444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The financial protection market is a crucial segment of the overall insurance industry that focuses on providing individuals and businesses with protection against financial risks. It encompasses various insurance products designed to mitigate the adverse impact of unexpected events, such as death, disability, illness, and property damage. Financial protection products offer peace of mind by providing financial support in challenging times, ensuring that individuals and businesses can recover and continue their operations. This market plays a vital role in safeguarding the economic well-being of individuals, families, and organizations.

Meaning

Financial protection refers to the measures taken to safeguard individuals and businesses from the potential financial losses resulting from unforeseen events. It involves the utilization of insurance products that provide financial compensation or support in the event of a covered loss or damage. These products typically include life insurance, disability insurance, health insurance, property insurance, and liability insurance. By obtaining appropriate financial protection coverage, individuals and businesses can mitigate the risks associated with unforeseen circumstances and secure their financial future.

Executive Summary

The financial protection market is witnessing significant growth due to increasing awareness about the importance of risk mitigation and the growing need for financial security. With the rise in uncertain events and economic volatility, individuals and businesses are recognizing the need for adequate financial protection. This has led to a surge in demand for various insurance products that offer comprehensive coverage against a range of risks. The market is characterized by the presence of both established insurance companies and emerging players, offering a wide array of products tailored to meet the diverse needs of consumers.

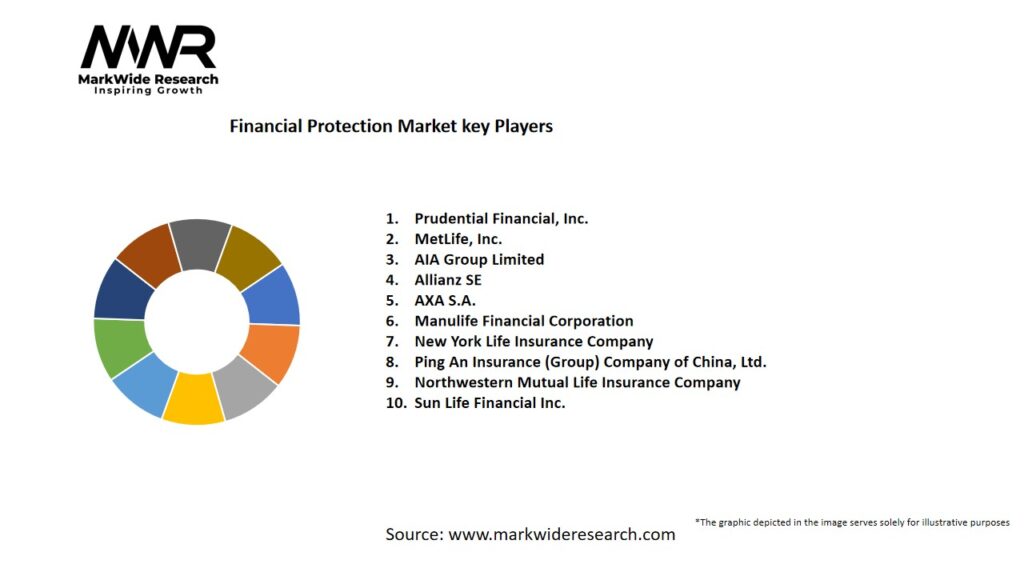

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The financial protection market is characterized by intense competition, evolving customer expectations, technological disruptions, and regulatory frameworks. Market players are striving to differentiate themselves by offering unique product features, superior customer service, and innovative distribution models. The market dynamics are influenced by factors such as changing economic conditions, geopolitical events, advancements in data analytics, and emerging risks. To succeed in this dynamic landscape, insurance companies need to continuously adapt, innovate, and focus on building strong customer relationships.

Regional Analysis

The financial protection market exhibits regional variations in terms of market size, consumer preferences, regulatory environments, and socioeconomic factors. Developed economies, such as North America and Europe, have well-established financial protection markets with high insurance penetration rates. In contrast, emerging economies in Asia-Pacific, Latin America, and Africa present immense growth potential due to rising incomes, expanding middle-class populations, and increasing awareness about financial risks. Regional analysis helps insurance companies understand the unique dynamics of each market and tailor their strategies accordingly.

