444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The Financial Service Outsourcing market represents a vital segment within the broader outsourcing industry, catering to the specialized needs of financial institutions, banks, insurance companies, and investment firms. Financial service outsourcing involves the delegation of specific financial processes, such as accounting, payroll, risk management, compliance, and customer service, to third-party service providers. This market plays a crucial role in helping financial institutions optimize operational efficiency, reduce costs, mitigate risks, and focus on core business functions while leveraging the expertise and scalability of outsourcing partners.

Meaning

Financial service outsourcing refers to the practice of contracting specific financial functions or processes to external service providers. These outsourcing arrangements allow financial institutions to access specialized skills, technology infrastructure, and cost-effective solutions to streamline operations, improve service quality, and enhance competitive advantage. Financial service outsourcing encompasses a wide range of activities, including back-office operations, middle-office functions, customer support, data management, and regulatory compliance services.

Executive Summary

The Financial Service Outsourcing market is experiencing robust growth driven by factors such as increasing regulatory complexity, cost pressures, digital transformation, and the need for operational efficiency. This executive summary provides a concise overview of key market insights, trends, and challenges, highlighting the strategic importance of outsourcing partnerships in enabling financial institutions to adapt to evolving market dynamics and achieve business objectives.

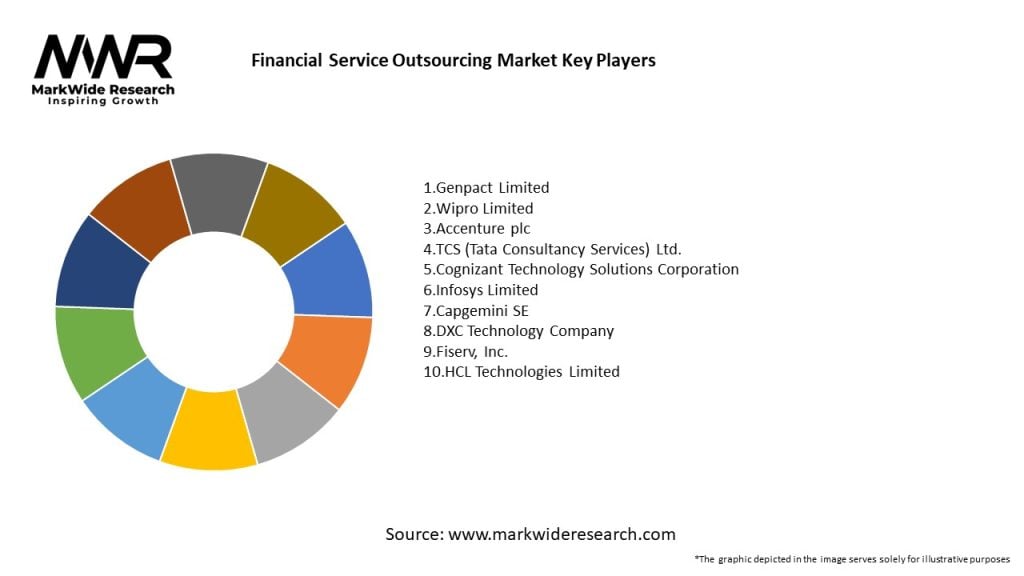

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Financial Service Outsourcing market operates within a dynamic and evolving landscape influenced by technological advancements, regulatory changes, geopolitical factors, and market trends. Outsourcing providers navigate these dynamics by offering innovative solutions, adapting to client needs, and ensuring compliance with industry standards and regulations to drive market growth and sustainability.

Regional Analysis

Competitive Landscape

Leading Companies in the Financial Service Outsourcing Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

