444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Factory automation in Japan represents one of the most sophisticated and technologically advanced manufacturing ecosystems globally. The Japanese market has consistently led innovation in robotics, artificial intelligence, and smart manufacturing solutions, establishing itself as a benchmark for industrial automation excellence. Japan’s factory automation sector encompasses a comprehensive range of technologies including industrial robots, programmable logic controllers, human-machine interfaces, and integrated manufacturing execution systems.

Manufacturing excellence has been deeply embedded in Japanese industrial culture for decades, with companies like Fanuc, Yaskawa, and Mitsubishi Electric pioneering revolutionary automation technologies. The market demonstrates remarkable growth momentum, driven by increasing labor shortages, aging workforce demographics, and the imperative for enhanced productivity. Industry 4.0 adoption has accelerated significantly, with Japanese manufacturers integrating IoT sensors, machine learning algorithms, and predictive maintenance systems at an unprecedented pace.

Regional manufacturing hubs across Japan, including the Kansai region, Greater Tokyo Area, and Chubu region, showcase diverse automation implementations spanning automotive, electronics, pharmaceuticals, and food processing industries. The market exhibits strong growth potential, with automation penetration rates reaching 78% in automotive manufacturing and 65% in electronics assembly. Government initiatives such as Society 5.0 and the Connected Industries program have provided substantial momentum for digital transformation across manufacturing sectors.

The factory automation in Japan market refers to the comprehensive ecosystem of technologies, systems, and solutions designed to automate manufacturing processes, reduce human intervention, and optimize production efficiency across Japanese industrial facilities. This market encompasses hardware components, software platforms, integration services, and maintenance solutions that enable smart manufacturing capabilities.

Factory automation systems in Japan integrate multiple technological layers including mechanical automation, process control systems, data analytics platforms, and artificial intelligence algorithms. These solutions enable manufacturers to achieve higher precision, consistency, and throughput while minimizing operational costs and quality variations. Japanese automation philosophy emphasizes continuous improvement (kaizen), lean manufacturing principles, and total quality management integration.

Market participants include equipment manufacturers, system integrators, software developers, and service providers who collectively deliver end-to-end automation solutions. The ecosystem supports various automation levels from basic mechanization to fully autonomous smart factories with self-optimizing capabilities. Technology convergence has created opportunities for innovative solutions combining robotics, AI, IoT, and cloud computing platforms.

Japan’s factory automation market stands at the forefront of global manufacturing innovation, characterized by exceptional technological sophistication and widespread adoption across diverse industrial sectors. The market demonstrates robust expansion driven by demographic challenges, competitive pressures, and technological advancement opportunities. Key growth drivers include labor shortage mitigation, quality enhancement requirements, and digital transformation imperatives.

Market dynamics reveal strong momentum in robotics integration, with collaborative robots (cobots) experiencing particularly rapid adoption rates of 42% annually among small and medium enterprises. Automotive manufacturing continues to dominate automation investments, followed by electronics, pharmaceuticals, and food processing industries. The market benefits from Japan’s strong industrial base, advanced research capabilities, and government support for digital manufacturing initiatives.

Competitive landscape features both established Japanese manufacturers and emerging technology providers, creating a dynamic ecosystem of innovation and collaboration. Investment trends indicate increasing focus on AI-powered automation, predictive maintenance solutions, and flexible manufacturing systems. The market outlook remains highly positive, supported by continuous technological evolution and expanding application areas across traditional and emerging industries.

Strategic insights reveal several critical trends shaping Japan’s factory automation landscape:

Market maturation has created opportunities for specialized solutions addressing specific industry requirements, while technological convergence enables integrated platforms delivering comprehensive automation capabilities. Innovation cycles continue accelerating, with new technologies emerging regularly to address evolving manufacturing challenges and opportunities.

Demographic pressures represent the primary catalyst driving factory automation adoption across Japan. The country’s aging population and declining birth rates have created acute labor shortages in manufacturing sectors, compelling companies to invest in automated solutions. Workforce demographics indicate that manufacturing employment has decreased by 15% over the past decade, while production output requirements continue increasing.

