444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The factory automation and industrial controls market represents a transformative sector driving the fourth industrial revolution across global manufacturing landscapes. This dynamic market encompasses sophisticated technologies including programmable logic controllers, distributed control systems, supervisory control and data acquisition systems, and advanced robotics solutions that revolutionize traditional manufacturing processes.

Manufacturing industries worldwide are experiencing unprecedented demand for automated solutions as companies seek to enhance operational efficiency, reduce production costs, and maintain competitive advantages in increasingly complex global markets. The integration of Internet of Things (IoT) technologies, artificial intelligence, and machine learning capabilities has accelerated adoption rates significantly, with industrial automation penetration reaching 78% across major manufacturing sectors.

Key market segments demonstrate robust growth trajectories, particularly in automotive manufacturing, food and beverage processing, pharmaceuticals, and electronics production. The convergence of operational technology and information technology has created new opportunities for smart manufacturing implementations, enabling real-time monitoring, predictive maintenance, and adaptive production scheduling.

Regional market dynamics show strong expansion across North America, Europe, and Asia-Pacific regions, with emerging markets in Latin America and the Middle East demonstrating increasing adoption rates. The market experiences continuous innovation through advanced sensor technologies, edge computing solutions, and cloud-based industrial platforms that enhance manufacturing flexibility and responsiveness.

The factory automation and industrial controls market refers to the comprehensive ecosystem of technologies, systems, and solutions designed to automate manufacturing processes, enhance operational efficiency, and optimize industrial production through intelligent control mechanisms and data-driven decision making.

Factory automation encompasses the integration of mechanical, electrical, and computer-based systems that perform manufacturing tasks with minimal human intervention. This includes robotic assembly lines, automated material handling systems, quality control mechanisms, and production scheduling software that work cohesively to streamline manufacturing operations.

Industrial controls represent the sophisticated hardware and software components that monitor, regulate, and optimize industrial processes in real-time. These systems include programmable logic controllers, human-machine interfaces, variable frequency drives, and advanced process control algorithms that ensure consistent product quality and operational reliability.

Modern industrial automation extends beyond traditional mechanization to incorporate artificial intelligence, machine learning, and predictive analytics capabilities. These technologies enable autonomous decision-making, adaptive process optimization, and proactive maintenance scheduling that significantly enhance manufacturing productivity and reduce operational costs.

Market dynamics in the factory automation and industrial controls sector reflect accelerating digital transformation initiatives across global manufacturing industries. Companies increasingly recognize automation as essential for maintaining competitive positioning, achieving operational excellence, and responding effectively to evolving market demands.

Technology convergence drives market expansion as traditional automation systems integrate with advanced digital technologies including cloud computing, edge analytics, and industrial IoT platforms. This integration enables smart manufacturing capabilities that provide unprecedented visibility into production processes and facilitate data-driven optimization strategies.

Investment trends show significant capital allocation toward automation infrastructure, with manufacturing companies dedicating 23% of their capital expenditure to automation and digitalization projects. This investment focus reflects growing recognition of automation’s role in addressing labor shortages, improving product quality, and enhancing manufacturing agility.

Competitive landscape features established industrial automation leaders alongside emerging technology providers specializing in artificial intelligence, robotics, and industrial software solutions. Market consolidation through strategic acquisitions and partnerships accelerates innovation and expands solution portfolios across diverse industrial applications.

Future growth prospects remain robust as manufacturers pursue comprehensive digital transformation strategies that integrate operational technology with enterprise systems, enabling end-to-end visibility and control across manufacturing value chains.

Strategic market insights reveal fundamental shifts in manufacturing approaches as companies embrace comprehensive automation strategies to address contemporary business challenges and capitalize on emerging opportunities.

Primary market drivers propelling factory automation and industrial controls adoption stem from fundamental changes in manufacturing requirements, technological capabilities, and competitive pressures across global industrial sectors.

Labor shortage challenges represent a critical driver as manufacturing industries face persistent workforce gaps in skilled technical positions. Automation solutions address these challenges by reducing dependency on manual labor while enhancing productivity and operational consistency. The demographic shift toward aging workforces in developed economies further accelerates automation adoption as companies seek sustainable production strategies.

Quality and consistency requirements drive automation investments as manufacturers pursue zero-defect production goals and stringent quality standards. Automated systems provide precise control over manufacturing parameters, reducing variability and ensuring consistent product quality that meets increasingly demanding customer expectations and regulatory requirements.

