444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The feed flavors, sweeteners and natural enhancers market represents a dynamic and rapidly evolving sector within the global animal nutrition industry. This specialized market encompasses a comprehensive range of additives designed to improve palatability, enhance nutritional value, and optimize feed conversion efficiency in livestock and aquaculture operations. Market dynamics indicate robust growth driven by increasing demand for high-quality animal protein, rising awareness of animal welfare, and the growing emphasis on sustainable farming practices.

Industry transformation is being propelled by technological advancements in feed formulation, regulatory changes promoting natural alternatives to synthetic additives, and evolving consumer preferences for clean-label animal products. The market serves diverse segments including poultry, swine, ruminants, aquaculture, and companion animals, each requiring specialized flavor profiles and enhancement solutions. Growth projections suggest the market will expand at a CAGR of 6.2% over the forecast period, reflecting strong demand across both developed and emerging economies.

Regional variations in market development are influenced by local regulatory frameworks, agricultural practices, and economic conditions. North America and Europe maintain leadership positions due to advanced animal husbandry practices and stringent quality standards, while Asia-Pacific emerges as the fastest-growing region driven by increasing meat consumption and modernization of livestock operations. Market penetration of natural enhancers has reached approximately 42% in developed markets, indicating significant opportunities for further expansion.

The feed flavors, sweeteners and natural enhancers market refers to the specialized industry segment focused on developing, manufacturing, and distributing additives that improve the palatability, nutritional value, and overall quality of animal feed formulations across various livestock and aquaculture applications.

Feed flavors encompass a wide range of taste-enhancing compounds designed to make feed more appealing to animals, thereby improving feed intake and reducing waste. These include both synthetic and natural flavor compounds that mimic familiar tastes such as vanilla, fruit, herbs, and spices. Sweeteners serve to mask bitter tastes in feed ingredients while providing palatability enhancement without adding significant caloric content. Natural enhancers represent a growing category of plant-based extracts, essential oils, and organic compounds that provide multiple benefits including flavor enhancement, antioxidant properties, and potential health benefits.

Market applications span across multiple animal categories including poultry, swine, cattle, sheep, goats, fish, shrimp, and companion animals. Each application requires specific formulations tailored to the unique taste preferences and nutritional requirements of different species. The market also encompasses various delivery formats including liquid concentrates, powder blends, encapsulated products, and premix formulations designed for easy integration into existing feed manufacturing processes.

Market leadership in the feed flavors, sweeteners and natural enhancers sector is characterized by strong innovation capabilities, extensive distribution networks, and deep understanding of animal nutrition science. The industry has witnessed significant consolidation in recent years, with major players expanding their portfolios through strategic acquisitions and partnerships. Technology advancement remains a key differentiator, with companies investing heavily in research and development to create more effective and sustainable solutions.

Consumer trends toward natural and organic animal products are driving demand for clean-label feed additives, creating opportunities for companies specializing in plant-based enhancers and natural flavor systems. The market benefits from increasing awareness of the relationship between feed quality and animal performance, with producers recognizing that palatability improvements can lead to 15-20% increases in feed conversion efficiency. Regulatory support for natural alternatives is strengthening market prospects, particularly in regions with strict guidelines on synthetic additive usage.

Competitive dynamics are intensifying as new entrants leverage innovative extraction technologies and novel natural compounds to challenge established players. The market is experiencing rapid product development cycles, with companies launching specialized solutions for emerging applications such as insect protein feeds and alternative protein sources. Supply chain optimization has become increasingly important, with companies focusing on securing reliable sources of natural raw materials and developing efficient manufacturing processes.

Market segmentation reveals distinct growth patterns across different product categories and applications. Natural enhancers represent the fastest-growing segment, driven by regulatory preferences and consumer demand for clean-label products. The following key insights shape market development:

Market maturity varies significantly across regions and applications, with developed markets showing steady growth while emerging markets exhibit higher growth rates. Innovation cycles are accelerating, with new product launches occurring at increasing frequency to meet evolving customer needs and regulatory requirements.

Primary growth drivers for the feed flavors, sweeteners and natural enhancers market stem from fundamental changes in global food production systems and consumer preferences. The increasing global population and rising income levels in developing countries are driving unprecedented demand for animal protein, creating sustained growth opportunities for feed enhancement solutions.