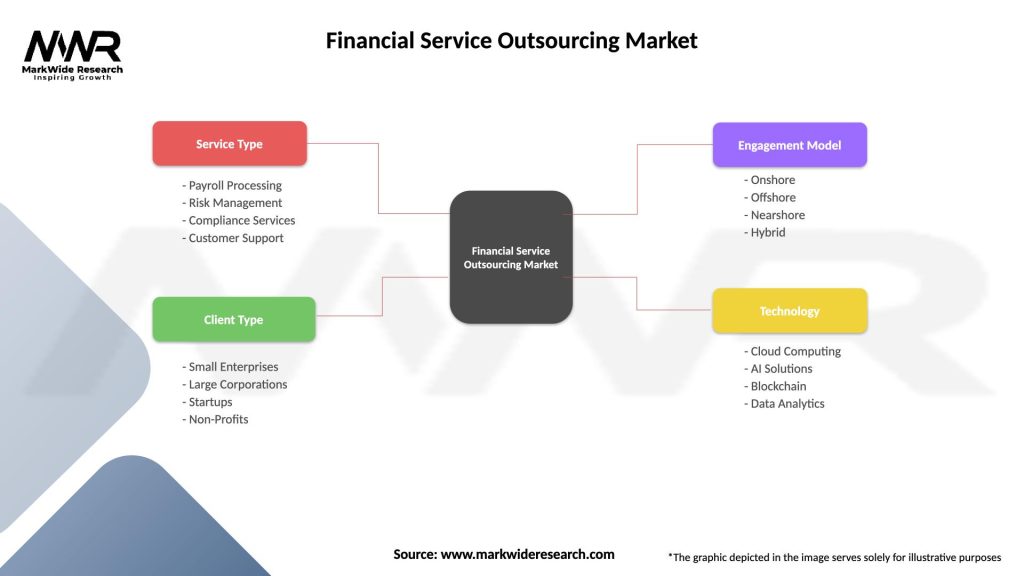

Segmentation

The Financial Service Outsourcing market can be segmented based on various factors, including:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

Key Industry Developments

Analyst Suggestions

Future Outlook

The Financial Service Outsourcing market is poised for continued growth and innovation, driven by digital transformation, regulatory complexity, technological advancements, and changing market dynamics. Outsourcing providers that embrace technology, prioritize client-centricity, and deliver value-added solutions are well-positioned to capitalize on emerging opportunities and drive industry evolution in the dynamic and competitive landscape of financial services.

Conclusion

In conclusion, the Financial Service Outsourcing market represents a critical enabler of operational efficiency, risk management, and innovation within the financial services industry. As financial institutions navigate regulatory complexities, technological disruptions, and cost pressures, the role of outsourcing partners becomes increasingly indispensable in driving business transformation, enhancing service quality, and delivering value to clients and stakeholders. By embracing digitalization, adopting best practices, and fostering collaborative partnerships, financial service outsourcing providers can navigate market uncertainties, capitalize on growth opportunities, and drive industry evolution in the pursuit of operational excellence and sustainable growth.

What is Financial Service Outsourcing?

Financial Service Outsourcing refers to the practice of delegating financial operations and processes to third-party service providers. This can include functions such as accounting, payroll, tax preparation, and financial analysis, allowing companies to focus on their core business activities.

What are the key players in the Financial Service Outsourcing Market?

Key players in the Financial Service Outsourcing Market include Accenture, Infosys, and Wipro, which provide a range of financial services to various industries. These companies leverage technology and expertise to enhance efficiency and reduce costs for their clients, among others.

What are the main drivers of growth in the Financial Service Outsourcing Market?

The main drivers of growth in the Financial Service Outsourcing Market include the increasing need for cost reduction, the demand for specialized expertise, and the growing adoption of digital technologies. Companies are increasingly outsourcing to improve operational efficiency and focus on strategic initiatives.

What challenges does the Financial Service Outsourcing Market face?

Challenges in the Financial Service Outsourcing Market include data security concerns, regulatory compliance issues, and the potential for service quality variability. Companies must navigate these challenges to ensure successful outsourcing relationships.

What opportunities exist in the Financial Service Outsourcing Market?

Opportunities in the Financial Service Outsourcing Market include the expansion of cloud-based services, the rise of artificial intelligence in financial processes, and the increasing demand for real-time data analytics. These trends can lead to innovative service offerings and enhanced client satisfaction.

What trends are shaping the Financial Service Outsourcing Market?

Trends shaping the Financial Service Outsourcing Market include the growing emphasis on automation, the integration of advanced technologies like blockchain, and the shift towards more flexible service models. These trends are transforming how financial services are delivered and consumed.

Financial Service Outsourcing Market

| Segmentation Details | Description |

|---|---|

| Service Type | Payroll Processing, Risk Management, Compliance Services, Customer Support |

| Client Type | Small Enterprises, Large Corporations, Startups, Non-Profits |

| Engagement Model | Onshore, Offshore, Nearshore, Hybrid |

| Technology | Cloud Computing, AI Solutions, Blockchain, Data Analytics |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Financial Service Outsourcing Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at