Competitive intensity in global markets necessitates enhanced productivity, quality, and cost efficiency that automation technologies enable. Japanese manufacturers face pressure from lower-cost international competitors, driving investment in advanced automation systems that provide sustainable competitive advantages. Quality standards in industries such as automotive and electronics require precision levels achievable only through automated processes.

Technological advancement has made automation solutions more accessible, affordable, and capable than previous generations. AI integration, machine learning algorithms, and IoT connectivity have expanded automation possibilities while reducing implementation complexity. Government initiatives including digital transformation subsidies and Industry 4.0 promotion programs provide additional momentum for automation adoption.

Customer expectations for customization, rapid delivery, and consistent quality drive manufacturers toward flexible automation systems capable of handling diverse product requirements. Supply chain resilience concerns, highlighted by recent global disruptions, have emphasized the importance of automated domestic manufacturing capabilities.

Implementation costs remain a significant barrier for many manufacturers, particularly small and medium enterprises with limited capital resources. Initial investment requirements for comprehensive automation systems can be substantial, requiring careful ROI analysis and financing considerations. Integration complexity with existing manufacturing systems often necessitates extensive customization and professional services.

Skills shortage in automation technology management and maintenance creates operational challenges for manufacturers adopting advanced systems. Technical expertise requirements for programming, troubleshooting, and optimizing automated systems exceed many companies’ current capabilities. Training investments and workforce development programs require additional resources and time commitments.

Cybersecurity concerns associated with connected manufacturing systems create hesitation among manufacturers regarding digital automation adoption. Data protection requirements and potential vulnerability to cyber attacks necessitate robust security measures and ongoing monitoring capabilities. Regulatory compliance with evolving safety and security standards adds complexity to automation implementations.

Technology obsolescence risks concern manufacturers investing in rapidly evolving automation technologies. Compatibility challenges between different automation vendors and systems can limit flexibility and increase long-term costs. Change management requirements for transitioning from traditional to automated manufacturing processes often encounter organizational resistance.

Emerging industries present substantial growth opportunities for factory automation providers, including renewable energy manufacturing, biotechnology, and advanced materials production. Green manufacturing initiatives create demand for energy-efficient automation solutions supporting sustainability objectives. Pharmaceutical manufacturing expansion, accelerated by recent global health challenges, requires sophisticated automation for quality assurance and regulatory compliance.

Small and medium enterprise automation adoption represents a significant untapped market segment, with SME automation penetration currently at only 28% compared to large enterprise adoption rates. Collaborative robotics and modular automation solutions specifically designed for smaller operations create accessible entry points for these manufacturers.

Service opportunities in maintenance, optimization, and system upgrades provide recurring revenue streams for automation providers. Digital services including remote monitoring, predictive analytics, and performance optimization create value-added offerings beyond traditional equipment sales. Retrofit solutions for existing manufacturing equipment enable automation benefits without complete system replacement.

International expansion opportunities exist for Japanese automation companies leveraging their technological expertise in emerging markets. Technology export potential includes both equipment and expertise transfer to developing manufacturing economies. Partnership opportunities with global manufacturers seeking Japanese automation excellence create collaborative growth possibilities.

Supply chain evolution significantly influences factory automation dynamics in Japan, with manufacturers seeking greater control and visibility over production processes. Reshoring trends have accelerated automation investments as companies bring manufacturing operations back to Japan, requiring advanced systems to maintain cost competitiveness. Supply chain digitization creates opportunities for integrated automation platforms connecting manufacturing with logistics and distribution systems.

Innovation cycles in automation technology continue accelerating, with new capabilities emerging regularly to address evolving manufacturing requirements. AI advancement enables more sophisticated automation applications including quality prediction, process optimization, and autonomous decision-making. Sensor technology improvements provide enhanced monitoring and control capabilities at reduced costs.