Animal welfare considerations are becoming increasingly important in feed formulation decisions. Producers recognize that palatability improvements can reduce stress in animals, leading to better health outcomes and improved production efficiency. Feed conversion optimization has become a critical focus area, with enhanced palatability contributing to 12-18% improvements in feed utilization rates across various species.

Regulatory trends favoring natural alternatives are accelerating market adoption of plant-based enhancers and organic flavor systems. Government initiatives promoting sustainable agriculture practices are creating supportive policy environments for natural feed additives. Consumer awareness of food production methods is driving demand for clean-label animal products, indirectly boosting demand for natural feed enhancement solutions.

Technological advancements in extraction and formulation technologies are enabling the development of more effective and cost-efficient products. Research developments in animal nutrition science are providing deeper insights into taste preferences and nutritional requirements across different species, facilitating more targeted product development.

Cost considerations represent a significant challenge for market expansion, particularly in price-sensitive agricultural markets. Natural enhancers and specialized flavor systems typically command premium pricing compared to basic feed ingredients, creating adoption barriers for smaller producers operating on tight margins. Economic pressures in the agricultural sector can lead to reduced spending on non-essential feed additives during periods of commodity price volatility.

Regulatory complexity poses ongoing challenges for market participants, with varying approval processes and safety requirements across different regions. The time and cost associated with regulatory compliance can be substantial, particularly for companies seeking to introduce innovative natural compounds. Supply chain vulnerabilities for natural raw materials can create availability and pricing challenges, especially for specialized botanical extracts and essential oils.

Technical limitations in some applications continue to constrain market growth. Certain natural enhancers may have stability issues under specific storage conditions or may interact negatively with other feed components. Performance variability of natural products compared to synthetic alternatives can create hesitation among feed manufacturers seeking consistent results.

Market education remains an ongoing challenge, as some producers may not fully understand the benefits of feed enhancement or may lack the technical expertise to properly implement these solutions. Competition from alternative approaches such as genetic improvements in feed crops or novel protein sources may reduce demand for traditional enhancement solutions.

Emerging applications in alternative protein production present significant growth opportunities for the feed flavors, sweeteners and natural enhancers market. The rapidly expanding insect farming industry requires specialized palatability solutions, while plant-based protein production for animal feed creates new market segments. Aquaculture expansion represents a particularly promising opportunity, with the sector experiencing rapid growth and increasing sophistication in feed formulation approaches.

Geographic expansion into developing markets offers substantial potential, particularly in regions experiencing rapid economic growth and dietary transitions. Countries in Southeast Asia, Latin America, and Africa are modernizing their livestock production systems, creating demand for advanced feed enhancement solutions. Market penetration in these regions currently stands at less than 25%, indicating significant room for growth.

Product innovation opportunities abound in the development of multifunctional enhancers that combine palatability improvement with health benefits such as immune system support, digestive health enhancement, and stress reduction. Precision nutrition approaches enabled by digital technologies are creating opportunities for customized enhancement solutions tailored to specific production conditions and animal requirements.

Sustainability initiatives are driving demand for environmentally friendly enhancement solutions, creating opportunities for companies developing products from waste streams or utilizing sustainable production methods. Circular economy approaches that convert agricultural byproducts into valuable feed enhancers represent emerging business opportunities.

Supply and demand dynamics in the feed flavors, sweeteners and natural enhancers market are influenced by complex interactions between agricultural commodity prices, regulatory changes, and technological developments. Demand patterns show strong correlation with global meat consumption trends, with poultry and aquaculture segments driving the highest growth rates.

Price dynamics are characterized by premium positioning for natural and specialized products, while commodity-based enhancers face pricing pressure from large-scale production. Value chain optimization has become increasingly important, with companies seeking to reduce costs through vertical integration and supply chain efficiency improvements.

Innovation cycles are accelerating, driven by competitive pressures and evolving customer requirements. Companies are investing heavily in research and development, with R&D spending typically representing 8-12% of revenue for leading market participants. Collaboration trends between feed additive companies and animal nutrition research institutions are facilitating faster product development and validation.

Market consolidation continues as larger companies acquire specialized firms to expand their product portfolios and geographic reach. Strategic partnerships between ingredient suppliers and feed manufacturers are becoming more common, creating integrated solutions that optimize both product performance and supply chain efficiency.

