partnerships and acquisitions to accelerate technology development and market expansion.

Market entry strategies for international vendors should prioritize local partnerships, regulatory compliance, and understanding of Finnish business culture. Establishing local presence and demonstrating commitment to the Finnish market will be essential for long-term success.

Talent development initiatives should receive increased attention from both vendors and end-user organizations to address the growing skills gap. Collaboration with educational institutions, professional development programs, and knowledge sharing initiatives will be critical for market growth.

Future market projections indicate continued strong growth for Finland’s cybersecurity market, driven by persistent threat evolution, regulatory requirements, and digital transformation acceleration. MarkWide Research forecasts suggest the market will maintain robust expansion with particular strength in cloud security, AI-powered solutions, and managed services segments.

Technology evolution will focus on quantum-resistant cryptography, advanced threat intelligence, and autonomous security operations as organizations prepare for next-generation cyber threats. Finnish companies are well-positioned to lead in these emerging technology areas given their strong research capabilities and innovation culture.

Market consolidation is expected to continue as larger vendors acquire specialized capabilities and smaller companies seek resources for growth and international expansion. This consolidation will likely result in more comprehensive security platforms while maintaining innovation through continued startup activity.

International expansion opportunities will grow as Finnish cybersecurity companies leverage their domestic success to serve global markets, particularly in areas such as secure communications, privacy protection, and critical infrastructure security where Finland has developed recognized expertise.

Finland’s cybersecurity market represents a dynamic and rapidly evolving ecosystem characterized by strong fundamentals, innovative companies, and growing international recognition. The market benefits from exceptional government support, world-class technical talent, and a sophisticated customer base that values advanced security solutions. Growth prospects remain robust despite challenges such as skills shortages and international competition.

Strategic positioning as a cybersecurity innovation hub provides Finland with significant competitive advantages in the global market. The country’s commitment to digital sovereignty, privacy protection, and critical infrastructure security creates a favorable environment for continued market development and international expansion of Finnish cybersecurity capabilities.

Future success will depend on continued investment in talent development, technology innovation, and international collaboration while maintaining the strong public-private partnerships that have contributed to Finland’s cybersecurity leadership position in the Nordic region and beyond.

What is Cybersecurity?

Cybersecurity refers to the practices and technologies designed to protect networks, devices, and data from unauthorized access, attacks, or damage. It encompasses various measures including firewalls, encryption, and intrusion detection systems.

What are the key players in the Finland Cybersecurity Market?

Key players in the Finland Cybersecurity Market include F-Secure, Nixu Corporation, and Elisa, which provide a range of cybersecurity solutions such as threat intelligence, managed security services, and incident response, among others.

What are the main drivers of growth in the Finland Cybersecurity Market?

The main drivers of growth in the Finland Cybersecurity Market include the increasing frequency of cyberattacks, the rising adoption of cloud services, and the growing regulatory requirements for data protection across various industries.

What challenges does the Finland Cybersecurity Market face?

Challenges in the Finland Cybersecurity Market include the shortage of skilled cybersecurity professionals, the rapid evolution of cyber threats, and the complexity of integrating new security technologies with existing systems.

What opportunities exist in the Finland Cybersecurity Market?

Opportunities in the Finland Cybersecurity Market include the expansion of IoT devices, the increasing demand for cybersecurity solutions in small and medium-sized enterprises, and the potential for growth in sectors such as healthcare and finance.

What trends are shaping the Finland Cybersecurity Market?

Trends shaping the Finland Cybersecurity Market include the rise of artificial intelligence in threat detection, the growing emphasis on zero-trust security models, and the increasing focus on cybersecurity awareness training for employees.

Finland Cybersecurity Market

| Segmentation Details | Description |

|---|---|

| Solution | Endpoint Security, Network Security, Cloud Security, Application Security |

| Deployment | On-Premises, Cloud-Based, Hybrid, Managed Services |

| End User | Government, BFSI, Healthcare, Retail |

| Service Type | Consulting, Implementation, Managed Security Services, Training |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Finland Cybersecurity Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at