Market consolidation trends among automation providers create opportunities for comprehensive solution offerings while potentially reducing competition. Strategic partnerships between technology companies, system integrators, and manufacturers foster innovation and market expansion. Investment patterns show increasing focus on software and services components of automation solutions.

Regulatory environment evolution supports automation adoption through safety standards, environmental requirements, and digital transformation incentives. Industry standards development facilitates interoperability and reduces implementation risks for manufacturers. Government policies promoting smart manufacturing and digital economy growth provide favorable market conditions.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into Japan’s factory automation market. Primary research includes extensive interviews with industry executives, technology providers, system integrators, and end-user manufacturers across diverse industrial sectors. Survey methodologies capture quantitative data on adoption rates, investment priorities, and technology preferences.

Secondary research encompasses analysis of industry reports, company financial statements, government publications, and academic studies related to factory automation trends. Market data validation occurs through cross-referencing multiple sources and expert verification processes. MarkWide Research analysts conduct field visits to manufacturing facilities and automation demonstrations to gain firsthand insights into technology applications and market dynamics.

Quantitative analysis utilizes statistical modeling techniques to project market trends, growth patterns, and competitive dynamics. Qualitative assessment provides contextual understanding of market drivers, challenges, and opportunities through expert interviews and industry observation. Technology assessment evaluates emerging automation technologies and their potential market impact.

Data collection spans multiple time periods to identify trends and validate market projections. Regional analysis examines automation adoption patterns across different Japanese manufacturing regions and industry clusters. Competitive intelligence gathering includes analysis of company strategies, product developments, and market positioning approaches.

Greater Tokyo Area dominates Japan’s factory automation market, accounting for approximately 35% of total automation investments due to its concentration of electronics, precision machinery, and automotive component manufacturers. Tokyo metropolitan region benefits from proximity to research institutions, technology providers, and skilled workforce availability. Innovation clusters in areas like Kanagawa and Saitama prefectures foster collaboration between automation companies and end-users.

Kansai region represents another significant automation hub, particularly strong in automotive manufacturing and industrial machinery production. Osaka and surrounding prefectures host major automation companies and manufacturing facilities requiring sophisticated automation solutions. Regional specialization in precision manufacturing and quality control creates demand for advanced automation technologies.

Chubu region demonstrates exceptional automation adoption rates, driven by the concentration of automotive manufacturers and suppliers in Aichi Prefecture. Manufacturing density in this region creates economies of scale for automation providers and facilitates technology sharing among manufacturers. Supply chain integration requirements drive comprehensive automation implementations across multiple facility levels.

Tohoku and Kyushu regions show growing automation adoption as manufacturers establish operations in these areas to access skilled workforce and government incentives. Regional development programs support automation technology deployment in emerging manufacturing clusters. Semiconductor manufacturing concentration in Kyushu creates specialized automation requirements and opportunities.

Market leadership in Japan’s factory automation sector features a combination of established domestic companies and international technology providers. Key players demonstrate strong competitive positioning through technological innovation, comprehensive solution offerings, and extensive service networks:

Competitive strategies focus on technological differentiation, customer relationship development, and comprehensive service offerings. Innovation investments in AI, IoT, and collaborative robotics create competitive advantages and market expansion opportunities. Partnership networks with system integrators and technology providers enhance market reach and solution capabilities.

Market positioning varies among competitors, with some focusing on specific industry verticals while others pursue broad market coverage. Service capabilities increasingly differentiate providers as customers seek comprehensive support throughout automation system lifecycles.

By Technology:

By Industry Application:

By Automation Level:

Industrial robotics represents the largest and fastest-growing segment within Japan’s factory automation market, with adoption rates increasing by 18% annually across manufacturing sectors. Collaborative robots demonstrate particularly strong growth as manufacturers seek flexible automation solutions that work alongside human operators. Automotive applications continue driving robotics demand, while electronics and pharmaceutical industries show accelerating adoption.

Control systems evolution toward intelligent, connected platforms creates opportunities for enhanced manufacturing optimization and integration. Edge computing integration enables real-time decision-making and reduces latency in automated processes. Cybersecurity features become increasingly important as control systems connect to enterprise networks and cloud platforms.