Cost competitiveness pressures motivate automation adoption as companies seek to reduce production costs while maintaining quality standards. Automation enables significant labor cost reductions, improved material utilization, and enhanced energy efficiency that collectively strengthen competitive positioning in global markets.

Technological advancement accessibility facilitates automation adoption as advanced technologies become more affordable and user-friendly. The proliferation of cloud-based industrial platforms, standardized communication protocols, and modular automation components reduces implementation barriers and enables scalable automation strategies.

Regulatory compliance requirements increasingly mandate automated monitoring and control systems across industries such as pharmaceuticals, food processing, and chemicals. These regulations drive automation investments to ensure consistent compliance with safety, quality, and environmental standards.

Implementation challenges present significant restraints to factory automation adoption, particularly for small and medium-sized manufacturers with limited technical resources and capital availability. The complexity of modern automation systems requires specialized expertise for design, implementation, and maintenance, creating barriers for organizations lacking internal technical capabilities.

Capital investment requirements represent substantial financial barriers as comprehensive automation projects often require significant upfront investments in equipment, software, and infrastructure. Many manufacturers struggle to justify automation investments due to uncertain return timelines and competing capital allocation priorities, particularly during economic uncertainty periods.

Integration complexity poses challenges as manufacturers attempt to integrate new automation technologies with existing legacy systems and processes. Compatibility issues, data integration challenges, and workflow disruptions during implementation can create operational risks and extended deployment timelines that discourage automation adoption.

Cybersecurity concerns increasingly restrain automation adoption as connected industrial systems create potential vulnerabilities to cyber threats. Manufacturers worry about protecting intellectual property, maintaining operational continuity, and ensuring data security in increasingly connected manufacturing environments.

Workforce resistance can impede automation implementation as employees fear job displacement and organizational changes. Managing workforce transitions, providing adequate training, and addressing cultural resistance requires significant change management efforts that can delay or complicate automation projects.

Technology obsolescence risks concern manufacturers investing in rapidly evolving automation technologies. The pace of technological advancement creates uncertainty about long-term technology viability and upgrade requirements, making investment decisions more complex and potentially deterring automation adoption.

Emerging market expansion presents substantial opportunities as developing economies invest in manufacturing infrastructure and industrial modernization initiatives. Countries in Asia-Pacific, Latin America, and Africa demonstrate growing demand for automation solutions as they establish competitive manufacturing capabilities and attract international investment.

Industry 4.0 implementation creates comprehensive opportunities for integrated automation solutions that combine traditional control systems with advanced digital technologies. The convergence of artificial intelligence, IoT, and cloud computing enables new automation applications and service models that expand market potential significantly.

Sustainability initiatives drive demand for automation solutions that optimize energy consumption, reduce waste, and minimize environmental impact. Manufacturers increasingly seek green automation technologies that support sustainability goals while improving operational efficiency, creating opportunities for environmentally focused automation providers.

Customization and flexibility requirements generate opportunities for adaptive automation systems that enable rapid product changeovers and flexible manufacturing approaches. The growing demand for personalized products and shorter product lifecycles requires automation solutions that support agile manufacturing strategies.

Service and maintenance markets offer expanding opportunities as the installed base of automation systems grows. Predictive maintenance, remote monitoring, and lifecycle management services represent recurring revenue opportunities that complement traditional equipment sales.

Small and medium enterprise penetration represents significant untapped market potential as automation technologies become more accessible and affordable. Simplified automation solutions and cloud-based platforms enable SME automation adoption that previously was economically unfeasible.

Market dynamics in the factory automation and industrial controls sector reflect complex interactions between technological innovation, economic factors, and evolving manufacturing requirements that shape industry development and competitive positioning.

Technology evolution cycles significantly influence market dynamics as rapid advancement in artificial intelligence, robotics, and industrial IoT creates continuous opportunities for innovation and market disruption. Companies must balance investment in current technologies with preparation for emerging capabilities to maintain competitive advantages.

Economic fluctuations impact automation investment patterns as manufacturers adjust capital expenditure priorities based on market conditions and growth prospects. Economic uncertainty can delay automation projects, while economic expansion accelerates investment in productivity-enhancing technologies.