Competitive Landscape

Leading Companies in the Financial Protection Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

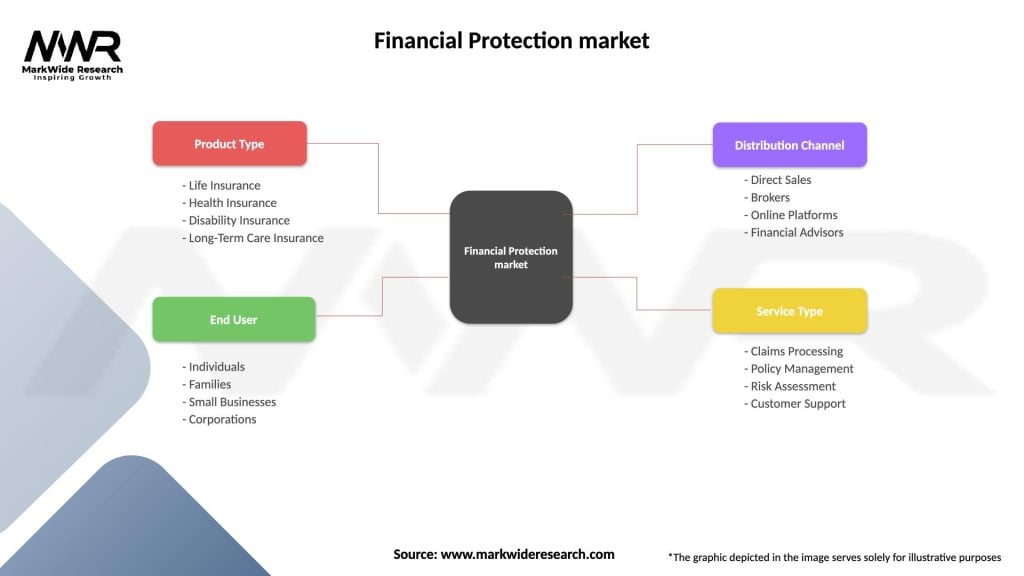

Segmentation

The financial protection market can be segmented based on various factors, including insurance product type, customer segment, distribution channel, and geographic region. Segmentation allows insurance companies to target specific customer groups, tailor their offerings, and optimize their marketing strategies. Common segmentation categories include life insurance, health insurance, property insurance, business insurance, individual consumers, small and medium-sized enterprises (SMEs), direct distribution, agency distribution, and online distribution.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has had a significant impact on the financial protection market. The pandemic highlighted the importance of financial security and the need for adequate insurance coverage. The crisis has led to an increased awareness about health insurance, life insurance, and business interruption insurance. Insurance companies have faced challenges in terms of claim settlements, managing customer expectations, and adapting to remote work environments. However, the pandemic has also accelerated the adoption of digital technologies, with insurers leveraging virtual platforms for policy sales, claims processing, and customer support.

Key Industry Developments

Analyst Suggestions

Future Outlook

The financial protection market is expected to continue its growth trajectory in the coming years. Factors such as increasing awareness about financial risks, evolving consumer preferences, and technological advancements will drive market expansion. Insurers will focus on developing innovative products, leveraging digital platforms, and enhancing customer experiences. The market will witness increased adoption of personalized coverage options, parametric insurance, and wellness-focused solutions. The ongoing integration of technology and data analytics will enable insurers to better assess risks, streamline operations, and improve underwriting processes. Furthermore, the pandemic has highlighted the need for robust insurance coverage, leading to a surge in demand for financial protection products.

Conclusion

The financial protection market plays a vital role in safeguarding individuals and businesses from financial risks. With the increasing awareness about the importance of risk mitigation and the growing need for financial security, the market is witnessing significant growth. While challenges such as affordability concerns and lack of awareness persist, there are ample opportunities for market participants to innovate, collaborate, and leverage technology. By embracing digital transformation, focusing on customer-centric approaches, and developing tailored solutions, insurance companies can thrive in this dynamic and competitive market. The future outlook for the financial protection market is optimistic, with a continued emphasis on personalization, technology integration, and enhanced customer experiences.