Software solutions represent the highest growth potential segment, with manufacturers recognizing the value of data analytics, predictive maintenance, and optimization algorithms. AI integration transforms traditional automation into intelligent systems capable of learning and adapting to changing conditions. Cloud-based platforms enable scalable deployment and remote management capabilities.

Sensor technology advancement enables more sophisticated monitoring and control capabilities while reducing costs and complexity. Vision systems integration supports quality control, positioning, and safety applications across diverse manufacturing processes. IoT sensors provide comprehensive data collection for analytics and optimization purposes.

Manufacturers implementing factory automation solutions realize substantial operational improvements including enhanced productivity, consistent quality, and reduced labor costs. Production efficiency gains typically range from 25% to 45% depending on automation scope and implementation quality. Quality improvements reduce defect rates and customer complaints while enhancing brand reputation and market competitiveness.

Technology providers benefit from expanding market opportunities, recurring service revenues, and long-term customer relationships. Innovation leadership in automation technologies creates competitive advantages and premium pricing opportunities. Market expansion into new industries and applications provides growth diversification and risk mitigation.

System integrators gain access to growing demand for automation implementation services, customization capabilities, and ongoing support requirements. Expertise development in emerging technologies creates differentiation and value-added service opportunities. Partnership relationships with technology providers enhance solution capabilities and market access.

Workforce benefits from automation include reduced exposure to hazardous conditions, opportunities for skill development, and focus on higher-value activities. Job evolution toward technical roles, system monitoring, and process optimization creates career advancement opportunities. Training programs supported by automation companies enhance workforce capabilities and employment prospects.

Economic stakeholders including government agencies and regional development organizations benefit from enhanced manufacturing competitiveness, increased productivity, and technology leadership. Export opportunities for Japanese automation technologies contribute to trade balance and economic growth.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration represents the most significant trend transforming factory automation in Japan, with AI adoption in manufacturing increasing by 52% over the past two years. Machine learning algorithms enable predictive maintenance, quality optimization, and autonomous process adjustment capabilities. Computer vision applications expand beyond traditional inspection to include complex decision-making and adaptive control functions.

Collaborative robotics adoption accelerates as manufacturers recognize the benefits of human-robot cooperation in flexible manufacturing environments. Cobot applications extend from assembly and packaging to quality control and material handling operations. Safety improvements and intuitive programming interfaces make collaborative robots accessible to smaller manufacturers and diverse applications.

Digital twin technology implementation enables virtual modeling and simulation of manufacturing processes before physical implementation. Process optimization through digital twins reduces commissioning time and improves system performance. Predictive capabilities support maintenance planning and production scheduling optimization.

Edge computing deployment brings processing power closer to manufacturing equipment, reducing latency and enabling real-time decision-making. Local processing capabilities support autonomous operation and reduce dependence on cloud connectivity. Data security improvements through edge computing address cybersecurity concerns in connected manufacturing.

Sustainability focus drives demand for energy-efficient automation solutions and circular economy principles in manufacturing. Green automation technologies support environmental objectives while maintaining productivity and quality standards.

Recent technological breakthroughs in factory automation include advanced AI algorithms, improved sensor technologies, and enhanced connectivity solutions. Fanuc introduced next-generation collaborative robots with enhanced safety features and simplified programming interfaces. Yaskawa launched AI-powered motion control systems enabling autonomous optimization of manufacturing processes.

Strategic partnerships between automation companies and technology providers create comprehensive solution offerings. Mitsubishi Electric partnered with cloud computing providers to deliver integrated IoT platforms for smart manufacturing. Omron expanded its AI capabilities through acquisitions and technology licensing agreements.

Government initiatives including the Society 5.0 program and Connected Industries strategy provide framework and funding for automation advancement. Research investments in universities and technology institutes support innovation in robotics, AI, and manufacturing technologies. Regulatory updates facilitate adoption of collaborative robots and connected manufacturing systems.