Supply chain considerations increasingly influence automation decisions as manufacturers seek to reduce dependency on external suppliers and enhance production flexibility. Automation enables supply chain localization and reduces vulnerability to global disruptions, driving strategic automation investments.

Competitive pressures accelerate automation adoption as companies seek to maintain cost competitiveness and operational efficiency advantages. The demonstration effect of successful automation implementations encourages broader industry adoption and creates momentum for market expansion.

Regulatory evolution shapes market dynamics as governments implement policies supporting industrial modernization and digital transformation. Incentive programs, tax benefits, and regulatory requirements influence automation investment decisions and market development patterns.

Partnership ecosystems emerge as critical market dynamics as automation providers collaborate with technology companies, system integrators, and industry specialists to deliver comprehensive solutions. These partnerships enable market expansion and accelerate innovation through combined expertise and resources.

Comprehensive research methodology employed in analyzing the factory automation and industrial controls market incorporates multiple data sources, analytical frameworks, and validation techniques to ensure accurate and reliable market insights.

Primary research activities include extensive interviews with industry executives, technology providers, system integrators, and end-user organizations across diverse manufacturing sectors. These interviews provide firsthand insights into market trends, technology adoption patterns, and future requirements that inform market analysis and projections.

Secondary research encompasses analysis of industry reports, company financial statements, patent filings, and regulatory documents to understand market structure, competitive dynamics, and technology development trends. This research provides comprehensive context for market assessment and validation of primary research findings.

Market modeling techniques utilize statistical analysis, trend extrapolation, and scenario planning to develop market projections and identify key growth drivers. These models incorporate economic indicators, technology adoption curves, and industry-specific factors to generate realistic market forecasts.

Expert validation processes involve consultation with industry specialists, academic researchers, and technology experts to verify research findings and ensure analytical accuracy. This validation provides confidence in research conclusions and enhances the reliability of market insights.

Data triangulation methods cross-reference information from multiple sources to identify consistent patterns and validate market observations. This approach reduces research bias and improves the accuracy of market analysis and strategic recommendations.

North American markets demonstrate strong automation adoption driven by advanced manufacturing capabilities, technological innovation, and competitive pressures from global markets. The United States leads regional automation investments with 42% market share, focusing on automotive, aerospace, and high-technology manufacturing sectors.

European markets emphasize Industry 4.0 implementation and sustainable manufacturing practices, with Germany, France, and the United Kingdom driving regional automation growth. European manufacturers prioritize energy-efficient automation solutions and integrated digital manufacturing platforms that support environmental sustainability goals.

Asia-Pacific regions experience rapid automation expansion as emerging economies invest in manufacturing infrastructure and established markets pursue advanced automation capabilities. China represents the largest regional market with 38% market share, followed by Japan and South Korea with significant automation investments in electronics and automotive sectors.

Latin American markets show growing automation adoption as countries develop manufacturing capabilities and attract international investment. Brazil and Mexico lead regional automation growth, particularly in automotive and consumer goods manufacturing sectors that require competitive production capabilities.

Middle East and Africa demonstrate emerging automation opportunities as countries diversify economies and develop industrial capabilities. The United Arab Emirates and South Africa lead regional automation adoption, focusing on oil and gas, mining, and manufacturing sectors.

Regional competitive dynamics vary significantly based on local manufacturing priorities, economic conditions, and technology infrastructure. Established markets emphasize advanced automation capabilities, while emerging markets focus on foundational automation implementations that enhance basic manufacturing efficiency.

Market leadership in the factory automation and industrial controls sector features established industrial automation companies alongside emerging technology providers that bring innovative solutions and disruptive approaches to traditional manufacturing challenges.

Competitive strategies focus on technology innovation, strategic acquisitions, and partnership development to expand solution portfolios and market reach. Companies invest heavily in research and development to maintain technological leadership and address evolving customer requirements.

Market consolidation continues through strategic acquisitions as companies seek to expand capabilities, enter new markets, and achieve economies of scale in increasingly competitive automation markets.

Technology-based segmentation reveals diverse automation solution categories that address specific manufacturing requirements and operational challenges across different industrial applications and production environments.

By Technology:

By Industry Application:

Process automation categories demonstrate strong growth as manufacturers seek to optimize continuous production processes and enhance operational efficiency through advanced control systems and real-time monitoring capabilities.