What is Financial Protection?

Financial Protection refers to strategies and products designed to safeguard individuals and businesses from financial loss due to unforeseen events, such as accidents, illnesses, or economic downturns. This can include insurance policies, savings plans, and investment strategies aimed at providing security and peace of mind.

What are the key players in the Financial Protection market?

Key players in the Financial Protection market include companies like Prudential Financial, MetLife, and AIG, which offer a range of insurance and financial products. These companies compete on the basis of product offerings, customer service, and technological innovations, among others.

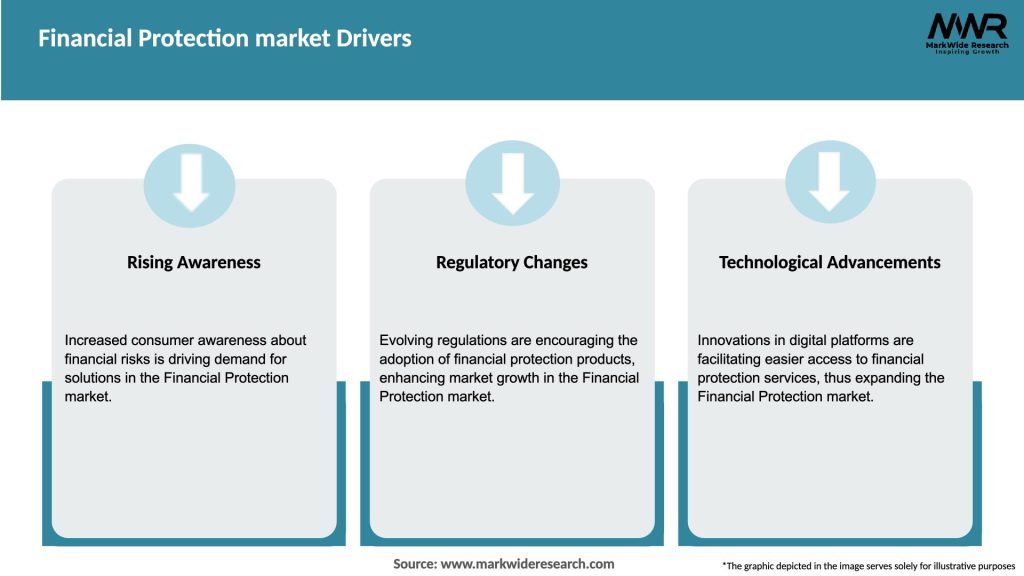

What are the main drivers of growth in the Financial Protection market?

The growth of the Financial Protection market is driven by increasing awareness of financial risks, a growing middle class seeking security, and advancements in technology that facilitate easier access to financial products. Additionally, regulatory changes are encouraging more individuals to seek financial protection solutions.

What challenges does the Financial Protection market face?

The Financial Protection market faces challenges such as regulatory compliance, market saturation, and the need for companies to adapt to rapidly changing consumer preferences. Additionally, economic uncertainties can impact consumer spending on financial protection products.

What opportunities exist in the Financial Protection market?

Opportunities in the Financial Protection market include the development of personalized financial products, the integration of digital technologies for better customer engagement, and the expansion into emerging markets where financial literacy is increasing. Companies can leverage these trends to enhance their offerings and reach new customers.

What trends are shaping the Financial Protection market?

Trends shaping the Financial Protection market include the rise of insurtech companies that utilize technology to streamline services, an increasing focus on sustainability in financial products, and a shift towards more holistic financial planning approaches. These trends are influencing how consumers perceive and engage with financial protection solutions.

Financial Protection market

| Segmentation Details | Description |

|---|---|

| Product Type | Life Insurance, Health Insurance, Disability Insurance, Long-Term Care Insurance |

| End User | Individuals, Families, Small Businesses, Corporations |

| Distribution Channel | Direct Sales, Brokers, Online Platforms, Financial Advisors |

| Service Type | Claims Processing, Policy Management, Risk Assessment, Customer Support |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at