Market expansion activities include new facility construction, capacity increases, and geographic expansion by major automation providers. International collaborations enable technology transfer and market access for Japanese automation companies. Investment trends show increasing focus on software development and service capabilities.

Industry consolidation through mergers and acquisitions creates larger, more comprehensive automation solution providers. Technology integration efforts combine hardware, software, and services into unified platforms addressing complete manufacturing requirements.

Strategic recommendations for manufacturers considering factory automation investments emphasize comprehensive planning, phased implementation, and workforce development priorities. ROI analysis should consider both direct cost savings and indirect benefits including quality improvements, flexibility enhancement, and competitive positioning. Technology selection requires careful evaluation of current and future requirements, integration capabilities, and vendor support quality.

Implementation approach should prioritize pilot projects and gradual expansion rather than comprehensive system replacement. Change management programs must address workforce concerns, training requirements, and operational procedure modifications. Partnership selection with experienced system integrators and technology providers significantly impacts project success rates.

Technology providers should focus on developing comprehensive solution portfolios combining hardware, software, and services. Market expansion opportunities exist in underserved segments including small manufacturers and emerging industries. Service capabilities development creates recurring revenue opportunities and enhanced customer relationships.

Investment priorities should emphasize flexible, scalable automation solutions supporting diverse manufacturing requirements. Cybersecurity measures must be integrated from initial system design rather than added as afterthoughts. Skills development programs for technical workforce ensure successful automation implementation and ongoing optimization.

MarkWide Research analysis indicates that successful automation projects typically involve comprehensive stakeholder engagement, realistic timeline expectations, and continuous optimization approaches rather than one-time implementations.

Long-term prospects for Japan’s factory automation market remain exceptionally positive, driven by demographic trends, technological advancement, and competitive pressures. Market evolution toward intelligent, autonomous manufacturing systems will create new opportunities for innovation and growth. AI integration will become standard rather than exceptional, with autonomous manufacturing capabilities expanding significantly over the next decade.

Technology convergence will blur traditional boundaries between robotics, control systems, and software platforms, creating integrated solutions addressing complete manufacturing requirements. 5G connectivity will enable new applications requiring ultra-low latency and high reliability communication. Quantum computing potential may revolutionize optimization algorithms and simulation capabilities.

Industry transformation will extend beyond traditional manufacturing to include new sectors such as space technology, biotechnology, and sustainable energy production. Customization demands will drive development of highly flexible automation systems capable of rapid reconfiguration. Sustainability requirements will influence automation design toward energy efficiency and circular economy principles.

Workforce evolution will continue toward higher-skilled technical roles focused on system optimization, maintenance, and innovation rather than routine production tasks. Education systems will adapt to provide relevant technical skills for automation-intensive manufacturing environments. Human-machine collaboration will become more sophisticated and intuitive.

Market growth projections indicate sustained expansion with annual growth rates expected to maintain 8-12% range over the next five years, driven by continued technological advancement and expanding application areas.

Japan’s factory automation market represents a dynamic and rapidly evolving ecosystem characterized by technological leadership, comprehensive adoption, and continuous innovation. The market demonstrates exceptional growth potential driven by demographic challenges, competitive pressures, and technological advancement opportunities. Key success factors include strategic planning, comprehensive implementation approaches, and ongoing optimization efforts.

Market participants across the entire value chain benefit from expanding opportunities, technological advancement, and growing recognition of automation’s strategic importance. Manufacturers gain competitive advantages through enhanced productivity, quality, and flexibility, while technology providers access expanding market opportunities and recurring revenue streams. Economic benefits extend beyond individual companies to support national competitiveness and technological leadership.

Future development will focus on intelligent, autonomous systems capable of self-optimization and adaptation to changing requirements. Technology integration will create comprehensive platforms addressing complete manufacturing ecosystems rather than individual process components. Sustainability considerations will increasingly influence automation design and implementation decisions.