Comprehensive market analysis for the feed flavors, sweeteners and natural enhancers market employs multiple research methodologies to ensure accuracy and reliability of findings. Primary research involves extensive interviews with industry stakeholders including feed manufacturers, livestock producers, ingredient suppliers, and regulatory officials across key geographic markets.

Secondary research encompasses analysis of industry publications, regulatory databases, trade association reports, and company financial statements. Market sizing methodologies utilize both top-down and bottom-up approaches, incorporating production data, consumption patterns, and trade statistics from reliable government and industry sources.

Data validation processes include cross-referencing information from multiple sources and conducting expert interviews to verify key findings. Trend analysis incorporates historical data spanning multiple years to identify patterns and project future market developments. Regional analysis considers local market conditions, regulatory environments, and economic factors that influence market dynamics.

Technology assessment involves evaluation of emerging innovations and their potential market impact. Competitive intelligence gathering includes analysis of patent filings, product launches, and strategic initiatives by key market participants. Forecasting models incorporate multiple variables including economic indicators, demographic trends, and regulatory changes to project market growth trajectories.

North American markets maintain leadership positions in the feed flavors, sweeteners and natural enhancers sector, accounting for approximately 35% of global consumption. The region benefits from advanced livestock production systems, stringent quality standards, and strong regulatory support for natural alternatives. United States dominates regional consumption, driven by large-scale poultry and swine operations that prioritize feed efficiency optimization.

European markets represent approximately 28% of global demand, with strong emphasis on natural and organic enhancement solutions. Regulatory frameworks in the European Union favor natural alternatives and restrict certain synthetic additives, creating favorable conditions for plant-based enhancers. Germany, France, and the Netherlands lead regional consumption, supported by advanced agricultural practices and high animal welfare standards.

Asia-Pacific emerges as the fastest-growing region, with market expansion driven by increasing meat consumption, modernizing livestock operations, and growing aquaculture production. China represents the largest individual market in the region, while countries such as Vietnam, Thailand, and India show particularly strong growth rates. Regional growth is projected at 8.5% CAGR, significantly above the global average.

Latin American markets show steady growth supported by expanding livestock production and increasing export orientation. Brazil leads regional consumption, particularly in poultry and swine applications, while Argentina and Mexico represent significant growth opportunities. Middle East and Africa markets remain relatively small but show promising growth potential as agricultural modernization accelerates.

Market leadership in the feed flavors, sweeteners and natural enhancers sector is characterized by a mix of large multinational corporations and specialized ingredient companies. The competitive landscape features both established players with comprehensive product portfolios and innovative newcomers focusing on natural and sustainable solutions.

Competitive strategies focus on product innovation, geographic expansion, and strategic partnerships. Market differentiation is achieved through specialized applications, superior technical support, and demonstrated performance benefits. Acquisition activity remains high as companies seek to expand their natural product portfolios and enter new geographic markets.

Product segmentation of the feed flavors, sweeteners and natural enhancers market reveals distinct categories with varying growth trajectories and applications. By Product Type:

By Animal Type:

By Form:

Feed flavors category represents the most established segment, with mature markets in developed regions and growing adoption in emerging economies. Vanilla and fruit flavors dominate consumption across multiple species, while specialized flavors for specific applications continue to gain market share. Innovation focus centers on developing more stable and cost-effective flavor delivery systems.

Sweeteners segment shows steady growth driven by the need to mask bitter tastes in medicated feeds and high-protein formulations. Natural sweeteners such as stevia extracts and monk fruit are gaining popularity due to clean-label trends. Application expansion into aquaculture feeds represents a significant growth opportunity for sweetener manufacturers.

Natural enhancers category exhibits the strongest growth trajectory, benefiting from regulatory support and consumer preferences for natural products. Essential oils and plant extracts lead this segment, with oregano, thyme, and cinnamon-based products showing particularly strong demand. Multifunctional products that combine palatability enhancement with health benefits are driving premium pricing and market expansion.

Regional preferences vary significantly, with European markets showing strong preference for organic and natural solutions, while Asian markets prioritize cost-effectiveness and performance. Application-specific formulations are becoming increasingly important as producers seek optimized solutions for specific production conditions and animal requirements.