Discrete manufacturing automation shows robust expansion driven by automotive, electronics, and consumer goods industries requiring flexible production capabilities and rapid changeover times. These applications emphasize modular automation solutions that support diverse product configurations and manufacturing requirements.

Safety and security systems represent rapidly growing categories as manufacturers prioritize worker safety and cybersecurity protection. Integration of functional safety systems with industrial automation platforms ensures compliance with safety standards while maintaining operational efficiency.

Energy management automation gains prominence as manufacturers focus on sustainability goals and energy cost optimization. These systems provide real-time energy monitoring and optimization capabilities that reduce environmental impact while improving operational economics.

Predictive maintenance solutions emerge as high-value categories that leverage artificial intelligence and machine learning to optimize equipment performance and reduce unplanned downtime. These solutions deliver significant cost savings through proactive maintenance scheduling and equipment optimization.

Cloud-based automation platforms represent emerging categories that enable scalable automation deployment and remote monitoring capabilities. These platforms provide flexible deployment options and reduce infrastructure requirements for automation implementation.

Manufacturing companies realize substantial benefits from factory automation investments including enhanced productivity, improved product quality, reduced operational costs, and increased manufacturing flexibility that strengthens competitive positioning in global markets.

Operational efficiency improvements enable manufacturers to achieve higher production throughput with consistent quality while reducing labor requirements and minimizing production variability. Automation systems provide 24/7 production capabilities that maximize asset utilization and improve return on investment.

Quality enhancement benefits include reduced defect rates, improved product consistency, and enhanced traceability that support quality management initiatives and customer satisfaction goals. Automated quality control systems provide real-time quality monitoring and immediate corrective actions.

Cost reduction advantages encompass labor cost savings, material waste reduction, energy optimization, and maintenance cost improvements that collectively enhance profitability and financial performance. Automation investments typically deliver payback periods of 18-24 months through operational improvements.

Flexibility and agility benefits enable manufacturers to respond quickly to market changes, customize products efficiently, and adapt production schedules based on demand fluctuations. Modern automation systems support rapid product changeovers and flexible manufacturing approaches.

Safety and compliance advantages include reduced workplace accidents, improved regulatory compliance, and enhanced environmental performance that support corporate responsibility goals and risk management objectives.

Technology providers benefit from expanding market opportunities, recurring service revenues, and partnership opportunities that support business growth and market expansion strategies.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration represents a transformative trend as manufacturers incorporate machine learning algorithms and predictive analytics into automation systems. This integration enables autonomous decision-making and adaptive process optimization that significantly enhance manufacturing intelligence and responsiveness.

Edge computing adoption accelerates as manufacturers seek to process data closer to production equipment for real-time decision-making and reduced latency. Edge computing solutions provide local processing capabilities that enhance system responsiveness while reducing bandwidth requirements and cloud dependency.

Collaborative robotics expansion transforms manufacturing environments as companies deploy robots designed to work safely alongside human workers. These collaborative systems enable flexible automation approaches that combine human creativity with robotic precision and consistency.

Digital twin implementation gains momentum as manufacturers create virtual replicas of physical production systems for simulation, optimization, and predictive maintenance. Digital twin technology enables virtual commissioning and process optimization that reduces implementation time and improves system performance.

Sustainability-focused automation emerges as manufacturers prioritize environmental responsibility and energy efficiency. Automation solutions increasingly incorporate energy optimization features and environmental monitoring capabilities that support corporate sustainability goals.

Cloud-native automation platforms develop as manufacturers seek scalable and flexible automation deployment options. These platforms provide subscription-based models and reduced infrastructure requirements that make automation more accessible to diverse manufacturers.

According to MarkWide Research analysis, these trends collectively indicate a fundamental shift toward intelligent, connected, and sustainable manufacturing environments that leverage advanced automation capabilities.

Strategic acquisitions reshape the competitive landscape as major automation providers acquire specialized technology companies to expand capabilities and enter new market segments. Recent acquisitions focus on artificial intelligence, cybersecurity, and industrial software companies that complement traditional automation portfolios.

Partnership formations accelerate between automation providers and technology companies to deliver integrated solutions that combine operational technology with information technology. These partnerships enable comprehensive digital transformation offerings that address evolving customer requirements.