Strategic positioning in this market requires commitment to continuous innovation, comprehensive solution development, and customer relationship excellence. Long-term success depends on adaptability to technological change, market evolution, and customer requirement development. The market outlook remains highly positive, supported by strong fundamentals and expanding application opportunities across diverse industrial sectors.

What is Factory Automation in Japan?

Factory automation in Japan refers to the use of control systems such as computers or robots for handling different processes and machinery in an industry to replace human intervention. This includes applications in manufacturing, assembly lines, and material handling.

What are the key companies in the Factory Automation in Japan Market?

Key companies in the Factory Automation in Japan Market include Fanuc Corporation, Yaskawa Electric Corporation, and Mitsubishi Electric Corporation, among others.

What are the main drivers of growth in the Factory Automation in Japan Market?

The main drivers of growth in the Factory Automation in Japan Market include the increasing demand for efficiency and productivity in manufacturing processes, advancements in robotics technology, and the need for improved quality control in production.

What challenges does the Factory Automation in Japan Market face?

Challenges in the Factory Automation in Japan Market include high initial investment costs, the complexity of integrating new technologies with existing systems, and a shortage of skilled labor to operate advanced automation systems.

What future opportunities exist in the Factory Automation in Japan Market?

Future opportunities in the Factory Automation in Japan Market include the expansion of smart factories, increased adoption of artificial intelligence in automation processes, and the growth of the Internet of Things (IoT) for enhanced connectivity and data analysis.

What trends are shaping the Factory Automation in Japan Market?

Trends shaping the Factory Automation in Japan Market include the rise of collaborative robots (cobots), the integration of machine learning for predictive maintenance, and a focus on sustainability through energy-efficient automation solutions.

Factory Automation in Japan Market

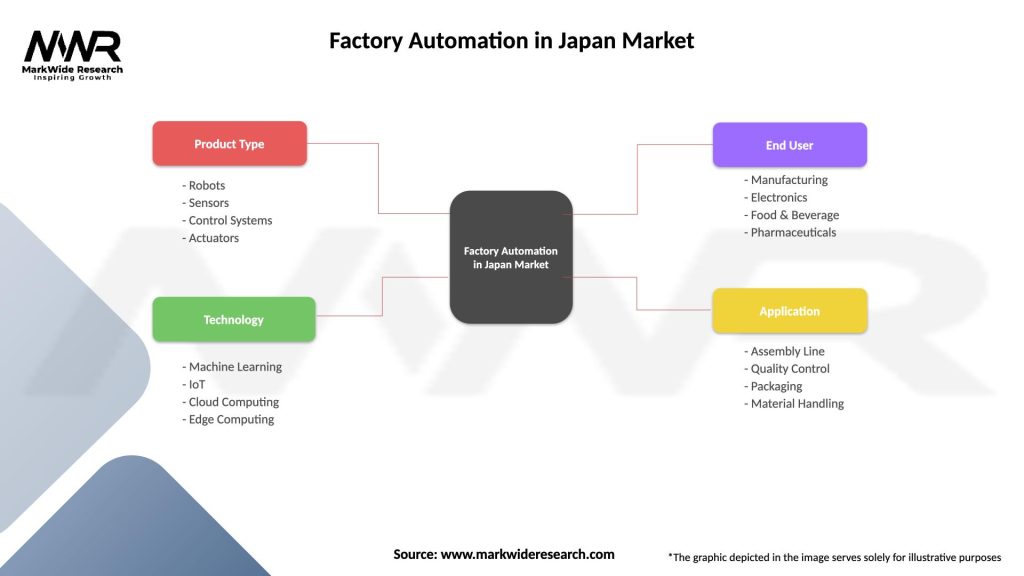

| Segmentation Details | Description |

|---|---|

| Product Type | Robots, Sensors, Control Systems, Actuators |

| Technology | Machine Learning, IoT, Cloud Computing, Edge Computing |

| End User | Manufacturing, Electronics, Food & Beverage, Pharmaceuticals |

| Application | Assembly Line, Quality Control, Packaging, Material Handling |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Factory Automation in Japan Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at