Feed manufacturers benefit from enhanced product differentiation and improved customer satisfaction through the incorporation of flavors, sweeteners, and natural enhancers. Production efficiency improvements result from better feed acceptance and reduced waste, while quality consistency is enhanced through standardized palatability solutions.

Livestock producers realize significant economic benefits through improved feed conversion ratios, reduced feed waste, and enhanced animal performance. Animal welfare improvements result from reduced stress and better feeding behavior, while production sustainability is enhanced through more efficient resource utilization.

Ingredient suppliers benefit from growing demand for specialized products and premium pricing opportunities. Market expansion into new applications and geographic regions provides revenue growth opportunities, while innovation capabilities enable competitive differentiation and customer loyalty.

Regulatory compliance benefits include reduced risk of violations and improved alignment with evolving standards favoring natural alternatives. Supply chain partners benefit from stable demand patterns and opportunities for value-added services such as custom formulation and technical support.

End consumers benefit indirectly through improved animal product quality, enhanced food safety, and alignment with preferences for naturally-produced foods. Environmental benefits include reduced resource consumption and waste generation through improved feed efficiency.

Strengths:

Weaknesses:

Opportunities:

Threats:

Natural and organic trends continue to dominate market development, with increasing demand for plant-based enhancers and clean-label solutions. Consumer awareness of food production methods is driving livestock producers to seek natural alternatives that align with market preferences for sustainably produced animal products.

Precision nutrition approaches are gaining traction, enabled by digital technologies and advanced analytics. Customization trends involve developing tailored enhancement solutions based on specific animal genetics, production conditions, and performance objectives. Data-driven formulation is becoming increasingly sophisticated, incorporating real-time performance monitoring and adjustment capabilities.

Sustainability focus is intensifying across the value chain, with companies prioritizing environmentally responsible sourcing and manufacturing processes. Circular economy principles are being applied to develop enhancement solutions from agricultural waste streams and byproducts. Carbon footprint reduction initiatives are influencing product development and supply chain decisions.

Multifunctional products are gaining popularity as producers seek solutions that provide multiple benefits beyond palatability enhancement. Health and wellness positioning is becoming more prominent, with products offering immune support, digestive health benefits, and stress reduction properties. Premiumization trends are evident in companion animal and specialty applications where performance and quality command higher pricing.

Recent innovations in the feed flavors, sweeteners and natural enhancers market include advanced encapsulation technologies that improve stability and targeted delivery of active compounds. Microencapsulation and nano-encapsulation techniques are enabling more effective protection of sensitive ingredients and controlled release profiles.

Strategic acquisitions have reshaped the competitive landscape, with major players acquiring specialized companies to expand their natural product portfolios. Partnership developments between ingredient suppliers and technology companies are accelerating innovation in precision nutrition and digital formulation tools.

Regulatory approvals for new natural compounds are expanding the available ingredient palette, particularly in regions with strict guidelines on synthetic additives. Research breakthroughs in understanding animal taste preferences and nutritional requirements are enabling more targeted product development.

Manufacturing investments in production capacity and technology upgrades are supporting market growth, particularly in Asia-Pacific regions experiencing rapid demand expansion. Supply chain developments include vertical integration initiatives and strategic sourcing partnerships to ensure reliable access to high-quality natural raw materials.

Digital transformation initiatives are enabling more sophisticated customer support services, including formulation optimization tools and performance monitoring systems. Sustainability certifications and traceability systems are becoming increasingly important for market access and customer acceptance.

MarkWide Research analysis indicates that companies should prioritize investment in natural product development and sustainable sourcing capabilities to capitalize on evolving market preferences. Strategic recommendations include expanding research and development efforts focused on multifunctional enhancers that provide both palatability and health benefits.

Geographic expansion strategies should target high-growth emerging markets while maintaining strong positions in developed regions. Partnership opportunities with local distributors and feed manufacturers can accelerate market penetration and reduce entry barriers in new regions.

Technology investments in digital formulation tools and precision nutrition capabilities will become increasingly important for competitive differentiation. Customer education programs demonstrating return on investment and proper application methods should be prioritized to drive adoption rates.

Supply chain resilience should be enhanced through diversification of raw material sources and development of alternative supply routes. Regulatory compliance capabilities must be strengthened to navigate evolving approval processes and safety requirements across different markets.