Technology standardization initiatives advance through industry collaboration on communication protocols, cybersecurity frameworks, and interoperability standards. These initiatives reduce integration complexity and enable multi-vendor automation environments that provide greater flexibility and choice.

Investment announcements in research and development demonstrate continued commitment to innovation and technology advancement. Companies allocate significant resources to developing next-generation automation capabilities that incorporate artificial intelligence, machine learning, and advanced analytics.

Market expansion activities include new product launches, geographic expansion, and vertical market penetration strategies that broaden market reach and customer base. Companies focus on emerging market opportunities and underserved industry segments.

Regulatory developments influence industry practices through new safety standards, cybersecurity requirements, and environmental regulations that shape automation system design and implementation approaches.

Investment prioritization should focus on automation solutions that provide clear return on investment through measurable productivity improvements, quality enhancements, and cost reductions. Manufacturers should conduct thorough feasibility studies and develop phased implementation approaches that minimize risk and maximize benefits.

Technology selection requires careful evaluation of current and future requirements, integration capabilities, and vendor support quality. Companies should prioritize scalable automation platforms that support future expansion and technology evolution while ensuring compatibility with existing systems.

Skills development represents a critical success factor as automation implementation requires specialized technical expertise for design, deployment, and maintenance. Organizations should invest in workforce training programs and partner with educational institutions to develop necessary technical capabilities.

Cybersecurity planning must be integrated into automation strategies from the initial design phase to ensure comprehensive protection against evolving threats. Companies should implement layered security approaches and establish incident response procedures for connected manufacturing environments.

Partnership strategies can accelerate automation success through collaboration with experienced system integrators, technology providers, and industry specialists. Strategic partnerships provide access to specialized expertise and reduce implementation risks while accelerating deployment timelines.

Performance measurement systems should be established to track automation benefits and identify optimization opportunities. Regular assessment of key performance indicators enables continuous improvement and validates automation investment decisions.

Market growth prospects remain robust as manufacturing industries continue digital transformation initiatives and pursue competitive advantages through advanced automation capabilities. The convergence of artificial intelligence, IoT, and cloud computing creates unprecedented opportunities for intelligent manufacturing systems that adapt dynamically to changing conditions.

Technology evolution will accelerate integration of advanced capabilities including machine learning, computer vision, and natural language processing into automation systems. These technologies will enable autonomous manufacturing environments that require minimal human intervention while maintaining high flexibility and responsiveness.

Market expansion will continue in emerging economies as countries develop manufacturing capabilities and attract international investment. The democratization of automation technology through cloud-based platforms and simplified deployment approaches will enable broader market penetration across diverse industry segments.

Sustainability integration will become increasingly important as manufacturers pursue environmental responsibility goals and regulatory compliance requirements. Future automation systems will incorporate comprehensive sustainability features that optimize energy consumption, reduce waste, and minimize environmental impact.

Service market growth will accelerate as the installed base of automation systems expands and companies seek to maximize return on automation investments. Predictive maintenance, remote monitoring, and optimization services will represent significant revenue opportunities for automation providers.

MWR projections indicate continued market expansion with growth rates of 8.5% CAGR driven by technological advancement, competitive pressures, and evolving manufacturing requirements that favor automated production approaches.

The factory automation and industrial controls market represents a dynamic and rapidly evolving sector that plays a crucial role in modern manufacturing transformation. The convergence of traditional automation technologies with advanced digital capabilities creates unprecedented opportunities for intelligent, efficient, and sustainable manufacturing operations.

Market drivers including labor shortages, quality requirements, cost pressures, and technological advancement continue to accelerate automation adoption across diverse industrial sectors. While implementation challenges and capital requirements present barriers, the long-term benefits of automation investment significantly outweigh these constraints for most manufacturing organizations.

Technological innovation remains the primary catalyst for market growth as artificial intelligence, edge computing, and collaborative robotics transform traditional automation approaches. These technologies enable new levels of manufacturing intelligence and flexibility that support competitive positioning in global markets.

Regional market dynamics show strong growth across established and emerging economies, with particular momentum in Asia-Pacific regions and continued strength in North American and European markets. The global nature of manufacturing competition drives automation adoption as companies seek to maintain cost competitiveness and operational excellence.

Future success in the factory automation market will depend on effective integration of advanced technologies, strategic partnership development, and comprehensive approaches to workforce development and cybersecurity. Organizations that embrace automation as a strategic capability rather than simply a cost reduction tool will achieve the greatest benefits and competitive advantages in the evolving manufacturing landscape.