Innovation focus should emphasize sustainability, functionality, and cost-effectiveness to address key customer priorities. Market intelligence systems should be enhanced to monitor competitive developments, regulatory changes, and emerging customer needs.

Long-term prospects for the feed flavors, sweeteners and natural enhancers market remain highly positive, supported by fundamental drivers including global population growth, rising protein consumption, and increasing focus on sustainable agriculture. Market evolution will be characterized by continued shift toward natural and multifunctional solutions, with synthetic alternatives gradually losing market share.

Technology advancement will enable more sophisticated and effective enhancement solutions, including personalized nutrition approaches and smart delivery systems. Artificial intelligence and machine learning applications will optimize formulations and predict performance outcomes with greater accuracy. Biotechnology developments may introduce novel natural compounds and more efficient production methods.

Regional growth patterns will favor Asia-Pacific and Latin American markets, while developed regions will focus on premium and specialized applications. Market consolidation is expected to continue as companies seek scale advantages and comprehensive product portfolios. Vertical integration trends may accelerate as companies seek greater control over supply chains and quality standards.

Regulatory evolution will likely favor natural alternatives and impose stricter requirements on synthetic additives. Sustainability requirements will become more stringent, driving innovation in environmentally friendly production methods and packaging solutions. Market growth is projected to maintain a CAGR of 6.8% through the next decade, with natural enhancers showing the strongest expansion rates.

The feed flavors, sweeteners and natural enhancers market represents a dynamic and growing sector within the global animal nutrition industry, driven by increasing demand for high-quality animal protein and evolving preferences for natural and sustainable solutions. Market fundamentals remain strong, supported by technological advancement, regulatory support for natural alternatives, and demonstrated performance benefits in animal production systems.

Growth opportunities are particularly significant in emerging markets and new applications such as aquaculture and alternative protein production. Innovation trends toward multifunctional and sustainable solutions are reshaping product development priorities and creating competitive advantages for companies that successfully adapt to changing market requirements.

Success factors for market participants include strong research and development capabilities, sustainable sourcing strategies, and effective customer education programs. MWR projections indicate continued market expansion with natural enhancers leading growth, while traditional synthetic products face increasing pressure from regulatory and consumer preference changes. The market’s future will be shaped by companies that can effectively balance performance, sustainability, and cost-effectiveness in their product offerings.

What is Feed Flavors, Sweeteners And Natural Enhancers?

Feed flavors, sweeteners, and natural enhancers are additives used in animal feed to improve palatability, enhance nutritional value, and promote better feed intake among livestock. These components play a crucial role in animal health and growth performance.

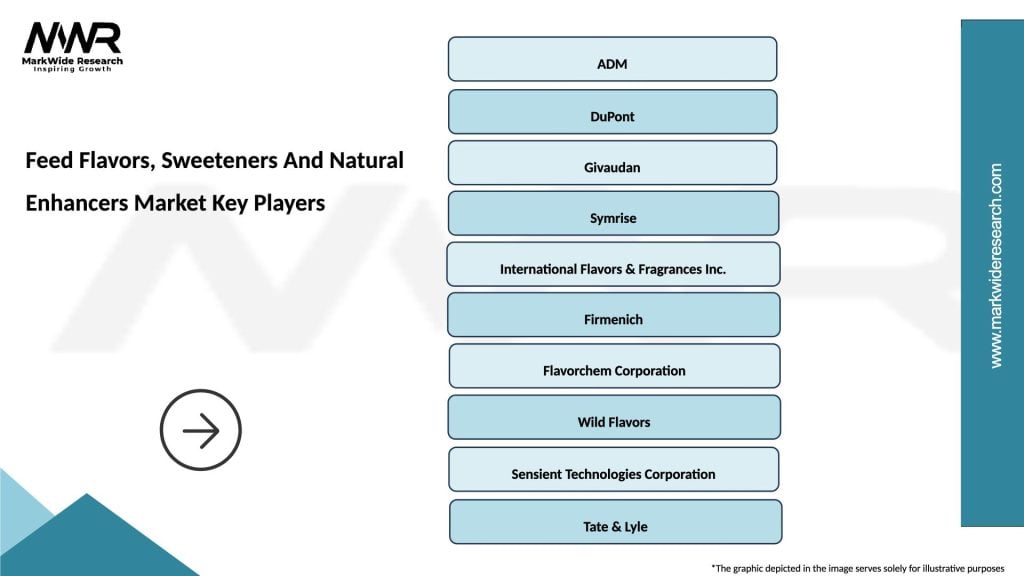

What are the key companies in the Feed Flavors, Sweeteners And Natural Enhancers Market?

Key companies in the Feed Flavors, Sweeteners And Natural Enhancers Market include Archer Daniels Midland Company, DuPont de Nemours, Inc., and BASF SE, among others. These companies are known for their innovative products and extensive research in animal nutrition.

What are the growth factors driving the Feed Flavors, Sweeteners And Natural Enhancers Market?

The growth of the Feed Flavors, Sweeteners And Natural Enhancers Market is driven by increasing demand for high-quality animal products, rising awareness of animal health, and the need for improved feed efficiency. Additionally, the trend towards natural and organic feed additives is gaining momentum.

What challenges does the Feed Flavors, Sweeteners And Natural Enhancers Market face?

The Feed Flavors, Sweeteners And Natural Enhancers Market faces challenges such as regulatory compliance, fluctuating raw material prices, and competition from synthetic alternatives. These factors can impact product availability and pricing strategies.

What opportunities exist in the Feed Flavors, Sweeteners And Natural Enhancers Market?

Opportunities in the Feed Flavors, Sweeteners And Natural Enhancers Market include the growing trend of pet humanization, which increases demand for premium pet food, and the expansion of aquaculture, which requires specialized feed formulations. Innovations in natural ingredients also present new avenues for growth.

What trends are shaping the Feed Flavors, Sweeteners And Natural Enhancers Market?

Trends in the Feed Flavors, Sweeteners And Natural Enhancers Market include a shift towards clean label products, increased use of plant-based ingredients, and advancements in flavor technology. These trends reflect consumer preferences for transparency and sustainability in animal nutrition.

Feed Flavors, Sweeteners And Natural Enhancers Market

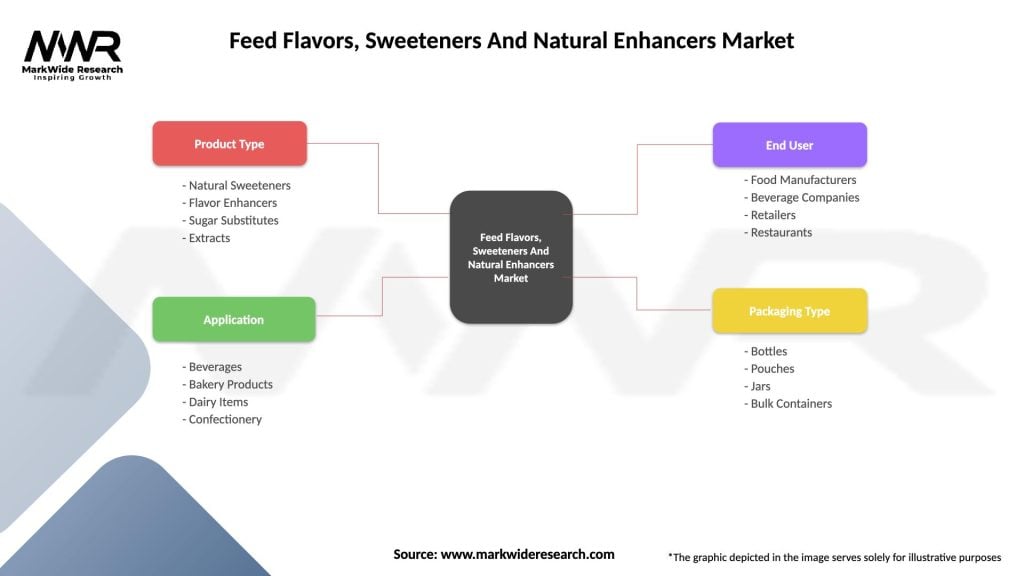

| Segmentation Details | Description |

|---|---|

| Product Type | Natural Sweeteners, Flavor Enhancers, Sugar Substitutes, Extracts |

| Application | Beverages, Bakery Products, Dairy Items, Confectionery |

| End User | Food Manufacturers, Beverage Companies, Retailers, Restaurants |

| Packaging Type | Bottles, Pouches, Jars, Bulk Containers |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Feed Flavors, Sweeteners And Natural Enhancers Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at