What is Factory Automation and Industrial Controls?

Factory Automation and Industrial Controls refer to the use of control systems such as computers or robots for handling different processes and machinery in an industry to replace human intervention. This includes various applications like assembly lines, boilers, and heat treating ovens, as well as switching on telephone networks and aircraft flight control.

What are the key players in the Factory Automation and Industrial Controls Market?

Key players in the Factory Automation and Industrial Controls Market include Siemens, Rockwell Automation, Schneider Electric, and Honeywell, among others. These companies are known for their innovative solutions and technologies that enhance operational efficiency and productivity in various industries.

What are the main drivers of growth in the Factory Automation and Industrial Controls Market?

The main drivers of growth in the Factory Automation and Industrial Controls Market include the increasing demand for operational efficiency, the rise of Industry Four Point Zero, and the need for enhanced safety and compliance in manufacturing processes. Additionally, the integration of IoT and AI technologies is significantly contributing to market expansion.

What challenges does the Factory Automation and Industrial Controls Market face?

The Factory Automation and Industrial Controls Market faces challenges such as high initial investment costs, the complexity of integrating new technologies with existing systems, and a shortage of skilled workforce. These factors can hinder the adoption of automation solutions in various sectors.

What opportunities exist in the Factory Automation and Industrial Controls Market?

Opportunities in the Factory Automation and Industrial Controls Market include the growing trend of smart factories, advancements in robotics and AI, and the increasing focus on sustainability and energy efficiency. These trends are expected to drive innovation and investment in automation technologies.

What are the current trends in the Factory Automation and Industrial Controls Market?

Current trends in the Factory Automation and Industrial Controls Market include the adoption of cloud-based solutions, the rise of collaborative robots (cobots), and the implementation of predictive maintenance strategies. These trends are reshaping how industries approach automation and control systems.

Factory Automation and Industrial Controls Market

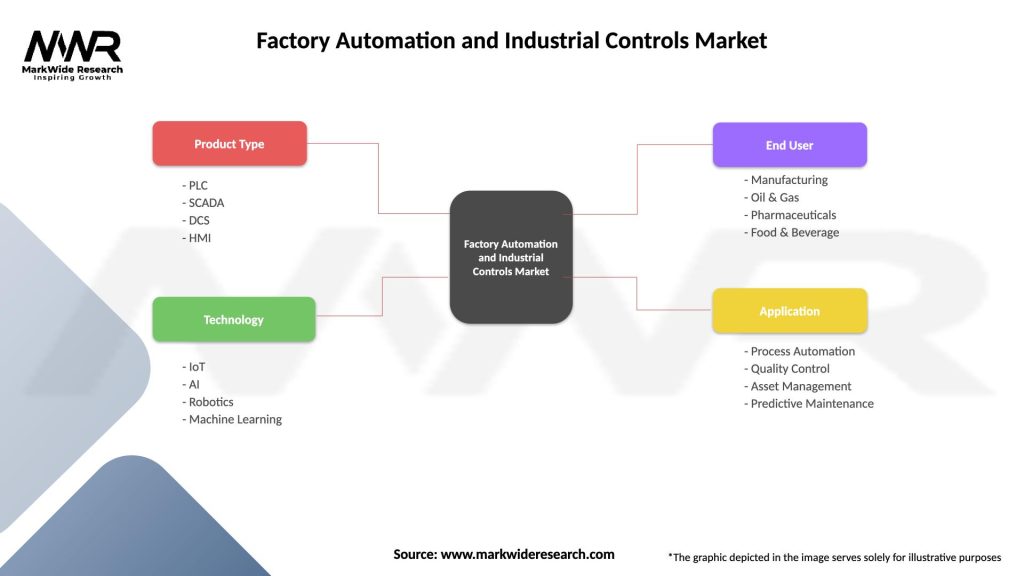

| Segmentation Details | Description |

|---|---|

| Product Type | PLC, SCADA, DCS, HMI |

| Technology | IoT, AI, Robotics, Machine Learning |

| End User | Manufacturing, Oil & Gas, Pharmaceuticals, Food & Beverage |

| Application | Process Automation, Quality Control, Asset Management, Predictive Maintenance |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Factory Automation and Industrial Controls Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at